Research Article: 2022 Vol: 25 Issue: 5S

Issues of Business Ethics in Credit Derivatives: Evidence from CDS Index Option

Sumit Kumar, IIM Kozhikode

Citation Information: Kumar, S. (2022). Issues of business ethics in credit derivatives: Evidence from CDS index option. Journal of Legal, Ethical and Regulatory Issues, 25(S5), 1-19.

Abstract

Credit Derivatives are primarily a hedging instrument but at times is used as leverage seeking instrument. Because of its opacity in calculations and business protocols, It is not usually an investment an ordinary investor/ hedger can do. Therefore, they go to Investment Banks for their expert advice services. These big Investment Banks have more information in this business than these ordinary investors. It creates a kind of information asymmetry and an information bias towards these banks, who, at not acting in good faith, try to monetize this situation by not act in fairly. This creates moral hazards and issues in business ethics. Current work tries to highlight one such scenario related to the CDS Index option depicting a future possible case of unethical transactions between a Bank and its Client with whom banks owe a fiduciary responsibility. This works us distributed in 5 sections with Introduction, Literature Survey, a case analysis of CDS Index Option, and synthesis of a theoretical framework of Business Ethics > present work is ended with concluding remarks and possibilities for future research. Widely accepted Option Pay off methodology has been used to generate a simulated pay off of CDS Index Option and tried to create a stressed Market condition to simulate the scenario in which this unethical business practice might occur. Credit Crisis data has been used as a baseline for the spread simulation purpose.

Keywords

CDS Index Option, Settlement Recovery, Implied Strike, Value of Default.

Introduction

The ethics principles in any business organization are considered the moral standards applied by the stakeholders in financial institutions during decision-making. Companies with the principle ethics depict brand policies that provide the easiest way to look for ethical values that also have extensive information essential for investors and traders (Hans, 2020). Moreover, some of the ethical principles include autonomy, justice, non-maleficence, beneficence, and promisekeeping. When these aspects are put under positive considerations and operationalized, they enhance the business partners to maximize profits. The beneficence provides that the Chief Executive Officer (CEO), Chief Financial Officer (CFO), and Chief Investment Officer (CIO) should perform duties of doing good for the security of acquired loans, cooperate bonds, and treasury bonds. On the other hand, non-maleficence requests an individual in the top management to avoid disadvantaging the juniors by providing equal rights and guidelines regarding the investment policies. Ethics in the capital market is a relevant subject not just because it is important but also because it has witnessed catastrophic situations right from the great depression of the 30s to the credit crisis of 2008. Ethics and governance become more important from continuous assessment and evaluation purposes as we have seen London Whale happening post the regulations like Dodd-Frank, etc.

Credit Derivative Product has been primarily blamed for the credit crisis and several such situations. Even Pope Francis termed it as unethical, so it was imperative to look into these products from a business ethics perspective. While CDS (Credit Default Swap) and CDS Index (Credit Default Swap Index) have been discussed by few researchers from an ethics perspective but CDS Index Option (Credit Default Swap Index Option), have not been discussed extensively as a product which can be used unethically in certain scenarios. These scenarios are typically the stressed market conditions when default may happen quite frequently. This had happened in the past during the credit crisis, and until a few years later, when the economic conditions started to get stabilized. In this paper, I would like to explore a situation where CDS Index Option can create business ethics. Issues of ethics in credit derivative have been elaborated well by Kumar & Baag (2021).

In a normal European Option, the exercise decision is taken as the option goes in the money. For a normal Call Option, the option is exercised when the spot crosses the strike. CDS Index Option is a bit different. Since the CDS Index is exposed to the credit event, a credit event is possible before the option expiry. If an index suffers a credit event, it results in the settlement payment. This settlement payment, dependent on settlement recovery and other market factors (Credit DV01, etc.), could result in an early exercise. A buyer of a Payer Index Option may find it lucrative to exercise the option below the strike, resulting in a positive pay off. This paper investigates the evidence of the below strike exercise situation using a couple of simulated scenarios that result in early strike motivation and estimate a payoff. It also computes the change of strike per defaulted name or Strikes Sensitivity per name. This clearly breaks the option pricing formula given by Black Model and provides a trader an opportunity to exercise the option even Option is not in the money. This artificially lowers down the strike much below the actual strike decided on the trade confirms. In this particular scenario, a trader has changed Premium for protecting the Credit Portfolio on a strike price, which is a higher and charged premium, which is equivalent to the higher strike but ended up exercising at a lower spread. In this scenario, this trade has earned an extra premium from its customers or clients, and therefore it is not ethical. As a Bank or Market maker, they should pass on this benefit to their client regarding a premium discount.

The primary objective of this paper is as follows

1. Depiction of Ethics and Moral hazard issues in Credit Derivative trading and discuss a possible scenario where Ethics could be compromised.

2. CDS Index Option as a use case to provide evidence of possible ethical issues in Credit Derivatives trading in general.

3. Analysis of Derivative trading in Ethical Business framework.

Literature Review

CDS trading and poor risk management, together with ethical issues among trades, had become a major risk factor for the banks and financial institutions, which weren't so easy to manage (Bai et al., 2017). CDS instruments are used for manipulations and creating a highly leveraged position (Brinded, 2017). Though Investment product may be blamed to some extent, but a lot depends of firm’s organization, values & Culture. In most cases, the significance of ethics depends on the firm’s structure and leadership management that can handle normal business activities (Hans, 2020). It has been analyzed how the work ethic of managers impacts a firm's employment contracts, riskiness, growth potential, and organizational structure (Ian-Carlin & Gervais, 2009). It has been observed that firms with foreign sales tend to factor employee benefits in their currency hedging policies when their acquisition, development, and retention of human capital are especially costly or highly valued. Risk taking is anyway the business of a bank but there must be a difference between risk taking and “Leverage”. In the recent past, banking sector has observed noticeable number of instances of risk-taking that frequently have been attributed to the unprofessional and unethical norms (Cohn et al., 2017). It has also been observed that the practice of excess risk taking and resorting sometime to unethical practices is prevalent in financial industry to showcase the managerial talent (Acharya et al., 2016).

In financial institutions, ethics requires one to be fully informed with financial information and always prepared to handle the risks either by taking risks or being risk-averse to avoid traders' loss (Svetlova & Thielmann, 2020). Some companies resort to unethical lobbying for gains. Value of ethics can be understood from the fact that lobbying which is not ethical result into financial losses and incur deterioration of shareholders value in the stressed economic scenario or financial shocks (Borisov et al., 2016).

Observably, the credit derivative markets expose the creditors to high risks of losing their capital; therefore, the use of the ethical regulation solves the potential risks that may exist during the investments done in a firm (Saft, 2009; Tyge & Oleg, 2019) explained how the principalagent problem could lead to a moral hazard in Business (Tyge & Oleg, 2019). It was further explained that the consequences of PA (Principal-Agent) problem in general business management could lead to financial fraud and devaluation of the firm's market value (Tyge & Oleg, 2019). Researchers have attributed moral hazards to the Credit Crisis. The central problem of the Credit Crisis is the misuse of Credit Derivative and related instruments by the financial firms who were otherwise designated as Agents by the common people by paying premiums. Role of Credit Rating agencies was also suspicious. It has also been observed in the past that Credit rating agencies have indeed issued unfavorable unsolicited credit ratings. This has enabled them to extract higher fees from the issuers by credibly threatening to punish those who do not acquire their services. This fact was also alluded by Kumar & Baag (2021).

Specific to credit Derivatives, there is evidence of Principal-agent problem arising due to information bias. It is interesting to see if regulations can tackle these systemic failures due to the Principal-Agent Problem. Credit Derivatives is always looked at as a Product/Weapon of mass destruction. In a statement issued from the holy city of Vatican, it was once said that "Gambling on others' failures is unethical". They further stated that The process of acquiring these instruments [CDS products], by those who do not have any risk of credit already in existence, creates a unique case in which persons start to nurture interests for the ruin of other economic entities, and can even resolve themselves to do so. There is a school of thought who believes Credit Derivatives and Structured Credit Products are the primary reason for the credit Crisis (Rene, 2010). CDS Valuation and Mark to Market process indeed have some opacity. It is not very transparent in terms of observation and calculation of parameters to compute the default probabilities, which led to market instability in Credit Crisis (Terzi & Ulucay, 2011). The financial credit crash of 2007 and 2008, based on various explanations of credit derivatives and housing bubbles that caused many financial institutions to lend money to those who could not repay, has its foundations in Agency Theory and faulty business.

While much has been talked about single name CDS (Culp et al., 2016) and CDS Index (O’Kane, 2011) but a detailed analysis of CDS Index Option from business ethics perspectives in need as CDS Index Option is typically used to buy an Option to enter into a credit default swap Index to hedge a corporate bond portfolio (Mahadevan & Patkar, 2015). While CDS Index Option is typically used to hedge credit risk in a Bond Portfolio, it is also a primary instrument to express a view on spread volatility and obtain a wider range of payoffs by structuring the Option in the desired way (Richard, 2011).

Ethical Issues with CDS Index Option: Early Exercise

CDS Index option is an OTC credit Derivative contract which gives right but not an obligation to Buy/sell protection on the CDS Index. Most liquid CDS Index Option is quoted on 5Y maturity of CDX IG Series and ITraxx main series and generally done for on the run index. Usually, every 6 months, a new series comes to the existing index become Off-the-run, and the new series becomes on-the- run. This is also why CDS Index Option expiry is usually less than 6 months because, within 6 months, the existing index becomes off-the-run and losses liquidity in the market.

There are primarily two types of Index Option, namely Payer Index Option and Receiver Index Option. A Payer Index Option is the one in which the option holder has the option to enter into a Long protection position in the index swap at the strike spread. The option typically is exercised if the index spread widens. It can be used as a way to take a short credit position on the index constituents. A Receiver Index Option can enter into a short protection position in the index swap at a strike spread. It is usually exercised when credit tightens.

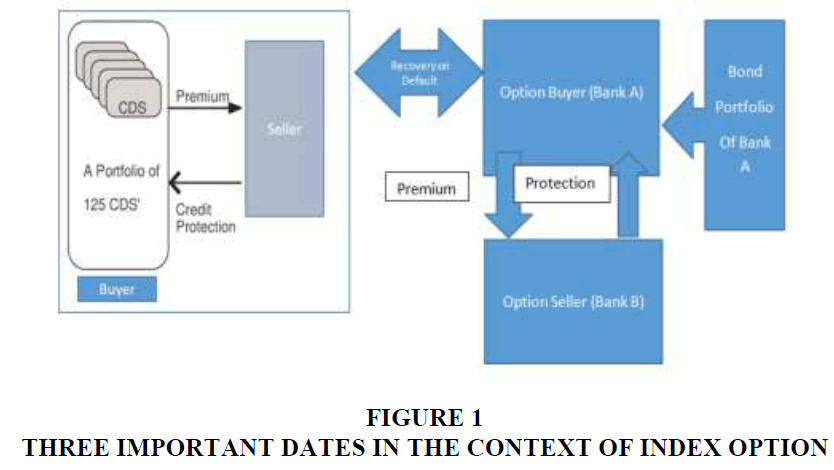

A typical use case of CDS Index Option: Usually, a Regional Bank (Bank A) buy/sell various types of debt instruments to manage their treasury activities. These debt instruments, primarily bonds, are exposed to market risk factors like Interest rate risk and Credit Spread risk. Interest rate risk can be hedged using Interest Rate Swap. If Bank A believes that it needs hedging only when the interest rate goes up by a certain percentage, they enter into a contract with a big broker-dealer/ Market Maker (Say Bank B) whose main business is to provide hedging services to small banks who do not have access to the market, clearinghouses and also lack expertise in Capital Market/ trading activities. Similarly, Bank A will go to Bank B (And any Bank providing services like Bank B) to hedge their portfolio against Credit Spread movement. As discussed in the introduction section, CDS Index (O’Kane, 2011) is a way to get a macro hedge on a big portfolio of Bonds. CDS Indices are the indices of issuers, and one can buy/sell protection on those issuers in case of default. So if Bank A has Corporate Bonds in their portfolio, which is a close resemblance of Issuers in one of those many Credit Indices available to buy/sell protection on, Bank A will simply buy protection on that index. For the hedging purpose, buying protection is always preferred against buying protection on single-name CDSs for the following reasons.

1. CDS Indices are the standard product with a fixed running coupon, while Single names CDSs are purely bi-lateral contracts.

2. CDS Index is professionally maintained by MARKIT (IHS MARKIT) with ISDA (International Swaps and Derivatives Association) guidelines and Protocols.

3. It is now being cleared through ICE (International Continental Exchange), properly margined, and professional counterparty risk managed.

4. For the above reason, the CDS Index has become more liquid than the single-name CDS. CDS Index Bid- Ask spread is much tighter than single-name CDS.

5. For a reason stated above, in the case of a typical hedging purpose of a corporate Bond portfolio, CDS Index is an obvious choice as the hedging cost is much lower than hedging one-by-one each bond using the single-name CDS.

Bank A has a Bond portfolio consisting of 110 names primarily from North American who has Investment grade credit. MARKIT provides several Indices, and one of the indices among them is DJ CDX NA IG (Dow Johns Credit Default Index, North America Investment Grade), which has 125 names in it. Every year on 20th June and 20th December, MARKIT comes with new series of IG indexes, so as soon as the new index comes, the older series becomes an off-therun index, and the newest series becomes on-the-run series. The current on-the-run series is Series 34 (At the time of writing). So Bank A for the hedging purpose can directly buy protection on CDX NA IG S34 (Series 34), or if they feel that they don't need any credit Protection below a certain spread (say 55 bps), then they would prefer to buy a CDS Index Option on CDX NA IG S34. In this case, they are protected when the over spread moves beyond 55 bps. A typical schematic of the CDS Index Option is shown below Figure 1.

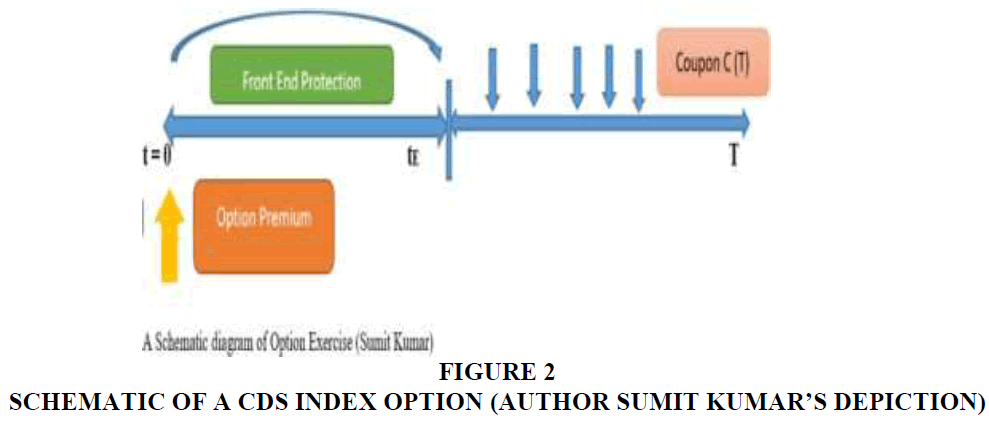

1. First is the contract start date t=0 when the option's strike is set, and the option premium is paid. Any default in the index portfolio, which occurs after this date, will impact the index pricing.

2. Second is the option expiry date tE on which the decision of exercise is taken. Typically Index Options are European options, and exercise decision is made on expiry.

3. Last is the maturity of the index T. Most liquid Index options are written on the 5Y maturity Index (Figure 2).

Let’s consider the case of a Payer Option in which a buyer has an option to enter into a long protection position in the Credit Index at a fixed Strike K. If exercised, the payoff for the payer swaption at expiry is made up of the following three components.

1. The holder of the payer swaption can exercise the swaption and settle the protection payment for any credit in the index that might have defaulted from t=0 to tE. To accomplish this option buyer purchases the defaulted credit at a settlement recovery and, in return, gets the par from the seller of the protection.

2. Settlement amount =Notional X (1-Settlement Recovery)

3. The Option buyer also pays exercise fee G (K) to the seller of the protection. This is the value of the CDS Index Option priced using Index spread on a Full un-defaulted notional given by

G (K)=[K–C (T)]. RPV01 (tE, T, K)

The Option Buyer receives the CDX Index (Defaulted with the name suffered Credit event is removed from the index) from the seller of the protection at the current market Index Spread S. The value of this payment would be [S–C (T)]. RPV01 (tE, T, S). Now we can consider our use case CDS Index Option trade and calculate the payoffs Table 1.

| Table 1 A Sample CDS Index Trade Details | |

| Option Type | European Payer |

| Notional | 10,000,000 |

| Underlying Index | CDX IG S34 |

| Index Coupon | 40 (bps) |

| Valuation Date | 1-Aug-20 |

| Option Expiry | 1-Feb-21 |

| Option Strike | 55 (bps) |

| Maturity | 20-Dec-25 |

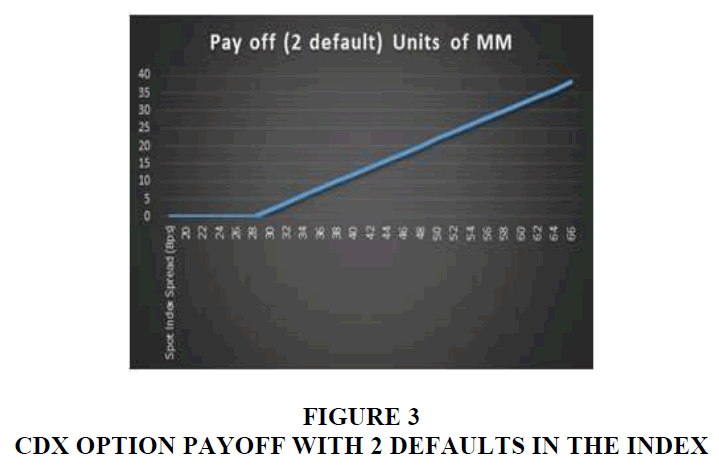

Let’s assume that there have been two defaults (Credit Events) between the option Initiation date and options expiry date. We also assume that the index spread curve is at 44 bps at option expiry, and the LIBOR curve is flat at 5%. As stated above, the Option payoff is composed of the following three payments.

1. At an option expiry let’s assume the settlement recovery is 45% and notional exposure per name (Index being perfectly homogenous) is 10,000,000 X 2/125 therefore the settlement payment is 10,000,000 x (2/125) x (1-45%)=$88,000.

2. Index Payoff to be settled by the seller to the buyer is calculated on the defaulted index of the remaining notional 10M x (1-2/125), which is equal to 9.84 M. Let’s assume the RPV01 (Credit PV01) being 3.74 the total value of the index pay off =9.84M x 3.74 x (44- 40) bp which is equal to $14717

3. Seller will receive the index price at 55 bps. Let’s assume the RPV0=3.726 therefore the seller’s pay off would be 10M x 3.726 x (55-40)=$ 55 890

Therefore, the total payoff for the buyer of the protection =$88,000+$14717-$ 55890=$46,827. Please note that index Spot spread (44 bps) is much below the strike spread of 55bps if we assume the two defaults has already taken place before the index expiry. So the exercise decision is very much dependent on the number of defaults that have taken place between index option initiation and Index expiry.

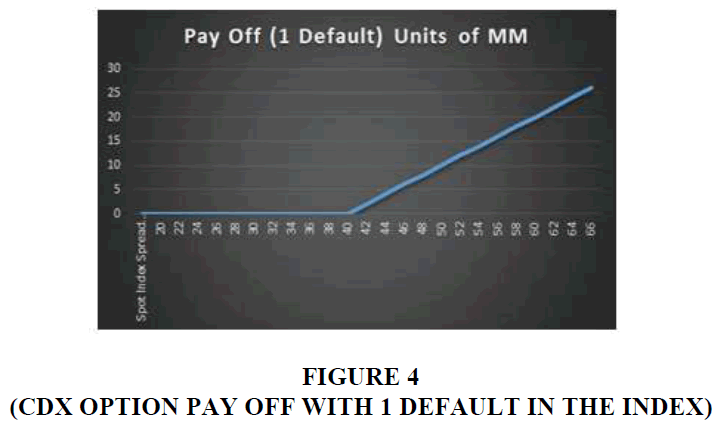

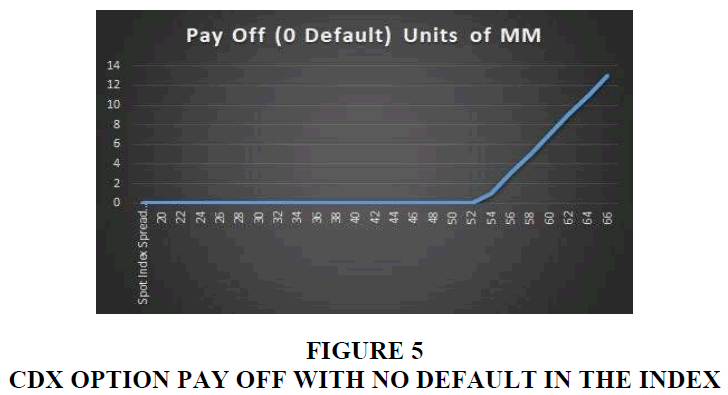

As we have seen in the previous example, if there is no default, the payer swaption can be exercised at the strike spread of 55 bps, but it is profitable to exercise the Index option below the strike in case of default. If we try to numerically solve for a payoff, which is just positive with the number of credit events the index has suffered, we find that with one credit event, it can be exercised at 42 bps, and with 2 credit events, it can be exercised at around 30 bps. So loosely speaking, each default before the option expiry can bring the implied exercise spread by 12 bps, or the value of 1 default lower the strike by 12 bps (Figures 3 & 4).

As we have seen above Figure 5, the use case that a $46 827, which was paid to the buyer of the protection is paid at the end of the option contract. It is possible that this amount can be paid upfront using a Present value computed using some sort of credit risk discounting over and above the risk-free rate.

If not, premium cash back can also be an option if the market is stressed. More than that, a good disclosure of this amount should be a part of the trade confirmation, and bank B should have done and provided Bank A some kind of Simulation results of the expected value of this payment in certain scenarios and let Bank A decide what they would like to do. As a buyer of the protection, Bank A may want to get this money upfront or at least given an option to get paid upfront as a choice.

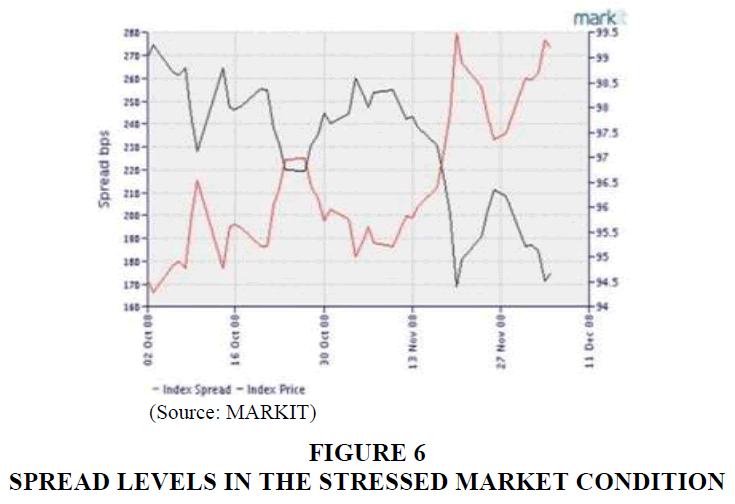

During the stressed market conditions, the default within the option expiry is quite probabilistic, as evident during the 2008 credit crisis. A quick snapshot of the spread movement during the credit crisis is given below (From IHS MARKIT)

1. CDX (North American, investment-grade) Index: down from 233 to 274

2. CDX (North America, high yield) Index: down from 1,376 to 1,461

3. Markit iTraxx Europe Index: down from 163 to 216

4. Markit iTraxx Europe Crossover Index: down from 869 to 1,094

5. Markit iTraxx Japan Index: down from 320 to 375

6. Markit iTraxx Asia ex-Japan IG Index: down from 360 to 435

7. Markit iTraxx Asia ex-Japan HY Index: down from 1,218 to 1,300

As shown above, the spread levels in the stressed market condition and Stressed Credit Scenario could bring a situation when there could be defaults within the Index names before the CDS Index Option expiry. Therefore we can notice that the situation we discussed above is not something that cannot happen. It has happened in the past, and it can happen again in the future (Figure 6).

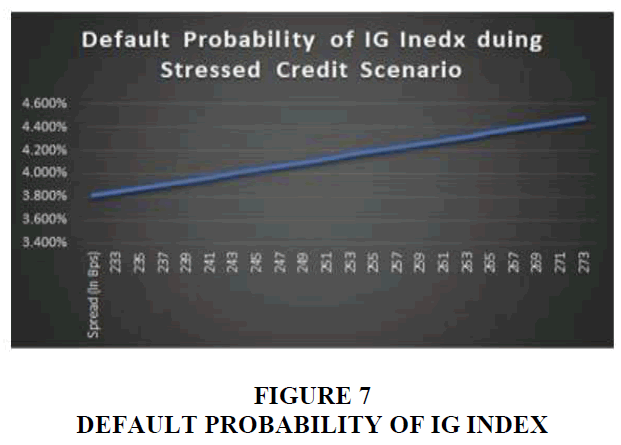

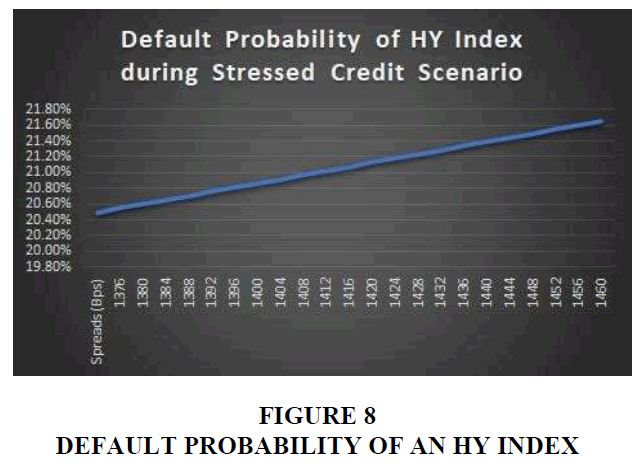

Default Probability Calculation in the Stressed Market Scenario: To justify our case of the above situation occurring, we would like to do a quick calculation of the default probability of IG (Investment Grade) and HY (High Yield) Index as follows (O’Kane, 2011)

Default Intensity

Where R is the Recovery Rate

Probability of default P=1-e-λt

Using the condition that we observed during the Credit Crisis, we run a simulation on IG Index and found a finite default Probability of few names defaulting before the Option expiry (Figure 7).

We ran similar simulations for the High yield Index. We found that with HY (High Yield Index), the Default Probability goes very high, and the probability of few names (Possibly more than one name) is highly probable (Figure 8).

Therefore, we can say that the situation that can lead to business ethical issues can happen whenever the market goes through a distressing condition. Therefore, it makes sense to analyze the ethical principles and its possible violations in the light of some established ethical theories. Question may arise as if this situation is possible again, I would say it is quite likely and largely depend on the economy and market scenario. Since the exercise of Option below the strike was not very uncommon during the credit crisis and that we are to some extent in a similar situation, my argument is that it may happen again.

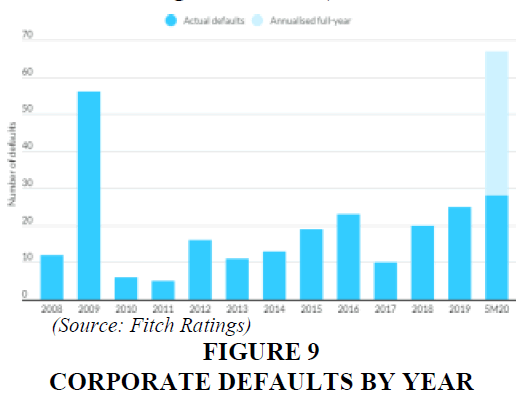

Fitchratings

Fitch is a well-known credit rating agency (Figure 9). From Fitch depicts the number of defaults happened during the credit crisis and this study becomes more important at this frame when the whole entire world is fighting with COVID-19 which to some extent brings back the similar scenarios that we observed during Credit Crisis (Bondoc & Taicu, 2019).

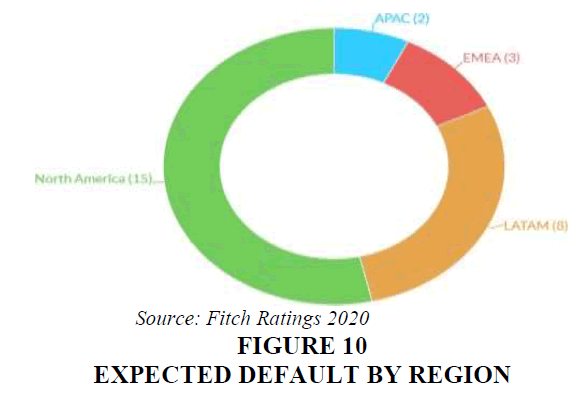

Fitch in his published research (Fitch Ratings) has also indicated that these defaults are heavily skewed towards North America and LATAM regions. Our Analysis on CDX IG index and CDX HY Index covers most of these Issuers (Figure 10).

Ethical Framework

Introduction of ethical framework of business

Scientific and technological advancement, coupled with economic realities and pluralistic worldview, requires that professionals in general and finance professionals like to make ethical considerations in their work (Hoekstra & Kapteyn, 2020). Ethical directives are a source of major debate as this debate brings forth varied opinions and feelings. This is so because some people refer to ethics as merely personal opinions. This kind of thinking seems unfounded as basing ethics on personal opinions, intuition, or unexamined beliefs of individual people can only work theoretically but difficult to implement in reality (Hoekstra & Kapteyn, 2020). Therefore, all professionals must understand the concepts, principles, and theories relating to ethics. This is framed well by Hawkes (2019), who mentions a need to develop hearts and minds.

Ethics is a branch of moral philosophy that is generally defined in terms of its original use. It refers to the study of appropriate behavior and the right kind of conduct (Hoekstra, & Kaptein, 2020). Different theorists and moral philosophers, especially Greek philosophers, whom ethical debates have existed for long, have taken different ethics approaches and defined the related concepts. For instance, Aristotle believed that the right behavior includes practices that satisfy the end goal of "Eudaimonia". This is a Greek term that, when loosely translated, means being overly excited or happy. In contrast, Kant, an 18th-century philosopher and ethicist, believed that ideal behavior encompasses acting according to one's duty (Hoekstra, & Kaptein, 2020). Kant further explained that wellbeing could symbolize the liberty to exercise autonomy, not being used as a means to an end, being treated with dignity, and having rational thoughts/arguments.

As discipline ethics is regarded as a critical way to understand, analyze, and distinguish right from wrong, good from bad since it relates to wellbeing. The determinants of ethics are assessed using approaches of formal theories and code of conduct. These codes of conduct include codes that are designed for different professions and world religions. Ethics is not a static position but rather an active process (Hoekstra & Kaptein, 2020; Dziubaniuk & Nyholm, 2020). Thus, it is common for theorists and philosophers to use the expression of doing ethics to refer to ethical consideration when performing an action or exhibiting behavior in line with ethics.

Another assertion on the debate for ethics is that since people believe and hold a different view of ethics, one must justify their ethical standpoint and support their beliefs and assertions through sound and logical arguments. Evaluations arrived at from practice of ethics demand a proper balance of emotion and reason. This is because basing emotions on ethical related discussion and argument and making decisions does not provide a good foundation. This can be illustrated by the example of Warren Buffet's decision to purchase Berkshire Hathaway so that he would get the pleasure of firing the CEO, Stanton, not considering the company was in terminal decline. Stanton had broken a gentleman's agreement with Buffet about the share price by offering a lower price than initially agreed.

The difference between ethics and morals pertains to the belief system, behavioral conduct (Hoekstra & Kaptein, 2020). If a person behaves or rather exhibits unamiable traits or exudes a character that defines a code of conduct held by that person's society, community, or profession, he is referred to as being unethical.

Banks are in the position to secure the consequences of the credit quality by avoiding moral hazards. The use of good and proper social norms of an institution helps the leaders explore the roles for codes of ethics in improving ethical norms applicable to the financial institutions' accountability mechanisms. Another study provides that hiring ethical officers, for instance, the CIO and the CFO in an organization, reduces the corruption and moral hazards scandals (Jones et al., 2020). It is good for the organizations to offer ethical education to newly hired employees that seem to be less ethical to avoid future misconduct in the financial sectors and offices, which minimizes the corporate accounting scandals.

Based on the arguments presented in Section 3, it is possible that the traders in BANK B may not act in good faith and do not comply with the general ethical framework. Several big banks have explicitly set forward their ethical practices and standard of business conduct well in writing, and every employee or associates have to follow those principals of Ethics.

Goldman Sachs ethics and Compliance group in January 2011, formulated a 14 point “Ethics and Standard of Business Conduct” and time to time revise it. They also make a significant investment in training their employees and partner about those 14-point principals of Ethics. Almost all big banks do have such Ethics and compliance program in their organization.

Virtue Ethics Theory

Unlike the other two approaches, which focus on action as the moral evaluation object, this approach focuses on the person acting (Krambia-Kapardis, 2016; Huang et al., 2019). Rather than taking account of what people do and the repercussions, it looks at who these people are by analyzing their personal qualities. However, it does not consider the physical qualities like height, age, and size but the intangible qualities such as abilities, intentions, and motives (Krambia- Kapardis, 2016). Evaluating this intangible quality makes it easier to determine how an individual will behave in a morally problematic scenario, and thus evaluation in moral terms is easier. Therefore, through how people act, they can be categorized as honest, just, or reliable.

Virtue is a Greek word referring to someone’s or something’s ability to achieve a specific goal (Krambia-Kapardis, 2016). This theory modeling is largely credited to Greek philosophers of ancient times but got publicized in the late twentieth century. Philosophers credited to this theory include Aristotle. He stipulated that having a virtuous character is the basis for the right action. Therefore, an act is determined to be ethical if performed by a person who holds the right virtues virtuous. The character to identify a virtuous person is one who portrays honesty, humility, and prudence.

Consequentialist Ethics Theory

The consequentialist ethics hold that moral acts can be determined by looking at the consequences that result from performing a certain action (Hoekstra & Kaptein, 2020). This involves both the real and expected consequences of an action. Ideal behavior is considered to be desirable and unethical when the consequences are undesirable (Hoekstra & Kaptein, 2020).

The purpose or end of a certain action then determines the measure against which actions are weighed. The consequentialist ethics are also referred to as teleological ethics derived from the Greek word, telos, which means end. When the ends satisfy their own gain, they are considered intrinsic while termed instrumental if used to attain another goal.

Consequentialist theory can be classified as monistic or pluralistic, depending on the number of intrinsic ends it uses. Monistic theories imply that there is only one intrinsic end in which all other ends are set to achieve and the measure through which all actions can be morally evaluated (Dziubaniuk & Nyholm, 2020). At the same time, pluralistic teleological theories posit two or more intrinsic ends. In the CDS Index Option, it is expected that traders from Bank B should possess virtue ethics and wear good moral character while dealing with Clients and Partners in absolute fairness.

Hedonism refers to the teleological theory used to achieve pleasure or delight. This measurement standard of action stretches to the initial stages of classical antiquity. The age-old dilemma for hedonists is how to rank or determine the magnitude of pleasure. Questions have been posed about how a short but intense pleasure compares to a longer but mildly intense pleasure. Epicurus, a Greek philosopher, posited that physical pleasure should not be the end goal rather than the spirit. He argued that seeking pleasure in the physical is momentous and would likely result in evil actions. According to Epicurus, spiritual pleasure is more valuable as it lasts longer and ensures a sense of wellbeing. Though, Hedonism is not documented but was prevalent among the sell-side traders, Broker- Dealers, Business Managers of Investment Bank during the pre-credit Crisis. Among the Credit Traders and those dealing in CDS, CDS Index, Tranches, or CDS Index Options were among the highest earners during the pre-credit crisis-era with Hedonism prevalent among them.

Teleological theories center on this targeted end and can vary from one individual to another. Since individual ends mostly conflict with each other, the question becomes what end should be used to determine a moral action. This question subdivides teleological theories further. At this third stage, ethical egoism, which posits individual pleasure and pain, should be the basis, whereas utilitarianism holds that the common good forms the true end. In his Ph. D. thesis "Proand Anti-Capitalism," Xu et al. (2016) has explained this phenomenon among the bank traders and Investment bankers. This has been depicted in a few movies and documentaries also to a great extent. Some of those movies and documentaries have been listed in the last section of the Bibliography.

Utilitarianism Theory

Utilitarianism implies that actions are evaluated by the usefulness or utility of their consequences. It is meant to promote the greatest good/pleasure/happiness and result in the least amount of pain or suffering. The phrase "providing the greatest good for the greatest number" of people that an action results in is commonly inferred by utilitarianism to determine what is good and ethical for society (Mudrack & Mason, 2019; John & Bruhl, 2018). It is estimated that at one time, JPM lost close to 2 billion on a single day. The huge losses made by the company were felt far and beyond the company's walls.

When individual entities take risks, it could result in huge gains, yet the same could happen with losses. The downside is that individual risk is transferred and reallocated into the system, which affects the whole economy.

Utilitarianism needs to be understood well among capital market participants. There is a thin line between Profit and leverage. Profit is a business outcome, while leverage is the outcome of greed and moral hazard. The bifurcation between the two is not easy to understand when things go as per the expectation, and the economy is good. We see the difference only in stressed scenarios. In our CDS Index Option example, we will never see the difference between profit and leveraged gain when the market moves in favor. There is no default/credit event from Option initiation to Option expiry.

Deontology Ethics Theory

This approach in ethics is focused on duties and rules. Immanuel Kant, a British Philosopher, is most credited with this deontological way of thinking. Kant was of the idea that individuals have the intuition to act rationally and morally automatically (Xu et al., 2016). According to Kant, as cited in Xu et al. (2016), actions can be described as moral only when they are dutiful. Kant revealed that acting from rationality is more appropriate than emotions that are hard to exercise control over.

Deontology is coined from the Greek word Deon that means "one must." This theory's proponent stipulates that ethical behavior is achieved through strict adherence to a set of rules or obligations that cannot be compromised. Deontologists refer to these obligations as duties. The deontological and teleological theories differ on the consequences that an action under consideration is given. Deontologists believe that an action's results are not an efficient method to determine a moral character when compared to rules. They posited that keeping a promise does not entirely mean a reward to be gained. A moral duty rather is cultivated for those who consider themselves ethical (Xu et al., 2016). Analyzing the JPM case study through the deontological approach reveals a serious violation of ethics. JPM defied the Volcker rules, which are meant to have a regulatory effect on risk management of financial institutions like banks, hedge funds, etc. In this case of the CDS Index option, it is the duty of Bank B traders and business managers to provide transparency in dealing with their fiduciary responsibility. Any loss scenarios or earning scenarios should be extensively discussed as an addendum to the typical trade confirmation document. Full and honest disclosure is a must in dealing with Clients as laid out by Deontological ethics and its framework.

The Social Contract Theory

Thomas Hobbes believed that people would rationally choose to have some form of government; he termed this as the social contract (Romious et al., 2016). He postulated that this social contract is entered as people are willing to free up to certain rights to a governing authority in exchange for security and common benefits. This is a dilemma that existed since ancient times, and until now, there is a need to balance the human desire for freedom and human desires for order. This kind of contract naturally exists between organizations and society. The corporation trades perpetual life and limited liability for society's corresponding duties. Theorists that advocate for social contract explain that all communities, just like countries, enact rules for all its members' good. All institutions and organizations have a rule book that everyone is expected to follow to be allowed as members of that group. When these rules are broken, the members face elimination from the group (Vogelgesang et al., 2020). We discussed earlier how every investment bank has laid out its own Ethics and Standard Business principles while conducting business. This is also an example of Social Contract theory. We expect Govt bodies and regulators to develop innovative ideas to promote a culture and values of ethics in business. Some of the recent rules and regulations have attempted to address these concerns in their own way (Brinded, 2017).

Summary and Future Research

Concluding Remarks and Summary

Credit Derivatives are indeed a hedging instrument, but it can easily is used as leverageseeking instruments. Because of its opacity in calculations and business protocols, it can’t be used by general investors who are otherwise self-sufficient in investing Stocks, Bond or other cash instruments. They need expertise in investing in Derivatives for various purposes. For that, they have to reach out to experts who are generally big Investment Banks, Broker-Dealers, and various other financial services companies. These companies generally have more information about the business than ordinary investors, just like in our example of Bank A. There is an obvious asymmetry of information and information bias towards these big banks. Sometimes, these big banks try to leverage this bias and monetize their position using unfair means and unethical practices. Derivatives in general and Credit Derivatives products, particularly because of its inherent complex structure, provide this unethical opportunity more than regular financial products. We discussed the case of the CDS Index Option as an example that can create such a possible scenario where the moral hazard can take over on the fiduciary responsibility, and big banks like Bank B in our example can resort to such malpractices. Though this is a possible future scenario, that doesn’t mean it hasn’t happened in the past. Procter and Gamble vs. Banker Trust is exactly this scenario but happened with Complex interest rate Option Product.

Future Research Possibilities

A lot can be gathered from studying ethical issues in Credit Derivatives in general and CDS Index Option in particular. Certain research possibilities may be created from it. However, the one involving the case as it relates to the Volcker rule is simply too appealing. One aspect of the Volcker Rule is to remove proprietary trading from banks. Proprietary trading is considered a moral hazard for systemically important banks. Banks may tend to take an excessive risk as the government/taxpayers incur the cost, as witnessed in the last financial crisis and the government's decision to stop and rescue the big bank. Consider the following areas:

1. Distressed debt trading (high-risk lending). The bank will claim this is part of a bank's core function, which is to lend money. This is a gray area. In reality, distressed debt trading is a high risk, often more so than equity trading. While many equity proprietary trading desks are now dissolved under the Volcker Rule, the distressed debt trading desk continues to thrive.

2. Market making in illiquid assets. A bank also functions as market makers.

To make markets, a trader needs to hold some assets on the bank's balance sheet. This allows the trader to show an offer (basically a price where a client can buy the particular asset) at all times. That is open to interpretation. The trader may hold much more than necessary as a side bet to make money with the bank's balance sheet. These are some examples that exist as it relates to one aspect of the Volcker rule. Possibly, various derivatives desks will hide under the headline of hedging activities to avoid scrutiny. Certain risks (particularly in derivatives) can be open to interpretation and reclassified to get around the Volcker rule. Hedging and market-making versus outright speculation are often not black and white.

The Volcker rule says that banks cannot use FDIC insured funds to finance derivative operations, so what a bank can do is use non-FDIC insured funds to finance derivative operations. Banks have a subsidiary covered by Volcker, but they have a separate subsidiary that is not. This does have an impact because since banks cannot use FDIC-funds to finance derivative operations, banks have less money on their balance sheet, which means that they can issue fewer derivatives.

Future research possibilities have to consider the provision of advanced regulations to guard the financial systems and traders in-depth. For instance, there should be good risk management plans that do not ignore other metrics as experienced before. The higher management will have to foresee how the limitations are imposed on the SCP's market values to avoid further breaches to be caused in other bank metrics. Apart from GAAP, the accounting sectors will also have to consider other sub-methods for handling financial matters. For instance, the use of the integrated financial information systems for accuracy purposes to prevent the London whale from economic depressions.

The other thing is that what constitutes FDIC-funds and what does not is something that ethicists will argue about, and a lot of the regulator effort involves defining those terms. They will have an attorney arguing the meaning of every single word in the legislation. Also, banks cannot "hide" anything. They can hire lots of lawyers and lobbyists and get rulings from the regulators that certain things are not covered. Part of the chess game involves figuring out which regulator issues which ruling.

Once the regulator issues a ruling, then the lawyers in a bank will issue a policy statement. The people in the bank will argue over the meaning of every word in that policy statement. The Volcker Rule is absurd. Trying to determine regulation based on why someone holds something is too hard and wasteful. It is complicated to segregate the types of transactions that are helping customers and those strictly proprietary.

What Dodd-Frank is, is instructing through the law what certain agencies ought to try to do. Banks cannot do things that way because then the regulatory agencies proceed to fuss around to figure out how to do what the law says. For example, Dodd-Frank had a provision that banks must give qualified mortgages, and if they do not give them, then there are stiff penalties. The act never went on to define what a qualified mortgage is. Hence, banks are reluctant to make loans. For the Volcker Rule, it’s the same case. There is no hardwiring in the law for how to prevent banks from speculating with their own money. The law just says banks must not do proprietary trading.

Comparatively, reflecting on the ethics and regulations' prior mentioned features, an individual needs to know that the two can be implemented. Reasonably, ethics and regulations work alongside one another, whereby ethics without regulation, there will be the likelihood of little value in the two aspects. Notably, ethics is the main determinant since, in any given organization most regulators consider the image of regulations, which depends on the ethical considerations. This simply implies that the use of rules and regulations that are strict enough helps eliminate the ambiguous distinctions in any given organization. However, the London Whale failed to implement such regulations, making the traders submerged to unethical issues, which exposed the JPMorgan banking system to more risks of moral hazards.

Conclusion

The moral hazards are believed to arise due to lack of ethics among the senior management and, in the long run, caused the financial crisis in banking institutions, which in turn affected the wellbeing of the traders. Alternatively, the London Whale case calls for a need to apply ethics, for example, in the use of credit default swaps (CDS) in hedging against risks and acts as insurance for regulation purposes.

With the resultant disaster that nearly led to the collapse of the whole market, the government initiated the rules, pointing out that heavy fines were to be imposed as a deterrence measure in case of the violations. In contrast, it is beyond doubtful reasoning that ethics can be implemented with regulations since, during the law creation and interpretation, ethics is used to make the formulations. Finally, any firm should be fair and consider the need for subjective values while making the laws to achieve the proper functioning of ethics in handling administrative duties.

References

Acharya, V., Pagano, M., & Volpin, P. (2016). Seeking alpha: Excess risk taking and competition for managerial talent. The Review of Financial Studies, 29(10), 2565-2599.

Indexed at, Google Scholar, Cross Ref

Bai, X., Hu, N., Liu, L., & Zhu, L. (2017). Credit derivatives and stock return synchronicity. Journal of Financial Stability, 28, 79-90.

Indexed at, Google Scholar, Cross Ref

Bondoc, M.D., & Taicu, M. (2019). Ethics in financial reporting and organizational communication. Scientific Bulletin-Economic Sciences, 18(3), 168-174.

Borisov, A., Goldman, E., & Gupta, N. (2016). The corporate value of (corrupt) lobbying. The Review of Financial Studies, 29(4), 1039-1071.

Indexed at, Google Scholar, Cross Ref

Brinded, L. (2017). The London Whale' trader who made a $6.2 billion trading loss says he'd welcome a lawsuit to retrieve his stolen life.

Ian-Carlin, B., & Gervais, S. (2009). Work ethic, employment contracts, and firm value. The Journal of Finance, 64(2), 785-821.

Indexed at, Google Scholar, Cross Ref

Cohn, A., Fehr, E., & Maréchal, M.A. (2017). Do professional norms in the banking industry favor risk-taking. The Review of Financial Studies, 30(11), 3801-3823.

Indexed at, Google Scholar, Cross Ref

Culp, C.L., Van der Merwe, A., & Staerkle, B. (2016). Single-name credit default swaps: A review of the empirical academic literature. Johns Hopkins Institute for Applied Economics, AF/No, 11.

O'Kane, D. (2011). Modelling single-name and multi-name credit derivatives. O'Kane/Modelling - Advanced multi-name credit derivatives, 573.

Dziubaniuk, O., & Nyholm, M. (2020). The constructivist approach in teaching sustainability and business ethics: A case study. International Journal of Sustainability in Higher Education.

Indexed at, Google Scholar, Cross Ref

Hans,V. (2020). Principle of ethics and capital markets.

Hawkes, D. (2019). Against financial derivatives: Towards an ethics of representation. Journal of Interdisciplinary Economics, 31(2), 165-182.

Indexed at, Google Scholar, Cross Ref

Hoekstra, A., & Kaptein, M. (2020). The integrity of integrity programs: Toward a normative framework. Public Integrity, 1-13.

Indexed at, Google Scholar, Cross Ref

John, J., & Bruhl, R. (2018). How Friedman’s view on individual freedom relates to stakeholder theory and social contract theory. Journal of Business Ethics, 153(1), 41-52.

Indexed at, Google Scholar, Cross Ref

Jones, M.C., Kappelman, L., Pavur, R., Nguyen, Q.N., & Johnson, V.L. (2020). Pathways to being CIO: The role of background revisited. Information & Management, 57(5), 103234.

Indexed at, Google Scholar, Cross Ref

Krambia-Kapardis, M. (2016). Contributing to financial crisis prevention through banking and financial services regulation. Banking and Financial Services Policy Report.

Kumar, S., & Baag, P.K. (2021). Erosion of ethics in credit derivatives: A case study.

Indexed at, Google Scholar, Cross Ref

Kumar, S., & Baag, P.K. (2021). Ethics erosion in capital market: Lehman brothers’ case study of repo.

Indexed at, Google Scholar, Cross Ref

Mahadevan, S., & Patkar, V. (2015). Credit options basics, credit derivative strategy. Morgan Stanley research, North America.

Mudrack, P.E., & Mason, E.S. (2019). Utilitarian traits and the Janus-Headed model: Origins, meaning, and interpretation. Journal of Business Ethics, 156(1), 227-240.

Indexed at, Google Scholar, Cross Ref

Huang, P., Huang, H.Y., & Zhang, Y. (2019). Do firms hedge with foreign currency derivatives for employees. Journal of financial Economics, 133(2), 418-440.

Indexed at, Google Scholar, Cross Ref

Rene, M.S. (2010). Credit default swaps and credit crisis. Journal of Economic Perspectives, 24(1), 73-92.

Indexed at, Google Scholar, Cross Ref

Richard, J.M. (2011). A CDS option miscellany.

Romious, T.S., Thompson, R., & Thompson, E. (2016). Ethics training and workplace ethical decisions of MBA professionals. Journal of Education and Learning, 5(1), 190-198.

Indexed at, Google Scholar, Cross Ref

Saft, J. (2009). Ethics without regulation won’t cut it.

Svetlova, E., & Thielmann, K. (2020). Financial risks and management. International Encyclopedia of Human Geography.

Indexed at, Google Scholar, Cross Ref

Terzi, N., & Ulucay, K. (2011). The role of credit default swaps on financial market stability. Procedia Social andBehavioral Sciences.

Indexed at, Google Scholar, Cross Ref

Tyge, P.G., & Oleg, V.P. (2019). Agency theory in business and management research .

Indexed at, Google Scholar, Cross Ref

Vogelgesang, G.R., Crossley, C., Simons, T., & Avolio, B. J. (2020). Behavioral integrity: Examining the effects of trust velocity and psychological contract breach. Journal of Business Ethics, 1-16.

Indexed at, Google Scholar, Cross Ref

Xu, Z.X., & Ma, H.K. (2016). How can a deontological decision lead to moral behavior? The moderating role of moral identity. Journal of Business Ethics, 137(3), 537-549.

Indexed at, Google Scholar, Cross Ref

Received: 16-Jan-2022, Manuscript No. JLERI-22-10885; Editor assigned: 18-Jan-2022, PreQC No. JLERI-22-10885(PQ); Reviewed: 01- Feb-2022, QC No. JLERI-22-10885; Revised: 01-Mar-2022, Manuscript No. JLERI-22-10885(R); Published: 08-Mar-2022