Research Article: 2018 Vol: 17 Issue: 1

Market Friendly Approach on Islamic Bank's Non Muslim Customer in Palembang and its Effect on Attitude

Maya Panorama, State Islamic University of Raden Fatah Palembang

Lemiyana, State Islamic University of Raden Fatah Palembang

Keywords

Market Friendly, Non-Muslim Customer, Attitudes, Islamic Bank.

Introduction

Based on data from the Financial Services Authority (FSA), in October 2015 the market share of Islamic banking is expected to reach 5% this year with the release of a package of measures for the industry. The development of Islamic banks in Indonesia is still very low even though Indonesia is the largest Muslim country in the world. It was seen from the market share of Islamic banking is currently less than 5 percent, the main problem in the development of Indonesian Islamic banks exist in the bank reinforcement system that has not been repaired. Thus, the problem hindered the development of Islamic banks. In addition, human resources (HR) Islamic banking is still not strong enough to compete, development of Islamic banks is promising, but needs to develop in order to compete strong competitive with conventional banks. Islamic banks have huge potential, but the challenge of Islamic banks is also increasingly widespread. From the data gathered, until the beginning of 2016 the number of Islamic banks in Indonesia as many as 12 banks by the number as many as 1,970 bank branch offices. (Fauzi & Ahmad, 2016).

Islamic banks in running its operations based on Islamic principles, so most people will view that Islamic banks is identical with Islam and Muslims. In other words, Islamic banks cater and serve only to people who are Muslims, while other religions [non-Muslims] cannot do the transaction in it. This view is certainly wrong and needs to be clarified. If it is said that Islamic banks identical with Islam, it is true, because when we talk about sharia, it will automatically talk about Islam. Both a unity that cannot be separated. However, that need to be understood, Islamic banks are not related at all to religious ritual or worship of the religion of Islam. Islamic banks, in carrying out its activities, not limited only to people who are Muslims, but also open to non-Muslims. In other words, Islamic banks can provide financing or services to non-Muslims.

The non-Muslims can save money, ask for financing and/or use the services of Islamic banks, could even work there. At present, Islamic banking is growing rapidly around the world, not only in the Islam country/Muslim-majority, but also in countries that are not Islam, such as the United States, Singapore, United Kingdom, etc. Islamic banking and finance is growing rapidly in there, but not an Islam country. Reciprocally with Singapore, which was determined to be the centre of Islamic finance in the world to loosen rules concerning Islamic banking so that it can thrive? In Malaysia, almost 15 per cent of customers of Islamic banks are non-Muslim. This indicates clearly that Islamic banks are not only for people who are Muslims. (Rasyid & Abdul, 2015).

Cultural characteristics of non-Muslims who are less able to work together and the spirit of capitalism that is commonly attached to the non-Muslims, naturally make a Conventional Bank has the capitalist system as a promising investment vehicle. But in reality, the majority of non-Muslim customers are also keen to keep funds in Sharia banking. Decision of non-Muslim communities to become customers in the Bank of Shariah can be influenced by several factors. Factors that influence the decision of customers to use banking services of Shariah, is of particular interest in the continuity of the management of the banking and fixed eksisnya the institution. (Sinungan, 2000). Based on survey results Islamic Bank of Britain (IBB), the majority of non-Muslim customers believe sharia economy relevant to all religions. Even 81 per cent of customers IBB, which is mostly non-Muslims, were satisfied with Islamic banking products. (Alamsyah, Ichsan & Emrald, 2014).

Research on the selection criteria for banks was mostly done by researchers at home and abroad. Erol & El-Bdour (1990) is regarded as the researcher who first examines consumer attitudes toward the Islamic bank. Research using questionnaires to determine the attitudes, behaviors and factors of bank selection criteria, both conventional and Islamic bank in Jordan. In that study concluded that a fast and efficient service, reputation and image bank and the bank's credibility is a major factor in choosing a bank, both conventional and Islamic bank. (Erol & El-Bdour, 1990).

Adawiah (2010) proposed in her research that there are seven factors that consumers consider in choosing a bank Syari'ah include: Perception, process, physical condition, pricing, human resources and social and location factors. Consumer perceptions are factors that most influence on consumer decisions in choosing a Sharia bank. Most respondents had limited knowledge of Sharia banking products. Religion is not the main reason for the individual consumer in choosing a Sharia bank. Consumers are more expensive profit or for the results offered the Sharia bank than other factors.

Another study conducted by Sukron (2012), showed that the factors significantly influence the interest in non-Muslim customers into customer in Bank BNI Cabang Syari'ah Semarang. According to Irfan & Fithri (2014), variables that influences the selection of non-Muslim customers of Islamic bank is the highest administrative advantages as significant and indicate when cost in Islamic bank getting lower and provide for high profit sharing, it is a great opportunity for non-Muslim customers interested in Islamic bank.

Based on what has been described the problem in this research is: How high is direct effect of market friendly on non-Muslim customers? How high the changes in attitudes directly influence the non-Muslim customers? How high user markets directly influence attitude change? As well as how high is indirect affect the market friendly through changes in customers' attitudes toward non-Muslims? The contribution of this study is to provide information for management of Islamic banks in the field of market friendly, religious stimuli, profit sharing and the attitude of non-Muslim customers become customers in the Islamic bank and conventional bank.

Literature Review

In Act No. 10, 1998 changes of Law No. 7 of 1992 about Banking, mention that Bank is the institution that collects funds from the public in the form of deposits and distribute in the form of loans and other forms in improving people's welfare. Meanwhile, Bank Syariah regulated in Law No. 21 of 2008 concerning Sharia Banking, bank whose business activities are carried out based on the principles of the Sharia. While the principles of Shariah is Islamic law based on the treaty rules. According to Aziz (2010) Bank Sharia is the main business of financial institutions that provide financing and other services in payment traffic and circulation of money that operations adjusted to the principles of Shariah.

Sharia banking system has experienced radical growth over the past three decades. Sharia banks are more stable, better capitalized and have higher quality assets. Zopounidis (2017) examined the stability and profitability of conventional vs. Islamic banks before and after the financial crisis in 2007. They found that for pre-recession showed that IB profitability was positively affected by size and cost of personnel and was negatively affected by risk. While CB shows that personnel costs have a positive impact on profitability and risk, claims to the central government, negative impact inflation. For the post-recession period it is clear that its profitability positively influenced by size and capital only affects the profitability of IB. CB's profitability is also positively influenced by personnel costs, while risk has a negative impact. In addition, the risk also affects the stability of IB and CB negatively before and after the recession. Given IB risk, claims in government centres, domestic credit from private sector and inflation have negative correlation with profitability, while domestic credit provided by banks was found to have a positive relationship.

Naf'an (2004), mention that Islamic banking (al-Mashrafiyah al-Islamiyah) is a banking system based on the implementation of Islamic law (sharia). Basic fundamental of Shariah Bank refers to the teachings of Islam that are refers to Koran, Hadith/Sunnah and Ijtihad. While the purpose of Shariah banking is established due to taking usury in the financial and non-financial transactions.

Elements of market friendly are the investment in human resources. Investment activity in the field of human resources is a sector that should be provided and built by the government. Orientation towards the competitive market is the second element from market friendly approach. The third element is the opening of economic activity and investment. (Randy Wrihatnolo, 2008).

Market friendly regulation, namely the regulatory policy that gives comfort for investors to invest with a long term horizon. Investors in making investment basically is the expectations of the rate of profit or of return and investment risk, with a strong economic structure, security of investment and market friendly regulation. (Eddy Seoryanto Soegoto, 2010).

The attitude was initially interpreted as a sign condition for the rise of an action. The concept was then spread more widely and is used to describe the presence of a specific or general intent, relating to the control of the response to specific circumstances. (Elmubarok, 2009).

Definition of attitude are classified into three framework, among others: (Azwar & Ananda, 2009) namely: 1) Attitude is a form of reaction or evaluation feelings, attitudes towards a particular object is an impartial and non-partisan; 2) The attitude is a readiness to react to certain objects; and 3) the attitude is a constellation of components of cognitive, affective and conative which interact with one another.

Customers are consumers as providers of funds. (Saladin, 2006). In this study is a prospective customer is one who will be the responsibility of a company's bank and not yet a customer of a company bank. Meanwhile, according to the dictionary management clients are people who have savings or loans estimates on a bank, (Marbun, 2005).

Meanwhile, according to the Regulation of Bank Indonesia Number 21 of 2008 concerning Sharia Banking is as follows: 1) Customer is parties that using the services of Bank Syari'ah or Business Unit Sharia; 2) Customer funding are customers who place their funds in banks in the form of deposits such as savings, current accounts and deposits; and 3) lending customers are customers who borrow funds in such bank credit. (Martono, 2010). Determinate factor of customer satisfaction In Greek Banks, the quality of the provided services strongly correlated with customers’ loyalty. Banks will earn loyal customers, which leads to a competitive advantage correlated with the market value of banks, especially in a period of financial crisis. (Skordoulis & Pekka, 2015).

Erol & El-Bdour (1990) proposed research about consumer attitudes toward Islamic bank by using a questionnaire to determine the attitudes, behaviors and factors in the bank selection criteria and conventional Islamic bank in Jordan. In accordance with other researchers results (Chalikias, 2016; Chalikias, 2016), they concluded that the rapid and efficient service, reputation and bank image, along with the bank's credibility is a major factor in choosing a bank, both conventional and Islamic bank.

Similar results were obtained from studies conducted by Haron & Yamirudeng (2003) found that the service is fast and efficient have the highest scores among the other selection criteria. Service efficiency seems to be an important construct of customers' attitude (Skordoulis, 2017; Armira, 2006). While the research results from Gait and Worthington (2008), shows that the religious factor is not the main reason for consumers to choose Islamic bank.

Another study conducted by Sukron (2012) Factors affecting non-Muslim customers through a customer in Semarang branch of BNI sharia" found there’s a significant difference between the non-Muslim customers' interest factors to Bank BNI Syariah Semarang Branch.

Adawiah (2010) states that there are seven factors that consumers consider in choosing a bank Syari'ah i.e., perception, process, physical condition, pricing, human resources, social and location factors. Consumer perception is the most influential factor on customer decision in choosing Bank Shariah. Most respondents had limited knowledge of Sharia banking products. Religion is not the main reason of individual consumers in choosing Shari'ah bank. Consumers are more consider profit or profit sharing which offered by Shariah bank than other factors.

Yupitri & Sari (2012) states variables facilities (X1) have a moderate effect, namely 0.469 against non-Muslim customers to become customers in Bank Syari'ah Mandiri. Promotion variables (X2) has a strong influence on the customer that is 0.730 against non-Muslims to become customers in Bank Syari'ah Mandiri. Variable product (X3) has a strong influence, namely 0.529 against non-Muslim customers to become customers in Bank Syari'ah Mandiri.

Conceptual Framework and Research Hypotheses

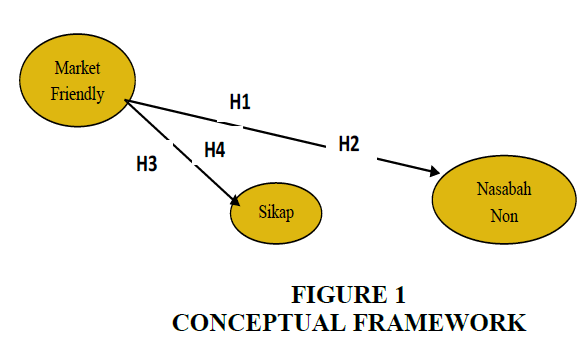

Conceptual framework develops in this research can be found in Figure 1 below:

While research hypotheses as follows:

H1: Market friendly has directly affect positive significant on non-Muslim customers.

H2: Changes in attitudes has directly affect positive significant on non-Muslim customers.

H3: Market friendly has directly affect positive significant on Changes in attitudes.

H4: Market friendly has indirectly effect positive significant through changes in customers' attitudes toward non-Muslims.

Methodology of Research

The population is a group of complete element, which we are keen to learn or become the object of research. (Kuncoro, 2009) In this study population of Islamic finance customers in Palembang made up of elements that elusive number. (Arikunto, 2010) While sample is part of the population that has similar characteristics and is considered to represent the population. (Puspowarsito, 2008) Using a purposive sampling method with the purpose to obtain representative samples in accordance with the specified criteria. (Sugiyono, 2011).

Variables used in this research are: Market Friendly with 3 dimensions as the dependent variable (X1) which is a change of attitude in the non-Muslim customers becomes customers of Islamic banking. Independent Variables are changes in attitudes of non-Muslims in Islamic banking as a customer with a three-dimensional (Y1) and the Customer a non-Muslim with a 2-dimensional (Y2).

The variables and detail dimensions can be seen in the following Table 1:

| Table 1: Descriptions Variable | ||||

| Variable | Operational Definition | Dimensions | Indicator | Scale |

|---|---|---|---|---|

| Market Friendly(X) | Economic strategy that promotes long-term investment in human capital. (Riant & Randy, 2008) | Investment activity in the field of Human Resources | -Qualified workforce -High Skills -High Productivity |

Likert scale, with numbers ranging from 1 to 5 |

| Orientation to the market | -A competitive market/competition -Price (interest rate) |

|||

| The creation economic activity and investment | -Improved on efficiency -The ability to transfer technology |

|||

| Attitudes (Y1) | The tendency to respond to an object or group of objects either liked or disliked consistently (Gordon Allport, 2006) | Cognitive component | Perceptions and beliefs | Likert scale, with numbers ranging from 1 to 5 |

| Affective components | Feeling happy or not happy, likes or dislikes of an object | |||

| Components Cognitive/Behavioral | The behavior of the object to be faced | |||

| Non-Muslim Customers (Y2) |

Non-Muslims who put their money in Islamic Bank in the form of deposits or borrow funds in the bank. (Edy Wibowo, 2005) | From the individual's it self | Customers intend to becoming customers of Islamic banks | Likert scale, with numbers ranging from 1 to 5 |

| Information submitted by relative/friend (Abdul RachmanShaleh & Muhbib Abdul Wahab, 2004) | Suggestion to others to become customers in the Islamic bank. | |||

The method used is causality or relationships or influences method. To test the hypothesis with Structural Equation Model or SEM. While data collection methods is survey, in which respondents answered questionnaires. Structural models describe the relationship between latent variables or exogenous variables with latent variables or variables exogenous and endogenous. SEM Model consists of two types of models, so that the analysis tool used is also related to the purpose of the analysis of both types of models. (Kusnendi, 2008).

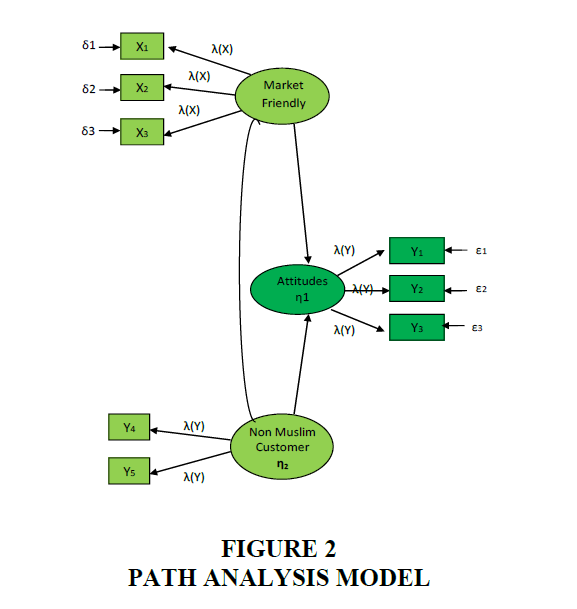

Construction of Development Path Analysis in this study as follows:

Goodness of Fit Test

Goodness of Fit is a match between the sample covariance matrix with an estimated population covariance matrix resulted. A model (model of measurement and structural models) is said to be fit or in accordance with the data if the sample covariance matrix is not different from population estimates covariance matrix is generated (Figure 2). Overall goodness of fit of a model can be assessed by several measures of fit as follows: Chi-Square and Probabilities, Root Mean Square Error of Approximation (RMSEA), Normed Fit Index (NFI); TLI-Tucker Lewis Index; Comparative Fit Index (CFI); Incremental Fit Index (IFI); Root Mean Residual (RMR); Goods of Fit Indices (GFI) and Adjust Goods of Fit Index (AGFI).

Annotation:

Y: Variable manifest for endogenous latent variables.

X: Variable manifest for exogenous latent variables.

η: Eta, states for endogenous latent variable.

ξ: Ksi, states for latent exogenous variable.

ε: Theta-Epsilon, error of measurement for a manifest of endogenous Y.

δ: Theta-Delta, error of measurement for a manifest of exogenous X.

ζ: Zeta, errors or residual structural equation between the latent variables.

γ: Gamma, the path coef latent exogenous var to the latent endogenous var.

λ(x): Lambda-X, weighting factors manifest variables to a latent exogenous.

λ(y): Lambda-Y, weighting factors manifest variables to a latent endogenous.

Results and Discussion

Respondent Characteristic

The number of samples in this study was 120 respondents’ non-Muslim customers. Description of non-Muslim customer who became the sample is as follows: Based on Religion clients, most clients are Catholic (62.5%), Protestants (31.67%) and Buddhists (5.83%). Based on the age of the respondents that the majority of respondents or 43.33 percent or 52 respondents aged between 31-40 years, there are 15.83 percent or 19 respondents aged between 21-30 years. A total of 26.67 percent or 32 respondents aged between 41-50 years, 10 percent or 12 respondents aged over 50 years and there is only 4.17 percent or 5 respondents aged less than 20 years. If by sex shows the proportion of more than 92 respondents or 76.67 percent, while women were 28 respondents or 23.33 percent. Meanwhile, from the old into financing customers 51.67 percent or 62 respondents have a customer financing (financing) between 1-2 years and between 3-4 years there are 33.33 percent or 40 respondents. The remaining 15 percent or 18 respondents over 5 years have been customer financing.

Validity and Reliability

Before the questionnaire used, has conducted test to the 30 respondents which chosen randomly at customers of non-Muslims who do the financing in Islamic banking. Then the data from these trials used to test the validity and reliability of the instrument (questionnaire) as a measuring tool in research. The validity of the test calculations made by the Spearman rank correlation. Reliability testing can be done by using Cronbach's alpha statistic. The instrument reliable if it has a value of α>0.60. (Ghozali, 2001).

There are 22 items that an indicator variable user market which consists of three dimensions: The dimensions of Investment Activities In the field of Human Resources, the dimensions of Orientation to Market, dimensional openness of Economic Activity and Investment. The results of calculation of reliability Cronbach Alpha value for the variable Friendly Market is equal to 0.770. That is the statement of the 22 items that serve as an indicator variable Friendly Market (X1) is reliable.

To see attitude by answering 10 statements item which is an indicator of the attitude variables consisting of three dimensions, namely: Cognitive Component dimensions, dimensions and dimensional component Affective component Behavior? The results of calculation of reliability Cronbach Alpha value for the variable is the attitude of 0.779. That is a statement of 10 items that serve as indicators of the attitude variables (Y1) is reliable.

To see the level of non-Muslim customers have been done by answering 7 statement items as an indicator. This variable consists of two dimensions, namely: Individual himself dimensions and dimension information presented Friend/Brother. The results of calculation of reliability Cronbach Alpha value for the variable Customer Non-Muslims are of 0.960. That is a statement of 7 items that serve as indicators of the variable Customer Non-Muslims (Y2) is reliable.

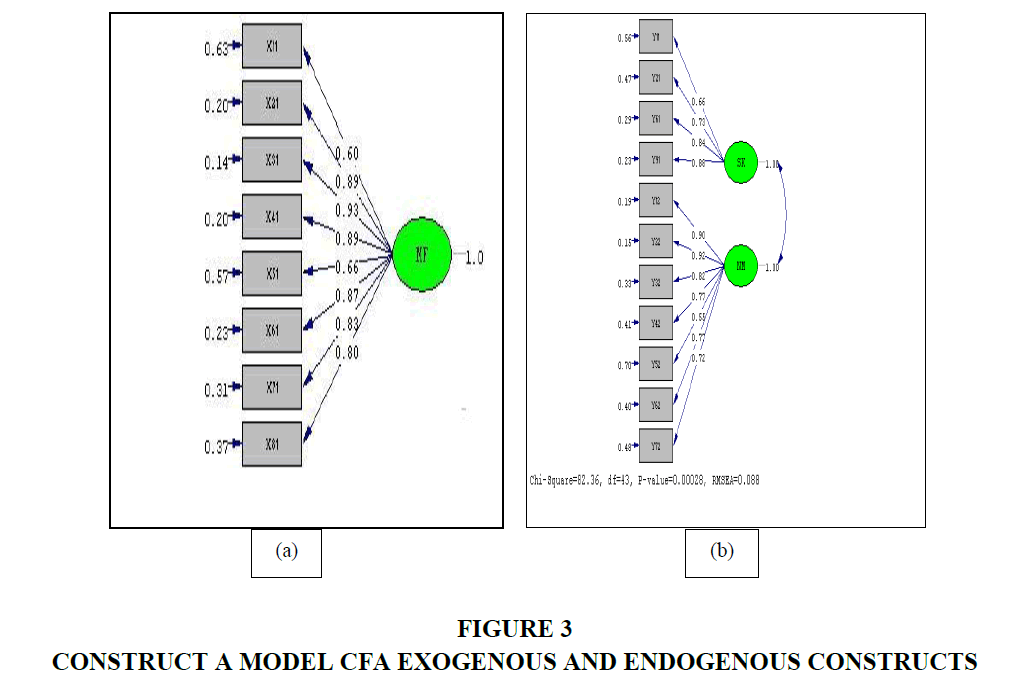

Indicators of Market Friendly variables indicate that the indicator has a more standardized loading factor of 0.5 is an indicator of X11, X21, X31, X41, X51, X61, X71 and X81, which means that such indicators are valid. Indicators that have standard load factor score (standardized loading factor) is less than 0.5, namely X91, X101, X111, X121, X131, X141, X151, X161, X171, X181, X191, X201, X211 and X221, which means that the indicators are not valid and must be removed in subsequent analyzes. Value Construct Reliability (CR) of variable Friendly Market 0.76 (greater than 0.7). It can be concluded that the indicators of variable Friendly Market in Confirmatory Factor Analysis/CFA has been reliable.

The below Table 2 indicates that the CFA Model Exogenous constructs that have formed still occur indicators in the overall model (Full Model) which having a value standard factors less than 0.5 so that the indicators are not valid and must be removed in subsequent analyses. While the value of Construct Reliability (CR) shows that of the entire construct of exogenous above 0.7. Thus it can be concluded that all the dimensions and variables research in the Full Model have good reliability, but there is invalid indicators that need to be corrected by issuing an invalid indicator obtained Model_2 CFA Exogenous constructs.

| Table 2: Test Results Construct Validity And Reliability Indicators Exogenous Variables 1 |

||||

| Dimension | Indicator | λ | Error=1-λ2 | CR=(∑λ)2/((∑λ)2+∑Error) |

|---|---|---|---|---|

| Market Friendly | X11 | 0.61 | 0.63 | 0.76 |

| X21 | 0.89 | 0.21 | ||

| X31 | 0.93 | 0.14 | ||

| X41 | 0.89 | 0.20 | ||

| X51 | 0.65 | 0.57 | ||

| X61 | 0.87 | 0.24 | ||

| X71 | 0.83 | 0.31 | ||

| X81 | 0.80 | 0.37 | ||

| X91 | -0.12 | 0.99 | ||

| X101 | -0.01 | 1.00 | ||

| X111 | 0.09 | 0.99 | ||

| X121 | -0.03 | 1.00 | ||

| X131 | -0.08 | 0.99 | ||

| X141 | 0.21 | 0.96 | ||

| X151 | 0.18 | 0.97 | ||

| X161 | 0.06 | 1.00 | ||

| X171 | 0.06 | 1.00 | ||

| X181 | -0.01 | 1.00 | ||

| X191 | 0.06 | 1.00 | ||

| X201 | 0.12 | 0.98 | ||

| X211 | 0.15 | 0.98 | ||

| X221 | 0.05 | 1.00 | ||

Indicators of Market Friendly variable indicates that there is standardized loading factor is less than 0.5, so that all the indicators in the variable Market Friendly is already valid. Construct Reliability (CR) value of variable Market Friendly of 0.94 (greater than 0.7) (Table 3). It can be concluded that the indicators of variable Friendly Market in Confirmatory Factor Analysis/CFA has been reliable and valid.

| Table 3: Test Results Construct Validity And Reliability Indicators Exogenous Variable 2 |

||||

| Dimension | Indicator | λ | Error=1-λ2 | CR=(∑λ)2/((∑λ)2+∑Error) |

|---|---|---|---|---|

| Market Friendly | X11 | 0.61 | 0.63 | 0.94 |

| X21 | 0.89 | 0.20 | ||

| X31 | 0.93 | 0.14 | ||

| X41 | 0.89 | 0.20 | ||

| X51 | 0.66 | 0.57 | ||

| X61 | 0.88 | 0.23 | ||

| X71 | 0.83 | 0.31 | ||

| X81 | 0.80 | 0.37 | ||

Based on Figure 3 (a): Indicates that the CFA constructs Exogenous no longer value loading factor of less than 0.5; so all indicators on Exogenous variables have shown valid for all the indicators have had a loading factor loadings greater than 0.5. Calculation results obtained with Construct validity and reliability (CR) of Confirmatory Factor Analysis/CFA.

Based on Figure 3 (b): Indicates that the CFA Model Construct Endogenous there is no value cargo loading factor of less than 0.5, so all indicators on the endogenous variables have shown valid for all the indicators have had a loading factor loadings greater than 0.5. Calculation results obtained with Construct validity and reliability (CR) Confirmatory Factor Analysis/CFA.

CFA Construct Endogenous no longer had value on loading factor of less than 0.5, so all indicators on the endogenous variables have shown valid because all the indicators have had a loading factor greater than 0.5. While the value of Construct Reliability (CR) shows that of the entire construct of endogenous above 0.7. Thus it can be concluded that all the dimensions and variables in this research in full model has good reliability and validity.

Structural Equation Modelling (SEM) Analysis

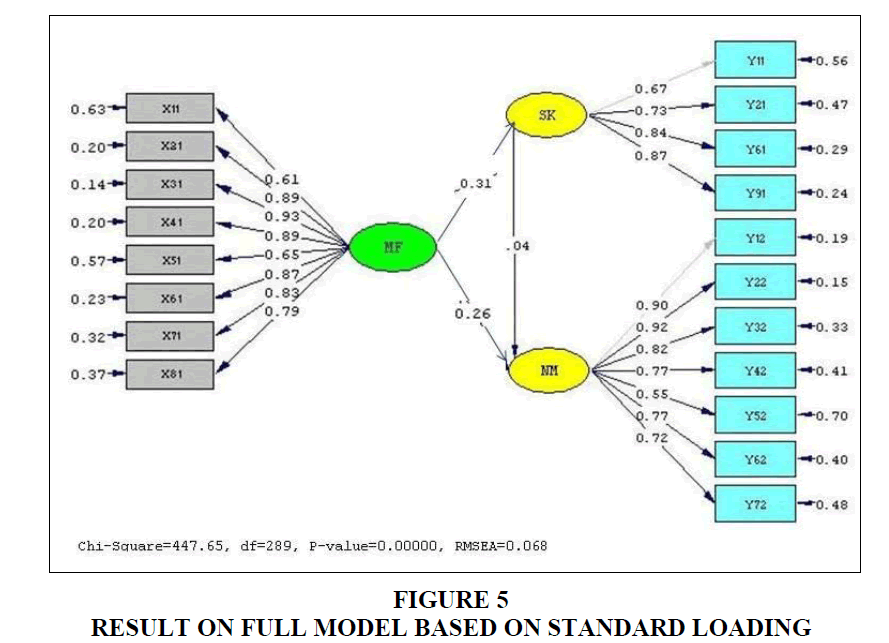

Analysis of Structural Equation Modelling (SEM) for the full model made after confirmatory factor analysis of the indicators forming a latent variable or construct exogenous or endogenous declared valid and reliable. Analysis of the data processing in the full model (1) obtained estimated values as shown in Figure 5.

To test the feasibility of the overall model (Full Model) done with notice result of the calculation Goodness of Fit Statistics with LISREL Software 8.5. The test refers to the criteria model fit which contained in the Goodness of Fit Index Table 4 below:

| Table 4 : Goodness Of Fit Index | |||||

| No | Goodness Of Fit Index | Value | Cut off Value (Nilai Batas) | Criteria | Adjective |

|---|---|---|---|---|---|

| 1. | Chi-Square | 447.65 | <α.df | Good Fit | Marginal Fit |

| Probability | 0.000 | >0.05 | |||

| 2. | RMSEA | 0.068 | ≤ 0.08 0.08-0.10 |

Good Fit Marginal Fit |

Good Fit |

| 3. | NFI | 0.88 | ≥ 0.90 0.80-0.89 |

Good Fit Marginal Fit |

Marginal Fit |

| 4. | TLI atau NNFI | 0.94 | ≥ 0.90 0.80-0.89 |

Good Fit Marginal Fit |

Good Fit |

| 5. | CFI | 0.95 | ≥ 0.90 0.80-0.89 |

Good Fit Marginal Fit |

Good Fit |

| 6. | IFI | 0.95 | ≥ 0.90 0.80-0.89 |

Good Fit Marginal Fit |

Good Fit |

| 7. | RMR | 0.044 | ≤ 0.05 0.05-0.10 |

Good Fit Marginal Fit |

Good Fit |

| 8. | GFI | 0.88 | ≥ 0.90 0.80-0.89 |

Good Fit Marginal Fit |

Marginal Fit |

| 9. | AGFI | 0.83 | ≥ 0.90 0.80-0.89 |

Good Fit Marginal Fit |

Marginal Fit |

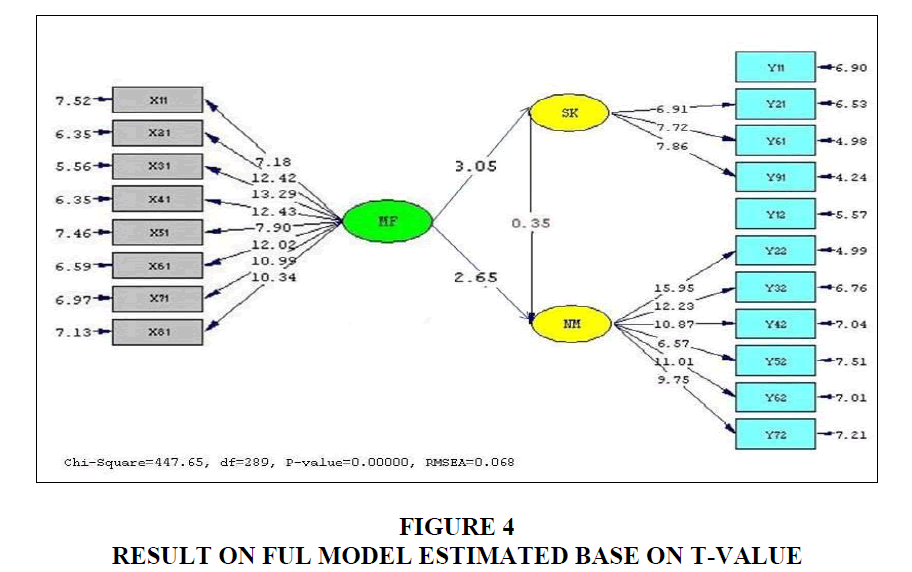

The test results for the full model SEM analysis based on the t-value is shown in the following Figure 4:

Based on Figure 4 above it can be seen the test results to the structural model and the measurement model. For the measurement model Market Friendly significant indicators at the level of 5%, while for structural models there is a direct relationship is not significant at the 5% level, i.e., Customer Attitudes toward non-Muslims, because the t-counted value is smaller than 1.96.

The results of estimation for the full model SEM analysis based on the standard loading are shown in Figure 5 below:

Based on the structural model above can be explained that the change in attitude is directly affected by variable market friendly. Variable market friendly affect positive, this means that the better market friendly, then non-Muslim customer change attitude in doing syariah financing will increase. The influence on the market friendly change in attitude of 0.31 means that market friendly has a great influence on the change of attitude of non-Muslim customers than any other factor. Customer non-Muslims directly affected by variable market friendly and attitudes and indirectly affected by the variable market friendly. However, only the direct effect of any significant market friendly to non-Muslim customers, whereas no significant direct effect attitude toward non-Muslim customers. The magnitude of the effect of market friendly to non-Muslim customers by 0.26, attitudes effect by 0.04 means that user market has a greater influence on customers’ non-Muslims than any other factor.

Market Friendly has direct effect on attitudes can be concluded that the Market Friendly has a quite large direct impact on the attitude by 3.05. The results of calculation of direct effect and change Market Friendly and Attitudes to non-Muslims Customer can be concluded that the Market Friendly also has a greatly direct effect to customer non-Muslims (2.92) than the direct effect of changes in attitude that only 0.35. The result of the calculation of the indirect effect of Market Friendly to non-Muslim customer through attitude shows that the Market Friendly also has a large indirect effect (0.35).

From the analysis of the direct influence of variable market friendly to non-Muslims customer as above, it can be concluded that the variable market friendly positive and significant impact directly to non-Muslims customer, meaning that in Islamic banking in particular the financing is considered more market friendly for non-Muslims customers to obtain liquidity of business. This is consistent with the theory from Soegoto (2010) that the market friendly regulation would provide comfort to investors that non-Muslim customers to invest in the long term. With a market friendly regulation will increase investors' expectations in the banking Shariah.

Research Implications

The implication of this study can be summarized as follows:

1. Market friendly has significant positive direct effect to non-Muslim customers; this implies that the future Islamic banking is more able to improve market friendly factors which become dominant factor on the attitudes of non-Muslim customers in Shariah banking in improving financing in Sharia Banking.

2. Shariah banking should adhere the attitude change on human resources, to attract non-Muslim customers.

3. The government should make policies that can improve the performance of banks so will not to lose customers.

Conclussion and Recommendation

Based on the analysis that has been done, then in this study can be summarized as follows:

1. Market Friendly, impact directly positive and significant to non-Muslim customer to 0.26 pales market friendly increases, the non-Muslim customers in financing ownership in the sharia will be increasing as well.

2. Attitude effect significant positive but not directly to non-Muslim customer at 0.04.

3. Market Friendly, impact directly positive and significant on the attitudes (0.31) means that if Market Friendly increases, then the attitude in the shariah financing will be increased as well.

4. Market Friendly, effect indirectly significant positive to non-Muslim customer through attitude of 0.35.

Based on the above conclusions, it is recommended as following:

1. From the analysis of the calculation of the direct and indirect effects of the exogenous variables on endogenous variables in this study as stated above, it can be suggested that to improve the Customer Attitudes and non-Muslims in financing then that should be done by management is to further enhance the market friendly.

2. For future researchers expected to examine other factors that influence attitudes, as well as its impact on non-Muslim customer.

References

- Alamsyah, Ichsan & Emrald (2014). 81 persen nasabah non-Muslim puas dengan perbankan syariah. Retrieved March 10, 2017, from http://www.republika.co.id/berita/ekonomi/syariah-ekonomi/14/02/07/n0mkq1-81-persen-nasabah-nonmuslim-puas-dengan-perbankan-syariah

- Armira, A., Armira, E., Drosos, D., Skordoulis, M. & Chalikias, M. (2016). Determinants of consumers’ behavior toward alcohol drinks: The case of Greek millennial. International Journal of Electronic Customer Relationship Management, 10(1), 14-27.

- Aziz & Abdul (2010). Manajemen investasi syari’ah. [Sharia management of investment]. Bandung: Alfabeta.

- Azwar & Ananda (2009). Psikologi pendidikan. [Educational psychology]. Jakarta: Bumi Aksara.

- Bank Indonesia (2008). Regulation of bank Indonesia number 21. Jakarta: Indonesia.

- Chalikias, M., Lalou, P. & Skordoulis, M. (2016). Modelling advertising expenditures using differential equations: The case of an oligopoly data set. International Journal of Applied Mathematics and Statistics, 55(2), 23-31.

- Chalikias, M., Lalou, P. & Skordoulis, M. (2016). Modeling a bank data set using differential equations: The case of the Greek banking sector. Proceedings of 5th International Symposium and 27th National Conference of H.E.L.O.R.S on Operation Research, Piraeus: Piraeus University of applied sciences, 113-116.

- Djaslim & Saladin (2006). Manajemen pemasaran: Edisi keempat. Bandung: Linda Karya.

- Erol, C., Kaynak, E. & Radi, E.B. (1990). Conventional and Islamic banks: Patronage behavior of Jordanian customers. International Journal of Bank Marketing, 8(4), 25-35.

- Fauzi & Ahmad (2016). Menkeu: Perkembangan bank syariah masih mini. Retrieved May 6, 2016, from http://bisniskeuangan.kompas.com/read/2016/05/16/170814526/Menkeu.Perkembangan.Bank.Syariah.Masih.Mini

- Ferdinand in Mariam Rani (2009). Pengaruh gaya kepemimpinan dan budaya organisasi terhadap kinerja karyawan melalui kepuasan kerja karyawan sebagai variabel intervening. Thesis: Universitas Diponegoro: Semarang.

- Gait, A. & Worthington, A. (2008). An empirical survey of individual consumer, business firm and financial institution attitudes towards Islamic methods of finance. International Journal of Social Economics, 35(11), 783-808.

- Ghozali & Imam (2008). Aplikasi analisis multivariate dengan program SPSS. Universitas Diponegoro: Jakarta.

- Haron, S. & Yamirudeng, K. (2003). Islamic banking in Thailand: Prospects and challenges. International Journal of Islamic Financial Services, 5(2), 1-11.

- Irfan & Fithri (2014). Studi preferensi nasabah non-Muslim terhadap jasa perbankan syari’ah. Jurnal Ekonomi Islam Republika, 23.

- Kuncoro & Mudrajat (2009). Metode riset untuk bisnis & Ekonomi bagaimana meneliti & Menulis tesis. Edisi 3: Jakarta, Penerbit Airlangga.

- Kusnendi (2008). Model-model persamaan struktural satu dan multigroup sampel dengan LISREL. Bandung: Alfabeta.

- Marbun, B.N. (2005). Kamus manajemen. [Dictionary of management]. Jakarta: Pustaka Sinar Harapan.

- Martono. (2010). Bank dan lembaga keuangan lain. Yogyakarta: Ekonosia.

- Naf’an. (2014). Pembiayaan musyarakah dan mudharabah. Yogyakarta: Graha Ilmu.

- Nunnally in Ghozali Imam. (2001). Aplikasi analisis multivariate dengan program SPSS. Badan Penerbit Universitas Diponegoro: Semarang.

- Puspowarsito (2008). Metode penelitian organisasi dengan aplikasi program SPSS. Bandung: Humaniora.

- Randy, W.R. (2008). Manajemen privatisasi BUMN. Jakarta: Elex Media Komputindo.

- Rasyid & Abdul. (2015). Apakah bank syariah hanya untuk Muslim? Retrieved January 25, 2017, from http://business-law.binus.ac.id/2015/01/29/apakah-bank-syariah-hanya-untuk-muslim/

- Sigit, W. & Ismaya. (2007). Kamus besar ekonomi. Bandung: Pustaka Grafika.

- Sinungan, Moch & Darsyah. (2000). Manajemen Dana bank. Jakarta: Rineka Cipta.

- Skordoulis, M., Alasonas, P. & Pekka-Economou, V. (2017). E-Government services quality and citizens satisfaction: A multicriteria satisfaction analysis of TAXIS net information system in Greece. International Journal of Productivity and Quality Management, 22(1), 82-100.

- Soegoto & Eddy, S. (2010). Enterpreneurship menjadi-pembisnis ulung (Edisi revisi) [Entrepreneurship, become a good entrepreneur]. Jakarta: Elex Media Komputindo.

- Sugiyono. (2011). Statistika untuk penelitian. Bandung: Alfabeta.

- Suharsimi, A. (2010). Prosedur penelitian: Suatu pendekatan praktik (Edisi revisi). Jakarta: Rhineka Cipta.

- Sukron. (2012). Faktor yang mempengaruhi minat nasabah non-Muslim menjadi nasabah di bank bni syari’ah cabang semarang. Jurnal IAIN Walisongo. 1.

- Wiwik, R.A. (2010). Pertimbangan, pengetahuan, dan sikap konsumen individual terhadap bank syari’ah mandiri di banyumas purwokerto. Jurnal Ekonomi Pembangunan, 11(2), 191-201.

- Yupitri, E. & Sari, R.L. (2012). Analysis faktor-faktor yang mempengaruhi non-Muslim menjadi nasabah bank syari’ah di Medan. Jurnal Ekonomi Dan Keuangan, 1(1), 1.

- Zaim, E. (2009). Membumikan pendidikan nilai. Bandung: Alfabeta.