Research Article: 2021 Vol: 20 Issue: 2S

Key Success Factors and Framework of Fundraising for Early-Stage Startups in Thailand

Ajaree Thanapongporn, Chulalongkorn University

Ronnakorn Ratananopdonsakul, Chulalongkorn University

Warayutt Chanpord, Chulalongkorn University

Keywords

Startup, Fundraising, Information Asymmetry, Financial Cost, Market Scalability

Abstract

Due to the important of startup to Thailand’s competitive advantage by innovation and the most challenging activity to acquire the financial resource for startup, especially, the early-stage startup. This research is to explore and understand the pattern and key success factors of new startup’s fund raising in Thailand on how startups in Thailand financing in each early stage from establishment to Pre-Series A through investigating the entrepreneurial journey of selected startups in Thailand. The key elements are to understand their approaches, the end-to-end processes of funding via examining the entrepreneurial journey of startups in Thailand adopting an investor and startup perspectives to explore how they access sources of fund from start-up to Pre-Series A funding. Moreover, this research would like to propose the appropriate framework that can utilize as an initial guideline to develop the appropriate financial platform with good approach and technology like block chain and AI for startup fundraising in Thailand in the future. Design/Methodology/Approach: This research’s methodology is utilized cases study approach by qualitative using in-depth listening interview to 3 startups and one corporate venture capital. Then, research team applied secondary sources of data from literature review and related startup websites to support the interviews to clearly understand interviewees’ insights. Finding: Main findings are the patterns and key success factors of seed to early-stage startup’s fundraising in Thailand. Key elements are funding type, founder’s character, education and experience, domain knowledge, unfair advantage, traction, social network, information asymmetry, market response and supportive ecosystem. Research Limitations/Implications: This study is derived from interviews from only 1 CVC and 3 startups so the further research by other methodology (quantitative) with the samples from other funders and startups in several industries are recommended. Practical Implications: Literature’s review is performed in the area of startup fundraising, patterns and key success factors from internal and external factors which lead to the successful fundraising. Finally, we propose the framework that may facilitate the new venture to get fund easier. The study results can utilize as the initial guide for the seed to early-stage startup to prepare themselves to get fund easier.

Introduction

Startup’s main purpose is to launch new products with a business model that is repeatable and scalable. Access to the necessary resources are the challenges for entrepreneurs due to their newness, their limited legitimacy, knowledge, and search ability for resources providers (Hite & Hesterly, 2001). However, the utilization of this potentiality is limited. By shortage of the financing market to early-stage entrepreneurial finance (Denis, 2004; Estrin & Caval, 2016). Financial literatures also be described how the asymmetry information between entrepreneurs and investors often prevent startup from raising capital (Jensen & Meckling, 1976). This is because the transaction costs of collecting accurate information are high. Instead, entrepreneurs have traditionally financed their new ventures with personal savings, investments From Friends and Family (FFF) and seeking support from angel investors before turning to Venture Capital (VC), banks or equity markets (Cosh et al., 2009). Recently, entrepreneurs have also begun to use Equity Crowd Funding (ECF), an innovation utilize the power of social media to provide a new channel linking public investors with entrepreneurs (Estrin & Khavul, 2016). Refer to Thailand’s National Innovation Agency’s definition, Startup means the entrepreneur which just starting to grow and has the innovation in their products or services. Startups can be divided into business types as follows; FinTech (Financial products & services providing startup), FoodTech (Food innovation startup), EdTech (Long-distance Education or tools providing startup), InsurTech (Insurance startup), HealthTech (Medical and healthcare startups), PropTech (Property startup), AgriTech (Agricultural startup), TravelTech (Tourism and Travel startup), E- Commerce (Sell & Buy platform) and Industry Tech (Industry support startup), Lifestyle (Digital Life Service Providing Startup), Moreover, NIA (National Innovation Agency, Thailand) provided definition of each startup stage which aligned with the financing cycle as follows; early-stage startup, growth-stage startup and later stage. Early-stage startup consists of a seed stage (startup during “Proof of Concept” to firstly test their product in the market around 1-2 years (not over USD 1 Mil, focus on market survey)) and series A stage (test if the market really like their products (USD 1-3 Mil., focus on marketing)). Growth-stage startups consist of series B and series C stage (fund is used for customer scaleup and forming company organization to service large customer-base). For later stage (series C and up stage), the business structure and revenue are very stable, well-established, and prepared to exit.

Family investor is bootstrap or funding from founder, FFF (Friend, Family, and Fool) (Lee & Persson, 2016) that normally support and believe in founders so that the founder can start, develop the product and grow the business in the way they believe and can control the direction by themselves (Worapongdee, 2018) Non-family investor consists of angel investor, incubator/accelerator, Venture Capital (VCs) or corporate venture capital and crowd funding or block chain-based crowd funding. Angel Investor is a group of independent investors who use their own funds to invest. Most of them are the successful startups and have experiences and expertise in the interested startups. In addition to providing funds, Angle investor can provide advice to help startup find business connection. Fund from the angle investor may not big but their support can help the seed- stage startup to establish their business (Worapongdee, 2018). Incubator/Accelerator will help the business grow by providing support, business advisory in various aspects including marketing, financial management, co- working space, funding sources, finding suitable partners, those will help accelerating the startup growth. Startups can join various competition programs held by the government/ private organization. These supports may be granted for free or exchange for equity. This will be funded by businesses plan to begin with. However, different approaches among incubators may affect the startup’s business growth (Worapongdee, 2018). Venture Capital or Corporate Venture Capital (CVC), investor institution that sourcing fund from group investors or corporate to invest in startups, which may be the establishment of a fund to collect investments from investors. The VCs are both sourced from overseas and Thailand such as 500 TukTuks, Cyber Agent Ventures and Golden Gate Ventures. VC normally invest in startups in growth stage (Series A and up) that need a large funding to scale up the customer base and want to grow business in overseas (Worapongdee, 2018). Crowd funding or block chain- based crowd funding is the intermediary platform matching for the peer investors from the public who would like to invest in startups. This model will give the opportunities for the seed to early- stage startup to access to funding sources. In addition, it allows startup to test the idea that the products or services are fit to the market. How many people that are interested in their product/service in the same approach of the pre- order transaction. At the same time, it provides the opportunities for the low-capital investors to invest in the potential startups with good ideas (Worapongdee, 2018). The block chain-based crowd funding is applied block chain technology capabilities to increase the platform creditability by tracking fund usage instead of escrow account service or to exchange their utility coins for funding to investor instead of equity. The crowd funding model divided into 4 types. Donation- based crowd funding is the platform for a donation fundraiser (Belleflamme et al., 2014). Reward crowd funding is a fundraising platform for investor to exchange for product/service in pre- order pattern (Bradford, 2012). Peer- to- peer lending is an investment in which individual lenders receive interests from startup in return (Agrawal et al., 2015). Equity-based crowd funding is similar to Peer-to-Peer lending. Investors will receive equity from startup in return (Belleflamme et al., 2014). Startup raises funds this way, mostly, in seed stage that is categorized into the high-risk capital.

There are 1,700 startups register with http://startupthailand.org, which are only 44 startups that get fund totally USD 30 million from the government- bank incubators. From Thailand Startup Ecosystem Survey 2019 Report, there are Investment volume is USD 97. 55 million from 32 deals. Startup in growth stage can raise fund from stage Series A to Series C, Pomelo, the fashion e- commerce success to raise fund valued USD 52 million. Early- stage startup face challenges from funding resource and advisory support. Especially, DTAC Accelerate, the top of the industry, has stopped this startup-supporting business. Normally Seed to Series A and Series A to B is the most challenged stages because of the scale-up.

Bootstrap is the most popular funding option for Thailand’s startup at 31%, (co- founder) 28%, family 26% due not to lose business control. Angle investor is the second- popular funder at 22% (referred by friend connection 32%, a cold meeting 19%) the reasons are to receive strategic-partner, networking, and advisory service. Benefit to angle inventor is equity. Venture Capital approached by business plan meeting 44% and by pitching 39% due to their scale- advice and regional network. Benefits are equity and board of direction seat. Incubators approached by government competition 57% and 43% by corporate-held competition. It provides startups the practical journey and networks. Benefits from startup are equity or for free. There are still gap the fund-raising option to provide fund to startups to replacing the bootstrap area.

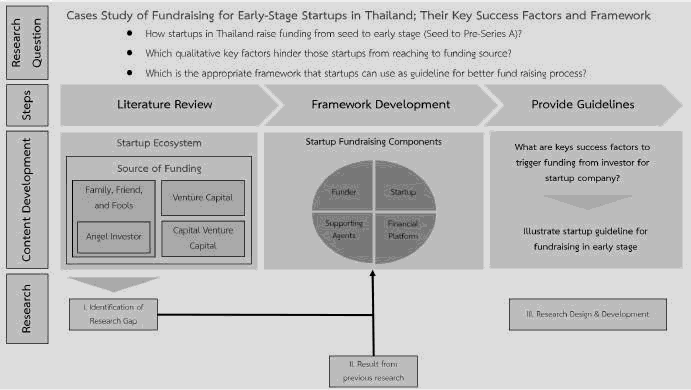

Peter, et al., (2019) demonstrated the development of guidelines in business, in order to create recommendation for startup; there is a requirement to draw a picture of research question, steps, content development, and research. This paper is developed using example to show the synthesis thinking of how to construct the research. The figure 1 is illustrated as below starting from research topic following research question to create step needed as mentioned by Peter, et al., (2019). Then this research was developed on exploring startup ecosystem under source of funding categories, fundraising components, and summary guideline from selected case studies of startup companies.

Research Questions

• How startups in Thailand raise funding from seed to early stage (Seed to Pre-Series A)?

• Which qualitative key factors hinder those startups from reaching to funding source?

• Which is the appropriate framework that startups can use as guideline for better fund- raising process?

Research Objective

• To investigate the entrepreneurial on funding journey of startups in Thailand, adopting the demand and supply side and to explore sources of finance available for fund raising at each stage.

• To explore and understand the pattern and key success factors of new startup’s fund raising in Thailand. How startups in Thailand finance in each early stage from establishment to Pre- Series a financing stage? By investigating the entrepreneurial journey of some startups in Thailand, adopting an investor and startup perspectives to explore how they access sources of fund from startup to Pre-Series A funding.

• To propose the appropriate framework that can utilize as an initial guideline to develop the appropriate financial platform with good approach and technology like blockchain and AI invented to improve the fundraising of startups ( Seed to Pre- series A level) in Thailand in the future.

Literature Review

Startup’s Raising Fund Pattern by Life Cycle Stage

Santisteban & Mauricio (2017) present a Systematic Literature Review and derived 21 critical success factors grouped into three categories (organizational, individual, and external) and 4 stages of development through which a Startup passes (seed, early, growth and expansion). They found that the previous experiences of the founding team and government

Support factors affect the seed stage; the venture capital factor affects the early stage. They also define that a successful startup is considered a new company that offers products and/or services capable of being in market fit, jobs generated and transform the way people do things. Additionally, Santisteban & Mauricio (2017) identify the factors that influence the development stages in the startup, this work has considered the stages showed as follows.

In 2012, Atherton found that multiple cases of startup funding patterns did not tally with the established explanations of small business financing such as pecking order (internal finance, short- term debt, long- term debt, and equity financing). Rationale Startups are extended to incorporate previous experiences of acquiring finance and perceptions of the ease and feasibility of doing so to select the patterns in new venture financing.

Success Factors by Categories

Santisteban & Mauricio ( 2017) also found that the literatures can be classified into 3 categories; 1) Organizational categories that the studies have been focused on factors such as the organizational age (Song et al., 2008) and the organizational size (Baptista et al., 2007). In the study of Hormiga, et al., (2011), the role of the location is important and Guzmán & Lussier (2015) claim partners are important for the survival and growth of the startup, 2) Individual’s category represent the challenges related to the human capital of the startup (the entrepreneur leader and the work team). The founders well-trained with the necessary experience has the positive effect to business success and 3) The externals category or the environment or ecosystem where the startups operate. Some researches point out that the external factors can work/ act/ serve as the driving force behind the performance and growth of the organization. The lack of financing is often one of the reasons entrepreneurs give up on their business initiatives (Gelderen et al., 2005; Song et al., 2008; Azimzadeh et al., 2013; Kakati, 2003).

Key Success Factor of Startup Fundraising

Based on Competitive Advantage Theory, Sathaworawong, et al., 2019 categorizes the factors effecting likelihood of fund- raising success based on two perspective: Market- based view draw from investor side and Resource-based view draw from entrepreneur side. Deriving from 43 literatures, has derived 4 key success factors from market-base view (industry, market response, firm location and investor location) and 7 key success factors from Resource-based view for the successful raise-funding (team, gender, experience, education, network, product and firm age)

In Seed stage, there are some significant factors that affect the startup fundraising include Investor location, Market Response, Startup’ s Education, Location, Management Experience, Network, Technical Specialist/Professional Service/Media Industry/Fintech Industry. However, the significant factors in Early Stage round are reduce to education, Investor location, Market Response, Startup Location, IT infrastructure Industry, Management Experience and Firm Age.

Tax Incentive & Legitimate and Startup Fundraising

From Manigart, et al., (2013), they gather literatures utilize corporate income tax and capital gain tax as the independent variables. Both factors significantly impact on venture capital investment.

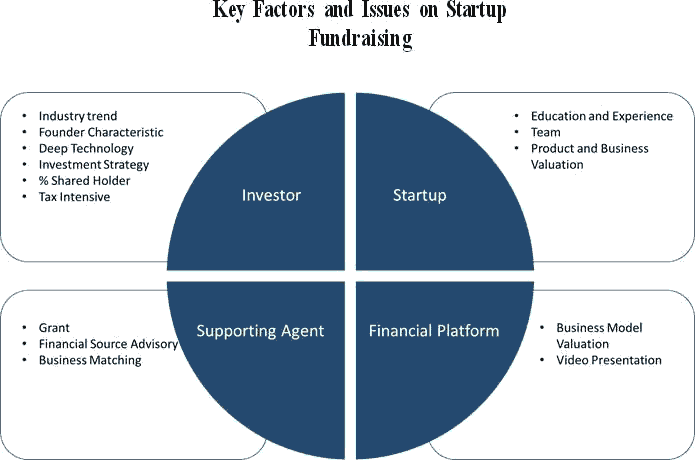

Conceptual Framework

The conceptual framework shown in Figure 2 was constructed based on our literature reviews in several aspects. We decide to select the key success factors to raise fund as derived from 1. The investor perspective 2. Startup perspective 3. Supporting agent perspective and finally we propose the integrated framework for the seed to early- stage startup as the self- assessment guideline for better preparation.

Research Methodology

| Table 1 Research Methodology Components |

|

|---|---|

| Subject | Contents |

| 1. In-depth Interview | 1 CVC 2 Startups in Seed level and 1 startup in Series A level |

| 2. Criteria of samples | Investor (CVC) Have in- depth knowledge & experiences as the decision management of VC or CVC more than 5 years. Have hands-on experience in startup valuation in seed to series level more than 10 years. Startup (1 seed level and 2 Series-A level) Founder, CEO or CFO of startup companies in tech or online services. Has experienced in get funding from VC, CVC, crowdfunding or lender. |

| 3. Instrument Design | Semi-structured Interview |

Research Method

The stated conceptual framework was constructed to explore the key success factors of fund raising for startup in Thailand. The inductive approach is utilized to analyze the thematic qualitative data to get insights of success factors and patterns of fundraising in the early-stage startups in Thailand. The cases studies employed qualitative methods to extract rich, precise, and holistic insights from the case being studied.

Sampling Design

The co- founders of 3 startups and 1 corporate venture capital were selected as the sample for in-depth interviews. The researcher selected the sample based on the criteria that startups must be scalable technology or deep- tech startup companies with limited company status registered in Thailand. They should be quite famous and successful role- model. The CVC is very famous and represent their career path as VC for over 10 years. We refer their interviews in the cited website to understand more on their insights.

Instrument Design

Guidelines for semi-structured interviews were derived from relevant literatures involving key success factors and pattern of fundraising of startup and by CVC points of views. Respondents answered open- ended questions that asked them to share their perspectives in detail during the interview.

Data Collection

The data collection is done using a qualitative method as it provides a deeper listening to understand the ecosystem from different perspectives. The involved participants namely 3 startups in the early-stage startups (Seed to Series A) and one corporate venture capital. In order to get their opinions, perspectives and attitudes, we spend almost 1 hour for each interview by face-to-face meeting and by Zoom meeting (Nassaji, 2015). Data will be collected via interviews with a set of the semi-structured questions (see appendix for the list of questions).

Results

Startups

Journey and Key Success Factors

As a result of interviews with three startups in Thailand's technology and online service segment, the startups received their first investment from the founders and co-founders, which are the family investor and then raises funds through non-family investors in the future. Investing among founders and co-founders has two advantages: it creates a beta prototype or business plan and creates trust for investors who will invest in the future. The technology and online services startups' access to funding is divided into five stages: Idea stage> pre-seed stage> seed stage> pre-series A stage> series A stage. However, some startups are able to promote from an idea stage to a seed stage or to a series A stage immediately after receiving funds from the government grant. The results of the interviews show that the first thing a startup must do is checking who is doing the same and who is a competitor and team members should be diverse in their fields to have both technology and domain knowledge. In addition, products and services should be new technology or deep technology. However, we suggest that startups should consider market scalability because Thailand has a smaller market base compared to other countries like China. Moreover, deep technology requires a lot of capital, so startups in the idea stage may not be able to attract angel investors because the angel investors may not have the limited capital. Even the larger capital holder like the VC, they might foresee the deep-tech startup as the high-risk. As a result, startups using deep technology may have problems in sourcing fund to set up their prototype or MVP (minimum valuable product) in Thailand until they really test the product market fit. Likewise, startups should develop technologies that meet the basic needs of their customers such as finance and accounting technology, which is a fundamental need of every organization.

According to the interview, there are fundraising tips for startups in the idea stage. Startups at the idea stage should take fund from the government grant to increase the valuation of startups, which affects their ability to negotiate with other angel investors. Then, as startups grow, they switch to funding through venture capital. However, startups must know their investors' strategic investment goal in order to offer them what they want. On the other hand, the factor that made it difficult for startups to access funding is the regulation of Thailand, because each regulator involved in investment has different requirements. In addition, there are vague tax policies to attract investors who want to invest in a startup, such as tax deduction privileges.

As for crowd funding, there were only one startup that had previously used the crowd funding platform but had no success. Meanwhile, two other startups have yet to raise funds from a crowd funding platform. We have come up with the idea of crowd funding that a small number of startups in Thailand are able to advance from seed stage to series. A stage, so crowd funding may replace the bootstrap area, sharing risk from the FFF and give the opportunities to the deep- tech or the new startups to get fund from the interested public investors. However, the funding from the crowd funding platform is not popular comparing to the VC because startups in Thailand are not confident on the number of gathering investors, the timing and process to do with several investors. Moreover, the VC/CVC has a strategic investment strategy that provides good advice on managing finances, entering markets, and building a client base for selected startups.

Startup

Business and Financial Plan

Interviewees confirmed that business and financial plan are necessary parts of the startup in order to raise fund with investors. There are two out of three startups (Startup A and Startup B) that they endorsed the using of business plan, SWOT analysis and five forces model to prepare and present their products or service and company’s value to investors. However, there is one startup which denied this method of getting fund as this startup’s founder used something different from business plan or feasibility plan which is actual numbers of customers and venture’s cash flow or traction plan. Startup C’s founder also claimed that his business is differentiated apart from other existing startups as his venture provide online accounting service in Thailand which there is no other competitor yet. This was a good opportunity of him to do a fundraising with investors easily. Startup C’s founder repeatedly that his pitching went smoothly with no problem at all.

Investor

Journey and Key Success Factors

In an interview with venture capital executives who have experience in startup valuation in seed to series level more than 10 years, we find that venture capital is more likely to invest in growing startups. Selected startups often have substantial customers using their products or services, which are pre-series A stage - series A stage startups. Venture capital has a strategic investment strategy that provides good advice on managing finances, entering markets, and building a client base for selected startups. The existing sources of funds in Thailand have a large amount of investment. Each source of funds has different investment goals. However, most of the funds are available for startups in the pre-series A stage - series A stage and above. Likewise, with startups that are divided into multiple stages, in order to receive series A stage funding, it is necessary to start from the seed stage. Startups in the seed stage receive funding from investors who look for startups in the seed stage. In the event that a startup in the seed stage requires more capital, it is necessary to move from the seed stage to a higher stage. Most of the investments come from corporate venture capital account for more than 80% of the total investment in the system, rarely choose to invest in startups at the seed stage and often choose to invest in startups at pre-series A stage to series A stage. Interviewees suggested that seed-stage startups should start raising funds from the government grant, where it is not difficult to find, but the fund is smaller than the higher-stage investor group. The funds received from the government grant are usually not more than 3 - 5 million baht. However, only the short-list startups in the focus industry are funded by the government grant. Government funding agencies often ignore funding the previous-funded startups. Government funding agencies tend to ignore the well-funded startups; as a result, the previous-funded startup cannot level up to from seed stage to series A stage due to the lack of support.

The factors that contribute to the success of startups are key competence or the domain knowledge of the founders and co-founders. Young founders and co-founders often have good ideas, but they lack manageability, which makes startups unable to advance from seed stage to series A stage. By contrast, older founders and co-founders are more experienced and successful than younger founders and co-founders. However, the age of the founders and co-founders is not a key measure of a start-up's success. Most of the problems with startups in the seed stage that prevent investors from getting funding are ideas that are not new, not deep technology, and most of them are lifestyle ideas that have been done before. A major problem that prevents startups from getting funding is old ideas, which are mostly lifestyle ideas that were done before and not deep technology.

Technology, Mentoring and Management.

For crowd funding industry in Thailand, this funding source is a different market from the venture capital. Crowd funding is often invested in product groups that are easy to understand or have a simple business model, such as making cartoons and headphones with a new feature, but still the original shape. It needs block chain to hold money until product launched. In mentoring and management, interviewees invest in startups with less than 20% ownership and send one or more people to the start-up management board to confirm the direction and support startup as the advisory. As for the exit strategy, there are no plans to exit the investment, because startups can be used to boost revenue, increase customer base and generate new businesses in the future.

Discussion and Conclusion

The first funding the startups in the idea stage were funded by the founders and co- founders. Lee & Persson (2016), suggested that this method was considered a family investor. Startups in the seed stage are still high-risk businesses. Products and services may be ideas and are still in the development stage. Moreover, without a clear business plan, it is difficult to find other sources of funding. However, we have the view that investing from founders and co- founders' funds has the advantage of enabling beta prototypes or business plans and create trust for investors who will join in investing in the future. In this research, startups and venture capital have the same view that startups in the idea and seed stages should start raising funds from non- family investors. (Lee & Persson, 2016). This type of funding is a government grant, which is not difficult to find. The government grants funds usually provide approximately 3-5 million baht. This is consistent with NIA research showing that government grant funding is usually less than 5 million baht. (Shin & Limapornvanich, 2017) This type of funding is used for traction to increase the valuation of startups and increase their negotiating ability with angel investors. When startups grow, the next step is to raise funds through venture capital.

In this research, factors that affect the success of the startups' funding, the first thing a startup must do is check who is doing the same and who is a competitor and team members should be diverse in their fields to have both technology and domain knowledge. In addition, products and services should be new technology or deep technology. However, there is a difference in deep technology between the perspective of startups and venture capital. Venture capital expects startups to use deep technology and differentiate themselves from their competitors. On the other hand, startups view that deep technology is not suitable for startups in the idea stage due to large capital expenditures. In addition, the regulator should have a tax policy to attract investors who want to invest in startups, such as tax deduction.

Based on our result on study, we found that the data extracted from interviews with both 3 startups and 1 corporate venture capital can be linked to our research objective and questions as followed.

Fundraising Pattern and Characters

| Table 2 Summary Of Startup’s Journey On Fundraising |

||||

|---|---|---|---|---|

| Startups | Stage | Stage 1 | Stage 2 | Stage 3 |

| 1. Startup A | Pre-Series A | FFF | Angle Investment | Corporate Venture Capital |

| 2. Startup B | Seed | FFF | Incubator Competition in Thailand | - |

| 3. Startup C | Series A | FFF | Incubator Competition in Thailand and Singapore | Corporate Venture Capital |

The funding pattern of startups in Thailand based on our interview showed that normally all of founders initially started from using their own fund in the very first stage of starting businesses (Idea Stage) and then they started to request for funding through their surrounded people which are family, friends, and fools ( FFF) (Kotha & George, 2012). After they finished on their first prototype then they stepped into finding angel investor or joining the competition to get connection, social network and advisory from the committees and related person in the contest to develop MVP for product market fit. Mondal & Shrivastava (2016) also confirmed the step of startup on searching for angel investor for raising fund.

When the Thai startups had strong confidence on their MVP testing which they were tested both internal and external volunteer users, they then approached the formal sources of funds from angel investor or the incubator. This insight is supported by Mukti, et al., (2019), they stated that once startups finished created business model then they would try to move quickly to MVP stage. After the Thai startups received the clear business model and traction on users and revenues, they would try to approach CVC or VC that can contribute the huge customer base, strengthen their knowledge base, improve their performances by doing a test on their MVPs and to scale up the customer base in vertical and horizontal expansion (Benson & Ziedonis, 2009).

Key Success Factors on Fundraising

| Table 3 Startup’s Key Success On Fundraising |

|

|---|---|

| Seed-Stage Startup | Early-Stage Startup |

| FFF – Incubator/Angel Investor | VC/CVC Investor |

| Founder’s Character (Passion & Trust) | Founder’s Character (Trust & Collaboration) |

| Domain Knowledge/Innovation | Business Model/Business Traction |

| Newness, Product Market Fit | Strategy Alignment |

| Competency Team | Industry Trend (Market Response) |

| Social Network | Tax & Legitimation |

The second objective was answered through the second research question which derived from interview information of the startup’s founders answered. They were categorized into 2 groups which are seed-stage startup and early-stage startup which this paper is focused.

The seed-stage startups were identified key successes on raising fund in the early stage are included funding from FFF as supported by Kotha & George (2012) which are nearest people to support, Fan & Leung (2020) also agreed with our research as founders’ characters which must have strong passion and trust in their ideas to make them become realistic, solving their actual pain points by their domain knowledge and technology to turn them into products or services, newness or product market fit which they offered the correct products or services that are matched to customers’ needs (Zhao & Ziedonis, 2020; Seet et al., 2018; Assyne & Wiafe 2019) supported that competency team is another core area to strengthen the product or service, and social network which related to know-who and know-how matters to support ideas, products, and connections (Almeida & Santos, 2020).

The early-stage startups were examined by interview and the result from transcribe was shown that key successes on getting fund at this stage are included fund from VC or CVC investor as this level startups mostly require huge funds to inject into their research and development (Park & LiPuma, 2020), founders’ characters also were mentioned by interviewees that trust and collaboration were the essential parts of founders to the venture (Sathaworawong et al., 2019), McDonald & Eisenhardt (2020) agreed on business model and traction were pointed out to be the key milestones and hurdle that startups need to conquer, Muro, et al., (2020) confirmed the point of this paper that strategy alignment is another thing stated from them to meet VC or CVC expectations, founders stressed on industry trend or market response that developed product or service needed to stay in line with trending business of that industry or market, and tax & legitimation is the most hardest matter for them on raising fund and passing through the process as Thailand currently has not been supported startup enough and the legitimation cost is very high. The startup law is also impacted to Italy same issues as Thailand which is mentioned by Giudici & Agstner (2019).

Key Success Factors on Fundraising

The third objective is analyzed altogether with proposed framework in order to create fundraising guideline for startup in Thailand which is shown as minimum criteria to receive funding from VC or CVC investor in Table 4.

| Table 4 Guideline To Get Funding From Investor |

|

|---|---|

| Subject | Minimum Criteria for Self-Assessment |

| 1. Problem/Solution | Startup should have their domain knowledge +innovation to build Product/Service that seriously solve the foundation problem. |

| 2. Product Market Fit and Unfair Advantage | Product/Service should really fit with the strategic market. The deep technology should have entry barrier. |

| 3. Business Model and Traction | The no. of willing to pay customer should be scalable, repeatable with decreasing cost. (10,000 and up). |

| 4. Founder & Team Character | Founder should be trustworthy, passionate, and team should be complimentary. Graduated university and Experienced in the related area is recommended to have the domain knowledge. |

| 5. Valuation and % Shareholder | % equity should not over 10% per one funding round |

| 6. Strategy Alignment | Select the funding option aligned with your strategy and stage such as CVC or incubator is recommended. |

| 7. Type of Investor | Incubator/CVC is recommended for the seed to early-stage startup. |

| 8. Support Needed | Better ecosystem such as some legal and tax revision to promote the investment in risk capital. |

There are 8 subjects which are the minimum guideline of Thailand Startup Company to follow in case of requesting grant or fund from public or private sector to help and fund to the venture in the beginning period of startup journey. The problem and solution preparedness were identified to be extracted from founders and co-founder knowledge to build the prototype product or service. The product market fit is the criteria that startup should passed idea stage already and in between of developing prototype to asking for fund from investors (Yannopoulos et al., 2012). The business model and traction are other criteria to be judge from investor whether they will fund or not (Nigam et al., 2020; McDonald & Eisenhardt, 2020). Founder and team characters are the part of readiness in support when pitching to investors. This is supported by Shane et al. (2020) that founder and team are the key part to do pitching. Valuation and % of shareholders are the part which ventures need to analyze and discuss on proper percentage or possible ratio before asking for funding from VC or CVC (Halminen et al., 2019). There is a need for venture to check on investor’s preference or strategy whether the venture is fit in the investor’s tactic or portfolio (Zhong et al., 2018). Type of investor is a source that all startups need to study them to know what they want from startup company then it will become easy for startup to pitch to them (Zhong et al., 2018). Lastly the support needed from the local or national government on the lacking of supportive in law and tax issues which will be obstructed the growth of startup companies in Thailand which currently the method or the way that crowdfunding, VC or CVC supported to each startup firm may not be correctly 100% against the actual law and tax matter which are relied on normal type of businesses. Zheng & Zhang (2020) also agreed that startup was prevented from driving innovation if there was a high tax policy. In China, the government reduced the tax rate for startups which drive the innovation rate and the economic market since 2004. Pavlykivska, et al., (2020) supported that startup or small business really needs government support on the early stage of forming the venture.

Implication+Future Research

Based on the qualitative cases studies results, the successful fundraising pattern of startups in Thailand during seed stage is initially using their own fund, then From Family and Friends (FFF) to draft their first business plan/prototype then from angel investor or joining the incubator competition for business connection and advisories to develop MVP for product market fit for reference to the next round of funding. Besides that, founder’s passion & trustworthy character, their deep knowledge with innovation to really solve some scalable market with high competency team and good network are also key success factors of fundraising for seed-stage startups in Thailand.

For startups during the early stage, the success funding patterns from CVC or VC are recommended to get the market testing and their large customer base. Apart from that, founder’s character of trustworthy and collaboration, its clear business model and traction, strategy alignment and its industry trend and tax & law revision are key success factors for the early-stage startups in Thailand.

For the derived 8 guidelines for self-assessment for seed to early-stage startup when raising fund from investors are 1) its clear solution to the selected problem, 2) finding the market that need its solution with high barrier, 3) the precise business model and traction, 4) good founder and team, 5) manage the exchanged equity for each funding round, 6) Know your investor’s goal and needs, 7) Select the compatible investor for each stage and 8) Try to find supportive advisory on tax and legitimation to shorten the fundraising journey and cutting cost.

The obtained results of this study contribute to adding more knowledge to the existent literature about success factors of startup’s fundraising in Thailand. Additionally, the results could play a major part for the startup, investor, government supporting policy to develop the fundraising platform or eco-system in the future to finally help startup to survive and contribute to Thailand’s economic growth and competitive advantage in innovation.

Limitation

The selected case studies on both startup companies and investor (CVC) are the sources that researchers can access and interview through limited relationship, so the result of study shown only related finance industry startup companies. The future research could explore and choose more variety industries of startup to increase samples in order to make the guideline more precise. Also, on the investor side, future research might select general investors as general investor may give different answer apart from this research which investor is from the finance institution.

Acknowledgement

This study was supported by Prof. Dr. Achara Chandrachai, Assoc. Prof. Dr. Pakpachong Vadhanasindhu, Dr. Kwanrat Suanpong, Department of Commerce, Faculty of Commerce and Accountancy, Chulalongkorn University, Technopreneurship and Innovation Management Program, Chulalongkorn University.

References

- Agrawal, A., Catalini, C., & Goldfarb, A. (2015). Crowdfunding: Geography, social networks, and the timing of investment decisions. Journal of Economics & Management Strategy, 24(2), 253-274.

- Almeida, F., & Santos, J. (2020). The role of social networks in the internationalisation of startups: Linkedin in portuguese context. Management & Marketing, Challenges for the Knowledge Society, 15, 345-363.

- Assyne, N., & Wiafe, I. (2019). A dynamic software startup competency model. International Conference on Software Business, 10th International Conference, November 18-20, 2019, 419-422.

- Atherton, A. (2012). Cases of start-up financing: An analysis of new venture capitalisation structures and patterns.

- International Journal of Entrepreneurial Behavior & Research, 18, 28-47.

- Azimzadeh, M., Pitts, B., Ehsani, M., & Kordnaeij, A. (2013). The vital factors for small and medium sized sport enterprises start-ups. Asian Social Science, 9, 243-253.

- Baptista, R., Karaöz, M., & Mendonça, J. (2007). Entrepreneurial backgrounds, human capital and start-up success. Jena Economic Research Papers, No. 2007,045, Friedrich Schiller University Jena and Max Planck Institute of Economics, Jena

- Belleflamme, P., Lambert, T,. & Schwienbacher, A. (2014). Crowdfunding: Tapping the right crowd. Journal of Business Venturing, 29, 585-609.

- Benson, D., & Ziedonis, R.H. (2009). Corporate venture capital as a window on new technologies: Implications for the performance of corporate investors when acquiring startups. Organization Science, 20, 329-351.

- Bradford, C. (2012). Crowdfunding and the federal securities laws. Columbia Business Law Review, 1, 1-150.

- Cosh, A., Cumming, D., & Hughes, A. (2009). Outside enterpreneurial capital. The Economic Journal, 119, 1494- 1533.

- Denis, D.J. (2004). Entrepreneurial finance: An overview of the issues and evidence. Journal of Corporate Finance, 10, 301-326.

- Estrin, S., & Khavul, S. (2016). Equity crowdfunding: A new model for financing entrepreneurship? CentrePiece - The Magazine for Economic Performance, 20, pp. 6-9.

- Estrin, S., Gozman, D., & Khavul, S. (2016). Case study of the equity crowd funding landscape in london: An entrepreneurial and regulatory perspective. Fires Reports, 5, 2.

- Fan, J.P.H. & Leung, W.S.C. (2020). The impact of ownership transferability on family firm governance and performance: The case of family trusts. Journal of Corporate Finance, 61, 1-25.

- Gelderen, M., Bosma, N., & Thurik, R. (2005). Success and risk factors in the pre- startup phase. Small Business Economics, 26, 319-335.

- Giudici, P., & Agstner, P. (2019). Startups and company law: The competitive pressure of delaware on italy (and europe?). European Business Organization Law Review, 20, 597-632.

- Gompers, P.A. (1995). Optimal investment, monitoring, and the staging of venture capital. Journal of Finance, 50, 1461-1489.

- Guzmán, J., & Lussier, R. (2015). Success factors for small businesses in guanajuato, mexico. International Journal of Business and Social Science, 6, 1-7.

- Halminen, O., Tenhunen. H., Heliste. A., & Seppälä. T. (2019). Factors affecting venture funding of healthcare ai companies. Studies in health technology and informatics, 262, 268-271.

- Hite, J., & Hesterly. (2001). The evolution of firm networks: From emergence to early growth of the firm. Strategic Management Journal, 22, 275-286.

- Hormiga, E., Batista-Canino, R., & Sánchez-Medina, A. (2011). The impact of relational capital on the success of new business start-ups. Journal of Small Business Management, 49, 617-638.

- Jensen, M.C. & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency cost and ownership structure. Journal of Financial Economics, 3, 305-360.

- Kakati, M. (2003). Success criteria in high-tech new ventures. Technovation, 23, 447-457.

- Kotha, R., & George, G. (2012). Friends, family, or fools: Entrepreneur experience and its implications for equity distribution and resource mobilization. Journal of Business Venturing, 27, 525-543.

- Lee, S., & Persson, P. (2016). Financing from family and friends. The Review of Financial Studies, 29, 2341-2386.

- Manigart, S., Standaert, T., Standaert, V., & Devigne, D. (2013). Literature review on the financing of young innovative ventures. Vlerick Business School, Ghent at Flemish Region, 7-59.

- McDonald, R.M. & Eisenhardt, K.M. (2020). Parallel play: Startups, nascent markets, and effective business-model design. Administrative Science Quarterly, 65, 483-523.

- Mondal, D. & Shrivastava, A. (2016). Angel funds: The new type of alternative investment fund in india. The IUP Law Review, 6, 57-64

- Mukti, I.Y., Wibowo, A.P.W. & Galih, S. (2019). Lessons learned to increase the digital startups success rate.

- Global Business and Management Research: An International Journal, 11, 226-234.

- Muro, P., Lecoeuvre, L., & Turner, R. (2020). Ambidextrous strategy and execution in entrepreneurial project- oriented organizations: The case of pagani supercars. International Journal of Project Management, 39, 45- 58.

- Nassaji, H. (2015). Qualitative and descriptive research: Data type versus data analysis. Language Teaching Research, 19(2), 129-132.

- Nigam, N., Benetti, C., & Johan, S.A. (2020). Digital start-up access to venture capital financing: what signals quality? Emerging Markets Review, 45, 1-36.

- Park, S., & LiPuma, J.A. (2020). New venture internationalization: The role of venture capital types and reputation.

- Journal of World Business, 55, 1-10.

- Pavlykivska, O., Marushchak, L., & Oleksandra, K., (2020). The world practice of governments support the small business: lessons for ukraine. Cogito Multidisciplinary Research Journal, 12, 110-131.

- Peter, L., Back, A. & Werro, T. (2019). Practical implications on how established companies innovate with startups: Tools and guidelines for innovation managers. International Journal of R&D Innovation Strategy, 1, 1-20.

- Santisteban, J., & Mauricio, D. (2017). Systematic literature review of critical success factors of information technology startups. Academy of Entrepreneurship Journal, 23, 1-23.

- Sathaworawong, P., Saengchote, K., & Thawesaengskulthai, N. (2019). Success factor of start-up fund raising in ASEAN. Asian Administration & Management Review, 2, 221-246.

- Sathaworawong, P., Saengchote, K., & Thawesaengskulthai, N. (2019). Success factor of start-up fund raising in ASEAN. Asian Administration and Management Review, 2, 221-246.

- Seet, P.S., Jones, J., Oppelaar, L., & Zubielqui, G.C. (2018). Beyond “know-what” and “know-how” to “know- who”: Enhancing human capital with social capital in an australian start-up accelerator. Asia Pacific Business Review, 24, 233–260.

- Shane, S., Drover, W., Clingingsmith, D., & Cerf, M. (2020). Founder passion, neural engagement and informal investor interest in startup pitches: An fmri study. Journal of Business Venturing, 35, 1-19.

- Shin, T., & Limapornvanich, C. (2017). Development of innovation platform of National Innovation Agency (NIA) in Thailand: Shaping-up of innovation policy for startups and SMEs,

- Song, M., Podoynitsyna, K., Bij, H., & Halman, J. (2008). Success factors in new ventures: a meta-analysis. Journal of Product Innovation Management, 25, 7-27.

- Stiglitz, J.E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Review, 71, 393-410.

- Worapongdee, N. (2018). Set your startup business guide. In set your startup business guide, nuchanat khunkwamdee, 2, thai setakij insurance, 74-82.

- Yannopoulos, P., Auh, S., & Menguc, B. (2012). Achieving fit between learning and market orientation: implications for new product performance. The Journal of Product Innovation Management, 29, 531-545.

- Zhao, B., & Ziedonis, R. (2020). State governments as financiers of technology startups: Evidence from michigan’s r&d loan program. Research Policy, 49, 1-19.

- Zheng, W. & Zhang, J. (2020). Does tax reduction spur innovation? Firm-level evidence from china. Finance Research Letters, 1-6.

- Zhong, H., Liu, C., & Xiong, H. (2018). Which startup to invest in: A personalized portfolio strategy. Annals of Operations Research, 263, 339-360.