Research Article: 2018 Vol: 21 Issue: 2

Juridical Implication of Share Cross Holding According to Limited Liability Company Law in Indonesia.

Irawan Soerodjo, University of Dr. Soetomo

Abstract

Share cross holding, which is based on the provisions in Limited Liability Company Law (UUPT) namely Law number 40 of 2007 which regulates that a Limited Liability Company (PT) is not allowed to issue new shares to be self-owned either directly or indirectly. Share cross holding often occurs in business activities, either within the country or overseas. With this share cross holding, without capital payment, a company may own and control another company through share ownership (either majority shares or controlling shares by cross holding. This is not in line with the purpose of capital increase of a business entity which is to have a sound financial condition. Business actors perform share cross holding merely for the purpose of controlling another company in order it is shown that there is enhanced effectiveness and productivity of the company for the sake of profit. As such capital increase is quasi, and as a matter of fact (in reality), there is no increased capital at all, thus such capital increase is only a formality and recorded in the company book

Keywords

Limited Liability Company, Share Cross Holding, Company Capital, Shares.

Introduction

In the company capital increase, the term of cross holding is known which regulates the prohibition as provided in Article 36 paragraph (1) of Law No. 40 of 2007?

The definition of indirect cross holding is share ownership of the first company in the second company through an ownership in one or more “Interval Company” and on the other hand the second company has shares in the first company.

Share cross holding is when one of the shareholders in the company is another company. This system is often used by entrepreneurs in Japan since Japan joined OECD in 1964 when companies in Japan are required to sell its shares in the capital market overseas. Through this system, the capital owner is trying to prevent foreign investors entering Japan. In addition to cross holding with another company, many companies in Japan also utilize banks or other financial institutions as its shareholder.

With the existence of Cross Holding, in terms of capital, specifically in the context of new share issuance, it is clear that there is no real capital payment to the company and in terms of management, cross holding tends to mix the ownership and management of one company with the other, as such in this case, the management is no longer independent with one another (widjaja, 2008).

Thus, one company may own and control another company through share ownership (both majority and controlling shares). The reason business actors and/or company conducts cross holding is, that controlling another company may increase effectiveness and productivity of the company for the sake of profit, because the objective of the Company is profit oriented.

In the previous UUPT, namely Law Number 1 of 1995, there is no rule prohibiting cross holding. Companies are prohibited to issue shares to be self-owned. In principle, share issuance is an effort of capital mobilization, therefore the obligation for payment of shares actually should be assumed by another party (Kansil, 2002).

However, share cross holding in UUPT has not been clearly provided for, as cross holding is only provided under Article 36 of UUPT, namely “prohibition” of company owning new shares issued by another company which shares directly or indirectly owned by a company and vice versa. With regard to the prohibition of share cross holding, it is implied that in principle share issuance is an effort of capital mobilization, therefore the obligation for share payment should actually be assumed by another party. This matter among others has been provided in article 33 of UUPT namely capital payment by the Company which is made in full.

The asset of Limited Liability Company in the Cross Holding is quasi. The reason is that the capital increase is only stated in a deed, and only recorded in the Balance Sheet (Financial Statement) of the Company but in reality the company capital increase is only transferred from the holding company to its subsidiary or the reverse. Therefore, if the capital payment is only transferred within the group and therefore in reality there is no real capital increase in the company and this is contrary to the content of article 33 of UUPT which is also contrary to the objectives of capital increase of company which is to strengthen the financial aspect of the Company.

This event is most interesting to be researched in line with the development in the thinking using juridical approach and based on commercial practice.

Methodology

Research is the main pillar in the science development. Research has the purpose to disclose the truth systematically, methodologically and consistently in this case it will include legal research. The research methodology of a study of law is by using normative law approach, normative juridical approach, including reviews and various analyses of legal materials related to the issues being analysed. Legal materials are collected by literature studies namely collecting materials by reviewing the literature materials and subsequently the materials are analysed using legal theory approach.

After studying the research method carefully, the researcher: A. for primary materials, namely the regulations under UUPT that provides Cross Holding; examined the opinions of the experts concerning the objectives of capital increase in the Limited Liability Company/PT; c. examined the opinions of experts concerning Cross Holding and objectives of Cross Holding; d. pay attention to the purpose of Cross Holding and purpose of prohibition of Cross Holding in PT in Indonesia; and e. examined the spirit and purpose of the drafter of UUPT concerning the prohibition of Cross Holding practices in Indonesia.

Result And Discussion

Definition of Limited Liability Company in Indonesia

Limited Liability Company is a legal entity which constitutes a capital alliance, established based on an agreement, conducting business activities with authorized capital which in its entirety comprising of shares and meet the requirements established by this Law and its implementing regulations. The Company comprises of all share nominal value. Article 1 number 1 of UUPT 2007, reads:

“Limited Liability Company, hereinafter referred to as the Company, means a legal entity constitutes a capital alliance, established based on an agreement, in order to conduct business activities with the Company’s Authorized Capital divided into shares and which satisfies the requirements as stipulated in this Law, and it implementation regulations.”

Departing from the provision of Article 1 number 1 of the above UUPT 2007, there are a number of principal elements that create a Limited Liability Company as a Legal Entity which should meet the following requirements:

1. Capital Alliance

A company as a legal entity has “authorized capital”, namely the amount of capital mentioned or declared in the Deed of Establishment or Articles of Association of Company.

The authorized capital comprises of and is divided into shares or zero. The capital which comprises of and is divided into shares is included by the shareholders in their status as members of the Company by paying or transferring the shares into the Company treasury. Therefore, there are a number of persons or Legal Entity as candidate shareholders that are in alliance to mobilize capital to implement company activities managed by the Company. The amount of Company’s authorized capital according to Article 31 paragraph (1) of UUPT 2007 comprises of all “nominal value” of the shares. Further according to Article 32 paragraph (1) the Company’s authorized capital shall at least be Rp.50.000.000 (fifty million rupiah).

As a matter of fact, an Alliance in the Company as a legal entity is not only a capital alliance, but also an alliance of members consisting of shareholders. However, the one prominent is capital alliance as provided in Article 1618 of Civil Code. However, it does not mean that an alliance of members is not required. UUPT requires Company’s Shareholders shall at the minimum 2 persons or more Legal Entities.

1.1 Agreement as a Foundation for the Establishment of Company

Company as Legal Entity shall be established pursuant to “Agreement”. An agreement is an event where a person promises to another person or where the two persons promise to each other to carry out something. The same thing is expressly stated in Article 1 number 1 of UUPT 2007.

UUPT does not limit the number of person (party) establishing a Limited Liability Company. With regard to the maximum number of person (party) that may establish a Limited Liability Company, shall be entirely left to the parties entering into an agreement, which is governed under UUPT is the minimum number of parties in establishing a Limited Liability Company, and not the maximum number (Scheeman, 2012).

From the point of view of agreement law, the nature of establishment of Company as a legal entity is “contractual” (contractual, by contract), namely a Company is created from an Agreement. As a result of a consent contained in an Agreement, a Company is established. Other than contractual in nature, it is also consensual, namely there is consent to enter into an Agreement for Company establishment.

As referred to in the provisions of Article 7 paragraph (1) of UUPT 2007, in order that the Agreement to establish a Company is valid under the law, the founder shall at least be 2 (two) “persons” or more. This is expressly stated in the elucidation of Article 7 paragraph (1) of UUPT 2007 second paragraph, that the principle applicable based on this law, the Company as a legal entity is established based on the Agreement, therefore it has more than 1 (one) shareholder. What is meant by “person”: According to the elucidation, namely: A natural person (Indonesian as well as foreign citizen) or Indonesian or foreign legal entity) (elucidation of Article 7 paragraph (1) of UUPT 2007).

The provision as set forth in Article 7 paragraph (1) of UUPT 2007 as well as its elucidation is in line with the provisions set forth in Article 1313 of Civil Code. An agreement is an action where one or more person(s) bind himself or themselves to one person or more.

Further according to Article 1320 of Civil Code, in order that the Agreement on a Company Establishment is valid, it shall meet the following requirements:

• There must be consent (agreement);

• There must be capacity (competence) to conclude an agreement;

• There must be a specific subject (fixed subject matter);

• There must be an admissible cause (allowed cause).

If an Agreement is valid, then based on Article 1338 of Civil Code, the Agreement on the establishment of the Company, shall be binding as a law for them. In this case, the “consecualism principle” shall be applicable.

Through the limitations given above there are five subject matters that can be pointed out here:

• Limited Liability company shall be a legal entity;

• Established based on an agreement;

• Carry out certain business;

• Has capital comprising of shares:

• Comply with the requirements of the law (Yani & Widjaja, 2000).

In UUPT it is expressly stated that a company is a living legal entity because it is intended by the law. In line with the matter, Yahya Harahap mentioned that Limited Liability Company as a legal entity is a legal creature. This is different from Commercial Code which does not expressly state a company is a legal entity (Harris & Anggoro 2010).

1.2 Conducting Business Activities

According to provisions of Article 2 of UUPT 2007, a Company should have purpose and objectives as well business activities. Furthermore, in Article 18 of UUPT 2007 it is expressly stated, the purpose and objective as well as business activities should be specified in the Company’s Articles of Association according to the provisions of laws and regulations.

Pursuant to the part of elucidations of Article 18 of UUPT 2007, the purpose and objectives shall be the “main business” of the Company. While “business activities shall be “activities carried out” by the Company for the purpose of achieving the purpose and objectives.

A Company which does not have business activities, shall be deemed no longer exists. Although in the Articles of Association, the activities are clearly stated, however, if there are no activities for the activities mentioned in the Articles of Association, basically the Company shall be deemed no longer exists as a legal entity.

1.3 A Company is Established According to Legal Procedure through Government Ratification

The birth of Company as a legal entity, because it is created or manifested through legal process according to the provisions of laws and regulations.

The definition of legal entity is originated from Latin called Corpus or Body. It is different from a natural person. The birth of a person as a legal entity is through a natural process. On the other hand, a Company is created as a legal entity, through a legal process. That is the reason why a Company is called legal entity in an artificial form which is created by the state through a legal process.

The process of its birth as a legal entity absolutely is based on the Decree on Ratification by the Minister. This is expressly stated in Article 7 paragraph (4) of UUPT 2007 that reads:

“The Company obtains the status of legal entity on the date the Decree of Minister concerning the Company’s ratification as a legal entity is issued”

Its existence as a legal entity is proven based on the Deed of Establishment in which the Company’s Articles of Association is set forth. If the Company’s Articles of Association has obtained “ratification” from the Minister, the Company shall be a “corporation legal subject”.

Elements of PT

Before the independence of the Unitary State of the Republic of Indonesia (NKRI), a Limited Liability Company is known as Naamloze Vennootschap which is abbreviated as (NV); however in 2007 it is officially becomes a Limited Liability Company, as we can see from Law No.40 of 2007 on Limited Liability Company.

In order to establish a Limited Liability Company, there are some elements as requirements that should be fulfilled, namely:

1. Formal Requirements

A Limited Liability Company intended to be established should be made by a Notarial deed, as provided under article 7 of UUPT 2007 as follows:

• Companies must be established by 2 (two) or more persons by a notarial deed made in the Indonesian language.

• Each founder of a Company must subscribe shares at the time the Company is established.

• The provision contemplated in paragraph (2) does not apply in the context of a Consolidation.

• The Company obtains the status of a legal entity on date the Decree of the Minister concerning the Company’s ratification as a legal entity is issued.

• If after the Company obtains the status of a legal entity the number of shareholders becomes less than 2 (two) persons, then within 6 (six) months as from when that situation arises the shareholder concerned must assign part of the shares to some other person or the Company must issue new shares to some other person.

• In the event that the period contemplated in paragraph (5) has expired and there is still less than 2 (two) shareholders, the shareholder shall be personally liable for all legal relationships and losses of the Company, and at the request of a party concerned, a district court may wind up the Company.

• The provision which obliges Companies to be established by 2 (two) or more persons as contemplated in paragraph (1) and the provisions in paragraphs (5) and (6) do not apply to:

o State Limited Liability Companies all of whose shares are owned by the State; or

o Companies managing stock exchanges, clearing and guarantee houses, central securities

A Limited Liability Company is established based on an Agreement. Therefore, to be able to establish a Limited Liability Company, at least there should be 2 (two) persons that promise one another. UUPT does not limit the number of persons (parties) to establish a Limited Liability Company. As to the maximum number of persons (parties) that establish a Limited Liability Company, it will be entirely left to the parties making the agreement, which is provided under UUPT is the minimum number of parties that establish a Limited Liability Company, not the maximum number.

The provisions requiring a Company is established by 2 (two) persons or more do not apply to:

• Company whose shares are owned by the State;

• Company managing stock exchanges, clearing and guarantee houses, central securities depositories, and other institutions regulated in the Capital Markets Act.

• Public company.

The Establishment of Limited Liability Company is made based on an agreement, however the agreement should be made in a certain format and should be through the official authorized to do that. It means, to establish a Limited Liability Company, it is not only based on an agreement of the parties only, but it should also be made based on a Notarial Deed.

As a company established based on an agreement, then after the company has a status as a legal entity, the shareholders of the Limited Liability Company should still be limited up to at least 2 (two) persons or more legal entities. In the case shareholders are less than 2 (two) persons, then within the period of maximum 6 (six) months since such a condition, the concerned shareholders shall transfer part of its shares to another person. If that period has elapsed, the sole shareholder shall be liable personally for all legal relationships and losses of the Company and at the request of a party concerned, a district court may wind up the Company.

To be able to make an agreement, it should in line with the principles of agreement law as provided in Civil Code (hereinafter shall be referred to as “Civil Code”. In Article 1313 of Civil Code, it is stated that an agreement is an act pursuant to which one or more individuals bind themselves to one another. And in article 1234 of Civil Code it is stated that “their purpose is to provide something, to do something or not to do something”. Therefore, if the agreement is made validly, then such an agreement will give consequences to the parties entering into the agreement or bound to each other.

This is expressly stated in article 1338 of Civil Code paragraph (1) all valid agreements apply to the individuals who have concluded them as law. From the provision it is known that, an agreement that has been made validly shall be complied with by those making it. If it is related to the establishment of a Limited Liability Company, then it can be concluded that the relationship between shareholders and Company is based on a contractual relationship that originates from the rights and obligations governed in the laws and regulations and which have been agreed upon as contained in the Articles of Association (AoA) of Limited Liability Company. Therefore, AD is a manifestation of an agreement of Limited Liability Company (Sembiring, 2012).

However, according to Rudhy Prasetya it is necessary to know that agreement law theory is only applicable when the Limited Liability Company is about to be established, however, after the Limited Liability Company is established the agreement theory is no longer applicable. After a Limited Liability Company is established, “institutional” theory is applicable. According to this theory, shareholders shall submit to Limited Liability Company as a legal entity. In a Limited Liability Company, legal actions shall be taken on behalf of the Limited Liability Company and the one responsible is the Limited Liability Company itself. Shareholders shall not be responsible for the Actions of the Limited Liability Company. It means, if a Limited Liability Company experiences bankruptcy, in the case there is no violation governed under UUPT, such bankruptcy will not affect the assets of shareholders.

2. Material Requirements

Limited Liability Company is a legal entity which is a capital partnership, established based on an agreement, conducting business activities with authorized capital which entirely comprises of shares and meets the requirements set forth by this Law as well as its implementing regulations.

Thus the emphasis is capital that is the reason Limited Liability Company is called capital partnership. Therefore, it can be concluded that capital is the material requirements in the establishment of a Limited Liability Company. It means that to establish a Limited Liability Company, there should be capital with the minimum amount as stipulated UUPT, as explained below.

In addition to having rights due to share ownership, shareholders also have obligations. The main obligations of shareholders are to pay a portion of shares that are payable and so long as it has not been fully paid; it should not be transferred to another party without the approval of PT. The general obligations of PT shareholders are to manage the assets of individuals, driving company businesses and represent PT within and outside the law (Hasyim, 2009).

PT Capital

Company capital and shares shall be implemented pursuant to Law of the Republic of Indonesia No 40 of 2007 on Limited Liability Company. The authorized capital shall comprise of all nominal value of shares, provision of which shall not preclude the possibility the laws and a regulation on capital market provides company capital comprising of shares without nominal value.

The Law that regulates certain business activities may determine the minimum amount of Company capital greater than the provision on authorized capital, company authorized capital shall at least be Rp. 50.000.000-(fifty million rupiah).

The capital that should be subscribed and fully paid as contemplated shall be proven by a valid payment evidence, what is meant by “valid payment evidence” is among others:

• Evidence of payment of shareholders to the bank account in the name of Company;

• Data from financial report that has been audited by a public accountant; or

• Company balance of sheet which is signed by the Board of Directors and Board of Commissioners.

Payment of share capital may be made in the form of money and/or other forms. In the event share capital payment is conducted in another form as meant thereof, the valuation of share capital payment shall be determined based on fair value which is determined according to market price or by an expert which is not affiliated with the Company, Share payment in the form of immovable assets shall be announced in 1 (one) newspaper or more, within a period of 14 (fourteen) days after the deed of establishment is signed or after a General Meeting of Shareholders decide on the share payment.

The fair value of share capital payment shall be determined according to market value. If market value is not available, then the fair value shall be determined based on the appraisal most appropriate with the characteristic of payment, based on relevant information which is a professional appraiser in its field.

Shares are the main company capital when the company is established, as provided under Article 31 paragraph (1) of UUPT, company capital shall comprise of all share nominal value. These shares, are different according to the type of the company, it may be issued in various kinds and forms, as long as these shares are issued in the nominal of Indonesian currency. The provisions of UUPT do not preclude the possibility that laws and regulations on capital market govern company capital comprising of shares without nominal value (Megarita, 2012). Capital in a Limited Liability Company is differentiated as follows (Ginting, 2007):

1. Authorized Capital

Authorized Capital means the amount of capital mentioned in the Limited Liability Company’s Articles of Association.

In Article 31 of UUPT it is mentioned that:

• The company authorized capital shall consist of all nominal value of shares.

• The provision as referred to in paragraph (1) does not preclude the possibility that the laws and regulations on capital market govern company capital consisting of shares without appraising the share nominal value.

Authorized capital is the maximum amount of shares which may be issued by the company so that the authorized capital shall consist of all nominal share capital. This authorized capital which is often used as the criteria in order a company may be classified in a certain category, namely whether the company is classified as small, medium or large company.

Authorized capital should be determined and stated in the company’s Authorized Capital. This capital consists of a sum of capital comprising of shares that may be issued or allotted by a company together with the nominal value of each share issued (Scheeman, 2012).

Authorized capital as the amount of all capital which may be issued by the company. Authorized capital shall be stated in the company’s articles of association. The amount of this authorized capital may be increased or reduced (Keenan & Bisacre 2002).

Capital increase may only be made with an issuance of new shares by making an amendment to company’s Articles of Association. The amendment of Articles of Association itself shall be made through a General Meeting of Shareholders.

2. Issued Capital

Issued capital is shares that have been subscribed and actually have been sold, both to the founders or company shareholders. The founders have agreed to take a portion or a certain amount of company shares and therefore, they have the obligations to pay or make payment to the company.

Issued capital or capital that has been subscribed, namely part of company capital that has been approved to be subscribed by the founders, in the form of shares. Where in article 33 of UUPT it is stated that at least 25% (twenty-five percent) of authorized capital as referred to in article 32 shall be issued and fully paid.

3. Paid Up Capital

Paid up capital are the shares that have been fully paid to the company indicating that real payment has been made, both by the founders, as well as company shareholders.

Paid up capital, namely capital that is already in the Company treasury. This capital is paid by shareholders. All shares that have been issued should be fully paid during company ratification with a valid proof of payment. The capital paid by the founders of Company may be in the form of money and or other forms.

The Purpose of PT Capital Increase

The purpose of PT Capital Increase is to strengthen the Company capital used in business development.

However, company capital increase must obtain an approval of General Meeting of Shareholders (GMS) or Board of Commissioners that have been given an authority by GMS (vide Article 41-43 in conjunction with Article 44 of UUPT 2007).

PT Shareholders

1. Prohibition of a Single Shareholder

Article 36 paragraph (1) of Law Number 40 of 2007 on Limited Liability Company (“UUPT”) provides that, Limited Liability Company (“Company) is prohibited to issue shares to be self-owned by the Company as well as other Companies, which shares directly or indirectly are already owned by a Company. In principle it is implied that share issuance is an effort to mobilize capital, thus the obligation for the payment of shares should be assumed by the shareholders. For certainty, this provision determines that Company may not issue shares for themselves. This prohibition also includes prohibition of cross holding which occurs if the Company has shares issued by another Company, either directly or indirectly. The definition of direct cross holding ownership is if the first Company has shares in the second Company without going through ownership in one “Interval Company” or more and on the other hand the second Company has shares in the First Company. While, the definition of indirect cross holding is share ownership of first Company in the second Company through ownership in one “Interval Company” or more and on the other hand the second company has shares in the first Company.

The provision on the prohibition of share ownership as referred to above, shall not be applicable to the share ownership obtained based on transfer due to law, grant or bequest as provided in Article 36 paragraph (2) of UUPT. According to the elucidation of this Article, it is said since there is no share issuance that need payment of funds from other parties, this does not violate the provision on prohibition of share issuance as referred to in Article 36 paragraph (1) of UUPT.

Furthermore, the shares obtained based on law, grant and bequest pursuant to the provisions of Article 36 paragraph (2) of UUPT, within a period of 1 (one) year after the date of acquisition shall be transferred to another party that is not prohibited to own shares in the Company. If the other Company is a security company, then provisions of laws and regulation on capital market shall be applicable.

2. The Consequence of a Sole Shareholder

Other shareholders and creditors that have payment receivable from the Company cannot exercise right to collect (cessie) as a compensation for the obligation for payment for the price of shares that have been subscribed, unless approved by GMS. Right to collect (cessie) against the Company as contemplated that may be compensated by share payment is right to collect (cessie) against amount receivable from the Company arising from:

• Company has received money or delivery of tangible or intangible goods that can be valued by money;

• The party who becomes the one responsible for or guarantor of Company indebtedness has fully settled the Company indebtedness in the guaranteed amount; or

• Company becomes the party responsible for or guarantor of the debt of third party and Company has received benefit in the form of money or goods that may be valued in money which is directly or indirectly has been clearly received by the Company.

Resolutions of GMS as contemplated are valid if implemented according to the provisions concerning notice to the meeting, quorum, and total votes for amendment of articles of association as governed under this law and/or articles of association.

Cross Holding

1. Definition

The definition of Cross Holding is provided in the Law No. 40 of 2007 on Limited Liability Company, Article 36 paragraph (1) and its elucidation that explains that cross holding is:

“Cross holding that occurs if the company owns shares issued by another Company that own shares in that company, either directly or indirectly.”

The definition of direct cross holding is when the first company owns shares in the second company without ownership in one “Interval Company” or more and on the other hand the second company owns shares in the first company.

The definition of indirect cross holding is the ownership of first company of shares in the second company through ownership in one “Interval Company” or more and on the other hand the second company has shares in the first company (Huda, 2015).

2. Legal Grounds

Legal grounds concerning prohibition of cross holding are clearly set forth in the entire Article 36 of Law Number 40 of 2007 that reads as follows:

Article 36

• A Company shall be prohibited to issue shares either owned by the Company itself or owned by other Companies, which shares directly or indirectly are owned by the Company.

• The provisions on the prohibition of share ownership as referred to in paragraph (1) shall not be applicable on share ownership acquired based on transfer based on law, grant or bequest.

• Shares acquired based on the provision as meant in paragraph (2), within a period of 1 (one) year after the date of acquisition should be transferred to another party which is not prohibited to own shares in the Company.

• In the event the other Company as referred to in paragraph (1) is a security company, the laws and regulations on capital market shall be applicable.

3.Cross Holding Scheme

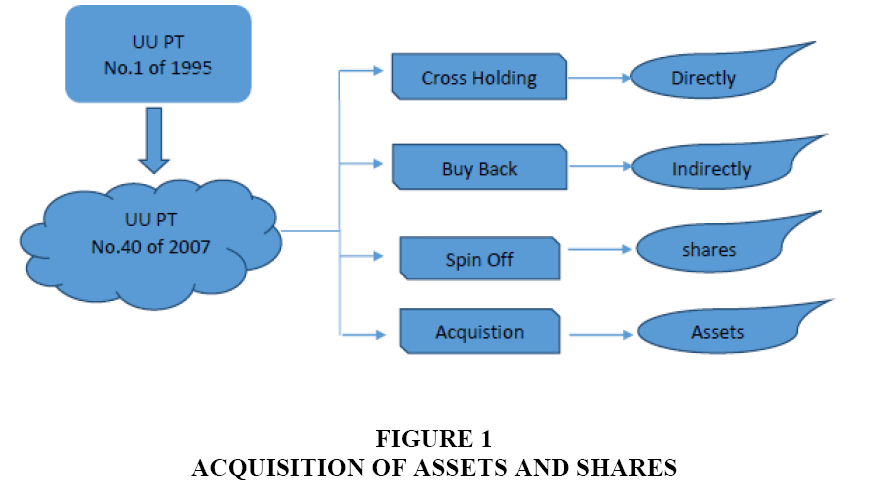

Prior to UUPT No.40 of 2007, UUPT No.1 of 1995 was applicable which took effect from 7 March 1996 (1 year after promulgation) to 15 August 2007, UUPT No.1 of 1995 was the substitute of the provision on Limited Liability Company provided in Commercial Code Article 36 to Article 56, and all its amendments? (Figure 1).

In Article 36 of UUPT No.40 of 2007, it is explicitly stated that the Company is prohibited to issue shares for their ownership or for the ownership of other Companies which shares directly or indirectly are already owned by the Company. Thus, UUPT No.40 of 2007 explicitly prohibit share cross holding.

4. Simulation of Calculation of GMS Quorum due to Cross Holding

Below is the simulation of calculation as an example if quorum for resolutions in GMS due to Cross Holding is not reached.

PT X with the composition of shareholders comprising of:

A=40 %

B=10 %

C=20 %

D=30 %

If PT X will hold a General Meeting of Shareholders (GMS) related to the amendment to Company’s Articles of Association, the explanation is as follows:

4.1 If Share A “without Cross Holding”.

The terms and conditions are:

• Quorum of attendance if all shareholders present are 100 %;

• Terms: Quorum of attendance to amend Articles of Association of 2/3 (two thirds) of total shares is reached;

• Quorum of Resolutions: 2/3 of shares that have voting rights;

• If Shareholder D does not agree, then the resolutions to amend Articles of Association may still be done. In view of the quorum to adopt resolutions is minimum 2/3 (two thirds) of total shares with voting rights. If shareholder saham A, B, C agree than the affirmative vote is 70 % (seventy percent) while the minimum threshold of quorum for taking votes is 2/3(two thirds) or 66,67% (sixty-six comma sixty-seven percent). It means that amendment to Articles of Association can still be made.

4.2 If Share A “with Cross Holding”. What Happens is that A does not have Voting Right or Resulting into Loss of Voting Right?

The terms and conditions are as follows:

• Attendance quorum is 100 %;

• The quorum calculated for resolutions are votes from B, C and D only, so that if D does not agree with GMS agenda to amend Articles of Association: 60 % (sixty percent). Where the votes required to amend Articles of Association are 2/3 (two thirds) of 60 % (sixty percent) namely 40 % (forty percent). Where Shareholder A is stated not to have voting right, while Shareholder D does not agree GMS agenda to amend Articles of Association, therefore quorum for adoption of resolutions is not reached in view that the valid votes calculated and agree to the amendment of Articles of Association are Shareholder B and C namely only 30 % (thirty percent).

We can see the difference that share A without cross Holding and with cross holding gives a most signification impact.

5. Prohibition

5.1 Prohibition to Issue Shares to be self-owned

Article 36 of UUPT 2007 is the basis of the provision on the Prohibition to issue shares to be self-owned by the Company.

5.2 Prohibition of Share Issuance that includes another Company.

Concerning the prohibition to issue shares to be self-owned according to Article 36 paragraph (1), that includes another company which shares directly or indirectly owned by the Company.

The part of elucidation of Article 36 paragraph (1) among others says that, In principle share issuance is an effort to mobilize capital, therefore the obligation to make payment for shares should be undertaken by another party. Based on this principle, for legal certainty those who are obliged to make payment for shares are other parties beyond the Company. This Article explicitly states that Company may not issue shares to be self-owned.

The prohibition includes the prohibition of cross holding which occurs if Company has shares issued by another Company that have shares in the Company, either directly or indirectly.

5.3 Direct & Indirect Cross holding

• Direct Cross Holding

Definition of direct cross holding is if the first Company has shares in the second Company without going through the ownership in one “Interval Company” or more and on the other hand the second Company has shares in the first Company; while

• Indirect Cross Holding

The definition of indirect cross holding is ownership of the first Company of shares in the second Company through ownership in one “Interval Company” or more and on the other hand the second Company has shares in the first Company.

Company is prohibited to issue shares to be self-owned or owned by another Company, which shares directly or indirectly are already owned by the Company. This provision provides that Company is not allowed to issue shares to be self-owned.

The prohibition also includes a prohibition of cross holding that occurs if the Company has shares issued by other Company that has shares of the Company, directly or indirectly.

Cross holding of shares in UUPT is a condition where Limited Liability Company has shares issued by another Limited Liability Company which shares directly or indirectly are already owned by the Company.

Example of direct ownership is:

• If Company A has shares in Company B directly without ownership in a interim company and on the other hand Company B has shares in Company A. While indirect cross holding is share ownership of company A in company B through one or more interim company and on the other hand company B has shares in Company A.

5.4 Strength of Capital of PT

In the 7th paragraph on the part of general elucidation of UUPT 2007, capital structure is provided and that is provided here is the same as provided under UUPT 1995, it still consists of authorized capital, subscribed capital and paid up capital. Capital structure in the Company clearly has a relationship with shares in “portfolio”, payment proof, further share issuance, payment of shares in other forms, the use of cessie as a compensation for share payment and prohibition to issue shares to be self-owned.

Authorized capital is “all nominal value” of Company shares stated in Articles of Association, this is explicitly stated in Article 31 paragraph (1) that authorized capital of the Company shall consist of total nominal value of shares. We can see the strength of capital in the Company in the capital obtained by the Company in the form of money through issued shares. The money is used by the Company to facilitate business activities and the business stipulated in the Company’s Articles of Association.

Company’s Authorized Capital in principle is the total amount of shares that may be issued by the Company. The Articles of Association itself that determines the amount of shares to be made authorized capital. The amount stipulated in the Articles of Association is the pure nominal value. Therefore, each share has “nominal value” which will be the amount of nominal value of Company authorized capital, which value is the same as the nominal value of all shares.

Furthermore, there is authorized capital namely the amount of shares that have been subscribed by the founders or shareholders, and some of the subscribed shares have been paid up and some have not been paid up. This authorized capital is the capital that the founders or shareholders are prepared to pay and the shares have been given to them to be owned. In UUPT 2007 it has been determined imperatively that 25% (twenty-five percent) of capital should have been authorized upon the establishment of Company.

Furthermore, after Authorized Capital, Subscribed Capital then the follow up is Paid up Capital. We can see in Article 33 paragraph 1 of UUPT 2007 that reads:

At least 25% (twenty-five percent) of authorized capital as referred to in Article 32 must be subscribed and fully paid.

Subscribed and fully paid up capital as referred to in paragraph (1) is proven by a valid payment proof, among others: Proof of payment of shareholders to the bank account in the name of Company, financial statement data that has been audited by accountant or balance of statement of Company signed by Board of Directors and Board of Commissioners. Further share issuance made each time to increase subscribed capital, should be fully paid. Each time shares in portfolio may be issued to increase issued capital. However, the issuance shall be subject to the provision of Article 33 paragraph 3 of UUPT 2007. This Article has confirmed further share issuance conducted for increase subscribed capital “which should be fully paid”. The payment should not be done by instalments.

5.5 Corporate Governance to Support PT Sound Financial Condition

One of the measurements for company success is financial condition, for example financial statement.

The existence and role of Corporate Governance will determine the level of financial soundness of the company. In a company included in Corporate Governance are shareholders, Board of Directors, Board of Commissioners, Auditor (external internal), Audit Committee and Management.

There are many factors that may affect the financial soundness of company, there is a possibility that a company may be under financial pressure as it is much affected by the ownership structure. Ownership structure explains the commitment of owners to save its company, in this case investor may also become shareholders in the company.

Financial aspect with real capital increase will create financial soundness of the company, however if Cross Holding occurs, although formally there is capital increase, as a matter of fact what happens is quasi capital increase, where only those companies conducting Cross Holding with their affiliates, as such there is no real capital increase in the company. As such in terms of company financial aspect, there is no increase of capital supposedly for the company’s financial soundness.

Total asset value is also a proksi for company’s measurement, where company measurement will be affected by the strength of company in dealing and/or maintain the financial health of company.

6. Background of Prohibition of Cross Holding

The prohibition of cross holding of shares as provided under Article 36 UUPT is because capital increase in company share issuance is not achieved, and there is no legal protection to minor shareholders and there is also no independence due to the mixture of interests between Company management and shareholders in the Company, as such business actors undertake share crossholding practice because they can run the company with a relatively cheap cost.

7. The Consequence of Cross Holding

With cross holding in the capital, particularly in the context of new share issuance, it is clear there is no real capital payment in the company and in terms of management, the impact of cross holding tends to cause a mixture between ownership and management of one company with the other, so that in this case management is no longer independent one to another.

The impact of cross holding to business activities both in public companies or closed companies, there are two or more companies that are integrated and it is under one ownership and management, such horizontal integration will impair and kill completion, vertical integration will cause the ability of company to determine price and conglomerate integration will impact on macro economy as small businesses cannot survive. The difference lies on the scale of the impact of cross (large or small), beside cross holding is easier to be seen in a public company.

7.1 Similarity of Cross Holding and Buy Back Share

• The form is the same which is capital partnership

• Both have share nominal value

• There is a transfer of share ownership

• There is a rule to increase capital/Right Issue.

• Both must obtain an approval from General Meeting of Shareholders

• While in PT. Tbk votes are not counted, both in the quorum or voting.

7.2 The Difference of Cross Holding and Buy Back Share

• Cross holding is prohibited in UUPT 2007 it is clearly provided under Article 36. While Buy Back Share is not prohibited in UUPT 2007 (Article 37).

• GMS Agenda.

In UUPT of 2007 share buyback is regulated under Article 37-40, with the following points:

• The nominal value of shares bought back by the Company is not more than 10% of the amount of authorized capital in the Company, unless otherwise governed in the laws and regulations on Capital Market.

• Shares that have been bought back by the Company may only be controlled by the Company for 3 years at the maximum.

• The transfer of share buy back as referred to above may only be carried out based on GMS approval, unless specified otherwise in Capital Market Law.

• Shares controlled by the Company due to buy back, shall not be used to cast votes in GMS and is not calculated in determining the amount of quorum that has to be achieved according to the provisions of the Law and/or articles of association.

• Bought back shares shall not be entitled to obtain dividends.

7.3 Monopoly Aspect and Business Competition

Business Competition Supervisory Commission (Komisi Pengawas Persaingan Usaha/KPPU) is a Commission established to supervise business actors in carrying out its business activities to prevent monopoly practices and or unhealthy business competition. KPPU is an independent agency which is free from the influence and power of Government and other parties. KPPU shall be responsible to the President.

The meaning of cross holding governed under UUPT is different from the definition of cross holding in Law No 5 of 1999 of Article 27 on Prohibition of Monopolistic Practices and unhealthy business completion The Prohibition as meant in Article 27 is called cross ownership. And the indication of cross ownership is as follows:

• The business group has more than one of similar companies that conduct business activities in shares; in the same market; or

• The business group establishes more than one company that have the same activities; in the same market.

Therefore, it is clear that the prohibition of cross holding in business competition law is far different from the meaning of cross holding according to Company Law (Widjaja, 2008).

Where in the business competition law what is emphasized is the same business activities in the same market, while in Company law what is emphasized is the share ownership system.

The duties of Business Competition Supervisory Commission (Law Number 5 of 1999 on Prohibition of Monopolistic Practice and Unhealthy Business Competition) Article 35, that include:

• Make an evaluation on the agreement which may result into monopolistic practices and or unhealthy business competition as regulated under Article 4 to Article 16;

• Evaluate the business activities and or actions of business actors which may result into monopolistic practices and or unhealthy business competition as regulated under Article 17 to Article 24;

• Make an evaluation on whether or not there is an abuse of dominant position that may result into monopolistic practices and or unhealthy business competition as provided in Article 25 to Article 28;

• Take actions according to the authority of Commission as provided under Article 36;

• Give recommendations and considerations on Government policies related to monopolistic practices and or unhealthy business competition;

• Prepare guidelines and or publications related to this Law;

• Provide report regularly on the work result of Commission to the President and the House of Representatives.

Article 26 of Law on Business Competition Supervisory Commission also explicitly states that an individual who has a position as a member of board of directors or board of commissioners in a company, is prohibited to concurrently having the position as a member of board of directors and board of commissioners in another company, if those companies are in the same concerned market or has a close inter-relation in a field of business or type of business or jointly may control market share of certain goods and or services, which may result into monopolistic practices and or unhealthy business competition.

Besides, in Article 27 of Law on Business Competition Supervisory Commission it is also explicitly explained that business actors are prohibited to have majority of shares in a number of similar companies that conduct business activities in the same field in the same concerned market or establish a number of companies that have the same business activities in the same concerned market, if the ownership has resulted to one business actor or one group of business actors control more than 50% (fifteen percent) of market share of one certain type of goods and services, two or three business actors or group of business actors controlling more than 75% (seventy five percent) market share or one certain type of goods or services. This Article 27 is about the principle of cross ownership.

Violation of cross holding may result into cross holding position by shareholders or business actors potentially lead to cartel. It certainly is not in line with a sound business competition.

(Violation to Law Number on Prohibition on Monopolistic practices and Unhealthy Business Competition).

8. Exception of Cross Holding

Share ownership which may result into share ownership by the Company itself or share cross holding is not prohibited if share ownership is obtained based on the transfer based on law, grant or bequest because in this case there is no share issuance which requires fund payment from other parties so that it does not violate the provision of prohibition as contemplated.

It means that the company may not issue shares to be self-owned. Cross holding may occur through share transfer process in general (agreement, laws, judge decision), in the Limited Liability Company the process that may cause change of ownership such as merger, amalgamation, take over and spin off conducted by closed company, public company and group company (closed or public) is provided.

Conclusion

In principle cross holding practices are in violation of the principle and purpose of company establishment, and especially in the aspect company capital increase which has the purpose to strengthen company financial structure, because by cross holding, the purpose of company to strengthen company financial structure is not achieved, because capital increase by cross holding will only increase capital in formality in the company book, however actually there is no payment and capital increase in reality in the company. Therefore, it is most reasonable that the drafter of UUPT states the prohibition of cross holding practices in Indonesia.

The implementation of Cross Holding overseas, perhaps is most suitable with the business practice condition in that country so that in a country which is already advanced in economy and the matter is based on the political will of the country concerned, however the condition in Indonesia as a developing country which requires to maintain the health financial aspect of the corporation, the prohibition of cross holding practices is most suitable.

References

- Article 27 (1999). Law Number 5 son prohibition of monopolistic practices and unhealthy business competition.

- Ginting, J. (2007). Limited liability company law, Law No. 40 of 2007. Citra Aditya Bakti. Bandung.

- Harahap, M.Y. (2013). Limited liability company law. Sinar Grafika. Jakarta.

- Harris, F. & Anggoro, T. (2010). Limited liability company law; obligation for notification by board of directors. Ghalia Indonesia. Bogor.

- Hasyim, F. (2009). Commercial law. Sinar Grafika. Jakarta.

- Huda, M.K. (2015). Profit sharing contract on oil and gas pursuant to act number 22 year 2001. American Scientific Research Journal for Engineering, Technology, and Sciences (ASRJETS), 15(3), 1-15.

- Kansil, C.S.T (2002). Basics of Indonesian commercial law knowledge. Sinar Grafika. Jakarta.

- Keenan, D. & Bisacre, J. (2002). Smith and Keenan’s company law. Pearson education limited. England.

- Megarita (2012). Legal protection to buyers of pledged shares. USU Press. Medan.

- Scheeman, A. (2012). The law of corporations, partnership, and sole proprietorships. Limited liability company law. Binoto Nadapdap.

- Sembiring, S. (2012). Company law on Limited Liability Company. Nuansa Aulia. Bandung.

- Syahrul, Ardiyos & Muhammad, A.N., (2000). Kamus lengkap ekonomi. Citra Harta Prima. Jakarta.

- Widjaja, G. (2008). Individual and collective rights of shareholders. Forum Sahabat. Jakaarta.

- Yani, A. & Widjaja, G. (2000). Business law series on limited liability company. Rajagrafindo Persada, Jakarta.