Review Article: 2021 Vol: 24 Issue: 1S

Interpretation of Sharia Accounting Practices in Indonesia

Nawang Kalbuana, Politeknik Penerbangan Indonesia Curug

Adelina Suryati, Universitas Bhayangkara Jakarta Raya

Rusdiyanto, Universitas Airlangga and Universitas Gresik

Azwar, Sekolah Tinggi Ilmu Ekonomi Bisnis Indonesia

Rudy, Sekolah Tinggi Ilmu Ekonomi Bisnis Indonesia

Yohana, Universitas Pramita Indonesia

Nugroho Heri Pramono, Sekolah Tinggi Ilmu Ekonomi Bank BPD Jateng

Nurwati, Institut Teknologi dan Bisnis Ahmad Dahlan Jakarta

Eko Hadi Siswanto, Institut Teknologi dan Bisnis Ahmad Dahlan Jakarta

Maylia Pramono Sari, Universitas Negeri Semarang

Rully Aprilia Zandra, Universitas Negeri Malang

Alwazir Abdusshomad, Politeknik Penerbangan Indonesia Curug

Kardi, Politeknik Penerbangan Indonesia Curug

Solihin, Politeknik Penerbangan Indonesia Curug

Budi Prasetyo, Politeknik Penerbangan Indonesia Curug

Zulina Kurniawati, Politeknik Penerbangan Indonesia Curug

Riyanto Saputro, Politeknik Penerbangan Indonesia Curug

Taryana, Politeknik Penerbangan Indonesia Curug

Yayuk Suprihartini, Politeknik Penerbangan Indonesia Curug

Oke Hendra, Politeknik Penerbangan Indonesia Curug

Benny Kurnianto, Politeknik Penerbangan Indonesia Curug

Indah Ayu Johanda Putri, Politeknik Pelayaran Surabaya

Muhammad Nazaruddin, University of Liverpool

Widi Hidayat, Universitas Airlangga

Keywords

Theory, Accounting Practices, The Qur'an and Hadith

Abstract

The aim of this study is to disclose a theory and practice of accounting in Indonesia on the basis of the Qur'an and Hadith. A review of research in several journals and associated books was used in this investigation process. This study is designed to study Sharia Accounting theology, interpreted sharia accounting theory, and accounting practices in Indonesia. The study is linked to Al Qur’an and Hadith. The results of this survey showed that the theory of sharia accounting is all about the Qur'an and Hadith. Maslahah and Maqasid al-Shari'ah are scaled in the world and beyond when implementing sharia accounting theory. In Islamic theory, Islamic accounting requires prioritization of group interests, not personal interests. Islamist accounts can be split in concept into three concepts: rahmatan lil 'alamin, spirituality concept, ukhuwah islamiah.

Introduction

The development of sharia accounting is part of the dynamics of the development of accounting theory with the condition of the Indonesian people who are predominantly Muslim. Sharia accounting practices in Indonesia have developed rapidly and received positive responses from the public and government. One of the government's responses is the existence of standards which serve as guidance for Islamic financial institutions. Behind the accounting practices that have developed today, both conventional and sharia accounting actually have ideas which underlie practice in the form of basic assumptions, concepts, explanations, descriptions, and reasoning which form the field of accounting theory. Therefore, it is necessary to explain the various basic assumptions which underlie sharia accounting practices in Indonesia. To understand and explain sharia accounting practices applied in Indonesia, accounting theories used with sharia accounting approaches, sharia accounting practices which are different from conventional accounting practices. So, we need an explanation of sharia accounting practices in Indonesia.

Previous research related to Islamic accounting is very limited so this indicates that accounting actually originated from Islam. Accounting developed and spread along with the spread of Arab trade which could be indicated as the spread of Islam. While trading, they taught how to record their trading activities all at once, and this was later identified as the origin of trade accounting (Masulah, 2014; Raharjo, 2010; Sawarjuwono, Basuki, & Harymawan, 2011; Suwiknyo, 2007). In the last few years, we have easily found seminars, workshops, discussions and various training which discuss the various activities of Islamic accounting such as banking, insurance, pawnshop, and education. All activities developed through a process of struggle that starts from the introduction of the meaning of accounting theory, application into practice, to the emergence of the awareness of the managers of accountant organizations, namely the Financial Accounting Standards Board which has a role in setting Islamic financial accounting standards (Muzahid, 2009; Napier, 2009; Rivai et al., 2017).

Taking into account research journals that implement accounting Quran and Hadith-based, this research focuses on sharia accounting studies and accounting practices which have been applied in Indonesia, then the emergence of writings in the form of articles, lectures, symposia, workshops, and the publication of the book of Islamic Accounting Ideology and Islamic accounting standards. This research is focused on a review of accounting theories and practices related to the Qur'an and Hadith. The results of this study for the future learning process as a review and guidelines related to the review between accounting theory and practice are important for researchers in Indonesia, only researching about theory and practice of accounting in general. This research is expected to produce documents or references that can be studied by future researchers.

Theory

Accounting and Theory Development

The basic concept of accounting by linking to accounting theory: "Does it only require one basic concept which can be applied to all accounting entities or there are many forms of various forms of business entities requiring a variety of different concepts”. Stages of three theories are proprietary theory, entity theory and enterprise theory.These three-theoretical approaches are able to provide a description of some basic theoretical concepts of accounting and the practical implications in financial statements (Apriyanti, 2017b; Masulah, 2014; Sumarno, 2014; Suwiknyo, 2007). Proprietary theory deals with ownership and becomes a center of accounting interest in which a Proprietor has an interest in the success and failure of a business owned by the company. Proprietorship makes the double-entry system a substance so that the owner or shareholder reporting system can be presented (Ilahiyah, 2012; Maulana, 2017; Zulfayani, 2019).

The concept of entity theory still has similarities with the proprietary theory which makes accounting information presented to find out about the invested capital and at the same time the maximum profit sharing on profits that have been invested in the company. The accounting position becomes very important to be controlled by the capital owner and the sole authority in the company (Mulawarman & Triyuwono, 2007; Mustain, 2013; Raharjo, 2010; Supangat, 2017). Accounting tends to strengthen the exploitative culture of stakeholders. The practical implications in the form of exploitation of the company's sustainability are not merely addressed to the company and also need to pay attention to stakeholders.

In companies in the United States until the early twentieth century, where Proprietary theory is the center of economic interest, the owners aimed at increasing net equity's value. In developments of the business world, Proprietary theory is not used due to the very rapid changes in the industrial environment in the development of capital markets globally and also the consequences of the reliability of accounting information which is increasingly reliable. Furthermore, the concept of entity theory changes the view from the center of attention to the economic unit and the distinction and separation of ownership between entities and individuals (Apriyanti, 2017a; Handayani & Abubakar, 2017; Hidayat, 2013; Himawati & Subono, 2013).

The concept of entity theory still has similarities with Proprietary theory which makes accounting information presented to determine the invested capital as well as maximum profit on the profits which have been invested. The accounting position becomes an important vehicle controlled by the owner of capital in a capitalist economic system in which the sole power is in the hands of the capitalist. Accounting finally tends to strengthen the exploitative culture of stakeholders and the exploitation of others like nature exploitation. The implication of this form of exploitation is that the continuity of the company is not solely aimed at the company but also needs to pay attention to stakeholders (Faiz, 2014; Kariyoto, 2014; Sari, 2014). Changing the direction of the company's goals by paying attention to stakeholders causes the two theories above are unable to answer so that raises another theory, namely Enterprise Theory. The basic framework of enterprise theory views companies as part of the social community. Companies in making decisions must pay attention to various groups, not limited to shareholders. Accounting is positioned to prepare reports aimed at and distributed to various groups of stakeholders. The focus of enterprise theory is that all parties have direct or indirect interests in the company that needs to be considered when the company is about to present its financial information (Faiz, 2014; Kariyoto, 2014; Mulawarman & Triyuwono, 2007; Rivai et al., 2017; Sari, 2014; Sawarjuwono et al., 2011; Supangat, 2017).

Presentation of financial information is not solely towards the owner but to other stakeholders who support the company's existence. The view of enterprise theory is based on the idea which business entities function as social institutions broad and complex economic influences which ultimately lead to social responsibility. This determines the purpose of business entities, namely providing welfare to several groups with an interest in the company so that the report does not focus on the profit or loss statement but rather on the value-added concept to measure income as a way for management to carry out accounting tasks from various interest groups by providing information better than the balance sheet and income statement (Apriyanti, 2017a; Handayani & Abubakar, 2017; Mulawarman & Triyuwono, 2007). The theoretical approach is used to explain how the accounting position in each business entity. The basic concepts inherent in each theory are used by accounting to provide financial information to interested parties. These three theories are often linked in the discussion of the implementation of conventional accounting.

Accounting and Islam

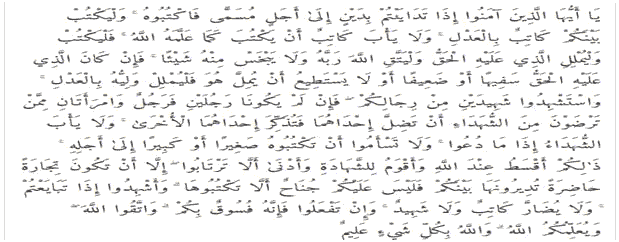

In the Qur'an, Allah says in Surah Al-Baqarah 282 verses which are often cited as one of the Islamic Accounting foundations:

“O you who have faith! When you are in debt for a specified term, write it down. Let a writer write it down with the truth. Let not the scribe refuse to write as God has taught him, so let him write it down. Let him who oweth dictate, and let him fear Allah, his Lord, and diminish not compromising anything from it. If the debtor is in poor health or incapable of dictating his own position, then his guardian should dictate it correctly. And witness with two male witnesses from among you....”

The meaning and derivation of this verse are very profound covering various dimensions. Through this verse, Islam is developing very rapidly in the economy, especially in terms of the importance of recording various economic events. Muslims from time to time practice this process as an important obligation in muamalah because it is not just a form of human responsibility but there are other forms of responsibility to the creator who will certainly be held to account in the hereafter.

Accounting can be defined as various functions such as business language, negotiation tools, main scripts in dramaturgy and various other functions that make accounting function a tool for each party. Each function is used to explain the truth of human reality faced in the world (Mulawarman & Triyuwono, 2007; Sawarjuwono et al., 2011; Suwiknyo, 2007).

Theory and reality are also influenced by secularism which is seen in three things. First, the disenchantment of nature is seen in the self-interest substance of accountants, standard setters, shareholders, bureaucrats and politicians as individuals involved in making efforts to maximize their expected utilities. Second, the separation of interests between the standard-setter from personal interests with the public interest. Third, the deconsecration of values through the rejection of normative values as rule certainty (Napier, 2009). Islam as a religion that has a different nature from the metaphysical and has a clear range of reason in accordance with the five senses. Through the Qur'an and Hadith, humanity in the world is made for the benefit of humanity in the world (Mulawarman & Triyuwono, 2007). Islam emphasizes the aim of science to improve the degree and quality of humanity itself and ultimately provide safety and peace for life in this world and the hereafter. Muslims make the Qur'an and Hadith as the center of absolute truth that is always sought and always able to answer various challenges. Efforts made by humans systematically and methodically to find the truth on an object can be called an epistemology.

Methodology of Research

Types of Research

The research method applied is the method of reviewing several journals related to accounting theory and practice. The selection of this method by considering the focus of a review study between theory and practice is to reveal the development of a review between Islamic accounting theory and practice. As the case in ethnography (Sawarjuwono, Basuki, and Harymawan 2011;Juanamasta et al., 2019; Prabowo, Rochmatulaili, Rusdiyanto, & Sulistyowati, 2020; Rusdiyanto, Agustia, Soetedjo, & Septiarini, 2020; Rusdiyanto, Hidayat, et al., 2020; Jannah et al., 2020; Luwihono, A., Suherman, B., Sembiring, D., Rasyid, S., Kalbuana, N., Saputro, R., Prasetyo, B., Taryana, T., Suprihartini, Y., Asih, P., Mahfud, Z & Rusdiyanto, 2021; Prasetyo et al., 2021; Susanto, H., Prasetyo, I., Indrawati, T., Aliyyah, N., Rusdiyanto, R., Tjaraka, H., Kalbuana, N., Rochman, A., Gazali, G & Zainurrafiqi, 2021))this research will reveal the development of a review of the theory and practice of Islamic accounting of the perpetrators. Therefore, the search was carried out and started from several related journals.

Process of Data Collection

Data collection is conducted by reviewing several related journals and further research development will be directed to several related journals. The focus of the discussion implies the direction of a review of Qurân and Hadith-based accounting theory and practice. Several reviewed journals are concluded based on the subject matter. In grouping the results of the review, the study then evaluated the relationship between one event and another. The linkage of the incident was rearranged into a discussion analysis in the description of the research findings so that it can be described in a chronological development process of Islamic accounting theory. Event after event in the journal is interpreted and linked to the focus of the study of sharia accounting theory with practice in Indonesian.

The reviews of several journals obtained were rearranged based on the results of the related journal reviews and the process of developing The theory and practice of the Qur'an and Hadith are re-written so that the theory and practice of accounting in Indonesia can more completely be organized theory and practice.

Results and Discussion

The results of this study review several journals relating to the focus of the study with the consideration which the emergence of a review between theory and practice is inseparable from the Qur'an and Hadith. Because accounting is always developing by following the culture of society, an understanding of culture can be used to interpret the development of accounting in Indonesia. Researcher's belief that a review of accounting theory and practice is related to the emergence of everything which can be indicated by accounting practices so the researcher looks for several journals and books that can convince research between the theory and practice of accounting based on the Hadith and the Quran are really related.

The research process begins with understanding and studying several journals and books related to the research topic, namely when the economic change in Indonesia is marked by the establishment of the first Islamic bank, Bank Muamalat Indonesia (BMI). BMI is the point of change in the Indonesian economy from a capitalist economy to an Islamic economy. Furthermore, various businesses and institutions based on sharia and science related to Islamic economics have emerged. The development of Islamic economics originating from the Qur'an and Hadith has found the latest form in economic life in Indonesia. Historically compared to other systems, especially capitalists, the introduction of the Islamic economic system was still relatively new about two decades ago, marked by the establishment of the first Islamic bank, BMI in Jakarta.

This research implies a review of accounting theory and practice related to the Qur'an and Hadith which is the result of a review evaluation from several journals leading to the starting point of this research when from a review of several related journals. Based on the review of several related journals, it can be interpreted that between theory and practice accounting is an Islamic banking accounting standard which forms a more concrete understanding of how Islamic accounting and the formation of institutions which concentrate on Islamic accounting. Sharia accounting in general and technical knowledge is a record of financial statement presentation. The Indonesian Institute of Accountants only formed the Sharia Accounting Committee on October 18, 2005. Documents that formally discuss sharia accounting have only been in existence since the 2002s.Existing documents explain the review of Quran and Hadith-based accounting and practice.

Other Findings From The Research Process

The findings of this study are that a review of accounting theory and practice is aimed at realizing an economy based on the Qur'an and Hadiths, namely upholding Islamic economics. This thinking is in accordance with the guidance in the Qur'an and Hadith. Accounting theory is part of accounting practices, namely an understanding of accounting theory that will drive the development of accounting towards sound accounting practices. Conceptually, sharia accounting practices exist as solutions to conventional transaction problems that are not in accordance with Islamic values. This aspect of conventional accounting cannot be applied to institutions that apply Islamic principles, Both from accounting theory and Qur'an and Hadith-based practice. Solutions or answers to various problems that arise are explained in the guidance in the Qur'an and Hadith which is a way of life for Muslims. This is very different from the answers to conventional accounting solutions obtained through clever tactics or reasoning or logical thinking.

Both conventional and sharia accounting actually have the same goal which is towards good and sound accounting practices. For good and sound accounting practices, the good and sound theory is needed. In the concept of sharia, a good and healthy theory is obtained through the Qur'an and Hadith as a guide to human life and sunnah in the form of all kinds of things done by the Prophet Muhammad. Sharia accounting is actually the answer to current economic problems and is not only intended for Muslims because the characteristics of the Qur'an and Hadith are rahmatan lil „alamin. From this explanation, it is not uncommon for non-Muslim societies to turn to the Islamic economy so that the consequences of transactions which contain sharia become accounting policies applied must be in accordance with sharia accounting standards.

Problem solving in conventional accounting practices is performed through clever tactics for problems which are simple and wisdom for complex problems and have a broad influence on accounting practices. Solving these problems often contains short-term practical and short-term interests which originate from standard makers. An example that often arises is the tendency of practitioners and professionals to only use their practical experience in solving accounting practice problems and feel satisfied with the achievement of those practical experiences. Whereas the advancement of the accounting profession is not only determined by the factor of practical experience but must also be supported by theory as a foundation in accounting research.

On the other hand, problem solving in sharia accounting must be free of interests and only intended for the right purpose in accordance with the objectives set out in the Qur'an and Hadith and oriented long term, not just short term orientation. With the correct theoretical approach, one should be able to see problems that arise with a broader perspective based on Islamic accounting theory with a deductive normative approach. Deductive normative approach is used because Muslims must apply the principles of sharia in all aspects of life including economic life. This approach is used in setting accounting standards which include how to understand the purpose of financial statements, accounting formulas and the definition of the concept of sharia principles. One thing that drives the emergence of sharia accounting is a review of the use of sharia as a guide in the development of accounting theory. Therefore, in developing accounting theory it should be based on sharia or in accordance with Islamic values. Accounting theory developed to understand sharia accounting practices must not conflict with sharia principles.

Development of Sharia Accounting

Concept of Islamic Economic Design

The development of accounting is influenced by various factors including ideology and economic system factors of a country. The development of the country's ideology and the economy will affect the development of accounting in the country. In Indonesia, the development of accounting from time to time is influenced by the development of Islamic religious ideologies, then encourages the development of Islamic economics as a form of reflection of Islamic ideology. Therefore, the development of accounting is strongly influenced by the development of Islamic economics so that Islamic accounting appears. Factors driving Islamic accounting needs are the emergence of Islamic financial institutions, international scale corporate scandals, Islamic banking systems,and also the emergence of accountants' awareness to act honestly, fairly, and not violate Islamic sharia provisions.

The factor driving the rise of Islamic accounting is the rapid development of Islamic financial institutions. The development of these institutions is accompanied by challenges faced or passed by the Islamic financial system including the accounting treatment by Islamic financial institutions as challenges faced by the Islamic economy, especially Islamic financial institutions. There are factors facing Islamic economics in the theoretical, operational and implementation aspects.The theoretical aspects faced by Islamic financial institutions, it is necessary to develop principles, philosophies, and functions of the financial statement presentation system on the basis of profit and loss sharing. The operational level, attention is needed to innovation, intermediation, risk control. The implementation stage, the application of a financial statement presentation system is needed according to the current regulations and conditions of society.

Accounting in Islam is not a new art and science. At the beginning of the emergence of Islam, accounting is known as baitul maal. It is an institution that functions as the state treasurer and guarantees social welfare. The introduction of accounting at that time was known as kitabat al amwaal or recording of money by the public. The use of the term accounting has also been used by Muslim researchers to introduce double entry in 1949. One of the manuscripts containing accounting and accounting systems used in Islamic countries is the manuscript entitled risalah falakiyah kitab as-siyaqat, by Abdullah bin Muhammad bin Kayah Al Mazindarani in 1363 AD.

A New Era of Islamic Accounting Revival

The rise of Islamic accounting in Indonesia is triggered by various things, one of which is by the existence of accounting scandals in large companies, such as Wordlcom, and the awareness of accountants to work more honestly, fairly and not contrary to the teachings of the Qur'an and Hadith. Some other issues that have contributed to the growth of sharia accounting studies are the harmonization of international accounting standards in Muslim countries, the proposed formatting of Islamic business entity reports, and a review of the philosophy of ethical construction in accounting knowledge and the use of sharia as a guide in the development of sharia accounting theories.

Islamic Accounting Theory

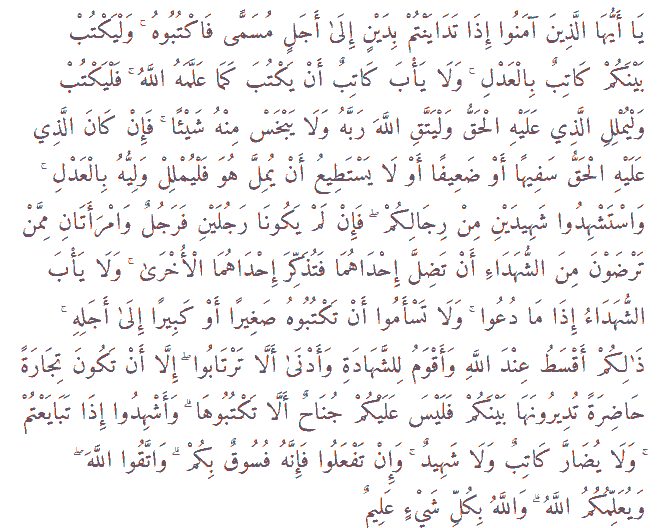

From the picture above, it can be explained that the main thing relating to accounting is the recording of financial transactions, recognition, valuation, and disclosure in financial statements. Islamic accounting is a social science where all the rules relating to Islamic accounting are obtained normatively from the instructions in the Qur'an, al-Baqarah verse 282. This is used as a direction for accounting practices. The direction of accounting practices is of course in accordance with sharia. In Islamic accounting, the recording of accounting transactions is associated with the spirit of Islam in accordance with the quotation of al-Baqarah verse 282:

Based on the explanation above, the researcher can underline that the statement of financial position (balance sheet), especially accounts payable accounts already exist in the Qur'an and Hadith as a guide for conducting transactions. Recording financial transactions that are adjusted to the spirit of Islam is the recording of transactions carried out by recording officers who are free from the negative effects of financial transactions. In accordance with al-Baqarah verse 282, accounting in Islam has the concepts of justice, truth, and accountability. The concept of justice in the context of accounting contains two meanings that are related to moral practices and are fundamental which are based on sharia values. The preparation of financial statements must be done fairly to meet the needs of all interested parties not just to meet the interests of certain parties. Accounting information compiled for the benefit of certain parties that tend to be unjust will mislead the public. This concept of truth is obtained from the explanation of al-Baqarah verse 282 that Allah commands to do the correct writing of each transaction during muamalah activities. The application of the concept of responsibility in Islamic accounting is the preparation of financial statements conducted by business people or individuals involved in business practices as a form of accountability for the mandate of the parties concerned.

The concept of Islamic accounting has two directions of power which can be shaped by the environment and can also affect the environment. Accounting can affect the environment so that Islamic accounting will affect economic actors including transaction actors to clearer behavior. Islamic accounting is based on Islamic principles which apply ethical attitudes including economic behavior. Accounting information has the power to influence thoughts, actions, even to the decision making in business. This will encourage the formation of a better business.

Principles of Sharia Accounting

Islamic accounting theory is human in the form of normative commands in the Qur'an relating to accounting and in accordance with human nature that it can be practiced by humans with all the potential which Allah has given to humans. Allah gives three potentials as basic human capital, namely the potential of ruhyah (soul), fikriah (mind), and jasadiah (physical). With these three potentials, humans can practice sharia accounting easily. With the high power of ruhiyah, man is obtained from his closeness to Allah as the creator. Humans have the power to carry out accounting practices in accordance with what was ordered by Allah, the essence that created humans. This power is the main force which is able to encourage someone to act in accordance with sharia, including in carrying out accounting practices. Someone does not have a closeness to the creator or the strength of his spirit is low, it will be easier to turn and do bad accounting practices, not in accordance with sharia. He will violate the normative rules in the Qur'an. The nature of fitrah will facilitate humans in carrying out accounting practices. Humans can distinguish between what is right and what is wrong and humans can think with the reason that Allah gave. An important potential is the potential of a gift that will make it easier for humans to do every activity in life without a healthy gift.

Al-Qur'an onal-Baqarah verse 283 explains that sharia accounting theory can provide changes and improvements to existing accounting theories and practices. Islamic accounting theory can also change the way of the human view from a narrow perspective to a broad perspective because Islamic accounting uses the Islamic world view. Sharia accounting theory can also be called a scientific discipline by adopting other disciplines such as sociology, psychology and also includes material and non-material aspects mental and spiritual. Furthermore, the principles of sharia accounting are explained as:

Objectives of Islamic Accounting

One of the plans of Islamic economics is nubuwwahthat Allah sent the Prophet Muhammad as the Messenger of Allah who perfected human behavior and as rahmatan lil „alamin. The concept of nubuwwah provides an understanding that when someone wants to achieve the salvation of the afterlife then all activities undertaken must be in accordance with the example of the Prophet Muhammad, including in economic activities or activities. Therefore, the purpose of sharia accounting which is a sub-system of Islamic economics is to realize the consequences of the concept of monotheism to one's love for Allah, namely by carrying out accountability for every transaction and economic event and also the production process in the organization. The purpose of sharia accounting helps achieve socio and economic justice (al-Falah) "fully recognize obligations to God, society, individuals,auditors, managers, accountants and parties involved in economic activitiesowners, governmentsas one of the activities of worship.

Al Qur'an on an-Nisa? verse 58 explains that understanding every activity related to economic activities as a form of worship is quite difficult for Islamic society because of the paradigm taught by capitalist economics that every economic activity carried out with auditors, accountants or the other party is transactional and contains the monetary value.Furthermore, the objectives of sharia accounting can be explained in the following verse:

Unlike the quantitative approach in constructing the construction of Islamic accounting theory, the withdrawal of ideas into a concept is not done through observation of phenomena that have similar characteristics. The concepts that form Islamic accounting theory are obtained through the withdrawal of ideas based on the Qur'an and Hadith. It?s possible to define Islamic Accounting Theory as a collection of accounting concepts derived from Islamic values and used to explain and develop accounting practices.

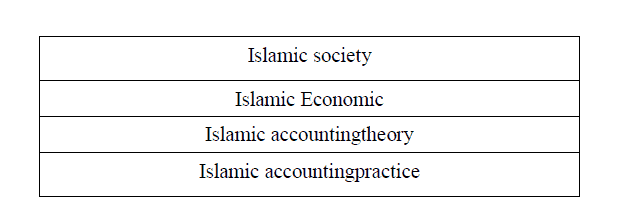

Position and Role of Islamic Accounting Theory

Accounting theory is very important for the development of accounting education, especially in quantitative research. Accounting theory is used to explain why accounting practices can occur. Therefore, sharia accounting theory is needed to explain sharia accounting practices which develop in Islamic financial institutions. Position of the Islamic accounting theory is explained in the chart of Islamic accounting concepts. The construction of sharia accounting is born from the cultural values of the Islamic community as a manifestation of the application of monotheism which is realized and practiced in all aspects of life, including socioeconomic life. Islamic accounting is the social construction of Islamic society in the application of Islamic economics is a sub-system of the Islamic economic system. To support healthy sharia accounting practices, it needs a healthy Islamic accounting theory.

Accounting theory is used to explain and predict accounting phenomena in a country. Islamic accounting theory is needed in the accounting system to separate between halal and haram transactions. The need for such an accounting system gave rise to various studies and studies on how accounting should be implemented in accordance with sharia, contrary to Islamic economic principles. Islamic accounting system is applied as part of the Islamic economy because Islamic accounting is able to sort out between halal and haram transactions (Mulawarman & Triyuwono, 2007). In general, sharia economics and sharia-based business have a unique characteristic of spiritual intelligence or what is called ukhuwah in Islam. This unique characteristic can be seen from the relationship, please help and trust. This unique feature is applied through a financing structure that is collateral-free and usury-free, as well as profit-sharing in the distribution system for the benefits of the financing.

Al-Qur'an on al-Baqarah verse 286 explains that the universal basic principle inherent in sharia accounting is the value of responsibility, justice, and truth. In accordance with verse:

“Allah does not burden any soul beyond its capacity. For him is the reward of his good deeds, and he is punished for what he earns. Our Lord, do not be of those who fear Us. Our Lord, do not burden us with a heavy burden as You have burdened those before us. Our Lord, do not burden us with that which we cannot bear. Forgive us, forgive us, and have mercy on us. You are our protector, so help us against the unbelievers."

The concept of responsibility is related to the concept of trust in every human activity. The implication of this concept in accounting is that everyone involved in business practices must take responsibility for the actions taken. Forms of written liability and actions in accounting are financial statements. Thus, Islamic accounting is a review of theory and practice to uphold Islamic economics but for practical reasons, namely efforts to free people from usury transactions.

Conclusion

This research succeeded in revealing a review Between the theory and practice of accounting in the Quran and Hadith which began with the need for Islamic banking accounting. With this research, The interpretation of events is expected to be possiblethat are relevant to the context of sharia accounting formation or to explain important matters which have not been explained and explain the historical reality of its fighters and spread the history of sharia accounting.

The history of sharia accounting standards starts from the vacuum of the accounting process felt by the management of the first sharia bank, Bank Muamalat Indonesia (BMI). Islamic accounting theory is part of sharia accounting practices that are guided by the Qur'an and Hadith. Islamic accounting theory is needed as a foundation in developing sharia accounting practices. An understanding of sharia accounting theory will encourage the development of accounting towards accounting practices that are in accordance with sharia principles based on the Qur'an and Hadith. Sharia accounting practices exist as answers to conventional transaction problems that are not in accordance with sharia values. Islamic accounting theory is needed to explain various basic assumptions which underlie sharia accounting practices in Indonesia and explain accounting practices that have been running in the development of sharia accounting in the future.

Conducting a journal review research with several related journal approaches is the difficulty in obtaining written data to support the research process and documents which describe the development process of accounting theory and practice discussions relating to the Qur'an and Hadith. Confirmation with the results of research that reveals documents related to Islam in the Muslim world is difficult to obtain and the rarity of research that focuses on a review of Qur'an and Hadith-based accounting theories and practices.

References

- Apriyanti, H. W. (2017a). Akuntansi Syariah: Sebuah Tinjauan Antara Teori Dan Praktik. Jurnal Akuntansi Indonesia, 6(2), 131–140.

- Apriyanti, H. W. (2017b). Perkembangan Industri Perbankan Syariah Di Indonesia : Analiasis Peluang DanTantangan. Maksimum, 1(1), 16–23.

- Faiz, I. A. (2014). Perekayasaan Kerangka Konseptul Akuntansi Dalam Pandangan Islam. ADDIN, 8(1), 81–106.

- Handayani, T., & Abubakar, L. (2017). Perkembangan hukum sektor jasa keuangan dalam upaya percepatan pertumbuhan ekonomi nasional. De Lega Lata, 2(2), 418–444.

- Hidayat, S. (2013). Penerapan Akuntansi Syariah Pada BMT Lisa Sejahtera Jepara. Jurnal Dinamika Ekonomi & Bisnis, 10(2), 167–179.

- Himawati, S., & Subono, A. (2013). Praktik Akuntansi Dan Perkembangan Akuntansi Syariah Di Indonesia. Akuntansi Syariah, 1–12.

- Ilahiyah, M. E. (2012). Pro Kontra Sistem Akuntansi Syariah Di Indonesia Terkait Konvergensi IFRS di Indonesia. Akuntansi Syariah, 1–24.

- Jannah, M., Fahlevi, M., Paulina, J., Nugroho, B. S., Purwanto, A., Subarkah, M. A., … Cahyono, Y. (2020). Effect of ISO 9001, ISO 45001 and ISO 14000 toward financial performance of Indonesian manufacturing. Systematic Reviews in Pharmacy, 11(10). https://doi.org/10.31838/srp.2020.10.134

- Juanamasta, I. G., Wati, N. M. N., Hendrawati, E., Wahyuni, W., Pramudianti, M., Wisnujati, N. S., … Umanailo, M. C. B. (2019). The role of customer service through customer relationship management (Crm) to increase customer loyalty and good image. International Journal of Scientific and Technology Research, 8(10), 2004–2007.

- Kariyoto. (2014). Akuntansi Syariah Dalam Persepektif Teori Dan Implementasinya. Jurnal JIBEKA, 8(2), 19–26.

- Luwihono, A., Suherman, B., Sembiring, D., Rasyid, S., Kalbuana, N., Saputro, R., Prasetyo, B., Taryana, T., Suprihartini, Y., Asih, P., Mahfud, Z & Rusdiyanto, R. (2021). Macroeconomic effect on stock price: Evidence from Indonesia. Accounting, 7(5), 1189–1202. https://doi.org/10.5267/j.ac.2021.2.019

- Masulah, S. (2014). Strategi Pengembangan Perbankan Syariah Di Indonesia. Akuntansi Syariah, 1–18.

- Masulah, S. (2014). Strategi Pengembangan Perbankan Syariah Di Indonesia. Akuntansi Syariah, 1–18.

- Maulana, B. H. (2017). Akuntansi Merdiban (Tangga): Sejarah & Praktek Akuntansi Islam Menuju Keadilan Dan Kepatuhan Illahiyah. Agergat: Jurnal Ekonomi Dan Bisnis, 1(1), 133–145. https://doi.org/10.22236/agregat

- Mulawarman, A. D., & Triyuwono, I. (2007). Reknstruksi Teknologi Integralistik Akuntansi SYari?ah : Shari?ate Value Added Statement. Jurnal Akuntansi Dan Keuangan Indnesia, 4(2), 1–24.

- Mustain. (2013). Etika Dan Ajaran Moral Filsafat Islam: Pemikiran Para Filosof Muslim Tentang Kebahagiaan. Jurnal Studi Keislaman, 17(1), 191–212.

- Muzahid, M. (2009). Kerangka Konseptual Akuntansi Konvensional Dan Akuntansi Syariah. Accounting, 1–15.

- Napier, C. (2009). Defining Islamic Accounting : current issues , past roots. Accounting History, 14(1), 121–144. https://doi.org/10.1177/1032373208098555

- Prabowo, B., Rochmatulaili, E., Rusdiyanto, & Sulistyowati, E. (2020). Corporate governance and its impact in company?s stock price: case study [Gobernabilidad corporativa y su impacto en el precio de las acciones de las empresas: Estudio de caso]. Utopia y Praxis Latinoamericana, 25(Extra10), 187–196. https://doi.org/10.5281/zenodo.4155459

- Prasetyo, I., Aliyyah, N., Rusdiyanto, Tjaraka, H., Kalbuana, N., & Rochman, A. S. (2021). Vocational training has an influence on employee career development: a case study indonesia. Academy of Strategic Management Journal, 20(2), 1–14. Retrieved from https://www.abacademies.org/abstract/vocational-training-has-an-influence-on-employee-career-development-a-case-study-indonesia-10418.html

- Raharjo, K. (2010). Filosofi Akuntansi Syariah Dalam Praktek Transaksi Lembaga Keuangan Islam. Akuntansi Syariah, 1–16.

- Rivai, H. amali, Lukviarman, N., Syafrizal, Lukman, S., Andrianus, & Masrizal. (2017). Identifikasi Faktor Penentu Keputusan Konsumen Dalam Memilih Jasa Perbankan: Bank Syariah vs Bank Konvensional. Center for Banking Reserch (CBR), 1–17.

- Rusdiyanto, Agustia, D., Soetedjo, S., & Septiarini, D. F. (2020). The effect of cash turnover and receivable turnover on profitability | El efecto de la rotación de efectivo y la rotación de cuentas por cobrar en la rentabilidad. Opcion, 36(Special Ed), 1417–1432.

- Rusdiyanto, Hidayat, W., Tjaraka, H., Septiarini, D.F., Fayanni, Y., Utari, W., … Imanawati, Z. (2020). The effect of earning per share, debt to equity ratio and return on assets on stock prices: Case study Indonesian. Academy of Entrepreneurship Journal, 26(2), 1–10.

- Sari, N. (2014). Akuntansi Syari?ah. Khatulistiwa, 4, 28–44.

- Sawarjuwono, T., Basuki, & Harymawan, I. (2011). Menggali Nilai, Makna, dan Manfaat Perkembangan Sejarah Pemikiran Akuntansi Syariah di Indonesia. JAAI, 15(1), 65–82.

- Sumarno, M. S. (2014). Perlakuan Akuntansi Zakat Pada Badan Amil Zakat (Studi Kasus Pada Badan Amil Zakat Kabupaten Sidoarjo). Akuntansi Syariah.

- Supangat. (2017). Pelaksanaan Shalat Kusyu? Ditinjau Psikologi Kepribadian. Jurnal Pendiddikan Islam Al I’tibar, 3(1), 74–94.

- Susanto, H., Prasetyo, I., Indrawati, T., Aliyyah, N., Rusdiyanto, R., Tjaraka, H., Kalbuana, N., Rochman, A., Gazali, G & Zainurrafiqi, Z. (2021). The impacts of earnings volatility, net income and comprehensive income on share price: evidence from Indonesia stock exchange. Accounting, 7(5), 1009–1016. https://doi.org/10.5267/j.ac.2021.3.008

- Suwiknyo, D. (2007). Teorisasi Akuntansi Syari?ah di Indonesia. Jurnal Ekonomi Islam, I(2), 211–227.

- Zulfayani, A. (2019). Dual Accountability: Manifestasi Akuntabilitas Dompet Dhuafa Sulawesi Selatan. ACCOUNTIA: Accounting, Trusted, Inspiring, Authentic Journal, 3(1), 319–330.