Research Article: 2021 Vol: 20 Issue: 6S

Legal Exemptions and Their Compatibility with Taxpayers' Incomes and Their Impact on Tax Revenues (Applied Research on A Sample of the Faculty of Human Education)

Khaldoun Salman Mohammed, University of Baghdad

Saleh Mahdi Hammadi, University of Diyala

Abstract

The study aimed to identify the legal exemptions as exemptions of a personal nature. These exemptions are granted pursuant to the personal tax principle that takes into account the personal circumstances and family considerations that provide the minimum living standards and family burdens for the taxpayer, whether he is single or married, and these tax exemptions are one of the important means to raise the volume of tax revenues, The results of the study showed that the application of legal (personal) exemptions participates in embodying one of the pillars of the justice base in a way that reduces psychological pressure on the taxpayer and increases his conviction, awareness, and duty to pay the tax, which generates positive behavioral patterns that prevent him from attempting tax evasion, and this leads to regular revenue flows Tax to finance the state treasury The study recommended that the tax legislator establish legislation and laws that determine the amount of exemptions granted to taxpayers that keep pace with changes in economic and social conditions that take into consideration the considerations of achieving tax justice.

Keywords

Legal Permits, Taxpayer, Tax Objectives, Tax Revenues

Introduction

Taxes are an effective tool that the state uses to obtain the revenues necessary to cover its expenditures by distributing public burdens on its citizens residing on its land, and accordingly the tax must be fair so that it does not lead to a change in the social and economic life of the citizen as the tax is deducted from the citizen’s income Which affects the level of income on which that tax is imposed, and from the aspect of applying the principles of justice in general and tax justice in particular, it is necessary to take into account the personal circumstances surrounding the taxpayers who are obligated to pay the tax, given that the state is not only responsible for legislating tax laws and obligating those who pay it to achieve revenues It also requires the state to legislate laws that lead to the provision of an appropriate environment, and among the requirements of that environment is the personal exemptions granted to the taxpayers in which the circumstances and family burdens of the taxpayer are taken into account, the assignment capacity of each taxpayer and the necessary income to meet the basic needs of the taxpayer and to meet his spending needs for him and his family if he finds a dependable person. And the development of economic development by achieving revenues that help finance the general budget for the country all from the other hand.

Research Problem

The problem of the study is represented in instability in granting legal exemptions on income tax under the Income Tax Law No. (113) of 1982 and its amendments in a way that makes it not commensurate with the economic and social variables and the taxpayer's income level, which leads to the failure to achieve the principle of justice in imposing income tax and the effect of this in not Creating and developing the conviction of the taxpayer to pay the tax directly and reducing the motives for evasion, thus achieving regularity of tax revenue streams.

Research Importance

The importance of the study is highlighted through the following aspects:

- The importance of the legal exemptions granted by the tax legislator and their positive role in creating a sense of justice for the taxpayer, encouraging him to pay the tax, not evading it, and providing revenues for the state.

- The importance of tax revenues in general, the tax revenue collected directly, and its role in supplying the state's public treasury and covering its expenses.

Research Objectives

The research aims to achieve the following:

- Explaining the importance of the exemptions stipulated in the Income Tax Law and their suitability for tax justice.

- A statement of the effect of the legal exemptions on tax revenues.

- A statement of the reasons for granting legal permits and their role in achieving the goal that led to their granting to the taxpayers.

Research Hypothesis

The study has a hypothesis and one is that the instability in granting legal exemptions over the incomes of taxpayers has an impact on tax revenues.

Study Population and Sample

A sample of the affiliates of the College of Education for Human Sciences/Diyala University for the period (2014-2018) was selected for the purpose of studying it and reviewing the reality of legal exemptions during this period.

Literature Review

- A study of Yaba & Amin (2018), the study aimed to identify the importance of tax exemptions and their compatibility with economic and political variables. It reached a set of results, the most important of which is that the legal exemptions, including the family, are monetary amounts that the tax legislator gives to the taxpayer according to the law. A set of recommendations, the most important of which is the need to adhere to the imposition of the tax, taking into account the reduction in the tax rate and its consistency with the exemptions granted.

- The study of Al-Baghdadi & Sindo (2013). Tax prices are one of the important means in increasing the tax revenue. The study points to the need to expand tax revenues due to their importance in financing the state's general budget.

The Theoretical Side

The Concept of Legal Exemptions, Types and Conditions for Imposing them

The Concept of Legal Exemptions

It is a legal term used by the income tax law legislator and called on personal exemptions, which are the amounts that the project allows to deduct from the income of the individual taxpayer before calculating the tax on him. The reason for giving this exemption is that the individual taxpayer bears personal costs, which are the sums that the taxpayer spends on his and his family's livelihood (Ramadan, 2002, p. 469), and legal exemptions are defined as a set of discounts and exemptions granted to personal income (Bessho & Hayashi, 2013). The personal needs necessary for the taxpayer, and since the personal needs are many and varied, the tax legislation has taken to determine the minimum or necessary for living and it is sometimes called (the subsistence limit) and includes the minimum expenses That which is spent on food, drink, clothing and housing, and there are considerations that must be taken into account when imposing the tax, and these considerations include:

- In exchange for the burden of living, the individual bears many burdens as a result of price fluctuations and highs, which leads to an increase in the expense of the taxpayer, so taxes are not imposed until after the taxpayer's income exceeds a certain minimum, meaning that the tax is imposed on the net income after this minimum is subtracted.

- In contrast to the family burdens, the costs of a single are different from the costs of a married person, and the costs of a married person who has children differs from a married person who has no children. Tax justice necessitates a distinction in treatment between these groups. Tax justice imposes equality in sacrifice in the sense of not only taking into account the amount of income, but taking into account his true cost-effective capacity (Al-Rahimi, 2017, p.13).

Types of Legal Exemptions

Article (12) of Income Tax Law No. 113 of 1982 amending has stipulated the following exemptions: (Yaba & Amin, 2018, p. 335)

Charged Self-Exemptions

It is the exemption decided upon for the taxpayer himself and it is determined on the basis of his condition for a year that is achieved regardless of his gender, age or description, so the taxpayer benefits from it, whether a male or female young or old, single or married, but the tax legislator tends to differentiate in the amount of self-exemption according to a purpose that occurs to the description of the taxpayer Where it grants a self-exemption to the widow and divorced more than the self-exemption to the rest of the taxpayer, out of appreciation for the reasons for widowhood and the circumstances of the widow and divorced.

Marital Exemption

The legislator decided to allow the wife to be granted to her husband as compensation for the burdens achieved in the case of marriage, and the reason behind this exemption is to achieve justice by providing for the obligated to face the burdens and requirements of marital life.

Children Exemption

Fanon adopted the income tax naming the children to include the son and the girl with a exemption granted to the costs of the family breadwinner and did not include a specific number, but whatever the number of children the assigned parent enjoys for them and according to their conditions, and the reason behind this type of exemption is to achieve justice by reducing the burdens on the fathers on their children.

Exemptions for Widowed or Divorced Women

It is the exemption that is granted for a circumstance that occurs to the description of the taxpayer, whereby it grants self-exemption to the widow and divorced in excess of the self-exemption for the rest of the taxpayer, in appreciation of the reasons for widowhood and the circumstances of the widow and divorced.

Exemption Aging

It is an additional exemption for every taxpayer over the age of sixty-three years of age and the reason for granting this exemption in order to provide for the taxpayer from the requirements of good health and nutrition services, because he may be exposed to emergency or chronic diseases (Al-Ghaly, 2002: 84).

Non-Iraqi Exemption upon Residence

A non-Iraqi is granted, in cases where he is legally considered a resident for the purposes of income tax, the legal exemptions to the extent of the number of months in which he resides in Iraq. With the exception of people who are contracted by the Iraqi government or used to teach for an academic year, they are granted full exemption (Shaheen, 2013: 69).

Conditions for Granting Legal Exemptions

In order for the taxpayer to be granted legal exemption before being subject to income tax, the following conditions are met:

- If the person in charge is a person or a joint partner:

- The exemption decided by the Iraqi tax law is for the natural person (individuals), and by that the moral persons graduate from the various funds and endowment companies and institutions and the permitting of these natural persons is linked to their existence in their own right and with their actualized entry and ends with the end of their lives and benefits from the rule of individuals in companies of solidarity, simple and individual project, and because the ruling The partner in people’s companies is the ruling of the individual trader. He has the legal permissibility that he deserves according to the law. As for the shareholders in companies, the funds do not enjoy the exemption because the tax is linked and imposed in the name of the company as a legal personality. Therefore, the tax legislator does not care about the personality of the shareholder partners. Their financial receivables are considered part of the company’s owed, and paying the tax falls on their shoulders and not on the company (Kadawi, 2008: 48).

- The taxpayer must be residing in Iraq.

- Persons who enjoy exemption are supposed to be residing in Iraq and the conditions of exemption are applied and non-resident people leave for considerations represented that the latter does not bear anything from the obligations imposed by the tax legislator, and therefore does not have the right to benefit from the benefits prescribed for the resident person and because the exemption is an aid to the resident on the cost of life and compensation Because of the effort and risks incurred to obtain income, the taxpayer takes into account the resident, his civil status, his family burdens, and the minimum standard of living for his family (Amin, 1997: 120).

- That the individual is granted legal exemption once, regardless of the number of sources of his income for each estimated year, based on his status in the year of income stars (Ramadan, 2001: 471) (Table 1).

| Table 1 Tax Brackets Granted To Taxpayers |

||

|---|---|---|

| Slides | Amount From -To(In Iraqi Dinars) | percentage |

| The first slide | 1 up to 250,000 | 3% |

| Second slide | 250,000 to 500,000 | 5% |

| The third slide | 500,000 to 1,000,000 | 10% |

| Fourth slide | 1,000,000 or more | 15% |

| Table 2 Legal Exemptions |

|

|---|---|

| The Condition Of The Taxpayer | Annual Exemption |

| A single employee who is widowed, divorced, or married, whose wife's income is independently controlled | 2500000 dinars |

| The employee is married and his wife, a housewife or female employee married and her husband is unemployed or retired and has no income subject for z suspicion after that support it from a branch of the General Authority for taxes (and depending on the geographical area) at the request of the integration of inputs during the period of progress starting from the first day until the atheist thirty of the month as the Wen Olathe that the fiscal year of the same | 4500000 dinars |

| Employee married and her husband is unable to work and has no subject to income tax after that support it from a branch of the General Authority for taxes (and depending on the geographical area) on the progress the integration of inputs during the period of application starting from the first day until today atheist thirty of the month as the Wen Olathe to me From the same fiscal year and the deficit is supported by a specialized medical committee | 5000000 dinars |

| An independent widowed or divorced employee | 3200000 dinars |

| Allowing additional employee whose age exceeds 63 years | 300000 dinars |

| Allow the children of employees who are entitled to legal exemption,and for each child, regardless of their number | 200000 dinars |

The Practical Side

About the Direct Withholding Tax

The tax is imposed by the method of direct deduction on the affiliates, whether it is male or female, and the term affiliated has been defined by the legislator as follows: Everyone who works for a wage or with a salary for everyone who works in state departments, the public sector, the mixed sector, the private sector, where the following must be noted When performing the tax deduction process from the income of affiliates:

- The Affiliate (Male): the tax is imposed in his name and deductions from it are the deductions and exemptions for him, his wife and children, as described in the next chapter

- Affiliated (Female): If you are not married, then the tax is imposed on her income and the deductions and exemptions are deducted as it is costly by itself, but if you are married, it is imposed on her if her income is not combined with her husband's income, or the tax is imposed in the name of her husband with the combination of her income with her husband's income.

- The tax is imposed on the income of a resident associate who gets it in or outside Iraq, regardless of where it was received.

- The tax is imposed on the income of a non-resident affiliated in Iraq, and we do not impose on the income generated by him outside Iraq.

- The tax is imposed on the income of a child who has not reached the age of eighteen years as follows:

- If he was not married and lost his parents, he is considered an independent taxpayer by himself and the tax is assessed in the name of the guardian or trustee.

- If he is not married and his parents are still alive, his income is added to his father's income and the tax is assessed in the name of the father.

- If he is not married and his father is deceased and his mother is alive, he is considered an independent taxpayer by himself and the tax is assessed in the name of the mother, guardian or custodian.

- If he was married, he is treated as an independent taxpayer by himself and the tax is assessed in his name.

The Mechanism for Computing Income Tax on the Income of the Taxpayers According To Direct Deduction

To him, the income tax is calculated on the income of the taxpayers according to the instructions and laws issued, including the Income Tax Law No. (113) of 1982, as amended according to the following: -

- Total annual income of the taxpayer (salary * 12 months).

- (-) Including retirement exemptions amounting to 10% of the set of inputs.

- (-) Including the total legal exemptions stipulated in the Income Tax Law No. 113 of 1982 as amended and according to what was mentioned in Table No. (2)

- (=) Taxable income (which is the income on the basis of which the tax due will be calculated) Where the tax will be calculated based on the tax rates shown in Table No.(1)

The Research Sample

Researchers took a sample from the salaries of the faculty of human education for the purpose of measuring the extent of change in the tax exemptions granted to them under the Income Tax Law No. 113 of 1982 amending the amount of income tax and its impact on tax revenues.

We note from the analytical Table no. (3) due to the failure to approve the budget of Iraq for the year 2014 due to the circumstances it went through represented by the war against terrorist organizations, which tried to control some Iraqi provinces, and the government at that time was forced to search for other sources in order to finance the state’s general budget and maximize its resources In order to cover the expenses costed by this war and to continue managing the state’s utilities and from these sources that the state has worked to maximize are tax revenues. Therefore, the state resorted to reducing the tax exemptions granted to taxpayers in order to maximize its resources from one of its sovereign sources, which is direct deduction taxes, but there is no doubt that the exemptions Taxation has an impact on the taxpayer and the tax administration, as the exemptions affect the taxpayer partially, and the society as a whole through creating, developing and convincing the taxpayer to pay direct tax and reducing the process of evading it, as tax exemptions form a corner of the pillars of achieving tax justice (equality), relieving pressure on him and increasing his awareness And his duty to pay tax and his belief in tax justice.

| Table 3 Comparative Analysis of the Amounts of Tax Withheld From Employees for the Year 2014 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| No. | Employee Name | His total annual income | Reducing pension contributions | Social status | Allow marital status | Allow kids | Taxable income | annual tax amount | amount of the monthly tax |

| 1 | X1 | 11,616,000 | 1,161,600 | Her husband is married to worker (husband) | 2,500,000 | 0 | 7,954,400 | 1,113,100 | 92,763 |

| 2 | X2 | 12,096,000 | 1,209,600 | Married, the wife is a housewife | 4,500,000 | 0 | 6,386,400 | 877,960 | 73,163 |

| 3 | X3 | 9,708,000 | 970,800 | Married, the wife is a housewife | 4,500,000 | 200,000 | 4,037,200 | 525,580 | 43,798 |

| 4 | X4 | 10,116,000 | 1,011,600 | Married, the wife is a housewife | 4,500,000 | 400,000 | 4,204,400 | 550,660 | 45,888 |

| 5 | X5 | 6,348,000 | 634,800 | Married, the wife is a housewife | 4,500,000 | 400,000 | 813,200 | 51,320 | 4,267 |

| 6 | X6 | 10,320,000 | 1,032,000 | Married, the wife is a housewife | 4,500,000 | 800,000 | 3,988,000 | 518,200 | 41,318 |

| 7 | X7 | 6,588,000 | 658,800 | He is married and the wife is an employee | 2,500,000 | 0 | 3,429,200 | 434,380 | 36,198 |

| 8 | X8 | 3,840,000 | 384,000 | She is married and the husband is an employee | 2,500,000 | 0 | 956,000 | 54,300 | 4,525 |

| 9 | X9 | 13,056,000 | 1,305,600 | He is married and the wife is an employee | 2,500,000 | 400,000 | 8,850,400 | 1,247,560 | 103,963 |

| 10 | X10 | 13,536,000 | 1,353,600 | He is married and the wife is an employee | 2,500,000 | 600,000 | 9,082,400 | 1,282,360 | 106,863 |

| 11 | X11 | 6,468,000 | 646,800 | He is married and the wife is an employee | 2,500,000 | 600,000 | 2,721,200 | 328,180 | 27,348 |

| 12 | X12 | 6,708,000 | 670,800 | He is married and the wife is an employee | 2,500,000 | 800,000 | 2,737,200 | 330,580 | 27,548 |

| 13 | X13 | 5,820,000 | 582,000 | widow | 3,200,000 | 0 | 2,038,000 | 225,700 | 18,808 |

| 14 | X14 | 4,980,000 | 498,000 | Divorced | 3,200,000 | 0 | 1,282,000 | 112,300 | 9,358 |

| 15 | X15 | 11,136,000 | 1,113,600 | Unmarried | 2,500,000 | 0 | 7,522,400 | 1,048,360 | 87,363 |

As for the legal exemptions granted to the taxpayers for the year 2015, the state continued to reduce them as in the year 2014 due to the state’s need for revenues to cover its expenditures due to the continuing war against terrorist organizations, and this is what the taxpayer considered a burden on his shoulders and deducted part of his income, and his lack of satisfaction and tax justice, as a result Lack of tax awareness among the taxpayer, and not feeling the importance of his contribution to a part of his income in financing the public expenditures of the state, as he has a feeling that it is not logical to give a exemption for himself that does not exceed the average monthly cost or sufficient for the cost of baby milk for a month. (Table 4)

| Table 4 Comparative Analysis Of The Amounts Of Tax Withheld From Employees For The Year 2015 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| No. | Employee Name | His total annual income | Reducing pension contributions | Social status | Allow marital status | Allow kids | Taxable income | annual tax amount | amount of the monthly tax |

| 1 | X1 | 11,856,000 | 1,185,600 | Her husband is married to a worker(employee) | 2,500,000 | 0 | 8,170,400 | 1,145,560 | 95,463 |

| 2 | X2 | 13,296,000 | 1,329,600 | Married, the wife is a housewife | 4,500,000 | 0 | 7,466,400 | 1,093,960 | 91,163 |

| 3 | X3 | 9,912,000 | 991,200 | Married, the wife is a housewife | 4,500,000 | 200,000 | 4,220,800 | 553,120 | 46,093 |

| 4 | X4 | 10,320,000 | 1,032,000 | Married, the wife is a housewife | 4,500,000 | 400,000 | 4,388,000 | 578,200 | 48,183 |

| 5 | X5 | 6,468,000 | 646,800 | Married, the wife is a housewife | 4,500,000 | 400,000 | 921,200 | 62,120 | 5,177 |

| 6 | X6 | 10,524,000 | 1,052,400 | Married, the wife is a housewife | 4,500,000 | 800,000 | 4,171,600 | 545,740 | 45,478 |

| 7 | X7 | 6,708,000 | 670,800 | He is married and the wife is an employee | 2,500,000 | 0 | 3,537,200 | 450,580 | 37,548 |

| 8 | X8 | 4,344,000 | 434,400 | She is married and the husband is an employee | 2,500,000 | 0 | 1,409,600 | 131,440 | 10,953 |

| 9 | X9 | 13,296,000 | 1,329,600 | He is married and the wife is an employee | 2,500,000 | 400,000 | 9,066,400 | 1,279,960 | 106,663 |

| 10 | X10 | 13,776,000 | 1,377,600 | He is married and the wife is an employee | 2,500,000 | 600,000 | 9,298,400 | 1,314,760 | 109,563 |

| 11 | X11 | 6,588,000 | 658,800 | He is married and the wife is an employee | 2,500,000 | 600,000 | 2,829,200 | 344,380 | 28,698 |

| 12 | X12 | 6,828,000 | 682,800 | He is married and the wife is an employee | 2,500,000 | 800,000 | 2,845,200 | 346,780 | 28,898 |

| 13 | X13 | 5,904,000 | 590,400 | widow | 3,200,000 | 0 | 2,113,600 | 289,057 | 24,088 |

| 14 | X14 | 5,148,000 | 514,800 | Divorced | 3,200,000 | 0 | 1,433,200 | 134,980 | 11,248 |

| 15 | X15 | 11,376,000 | 1,137,600 | Unmarried | 2,500,000 | 0 | 7,738,400 | 1,080,760 | 90,063 |

Based on the foregoing, it is evident through Table No. (5) That the state has learned of increasing tax exemptions for taxpayers, which led to a reduction in the tax deduction that the taxpayer bears. This procedure creates a feeling for the taxpayer to achieve tax justice, but we will negatively affect the tax administration by affecting tax revenues in The long-term fact that when the state imposes taxes and determines the tax exemptions, we find that it is based on the political factor or based on a strategy that is far from tax policy, and is not based on economic feasibility criteria, and economic and financial policy programs.

| Table 5 Comparative Analysis Of The Amounts Of Tax Withheld From Employees For The Year 2016 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| No. | Employee Name | His total annual income | Reducing pension contributions | Social status | Allow marital status | Allow kids | Taxable income | annual tax amount | amount of the monthly tax |

| 1 | X1 | 12,096,000 | 1,209,600 | Her husband is married to a worker(employee) | 3,125,000 | 0 | 7,761,400 | 1,084,210 | 90,351 |

| 2 | X2 | 13,536,000 | 1,353,600 | Married, the wife is a housewife | 5,635,000 | 0 | 6,547,400 | 902,110 | 75,176 |

| 3 | X3 | 10,116,000 | 1,011,600 | Married, the wife is a housewife | 5,635,000 | 300,000 | 3,169,400 | 395,410 | 32,951 |

| 4 | X4 | 10,524,000 | 1,052,400 | Married, the wife is a housewife | 5,635,000 | 600,000 | 3,236,600 | 405,490 | 33,791 |

| 5 | X5 | 6,588,000 | 658,800 | Married, the wife is a housewife | 5,635,000 | 600,000 | -305,800 | 0 | 0 |

| 6 | X6 | 10,524,000 | 1,052,400 | Married, the wife is a housewife | 5,635,000 | 1,200,000 | 2,636,600 | 315,490 | 26,291 |

| 7 | X7 | 6,828,000 | 682,800 | He is married and the wife is an employee | 3,125,000 | 0 | 3,020,200 | 373,030 | 31,086 |

| 8 | X8 | 4,416,000 | 441,600 | She is married and the husband is an employee | 3,125,000 | 0 | 849,400 | 49,940 | 4,162 |

| 9 | X9 | 13,536,000 | 1,353,600 | He is married and the wife is \an employee | 3,125,000 | 600,000 | 8,457,400 | 1,188,610 | 99,051 |

| 10 | X10 | 14,016,000 | 1,401,600 | He is married and the wife is an employee | 3,125,000 | 900,000 | 8,589,400 | 1,208,410 | 100,701 |

| 11 | X11 | 6,708,000 | 670,800 | He is married and the wife is an employee | 3,125,000 | 900,000 | 2,012,200 | 221,830 | 18,486 |

| 12 | X12 | 6, 948,000 | 694,800 | He is married and the wife is an employee | 3,125,000 | 1,200,000 | 1,928,200 | 209,230 | 17,436 |

| 13 | X13 | 5, 988,000 | 598,800 | widow | 4,000,000 | 0 | 1,389,200 | 128,380 | 10,698 |

| 14 | X14 | 5, 232,000 | 523,200 | Divorced | 4,000,000 | 0 | 708,800 | 29,580 | 2,465 |

| 15 | X15 | 11,616,000 | 1,161,600 | Unmarried | 3,125,000 | 0 | 7,329,400 | 1,019,410 | 84,951 |

We note from Table (6) that the state worked to reduce tax exemptions after the approval of the 2017 budget, noting that it increased these exemptions in 2016 after the end of the war against terrorist organizations. High state expenditures and budget deficits, so the state resort to this measure, as the tax performs its economic function when it contributes to public revenues and the expansion of tax deduction.

| Table 6 Comparative Analysis of The Amounts of Tax Withheld From Employees For The Year 2017 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| No. | Employee Name | His total annual income | Reducing pension contributions | Social status | Allow marital status | Allow kids | Taxable income | annual tax amount | amount of the monthly tax |

| 1 | X1 | 12,336,000 | 1,233,600 | Her husband is married to a worker(employee) | 2,500,000 | 0 | 8,602,400 | 1,210,300 | 100,858 |

| 2 | X2 | 13,776,000 | 1,377,600 | Married, the wife is a housewife | 4,500,000 | 0 | 7,898,400 | 1,104,760 | 92,063 |

| 3 | X3 | 10,320,000 | 1,032,000 | Married, the wife is a housewife | 4,500,000 | 200,000 | 4,588,000 | 608,200 | 50,683 |

| 4 | X4 | 10,728,000 | 1,072,800 | Married, the wife is a housewife | 4,500,000 | 400,000 | 4,755,200 | 633,280 | 52,773 |

| 5 | X5 | 6,708,000 | 670,800 | Married, the wife is a housewife | 4,500,000 | 400,000 | 1,137,200 | 90,580 | 7,548 |

| 6 | X6 | 10,728,000 | 1,072,800 | Married, the wife is a housewife | 4,500,000 | 800,000 | 4,355,200 | 573,280 | 47,773 |

| 7 | X7 | 6,828,000 | 682,800 | He is married and the wife is an employee | 2,500,000 | 0 | 3,645,200 | 466,780 | 38,898 |

| 8 | X8 | 4,488,000 | 448,800 | She is married and the husband is an employee | 2,500,000 | 0 | 1,539,200 | 150,880 | 12,573 |

| 9 | X9 | 13,776,000 | 1,377,600 | He is married and the wife is \an employee | 2,500,000 | 400,000 | 9,498,400 | 1,344,760 | 112,063 |

| 10 | X10 | 14,256,000 | 1,425,600 | He is married and the wife is an employee | 2,500,000 | 600,000 | 9,730,400 | 1,379,560 | 114,963 |

| 11 | X11 | 6,828,000 | 682,800 | He is married and the wife is an employee | 2,500,000 | 600,000 | 3,045,200 | 376,780 | 31,398 |

| 12 | X12 | 7,068,000 | 706,800 | He is married and the wife is an employee | 2,500,000 | 800,000 | 3,061,200 | 379,180 | 31,598 |

| 13 | X13 | 6,108,000 | 610,800 | widow | 3,200,000 | 0 | 2,297,200 | 264,580 | 22,048 |

| 14 | X14 | 5,316,000 | 531,600 | Divorced | 3,200,000 | 0 | 1,584,400 | 157,660 | 13,138 |

| 15 | X15 | 11,856,000 | 1,185,600 | Unmarried | 2,500,000 | 0 | 8,170,400 | 1,145,560 | 95,463 |

From Table No. (7) it appears that the state has continued to reduce the tax exemptions granted to the taxpayer under the amended Income Tax No. Its specified time in a manner that helps it regularize tax revenue streams to finance the state's general budget.

| Table 7 Comparative Analysis of The Amounts of Tax Withheld From Employees For The Year 2018 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| No. | Employee Name | His total annual income | Reducing pension contributions | Social status | Allow marital status | Allow kids | Taxable income | annual tax amount | amount of the monthly tax |

| 1 | X1 | 12,576,000 | 1,257,600 | Her husband is married to a worker(employee) | 2,500,000 | 0 | 8,818,400 | 1,242,760 | 103,563 |

| 2 | X2 | 14,016,000 | 1,401,600 | Married, the wife is a housewife | 4,500,000 | 0 | 8,114,400 | 1,137,160 | 94,763 |

| 3 | X3 | 10,524,000 | 1,052,400 | Married, the wife is a housewife | 4,500,000 | 200,000 | 4,771,600 | 635,740 | 52,978 |

| 4 | X4 | 10,932,000 | 1,093,200 | Married, the wife is a housewife | 4,500,000 | 400,000 | 4,938,800 | 660,820 | 55,068 |

| 5 | X5 | 6,828,000 | 682,800 | Married, the wife is a housewife | 4,500,000 | 400,000 | 1,245,200 | 106,750 | 8,896 |

| 6 | X6 | 10,932,000 | 1,093,200 | Married, the wife is a housewife | 4,500,000 | 600,000 | 4,738,800 | 630,820 | 52,568 |

| 7 | X7 | 6,948,000 | 694,800 | He is married and the wife is an employee | 2,500,000 | 0 | 3,753,200 | 482,980 | 40,248 |

| 8 | X8 | 4,560,000 | 456,000 | She is married and the husband is an employee | 2,500,000 | 0 | 1,604,000 | 160,600 | 13,383 |

| 9 | X9 | 14,016,000 | 1,401,600 | He is married and the wife is \an employee | 2,500,000 | 400,000 | 9,714,400 | 1,377,160 | 114,763 |

| 10 | X10 | 14,496,000 | 1,449,600 | He is married and the wife is an employee | 2,500,000 | 600,000 | 9,946,400 | 1,411,810 | 117,651 |

| 11 | X11 | 6,948,000 | 694,800 | He is married and the wife is an employee | 2,500,000 | 600,000 | 3,153,200 | 392,980 | 32,748 |

| 12 | X12 | 7,188,000 | 718,800 | He is married and the wife is an employee | 2,500,000 | 800,000 | 3,169,200 | 392,380 | 32,698 |

| 13 | X13 | 6,228,000 | 622,800 | widow | 3,200,000 | 0 | 2,405,200 | 280,780 | 23,398 |

| 14 | X14 | 5,400,000 | 540,000 | Divorced | 3,200,000 | 0 | 1,660,000 | 169,000 | 14,083 |

| 15 | X15 | 11,856,000 | 1,209,600 | Unmarried | 2,500,000 | 0 | 8,386,400 | 1,177,960 | 98,163 |

Based on the foregoing, it is clear from the following table that the change in the legal exemptions granted to the taxpayer has been affected by tax revenues, and their reflection on the behavior of the taxpayer.

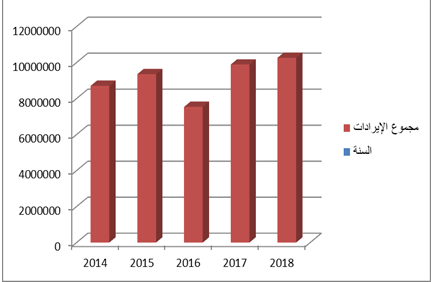

We note through Table No. (8) that the amount of tax levied on the affiliates of the research sample is a big difference in the amount of the tax paid for the years (2014, 2015, 2016, 2017 and 2018) and that this difference is the result of instability in granting the legal permits granted by the tax legislator to taxpayers, where we note In the year (2014 and 2015) an increase in the amount of the tax realized and this increase resulted from the change in the legal exemptions granted by the financial authority to the taxpayers, which led to an increase in the amount of the tax imposed on the income of the taxpayers according to the amount of their income and the burdens they bear, and this indicates that the state It tended to achieve the financial goal, which is to maximize its resources by increasing tax revenues by reducing the legal permits and increasing the burden on the taxpayer, forgetting that the tax has other objectives, which are the social goal that seeks to provide a minimum standard of living and reduce the burdens placed on the shoulders of the taxpayer in order to achieve luxury Social and realization of the principle of tax justice, and this will lead to the taxpayer's sense of unfairness of the tax legislator and his lack of conviction with the performance of direct tax And trying to evade part of the amount of tax imposed on his income by not providing incorrect information to the Payroll Division about his marital status, trying to increase the exemptions to reduce the taxable income, and this is considered tax evasion that leads to a reduction in tax revenues. (Figure 1)

| Table 8 Evolutionary Analysis Of Total Tax Revenue Withheld From Employee Salaries During The Period 2014-2018 |

||||||

|---|---|---|---|---|---|---|

| No. | Employee Name | 2014 | 2015 | 2016 | 2017 | 2018 |

| 1 | X1 | 1,113,100 | 1,145,560 | 1,084,210 | 1,210,300 | 1,242,760 |

| 2 | X2 | 877,960 | 1,093,960 | 902,110 | 1,104,760 | 1,137,160 |

| 3 | X3 | 525,580 | 553,120 | 395,410 | 608,200 | 635,740 |

| 4 | X4 | 550,660 | 578,200 | 405,490 | 633,280 | 660,820 |

| 5 | X5 | 51,320 | 62,120 | 0 | 90,580 | 106,750 |

| 6 | X6 | 518,200 | 545,740 | 315,490 | 573,280 | 630,820 |

| 7 | X7 | 434,380 | 450,580 | 373,030 | 466,780 | 482,980 |

| 8 | X8 | 54,300 | 131,440 | 49,940 | 150,880 | 160,600 |

| 9 | X9 | 1,247,560 | 1,279,960 | 1,188,610 | 1,344,760 | 1,377,160 |

| 10 | X10 | 1,282,360 | 1,314,760 | 1,208,410 | 1,379,560 | 1,411,810 |

| 11 | X11 | 328,180 | 344,380 | 221,830 | 376,780 | 392,980 |

| 12 | X12 | 330,580 | 346,780 | 209,230 | 379,180 | 392,380 |

| 13 | X13 | 225,700 | 289,057 | 128,380 | 264,580 | 280,780 |

| 14 | X14 | 112,300 | 134,980 | 29,580 | 157,660 | 169,000 |

| 15 | X15 | 1,048,360 | 1,080,760 | 1,019,410 | 1,145,560 | 1,177,960 |

| Total | 8,700,540 | 9,351,397 | 7,531,130 | 9,886,140 | 10,259,700 | |

Figure 1: Evolutionary Analysis of Total Tax Revenue Withheld from Employee Salaries During The Period 2014-2018

Source: Prepared by researchers based on employee salaries data during the period from 2014-2018

As for the year 2016, we see there is a decrease in the amount of tax achieved due to the tax legislator increasing the legal permits due to the improvement of the Iraqi economy and the high rates of oil prices, which must increase the amount of legal exemptions to keep pace with economic changes to provide the minimum standard of living and reduce the burdens placed on the taxpayer for the sake of Achieving social welfare, and this in turn leads to creating a sense of fairness for the taxpayer and creating, developing a feeling and a desire for the taxpayer to perform his duty to pay the tax and not trying to evade paying the tax in any form of tax evasion, which leads to regular tax flows and secure resources for the state to cover public expenditures.

As for the year (2017 and 2018), we also notice an increase in the amount of the tax realized and this increase is also a result of the legislator reducing the legal exemptions granted to the costs, which led to an increase in the amount of taxable income and thus an increase in the amount of tax realized and this indicates that the state has tended once again to achieve the goal Financial, which is maximizing its resources by increasing tax revenues, and increasing the burden placed on the taxpayer, and this will lead to his sense of the tax legislator’s unfairness and lack of conviction in the performance of direct tax and trying to evade part of the amount of tax imposed on his income.

Based on the foregoing, researchers see that instability in granting legal exemptions leads to the state’s focus and direction on achieving the financial goal in order to maximize its resources at the expense of the social goal, and this does not lead to achieving the principle of tax justice, and this is evident from the request for dissatisfaction with the taxpayer and his dissatisfaction to the extent Which may explain the imposition of tax to this extent towards the violation and inactivity and the orientation towards other areas such as evading from paying the tax due on his income as much as possible and this will affect the amount of tax revenues through the irregularity of tax cash flows.

Conclusion

That the exemptions are exemptions, but they are exemptions of a personal nature. These exemptions are granted pursuant to the principle of the personality of the tax, which takes into account personal circumstances and family considerations. This principle differs from the principle of a tax that does not take into account the personal and family burdens facing the taxpayer.

1. That the application of (personal) legal exemptions participates in embodying one of the pillars of the justice rule in a way that relieves psychological pressure on the taxpayer and increases his conviction, awareness and duty in paying the tax, which generates positive behavioral patterns that prevent him from attempting tax evasion and this leads to regular flows of tax revenues to finance State Treasury.

2. Tax revenues occupy an unimaginable place compared to other revenues that can be relied upon in financing the state's general budget and which enables it to implement its obligations in a manner that secures financial stability.

3. Failure to fully take into account personal and family burdens and grant exemptions to support the persons who depend on them other than the first wife of his wives, parents and those who provide for them.

4. Lack of coordination between the General Tax Authority and its branches and the rest of the state departments that deduct income tax by direct deduction on the mechanism for accurately calculating the tax from the taxpayers ’salary

Recommendations

1. The tax legislator has drawn up legislation and laws that determine the amount of exemptions granted to taxpayers that keep pace with changes in economic and social conditions that take into account achieving tax justice.

2. The necessity to take into account the personal and family burdens such as marriage and children. It is possible, as in some countries, to exempt an amount from entry to support other than the wife and children, such as parents.

3. Using the reports of the Central Bureau of Statistics in determining and estimating personal exemptions or exemptions because they are the documented evidence of the general level of prices and thus determine the level or minimum of the individual’s living.

4. The necessity for the General Tax Authority and its branches to coordinate with the rest of the state’s departments and to conduct visits and training courses from time to time for accountants who are responsible for calculating income tax. The mechanism for calculating the tax should be set in an accurate manner.

References

- A set of income tax laws (Income Tax Law No. 113 of 1982 as amended).

- Amin, M.A. (1997). “Income Tax in the Iraqi Tax Legislation,” (First Section). Baghdad.

- Al-Badrani, Q.H.A. (2002). Legal center for taxpayer in income Tax. PhD thesis, University of Mosul, 185.

- Adel-Fuleih, A.-A. (2002). “Public finance and financial legislation.” University House for Printing, Publishing and Translation, Al-Mouss.

- Al-Rahimi, S.K. (2017). “The legal regulation of the rights of the taxpayer towards the tax administration”. Journal of Al-Hali Law for Legal and Political Sciences, 2.

- Ramadan, I.K. (2002). “Tax Accounting,” (First Edition). Dar Al Kutub, Baghdad.

- Kamal A., Amin, & Al-Din A.S. (2018). The effect of personal and family exemptions on income tax performance in Iraq. Legal and Political Studies, 12.

- Kadawi, T.M. (2008). “Financial Legislation and Tax Accounting.” Dunya Computer Office, Mosul.

- Shaheen, M.H. (2013). “Discounts in the income tax law,” (First Edition). Zain Human Rights Publications, Lebanon.

- Bessho, S.I., & Hayashi, M. (2014). Intensive margins, extensive margins, and spousal exemptions in the Japanese system of personal income taxes: A discrete choice analysis. Journal of the Japanese and International Economies, 34, 162-178.