Research Article: 2017 Vol: 16 Issue: 2

Key Stakeholders in the Development of Transboundary Hydrocarbon Deposits: The Interaction Potential and the Degree of Influence

Alexey Evgenievich Cherepovitsyn, Saint Petersburg Mining University

Alina Alexandrovna Ilinova, Saint Petersburg Mining University

Natalya Vladimirovna Smirnova, Saint Petersburg Mining University

Keywords

Trans-Boundary Deposits, Unitization, Hydrocarbon Resources, Stakeholders, Person Concerned, Unitization Agreements, Interaction, International Experience, Tran-Boundary Resources, Development.

Introduction

In the modern world, in terms of globalization and internationalization of the world economic systems, the formation and development of the international relations play an important role. The conflict of interests of different countries in the field of development of trans-boundary hydrocarbon deposits (THD) is a very relevant issue today due to the strategic focus of the national interests of the countries in favour of owning the resources as an indicator of financial stability and independence, especially when it comes to oil and gas reserves.

The term "trans-boundary deposits" is understood in the foreign practice of subsoil use as the deposits that intersect with the various borders-interstate, intrastate, the borders of the subsurface users' plots, as well as other boundaries separating the territories with different legal regimes (Mareeva, 2004). In order to improve the control over the development of THD, the mechanism for unitization was developed, based on the conclusion of an agreement between the countries claiming to operate the hydrodynamically related hydrocarbon deposits or fields (Edilkhanov, 2011).

According to the international law, the unitization is the combination of the efforts of two or more owners of subsoil plots for the purpose of development of the entire hydrocarbon deposit (Mareeva, 2003).

The unitization agreement, as a normative legal document, provides for the mutual merger agreement of the parties for the purpose of joint operation of the deposit and establishes certain conditions (economic, technological and legal). The basis for the unhindered processing of the raw materials is a clear establishment of the territory of the agreement and the coordinates of the unit's deposit (the subject of the unitization agreement). In addition to the separation and establishment of the specific shares of reserves and, accordingly, the economic effect between the countries, it is important to appoint the independent operator within the framework of unitization to perform the supervision over the development of the field (Ulyanov & Dyachkova, 1998).

The undoubted advantage of the unitization agreements is a clear definition of the boundaries and operating conditions of oil and gas deposits at the legal level, taking into account possible sanctions for their violation, allowing to avoid any resource conflicts and to obtain a multilateral economic effect (Ilinova & Cherepovitsyn, 2016).

Within the framework of international cooperation on joint development of the trans-boundary deposits, the identification of the main stakeholders of this process and the determination of their immediate interests are of high relevance.

The world experience in the development of trans-boundary oil and gas deposits crossed by the interstate borders is considered in this article, the unitization agreements used in the world practice of development of hydrocarbon deposits are assessed and the key stakeholders in the development of such deposits, their role and mutual influence are considered in more detail herein.

Methods

Theoretical Background

At the moment, there is a series of approaches to the definition and settlement connected with trans-boundary deposits, which constitute the theoretical base of this study. There are a lot of Russian papers devoted to legal aspects of this issue (Vylegzhanin, 1997; Vylegzhanin, 2001; Mareeva, 2003; Edilkhanov, 2011). The theme of trans-boundary adjustment from political point of view is considered by many foreign authors (Henderson, 2012; Anteasyan, 2013; Bryza, 2013; Gurel et al., 2013; Nathanson, 2012; Nopens, 2013). Many papers present case descriptions related to the unitization and trans-boundary fields and discuss such issues as geopolitics, territorial aspects, energy security, forms of contracts and others. However, there are no research papers focusing specifically on stakeholders of this process, though this topic is relevant. This paper sets out to analyse the main stakeholders of unitization through the analysis of world experience of utilization, to define their interests, influence and the level of interaction.

The analysis and evaluation of unitization world experience is carried out based on the Russian and foreign papers (Rubtsova, 2014; Bastida et al., 2007). The legal basis of research is international acts and documents related to utilization.

For analysis of practical experience of the countries in the sphere of unitization of trans-boundary fields, we use real contracts which are concluded between different countries, namely: The Agreement between the Government of the United Kingdom of Great Britain and Northern Ireland and the Government of the Kingdom of Norway relating to the delimitation of the continental shelf between the two countries (AGR, 1965), United Kingdom of Great Britain and Northern Ireland and Norway Agreement relating to the operation of the Frigg Field Reservoir and the transmission of gas there from to the United Kingdom (AGR, 1976), Framework Agreement between the Government of the United Kingdom of Great Britain and Northern Ireland and the Government of the Kingdom of Norway concerning Cross-Boundary Petroleum Cooperation (FAGR, 2005), Treaty to Resolve Pending Boundary Differences and Maintain the Rio Grande and Colorado River as the International Boundary between the United Mexican States and the United States of America (TR, 1970), Agreement between the United States of America and the United Mexican States Concerning Trans-boundary Hydrocarbon Reservoirs in the Gulf of Mexico (AGR, 2012), Treaty of Continental shelf in the Persian Gulf between Governments of Iran and Qatar dividing their respective continental shelves in the Persian Gulf (1970).

The Analysis of the World Experience in Unitization of Oil and Gas Deposits

The world experience in conclusion and use of the unitization agreements in the course of hydrocarbon deposit development has been accumulated by now, but it is ambiguous.

The analysis of the world experience on the issue under consideration with the identification of the applicant countries for the development of trans-boundary deposits, the main conditions for conclusion of the agreements and the results of unitization (Ilinova & Cherepovitsyn, 2016) are represented in Table 1.

| Table 1: The Analysis Of The World Experience In Unitization Of Oil And Gas Deposits (Abbasly, 2008; Boyarko & Zolotenkov, 2015; Dyachkova & Ulyanov, 1998; Rubtsova, 2014; Ulyanov & Dyachkova, 1998) | |||

| Subsoil plots/deposits | Countries-candidates for the development | Terms of agreement | Results of unitization |

|---|---|---|---|

| The Frigg gas field (the North Sea) | The UK and Norway | The Anglo-Norwegian Agreement of 1976 on the operation of the Frigg gas field and the transportation of gas to the UK (amended by the Agreement of 1998). Joint development of the deposit with the share of Norway equal to 60.82% and the share of the UK equal to 39.18%. The consistency in the definition of the reserves and applied technologies, the procedure for issuing licenses, the environmental auditing; joint construction of gas pipelines; two-way information exchange. A single independent unit operator is assigned | Consistent operation of the deposit as a whole (1976-2004); distribution of the extracted raw materials in specified shares; absence of conflicts; example for further conclusion of such agreements |

| Oil and gas resources in the Gulf of Mexico | Mexico and the USA | The agreement on THD of 2012 (AGR 2012). The enshrinement of the joint development of the western zone with 38% and 62% shares for the USA and Mexico, respectively. The opportunity for both countries to avoid the appointment of a single operator and to develop the deposit independently. The approval of the Act on the reduction of royalties in the case of unilateral operation of deep-sea oil deposits; full coordination of all spheres of well operation; the imposition of fines and penalties for the violation of the joint operation agreement | Joint development on the basis of the principle of unitization. The adoption of a general document calling for cooperation. The achievement of a synergistic effect in the joint development of deposits. The absence of conflicts and attempts to terminate the agreement due to bilateral interest |

| The Timor Gap (the zone of cooperation between the Indonesian province of East Timor and the northern coast of Australia) | Australia and Indonesia | The determination of the exact maritime boundaries for the purposes of further cooperation (1972); the Timor Gap Treaty entered into force in 1991. The establishment of the control over development of the deposits in the person of the Council of Ministers and the Joint Authorized Body, consisting of the representatives of both states; the parties should strive to reach an agreement on the method of trans-boundary deposits development and on the sharing of the revenues from operation. There are basic provisions for taxation, as well as a production sharing agreement | The agreement, contributing to cooperation between the parties. The amicable regulation of the trans-boundary natural resources development; agreements on communication and joint research |

| Continental deposit in the Gulf of Rio de la Plata | Argentina and Uruguay | The agreement on the joint operation of the trans-boundary continental deposit and unconditional sharing of the mined products proportionally to the size of the resources on each side | Predestination of possible inconsistencies and their overcoming through joint decisions on the operation of the hydrocarbon deposit |

| Continental shelf in the Persian Gulf | Bahrain and Iran; Saudi Arabia and Iraq; Oman and Qatar | The consistency on the joint development of the hydrocarbon deposits with the assumption of the independent operation of the own plots based on maintenance of the current efficiency for the other party | Legal enshrinement of the collision avoidance during the independent operation of the deposit |

| Deposits in the Gulf of Thailand (the East China Sea) | Thailand, Malaysia, Cambodia and Vietnam | The signing of the Memorandum of Understanding (1979) on the establishment of a Joint Development Zone; the signing of the Joint Development Agreement (1990), which provides for the equal sharing of production between Thailand and Malaysia after deduction of the royalties and production costs; the signing of the additional production sharing agreements to attract foreign investors | Establishment of a zone of mutual understanding by concluding an agreement on unitization; the overcoming the problems resulting from four contenders for a share in the unit; the development of the agreement and the definition of the appropriate conditions able to solve actually the problems of the trans-boundary deposits’ development |

Thus, according to the experts (Vylegzhanin, 1997), the agreements on the operation of the Frigg gas field, concluded between Norway and the UK, are the classic successful example of unitization. The maritime boundary between the states was defined as far back as 1965. Following the form of the Frigg Agreement, a number of similar agreements between these countries were signed (Statfjord & Murchison). In 2005, the countries signed the Framework Agreement (FAGR, 2005), consolidating the existing experience of interaction between the countries in this matter.

As for the fields in the Gulf of Mexico, the USA and Mexico, in contrast to Norway and the UK, in 2012 signed the general agreement, in contrast to the agreement on individual deposits, inclining the countries to cooperation and mutual interest.

As for the Timor Gap Treaty, concluded between Australia and Indonesia, it is much broader than the Frigg Field Agreement. This agreement establishes the licensing system of a new type in the agreed zone, which is absolutely independent of the licensing systems of each of the two states.

The analysis of the agreements on the continental deposit between Argentina and Uruguay, as well as on the deposits in the East China Sea and on the shelf of the Persian Gulf is presented in Table 1.

The recognized benchmarks of the unitization agreements are the Australia-Indonesia Timor Gap Treaty and the agreement on joint development of the oil deposit in the Gulf of Thailand (The Joint Development Agreement of 1990 between Thailand, Malaysia, Cambodia and Vietnam) due to the high degree of elaboration and detailedness of the issues related to taxation, product sharing, environmental audit, rights and obligations of the parties as a whole.

Results

Based on the analysis of the world experience in the field of the unitization of THD, as well as the review of the above-mentioned treaties and model unitization agreements of the American Petroleum Institute (The Agreements of the American Petroleum Institute for Trans-boundary Deposits (1961)), it is possible to single out such key players in unitization as the state (state agencies), the license holders (The mining companies conducting the development of the deposit), the unit operator, appointed based on the agreement of all parties, the unitization committee, the investors, as well as the media and the community.

Table 2 presents the analysis of the main stakeholders in the THD development, acting on the basis of the unitization mechanism.

| Table 2: Major Stakeholders In The Development Of The Thd (Lyons, 2012; Weaver, 2013, Oil & Gas Authority & Norwegian Petroleum Directorate, 2005; Cherepovitsyn & Chanysheva, 2016; Cherepovitsyn & Moe, 2016) | ||

| Stakeholders | Interests | Interaction functions |

|---|---|---|

| States | The efficient use and development of mineral resources; the equitable distribution of raw materials; the implementation of priority oil and gas projects on mutually beneficial terms; the preservation of the status and the state sovereignty; the increased budget efficiency; the strategic development of the Arctic zone; the reduction of the negative impact on the environment | The establishment of the interstate territorial boundaries; the development and harmonization of the regulatory and legal framework on the issues of unitization; the basic parameterization of the unitization for the parties involved; the implementation of the appropriate control over the conclusion and execution of the unitization agreement by the mining companies |

| License holders (the oil and gas companies) | Maximum production volumes; minimum costs of deposit operation and sales; the maximization of financial results; optimal well location on the territory of the hydrocarbon deposit | Joint development of oil and gas deposits on mutually beneficial terms; the use of the joint innovative technologies for extraction and transportation of oil and gas resources |

| Unitization committee(formed from the participants) | The execution of the established obligations by the parties; the conformity of the process of unitization with the international standards | The control over the fulfilment by the parties of the rights and obligations specified in the agreement; the assistance in the implementation of the conditions of unitization |

| Unit operator | The participation in large oil and gas projects; the protection of the interests of the parties to the unitization agreement; the economic benefits | The representation of the interests of the parties to the unitization; the participation in emerging disputes; the coordination of the actions of the parties to the unitization; the control over the execution of the agreement terms |

| Investors | The increase in profit; the minimization of possible risks | The financing of the large-scale strategically significant projects; the promotion of the Arctic shelf development |

| Mass media and community | The possibility to obtain the information on the project under implementation, including the environmental issues of the problem; the increase in the number of jobs; the infrastructure development; the socio-economic development of the region as a whole | The assistance in the implementation of the projects (engagement of the highly qualified personnel); the informing |

The complexity of the stakeholder interaction in this case lies in the presence of several parties seeking simultaneously to realize their own interests aimed at possessing the largest amount of reserves while maximizing the economic effect and minimizing the costs. Given the complexity of the offshore projects (Carayannis & Cherepovitsyn, 2017) associated with the unfavourable conditions in the Arctic region, the need to use the unique technologies for exploration and extraction of raw materials, which in turn requires considerable financial resources and is associated with a number of serious risks, the disagreements between the parties to the Treaty can vary significantly from the coordination of the development system to the production sharing.

An important role in the development of trans-boundary deposits is played by the state, the functions of which are indicated in Table 2. As part of the consideration of joint THD development for license holders, it is necessary to note the sharing of the financial investments, tax and other liabilities, as well as the technological risks between the participants, which is an absolute advantage due to the significant capital intensity of oil and gas projects. The insurance against unfair conduct of the parties to the agreement is performed on a legal basis by conclusion of the additional agreements. The unit operator, representing the interests of the parties and the appointed unitization commission, acting in compliance with the international standards, controls the fulfilment of the main and additional conditions of the agreements and informs the relevant government agencies (Boyarko & Zolotenkov, 2015; Borges et al., 2014; Dzhunsova, 2012).

An important role is played also by the investors of such projects, whose main goal is traditionally to maximize the profits and to minimize the relevant risks, as well as the media and the community, also pursuing their goals.

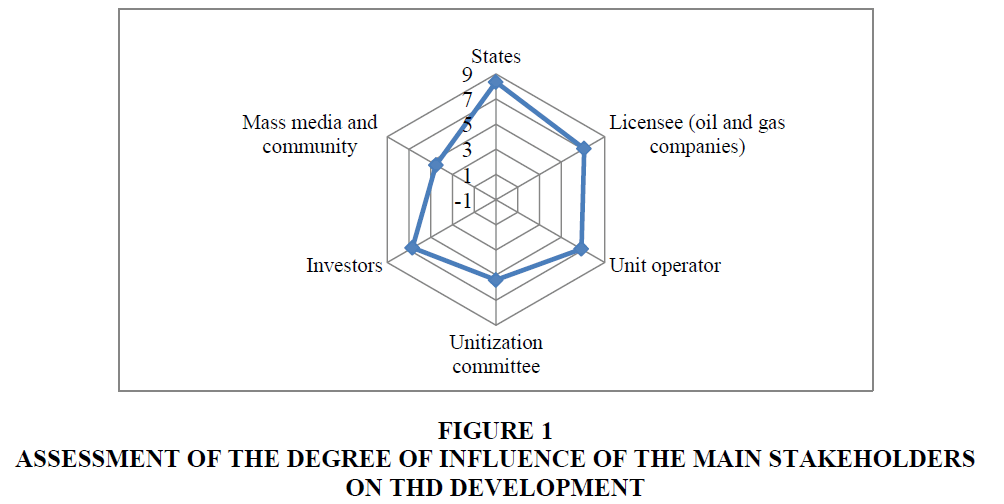

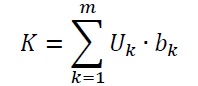

Based on the analysis of the main stakeholders in accordance with the provisions of the normative legal documents and using the integrated assessment method, which provides for an integral indicator based on the synthesized assessments of the stakeholder impact indicators, the chart of unitization stakeholders is graphically displayed on the basis of the calculations using the following formula:

Where K is the indicator of stakeholder assessment  is the relative value of the functional indicator of the stakeholder assessment;

is the relative value of the functional indicator of the stakeholder assessment;  is the specific weight of the stakeholder assessment criterion (Skachkov & Skachkova, 2016).

is the specific weight of the stakeholder assessment criterion (Skachkov & Skachkova, 2016).

The results of the calculations are shown in Figure 1 in the form of a multilateral chart.

The greatest influence is exerted by the government agencies and license holders with the greatest degree of interest in the implementation of the similar projects and a significant potential for participation and interaction. The unit operator is also an important element in the stakeholder system, being a link between two or more parties in legal, economic and other aspects. The coordination and monitoring of compliance with the international standards and the country's subsoil use documents is performed by the unitization committee, which is entitled to receive the information on the progress and on-going works on the project. Nevertheless, the decision on its establishment is not always taken.

Despite the fact that investors do not make the decision related to the regulation of the unitization conditions, their role in the implementation of the large-scale projects for the THD development is very significant in terms of the above capital intensity of such projects. That is why they play a significant role in assessment of the stakeholders.

The media and the community can also be defined as the party to the interaction, with its own specific interests and position. In this aspect, the achievement of balance is facilitated by the availability of the information, as well as by the social interaction, the implementation of international standards of social responsibility.

Discussion

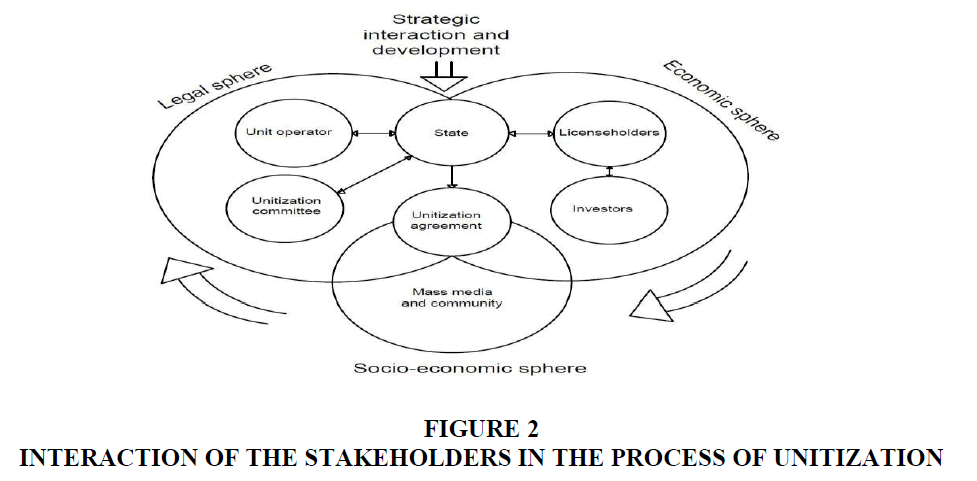

Based on the studies, a structural chart of key stakeholders, presented in Figure 2, is drawn up. Within the scope of the interaction areas, the following main components are identified: The legal and the economic and socio-economic spheres, which are interacting and mutually complementary. The central element of such interaction is the direct coordination of the unitization agreement, the terms of which regulates subsequently the development of the hydrocarbon deposit and determines the allocation of the resources for each individual party.

As part of the implementation of the unitization, Russia has certain experience and some legal developments (the Treaty between the Russian Federation and the Kingdom of Norway, the Agreement between the Government of the Russian Federation and the Government of the Republic of Kazakhstan, Federal Law No. 225-FZ "On Production Sharing Agreements", Federal Law No. 115-FZ "On Concession Agreements", Federal Law No. 187-FZ "On the Continental Shelf of the Russian Federation" and others). Thus, the legal regulation of the exploitation of the Khvalynskoye oil and gas deposit located on the border of the Russian Federation and Kazakhstan was carried out on the basis of mutual cooperation through the implementation of the agreement on joint development of the deposit in approved equal shares (50/50%). Within the framework of the agreement, a single operator was appointed to oversee the operation in the person of LUKOIL company. The result of introduction of the unitization mechanism was the mutually beneficial exploitation of the deposit on an equitable basis, which led to a positive economic effect for both participating countries (Rubtsova, 2014).

The similar agreements are now being considered in the framework of international cooperation between Russia and Norway on the exploitation of the THD. At the same time, a necessary condition within the framework of possible unitization is the preservation of spheres of influence and national interests of the main participants.

Within the conducted research we submit the following recommendations for improvement of unitization process of THD:

1. First of all, if the field crosses the territory of two and more countries and the border between the states is not established, accurate definition of sea and overland borders between the states is necessary (in particular on the Arctic shelf) that will considerably simplify further process of unitization;

2. Accurate establishment of the territory of unitization agreement and coordinates of deposits and also concrete shares of reserves between the countries is necessary that will allow to avoid the resource conflicts;

3. Accurate documentary recorded definition of main conditions of THD development taking into account possible sanctions for their non-compliance and also the rights and obligations of main parties of unitization is necessary;

4. Increase of satisfaction of main stakeholders at the initial stages requires understanding of their interests, expectations from the project and also accurate collecting and documentary fixation of requirements from key stakeholders;

5. Distinctions of national legal basis in the fields of mining, oil and gas, environmental protection, tax and others have to be coordinated between the main participants of unitization;

6. Appointment of independent operator for control of main requirements of unitization and additional agreements and also informing the relevant government institutions is necessary;

7. For achievement of strategic consensus during THD development drawing up matrixes of responsibility for the business processes and also definition of necessary tools of management and control, such as policy and standards, key performance indicators, principles of development, etc., are recommended;

8. It is necessary to define the list of business processes which are strategically important for THD development and have to be controlled at the highest level and the others business processes have to be transferred to control on lower levels;

9. Effective management during THD development requires accurate distribution of responsibility during the developing and approval of the main documentation, coordination of strategic and operational decisions, what is possible through creation of the uniform centre which is responsible for these issues;

10. At process of project’s planning it is necessary to place elaborately priorities, considering both the interests of various countries and participants from each of the countries;

11. At process of project’s planning the careful plan at early stages, including all package of Research and Development (R&D) and the design and exploration work in order to avoid expensive changes at the introduction stage of the project has to be developed;

12. Accurate performance of the main stages of the project with use of Key Performance Indicators (KPI) is necessary for the analysis and confirmation of effective implementation of the project at certain stages of planning, testing and introduction (Stage gate concept);

13. The success of THD development can increase considerably in the presence of arrangements on timely exchange of information between main participants and carrying out joint scientific research.

Conclusion

Thus, the foreign experience in development of the THD shows that subsoil users are generally interested in clear regulation of the process of THD development. The state is also interested in such regulation. In its absence, a number of rather complex issues and contradictions arise, reducing the efficiency of field operations for all major stakeholders of this process.

The achievement of the consensus among the states involved in unitization is laborious and requires significant time and financial expenditures; moreover, in the final analysis, it is not always possible. For example, the coordination of the agreement on the gulf of Thailand took about 11 years (Rubtsova, 2014). At the same time, even if the parties reach an agreement, there is a possibility of unfair conduct of the partners towards maximizing their own economic effect. The territorial distribution of shares for the right to develop the trans-boundary resources may be incorrect, since there are a number of other criteria, such as the countries technological and the economic readiness to conduct the operations for exploitation of the deposit, various mining and geological conditions in different countries and others. Moreover, the problem may be the reluctance of one of the parties to develop the deposit at a given time based on national interests or current market conditions.

Despite the experience, it can be concluded that the mechanism for signing the unitization agreements is developed quite poorly, including in part of interaction among the main stakeholders of this process. The reference point is still the agreements of different countries, which have been developed during a long period of time using the "trial and error" method. Thus, the analysis and assessment of the unitization relations used in world practice today is one of the priority directions for the development of the regulatory and legal framework in the sphere of subsoil use.

Russia, as a country with a significant resource potential, requires the development of its own regulatory and legal framework on this issue. Currently, the definition of the potential for the interaction between the main stakeholders of this process in terms of their main interests and the degree of influence on each other is of high relevance.

Each country, in the territory of which the reserves of THD are located, requires the determination of its own position on the development of such deposits by developing its own rules and documents, determining the policy within the framework of international cooperation on these issues, taking into account the interests of the main stakeholders, both on its own part and on the part of its partners. A prerequisite is a clear definition of the areas and levels of interaction of stakeholders involved in this process.

Acknowledgment

The study was carried out with the financial support of the Russian Foundation for Basic Research (RFBR), the project "Mechanisms of cross-border cooperation between Russia and Norway in the development of hydrocarbon resources on the Arctic shelf" No. 15-27-24002.

References

- Mareeva, S.Y. (2004). Pravovoe regulirovanie ispolzovaniya transgranichnykh mestorozhdenii poleznykh iskopaemykh: Avtoref. diss. na soisk. uch. st. kand. yur. nauk[Legal Regulation of the Use of Trans-boundary Mineral Deposits]. Ph.D. Thesis Abstract, Moscow. Retrieved August 24, 2017, fromhttp://www.dissercat.com/content/pravovoe-regulirovanie-ispolzovaniya-transgranichnykh-mestorozhdenii-poleznykh-iskopaemykh#ixzz4N2tDJmin

- Edilkhanov, U.S. (2011). Pravovoe ponyatie i sushchnost transgranichnykh mestorozhdenii poleznykh iskopaemykh [Legal concept and essence of trans-boundary mineral deposits]. Trudy nefti i gaza im. I.M. Gubkina, 3(264), 170-176.

- Mareeva, S.Y. (2003). Mezhdunarodnye yunitizatsionnye soglasheniya kak sposob zashchity natsional'nykh interesov Rossii na transgranichnykh mestorozhdeniyakh [International unitization agreements as a way of protecting Russia's national interests on trans-boundary deposits]. Mineralnye resursy Rossii: Ekonomika i upravlenie, 5-6, 77-84.

- Ulyanov, V.S. & Dyachkova, E.A. (1998). Analiz mirovogo opyta regulirovaniya razrabotki mestorozhdenii, peresekaemykh gosudarstvennymi, administrativnymi granitsami i granitsami litsenzionnykh uchastkov [Analysis of the world experience in regulating the development of the deposits intersected by the state, administrative boundaries and the boundaries of the licensed areas]. Retrieved August 24, 2017, fromhttp://www.yabloko.ru/Publ/Unit/unit.html

- Boyarko, G.Y. & Zolotenkov, Y.V. (2015). O sovershenstvovanii upravleniya razrabotkoi transgranichnykh mestorozhdenii poleznykh iskopaemykh [On improving the management of trans-boundary mineral deposit development]. Gorniy zhurnal, 11(26), 8-16.

- Ilinova, A.A. & Cherepovitsyn, A.E. (2016). Assessment of the merits and demerits of the unitization agreements used in the world practice in the development of oil and gas deposits. Economics and Entrepreneurship, 10-3(75-3), 697-700.

- Rubtsova, A.I. (2014). Livano-Izrailskii leviafan i mirovoi opyt razresheniya sporov po transgranichnym mestorozhdeniyam uglevodoroda [Lebanon-Israel leviathan and the world experience in resolving the disputes on transboundary hydrocarbon deposits]. Uchenie zapiski Kazanskogo Universiteta, 4, 209-216.

- Vylegzhanin, A.N. (1997). Prava na morskie prirodnye resursy [Rights to sea natural resources]. Khozyaistvo i pravo, 5.

- Vylegzhanin, A.N. (2001). Morskie prirodnye resursy (mezhdunarodno-pravovoi rezhim) [Sea natural resources (International legal mode)]. Moscow: Council for the study of productive forces of the ministry of economic development of Russian Federation and RAS.

- Vylegzhanin, A.N. (2011). Mezhdunarodnoe pravo i transgranichnye prirodnye resursy: Sovremennye mekhanizmy sovmestnogo upravleniya [International law and trans-boundary natural resources: Modern mechanisms of joint management]. Retrieved August 24, 2017, from http://old.mgimo.ru/news/experts/document185294.phtml

- Henderson, S. (2012). Energy discoveries in the Eastern Mediterranean: Source for cooperation or fuel for tension? The case of Israel. The German Marshall Fund of the United States. Retrieved August 24, 2017, from http://www.gmfus.org/publications/energy-discoveries-eastern-mediterranean-source-cooperation-or-fuel-tension-case-israel

- Anteasyan, A. (2013). Gas finds in the Eastern Mediterranean: Gaza, Israel and other countries. Retrieved August 24, 2017, from http://www.palestine-studies.org/jps/fulltext/162608

- Bryza, M.J. (2013). Eastern Mediterranean natural gas: Potential for historic breakthroughs among Israel, Turkey and Cyprus. Retrieved August 24, 2017, from https://www.icds.ee/publications/article/eastern-mediterranean-natural-gas-potential-for-historic-breakthroughs-among-israel-turkey-and-cy/

- Gurel, A., Mullen, F. & Tzimitras, H. (2013). The Cyprus hydrocarbons issue: Context, positions and future scenarios. Retrieved August 24, 2017, from http://file.prio.no/publication_files/Cyprus/Report%202013-1%20Hydrocarbons.pdf

- Nathanson, R. (2012). Natural gas in the Eastern Mediterranean Casus Belli or chance for regional cooperation?Retrieved August 24, 2017, from http://library.fes.de/pdf-files/bueros/israel/09591.pdf

- Nopens, P. (2013). Geopolitical shifts in the Eastern Mediterranean. Security policy brief. Retrieved August 24, 2017, from http://www.egmontinstitute.be/wp-content/uploads/2013/07/SPB43.pdf

- Bastida, A.E., Ifesi-Okoye, A., Mahmud, S., Ross, J. & Walde, T. (2007). Cross-border unitization and joint development agreements: An international law perspective. Unitization EIC Edits.

- Abbasly, G.A. (2008). Mezhdunarodno-pravovye problemy razgranicheniya morskikh prostranstv: Avtoref. diss. na soisk.uch. st. kand. yur. Nauk [International legal problems of delimitation of sea areas]. Ph.D. Thesis Abstract, Moscow.

- Dyachkova, E.A. & Ulyanov, V. (1998). Forma sotrudnichestva pri osvoenii transgranichnykh resursov nefti i gaza [The form of cooperation in the development of trans-boundary oil and gas resources]. Pravo, 10-11(26), 11-17.

- Carayannis, E.G., Cherepovitsyn, A.E. & Ilinova, A.A. (2017). Sustainable development of the Russian Arctic Zone energy shelf: The role of the quintuple innovation helix model. Journal of the Knowledge Economy, 8(2), 456-470. Retrieved August 24, 2017, from https://link.springer.com/article/10.1007/s13132-017-0478-9?no-access=true

- Lyons, Y. (2012). Trans-boundary pollution from offshore oil and gas activities in the seas of Southeast Asia. In trans-boundary environmental governance: Inland, coastal and marine perspectives (pp. 167-202). University of Wollongong, Australia: Ashgate Publishing Ltd.

- Weaver, J.L. (2013).Unitization of oil and gas fields in Texas: A study of legislative, administrative and judicial policies. U.S. University of Houston Law Centre.

- Oil & Gas Authority & Norwegian Petroleum Directorate. (2005). UK-Norway, Trans-boundary oil & gas fields: Guidelines for development of trans-boundary oil and gas fields. Retrieved August 24, 2017, from https://www.ogauthority.co.uk/media/2721/trans-boundary-fields-1016.pdf

- Cherepovitsyn, A.E., Chanysheva, A.F. & Smirnova, N.V. (2016). Integration mechanisms of interaction of foreign companies in the development of offshore oil and gas deposits. Naukovedenie, 8(6). Retrieved August 24, 2017, from http://naukovedenie.ru/PDF/20EVN616.pdf

- Cherepovitsyn, A., Moe, A. & Smirnova, N. (2016). Indian development of trans-boundary hydrocarbon fields: Legal and economic aspects. Science and Technology, 9(46). Retrieved February 28, 2017, from http://indjst.org/index.php/indjst/article/view/107527/76058

- Borges, C., Szklo, A. &Bucheb, J.A. (2014). Windfall profits arising from the subadditivity of costs after unitization and compliance with minimum local content requirements in Brazilian deepwater offshore oil fields. World Energy Law and Business, 7(4), 390-406.

- Dzhunsova, D.N. (2012). Sovremennyi mezhdunarodno-pravovoi rezhim Severnogo Ledovitogo okeana i pribrezhnykh morei Arkticheskikh gosudarstv [The modern international legal regime of the Arctic Ocean and the Coastal Seas of the Arctic States]. Aktualnye problemy ekonomiki i prava, 1.

- Skachkov, A.N. & Skachkova, I.A. (2016). Otsenka i vybor steikkholderov predpriyatiya [Assessment and selection of the enterprise stakeholders]. Otkrytye informatsionnye i kompyuternye integrirovannye tekhnologii, 72, 164-169.