Research Article: 2021 Vol: 20 Issue: 6S

Islamic Banking System of Pakistan: Comparison between Perception and Experience

Soha Khan, Prince Mohammad bin Fahd University

Asma Zeeshan, Bahria University

Azeem Gul, National University of Modern Languages

Syed Arslan Haider, Sunway University Business School (SUBS), Sunway University

Abstract

Islamic banking has grown rapidly in the past three decades with its existence in more than 75 countries globally. The banking system litigates itself to be following Sharia law in its true sense, which is questioned by many religious scholars. This paper follows a qualitative approach to find out the differences of perceptions of Islamic banks and their experiences from two perspectives i.e., customers of Islamic banks and managers of Islamic banks. Our analysis suggests that there exists a difference between what people see Islamic banks are and what they experience. This gap is growing and calls for Islamic banking system to take measures in order to grow their banking system further.

Keywords

Islamic Banking, Perceptions, Experiences and Sharia Compliance

Introduction

Realization of the fact that Conventional banking uses interest-based system which is prohibited in Islam, gave birth to informal Islamic banking which was based on the Islamic law. Towards the formalization of Islamic banking system in mid 1940s, the first unsuccessful attempt was made to establish a Riba-free bank in Malaysia after which in late 1950’s an Islamic bank made its way to Pakistan and was successful in offering interest free loans. After which an interest-free lending system was introduced in India in late 1960’s (Erol & El-Bdour, 1989). New developments in terms of Islamic products offered and their Sharia compliance has been taking place throughout these six decades and innovations are still witnessed. The fame of Islamic banking led international Conventional banks to open an Islamic window as to capture maximum market as development of Islamic banks in more than 75 countries has brought a significant contribution in Islamic as well as non-Islamic economies (Kassim, 2016).

Apart from the global growth of Islamic banks, its utter compliance with Islamic Law in many of the products offered is still questionable, where some call it a mere change of names and according to few the asymmetry in information is faced by both Conventional as well as Islamic banks regardless of their nature of operations, making it difficult to distinguish between the two and there exists no significant difference between the two types of institution, minor differences are though observed (Kuran,1993; Subaigio, 2015; Sun et al., 2016; Wulandari, 2015). Whereas one of the few advocates of Islamic banking like Ahmad (1993) presented that similarity between the two types of banking was a phase in the development of Islamic banking which is slowly diminishing with Islamic banks bringing unique products that are totally Sharia compliant.

With these varying views, Controversies among definition and interpretation of Riba in Quran and Sunna still exist and it has given birth to different main stream believers (Caerio, 2004; Noorzoy, 1982; Salleh et al., 2012). Like questions raised by different Islamic scholars, many of the customers of Islamic banks are unaware of the method of calculation for base rates and queries like the similarity of base rate between Conventional and Islamic banking which in case of Pakistan is KIBOR (Karachi Inter Bank offered Rate) are also raised. This has created a need to investigate what customers perceived Islamic banking is and what are their experiences with it. The paper attempts to find out familiarity of Pakistani customers of Islamic banks regarding Islamic banking, their understanding of Sharia law, the compliance of Islamic banks with Quran and Sunna as per their experiences and their views about future of Islamic banking. To depict both sides of the story, views of bank managers are also part of the study.

Literature Review

Islam encourages trade and prohibits money on money (interest). As according to the religion interest gives a fixed return to the lender enabling the lender to get sure return and so putting the entire burden on the borrower (entrepreneur) who is uncertain about the profits/losses he will be incurring in future. So as to share the risks between the two parties Islam discourages sure gains and encourages profit and loss sharing (Ayub, 2002; Kuran, 1993; Erol & El-Bdour 1989) investigated the perception of customers about Islamic banks in Jordan using univariate and multivariate statistical techniques and found that shifting to Islamic banking is more peer driven than religious inspiration. Also, that the customers are well aware of the profit distribution and their withdrawals do vary with respect to announcement of Islamic banks about their increase/decrease in profits. On the contrary in Malaysia people are more concerned about the reputation of a bank, its Sharia compliance and prices of the products (Dususki & Abdullah, 2007).

Malaysia, being a developed Islamic State, has been experiencing Islamic Banking for quite a time now. In Malaysia, not just Islamic Banks but also Conventional Banks are also offering numerous Islamic Banking products. Osman, et al., (2009) carried out a study regarding customer satisfaction in Malaysian Islamic Banking using the CARTAR Model (Compliance, Assurance, Reliability, Tangibles, Empathy and Responsiveness) and found that Islamic Banks in Malaysia really need to focus on service quality and offer wide variety of products to compete against Conventional banks. It is also found to be similar with the study of Hosseini, et al., (2011) conducted in Iran and found that customer satisfaction is directly related with service quality. These studies corroborate with the findings of other investigations (Arasli et al., 2005; Othman & Owen, 2001; Parasuraman et al., 1991, Parasuraman et al., 1988).

Amin, et al., (2013) examined that Muslim customer in Malaysia have a high level of trust level on Islamic Banks and their products due to the fact that they believe them to highly Sharia compliant. (Kishada & Wahab, 2013). Islamic Banking Staff needs to be more focused on customer satisfaction and service quality to ensure customer loyalty to grow the Islamic Banking. A study conducted in Turkey concluded that if the customers do not entrust over the Sharia compliance of the Islamic banking Industry, they are never satisfied (Okumus, 2005) regardless of the fact that the reasonable majority of the customers being well educated personnel. They are also ignorant of a few key Islamic banking products which is a clear indication of low level of customer awareness.

Pursuant to study of Amin, et al., (2013) in Malaysia, study conducted in Bahrain adds that Islamic savings and investing products are more popular amongst that customers then Islamic financing products (Metawa & Almossawi, 1998). The study also reveals that the prime factor for selection of any Islamic Bank is religious beliefs as being Sharia Compliant followed by the rate of the return. Pakistan has a slightly different scenario when it comes to selecting an Islamic Bank, out of a few available, they select on the customer service and product features rather than religious beliefs and compliance with Sharia of these banks (Awan & Bukhari, 2011). Multiple studies corroborate with these findings (Ahmadet al., 2010). Customers in Pakistan are also aware of the available products by Islamic Banks but have doubts regarding their compliance with Islamic Sharia due to which they don’t end up buying those (Khattak & Rehman, 2010). Researches in Pakistan have highlighted the confusion in users of Islamic banking and has led researchers to investigate more about the difference between perception and reality, this study is unique in a way that it picks a qualitative approach towards the problem. As with quantitative studies, detailed views of customers and in depth understanding of the phenomena is not possible.

Methodology

Sample and Data

The initial sample included 25 individuals from Islamabad and Rawalpindi out of which 15 were customers of different Islamic banks and 10 were managers of different Islamic banks. The banks included in the study were Meezan bank, Dubai Islamic bank, Faysal bank, Alfalah bank, Askari bank, Standard Chartered Sadiq, UBL Ameen, and MCB Bank. Sampling was done using convenience sampling. The only difference between the banks was whether they are Conventional or Islamic, no discrimination was made on the basis of any other factors e.g., date of inception, number of branches, number of customers and type of accounts maintained. The subjects were sent an email introducing them with the project and requesting them about their availability for interviews. Out of 25, only 5 customers and 4 managers responded and showed their interest. They were then asked about the place of interview assuring them about the confidentiality of the information shared and no disclosure of their identities, to bring confidence in them and encourage them to speak out. The customers and managers were also asked to forward the interview guide to Islamic bank customers/managers they know.

Interviews

Qualitative approach was considered suitable due to the nature of the study which requires detailed views of subjects (Cassell & Symon, 1994). The interviews were semi structured. Two separate interview guides were prepared, one for customers and one for managers. Each guide had two sections, made using standard techniques of semi-structured interviews (Kvale & Brinkmann, 2015). In the first section interviewees were asked about the demographic details, employment status, position in house hold, type of accounts maintained with Islamic and Conventional banks. In the second section individual views about Islamic banking were asked for example, knowledge about Sharia compliance, satisfaction with their banking, challenges of Islamic banks and their opinion about status of Islamic bank as Conventional banks etc. Questions included were, ‘What do you know about the practice compliance with Quran and Sunna?’, ‘How do you compare performance of your Islamic bank with conventional bank?’, ‘Do you think there is a criticism faced by Islamic bank? What is your opinion?’, ‘Do you think Islamic bank is another name for Conventional bank?’ Similarly probing questions were also asked. The questions from managers included different products offered to customers, knowledge of customers about all the products offered, standing of their bank in Sharia law etc.

The interview lasted between 15-25 minutes, conducted at the pre decided places i.e., few of them were conducted at the offices of customers and managers whereas some took place at outside settings. The final sample included 14 interviews from 6 managers of Islamic banks and 8 customers of Islamic banks. The interviews were recorded and detailed field notes were also taken, the first five interviews from customers and managers were transcribed from the recordings, however the files of last 4 interviewees were made from the detailed field notes taken during interviews. Respondents were given unique names for better analysis as ‘C1-70-M’ means customer 1 with an age of 70 years and a male, similarly for managers, letter M was used instead of letter of C.

Data Analysis

The paper follows basic thematic analysis approach which is widely used in many qualitative studies. A thematic analysis is a method of categorizing, unifying and conveying meanings to patterns seen in a systematic way from the data set (Rice & Ezzy, 1999). At first the transcripts were imported into NVivo and coding was done using basic themes and concepts identified from the transcripts into an ordinal structure (Strauss & Corbin, 1998). Basic themes and concepts were identified from reading the transcribed files. At first the main areas of discussion were identified from the transcripts and then they were allied with first order codes e.g., Respondents describing how they came to know about Islamic banks, was grouped under the code of ‘Knowledge about Islamic banking’. Similarly, the same process was carried out to group all similar topics of discussion under one major group. Transcripts were reviewed to ensure fitting of each data item in the respective node. It was an iterative process as frequent movement between developed nodes and transcripts was made. Themes were refined after reading and re-reading. In total thirteen themes were made.

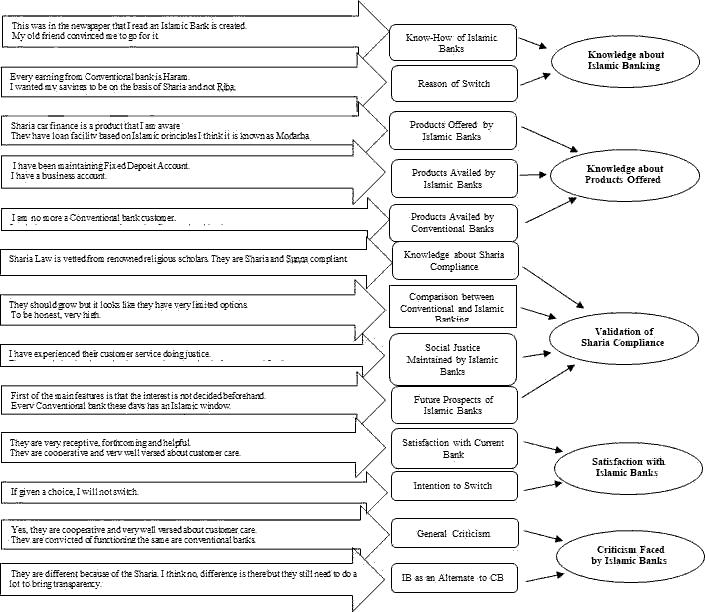

Once the first order nodes were made, the nodes were analyzed to see how many of them can together form a group. So e.g., products/services offered by Islamic Banks, products/services availed by Islamic banks and products/services availed by Conventional banks were coupled under the code of ‘Knowledge about products/services offered’. Similarly, all the first order themes were attached with major themes. The five major dimensions were (1) Knowledge about Islamic banks, (2) Knowledge about products offered, (3) Validation of Sharia compliance of Islamic banking (4) Satisfaction with Islamic banks and (5) Criticism faced by Islamic banks. The sub codes of each theme were: in knowledge about Islamic bank; know-how of Islamic banks and reason of switch were attached, under the code of knowledge of products offered; products offered by Islamic banks, services availed from Islamic banks and services availed from Conventional banks were added. Similarly in validation of Sharia compliance; knowledge about Sharia compliance, comparison between Islamic banks and Conventional banks, social justice and future prospects of Islamic banks and were added, satisfaction with Islamic banks had sub codes of current satisfaction and intention to switch and in criticism faced by Islamic banks took the sub codes of general criticism and Islamic banks as alternate to Conventional banks. They were again re-read to ensure appropriate relation of first order themes with their subsequent main orders. Figure 1 gives the details of arrays and the coding structure.

The summary of demographics is given in Table 1. Interviews were taken from Muslim customers and managers.30% of the total customers interviewed was female. The interviewees fell in the income bracket of Rs 50,000 and above. More than 70% customers and 60% managers interviewed were married with an age group of less than 50 as shown in Table 1.

| Table 1 Summary of Demographics |

|||

|---|---|---|---|

| Main Category | Sub Category | Percentage- Customers | Percentage- Managers |

| Gender | Male | 70% | 80% |

| Female | 30% | 20% | |

| Religion | Islam | 100% | 100% |

| Other religion | 0% | 0% | |

| Income bracket | <Rs.50,000 | 20% | 20% |

| Rs.50,000- Rs.100,000 | 70% | 60% | |

| >Rs.100,000 | 10% | 20% | |

| Locality | Urban | 100% | 100% |

| Rural | 0% | 0% | |

| Age | >50 | 90% | 100% |

| <50 | 10% | 0% | |

| Marital Status | Single | 30% | 40% |

| Married | 70% | 60% | |

| Position in household | Breadwinner | 50% | 40% |

| Secondary | 50% | 60% | |

Findings

Knowledge about Islamic Banks

Knowhow of Islamic banks

In light of the facts gathered as a result of interviews, it can rightly be said that in comparison to commercial banks, Islamic Banks failed to reach the vast consumer base. There is a gap left unfilled by Islamic Banks since Islamic banks have not been able to create awareness as to their positioning, products and services. More importantly as to how these Islamic Banking products vary from conventional banking products. The marketing skills to showcase their financial products they have used have not been as successful as they should have been.

Majority of the consumer base of Islamic Banks is free from any external influence i.e., these are volunteer customers who have researched about Islamic Banks and due the concept of Riba free banking they have joined Islamic Banks. Their affiliations with Islamic Banks have nothing to do with how Islamic Banking products have convinced or attracted them towards Islamic Banking. The findings can further understand by the fact that most of the Islamic Bank accounts are opened either due to peer pressure or due to the payroll company accounts. Islamic banks failed to create awareness amongst masses to attract true, more and genuine customers which has resulted in their defeat against conventional banks.

Reason of Switch

Islamic banking is a banking system primarily created for Muslims who want to escape conventional banking as their religion forbids interest and still, they want to have a substitute that they can count on so that they can also enjoy the services that conventional banks are offering like interest on fixed deposits. So, the respondents of the study, Muslims, mentioned it explicitly that in a try to escape interest, they have opted Islamic Banks. One of our respondents said:

It is ALLAH’s commandment to support good and piety in the society so that is when I knew about Islamic Banks due to which I felt compelled to go to those banks and in order to support this new system which is an alternative to normal interest system. This is why I switched to Islamic Banks (C1-70-M).

The study found that the respondents resorted to Islamic Banks for Savings and Business accounts that involve profits or in other word interest. On other hand, respondents were indifferent when it was to be decided for current or salary account as the accounts didn’t involve any dealings with profits or in other words interest. This aforementioned quote clearly indicates that due to religious believes consumers are switching from conventional banking system. It is further second by another respondent who said:

The main reason was… the earnings of banking sector are Haram even if you work for that banking Sector, every earning from there is Haram. The interest and the all money you take from an investment is Haram. It’s of great concern but now a days you can’t live away from Banking. You have to be a part of it somehow. The introduction to Islamic banking lead me to be an Islamic Banking customer and I truly believe it is going to grow higher in Pakistan. While living in UK, I witnessed everyone having accounts in Commercial Banking, but I believe Bank al Habib was the one which started Sharia Compliant banking there. And when I was leaving UK, I heard that other banks are also trying to adopt Islamic banking to attract the customers that made my decision easier (C2-36-M).

But in addition to religious concerns, study found evidence for another factor for switching i.e., payment and return on loan. Islamic banks offer loan on relatively lower returns and also their repayment schedule is easy and convenient and this is also one of the reasons why consumers opt for Islamic banks. As mentioned by one of the respondents of the study that, “I needed a loan which I wanted to be Riba free return, moreover the terms of payment were easy and I was comfortable with them” (C5-38-M).

Most of the customers were observed to have kept savings account with Islamic banks due to its profit-sharing return, as highlighted by the same respondent, “I received a handsome amount of loan and it was easily given to me on Islamic basis which satisfied me” (C5-38-M).

Study of reasons to opt for career in Islamic banks unveiled that the managers decided to have a career with Islamic banks because they are offering comparatively better opportunity to learn and grow as compared to Conventional banks. The interviews with the managers make it clear that their decision of staying with Islamic Bank has not been influenced by their religious beliefs or the philosophy and codes followed in Islamic banks in any way. As said by a respondent of this study, "I shifted because of better opportunity" (M3-30-M). In case of managers at Islamic Banks, the way their company earns profit has no bearing over their choice for career.

Knowledge of Products Offered

Products Offered by Islamic banks

It has already been noted that Islamic Banks have not been successful in creating awareness in comparison to conventional banks but even the knowledge that consumers have as to the products and services of Islamic banks is quite insightful (Haider & Kayani, 2020). The interview aimed at finding out the level of information consumers possess as to the product and services offered by the Islamic banks in general and about the services they are availing. Consumers’ response show that they only know about the services they are using and apart from that they have no knowledge of the products and services offered by the Islamic banks. Products and services offered by the Islamic Banks appeared poor rather it can be said that their knowledge was limited to the extent of the services they have availed.

Products/Services Availed From Islamic Banks

The level of understanding about Islamic Banking products and services can be easily understood by a respondents’ statement during the interview, “They have loan facility based on Islamic principles I think it is known as Modaraba and Musharika, other than that I get free cheque books, statements, plus online banking etc. and some other things” (C3-25-F).

The interview with the managers also supports the finding presented above i.e., the consumers lack knowledge about the products generally. The managers mentioned a number of products about which they believe that the consumers have no knowledge about, “Home Musharkah (for buying, construction, renovation of private residential real estate/property and balance transfer facility), Ijarah Bin Sayyarah (Islamic Car Leasing for both new and used, locally manufactured/imported vehicles), Murabaha, Muswamah, Ijarah, Salam, Istisna and Islamic Export Refinance” (M5-33-M).

On the contrary, managers also admitted in their interviews that the consumers are majorly opting for saving account that offer them return in form of profit sharing.

Products/Services Availed from Conventional Banks

Majority of the customers when asked about the type of accounts maintained with Conventional banks replied that they only keep current accounts or salary accounts with them. Except one customer who used car finance, respondents were seen to have shifted to Islamic banking especially in the case of fixed deposit accounts.

Validation of Sharia Compliance of Islamic Banking

Knowledge about Sharia Compliance

It has been mentioned earlier that the respondents, Muslims, looked unto Islamic banks as their aidto help them escape Riba. During interview, questions were asked to gauge the level of satisfaction of the consumers regarding their assessment of how compliant Islamic bank is to Sharia. The questions aimed at finding the degree to which they believe the Islamic banks are adhering to the principles of Quran and Sunna.

The respondents have diverse opinions as to their assessment of the Islamic Banks on basis of compliance. On one hand, some of the respondents were well aware of what Sharia compliance is and how it is incorporated in the working of the banks to ensure compliance and satisfy the spirit of creation of Islamic Banks while on the other hand some of the respondents lacked clear understanding and were confused.

The most interesting dimension of the findings for gauging consumers’ assessment of Sharia compliance is that a number of consumers are indifferent as to the level to which Banks are adhering to the rules of Quran or Sunna. They believe that going for a bank that has the title of Islamic Bank is enough to satisfy them that they are using product that is Sharia compliant and the profit they shall be earning will not be Haram. At the same time, a number of respondents admitted that they are quite aware that Islamic bank complying to Sharia ideally is only possible in an ideal world and in a world where Conventional Banking dominates the banking system, it is not possible to have a Sharia complying Bank.

According to a respondent of the interview:

I have heard that in order to defeat the provision of a fixed rate, the Islamic banks have a model of sharing profit and losses and there exists regulations that ensure that dealings of the Islamic bank comply Quran and Sunna. But in reality, I am a believer that all these things are merely subjective concepts for differentiating between Conventional and Islamic banks and in fact there exists no policy for making Islamic model purely Sharia compliant. (C6-24-M)

Furthermore, about Sharia Law, a few consumers are also aware of Sharia Board which ensures that the bank is being governed by a Sharia Law. We have found very few of the respondents beholding this information. An aware respondent was saying that:

The basic feature is that each one of these banks have a Sharia Law. Sharia Law is vetted from renowned religious scholars. And if some bank has a Sharia Law which audits and checks the transactions in order to streamline them according to the Sharia. Due to this I think that the customers’ responsibility is over and those Sharia Law are reassuring for the people to go to the Islamic Banks (C1-70-M).

Well informed managers who understand how banks work and the way banking system operates, asserted explicitly that system cannot be purely Sharia Compliant. When Islamic Banks have to work in a system dominated by Conventional Banks, there are few things that don’t adhere to the rules set forth by Quran and Sunna but still they cannot escape or bypass them. For example, base rate has to be used for the calculation of mark up and it is used in Conventional banks but Islamic banks have to do the same. Moreover, almost all of the bank’s use KIBOR (Karachi Inter Bank offered rate) which again defies Sharia as it is not interest free.

Seconding the above statement, a respondent said, “Islamic Banking is an emerging concept in Pakistan and their practices are not based on Quran and Sunnah and bankers have introduced new ways or systems (miscellaneous) to mold Islamic banking into more like Conventional banking for greater profit” (M6-26-M).

Comparison between Conventional and Islamic Banks

According to this study, customers had mixed opinions about the different between Islamic and Commercial (conventional) banks. Many customers know the difference between Islamic banks and Conventional bank, whereas few are observed to be satisfied by only the fact that Islamic banks call them Islamic and they are not interested to explore the differences between the two types of banking. These consumers are ignorant to explore the reality if these banks are actually Sharia complaint or not, “Well I cannot answer this question, all I know is my bank is Riba free which is a big satisfaction for me, other than that their service is as good as conventional bank” (C8-51-M).

On the contrary the well aware consumers have a firm understanding of the principle operating behind the Islamic banks and are satisfied with a clear understanding of Islamic bank operations and mechanism. According to a satisfied consumer of Islamic bank:

First of the main features is that the interest is not decided beforehand. Interest is decided every month by the Head Office of the Islamic Bank depending on the amount of profit that they have earned somewhere and then that is distributed. Profit is shared between the bank and the customer and the rate is different every month. Secondly in case of loss, if it happens, as a client, I am supposed to share it. And I have never suffered any loss with the bank so far. The bank deposits th the monthly profit to my account and that comes from the head office by the 10 of every month. (C1-70-M)

There are those consumers as well who are skeptical about the operating mechanism of the Islamic Banks. They categorize them as equal and being performing equally well. According to a respondent of this study, “…I have been reading news of Islamic banks progressing far better than Conventional counterparts; with respect to my personal experience, they are performing at least not lesser than Conventional ones” (C3-25-F).

It was also observed that people have opened accounts of banks which have Conventional as well as Islamic window, but according to them there is difference even with in different Islamic banks. According to one respondent:

We cannot give a general comment on just the type of bank, every Conventional bank these days has an Islamic window, so we can’t say its Conventional version is better. But on the whole, I have had experience with more Islamic banks other than Meezan bank and I am totally disappointed from other banks, however I am very satisfied with Meezan bank and its mechanism of operations. (C6-24-M)

These consumers have better understanding of how both Conventional and Islamic banking system operate in parallel. And it is quite evident for aforementioned quote, that there is a difference between the practices of the Islamic banks themselves. Then there is another important factor highlighted that there are certain banks who are operating simultaneously as Conventional and Islamic banks. They are confusing the consumers more and giving rise to an ambiguity which is the basis of this study as are the Islamic banks really compliant to Islamic Sharia or not.

Social Justice Maintained by Islamic Banks

Islam as a religion has emphasized a great length on social justice. Islamic banks consequently should have a strong focus on social justice. Interviewees were asked about the social justice their bank has maintained and what other aspects do they think Islamic banks have to work on in order to gain a social status. According to one respondent, “Yes, it does. I cannot recall a specific incidence; however, I have experienced their customer service doing justice as compared to Conventional banks when visited occasionally” (C7-34-F).

The aforementioned statement gives an overview that a reasonable amount of consumers aren’t entirely aware of the social justice system that Islam preaches, which should be by default a part of the governing Islamic Banking. They are only considering customer services to be a social justice. Another respondent said that:

I have good relationship with the manager on my bank. Other than that I do not know much about how they work. But he greets me very well. So, I think being nice to your customer is also part of social justice. Other than that, I cannot comment (C2-36-M).

There are also a few customers who are found aware of the term social justice and know how much an Islamic Bank should value and incorporate it in its practices. A few customers saw Islamic banks adopting an Islamic way of doing business so they not only expect good services butalso return to the society as well. Another respondent said that, “Yes I think, being a Riba free bank the whole idea is to distribute wealth evenly, although we need a bigger system in which everybody plays their part, but atleast my bank is doing its part” (C4-51-M).

Aforementioned quote illustrates that interest that Islamic Banking customers foresee and expect from an Islamic Bank. But the ratio of respondents to this section of the interview indicates that there is a gap that needs to be filled by Islamic Banks in educating its existing and potential customers about social justice.

Managers thought social justice could not be maintained as none of the entity is working for welfare; they are there to earn profits and not only earn profits but maximize profits as much as their counterparts’ i.e., conventional banks. If they want to survive in a competitive environment, they have to offer products that give them almost same returns if not more. A respondent from Managers ‘Interview said that, “…banks always lend someone based on lender’s assets and funds and in return receive double e.g., principle amount plus markup. No bank is ready to lend someone who does not have any equity” (M6-26-M). This statement raises a moral and ethical dilemma between practices of Islamic Banks and raises a question on Sharia compliance of these Islamic Banks.

Future Prospects of Islamic Banks

Islamic banks have come a long way since their inception. A variety of respondents have vowed for the bright future of Islamic banks. They witness Islamic banks gaining recognition and rapidly growing. The services offered by Islamic banks are so popular that their fame is not limited to Islamic states only but is widespread globally. According to a respondent of the interviews:

Well in my line of business I interact with a lot of other businessmen I think which I have noticed is that a lot of them have switched to Islamic banking which shows that this industry is growing, so I think it has a good future. (C8-51-M)

Awareness of Islamic banking amongst business men and them adopting is a very positive sign for Islamic banks. This statement was also second by another respondent by saying, “I think the trend toward Islamic banking is growing not only in Islamic states but overall and people have started to shift from Conventional to Islamic banking as it is convenient and less risky” (C5-38-M). Consumers today are becoming smart, educated and have starting weigh more factors than their predecessors.

The study respondents have also emphasized about the Islamic banking products and their compliance with Islamic Sharia. A respondent said that:

People like me who are very concerned about their earnings and savings and especially concerned about how these are being used and whether they are Islamic or not, so I think in future there will be more trend towards Islamic banking which is already seen to be growing. (C7-34-F) Consumers have started to look into the directions prescribed by basic Islamic principle and have started to follow the way to all known Islamic Sharia principles along with their social justice.

There were few respondents who thought commercial banks have gained more business than Islamic banks due to more options available. Regardless of the fact, people still think that Islamic banks have potential. As said by one of the respondents:

They should grow but it looks that they have very limited options for commercialization and for investing money in various projects. So that is the very reason they are not succeeding compared to the commercial banks. But if people adopt Islamic Banking, I think there would come a time there would be no commercial bank left and everyone would be doing Islamic Business (C3- 25-F).

In order to clear ambiguities regarding Sharia Compliance and authenticity of Islamic banking system in Pakistan, different ideas were highlighted by the respondents. One of the respondents said that, “First of all, they should be put to test by the learned scholars of the country. And this institution of Islamic Council, should do it” (C2-36-M), which will provide a third-party assurance and audit to authenticate the compliance of Islamic banks with Sharia.

Satisfaction with Islamic Banks

Satisfaction with Current Bank

Satisfaction is the fulfillment of expectations from a specific thing. Customers were investigated about their satisfaction level with Islamic banks as to find out customers with salary account in Islamic banks were found to be less concerned about the type of bank as the salary accounts are maintained with the employer and the interaction with the customers is very limited. Another reason of no concern observed was that customer of current or salary accounts have not availed any interest-bearing services or products so they were indifferent among the two types. In comparison, customers having saving accounts or ones who have availed any profit sharing services from Islamic banks showed their interest and satisfaction from banks. As said by a respondent that,“As soon as my job with the company was over, I again shifted to my Conventional bank.” (C6-24-M).

There were few examples where customers were satisfied to one Islamic bank and not the other due to either the services they offer or the renowned scholars they have on their board as said by a respondent:

As I have mentioned I opened a parallel account with another Islamic bank and my experience was pathetic, I opened the account because that was my salary account. They do not have any defined SOPs or at least the managers are not well aware and they do not treat their customers well (C5-38-M).

Intention to Switch

Satisfied customers are very loyal to Islamic banks. According to a respondent, “I have heard more about Dubai Islamic bank from my father and he is very satisfied, so if I will ever switch, I will switch to Dubai Islamic bank which is also an Islamic bank” (C7-34-F). Further this argument was second by another respondent stating that:

There are other banks but I will stick to it, I did not open account for materialistic purposes I opened account in this bank because Mufti Taqi Usmani endorsed it, I follow him, that is why I opened a bank account here. I trust his Islamic interpretations. So it is matter of belief not a matter of profit. (C8-51-M)

Criticism Faced by Islamic Banking

General Criticism

The concept of Islamic banking is although not new to Islamic states but to find out whether Islamic banks are welcomed and whether they portray a Sharia standing in front of customers, respondents were asked about the criticism faced by of Islamic banks. They mentioned that the main criticism faced by Islamic banks is their mechanism of working which is not significantly different from their Conventional counterparts:

They are convicted of functioning the same as Conventional banks. However, they rename the products to resemble Islamic terms. An example is car Ijarah scheme. Since their car rental is fixed and is termed to be the same as monthly interest (C2-36-M).

Due to this customer expect Islamic banks to bring transparency in disclosing their mechanism of working and calculating as one of the respondents said:

I think people like me who are not much sure about the mechanisms of calculation of profit sharing, question a lot about Sharia compliance of Islamic banks, which is I am sure not very clear to many people out there, so they have to answer how are they different from Conventional banks if they are. Moreover, they need to bring in transparency for clarity (C7-34-F).

Other than mechanisms of working, Muslims expect Islamic banks to follow all the guidelines given by Islam to run a Halal business. From customer dealing to employment opportunities and from Sharia compliance to social welfare, customers want Islamic banks to follow a proper religious path. It was witnessed that as Islam is a way of life not merely a religion, customers want Islamic banks to be Islamic in true sense, as one of the customers said:

I strongly believe that only by offering Sharia compliant products, the job of an Islamic bank is not over. They need to look into ethical aspects too … as Islam doesn’t only teach about Riba free saving but also about humanity and it is a way of living not just a product that is offered. (C5-38-M).

Managers responded differently to the question about criticism faced by Islamic banks, few were of the view that there is no criticism seen or observed for Islamic banking, rather its fame is spreading exponentially, as a manager believed,“…its just that there lack of awareness about Islamic Banking Products and Islamic Banks lack reach due to limited branch network” (M2-29-M), and another commented, “I believe that Islamic banking is growing very rapidly and in an Islamic country like Pakistan the future is bright and just Islamic banking needs a bit of exposure” (M1-28- M). Whereas some managers who said that the base rates used by Islamic banking is the Karachi Interbank Offered rate, which is used by Conventional banks, so in calculation of profit sharing the base rate used are on the basis of a fixed rate which is questionable:

The criticism most Islamic banks face is the rates they use i.e., KIBOR rates which are not Islamic and are used by Conventional banks. I think that KIBOR is just a benchmark for doing business in Islamic Banking as there are no such rates available for doing business. But just to promote Islamic Banking industry SBP is coming up with rates which are in true spirits going to be used in the banking industry, particularly by the Islamic Banks (M6-26-M).

Islamic Bank as an Alternate to Conventional Bank

This has been challenged by many scholars and received quite a pronounced focus to whether Islamic banks are Islamic? Or they are merely another name for Conventional banks? The customers interviewed were strongly agreeing that Islamic banks are significantly different from Conventional banks and by no means should they be called as Conventional ones, “No, it is better, based on Islamic principles” (C3-25-F). Few who agreed that there is difference were confused about the declaration of their mechanism, so according to them there is a difference between Islamic and Conventional banks, but the Islamic banks are required to disclosure as in how they differ from regular banks, This will not only bring transparency but also attract many customers who are confused about the fact that whether Islamic banks are truly different from Conventional banks, “I think no, difference is there but they still need to do a lot to bring transparency” (C7-34-F).

Managers were seen to have different views, some were advocating Islamic banks as their unique identity, however few said it is just a change of names, their operations and everything is same as Conventional banks as one of the managers replied, “Not really, apparently it might look same however; in essence both are based on totally different frameworks” (M2-29-M). Another respondent said, “Conventional banking is quite different from Islamic banking, its rules and regulations are not based on Sunna” (M5-33-M).

Majority of the managers were against Islamic banks being known as entities following Sharia Law. They said that when the mechanism of operating, using of base rates and competitiveness of mark-up in Islamic banks are same as Conventional Banks, How can they have a separate identity. By changing their names to ‘Islamic banks’ and not practicing true sense of the religion, their system does not become Islamic. As one of the managers reported, “Yes, I believe both are same. Islamic banks are using fancy Islamic terms just to attract general public towards Islamic banking. Most of the banks are opening their Islamic branches due to State Bank of Pakistan’s regulations” (C6-26-M).

Discussion

Our goal in this study was to understand alliance or differences between perception of customers of Islamic bank regarding their Sharia standing and their experiences. In doing so, it came out that the findings are consistent with (Dususki & Abdullah, 2007; Kumru & Sarntisart, 2016), as majority of customers in Pakistan are well aware of that Quran and Sunna prohibits money on money (usury or interest) and encourages risk sharing in order to bring economic welfare in the society. As soon as customers got to know about Islamic banks from newspapers, family and their peers working in different Islamic banks, they withdrew their savings from Conventional setting and deposited their funds into Islamic banking in order to follow their religious beliefs. However, as given by Erol & El-Bdour (1989) there were very few customers who shifted to Islamic banking due to peer pressure.

Evidences provided from the outcomes agree to the past studies showing that mostly customers prefer keeping saving accounts with Islamic banks due to the profit and loss sharing which is allowed in Quran and Sunna, (Dususki & Abdullah, 2007). An important finding came out as a weakness of Islamic banks being unable to position their products, since many customers were unaware of products discussed by managers of banks that were offered by different Islamic banks. Their Conventional counterparts on the other hand have relied extensively on their marketing techniques to position their products and by keeping a good quality service they are successful in reaching customers, as witnessed by the findings of studies conducted in different countries like Malaysia and Iran (Hosseini et al., 2011; Okumus, 2005; Osman et al., 2009).

In finding out the knowledge of customers regarding Sharia Law and their understanding of mechanisms of working of Islamic banks, it came out that many customers do not know how Islamic banks work. Pakistani customers are though well aware of what their religion teaches them, what is allowed in Islam and what is prohibited, but they have not investigated how accurate Islamic banks are in light of Sharia compliance. According to them, Islamic banks do not indulge themselves in risky events, they prefer to invest in real economy as compared to their conventional counterparts, but they are unsure of how Islamic banks calculate basis for profit/loss sharing. These results are consistent with the studies of Kishada & Wahab (2013); Abedifar, et al., (2016). However many customers agreed that the major criticism faced by Islamic banks is the mechanism used in profit sharing which is still questionable as according to them Islamic banks have no policy to disclose how they device procedures to set the base rates. Although as mentioned earlier, very few customers knew the technicalities of banking system, however it was clearly witnessed that the concern to investigate is increasing. Customers thought if Islamic banks bring transparency in disclosing their mechanisms of calculating profits they can attract more customers as agreed by previous studies (Kishada & Wahab, 2013).

Apart from the raising concern of Sharia compliance, the general satisfaction level of customers from Islamic banks in Pakistan was seen to be high due to their service quality, customer relations and the trust that they are Sharia compliant as given by Kishada & Wahab (2013). In Pakistan, current customers of Islamic banks are mollified with the fact that Islamic banking exists and it is practiced, as they have an opportunity to invest their money on which the return they get will be Halal and that came out as the main reason of customers’ intentions to keep banking with their current banks and not to switch.

Bank managers on the contrary had erratic views. Where majority of customers were satisfied from the banking system, few managers agreed to customer views, however examples were found where managers explained weaknesses of Islamic banks in light of their standing as a Sharia compliant entity. Firstly, the mechanism of calculation was questionable, where the base rates used by Islamic bank is same as of Conventional banks, like in case of Pakistan it is KIBOR. Secondly, the sources of finance for Islamic banks are not interest free as they are no isolated from the money market, which is interest based. Thirdly, the benchmark fixed by Islamic banks is not interest free, also the ‘mark-up’ is as competitive as prevailing interest rate charged by any Conventional bank which is consistent with findings of Sun, et al., (2016); Wulandari & Subaigio (2015), who have given that there exists no significant difference between the two types of institution, minor differences are though observed.

Conclusion

The current study has brought new insights to the literature by doing a comparative study of managers and customers of Islamic banking about difference of perception and experiences. It came out that there is an oxymoron understanding seen between customers and managers of Islamic banks in Pakistan. Customers are satisfied with the current Islamic banking system, but they are concerned about how these systems work, managers on the other hand view Islamic banks as alternates to Conventional bank with no significant differences between the two except few minor differences. What is alarming is that the gap between what people sees Islamic banking is and what it actually is seen to increase in near future due to various ambiguities faced by customers. Managers are well aware of this fact and it is about time that Islamic banks should take measure to satisfy their customers regarding their Sharia standing and they should recognize the need to be governed by a separate financial system that is purely based on Sharia law.

References

- Abedifar, P., Hasan, I., & Tarazi, A. (2016). Finance-growth nexus and dual-banking systems: Relative importance of Islamic banks. Journal of Economic Behavior & Organization.

- Ahmad, A. (1993). Contemporary practices of Islamic financing techniques. Research Paper, (20).

- Alqahtani, F., Mayes, D.G., & Brown, K. (2016). Economic turmoil and Islamic banking: Evidence from the gulf cooperation council. Pacific-Basin Finance Journal, 39, 44-56.

- Amin, M., Isa, Z., & Fontaine, R. (2013). Islamic banks: Contrasting the drivers of customer satisfaction on image, trust, and loyalty of Muslim and non-Muslim customers in Malaysia. International Journal of Bank Marketing, 31(2), 79-97.

- Amin, M., Isa, Z., & Fontaine, R. (2013). Islamic banks: Contrasting the drivers of customer satisfaction on image, trust, and loyalty of Muslim and non-Muslim customers in Malaysia. International Journal of Bank Marketing, 31(2), 79-97.

- Awan, H.M., & Shahzad, B.K. (2011). Customer's criteria for selecting an Islamic bank: Evidence from Pakistan. Journal of Islamic Marketing, 2(1), 14-27.

- Ayub, M. (2002). Islamic banking and finance: Theory and practice. Published by state bank of Pakistan press. Karachi, Pakistan.

- Brinkman, S., & Kvale, S. (2015). Interviews: Learning the craft of qualitative research interviewing.

- Cassell, C., & Symon, G. (1994). Qualitative research in work contexts. Qualitative methods in organizational research: A practical guide, 1-13.

- Erol, C., & El-Bdour, R. (1989). Attitudes, behavior, and patronage factors of bank customers towards Islamic banks. International Journal of Bank Marketing, 7(6), 31-37.

- Estiri, M., Hosseini, F., Yazdani, H., & Javidan, N.H. (2011). Determinants of customer satisfaction in Islamic banking: evidence from Iran. International Journal of Islamic and Middle Eastern Finance and Management, 4(4), 295- 307.

- Haider, S.A., & Kayani, U.N. (2020). The impact of customer knowledge management capability on project performance-mediating role of strategic agility. Journal of Knowledge Management, 25(2), 298-312.

- Khattak, N.A. (2010). Customer satisfaction and awareness of Islamic banking system in Pakistan. African Journal of Business Management, 4(5), 662.

- Kishada, Z.M.E., & Wahab, N.A. (2015). Influence of customer satisfaction, service quality, and trust on customer loyalty in Malaysian Islamic banking.

- Kumru, C.S., & Sarntisart, S. (2016). Banking for those unwilling to bank: Implications of Islamic banking systems. Economic Modeling, 54, 1-12.

- Kuran, T. (1993). The economic impact of Islamic fundamentalism.

- Majid, S.A., & Kassim, S. (2010, August). Islamic finance and economic growth: The Malaysian experience. In Kuala Lumpur Islamic Finance Forum, Kuala Lumpur, 2-5.

- Metawa, S.A., & Almossawi, M. (1998). Banking behavior of Islamic bank customers: Perspectives and implications. International Journal of Bank Marketing, 16(7), 299-313.

- Mollah, S., & Zaman, M. (2015). Shari’ah supervision, corporate governance and performance: Conventional vs. Islamic banks. Journal of Banking & Finance, 58, 418-435.

- Okumus, H.S. (2005). Interest-free banking in Turkey: A study of customer satisfaction and bank selection criteria. Journal of Economic Cooperation, 26(4), 51-86.

- Osman, I., Ali, H., Zainuddin, A., Rashid, W.E.W., & Jusoff, K. (2009). Customer’s satisfaction in Malaysian Islamic banking. International Journal of Economics and Finance, 1(1), 197.

- Othman, A., & Owen, L. (2001). Adopting and measuring customer Service Quality (SQ) in Islamic banks: A case study in Kuwait finance house. International Journal of Islamic Financial Services, 3(1), 1-26.

- Parasoraman, A. (1991). SERVQUAL: A multiple item scale for measuring consumer perceptions of service. Journal of Retailing, 64(1), 12-40.

- Parasuraman, A., Berry, L.L., & Zeithaml, V.A. (1991). Understanding customer expectations of service. Sloan Management Review, 32(3), 39-48.

- Rice, P.L., & Ezzy, D. (1999). Qualitative research methods: A health focus, 720.

- Strauss, A., & Corbin, J. (1998). Basics of qualitative research: Techniques and procedures for developing grounded theory. Sage Publications, Inc.

- Sun, P.H., Mohamad, S., & Ariff, M. (2016). Determinants driving bank performance: A comparison of two types of banks in the OIC. Pacific-Basin Finance Journal.

- Wajdi Dusuki, A., & Irwani Abdullah, N. (2007). Why do Malaysian customers patronize Islamic banks? International Journal of Bank Marketing, 25(3), 142-160.

- Wulandari, D., & Subagio, A. (2015). Consumer decision making in conventional banks and Islamic bank based on quality-of-service perception. Procedia-Social and Behavioral Sciences, 211, 471-475.