Research Article: 2021 Vol: 20 Issue: 6

Management of Social Partnership of Oil Industry Companies and Their Influence on Socio-Economic Development

Alisher Sansyzbayev, Narxoz University

Zhanna Kenzhalina, Narxoz University

Citation Information: Sansyzbayev, A., & Kenzhalina, Z. (2021). Management of social partnership of oil industry companies and their influence on socio-economic development. Academy of Strategic Management Journal, 20(6), 1-8.

Abstract

The article examines the influence of social partnership on the development of enterprises in the oil industry of the Republic of Kazakhstan, as a socio-political institution that ensures the interaction of the state, business, trade unions in modern society. The analysis of the interaction of subjects of social partnership is carried out; the institutional capabilities of oil industry enterprises as subjects of social partnership, the significance and influence of social partnership policy on the processes of democratization, social and political stability of Kazakhstan society are analyzed. This is reflected in the organization of social partnership. The accumulated potential of theoretical knowledge and practical experience on the problem under study is of great importance for the development of methods and mechanisms of interaction between the state and business, especially in the oil industry of Kazakhstan. The purpose of the study is to substantiate the directions for the development of social partnership as a socio-economic interaction between the state, business and non-profit organizations based on the materials of the oil industry. Authors had been analyzed the largest companies in the oil industry, it was revealed that all companies in the conditions of fierce competition and a rapidly changing situation should not only focus on the internal state of affairs, but also develop a long-term strategy that would allow them to keep pace with the changes taking place in their environment and to promote the further development of social partnership.

Keywords

Management, Oil Industry, Social Partnership, Trade Union, System, Governance.

Introduction

Social partnership is a specific idea and concept of the interaction of classes in a capitalist market economy, which arose within the framework of the social democratic and reformist tendencies of the labor movement.

Social partnership has a significant impact on the development of enterprises, including oil industry enterprises in the Republic of Kazakhstan. Studying the impact of social partnership on the oil industry, it should be noted that the oil and gas industry plays an important role in the economy of Kazakhstan and is one of the main factors in the country's GDP growth. This suggests that the country's economy is highly dependent on the income from this industry.

The role of the oil and gas production industry in Kazakhstan to this day remains undeniably significant and high. At the same time, it is necessary to have an empirical assessment of how dynamically changes in the output of the oil and gas industry can have a so-called “shock” effect on the main macroeconomic indicators of Kazakhstan. In particular, it is important to know how a change in trend in oil and gas production can affect economic growth and inflationary processes.

Literature Review

The literature presents a wide range of studies in the field of PPP and its role in the development of an innovative economy: concept, theory Ablaev & Akhmetshina (2016), methodology Javed et al. (2014), models of interaction between government and business structures in the framework of PPP Cruz & Marques (2014), approaches to assessing its effectiveness Berezin et al. (2018); Cong & Ma (2018), a comparative analysis of international experience in implementing PPP projects is considered in the scientific works of Akintoye et al. (2016); Roumboutsos (2015); Ullah et al. (2016).

Filatova et al. (2021) believe that the issue of implementation of public-private partnership (PPP) as a key tool allows using the available resources of the state and business to achieve sustainable development and investment attractiveness.

According to many scientists such as Masson-Delmotte et al. (2018) the refining industry is the backbone of the livelihoods of people and industries around the world. One of the global challenges for the sustainable development of the oil refining industry was the Paris Agreement within the framework of the UN Framework Convention on Climate Change in 2015, which, as a result, became a tendency to oust fossil energy sources from the fuel and energy balance of many countries.

Litvinenko (2020) argues that currently hydrocarbon raw materials are becoming less attractive due to the growing greening of the world community.

According to Stroykov et al. (2020) inter-fuel competition with alternative energy sources leads to tougher requirements for refined products and sets the main pace and direction for the development of the oil refining industry, for example, the petrochemical industry is seen as a source of new, environmentally friendly solutions for the oil refining industry.

Litvinenko & Sergeev (2019) in their studies focus on modernization by introducing high-tech equipment, which, in turn, requires significant investments in the oil refining industry.

As oil and gas companies respond to the current economic difficulties, they must choose where and how to compete. According to an analysis by the Wall Street Journal, in the first three quarters of 2020 alone, oil and gas companies in North America and Europe with the most assets amounted to 145 billion dollars, which is approximately equivalent to 10% of their market value. Climate Action 100, an investor initiative to ensure that large companies take the necessary action on climate issues, has more than 500 signatories, which together add up to more than 50 trillion dollars in assets under management.

Methodology and Analysis

In terms of proven oil reserves, Kazakhstan is among the 15 leading countries in the world, possessing 3% of the world's oil reserves. Oil and gas regions occupy 62% of the country's area, and have 172 oil fields, of which more than 80 are in development. More than 90% of oil reserves are concentrated in 15 largest fields - Tengiz, Kashagan, Karachaganak, Uzen, Zhetybai, Zhanazhol, Kalamkas, Kenkiyak, Karazhanbas, Kumkol, Northern Buzachi, Alibekmola, Central and Vostochnaya Prorva, Kenbai, Korolevskoe.

The deposits are located on the territory of six out of fourteen regions of Kazakhstan. These are Aktobe, Atyrau, West Kazakhstan, Karaganda, Kyzylorda and Mangistau regions. At the same time, approximately 70% of hydrocarbon reserves are concentrated in the west of Kazakhstan.

The most explored oil reserves are in the Atyrau region, on the territory of which more than 75 fields have been discovered with industrial grade reserves of 930 million tons. The largest field in the region is Tengiz (initial recoverable reserves - 781.1 million tons). The rest of the fields in the region account for about 150 million tons. More than half of these reserves are concentrated in two fields - Korolevskoye (55.1 million tons) and Kenbai (30.9 million tons).

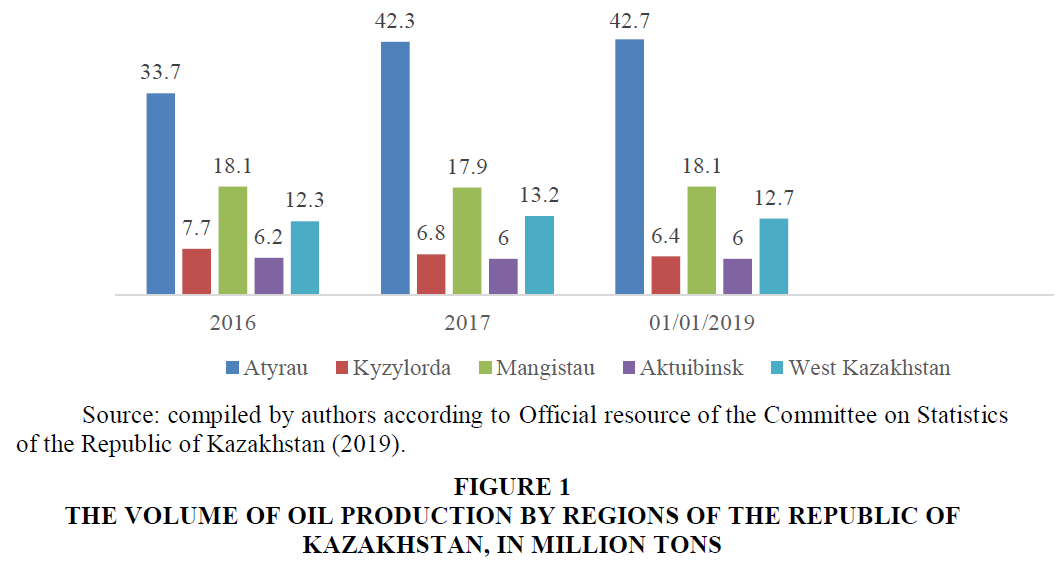

As of 1st of January 2019, the share of oil and natural gas production in the republican volume of industrial production amounted to 44.3% (Figure 1).

In the regional context, the western regions of the country are the main “suppliers” of hydrocarbon raw materials in Kazakhstan: Zhambyl, Kyzylorda and East Kazakhstan regions. Among the “non-Western” regions, the leader is the Kyzylorda region.

The oil and gas industry in Kazakhstan, with the highest production profitability among other activities, accumulates most of the foreign direct investment attracted to the country.

As of the third quarter of 2019, the profitability of the oil and gas industry was 49%, while in the republic this figure was 23%. At the same time, in 2005-2018, Kazakhstan attracted 289.6 billion US dollars of gross foreign direct investment, 25.8% of which was concentrated directly in oil and gas, and another 26.9% in geological exploration, which to a greater extent also applies to the oil production industry.

According to the Ministry of Economy, at the end of 2019, 238 subsoil use contracts for hydrocarbon raw materials were in force, including:

- For exploration - 47 contracts;

- For combined exploration and production - 117 contracts;

- For production - 74 contracts;

- Production Sharing Agreement (hereinafter - PSA) - 11 contracts.

There are 24 contracts for uranium, 3 for exploration, 8 for production, and 13 for combined exploration and production.

Note that a PSA is a special type of agreement on the establishment of a joint venture, an agreement on the division of natural resources concluded between a foreign mining company (contractor) and a state enterprise (state party), authorizing the contractor to conduct prospecting and exploration work and operation within a certain area (contract territory) in accordance with the terms of the agreement. It is not uncommon for a PSA to include provisions on exploration, production and resource sharing.

Consider data on PSA participants, their shares, countries of origin, data on contracts of the largest companies included in the top five (Table 1).

| Table 1 PSA Details: Investment, Social Costs and Taxes | |||||

| N° | Subsoil user | Years | Investments, million tenge |

Social expenditures, million tenge | Taxes, million tenge |

| 1 | Kazakhstan branch "Karachaganak Petroleum Operating B.V." | 2019 | 544298 | 11987 | 511380 |

| 2018 | 331766 | 8885 | 712313 | ||

| 2017 | 317199 | 10355 | 361760 | ||

| 2016 | 376679 | 8199 | 121333 | ||

| 2015 | 279891 | 8596 | 200066 | ||

| 2 | Branch "North Caspian Operating Company N.V." | 2019 | 450299 | 30132 | 76063 |

| 2018 | 356360 | 21604 | 104745 | ||

| 2017 | 327706 | 14030 | 19433 | ||

| 2016 | 1056064 | 14441 | 121611 | ||

| 2015 | 820533 | 15915 | 33051 | ||

| 3 | LLP JV Zhaikmunai | 2019 | 117933 | 114 | 13515 |

| 2018 | 92607 | 96 | 15703 | ||

| 2017 | 87360 | 98 | 15856 | ||

| 2016 | 74572,4 | 115 | 11899 | ||

| 2015 | 69013 | 55 | 18525 | ||

| 4 | Branch of the company Saygak Kazakhstan B.V. | 2019 | 2418,85 | 0.56 | 1231,35 |

| 2018 | 544,1 | 0 | 1515 | ||

| 2017 | 413,41 | 0 | 1038,3 | ||

| 2016 | 475,149 | 1,4 | 815,492 | ||

| 2015 | 540,74 | 0 | 817,36 | ||

| 5 | LLP Sagiz Petroleum Company | 2019 | 8036,06 | 114,2 | 5540,16 |

| 2018 | 7746,98 | 98,01 | 6005,4 | ||

| 2017 | 11035,78 | 112,51 | 4273,28 | ||

| 2016 | 10761,83 | 109,437 | 3727,952 | ||

| 2015 | 13405,44 | 55,34 | 4178,35 | ||

Let us determine the factors that affect the indicator “Volume of products (goods and services) produced from the extraction of crude oil and natural gas”, million tenge. To do this, we will use correlation-regression analysis.

Let us put forward hypotheses about the existence of a connection between the indicator under consideration and the following factors:

- Investments in fixed assets in the non-mining industry, million tenge;

- The number of employed population in the manufacturing industry in the Republic of Kazakhstan, thousand people;

- Shipment to the domestic market,% to the production volume;

- GVA of the oil and gas sector, million tenge;

Statistical data used for analysis for the period from 2010 to 2020 are presented in Table 2.

| Table 2 Dynamics of the Considered Indicators | |||||

| Year | The volume of products (goods and services) produced from the extraction of crude oil and natural gas, million tenge | Investments in fixed assets in the non-mining industry, million tenge | The number of employed population in the manufacturing industry in the Republic of Kazakhstan, thousand people | Shipment to the domestic market,% of the production volume | GVA of the oil and gas sector, million tenge |

| 2010 | 6195386 | 1651953 | 126,5 | 15,4 | 5518483,4 |

| 2011 | 8572795 | 1593634 | 126,8 | 15,6 | 7167934,4 |

| 2012 | 8720734 | 1599703 | 133,8 | 15,8 | 8012707,8 |

| 2013 | 9036471 | 1769433 | 131,6 | 16,0 | 7544508,7 |

| 2014 | 9164095 | 1984974 | 129,3 | 16,3 | 7925074,3 |

| 2015 | 5880227 | 2296567 | 128,7 | 17,8 | 7139733,2 |

| 2016 | 7409929 | 2730134 | 133,8 | 16,8 | 8498204,4 |

| 2017 | 9202733 | 2960272 | 118,3 | 15,4 | 9847272,9 |

| 2018 | 12060235 | 4493990 | 121,7 | 15,9 | 13032164,0 |

| 2019 | 12653589 | 5550068 | 135,3 | 16,0 | 14683110,4 |

| 2020 | 12172681 | 4986825 | 121,8 | 15,9 | 12237372,6 |

Application Functionality

The results of the regression analysis applied to the growth rate of the initial data show that a statistically significant and reliable relationship is observed between the volume of products (goods and services) produced from the extraction of crude oil and natural gas, shipment to the domestic market and the GVA of the oil and gas sector (Table 3).

| Table 3 Growth Rates of the Considered Indicators | |||||

| Year | The volume of products (goods and services) produced from the extraction of crude oil and natural gas, million tenge | Investments in fixed assets in the non-mining industry, million tenge | The number of employed population in the manufacturing industry in the Republic of Kazakhstan, thousands of people |

Shipment to the domestic market, % to the production volume | GVA of the oil and gas sector, million tenge |

| 2011 | 38,374 | -3,530 | 0.237 | 1.299 | 29,890 |

| 2012 | 1,726 | 0,381 | 5,521 | 1.282 | 11,785 |

| 2013 | 3,621 | 10,610 | -1,644 | 1.266 | -5,843 |

| 2014 | 1,412 | 12,181 | -1,748 | 1.875 | 5,044 |

| 2015 | -35,834 | 15,698 | -0.464 | 9.202 | -9,910 |

| 2016 | 26,014 | 18,879 | 3,963 | -5.618 | 19,027 |

| 2017 | 24,195 | 8,430 | -11,584 | -8.333 | 15,875 |

| 2018 | 31,051 | 51,810 | 2,874 | 3.247 | 32,343 |

| 2019 | 4,920 | 23,500 | 11,175 | 0.629 | 12,668 |

| 2020 | -3,801 | -10,148 | -9,978 | -0.625 | -16,657 |

The results of the data fit using the least squares method is presented in Table 4.

| Table 4 The Results of Evaluating the Equation of the Growth Rate of the Volume of Products (Goods and Services) Produced from the Extraction of Crude Oil and Natural Gas | |

| R | 0.919 |

| R2 | 0.844 |

| Adjusted R2 | 0.800 |

| Fisher's test | 18,996 (P-value=0,0001) |

| Variables | |

| Growth rate of the volume of products (goods and services) produced from the extraction of crude oil and natural gas,% - dependent variable | |

| Constant | 0.862 |

| Regression coefficients | |

| Growth rate of shipments to the domestic market, % | -1.802** |

| GVA growth rate of the oil and gas sector, % | 0.962*** |

| * p<0.1; ** p<0.05; *** p<0.01 | |

Analysis of the obtained parameters to the equations of multiple linear regression allows us to draw the following conclusions:

- an increase in the growth rate of shipments to the domestic market by 1% will contribute to a decrease in the growth rate of the volume of products (goods and services) produced from the extraction of crude oil and natural gas by an average of 1.802%;

- an increase in the rate of GVA of the oil and gas sector by 1% will contribute to an increase in the rate of increase in the volume of products (goods and services) produced from the extraction of crude oil and natural resources by an average of 0.962%.

This gives grounds for the fact that the production, processing of oil and oil products and their further sale are more profitable within the country, perhaps outside the country.

Thus, only two hypotheses were confirmed about the existence of a connection between:

1) The volume of products (goods and services) produced from the extraction of crude oil and natural gas and shipment to the domestic market;

2) The volume of products (goods and services) produced from the extraction of crude oil and natural gas and the GVA of the oil and gas sector.

Since the study analyzed the largest companies in the oil industry, it was found that all companies in the face of fierce competition and a rapidly changing situation should not only focus on the internal state of affairs, but also develop a long-term strategy that would allow them to keep pace with changes.

Conclusion

The specialization and concentration of the country in certain sectors of the economy plays a fundamental role in the formation of the state budget, the volume of exports / imports of goods and services, the rate of growth of industrial production, the level of prices for resources and has a significant impact on the exchange rate of the tenge in relation to major world currencies. In modern conditions of economic development, the world oil market is subject to serious market fluctuations. Kazakhstan, being one of the fundamental participants in the world oil market, is forced to predict and take into account additional financial risks, as well as take measures aimed at reducing the dependence of the state's economy on the situation on the world market for this raw material.

The economy of Kazakhstan has a raw material orientation, as a result of which it significantly depends on the situation on the world oil market. Exports of crude oil account for 1/3 of the total export of goods from Kazakhstan, and the volume of export supplies of oil play an important role in the formation of the country's budget.

As a result of the analysis of PSA data of large companies in the oil industry of the Republic of Kazakhstan, their share of participation in the socio-economic development of regions of the country was determined and factors that affect the indicator "Volume of products (goods and services) produced from the extraction of crude oil and natural gas" ... Based on the correlation-regression analysis, hypotheses were put forward and further confirmed the existence of a relationship between:

1) The volume of products (goods and services) produced from the extraction of crude oil and natural gas and shipment to the domestic market;

2) The volume of products (goods and services) produced from the extraction of crude oil and natural gas and the GVA of the oil and gas sector.

Since the study analyzed the largest companies in the oil industry, it was found that all companies in the face of fierce competition and a rapidly changing situation should not only focus on the internal state of affairs, but also develop a long-term strategy that would allow them to keep pace with changes. Occurring in their environment and to promote the further development of social partnership.

References

- Ablaev, I.M., & Akhmetshina, E.R. (2016). The role of the public private partnership in the innovation cluster development. Journal of Economics and Economic Education Research, 17(4), 220-232.

- Akintoye, A., Beck, M., & Kumaraswamy, M. (2016). Public private partnerships: A global review. Taylor and Francis, 412p.

- Berezin, A., Sergi, B.S., & Gorodnova, N. (2018). Efficiency assessment of public-private partnership (PPP) projects: The case of Russia. Sustainability: Open Access, 10(10), 1-18.

- Cong, X., & Ma, L. (2018). Performance evaluation of public-private partnership projects from the perspective of efficiency, economic, effectiveness, and equity: A study of residential renovation projects in China. Sustainability: Open Access, 10(10), 1-21.

- Cruz, C.O., & Marques, R.C. (2014). Theoretical considerations on quantitative PPP viability analysis. Journal of Management in Engineering, 30(1), 122-126.

- Filatova, I., Nikolaichuk, L., Zakaev, D., & Ilin, I. (2021). Public-private partnership as a tool of sustainable development in the oil-refining sector: Russian case. Sustainability, 10(13), 5153-5165.

- Javed, A.A., Lam, P.T.I., & Chan, A.P.C. (2014). Change negotiation in public-private partnership projects through output specifications: an experimental approach based on game theory. Construction Management and Economics, 32(4), 323-348.

- Litvinenko, V. (2020). The role of hydrocarbons in the global energy agenda: The focus on liquefied natural gas. Resources, 9(5), 59-67.

- Litvinenko, V.S., & Sergeev, I.B. (2019). Innovations as a factor in the development of the natural resources sector. Studies on Russian Economic Development, 7(30), 637-645.

- Masson-Delmotte, V., Zhai, P., Pörtner, H.O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., & Pidcock, R. (2018). Global warming of 1.5 ?C. In An IPCC Special Report on the Impacts of Global Warming of Globle Warming. IPCC: Geneva, Switzerland, 201p.

- Official resource of the Committee on Statistics of the Republic of Kazakhstan. (2019). Retrieved from www.stat.gov.kz

- Official resource of the Extractive Industries Transparency Initiative of the Republic of Kazakhstan. (2019). Retrieved from https://eiti.org/kazakhstan

- Roumboutsos, A. (2015). Public private partnerships in transport infrastructure: An international review. Transport Reviews, 35(2), 111-117.

- Stroykov, G., Cherepovitsyn, A.Y., & Iamshchikova, E.A. (2020). Powering multiple gas condensate wells in Russia’s arctic: Power supply systems based on renewable energy sources. Resources, 9(7), 130-137.

- Ullah, F., Ayub, B., Siddiqui, S.Q., & Thaheem, M.J. (2016). A review of public-private partnership: critical factors of concession period. Journal of Financial Management of Property and Construction, 21(3), 269-300.