Case Reports: 2019 Vol: 18 Issue: 2

McDonald's in Germany: Germans, Still Lovin' it?

Annalee Nuque-Joo, Ewha Womans University School of Business

Dohee Kim, Ewha Womans University School of Business

Seungho Choi, Ewha Womans University School of Business

Abstract

The factors in this paper aim to explain the decrease in revenues for one of McDonald’s international lead markets despite having a huge pool of assets, resources and knowledge in the fast food industry. The paper aims to analyze McDonald’s operations in Germany. In particular, this paper focuses on the importance of franchising strategies and market expansion of McDonald’s scale. This case contains concepts for senior level undergraduate and graduate students. This paper can be used for discussion on strategic management and international business classes.

CASE DESCRIPTION

The factors in this paper aim to explain the decrease in revenues for one of McDonald’s international lead markets despite having a huge pool of assets, resources and knowledge in the fast food industry. The paper aims to analyze McDonald’s operations in Germany. In particular, this paper focuses on the importance of franchising strategies and market expansion of McDonald’s scale. This case contains concepts for senior level undergraduate and graduate students. This paper can be used for discussion on strategic management and international business classes.

CASE SYNOPSIS

Despite an overall increase in revenue for other fast food restaurants in Germany, as well as aggressive regional expansion efforts by its parent McDonald’s Corporation, only McDonald’s Germany revenue and net income decreased dramatically compared to other fast food brands in Germany in 2012.

This paper’s findings show changing customer preferences in fast food dining, and rising competition from healthier and local brands led to a drastic -120% decrease in McDonald’s Germany’s revenue. Additionally, as they faced more criticism to provide healthier food while also matching local customers’ tastes, the brand was challenged to change their international strategy going forward.

Introduction

Arcadia, California-After seeing great success with their drive-in hotdog stand in the late 1930s, brothers Mac and Dick McDonald opened their very first burger-and-fries stand-alone restaurant in San Bernardino in 1948. The restaurant became popular for its consistent and high-quality burgers. This success was made possible by the brothers’ Speedy Service System, a standardized process where one employee was taught to perform only one step in a meal’s preparation for their entire shift. A few years after opening the stand-alone restaurant, the brothers met Ray Kroc, a sales agent who they had bought six new electronic multi-mixers from to use for the shakes they sold in the store. Realizing he was witnessing the growth of a potential business hit, Kroc offered to expand McDonald’s and become the brothers’ franchising agent. The McDonald brothers hesitated in fear an expansion meant risking the high-quality products associated with the McDonald’s brand. However, in 1954, Kroc finally convinced them and officially became the brothers’ business partner. Eventually, Kroc bought the restaurant from the brothers for 2.7 million dollars, with a hand-shake promise of 1.9% royalty to the brothers. In 1955, Kroc founded the McDonald’s Corporation and opened his very first Corporation-owned franchise in Illinois. In 1960, he then bought exclusive rights to the McDonald’s name and it’s Speedy Service System. The Speedy Service System was strictly enforced in all McDonald’s franchises to maintain the consistent and quality burgers that McDonald’s was known for. The Speedy Service System was eventually renamed into The System and has become the core of McDonald’s franchises in the US and all over the world.

Business Models And Strategies

The System: Suppliers, Employees and Franchises

Previously called the “Three-legged stool”, McDonald’s “system” is comprised of a network of suppliers, employees and franchises. As of year-end 2018, McDonald’s employed over 210,000 employees and operated a systematized franchise network of over 37,855 stores all over the world (McDonald’s Corporation, 2018). To manage and ensure effective application of their System, McDonald’s partners with local logistics companies that cover their major market segments’ logistics and operations. For instance, McDonald’s Europe market has partnered with HAVI Logistics for logistics services in Europe since 1981 (HAVI Marketing Analytics, 2015). Through their logistics providers, McDonald’s is able to leverage their huge network and produce standardized products at cheaper prices for their customers.

Suppliers-McDonald’s suppliers are composed of farmers and food manufacturers who provide ingredients for its food business and equipment suppliers for its kitchen and restaurant equipment needs. Farmers produce raw materials (meat, vegetable) and send them to food manufacturers who turn these materials into ingredients used for McDonald’s meals (frozen fries, patties). Distribution centers receive and store these ingredients, and only deliver to franchises on a per-request basis to minimize storage time and expenses. Coordination of all supplier activities are managed by McDonald’s Corporation’s (“company”) Restaurant Supply Planning departments, through an online McCommunications Network dedicated to the management of their global supply network (Birkinshaw, 2012). To maintain quality standards, McDonald’s sends third-party auditors to conduct on-site interviews, quality checkups and reviews of suppliers’ operations based on strict internal company standards.

Employees-McDonald’s employees are called crew members and are all recruited by individual franchise owners (franchisees). Due to varying sizes of its stores, there is no specific number of how many crew members are employed for each store. McDonald’s crew members are divided into three categories: salaried management, hourly paid management and hourly paid servers. Managers are responsible for tasks in sales and resource management, recruitment and training of crew members. The training provided to crew members is loosely based off of the original Speedy Service System (Royle, 2004). Although most training happens inside individual stores for crew members, McDonald’s Corporation operates a training center in Illinois called Hamburger University dedicated for its higher-level employees.

Franchises-The System allows McDonald’s Corporation to define franchising arrangements based on mixed ownership, shared revenues and standardized operating procedures. A typical franchise term is 20 years, and the three types of franchise contracts are conventional franchise, developmental license and foreign affiliate franchise. Under conventional franchise, the company owns the land and building, and a franchisee invests for the store equipment, seating, décor and additional business reinvestments over time. Under developmental license, the company does not invest in any capital. Licensees must provide capital for the entire business (finding land, building stores, recruitment and supply chain set-up), while the company receives upfront fees and royalty from sales. Lastly, the company has equity investments in foreign affiliated markets where they are able to receive a royalty fee based on a percentage of sales in invested stores. All three franchise types (Table 1) are operated by either one of two entities: McDonald’s Corporation or individual franchise owners (franchisees).

| Table 1: Mcdonald’s Corporation Franchise Type Number Of Mcdonald’s Stores By Franchise Type |

||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|---|

| Franchised | 27,075 | 27,882 | 28,691 | 29,544 | 30,081 | 31,230 | 34,108 | 35,085 |

| Conventional | 19,527 | 19,869 | 20,355 | 20,774 | 21,147 | 21,559 | 21,366 | 21,685 |

| Developmental License | 3,929 | 4,350 | 4,747 | 5,228 | 5,529 | 6,300 | 6,945 | 7,225 |

| Foreign Affiliate | 3,619 | 3,663 | 3,589 | 3,542 | 3,405 | 3,371 | 5,797 | 6,175 |

| Company operated | 6,435 | 6,598 | 6,783 | 6,714 | 6,444 | 5,699 | 3,133 | 2,770 |

| Total restaurants | 33,510 | 34,480 | 35,474 | 36,258 | 36,525 | 36,929 | 37,241 | 37,855 |

As expected of global brands such as McDonald’s, the company requires interested franchisees to satisfy specific requirements before being awarded a store. For example, McDonald’s stores in the USA must be “located in a corner or corner wrap with a signage on two major streets and/or signalized intersection” (Corporate McDonald’s, 2016). Other requirements include: Background checks and interviews of interested investors, proof of ability and resources, cash from non-borrowed resources, and proof of experience as a McDonald’s crew member (Corporate McDonald’s, 2016). Franchisees are allowed to own multiple stores as long as they meet those requirements.

Day-to-Day Operations

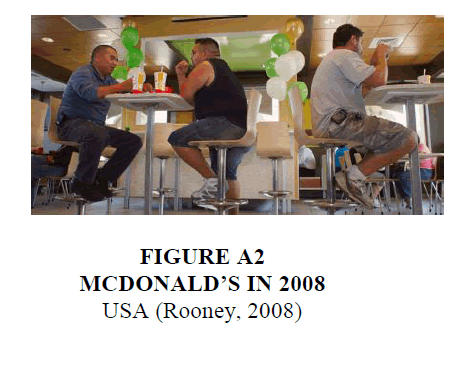

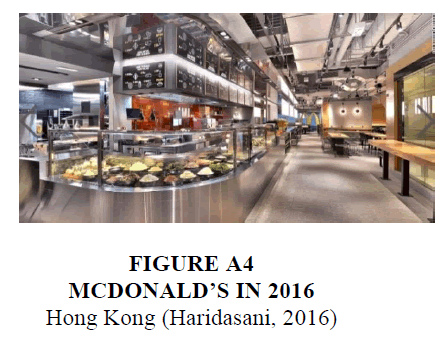

Historically, McDonald’s growth in the 1960s was often attributed to the urbanization of the US market through developments in automobile and highway systems (Nicolaides & Wiese, 2017). Equipped with better modes of transportation, more customers were able to eat out and access drive-through services while on highways. This meant good business for McDonald’s whose stores were often located in areas such as these. To cater to a growing customer base, it was important for McDonald’s stores to prepare menu items as quickly as possible while maintaining prices at affordable levels. Through the system, they were able to do so while also providing identical burgers, fries and beverage menu items to various types of customers all over the world. Consistently, store layout and designs also followed a “First In, First Out” theme related to quick customer turnover. Store furniture was made of plastic and is small in size to maximize restaurant space and foot traffic. However, changing consumer trends have pushed McDonald’s to start investing in more comfortable furniture for slower-eating customers. Especially in Europe where customers are seen as slow eaters than Americans, plastic chairs have been replaced with leather covered seats to make eating more comfortable (Patenaude, 2016). Other types of entertainment like free Wi-Fi and flat screen TVs were also introduced in stores (Appendix Figures A1-A4).

On top of their standard food operations, McDonald’s has been successful in positioning itself as an affordable coffee provider through its McCafé brand. McCafé was first conceptualized by a local Australian licensee in 1993. The licensee added additional coffee equipment into regular kitchen areas to sell hot coffee to breakfast customers. The initiative was later picked up by the company’s local Regional Corporate Team who aggressively expanded the coffee operations in Australia. By 2003, McCafé was the largest coffee shop brand in Australia and New Zealand (Balmer, 2014). Outside of Australia, the first McCafé store was opened in the US and some parts of Europe around the early 2000s (McDonald’s, 2001). Over the years, McCafé as a brand has since become one of the biggest in the world (Table 2). This growth may be attributed to the company’s initiatives to introduce McCafé as stand-alone stores and even having some regular franchises bake pastries in-house (Patten, 2016). McDonald’s Corporation has also started requiring franchisees to purchase new equipment for espresso machines (worth US $12,000) to keep up with new items on their McCafé menus (Close, 2016).

| Table 2: Top Ten Global Coffee Shop Chains Ranking Of Top Coffee Franchises By Sales (In Million Us $) |

||||

| Company | Country | 2015 | 2017 | CAGR |

|---|---|---|---|---|

| Starbucks | US | 21,095 | 21,300 | 0% |

| Costa Coffee | UK | 1,809 | 3,770 | 44% |

| Tim Hortons | Canada | 2,169 | 2,390 | 5% |

| Lavazza | Italy | 1,471 | 2,082 | 19% |

| McCafé | US | 1,462 | 1,049 | 15% |

| Gloria Jeans | Australia | 303 | 974 | 79% |

| Caribou Coffee | US | 311 | 933 | 73% |

| Dunkin Donuts | US | 811 | 861 | 3% |

| Coffee Beanery | US | 520 | 410 | 11% |

| Tully's Coffee | US | 440 | 242 | 26% |

Global Operations

Overview

Through the company’s system, McDonald’s is able to operate a vast global network of individual franchisees while still maintaining a strong brand image. As of 2018, McDonald’s operates in over 100 countries where 93% of stores are owned by individual franchisees (McDonald’s, 2018). Before 2015, their global franchisee network was segmented based on geographical proximity. In 2015, the company pursued a change in strategy which included organization restructuring and changes in market segmentation. Market segments of McDonald’s stores are shown in Table 3.

| Table 3: Market Segmentation Of Mcdonalds Stores Segmentation And Geographic Information Before And After 2015 Restructuring |

||

| Before 2015 (Geographical proximity) |

After 2015 (Similar market growth patterns) |

|

|---|---|---|

| Segment 1 | US (31% of stores in 2013) | US (38% of stores in 2015) |

| Segment 2 | Europe (40%) | International lead: Australia, Canada, France, Germany, UK (19%) |

| Segment 3 | APMEA: Asia Pacific, Middle East and Africa (23%) | High growth: China, Italy, Korea, Poland, Russia, Spain, Switzerland, Netherlands (16%) |

| Segment 4 | Other countries & Corporate: Canada, Latin America, Corporate (5%) | Foundational markets and corporate (28%) |

History and Global Expansion

Almost a decade after its establishment, McDonald’s first expanded into foreign markets through developmental franchise agreements in the Caribbean and Canada in the 1960s (Ahlers et al., 2017). This was the same period where Ray Kroc bought out the business from the McDonald brothers, who were skeptical of expansion outside the already successful US market. Now with full control of the business, Ray Kroc pursued aggressive global expansion initiatives. Under his leadership, the company pursued further expansion in Europe through joint venture agreements. The first European McDonald’s opened in the Netherlands and Germany in 1971. That same year, expansion into Asia followed where the company also entered joint venture agreements with Japanese businessmen.

Despite strict implementation of the system to standardize overall business processes, McDonald’s has encouraged global franchises to operate based on market demands. This means giving freedom to franchisees to develop menu items to match local markets’ tastes. It is through this freedom to develop new menu items that classics such as the Big Mac was born (developed by franchisee Jim Deligatti in 1967) and eventually became a permanent fix on menus all over the world (Klara, 2017). Globally, menu items vary across various food items: Burgers in Japan contain mashed potato and cabbage, while Hong Kong stores offer burgers with buns between rice cakes. Countries like the Philippines offer value meals with spaghetti and rice options, while India offers no beef burgers on the menu (Kelly, 2012).

Germany McDonald’s

Since the first franchise opened in Munich in 1971, Germany has grown to become McDonald’s biggest market segment in Europe. This growth was largely attributed to Denis Hennequin, McDonald’s Europe’s president who was of French descent. Using more than half of its global funding worth over US $1.1 billion, Hennequin shifted operations from the US’s famous drive-through dining experience to a more sit-down experience that Europeans were accustomed to. As discussed below, his expansion initiatives focused to satisfy the demands of the local market.

Industry highlights-In 2017; Germany’s food retailing market produced US $244 billion in revenues, and followed by France with US $181 billion (Atradius, 2018). This makes Germany the largest food and beverage retail market in Europe (GTAI, 2018). On top of this, it is also a market heavily focused on healthy and sustainable dining. As of 2017, Germany’s organic foods market reached US $13 billion in revenues. This makes it the largest organic foods market in Europe, followed by France (US $8 billion) and Italy (US $3 billion) (GTAI, 2018). This health-conscious mindset is supported by various surveys which show Germans choose “having too little exercise” as the number one vice they could have, even more so than “eating too many sweets” or “smoking too much” (STADA Arzneimittel AG, 2014). As the demand for organic and healthier living gained momentum in Germany, so did the rise of fast-food restaurants wanting to grow their market share? This meant more partnerships between fast-food restaurants and organic suppliers (many of whom were local in nature) to create healthier products. For McDonald’s Germany, they promoted their support for local suppliers by introducing more localized menu items, creating online videos and TV commercials centered on local farmers, and even changing their famous red-and-yellow logo to a green-and-yellow logo to appeal to health-conscious customers (Wheeland, 2009).

Menu-Apart from classic McDonald’s menu items, McDonald’s Germany also offers special German meals including: Brotchen, crispy bread rolls usually eaten for breakfast in Germany, Nuremburger, combination of burger and bratwurst (traditional pork sausage), and beer (the first McDonald’s market to offer alcohol in stores). The McRib, a barbecue flavored pork sandwich, became a permanent menu items in Germany despite being a seasonal item in other markets. To attract the mass market, McDonald’s Germany pursued price promotion initiatives such as Diene Basics series (“Basic Products”) where certain menu items were offered for 1 euro. To attract young and health conscious customers, McDonald’s launched the McB, McDonald’s Germany’s version of an organic burger. It cost around 10 euros and featured a 100% organic beef patty. McB patties were specially produced in uneven shapes to differentiate between standard McDonald’s patties that were round shaped and same in size. It was consistently advertised with the phrase “bio segel” (“organic label”), and employees wore aprons with phrases such as “ich arbeite im Bioladen” (“I work in an organic shop”) (Kohring, 2015). McDonald’s eventually stopped promotions for McB only a year later (Rauch, 2016).

Store design-As McDonald’s Germany’s popularity grew in Germany, McDonald’s Corporate started recognizing it as one of its lead markets and invested more into the country over time. To cater to more slow-eating customers in Europe, stores introduced more elegant interiors (e.g. more comfortable furniture) and different sized tables to cater to wide range of customer groups. Additionally, McDonald’s Germany also invested in eco-friendly infrastructure for its newer restaurants. For example, an eco-friendly restaurant called “EE-Tec” in Achim was designed to use energy efficient equipment (windmill, solar panels) and recycled materials for packaging and toilet paper (EE-Tec, 2009).

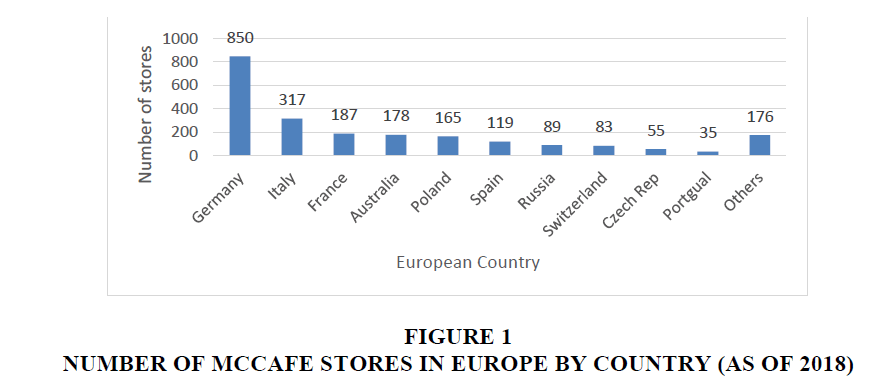

McCafé-Germany is recognized as one of the biggest markets for McCafé (Figure 1). The concept was first introduced in Cologne in 2003 and has since grown exponentially (Mussey, 2007; Nathaus, 2016). This rise in popularity may be due to European customers’ tendency to stay longer in fast food restaurants than their American counterparts (Patenaude, 2016). As of 2018, McCafé stores in Europe totaled to 850 stores (from 306 stores in 2007) (Statista, 2018).

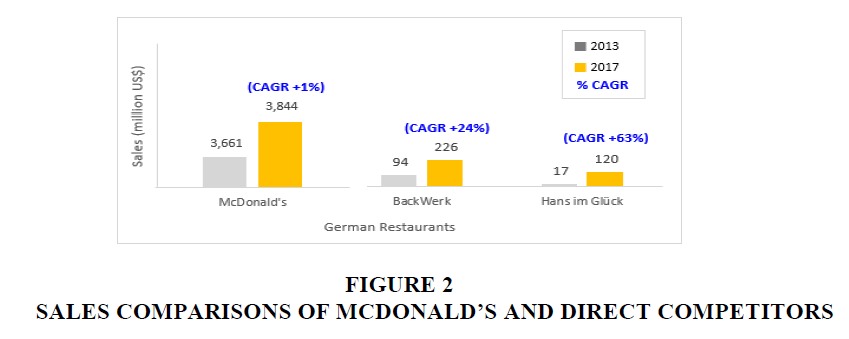

Competition-McDonald’s Germany maintained its status as the largest fast food restaurant in Germany for decades, accounting for 42% of total sales of Germany’s full-service restaurant industry in 2017 (Dehoga Bundesverband, 2017). However, as a brand that offered both full (i.e. dine-in) and quick-dining services (i.e. McCafé, drive-thru), McDonald’s faced competition from various local brands in Germany. Among the top 15 full service and quick restaurants in Germany, the most direct threat was seen from Hans im Glück and BackWerk. The two brands showed significant growth from 2013 to 2017, where growth rates reached 64% for Hans im Glück and 24% for BackWerk (McDonald’s grew 1% during the same period). Coincidentally, this was also the same period where McDonald’s saw a significant decrease in its overall revenues (growth in revenues shown in Figure 2, detailed information in Appendix Figure B2).

Hans im Glück was established by Thomas Hirschberger in Munich in 2010. The restaurant’s name comes from the Grimm Brother’s fairytale Hans im Glück (“Hans in luck”). The restaurant embodies this fairytale concept through its forest-themed interiors and fairytale themed menus. Their menus consist of a variety of breads, meats, salads, alcoholic and non-alcoholic beverages. Unlike traditional fixed meal seats provided in fast food chains such as McDonald’s, Hans im Glück allows customers to customize their meals and choose each of the elements of their food. Leaning more towards customization, this trait adds novelty to the customer experience. The brand emphasizes its use of fresh, natural and sustainable products for health-conscious customers. Despite having higher prices than regular fast food chains, the brand has grown rapidly over the years (Figures 3 and 4). The German Hotel and Restaurant Association (DEHOGA) categorizes Hans im Glück as a full-service (sit-down) restaurant.

BackWerk was established in 2003 in Essen and has since marketed itself as the first self-service franchise bakery in Germany (EQT, 2016). Initially, the restaurant focused on an affordable “self-service bakery” business model to grow its market share. In 2014, BackWerk changed its slogan to “Back Werk-iss frischer” (“BackWerk-eat fresher”) to promote the company’s efforts to provide healthier and local food offerings. This reflected changing customer behavior trends in Germany where studies showed fewer Germans ate breakfast at home due to increase of single households and work-related travel (Valora, 2017). BackWerk provided for this increased demand for to-go services by introducing more selections for bakery, products, beverages, sandwiches and beverages. Over time, the company introduced special items such as crispy chicken breast, meatballs and healthy salmon sandwiches. The company’s biggest success factor was their ability to provide a healthier substitute to typical fast food items, while allowing customer to create their own meals through self-service. Customers were allowed to directly pick ingredients from shelves filled with fresh vegetables and bread as slowly or as quickly as they would like. Restaurant-style tables and seats were also available for customers who want to spend more time inside the stores to eat. From 16 stores in 2003, the brand was able to expand and now has over 340 stores and over US $226 million in income for 2017 (Table 5). Through rapid expansion, BackWerk was able to reach the top three highest-grossing bakery brands in Germany of all time (BackWerk, 2016), with revenues growing to as much as 313% in less than a decade. In September 2017, BackWerk was acquired by Germany Company Ditsch, a pretzel and croissants franchising brand in Germany. BackWerk is categorized as a quick-service restaurant by the German Hotel and Restaurant Association (DEHOGA).

Challenges Faced

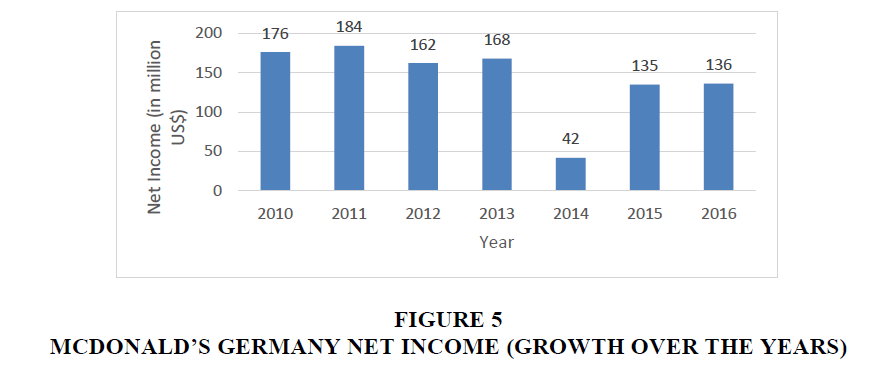

Among its European Markets, McDonald’s Germany experienced a dramatic decrease for its operating revenues in the periods between 2011-2015 (Figure 5 and Table 4). In fact, it was the first time ever since entering the Germany market that there was a negative year on year growth for the company in 2012 (Dehoga Bundesverband, 2015), with a drastic decrease following in 2014.

| Table 4: Mcdonald’s Germany Financial Data | ||||||||

| (in million US $) | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|

| Total Revenue | 245 | 252 | 260 | 263 | 229 | 212 | 210 | N/A |

| Operating Income | 189 | 194 | 195 | 199 | 169 | 159 | 161 | N/A |

| Net Income | 176 | 184 | 162 | 168 | 42 | 135 | 136 | N/A |

| YoY Growth % | - | 4% | (12%) | 4% | (75%) | 221% | 1% | N/A |

Notes: Data collected using Capital IQ terminal and annual reports (Appendix Table C1).

This sudden decrease in revenue cannot be blamed on an overall downwards trend in Germany’s fast food industry (Table 5). Reports showed a growing food industry in Germany during the same period. With the exception of McDonald’s and other global giants such as Burger King and Starbucks, local competitors showed positive growth rates during the same period. For instance, as shown in Table 5, McDonald’s Germany experienced negative year on year growth rates for the years 2013 (-5%) and 2014 (-3%), while the industry averaged growth rates of 6% and 5% respectively.

| Table 5: German Food Industry: Top 15 Rankings Total Income Before Tax Of Top 15 Restaurants In Germany (Million Us $) |

|||||||||

| Company Ranking | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|

| 1 | McDonald's | 3,563 | 3,773 | 3,835 | 3,661 | 3,555 | 3,637 | 3,702 | 3,844 |

| 2 | Burger King | 886 | 933 | 984 | 1,039 | 980 | 1,022 | 1,063 | 1,116 |

| 3 | LSG Sky Chefs | 809 | 843 | 862 | 889 | 933 | 973 | 947 | 916 |

| 4 | T&R Raststatten | 703 | 705 | 707 | 709 | 712 | 733 | 735 | 749 |

| 5 | Yum! (KFC/Pizza Hut) | 185 | 210 | 235 | 275 | 292 | 316 | 336 | 356 |

| 6 | Nordsee | 351 | 355 | 344 | 344 | 352 | 352 | 346 | 336 |

| 7 | Subway | 236 | 207 | 218 | 227 | 240 | 254 | 272 | 292 |

| 8 | Backer-Imbiss | 168 | 189 | 195 | 201 | 213 | 234 | 250 | 275 |

| 9 | Ikea-Gastronomie | 207 | 207 | 211 | 213 | 226 | 241 | 261 | 272 |

| 10 | PetitBistro (Aral) | 205 | 207 | 208 | 227 | 239 | 250 | 248 | 250 |

| 11 | Vapiano | 122 | 152 | 171 | 189 | 207 | 225 | 229 | 248 |

| 12 | SSP Deutschland | 217 | 218 | 215 | 206 | 193 | 201 | 218 | 242 |

| 13 | Joey's Pizza | 111 | 129 | 142 | 151 | 159 | 169 | 180 | - |

| 14 | BackWerk | - | 35 | 71 | 94 | 130 | 220 | 221 | 226 |

| 15 | Block Gruppe | 135 | 148 | 167 | 171 | 182 | 190 | 195 | 204 |

| - | Starbucks | 118 | 142 | 148 | 154 | 159 | 165 | 165 | 189 |

| - | Hans im Glück | - | - | - | 17 | 51 | 103 | 103 | 121 |

| McDonald’s Growth % | 4% | 6% | 2% | (5%) | (3%) | 2% | 2% | 4% | |

| Industry Growth % (Avg) | 4% | 5% | 11% | 6% | 5% | 10% | 3% | 4% | |

Company’s Effort

Refranchising

Although not specific to Germany, McDonald’s announced a worldwide Turnaround Plan in 2014 to improve its business (McDonald’s, 2014). The plan focused on refranchising initiatives to transfer control of company-owned stores to individual franchisees. A few years after initial announcement, franchised owned stores grew from 82% in 2012 to 92% in 2017. The shift to a more franchisee-heavy portfolio is part of efforts to provide more leeway for operational decisions for local franchisee owners. Additionally, it was an effort to increase margins and cut costs for headquarters. However, this may not be seen as a long-term solution. Pressure is high on individual franchisees due to burden of initial capital investments and expenses for day-to-day operations. Especially for a market such as Europe, the need for elegant interiors to cater to slow-eating customers would be added interior design costs on top of already high capital expenses. In terms of products, overall interest in McDonald’s products is relatively low compared to local brands that offer healthier and locally-produced substitutes.

McCafé Expansion

To cater to more slow-eating customers, McDonald’s consistently upgraded its McCafé operations expanding from in-store coffee services to elegant standalone stores. Efforts for McCafé expansion in Germany started in 2007 and were quick and direct. In under a year, separate sections were introduced inside 300 McDonald’s Germany stores (McDonald’s, 2007). Noteworthy is the fact that these aggressive expansion efforts were unique to Europe. To put this into perspective: During the same period, there were 13,000 McDonald’s stores in the US but not one had a separate McCafé section and counter (stores only had coffee machines). In contrast for Europe, most customers stayed in the stores to enjoy their coffee and less than half of the orders were to-go (Liu, 2009). Also, noteworthy are profiles of European customers. Studies showed McCafé customers were polar opposites of each other: young adults and adults over 50 (Nathaus, 2016). This showed McDonald’s efforts to attract various types of customers were working through an enhanced fast-food and café experience. In 2017, McCafé was the biggest coffee chain in Germany with more than 850 stores (Statista, 2018).

Customer Focused Menu Promotions

Although not specific to Germany, McDonald’s announced initiatives for improved restaurant experience for customers in their International Lead Markets (McDonald’s, 2015). These include self-order kiosks that allow customization of menus, table services and delivery promotions. Promotions for specific menu items were implemented as well such as one 1 euro burger and McB.

Partnerships with Local Suppliers

As previously mentioned, McDonald’s Germany has pursued efforts to work with local suppliers in Germany. To increase transparency and show their support for local farmers and suppliers, the brand has filmed introductory videos of their suppliers and posts the videos on their homepage. They also continuously emphasize their continued use of ingredients purchased from local suppliers-70% of their meat is from farms located in Germany, and 90% of the beef is from German slaughterhouses which follow strict guidelines and standards for quality. The rest of McDonald’s ingredients are imported from other EU countries because Germany is not able to provide for the quantity of supplies needed for its operations in the region (Zutaten, 2010).

Strategic Issue: Stuck In The Middle

Historically, McDonald’s success lies on its strict implementation of the System. Through the System, McDonald’s gained economies of scale by standardizing many areas of their value chain. However, recent changes in customer preferences and increasing competition have challenged McDonald’s current business model. Additionally, unsuccessful efforts to target different types of customers have led to a downhill performance for the brand. For instance, the unexpected short promotional period of McB may be due to the fact that it was just too expensive for younger customers who wanted affordable burgers from a brand they trusted. Even efforts to attract more sophisticated customers (i.e. introduction of organic products, health campaigns, incorporating McCafé sections in-store, table service) did not help as customers seemed to prefer other brands that had a distinctive premium value for quality dining and health (i.e. BackWerk, Hans im Glück)

Many of the initiatives pursued by McDonald’s show a shift in its global strategy to adapt a more localized strategy. However, McDonald’s standardized processes have restricted both headquarters’ and individual franchise owners’ ability to provide more flexible options for its customers. Even by changing its ownership structure and increasing the portion of individual franchisee owned stores, there is the increased risk of individual franchise owners not being able to meet strict requirements set by headquarters. This may lead to more negative customer experiences that headquarters may not be able to control. Overall, McDonald’s is in the verge of being stuck-in-the-middle in that they cannot identify what type of advantage works to create value for its business.

Case Body

This case shows that despite McDonald’s ability to finance global expansion, and despite having abundant resources and networks, increasing competition from distinct brands, and McDonald’s inability to identify what type of advantage worked for two distinctively different target markets led to a drastic decrease in revenue for one of their key markets. In its efforts to improve its business, the following questions remain.

Instructor’s Notes

What kind of strategy is McDonald’s pursuing for its global expansion?

Customers of the fast-food industry demand cheap and quick food on the go so businesses must provide for this demand. By developing effective standardize processes followed by all their stores; McDonald’s was able to provide the same burgers at low prices for all their customers. This reflects a global strategy: low pressure for local adaptation, high pressure for low cost, centralization and control from the headquarters. Their franchise business model consists of a wide network of independent franchisees that create value not only for independent markets but also for McDonald’s corporation as a whole. As their operations spread more all over the world, McDonald’s slowly integrated a transnational strategy because of increasing pressure to adapt to local markets taste in food. However, their integration of local foods items in their menu required additional operations and costs that made it difficult to retain the low-price philosophy Kroc intended for his company. Also, although the huge number of franchisees helped McDonald’s grow its global food print, it was difficult to control all independent franchisees and check on store operations and maintain efficient quality control.

What would happen if McDonald’s corporation decided to transfer 100% of fast-food operations to individual franchisees, and directly operate 100% of McCafé operations?

On average, 18-20% of system wide stores are operated by the company, while the rest are owned by individual franchisees. Refranchising efforts in 2015 helped make the portion of company owned stores smaller, and it also helped cut costs, and help shift focus to a value-creating part of its operations, ideally McCafé. As they did, McDonald’s Germany was able to see an increase in revenue and income. In that regard, a 100% transfer of fast-food operations looks like a good idea for McDonald’s, but their challenge will be to find franchisees who are willing to invest in a brand that is still stuck in the middle and lacks a clear customer segment to provide services for. Additionally, a 100% transfer of fast-food operations will require an overhaul of the System’s franchisee leg as it needs to define terms for McCafé counters operating inside regular McDonald’s restaurants, and stand-alone McCafé stores. There will also be the possibility of franchisees wanting to leave restaurant operations to pursue McCafé operations in fear of getting left with unhealthy and cheap restaurants. To avoid disputes with current networks of franchisees, McDonald’s must clearly define new terms for future contracts, provide support to handle increasing expenses and pursue refranchising and reimaging for restaurants separate from McCafé.

How would integration of McCafé into existing stores affect individual franchisee operations?

Integrating McCafé into existing stores may add to the burden of already high expenses for individual franchises. As explained in the franchise leg section of this paper, franchise contracts usually require individual franchise owners to pay for capital expenses on top of day-to-day expenses of the stores, plus royalty and rent expenses directed to the company. McCafé would mean good business for the corporation, but more requirements for McCafé operations meant more pressure for individual franchisees to meet requirements set by the corporation. These may mean stricter measures for financial performance, and more pressure to realign their supplier network to find smaller and local suppliers to fit localized menus. Additionally, despite the favorable performance by McCafé in Germany, low turnover ratio of McCafé customers may have negatively affected the sales of regular McDonald’s operations. Typically, time inside fast-food stores must be kept at a minimum for other guests to enter, eat and go. European dining, however, does not match this principle because of their slow-eating culture. Seeing full McDonald’s stores (where McCafé counters were found) may have prompted other potential customers to take their money somewhere else.

How should McDonald’s compete with local brands?

Instead of focusing on factors that their competitors compete in like ambience, image and taste, McDonald’s should focus on their core competency: offer cheap, fast food for young customers. To be able to do so, they have to decrease their operating costs. Their history and experiences have helped them achieve economies of scale to cut costs-a huge advantage that many of their competitors lack and which will take a significant amount of time to achieve. McDonald’s must allocate more of its revenues to value-creating activities and kick out non-valuable activities. They must evaluate which markets their products would reap more profit and align business activities to focus on those areas (i.e. price promotions, McCafé offerings).

Success factors of McCafé in Germany

McDonald’s has established a strong brand over the past decades. Their store locations, often found in highly frequented areas (e.g. highways, shopping areas) attract a large influx of customers to visit and eat at their stores. The close proximity to larger groups of customers allows for higher visitor counts in-store. McDonald’s is also known for highly standardized processes where all stores follow the same techniques and operate the same machineries. Not only does this make new store openings quicker and more efficient, it enables McDonald’s to provide the same customer experience for their customers in all of their stores globally. Lastly, McDonald’s offers a wide selection of menu items which can satisfy various types of customer needs.

How should McDonald’s Germany enhance their operations?

For such a large company known for quick and easy burgers, it would take a massive reorganization of suppliers and logistics to be able to integrate specific and localized initiatives into current standardized processes. To satisfy local tastes, McDonald’s would have to work with smaller, local suppliers, which translates to McDonald’s losing their high bargaining power to bigger suppliers because their purchasing volume would be spread over several smaller suppliers. This would eventually result in higher costs for ingredients and mirror an increase in prices for products. Going forward, the McCafé has potential to grow mainly due to its match with Europeans’ liking for slow-food dining experience. Refranchising efforts to integrate more McCafé counters into current restaurants, and also open stand-alone stores in high growth areas is a possible solution to help fuel growth.

Conclusion

Ray Kroc emphasized the company’s core principle as “quality”. However, his definition of quality and today’s customers’ perspective on quality are different. Kroc saw quality as producing the same looking burgers through standardization. Customers today see quality as local and health products. With more decision-making power given to individual franchisees, there is higher risk of mismanagement and low control from headquarters. Taking all of these into consideration, it is important for McDonald’s to not only improve the “food side” of the business, but also the “management” side to avoid disagreements with franchisees who want only the best services for local customers. With the right balance leveraging strengths of the System and a track record of being a well-loved brand in many markets all over the world, it will only take time before McDonald’s can get back on its feet and regain customer trust in its services again.

Appendices

Interiors Of Mcdonald’s Stores Over The Years (Global)

| Table B1: Rankings Of Full-And Quick-Service Restaurants In Germany | |||||||||||

| German Food Industry: Top 15 Rankings | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Top full-service (sit-down) restaurants in Germany | |||||||||||

| company name | Sales (million US $) | Stores (number of branches) | |||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2013 | 2014 | 2015 | 2016 | 2017 | ||

| 1 | McDonald's | 3,661 | 3,555 | 3,637 | 3,702 | 3,844 | 1,438 | 1,447 | 1,478 | 1,470 | 1,480 |

| 2 | Burger King | 1,039 | 980 | 1,022 | 1,063 | 1,116 | 695 | 695 | 694 | 701 | 708 |

| 3 | Yum | 275 | 292 | 316 | 336 | 356 | 163 | 172 | 191 | 218 | 236 |

| 4 | Nordsee | 344 | 352 | 352 | 346 | 336 | 334 | 332 | 320 | 316 | 310 |

| 5 | Subway | 227 | 240 | 254 | 272 | 292 | 590 | 598 | 610 | 641 | 670 |

| 6 | Edeka | 201 | 213 | 234 | 250 | 275 | 2,000 | 2,000 | 2,060 | 2,083 | 2,100 |

| 7 | AmRest (Starbucks) | 154 | 159 | 165 | 165 | 275 | 161 | 159 | 143 | 141 | 231 |

| 8 | Vapiano | 189 | 207 | 225 | 229 | 248 | 58 | 62 | 70 | 74 | 79 |

| 9 | BackWerk | 94 | 130 | 220 | 221 | 226 | 270 | 290 | 303 | 303 | 304 |

| 10 | Domino's (Joey's Pizza) | 151 | 159 | 169 | 180 | 181 | 210 | 209 | 212 | 214 | 207 |

| 11 | Marché Mövenpick | 132 | 133 | 139 | 149 | 158 | 27 | 26 | 96 | 100 | 103 |

| 12 | Le CroBag | 95 | 97 | 99 | 103 | 105 | 123 | 123 | 122 | 122 | 120 |

| 13 | Backfactory | 67 | 79 | 102 | 103 | 104 | 120 | 110 | 100 | 100 | 100 |

| 14 | Kamps | 83 | 91 | 92 | 94 | 98 | 464 | 477 | 467 | 459 | 453 |

| 15 | Hallo Pizza | 96 | 93 | 90 | 99 | 97 | 174 | 165 | 166 | 166 | 162 |

| Segment Total | 7,730 | 7,754 | 8,210 | 8,485 | 9,160 | 10,690 | 10,806 | 11,112 | 11,268 | 11,546 | |

| German Food Industry: Top 15 Rankings | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Top quick-service restaurants in Germany | |||||||||||

| company name | Sales (million US $) | Stores (number of branches) | |||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2013 | 2014 | 2015 | 2016 | 2017 | ||

| 1 | Block | 171 | 182 | 189 | 195 | 204 | 51 | 54 | 55 | 60 | 60 |

| 2 | L'Osteria | 51 | 79 | 104 | 136 | 173 | 22 | 32 | 45 | 58 | 70 |

| 3 | Kuffler | 144 | 144 | 144 | 138 | 139 | 48 | 47 | 46 | 42 | 42 |

| 4 | Hans im Glück | 17 | 51 | 103 | 103 | 120 | 13 | 30 | 43 | 44 | 50 |

| 5 | Gastro & Soul | 81 | 81 | 83 | 86 | 95 | 33 | 33 | 34 | 37 | 38 |

| 6 | Maredo | 122 | 112 | 105 | 93 | 83 | 56 | 56 | 51 | 48 | 43 |

| 7 | Laggner | 54 | 55 | 57 | 58 | 58 | 25 | 24 | 26 | 25 | 22 |

| 8 | Paniceus | - | - | - | - | 50 | - | - | - | - | 21 |

| 9 | Apeiron | - | - | - | - | 46 | - | - | - | - | 22 |

| 10 | Haberl | 47 | 45 | 45 | 43 | 45 | 10 | 10 | 10 | 9 | 9 |

| 11 | Hofbräu Betr.Blin | 26 | 29 | 36 | 42 | 42 | 3 | 5 | 7 | 9 | 9 |

| 12 | Barfüßer | 24 | 30 | 36 | 39 | 38 | 19 | 22 | 22 | 21 | 17 |

| 13 | Rauschenberger | 24 | 27 | 28 | 31 | 35 | 3 | 3 | 3 | 3 | 3 |

| 14 | AGG | 33 | 33 | 32 | 32 | 32 | 3 | 3 | 3 | 3 | 3 |

| 15 | Schweinske | 31 | 31 | 31 | 31 | 31 | 38 | 38 | 36 | 35 | 33 |

| Segment Total | 904 | 981 | 1,022 | 1,095 | 1,193 | 346 | 379 | 384 | 413 | 442 | |

| Table C1: Summary Of Selected Financial Data | ||||||

| Key Financials (in million US $) | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|

| Company-operated sales | 18,875 | 18,169 | 16,488 | 15,295 | 12,719 | 10,013 |

| Franchised revenues | 9,231 | 9,272 | 8,925 | 9,327 | 10,101 | 11,012 |

| Total revenues | 28,106 | 27,441 | 25,413 | 24,622 | 22,820 | 21,025 |

| Operating income | 8,764 | 7,949 | 7,146 | 7,745 | 9,553 | 8,823 |

| Net income | 5,586 | 4,758 | 4,529 | 4,687 | 5,192 | 5,924 |

| Cash provided by operations | 7,121 | 6,730 | 6,539 | 6,060 | 5,551 | 6,967 |

| Cash used for investing activities | 2,674 | 2,305 | 1,420 | 982 | (562) | 2,455 |

| Capital expenditures | 2,825 | 2,583 | 1,814 | 1,821 | 1,854 | 2,742 |

| Cash used for financing activities | 4,043 | 4,618 | (735) | 11,262 | 5,311 | 5,950 |

| Financial position at year end | 32 | |||||

| Total assets | 36,626 | 34,227 | 37,939 | 31,024 | 33,804 | 32,811 |

| Total debt | 14,130 | 14,936 | 24,122 | 25,956 | 29,536 | 31,075 |

| Total shareholders’ equity | 16,010 | 12,853 | 7,088 | (2,204) | (3,268) | (6,258) |

| Per common share | ||||||

| Earnings-diluted (US $) | 5.55 | 4.82 | 4.8 | 5.44 | 6.37 | 7.54 |

| Dividends declared (US $) | 3.12 | 3.28 | 3.44 | 3.61 | 3.83 | 4.19 |

| Market price at year end (US $) | 97.03 | 93.7 | 118.14 | 121.72 | 172.12 | 177.57 |

| company-Operated Restaurants | 6,738 | 6,714 | 6,444 | 5,669 | 3,133 | 2,770 |

| Franchised Restaurants | 28,691 | 29,544 | 30,081 | 31,230 | 34,108 | 35,085 |

| Total System wide restaurants | 35,429 | 36,258 | 36,525 | 36,899 | 37,241 | 37,855 |

| Franchised sales | 70,521 | 69,617 | 66,226 | 69,707 | 78,191 | 86,134 |

Note: Franchised sales are not recorded as revenues by McDonald's Corporation. Franchised sales are the basis on which the company calculates and records franchised revenues, and are indicative of the financial health of the franchise base.

| Revenues (By Market) | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|

| company-operated: (in million US $) | ||||||

| US | $4,512 | $4,351 | $4,198 | $3,743 | $3,260 | $2,665 |

| International Lead | 5,513 | 5,443 | 4,798 | 4,278 | 4,080 | 3,962 |

| High Growth | 6,322 | 6,071 | 5,442 | 5,378 | 4,592 | 2,848 |

| Foundational, Corporate | 2,528 | 2,304 | 2,050 | 1,896 | 787 | 538 |

| Total | $18,875 | $18,169 | $16,488 | $15,295 | $12,719 | $10,013 |

| Franchised: (in million US $) | ||||||

| US | $4,339 | $4,300 | $4,361 | $4,510 | $4,746 | $5,001 |

| International Lead | 3,023 | 3,101 | 2,817 | 2,945 | 3,260 | 3,638 |

| High Growth | 721 | 774 | 731 | 783 | 942 | 1,141 |

| Foundational, Corporate | 1,148 | 1,097 | 1,016 | 1,089 | 1,154 | 1,232 |

| Total | $9,231 | $9,272 | $8,925 | $9,327 | $10,102 | $11,012 |

| Total: (in million US $) | ||||||

| US | $8,851 | $8,651 | $8,559 | $8,253 | $8,006 | $7,666 |

| International Lead | 8,536 | 8,544 | 7,615 | 7,223 | 7,340 | 7,600 |

| High Growth | 7,043 | 6,845 | 6,173 | 6,161 | 5,533 | 3,989 |

| Foundational, Corporate | 3,676 | 3,401 | 3,066 | 2,985 | 1,941 | 1,771 |

| Total | $28,106 | $27,441 | $25,413 | $24,622 | $22,820 | $21,025 |

| % of company | 67% | 66% | 65% | 62% | 56% | 48% |

| % of Franchised | 33% | 34% | 35% | 38% | 44% | 52% |

Acknowledgement

Seungho Choi is a corresponding author (Tel: +82-2-3277-4138, choise@ewha.ac.kr).

References

- Ahlers, J., Carrascosa, R.M., Hermoso, L., Martinez, F.J., Ramudo, D., & Svensson, R. (2017). The internationalization process of fast food. BE International, Universidad Carloss III de Madrid. Retrieved from https://madi.uc3m.es/en/international-research-en/international-business-en-2-en/internationalization-process-of-fast-food/

- Atradius Market Monitor (2018). Market monitor food France 2018. Retrieved from https://atradius.fr/rapports/mm_food_dec_2018_eng_scr.pdf

- Australian chief breaks tradition. (2004). The age. Retrieved from http://www.theage.com.au/articles/2004/09/19/1095532175865.html?from=moreStories

- Backwerk: 350 Franchise Location to Open in 2016. (2016). Franchise journal, News from the franchise. Retrieved from http://www.franchiseportal.at/franchise-news/Backwerk-350.-Franchise-Standort-soll-noch-2016-eroeffnen.htm

- Balmer, C. (2014). Expandable brands: A guide to growing business locations while protecting your brand. Container Creative. Retrieved from https://books.google.co.kr/books?id=xO1UDQAAQBAJ&pg=PT107&lpg=PT107&dq=%22ann+brown%22+%22mccafe%22&source=bl&ots=qVy_Qmp4jD&sig=Xhy7yDcvXYhZhpcWQVI8RXQKdpA&hl=en&sa=X&ved=0ahUKEwiKtOGF9enXAhXIgLwKHZsLBAU4ChDoAQhDMAU#v=onepage&q=%22ann%20brown%22%20%22mccafe%22&f=false

- Birkinshaw, J. (2012). Reinventing management: Smart choices for getting work done. Wiley. Retrieved from https://books.google.co.kr/books?id=l0Ek_I5afyAC&pg=PT207&lpg=PT207&dq=%22Restaurant+Supply+Planning+Department%22&source=bl&ots=UxGXVJ7JG&sig=imSWZet_bfGiL78AFD6zSJ4_k&hl=en&sa=X&ved=0ahUKEwifyoGF8XXAhVRtJQKHcMCRkQ6AEISjAG#v=onepage&q=%22Restaurant%20Supply%20Planning%20Department%22&f=false

- Bowman, J. (2016). This is why McDonald's corporation is refranchising so many restaurants. The Motley Fool, Latest Stock Picks. Retrieved from https://www.fool.com/investing/general/2016/01/28/this-is-why-mcdonalds-corporation-is-refranchising.aspx

- Capell, K. (2008). A golden recipe for McDonald?s Europe. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2008-07-17/a-golden-recipe-formcdonaldseuropebusinessweek-business-news-stock-market-and-financial-advice

- Close, K. (2016). McDonald?s is buying $12,000 espresso makers for all of its US restaurants. Time, Money. Retrieved from http://time.com/money/4590891/mcdonalds-mccafe-starbucks-dunkin-donuts/

- Corporate McDonald?s. (2016). McDonald?s restaurant development. Retrieved from http://corporate.mcdonalds.com/mcd/real_estate/site_criteria/_jcr_content/genericpagecontent/download/file.res/USRD%202016%20Site%20Criteria%20Brochure.pdf

- Crumley, B. (2009). Supersizing Europe: The McDonald?s stimulus plan. Time. Retrieved from http://content.time.com/time/business/article/0,8599,1874034,00.html

- Dehoga Bundesverband. (2015). System gastronomie in Deutschland, 2015. Retrieved from www.dehoga-bundesverband.de/fileadmin/Startseite/01_UEber_uns/05_Fachabteilungen/01_Systemgastronomie/Broschuere/2015_FASG_Broschuere.pdf

- Dehoga Bundesverband. (2016). System gastronomie in Deutschland, 2015. Retrieved from https://www.dehoga-bundesverband.de/fileadmin/Startseite/06_Presse/Publikationen/Wirtschaftskraft_160629.pdf

- Dehoga Bundesverband. (2017). System gastronomie in Deutschland, 2015. Retrieved from https://www.dehoga-hessen.de/mein-dehoga/downloads/dl/get/dehoga-jahrbuch-systemgastronomie-in-deutschland-2017pdf/

- EE-Tec: McDonalds Opens World's only Energy Efficient Restaurant. (2009). Backnet. Retrieved from www.backnetz.eu/_REDAKTION/management/2009/20090427-MCD-EETEC.HTM

- EQT. (2016). EQT invests in German self-service bakery business backwerk. Retrieved from https://www.eqt.se/Newsroom/Press-Releases/2013/EQT-invests-in-German-self-service-bakery-business-BackWerk/

- Euromonitor. (2018). Fast food in Germany. Euromonitor International, Consumer Foodservice. Retrieved from http://www.euromonitor.com/fast-food-in-germany/report

- Final Transcript, MCD-Q1 2008 McDonald?s corporation earnings conference call [online transcript]. (2008). Wall Street Journal. Retrieved from http://www.wsj.com/public/resources/documents/MCD-Transcript-20080422.pdf

- Food Bev. (2015). German coffee shop market grows turnover by 2.2% annually. Food Bev, Beverage, Industries, Retail, Tea and Coffee. Retrieved from http://www.foodbev.com/news/german-coffee-shop-market-grows-turnover-by-2-2/

- GTAI (2018). Industry overview: The food & beverage industry in Germany issue 2019/2020. Germany Trade and Invest. Retrieved from https://www.gtai.de/GTAI/Content/EN/Invest/_SharedDocs/Downloads/GTAI/Industryoverviews/industry-overview-food-beverage-industry-en.pdf

- Haridasani, A. (2016). Big Mac with a side of quinoa? Inside the first McDonald?s Next. CNN, Experience Hong Kong. Retrieved from www.edition.cnn.com/2016/01/11/foodanddrink/hong-kong-mcdonalds-next/

- HAVI Marketing Analytics (2015). Mcdonald?s Europe recognizes Havi logistics Europe with supplier of the.... Retrieved from https://www.havi.com/press/mcdonalds-europe-recognises-havi-logistics-europe-supplier-year-award

- Heinze, K. (2016). German organic market grows to 8.6 billion euros. Organic Market Info, News in Brief Reports. Retrieved from www.organic-market.info/news-biofach/german-organic-market-grows-to-8-6-billion-euros.html

- Holtz, S. (2013). 7-Eleven: Fourth-Largest Seller of Coffee in the US. CSP, Foodservice. Retrieved from www.cspdailynews.com/category-news/foodservice/articles/7-eleven-fourth-largest-seller-coffee-us

- Holz, V.E. (2014). Hirschberger in luck. Gastronomist with visions, Suddeutsche Zeitung. Retrieved from http://www.sueddeutsche.de/muenchen/gastronom-mit-visionen-hirschberger-im-glueck-1.1868640

- Ingredients and Products, Suppliers and Partners. (2010). McDonald's Deutschland Inc, 2010. Retrieved from https://www.bigmac.de/mai/files/pdf/zutaten_und_produkte__lieferanten_und_partner2.pdf

- Kapalschinski, C. (2016). Hans no longer in luck. Handelsblatt, Handel Konsumguter. Retrieved from www.handelsblatt.com/unternehmen/handel-konsumgueter/mcdonalds-konkurrent-hans-nicht-mehr-im-glueck-/12896782.html

- Kelly, N. (2012). McDonald?s? local strategy, from El McPollo to Le McWrap Chevre. Harvard Business Review, International Business. Retrieved from https://hbr.org/2012/10/mcdonalds-local-strategy-from

- Klara, R. (2017). How a rogue McDonald?s franchisee invented the Big Mac and changed fast food forever. Adweek, Marketing Innovation. Retrieved from http://www.adweek.com/brand-marketing/how-a-rogue-mcdonalds-franchisee-invented-the-big-mac-and-changed-fast-food-forever/#/

- Kohring, B. (2015). May contain traces of fake: McDonald's new Bioburger. Bento, Green. Retrieved from www.bento.de/nachhaltigkeit/mcdonalds-bioburger-ist-gar-nicht-bio-29443/

- Lindel, D. (2015). Industry overview: The food & beverage industry in Germany. Germany Trade & Invest. Retrieved from https://www.gtai.de/GTAI/Content/EN/Invest/_SharedDocs/Downloads/GTAI/Industry-overviews/industry-overview-food-beverage-industry-en.pdf?v=5

- Liu, L. (2009). Coffee wars: McDonald's McCafe takes aim at Starbucks in Europe. Spiegel, Business. Retrieved from http://www.spiegel.de/international/business/coffee-wars-mcdonald-s-mccafe-takes-aim-at-starbucks-in-europe-a-651208.html

- McDonald?s Corporation. (2011). 2011 annual report of McDonald?s corporation. Retrieved from http://corporate.mcdonalds.com/content/dam/AboutMcDonalds/Investors/Investors%202012/2011%20Annual%20Report%20Final.pdf

- McDonald?s Corporation. (2012). 2012 annual report of McDonald?s corporation. Retrieved from http://corporate.mcdonalds.com/content/dam/AboutMcDonalds/Investors/Investor%202013/2012%20Annual%20Report%20Final.pdf

- McDonald?s Corporation. (2013). 2013 annual report of McDonald?s corporation. Retrieved from http://corporate.mcdonalds.com/content/dam/AboutMcDonalds/Investors/McDs2013AnnualReport.pdf

- McDonald?s Corporation. (2014). 2014 annual report of McDonald?s corporation. Retrieved from http://corporate.mcdonalds.com/content/dam/AboutMcDonalds/Investors/McDonalds2014AnnualReport.PDF

- McDonald?s Corporation. (2015). 2015 annual report of McDonald?s corporation. Retrieved from http://corporate.mcdonalds.com/content/dam/AboutMcDonalds/Investors%202/2015%20Annual%20Report.pdf

- McDonald?s Corporation. (2016). 2016 annual report of McDonald?s corporation. Retrieved from https://corporate.mcdonalds.com/content/dam/gwscorp/investor-relations-content/annual-reports/2016%20Annual%20Report.pdf

- McDonald?s Corporation. (2016). 2016 annual report of McDonald?s corporation. Retrieved from http://corporate.mcdonalds.com/content/dam/AboutMcDonalds/Investors/2016%20Annual%20Report.pdf

- McDonald?s Corporation. (2017). 2017 annual report of McDonald?s corporation. Retrieved from https://corporate.mcdonalds.com/content/dam/gwscorp/investor-relations-content/annual-reports/McDonald%27s%202017%20Annual%20Report.pdf

- McDonald?s Corporation. (2018). 2018 annual report of McDonald?s corporation. Retrieved from http://d18rn0p25nwr6d.cloudfront.net/CIK-0000063908/94ad07bd-66c3-433c-a81e-94f1587b0ed8.pdf

- McDonald?s Opens First McCafe in U.S.(2001). Entrepreneur. Retrieved from https://www.entrepreneur.com/article/40494

- McDonald?s Special Edition(2011). Retrieved from www.lilburner.wordpress.com/2011/06/13/mcdonalds-special-edition/

- McDonald?sFranchise Cost & Fees. (1955). Retrievd from https://www.franchisedirect.com/foodfranchises/mcdonalds-franchise-07030/ufoc/

- McDonald's Corporation (2015b). McDonald's Germany, Profiles. Retrieved from www.foodchainmagazine.com/2015/11/30/mcdonalds-germany/

- Mussey, D. (2007). Want a quiet cup of coffee in Germany? Head to McDonald's. Advertising age. Retrieved from www.adage.com/article/news/a-quiet-cup-coffee-germany-head-mcdonald-s/120236/

- Nathaus, K. (Ed.). (2016). Made in Europe: The production of popular culture in the twentieth-century. Routledge.

- Nicolaides, B., & Wiese, B. (2017). Suburbanization in the United States after 1945. Oxford Research Encyclopedias. Retrieved from http://americanhistory.oxfordre.com/view/10.1093/acrefore/9780199329175.001.0001/acrefore-9780199329175-e-64

- Patenaude, F. (2016). Why French people are thin (Hint: It's Not Their Diet). Renegate Health, Topics. Retrieved from www.renegadehealth.com/blog/eating-habits-france

- Patton, L. (2016). McDonald?s revamps its $4 billion McCafe brand. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2016-12-05/mcdonald-s-revamps-4-billion-mccafe-brand-as-it-lags-starbucks

- Phillips, M. (2014). Germany still can?t forgive McDonald?s for taking its ?1 cheeseburger away. Quartz, Where's the Beef? Retrieved from https://qz.com/211907/germany-still-cant-forgive-mcdonalds-for-taking-its-e1-cheeseburger-away/

- Rauch, M. (2016). Why McDonald?s first Organic burger McB flopped. LinkedIn. Retrieved from https://www.linkedin.com/pulse/mcdonalds-first-organic-burger-mcb-flopped-great-example-rauch

- Rooney, B. (2008). Patrons at a McDonald?s in Chicago. Retrieved from http://www.insideurbangreen.org/2008/11/mcdonalds-could-be-greener.html

- Rothman, L. (2015). The unlikely origin story of the egg McMuffin. Time, Business. Retrieved from www.time.com/4053832/history-egg-mcmuffin-mcdonalds-breakfast/

- Royle, T. (2004). Working for McDonald?s in Europe: The unequal struggle. Routledge.

- STADA Arzneimittel AG (2014). All the best: Germans? attitudes, desires and behavior towards health. STADA Health Report. Retrieved from https://www.stada.com/fileadmin/user_upload/B_stada.com/5_Media_Public_Relations/05_All-the-best-initiative/2014_STADA-Health-Report-2014.pdfs

- Statista (2018). Number of McCafé coffee shops units in Europe in 2018, by country. Retrieved from https://www.statista.com/statistics/515700/number-of-mccafe-stores-in-europe/

- Taylor, K. (2015). McDonald's to refranchise 3,500 restaurants worldwide. Entrepreneur, McDonald?s. Retrieved from https://www.entrepreneur.com/article/245809

- Taylor, K. (2017). McDonald?s newest menu items should terrify Starbucks. Business Insider, Retail. Retrieved from http://www.businessinsider.com/mccafe-new-gourmet-coffee-mcdonalds-2017-9

- Tdaxp. (2006). Chinese fast food. Retrieved from http://www.tdaxp.com/archive/2006/05/28/chinese-fast-food.html

- Thompson, M. (n.d). McDonald?s. Franchise Location Requirements. Chron, Small Businesses, Business Models & Organizational Structure. Retrieved from www.smallbusiness.chron.com/mcdonalds-franchise-location-requirements-4045.html

- Trefis, T. (2016). Here is why McDonald?s is increasing focus on McCafe. Nasdaq. Retrieved from http://www.nasdaq.com/article/heres-why-mcdonalds-is-increasing-focus-on-mccafe-cm718236

- Trotter, G. (2015). McDonald?s to line Germany?s autobahn with 100 restaurants. Chicago Tribune, Business. Retrieved from http://www.chicagotribune.com/business/ct-mcdonalds-autobahn-0724-biz-20150724-story.html

- Valora. (2017). Investor?s day: Acquisition of BackWerk and expansion of production capacity. Retrieved https://www.valora.com/media/investors/documents/en/presentations/2017/2017_investors_day_long_en.pdf

- Wheeland, M. (2009). McDonald's new green strategy extends to its signage. Green Biz. Retrieved from https://www.greenbiz.com/blog/2009/11/24/mcdonalds-new-green-strategy-extends-its-signage