Research Article: 2017 Vol: 16 Issue: 3

Islamic Perspective on Competence to Increasing Organizational Citizenship Behavior (OCB) with Knowledge Sharing Behavior as a Moderation Variable of Sharia Bank Employees in the Bangka Belitung Islands Province

Hamsani, Padjadjaran University

Ernie Tisnawati Sule, Padjadjaran University

Hilmiana, Padjadjaran University

Umi Kaltum, Padjadjaran University

Keywords

Sharia Competency, Knowledge Sharing Behavior-Islamic Perspective, OCB-Islamic Perspective.

Introduction

Based on the Global Islamic Financial Report (GIFR, 2014), the sharia banking industry in Indonesia is ranked seventh, while in 2011, Indonesia is in fourth down, meaning down three ranks after Iran, Malaysia and Saudi Arabia. If seen from several aspects in the calculation of index, such as the number of Sharia Banks, the amount of non-Islamic finance and the size of Islamic finance, it can be said that Islamic banking in Indonesia running on the spot has not even showed significant progress from previous years.

The existence of sharia banking in Indonesia is a manifestation of the demand of the people who need an alternative banking system which in addition to providing healthy and safe banking/financial services, also fulfil the principles of sharia, but in general the development of Islamic banking in Indonesia has not shown significant progress from in previous years. The development of sharia banking in Indonesia has not been able to compete with conventional banking (Syukron, 2013).

One of the reasons for the failure of sharia banking in Indonesia to compete with conventional banking is the low quality of human resources (Pratiwi, 2016; Hilmawan & Hapsari, 2015). Further Halimah (2016), revealed that the slow development of Islamic banking in Indonesia because it has not fully have human resources with knowledge and skills in the field of Islamic banking, religious behaviour and work ethics based on Islamic values.

The condition of the development of Islamic banking in the province of Bangka Belitung Islands, not much different from the condition of the development of Islamic banking nationally. Based on total assets and Third Party Funds (DPK), for the area of Sumatra, the Islands Province of Bangka Belitung Islands are in tenth position (OJK, 2016).

The results of the pre-survey of 7 sharia banks in the province of Bangka Belitung Islands indicate that the employees of Bank Sharia have not understood that work as worship, not just expect salary or position alone. They still show high individual attitudes, are less concerned with the duties and responsibilities of their co-workers and ignore the role of the group. It is as if individual duties and responsibilities are personal risks and must be solved on their own. They feel successful working that day if they are able to complete the tasks and responsibilities given by the leadership to them without showing extra role for both colleagues and the leadership. In addition, employees of Bank Sharia Province of Bangka Belitung Islands have inadequate knowledge, skills and expertise in the field of sharia.

Literature Review

OCB in Islamic Perspective

Organizational Citizenship Behaviour (OCB) in Islamic perspective is inseparable from the conventional OCB first coined by Barnard in 1938 using the term "willingness to cooperative". Then supported by Katz (1964) under the name "spontaneous and innovative behaviour". In the 80s, Batemen & Organ first used the term "OCB". Although the term OCB was introduced in the 80s, but in the 90s OCB research began to be encouraged until now. Then Williams & Anderson (1991) spawned the terms Organizational Citizenship Behaviour-Individual (OCB-I) and Organizational Citizenship Behaviour-Organization (OCB-O) (Chang & Chelladurai, 2003).

Organ (1988) defines OCB as the voluntary, non-voluntary behaviour of individuals, who are not directly rewarded by the formal reward system, as a whole encourages the effectiveness of organizational functions. While Stamper & Dyne (2001), OCB is a behaviour of company employees aimed at improving the effectiveness of the company's performance without neglecting individual employee productivity goals. More concisely Jahangir et al. (2004) explains that OCB is a work behaviour that exceeds the basic needs of a worker and even tends to ignore his personal interests and needs.

Not much research about OCB in Islam's perspective. The concept of OCB in Islamic perspective is based on Islamic teachings. The Qur'an commands Muslims to help each other in doing good and piety and forbid His people to help-help in sinning and transgression (Q. 5: 2). OCB in Islamic perspective (OCB-IP) is a voluntary action of individuals who are in accordance with Islamic shari'a and expect only falah or ridha Allah (Kamil et al., 2014). OCB in the perspective of Islamic law sunnah, meaning that if not done not get punishment or sin and will get a reward if done. Employees will be rewarded for caring and empathy with others (Wibowo & Dewi, 2017; Diana, 2012). Furthermore Wibowo & Dewi (2017) says that the concept of OCB in the Islamic perspective leads to the concept of brotherhood (ukhuwah) in Islam consisting of: Ta'aruf, tafaham, ta'awun and tafakul. So also with the opinion of Diana (2012), that the OCB in Islam adheres to the behaviour that is in accordance with the values taught in Islam, namely the values of sincerity, ta'awun, ukhuwwah and mujahadah.

Sharia Competence

Competence is a basic characteristic possessed by an individual in meeting the criteria required to occupy a position (Spencer, 1997). While the opinion Becker & Ulrich (2001) that the competence contains aspects of knowledge, skills and ability or personality characteristics that affect individual performance. Competence is the ability or capacity of a person to perform various tasks in a job, where this ability is determined by 2 (two) factors namely intellectual ability and physical ability. Then more fully, Bartram & Roe (2005), explains that competence can be described as the ability to perform a role or task, the ability to integrate knowledge, skills, attitudes and personal values and the ability to build knowledge and skills based on experience and learning.

Chairman of the Association of Bank Sharia Indonesia (Asbisindo), Amin, that the competence of sharia is the Human Resources (HR) that has the character of sharia. Furthermore, Amin stated that the most important thing in the effort to fulfil the requirement of syariah human resources is those who have sharia banking attitude and talent. The main requirement is not skill and knowledge about sharia, but is character and sharia behaviour, other deficiencies can be learned in the short term. While Rukiah (2015) that the characteristic of Sharia-based human resources is the HR that has three things, namely: (1) kafa’ah that is proficient or expert in the field of work done; (2) himmatul-'amal, which has a high spirit or work ethic; (3) amanah that is responsible and reliable in carrying out every duty or obligation.

Sharia-based human resources should essentially be laid on the foundations of spiritual conscience (servant of Allah) and rational (khalifah of Allah). There is no contradiction between spiritual consciousness and rational awareness in sharia economics. As a servant of God, man becomes a devout being who constantly carries out God's commandments and avoids his prohibition and as God's caliph, man becomes a successful and successful creature through the support of science (Ernie & Hasanuddin, 2016).

Knowledge Sharing Behaviour

Knowledge sharing is a voluntary attitude rather than coercion, therefore it is important for a company to grow knowledge sharing behaviour in an organization. Knowledge sharing is a process in which individuals exchange their knowledge (tacit knowledge and explicit knowledge) (Van & Ridder, 2004). Similarly, what is expressed by Hooff & Weenen (2004), knowledge sharing is an activity undertaken by individuals in organizations to exchange personal knowledge they have.

Knowledge Sharing Behaviour, commonly abbreviated as KSB, is defined as the extent to which an individual engages in knowledge-sharing activities in group meetings (Hung, Durcikova, Lai & Lin, 2011). In line with (Hung et al., 2011; Teh & Yong, 2011), defining Knowledge Sharing Behaviour reflects the extent to which employees share the knowledge gained with their peers. Meanwhile, according to Hsu et al. (2007), Knowledge Sharing Behaviour is a behaviour when an individual disseminates knowledge and acquires it to other members within an organization.

KSB in the perspective of Islam not only share knowledge, but reflect the attitude of Muslims who must be mutual advice-advice in the good, da'wah and broadcast religion. In connection with the KSB in the context of Islam, it reflects two important things: 1) the obligation to apply knowledge and knowledge and 2) to advise and to convey.

Research Methodology

This study was conducted on 280 employees of sharia banks in 7 sharia banks in the province of Bangka Belitung Islands. Using 33 question items, assessed with a 5-point likert scale, ranging from Strongly Disagree (score 1) to Strongly Agree (score 5). The rating range for descriptive analysis is given in Table 1:

| Table 1 Rating Range of 280 Employees in 7 Sharia Banks |

|

| Value Range | Categories of Respondents' Answers |

| 1.00<=1.80 | Strongly Disagree |

| 1.80<=2.60 | Disagree |

| 2.60<=3.40 | Less Agree |

| 3.40<=4.20 | Agree |

| 4.20<=5.00 | Strongly Agree |

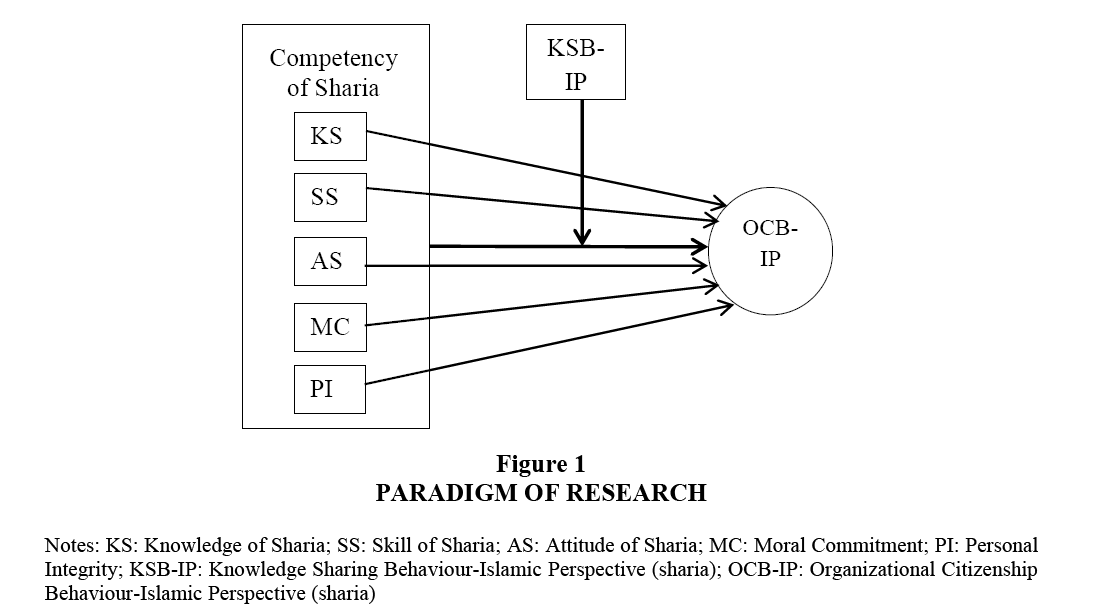

Analysis using SPSS version 20, OCB constructs in Islamic perspective using 4 dimensions: Al-Eathaar (6 items), Qayam Al-mumatwanah (4 items), Da'wah (3 items) and Raf'al haraj (4 items). The Competence of Sharia has 5 dimensions: Knowledge of Sharia (3 items), Skill of Sharia (2 items), Attitude of Shari'ah (3 items), Moral Commitment (2 items) and Personal Integrity (2 items). While Knowledge Sharing Behavior in Islamic perspective has 2 dimensions: Learning Islam (2 items), Syiar of religious (2 items).

Research Results and Discussion

This research was built to answer 2 problem formulation that is: how influence of Sharia Competence to OCB in Islamic perspective and whether KSB able to moderate relationship between Sharia Competence to OCB in Islamic perspective.

While the hypothesis (H) is built, H1: Sharia Competence has a positive and significant effect on OCB in Islamic perspective. H2: KSB moderates the relationship between Sharia Competence to OCB in Islamic perspective.

Table 2 above explains how to determine the partial effect of each dimension, with data (n) of 280 and the number of variables (k) is 6 (5 independent variables and 1 dependent variable, the dimension is considered as a variable), then the t table is 1.968. Using a significance level of 0.05 (5%), the four dimensions of Sharia Competence i.e. KS (knowledge of Sharia), SS (Skill of Sharia), MC (Moral Commitment) and PI (Personal Integrity) each have a probability below 0.05. This means that all four dimensions have a positive and significant effect on OCB-Perspective Islam. The four dimensions also have each t greater than t table, thus reinforcing that these four dimensions have a positive and significant effect on OCB-Islamic Perspective. This means that if employees increase knowledge, skills, commitment and integrity it will improve the attitude of OCB-Islamic Perspective. As for the US dimension (Attitude of Sharia) has a probability of 0.081 above 0.05. Has t count of only equal to 1.749 smaller than t table equal to 1.968. Statistically shows that AS (Attitude of Sharia) has a positive but not significant effect on OCB-Islamic Perspective. In other words, no relationship between the US (Attitude of Sharia), the US (Attitude of Sharia) has no impact on OCB-Islamic Perspective.

| Table 2 Coefficient Determinant of Sharia Competency to Ocb-Ip |

||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 25.601 | 2.864 | 8.938 | 0.000 | |

| KS | 0.470 | 0.251 | 0.120 | 2.568 | 0.043 | |

| SS | 0.913 | 0.407 | 0.148 | 2.241 | 0.026 | |

| AS | 0.400 | 0.229 | 0.109 | 1.749 | 0.081 | |

| MC | 0.875 | 0.487 | 0.131 | 3.196 | 0.044 | |

| PI | 1.723 | 0.398 | 0.297 | 4.327 | 0.000 | |

| a. Dependent Variable: OCB-IP | ||||||

Table 3 below explains how the simultaneous influence of Sharia Competence variables to OCB-Islamic Perspective.

| Table 3 Anova Analysis of Sharia Competency to Ocb-Ip |

||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 5332.783 | 5 | 1066.557 | 42.968 | 0.000b |

| Residual | 6801.328 | 274 | 24.822 | |||

| Total | 12134.111 | 279 | ||||

| a. Dependent Variable: OCB-IP | ||||||

| b. Predictors: (Constant), KS, SS, AS, MC, PI | ||||||

The amount of F count 42.968 while F table equal to 3.875 so F count bigger than F table and probability 0.00 below 0.05, hence simultaneously that Sharia Competence have positive and significant effect to OCB-Perspective Islam. Thus H1 is accepted.

Table 4 above shows the magnitude of R Square of 0.439 (43.9%), meaning that the ability of independent variables predicts the dependent variable of 43.9% while 56.1% comes from outside the variable, outside of this study.

| Table 4 Model Summary |

|||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | |||||

| 1 | 0.663a | 0.439 | 0.429 | 4.98220 | 0.439 | 42.968 | 5 | 274 | 0.000 |

| a. Predictors: (Constant): KS, SS, AS, MC, PI | |||||||||

Table 5 below shows that the KSB-IP variable has been able to moderate the relationship between Competency of Sharia to OCB-IP. The significance rate used is 0.05 (5%). Since the value is less than the degree of trust the hypothesis is accepted, thus H2 is acceptable.

| Table 5 Coefficient Diterminant of Moderator Influence to Ocb-Ip |

||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 58.720 | 0.979 | 59.998 | 0.000 | |

| CoS_MOD | 2.161E-008 | 0.000 | 0.452 | 8.429 | 0.000 | |

Thus the hypothesis proves that KSB-IP is able to moderate the relationship between Competency of Sharia to OCB-IP.

The second condition of the hypothesis can be seen in Figure 1 below.

Sharia Competence consisting of 5 dimensions of knowledge, skills, commitment, personal integrity, if have adequate knowledge will be better able to explain and inform customers about sharia banking. Dimensions of skills in the competence shows the ability of employees in operating a computer for example, operating applications of Islamic financial transactions will make it easier for these employees to help colleagues and leaders. Similarly, the attitude dimension, which reflects the attitude of helping customers, colleagues, friendly, courteous, utilizing the best time possible and high ability to cooperate. All indicators reflected in each competency dimension are in harmony with the OCB dimensions. Especially the nature of employees who like to help, care about colleagues and institutions. Commitment and integrity owned by employees of the bank will increase the loyalty and seriousness attitude of sharia bank employees in developing sharia banking. Despite the limited preceding journal of sharia competence, experts generally agree that competence positively affects OCB is supported by (Sofiah et al., 2014; Sudarma, 2011; Kagaari & Munena, 2007).

The first dimension of Sharia competence is general knowledge of sharia. This dimension reflects the extent to which Sharia Bank employees have basic knowledge of sharia bank, which is reflected through 3 indicators, namely: general knowledge of sharia, concept and purpose of sharia and concept of sharia transaction. Table 6 illustrates the condition of these 3 indicators based on the perceptions of Sharia Bank employees.

| Table 6 Indicator Score of the Sharia Knowledge Dimension of Sharia Competencies |

||||||

| Scale | Frequency of each Indicator | Score of each Indicator (scale × Freq of each indicator) | ||||

| 1 | 2 | 3 | 1 | 2 | 3 | |

| 5 | 79 | 75 | 54 | 395 | 375 | 270 |

| 4 | 193 | 197 | 100 | 772 | 788 | 400 |

| 3 | 4 | 4 | 84 | 12 | 12 | 252 |

| 2 | 0 | 0 | 30 | 0 | 0 | 60 |

| 1 | 4 | 4 | 12 | 4 | 4 | 12 |

| Total | 280 | 280 | 280 | 1.183 | 1.179 | 994 |

| Average score | 4.225 | 4.211 | 3.550 | |||

| Average Indicator | 3.995 (agree) | |||||

Source: Primary data is processed, 2017

The three indicators of Sharia Knowledge, the third indicator is the smallest average score is only 3.550 compared to the other two indicators of "knowledge of sharia" and "concept and purpose of sharia". This is because not all employees are directly in charge of transactions at Bank Sharia, but all employees agree and agree that they should have general knowledge about sharia banking and sharia concepts and goals including understanding sharia transactions.

The second dimension of Sharia Competence is Sharia skill. After having general knowledge about sharia banking, the next Sharia Bank employees must have the second element of Sharia Competence that is having skills in the field of sharia. According to Fahmi et al. (2014), some skills that must be equipped by sharia human resources such as muamalah application expertise, muamalah transaction, operate computer applications associated with muamalah transaction. Therefore, this dimension has 2 indicators namely: expertise in muamalah application and expertise in transaction (akad) muamalah. Table 7 illustrates how the perceptions of Sharia Bank employees about these two indicators.

| Table 7 Indicator Score of Sharia Competence Dimension of Sharia Competency |

||||

| Scale | Frequency of each indicator | Score of each Indicator (scale x Freq of each indicator) | ||

| 1 | 2 | 1 | 2 | |

| 5 | 61 | 78 | 305 | 390 |

| 4 | 206 | 195 | 824 | 780 |

| 3 | 7 | 3 | 21 | 9 |

| 2 | 2 | 2 | 4 | 4 |

| 1 | 4 | 2 | 4 | 2 |

| Total | 280 | 280 | 1.158 | 1.185 |

| Average score | 4.136 | 4.232 | ||

| Average Indicator | 4.184 (agree) | |||

Table 7 shows that 206 respondents (73.57%) agree and 61 respondents (21.79%) strongly agree that as employees of Bank Sharia have to master some applications related to muamalah/transactions in Bank Sharia. Besides understanding some of the application of muamalah/transactions, employees of Bank Sharia also have to understand various muamalah as indicated in the second indicator, such as: mudharabah (raise funds), musharaka (cooperation), wadi'ah (goods custody), greetings (reservations goods), istishna (financing of goods), qaradh (loan funds), ijrah (provision of funds), hawalah (transfer of debt). Table 6 explains that the majority of Sharia Bank employees agree that they have to master various muamalah.

The third dimension of Shari'a Competence is Sharia-compliant behaviour. Sharia-compliant attitude takes precedence over other competencies, skills and skills can be learned immediately or trained, but to shape Sharia-compliant behaviour should take precedence. The dimension of Sharia Competency has 3 indicators, namely: behaviour according to sunnah, motivation to run sharia and become role model.

The following Table 8 shows that the first indicator of Shari'ah behavior is "behavior in accordance with the sunnah" (Rosulullah) is still not as expected. The behaviour according to the Sunnah of the Prophet reflects the attitude and daily behaviour that has been embraced by Prophet Muhammad SAW. In the context of work in Sharia Banks, Sharia-compliant behaviour is not only demonstrated when working in the office but also must be shown outside the office. Some examples of sunnah-compliant behaviours include: greeting, good listener, speaking as necessary, never telling mistake of others, never criticizing when people are talking, not arguing, never interrupting, increasing brotherhood, always praising good deeds, convey the things that result in goodness, never degrade others, never give bad titles to anyone, never seek the disgrace of others, always ask of health from friends and others (taken from 100 properties of the Prophet).

| Table 8 Indicator Score of the Shariah Attitude Dimension of Sharia Competencies |

||||||

| Scale | Frequency of each indicator | Score of each Indicator (scale × Freq of each indicator) | ||||

| 1 | 2 | 3 | 1 | 2 | 3 | |

| 5 | 66 | 101 | 94 | 330 | 505 | 470 |

| 4 | 87 | 168 | 182 | 348 | 672 | 728 |

| 3 | 52 | 5 | 0 | 156 | 15 | 0 |

| 2 | 46 | 2 | 0 | 92 | 4 | 0 |

| 1 | 29 | 4 | 4 | 29 | 4 | 4 |

| Total | 280 | 280 | 280 | 955 | 1.200 | 1.202 |

| Average score | 3.411 | 4.286 | 4.293 | |||

| Average Indicator | 3.996 (agree) | |||||

The results showed that 52 respondents (18.57%) disagreed, 46 respondents (16.43%) disagreed, even 29 respondents (10.36%) strongly disagree with the sunnah. This confirms that Bank Sharia employees' behaviour in accordance with the sunnah is still low not as expected. Nevertheless the second and third indicators, "motivation to run sharia" and "to be exemplary" show encouraging results.

The fourth dimension is moral commitment. This dimension reflects that sharia human resources are a part of sharia banking, so it must have a moral responsibility for the development and progress of sharia banking. Therefore, this dimension has 2 indicators: "responsible" and "participation". When employees have a high moral commitment they are more responsible not only to the task they hold but also to the development and progress of the Sharia Bank. For that they must show a real contribution and participation.

Table 9 shows that the "responsible" indicators of 179 respondents (63.93%) agree and 96 respondents (34.29%) strongly agree that the development and progress of the Sharia Bank is also part and responsibility of the employees. Similarly, the second indicator of "participation", they agreed 149 respondents (53.21%) and 125 respondents (44.64%) strongly agree that for the majority of employees must show contribution and maximum participation for the development of Sharia Bank.

| Table 9 Indicator Score of the Moral Commitment Dimension of Sharia Competency |

||||

| Scale | Frequency of each indicator | Score of each Indicator (scale × Freq of each indicator) | ||

| 1 | 2 | 1 | 2 | |

| 5 | 96 | 125 | 480 | 625 |

| 4 | 179 | 149 | 716 | 596 |

| 3 | 3 | 2 | 9 | 6 |

| 2 | 0 | 2 | 0 | 4 |

| 1 | 2 | 2 | 2 | 2 |

| Total | 280 | 280 | 1.207 | 1.233 |

| Average score | 4.311 | 4.404 | ||

| Average Indicator | 4.357 (strongly agree) | |||

Source: Primary data is processed, 2017

The last dimension is Personal Integrity. Personal integrity reflects the inherent personality qualities of a person who constantly applies moral and ethical values in his or her daily actions and conduct. Honour, dignity, self-esteem, reputation and trust are the fruits of a personality of integrity; otherwise a person who loses integrity is like losing conscience. An employee of Sharia Bank who shows personal integrity will give priority to honesty and sincerity in working. Therefore, the dimension of personal integrity has "honest" and "sincere" indicators.

Table 10 informs that the majority of Sharia Bank employees agree that it is necessary to uphold personal integrity by showing genuine "honesty" and "sincerity" in working with the Sharia Bank. But it remains a concern for 26 employees whose level of "sincerity" is low. Sharia skill positively and positively affects OCB-IP, because there is strong linkage and positive relationship between the two. This means that if there is an increase in general knowledge about sharia, expertise in the field of sharia, moral commitment and personal integrity then the increase will also improve the behaviour of OCB-IP employees of Bank Sharia. Some indicators of the dimensions contained in Sharia Skill are also part of the indicators in the OCB-IP or the indicators contained in the CoS are complementary to indicators in the OCB-IP so there is a harmony between the two variables.

| Table 10 Indicator Score of the Personal Integrity Dimension of Sharia Competencies |

||||

| Scale | Frequency of each indicator | Score of each Indicator (scale x Freq of each indicator) | ||

| 1 | 2 | 1 | 2 | |

| 5 | 161 | 103 | 805 | 515 |

| 4 | 115 | 143 | 460 | 572 |

| 3 | 2 | 26 | 6 | 78 |

| 2 | 0 | 6 | 0 | 12 |

| 1 | 2 | 2 | 2 | 2 |

| Total | 280 | 280 | 1.273 | 1.179 |

| Average score | 4.546 | 4.211 | ||

| Average Indicator | 4.379 (strongly agree) | |||

Source: Primary data is processed, 2017

For example, Shari'ah, responsible, participatory, honest and sincere behaviour in work that is part of the CoS indicators, aligned with the indicators contained in the OCB-IP especially the Al-Eethaar dimension related to the sincerity of an employee in carrying out task. Employees who have the dimension of Al-Eethaar will assume that work as worship, so that when helping colleagues and leaders solely expect the blessings of Allah swt. Moreover work must be accompanied by sincerity and persistence.

Likewise with attitudes according to the sunnah and be an example contained in the indicator of Sharia Competency, where the employees show the attitude in accordance with the suggestion of sunnah Rosulullah both while in office and outside the office, the indicators of Sharia Competence is in harmony with the indicators contained in Qayam al-muwatwanah, this dimension reflects the level of awareness of employees towards colleagues and institutions.

Similarly, honesty and sincerity which are indicators in the Sharia Competency also reflect the existing da'wah indicators in the OCB-IP that call for good deeds and charitable deeds, including jutting to be honest and sincere.

The role of KSB-IP can enhance personal knowledge, skill, attitude, commitment and integrity. KSB is an activity undertaken by individuals within the organization to exchange their personal knowledge (Hooff & Weenen, 2004). Agreeing with Hooff, Weenen, Chang & Chuang (2011), KSB is a process whereby individuals exchange their knowledge (tacit knowledge and explicit knowledge).

The following table shows the results of the respondent's answer for each dimension by using the Likert 5-point scale (Strongly Disagree-Strongly Agree). Strongly Disagree=1, Strongly Agree=5.

The Table 11 above shows that Knowledge of Sharia (KS) has the lowest score (3.995) compared to other dimensions. However, the average respondent's answer for all dimensions is 4.182 (agree). This means that all respondents agree on the importance of all these dimensions in sharia banking, so employees should be able to improve their knowledge, skills, attitude, commitment and personal integrity to enhance employee role in developing sharia banking in Bangka Belitung Islands Province.

| Table 11 Results Average Respondents Answer |

||

| No. | Dimensions | Score |

| 1. | Knowledge of Sharia (SS) | 3.995 |

| 2. | Skill of Sharia (SS) | 4.184 |

| 3. | Attitude of Sharia (AS) | 3.996 |

| 4. | Moral Commitment (MC) | 4.357 |

| 5. | Personal Integrity (PI) | 4.379 |

| Average | 4.182 | |

Source: Primary data is processed, 2017

Conclusions and Suggestions

Conclusion

Sharia competence has a positive effect on OCB-IP. Therefore it is important to increase personal knowledge, skills, commitment and integrity. Statistically, syar’i behavior is insignificant to OCB-IP, but still has a positive impact on OCB-IP.

KSB-IP able to moderate the relationship between the competences of sharia against OCB-IP. The attitude of employees or leaders who sincerely knowledge and advise each other will advise on the improvement of OCB-IP attitude.

Suggestions

Employees should be enhanced their knowledge and skills through training, seminars or workshops. Likewise with the commitment and personal integrity needs to be increased so that employees are more concerned, loyal and responsible for the development of Islamic banks. Whatever forms of knowledge the employee possesses, should be disseminated and shared among co-workers to ensure continuous sharia banking.

Acknowledgement

OJK (Financial Services Authority) (2015), Statistics of Sharia Banking. Q (Qur’anul Karim, the Muslim’s holybook).

References

- Bartram, D. & Roe, R.A. (2005). Definition and assessment of competences in the context of the European diploma in psychology. European Psychologist, 10(2), 93.

- Becker, B.E., Huselid, M.A. & Ulrich, D. (2001). The HR scorecard: Linking people, strategy and performance. Harvard Business Press.

- Chang, H.H. & Chuang, S.S. (2011). Social capital and individual motivations on knowledge sharing: Participant involvement as a moderator. Information & Management, 48(1), 9-18.

- Chang, K. & Chelladurai, P. (2003). Comparison of part-time workers and full-time workers: Commitment and citizenship behaviours in Korean sport organizations. Journal of Sport Management, 17, 394-416.

- Diana, I.N. (2012). Organizational citizenship behaviour (OCB) in Islam. Journal of Economics and Social Sciences, 115-232.

- Ernie, T.S. & Hasanudin, M. (2016). Manajemen Bisnis Syariah, cetakan pertama. Penerbit: Refika Aditama.

- Halimah, C.N. (2016). Problema SDM Perbankan Syariah. Serambi Indonesia.

- dan Hapsari, H. (2015). Inilah 7 Kendala Perkembangan Bank Syariah di Indonesia. Suara.Com.

- Hooff, Van den, B. & de Leeuw van Weenen, F. (2004). Committed to share: Commitment and CMC use as antecedents of knowledge sharing. Knowledge and Process Management, 11(1), 13-24.

- Hsu, M.H., Ju, T.L., Yen, C.H. & Chang, C.M. (2007). Knowledge sharing behaviour in virtual communities: The relationship between trust, self-efficacy and outcome expectations. International Journal of Human-Computer Studies, 65(2), 153-169.

- Hung, S.Y., Durcikova, A., Lai, H.M. & Lin, W.M. (2011). The influence of intrinsic and extrinsic motivation on individuals' knowledge sharing behaviour. International Journal of Human-Computer Studies, 69(6), 415-427.

- Jahangir, N., Akbar, M. & Haq, M. (2004). Organizational citizenship behaviours: Its nature and antecedents. BRAC University Journal, 1(2), 75-85.

- Kagaari, J.R. & Munene, J.C. (2007). Engineering lecturers' competencies and organizational citizenship behaviour (OCB) at Kyambogo university. Journal of European Industrial Training, 31(9), 706-726.

- Kamil, M., Sulaiman, M.B., Osman-Gani, A. & Ahmad, K. (2014). Investigating the dimensionality of organizational citizenship behavior from Islamic perspective (OCBIP): Empirical analysis of business organizations in south-east Asia.

- Organ, D.W. (1988). Organizational citizenship behaviour: The good soldier syndrome. Lexington Books/DC Heath and Com.

- Pratiwi, I.C.D. (2016). Pengaruh kompetensi, motivas kerja dan kompensasi terhadap kinerja karyawan bank Muamalat dan BNI Syariah Cabang Jember dan Banyuwangi. Digital Repository Universitas Jember.

- Rukiah, R. (2015). Strategy of sharia human resource development facing global market. At-Tijaroh: Journal of Management Science and Islamic Business, 1(2), 105-121.

- Sofiah, K.K., Padmashantini, P. & Gengeswari, K. (2016). A study on organizational citizenship behavior in banking industry. International Journal for Innovation Education and Research, 2(7).

- Spencer, L.M. (1997). Competency assessment methods. What Works: Assessment, Development and Measurement, 1-36.

- Stamper, C.L. & Dyne, L.V. (2001). Work status and organizational citizenship behaviour: A field study of restaurant employees. Journal of Organizational Behaviour, 22(5), 517-536.

- Sudarma, K. (2012). Analisis kesejahteraan berbasis kinerja melalui competency dan organizational citizenship behavior (OCB) pada tenaga administrasi studi kasus pada universitas negeri semarang (UNNES). Dinamika Sosial Ekonomi.

- Syukron, A. (2013). Dinamika perkembangan perbankan sharia di Indonesia. Economic: Journal of Economic and Islamic Law, 3(2), 28-53.

- Teh, P.L. & Yong, C.C. (2011). Knowledge sharing in is personnel: Organizational behaviour’s perspective. Journal of Computer Information Systems, 51(4), 11-21.

- Van den Hooff, B. & De Ridder, J.A. (2004). Knowledge sharing in context: The influence of organizational commitment, communication climate and CMC use on knowledge sharing. Journal of Knowledge Management, 8(6), 117-130.

- Wibowo, U.D.A. & Dewi, D.S.E. (2017). The role of religiosity on organizational citizenship behaviour of employee of Islamic banking. IMC 2016 Proceedings, 1(1).