Research Article: 2023 Vol: 22 Issue: 1

Liquidity Risks and Working Capital Management: Empirical Study of Selected Consumer Goods Companies

Aguzue Sandra Adaeze, Covenant University

Ikpefan Ochei Ailemen, Covenant University

Ezeh Ugochi Lucy, Covenant University

Awogbenja Bukola Bolanle, Covenant University

Citation Information: Adaeze, A.S., Ailemen, I.O., Lucy, E.U., & Bolanle, A.B. (2023). Liquidity risks and working capital management: empirical study of selected consumer goods companies. Academy of Strategic Management Journal, 22(S1), 1-11.

Abstract

The research explained the impact of management of liquidity risk on the management of working capital of selected consumer goods organizations. Return on capital employed, equity returns, and asset returns were studied to see how they impact working capital which was measured by net working capital. Secondary data received from the five consumer goods companies’ financial statements were analyzed using the panel data regression. Both fixed and random effects regressions were conducted, however, Hausman test pointed to the fixed effect regression as significant, hence it was focused on. Findings from the fixed effect revealed that equity returns, asset returns, and return on capital employed were all negatively significance in impacting net working capital of the five selected companies. The study therefore recommended that the consumer companies’ boards of directors should put in place policy like corporate governance that would help manage the company’s liquidity in order to boost net working capital.

Keywords

Consumer Goods Companies, Return on Equity, Panel data regression, Fixed Effect, Hausman Test, Return on Capital Employed.

Introduction

Liquidity is the ease to convert a current asset into ready liquid fund without impacting the company’s market value. The effect of liquidity position in management of companies, especially the consumer goods company, has remained a debatable one. Embaye et al. (2017) explained liquidity to be the length to which an asset could be turned to cash whenever the need arises. A company that is liquid has enough cash and liquid assets, plus has the capability to get funds swiftly from various ways to clear its financial commitments before expiration.

Therefore, liquidity risk happens whenever the company is unable to clear its short-term obligations. The company also cannot easily convert its current assets into liquid funds without losing capital cause of efficient market and competent buyers.

Consumer goods companies are vital to the growth of the economy by expanding the economy through its activities. It also improves Nigerian consumers’ standard of living of consumers by establishing value chain. They also invest in various fixed and current assets in order to maintain their liquidity.

Good financial performance promotes high shareholders’ wealth maximization. Many consumer goods companies have faced many risks in the volatile business environment like liquidity and market risks along with other risks that may threaten the company’s survival and growth (Muriithi & Waweru, 2017).Despite the various acts and laws directed at protecting both the consumer goods companies and the consumers, the occurrence of illiquidity and failure has been on the rise in Nigeria.

However, a company’s profit may be negatively impacted by liquidity risk that arises whenever the company cannot meet its current liabilities (Nwanna & Ivie, 2017). This could be as a result of bad liquidity management and unfavorable economic circumstances. Liquidity problems could also arise as a result of the mismatch and mismanagement of current assets and current liabilities and would result drastic liquidity crisis (Nwanna & Ivie, 2017).

Hussan (2016) stated that companies focus more on profitability rather than on its liquidity. Therefore, company CEOs place more emphasis on profit-making. Brealey et al. (2012) explained that to measure profitability, the profitability ratios considered are asset returns (ROA) and equity returns (ROE), while liquidity is appraised through current ratio and acid ratio which help to know whether a company would clear its short-run obligations. Hence, low level of liquidity would make a firm struggle to clear its obligations, and would be forced to borrow should the need arise.

For example, the financial statement of Nestle PLC showed that the company had a current ratio of 1.68 and return on capital employed of 55.05 in December 2020. However, it had a current ratio of 1.74 in December 2019 and a return on capital employed figure of 56.25% in the same year (Money Control, 2020). Thus, December 2019 for Nestle PLC showed that it had both a high current ratio (liquidity ratio) and a high return on capital employed (profitability ratio) than in December 2020. This showed the relevance of liquidity in performance management of consumer goods firm.

Therefore, the paper seeks to determine the degree of impact management of liquidity risk would have on performance of consumer goods firms in Nigeria and how such risk could be effectively managed to boost their performances. The above is section one of the study. Section two dwells on literature review, theoretical review and empirical review while section three explains the methodology. Section four captures the data presentation and interpretation and Section five completes the study with summary of findings, conclusion and recommendation

Literature Review

Liquidity Concept

The capacity to resolve commitments immediately is liquidity. For both financial and non-financial companies, liquidity management is crucial (Ashworth, 2020). It is the duty of organizations to pay the financial obligations whether long-term or short-term and other financial costs as at maturity. Liquidity is a way for such organization to turn their current assets into cash to allow for settlement of the obligations (Ashworth, 2020). Liquidity is a way for organizations to convert their current assets into cash. Dabo et al. (2018) assumed that organizations turn their current assets into the form of cash to pay the due obligations as it is their duty. Companies with fewer current assets will face challenges in carrying out their procedures, and if the sum of current assets is too high, it indicates that the company’s return on investment is not in a negative condition.

Liquidity Management Strategies

These are methods or measures used by organizations to mitigate risks’ adverse effects (Olaoye, Akintola, & Ogundipe, 2019). The key strategies are:

Credit Derivatives

This involves risk-transfer to a default to a third party and it provides the company with a method that does not necessitate the adjustment of their credit list. It offers another earning source to the company and an opportunity to lessen their regulatory capital (Olaoye, Akintola, & Ogundipe, 2019). Technological advancements in credit derivatives market has enhanced the ability and ease to which companies can transfer credit risk to third parties while sustaining its relationship with its customers (Olaoye, Akintola, &Ogundipe, 2019).

Policy Strategy

Companies strive to have an updated liquidity policy manual in order to keep up with the ever-changing business environment. These policy manuals establish the rules and regulation that guides the essential aspects of the work executed within their liquidity department (Olaoye, Akintola, & Ogundipe, 2019). The purpose of the policy manual is to provide recognition and understanding of vital challenges and solutions to the challenges.

Diversification

Organizations attempt to spread their liquidity by dealing with different customers and borrowers such as businesses, individuals and other industries this helps in reducing the effect of loss. It is more suitable for large and international organizations like banks. Banks may also partake in syndicating loans thereby spreading risk among other banks and reducing the effect of default.

Compliance to the Basel Accord

The Basel Committee on Banking Supervision which was established in Switzerland in 1988 provides international philosophies and regulations that guide the operations of banks in order to ensure stability and soundness (Olaoye, Akintola, & Ogundipe, 2019). With the Basel Accord, the bank would have the ability to detect, create, trace, and make regular reports about risk-related matters in a unified manner with accuracy and transparency. It would provide the opportunity of improving banks liquidity and credit risk management process.

Working Capital Concept

Working capital being current assets minus current liabilities is the generator of short-term capital and working capital investment is one of the easiest ways to enhance shareholders value. Although working capital investment requires sound judgment from managers, however Akinleye & Roseline (2019) opine that working capital investment is not an only decision to be taken, but the financing strategies of working capital affect its performance.

Funding working capital is very essential and any bank that cannot fund it continuously may not be able to take advantage of attractive growth opportunities. According to Temtime (2016), investment and funding current asset and current liabilities decision is referred to as a working capital policy (WCP), polices related to current assets are called investment policies and those related to current liabilities are financing polices of working capital. This implies that, managers must formulate and implement an appropriate WCP on how much investment is to be made in its working capital, and how the working capital will be financed for profit maximization.

Theoretical Framework

Anticipated income theory

H.V. Prochnow developed the anticipated income theory (Sidhu, 2018). The theory explained that the bank should plan the liquidation of the term loan from the anticipated income of the borrower despite knowing the character and the nature of the borrowers’ business. Sales of assets by the borrower is not liquidation, or by passing the term loan to some other lenders as in shift ability theory of liquidity but by anticipating income of the borrower. In reality, this theory presumes that banks should create loans in accordance of the anticipated income of the borrower and not his current value. Sidhu (2018) explained that one noticeable feature of this theory is its “future oriented approach” to bank advances and loans.

The theory fulfills the three objectives of liquidity, profitability and safety, which makes it highly ranked than the real bill doctrine and shift ability theory. It also source funds for medium term. The anticipated income theory does not question the shiftability view that a banks important source of liquidity is its secondary reserves. Instead, once more concentrated observation on the types of loans suitable for a bank to make but came to quite a distinct deduction than that reached by the supporters of the commercial loan theory (Sidhu, 2018).

The theory proved that by examining the liquidity position of the firm, one can calculate its anticipated income. This is because a firm with high liquidity could invest in other areas thus giving the company many areas of increased earning and thus increasing its anticipated income position. This is one of the reasons the theory was utilized for the study as the theory showed a direct linkage between liquidity and performance.

Empirical Review

Ogilo et al. (2018) analyzed the effect of liquid risk management on bank profits. Findings revealed no evidence of long-run impact between liquidity risk and bad debt provision. Mulyana & Zuraida (2018) inquired into the impact liquidity risk has had on value of 150 quoted Indonesian manufacturing companies from 2011 to 2015. The result showed that both variables had impact on the value of all listed firms. Sidhu (2018) examined the impactof liquidity risk on capital market liquidity of 187 Indian companies from 2009 till 2013 utilizing multiple regression and findings showed negative effect among the variables. The study then concluded that low debt level was likely to lead to increase stock market liquidity. Moghadam & Jafari (2017) examined the effect liquidity ratios has had on equity returns of 14 banks quoted in the Tehran Stock Exchange and from 2010 to 2015 using multivariate linear regression. Finding showed that liquidity ratios were positively significant in impacting the banks’ equity returns.

Nabeel & Hussain (2017) examined impact of liquidity risk variables on 10 Pakistan banks from 2006 to 2015. Utilizing the regression methods, the study found that capital adequacy ratio and acid ratio have positive impact while cash and current ratios have negative effect on the banks’ ROE.

Edem (2017) studied effect of liquidity ratio on equity returns of 24 Nigerian deposit money banks from 1986 till 2011, using OL Seconometric technique. The result found a significant effect between liquidity ratio and equity returns of the Nigerian banks. Adenugba et al. (2016) examined impact between financial leverage and companies’ market value of 5 listed Nigerian companies from 2007 till 2012, using the OLS technique. The result found a significant impact between financial leverage and companies’ value.

Acheampong et al. (2014) studied the impact of financial leverage on stock returns of 5listed Ghanaian manufacturing companies from 2006 till 2010 utilizing OLS method, and found negative and significant impact in both variables. Ibe (2013) examined the impact of liquidity risk management on profitability of 3 selected Nigerian banks from 1995 till 2010. The study utilized OLS method and findings showed a significant impact in both variables. Lartey et al. (2013) studied impact between liquidity risk management and ROA of 7 Ghanaian quoted banks from 2003 till 2010. Results revealed a positive effect between liquidity and profitability of the banks.

Gap in Literature

Unlike previous studies, this study made use of working capital management as its dependent variable as against the reviewed literature that measured performance as their dependent variables. The dependent variables measured by the reviewed literature included profitability, return on asset, equity returned while this study would utilize net working capital as its dependent variable. Also, the study used panel secondary data which would be analyzed using the panel data analysis as against the reviewed literature which made use of other techniques like OLS, and so on.

Methodology

Methods

The study made use of the quantitative research design which involves the use of gathering of data and subjecting such gathered data into econometric analysis. This brought the use of secondary data of 5 selected service companies for the study. The companies were picked using the simple random sampling and they included Guinness Nig, Plc, Dangote Sugar Plc, Flour Mills Plc, Honeywell Plc, and Cadbury Nigeria Plc. The panel unit root test was conducted to test data for stationarity while panel data regression was utilized to analyze the data using Eviews nine econometric software. The panel data regression was selected due to the panel nature of the data which contained cross-sectional and time-series attributes.

Model Specification

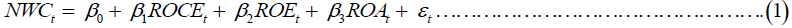

The adopted model utilized for this paper was from the work of Moghaddam & Abbaspour (2017) and modified:

Where:

ROEt = Equity Return at time period t ROAt = Asset Return at time period t ROCEt = Return on Capital Employed at time period t NWCt = Net Working Capital at time period t β0 = Constant β1- β3 = Coefficients to estimate the independent variables εt = Error term at time period t

Data on the selected variables over the period 2012-2020 for each of the 5 selected manufacturing companies. ROCE and NWC were logged due to first, the dataset were not in rates, and second, to make the data set balance across the variables (Wooldridge, 2015).

A Priori Expectation

All the parameter estimates (β1, β2,β3) of the two models were expected to be positive. The implication of this is that a direct relationship was expected among all the independent variables with the dependent variables.

Description of Variables

ROE: It showed how efficient the banks’ management was in using the banks’ equity funds. ROA: This showed how managers effectively utilize the asset of the company and make profit from them. ROCE: This represents the total profit or returns before tax of the company. NWC: This revealed the total current assets of the company after current liabilities have been deducted.

Data Analysis

Panel unit root test

This test was conducted to investigate the data stationarity. The stationarity of the data means that the data has properties of mean, variance and autocorrelation structure that do not change over a period of time (Wooldridge, 2015). Also, Wooldridge (2015) explained that panel unit root test should be carried out on panel data which involves time-series and cross-sectional data. The null and alternate hypothesis for the panel unit root test was stated as follows:

H0: Unit root was present in the data.

H1: Unit root was absent in the data.

The probability value (p-value) of the Levin, Lin & Chu t-statistics was investigated to know the stationarity at either levels or first difference. When the probability values are less than 0.05 or significant at 5 per cent level of significance, then the null hypothesis would be accepted and it would be agreed that there is the presence of a unit root and the data is stationary. Yet, if the probability values are more than 0.05 or insignificant at 5 per cent level of significance, then the null hypothesis would be rejected and the alternate hypothesis accepted. The panel unit root result in Table 1 revealed that all the variables were stationary at levels and therefore integrated to the order of 0 as the their probability values were stationary at 5 per cent level of significance.

Fixed-Effect Regression

It displayed the significant effect that would exist between the dependent variable (log of net working capital) (LNWC) and all the independent variables which were log of return on capital employed (LROCE), equity returns (ROE), and asset returns (ROA) using the panel unit root result. The result is shown in Table 1.

| Table 1 Panel Unit Root Test |

||||

|---|---|---|---|---|

| Variable | Levin, Lin & Chu t* statistics | Levin, Lin & Chu t* statistics (probability value) | Stationarity | Remark |

| ROE | -3.50259 | 0.0002 | Stationary at levels | I(0) |

| ROA | -4.51627 | 0.0000 | Stationary at levels | I(0) |

| LNWC | -62.9172 | 0.0000 | Stationary at levels | I(0) |

| LROCE | -2.40017 | 0.0082 | Stationary at levels | I(0) |

Source: Author’s Computation using Eviews 9

From Table 2, there was found a negative relationship between log of net working capital (LNWC) and all three independent variables equity returns (ROE), log of return on capital employed (LROCE), and asset returns (ROA) based on the signs of the coefficients and t-statistics. This means that an increase in the independent variable would lead to a decrease in the dependent variable.Also, the regression result revealed the significance of each independent variable in impacting the dependent variableand must be significant at 5%level of significancefor the independent variable to be significant in impacting the dependent variable.The probability value of LROCE, ROE, and ROA were all significant at 5 per cent level of significance with probability values of 0.0155, 0.0351, and 0.0108 respectively.

| Table 2 Fixed-Effect Regression |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 103.5018 | 10.15663 | 10.19056 | 0.0000 |

| LROCE | -0.341472 | 0.253989 | -1.344439 | 0.0155 |

| ROA | -2.205268 | 10.43969 | -0.211239 | 0.0351 |

| ROE | -4.211808 | 5.001299 | -0.842143 | 0.0108 |

| R2 = 0.92 | Adjusted R2 = 0.89 | Durbin-Watson Test = 1.75 | ||

This showed that the three independent variables all negatively and significantly have an effect on the dependent variable log of gross working capital (LGWC) based on the fixed effect panel regression.

The coefficient of determination (R-squared) of the model had a value of 0.92 meaning that all the independent variables explained about 92% of the variations in the dependent variable (LGWC). After adjusting for degree of freedom, the adjusted R-squared was 0.89 (89%).The durbin-watson test revealed whether there was autocorrelation in the model. The value of the durbin-watson variable must be estimated at 2 to ensure that there is no autocorrelation in the model. The durbin-watson value of 1.72 was approximately 2 to show that there was no autocorrelation in the model.

Random-effect Regression

The random-effect regression output in Table 3 revealed the significance of each independent variable in the model. The coefficient sign language showed that ROAhad a positive impact on NWC while LROCE and ROA had negative impacts on LNWC. Using the significance level of 5 per cent, the probability value of logs of asset returns (ROA) was only significant in impacting the dependent variable LNWC with probability value of 0.0421. This means that both log of return on capital employed (LROCE) and equity returns (ROE) were insignificant at 5 per cent significant level with probability values of 0.5512 and 0.3940 respectively.

| Table 3 Random-Effect Regression |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 14.39207 | 1.909691 | 7.536331 | 0.0000 |

| LROCE | -0.331135 | 0.547161 | -0.605189 | 0.5512 |

| ROA | 32.20191 | 17.67499 | 1.821892 | 0.0421 |

| ROE | -7.957301 | 9.152077 | -0.869453 | 0.3940 |

| R2 = 0.59 | Adjusted R2 = 0.48 | Durbin-Watson Test = 1.93 | ||

The coefficient of determination (R-squared) of the model under consideration which measures the goodness of fit of the model had a value of 0.59. This showed that all the independent variables explain about 59% of the variations in the dependent variable (bank performance). After adjusting for degree of freedom, the adjusted R-squared was 0.48 (48%).

Finally, the durbin-watson test was 1.93 to show that there was no autocorrelation in the model.

Post-Estimation Tests

Hausman test

This test was utilized to determine the model to select between the fixed effect regression and the random effect regression result. The null and alternate hypothesis used to test the Hausman test is:

H0: Random Effect (Probability greater than 0.05)

H1: Fixed Effect (Probability less than 0.05)

From Table 4, the Chi-Square Statistic probability value of 0.0002 was significant at 5 per cent level of significance. The significant result showed that the null hypothesis would be rejected and this means that the fixed-effect model was also appropriate for this study.

| Table 4 Hausman Test Result To Determine The Best Regression Output To Use |

|||

|---|---|---|---|

| Test Summary | Chi-Sq. Statistic | Chi-Sq. d.f. | Prob. |

| Cross-section random | 19.483574 | 4 | 0.0002 |

Breush Pagan LM Autocorrelation Test

This was utilized to test for autocorrelation in the panel data and also confirm the durbin-watson test. The null hypothesis showed no presence of autocorrelation and vice versa.

H0: There is no presence of autocorrelation in the model

H1: There is the presence of autocorrelation in the model

From the result in Table 5, the probability value of 0.3364 was not significant at 5% level of significance to show that there was no autocorrelation in the model.

| Table 5 Breush Pagan Lm Autocorrelation Test Result |

|||

|---|---|---|---|

| Test | Statistic | d.f. | Prob. |

| Breusch-Pagan LM | 17.26843 | 10 | 0.3364 |

Discussion of Findings

The panel unit root result revealed that all the variables are stationary at levels and means that the data was subjected to the fixed effect and the random effect panel regression. The Hausman test suggested the adoption of the fixed effects only.

The fixed effect regression result with net working capital as the dependent variable, all the three independent variables were negatively significant in effecting the dependent variable. Therefore, the null forms of the three hypotheses were rejected based on the significant relationship. Equity returns (ROE) was negatively significant to also confirm the importance of equity returns with respect to liquidity of the consumer firms. However, the negative sign showed that as equity returns becomes low, liquidity risk goes up and vice versa. Hence, firms should try as much as possible to reduce and mitigate their liquidity risks so as to improve and increase equity returns and boost performances.

Asset returns (ROA) was negatively significant in impacting the dependent variable. This proved that despite the fact that ROA was vital in impacting liquidity, the returns are shifted to other areas for example fixed assets, technological innovation. Thus, firms should try as much as possible to increase their asset returns as this would continuously improve performances overtime.

Return on capital employed (ROCE) was significant negatively in impacting liquidity risk as funds may be shifted also to other area of needs of the companies while a low ratio was apportioned to satisfy the liquidity needs of such company. Hence, firms should also focus on their liquidity needs so as to boost their performances.

Conclusion

The study examined how performance of five (5) selected consumer goods companies could be improved through the management of liquidity risk. The issue of how Consumer Goods Company could maximize their performances through liquidity risk management was investigated as the issue of performance has been an age-long challenge to the consumer goods companies. Liquidity risk management factors like return on capital employed, equity returns, and asset returns were examined against performance factors of gross working capital and net working capital. A model was adopted and modified and the fixed and random effect panel regression was conducted. The fixed effect was selected based on the Hausman test result for the two models and based on the result; all the independent variables return on capital employed, equity returns, and asset returns were significant in impacting the two performance representatives. This means that to maximize performance, the consumer goods companies must pay attention to their return on capital employed, equity returns, and asset returns as the three variables help reduce liquidity risks and boost performances.

Recommendations

1. The consumer companies’ boards of directors should make policies that would help manage the company’s liquidity in order to boost profit after tax. Policies like those on corporate governance could be made to block liquidity leakages from the companies.

2. The consumer goods’ companies should focus more on building their current assets so as to avoid any liquidity shortage.

3. A liquidity risk management department should be established in every consumer good company to monitor and reduce the risk management of such companies.

4. The consumer goods companies should create risk monitors that would display the liquidity risk level of the company so as to have good risk controls.

5. The government should create enabling environment for the consumer goods companies to have access to finance at moderate cost from financial institutions so as to improve their liquidity and hence boost their profit.

References

Acheampong, P., Agalega, E., & Shibu, A.K. (2014). The effect of financial leverage and market size on stock returns on the Ghana Stock Exchange: evidence from selected stocks in the manufacturing sector.International Journal of Financial Research,5(1), 125.

Adenugba, A.A., Ige, A.A., & Kesinro, O.R. (2016). Financial leverage and firms’ value: A study of selected firms in Nigeria.European Journal of Research and Reflection in Management Sciences,4(1), 14- 32.

Akinleye, G.T., & Roseline, A.D.E.B.O.B.O.Y.E. (2019). Assessing working capital management and performance of listed manufacturing firms: Nigeria evidence.Information Management and Business Review,11(2 (I)), 27-34.

Indexed at, Google Scholar, Cross Ref

Ashworth, M. (2020). Importance of working capital management.

Brealey, R.A., Myers, S.C., Allen, F., & Mohanty, P. (2012).Principles of corporate finance. Tata McGraw-Hill Education.

Dabo, Z., Andow, H. A., & Shekari, T N. (2018). Impact of working capital management on financial performance of listed manufacturing firms in Nigeria.International Journal of New Technology and Research,4(3), 263121.

Indexed at, Google Scholar, Cross Ref

Edem, D.B. (2017). Liquidity management and performance of deposit money banks in Nigeria (1986–2011): An investigation.International Journal of Economics, Finance and Management Sciences,5(3), 146-161.

Embaye, S.S., Fatime, C., & Abderaman, Z.T. (2017). The impact of credit risk management on financial performance of commercial banks-Evidence from Eritrea.Research Journal of Finance and Accounting,8(19), 70-76.

Ogilo, F., Omwoyo, J., & Zipporah, O. (2018). The relationship between liquidity risk and failure of commercial banks in Kenya. Universal Journal of Accounting and Finance, 6(1), 7-13

Hussan, J. (2016). Impact of leverage on risk of the companies.Journal of Civil & Legal Sciences,5(4), 2169-0170.

Ibe, S.O. (2013). The impact of liquidity management on the profitability of banks in Nigeria.Journal of Finance and Bank Management,1(1), 37-48.

Lartey, V.C., Antwi, S., & Boadi, E.K. (2013). The relationship between liquidity and profitability of listed banks in Ghana.International Journal of Business and Social Science,4(3).

Moghadam, D.M. & Jafari, M. (2015). The role of financial leverage in the performance of companies listed in the stock exchange. Indian Journal of Natural Sciences,5(30), 7402-7657.

Moghaddam, A., & Abbaspour, N. (2017). The effect of leverage and liquidity ratios on earnings management and capital of banks listed on the Tehran Stock Exchange.International Review of Management and Marketing,7(4), 99.

Money Control (2020). Financial Report of Nestle PLC 2020.

Mulyana, A., & Zuraida, M.S. (2018). The influence of liquidity, profitability and leverage on profit management and its impact on company value in manufacturing company listed on Indonesia Stock Exchange.International Journal of Managerial Studies and Research,6(1), 8-14.

Muriithi, J.G., & Waweru, K.M. (2017). Liquidity risk and financial performance of commercial banks in Kenya. International Journal of Economics and Finance, 9(3), 256-265

Nabeel, M., & Hussain, S.M. (2017). Liquidity management and its impact on banks profitability: A perspective of Pakistan.International Journal of Business and Management Invention,6(5), 28-33.

Nwanna, I.O., & Ivie, G. (2017). Effect of financial leverage on firm’s performance: A study of Nigerian banks (2006-2015).International Journal of Recent Scientific Research,8(7), 18554-18564.

Sidhu, M.K. (2018). Impact of leverage of a company on stock market liquidity in Indian markets.IOSR Journal of Business and Management,20(1), 1-8.

Temtime, Z.T. (2016).Relationship between working capital management, policies, and profitability of small manufacturing firms. Unpublished doctoral dissertation, Walden University.

Wooldridge, J.M. (2015).Introductory econometrics: A modern approach. Cengage learning.

Received: 08-Feb-2022, Manuscript No. ASMJ-22-11180; Editor assigned: 11-Feb-2022, PreQC No. ASMJ-22-11180(PQ); Reviewed: 04-Mar-2022, QC No. ASMJ-22-11180; Revised: 01-Oct-2022, Manuscript No. ASMJ-22-11180 (R); Published: 08-Oct-2022