Research Article: 2021 Vol: 20 Issue: 2S

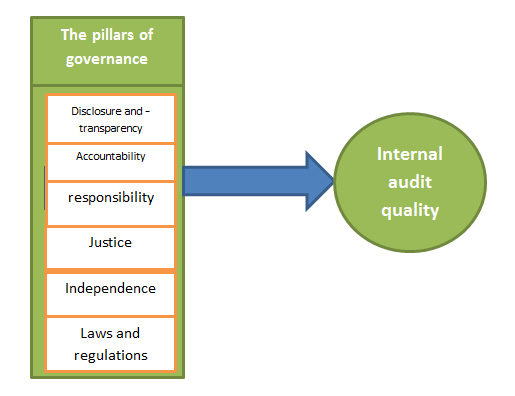

Measuring the Impact of Governance Pillars on the Auditing Quality

Alaa Saleh Abdallah, General Directorate for Education of Thi – Qar

Mohammed zuhair majeed, Imam Jaafar Al-Sadiq University

Ahmed Mohammad Hamzah, Summer University

Keywords

Pillars of Governance, Auditing Quality, Regulatory Systems, Corporate Administration.

Abstract

This study aimed to measure the impact of applying the pillars of corporate governance on the quality of internal auditing in industrial companies listed on the Iraq Stock Exchange, and the amount (114) companies the results of the study concluded that the implementation of corporate governance pillars (disclosure, accountability, straightforwardness, reasonableness, duty, autonomy, laws and guidelines) has an impact, collectively and separately, on the quality of internal audit in these companies. The study recommended the importance of the Iraqi industrial companies continuing to adhere to the application of corporate administration rehearses because of their unmistakable effect on the nature of inside reviewing.

Introduction

The importance of corporate governance emerged as a result of the economic and financial crises that affected many organizations around the world. It was found that the most important causes of the crises that led to the collapse of these organizations are due to financial and administrative corruption and weak regulatory systems. Hence the need for procedures to be developed and implemented by those responsible for managing these organizations to preserve the rights of the concerned gatherings and accomplish responsibility and oversight all the more adequately, as compelling corporate administration prompts guarantee the precision of monetary reports, for example, the report on inside control strategies and the report. Revealing the monetary outcomes and the viability of inside control strategies. Internal auditing is considered as the administrative tool that can be relied upon in organizing the movement of things, according to the paths that are set for them to achieve the required goals. Organizations have given the internal audit function great attention, believing in the importance of the services performed by this function. Therefore, developing the performance of internal auditors and upgrading the quality of internal auditing has become extremely important to reach the desired goals of contemporary business organizations. Hence, this study, which examines the relationship between the foundations of corporate governance and the quality of internal auditing, came out.

Literature Review

The need for institutional governance has emerged in many advanced and emerging economies during the past few decades, especially in the wake of the economic collapses and financial crises that have occurred in many countries, which prompted the world to pay attention to governance (Al-Essawi, 2003). The theoretical and historical basis for governance is due first to the agency theory, which first appeared to the Americans Berls and Means in 1932, who saw that there is a division between the responsibility for organization's capital and the cycle of control and oversight inside the organizations, and this partition has suggestions for the level of the organization's presentation (Fateh & Aishy, 2008). The Global Account Company has characterized administration as: "the framework by which organizations are overseen and their organizations are controlled” (Alamgir, 2007). The Organization for Economic Cooperation and Development defined it as: “a set of relationships among those in charge of the company’s management, the board of directors, shareholders, and other stakeholders” (Freeland, 2007). Williamson (1999) believes that corporate governance is a strategy adopted by the organization in its endeavor to achieve its main objectives. Given the increasing interest in institutional governance, many institutions have been keen to study, dissect and set explicit principles for its execution. Among these foundations are the Association for Financial Collaboration and Improvement, the Bank for Global Settlements addressed by the Basel Council, and the Worldwide Money Company of the World Bank. Institutional administration looks to ensure the privileges of investors, accomplish equity, secure the interests of different gatherings, give data and the respectability of correspondence channels, and characterize the technique of the foundation (OECD, 1999).

Numerous sorts of writing have shown that corporate administration depends on a bunch of fundamental columns to accomplish its objectives:

Disclosure & Transparency

Transparency means providing information to protect the future of shareholders and for making society recognize that the organization can fulfill its obligations (Japan Committee, 2001). Transparency is an important pillar to ensure fairness, integrity, and confidence in the procedures of managing organizations and managing their members (Khoury, 2003).

Accountability

This means that there will be continuous follow-up and evaluation of management by the concerned parties related to the organization, namely shareholders, workers, and society, (Fawzy, 2003) by providing a supervisory structure within the organization represented by independent audit committees and auditing bodies. Procedures that are formed to carry out their duties independently (Matar, 2003).

Responsibility

It means that the company has an ethical message that it must perform in society and that managers recognize that they have duties towards protecting the environment and towards employees and improving the services provided to them (Carroll, 2003).

Justice

It means respecting the rights of the stakeholders in the company, and distributing tasks, duties, and responsibilities among workers based on fairness and equality among them (SOCP, 2007).

Independence

It is a column that intends to lessen or kill irreconcilable situations by framing free panels and selecting evaluators and not permitting any impact from any gathering to control or impact the choices of the Directorate (El-Khoury, 2003; Jane, 2003).

Laws and Regulations

It means the overlapping of institutional governance rules in numerous laws, for example, corporate laws, monetary business sectors, banks, bookkeeping and inspecting, and different laws and enactments that explain the rights and obligations of investors (Zingales, 1997).

The inside review work assumes a significant part in the administration interaction, as it improves this cycle by expanding the capacity of residents to consider the organization responsible. Through the exercises they do, inner evaluator’s increment validity, reasonableness, improve the conduct of representatives working in organizations and lessen the dangers of authoritative and monetary debasement (Archambeault, 2002). The professional and regulatory bodies have recognized the importance of the internal audit function in the governance process and the interrelationship between them. The Cadbury committee, for example, emphasized the importance of the internal auditor's responsibility in preventing and detecting fraud and fraud. For this function to achieve its objectives, it should be autonomous, efficient, and dependent on its enactment. Thus, the freedom of this capacity is fortified when it reports straightforwardly to the Review Board of trustees and not to the administration. Likewise, the adequacy of the review board of trustees may increment when it can circulate the inner review staff to get significant data on issues explicit to the organization, for example, fortifying the inside control framework and the nature of the bookkeeping arrangements utilized (Cohen et al., 2004) as well as performing governance. For companies to ensure the exactness of monetary reports, for example, the report on inside control methods and the report on monetary outcomes, and the adequacy of interior control techniques (IIA, 2003).

Quality is defined characterized as the degree of similarity with necessities, as associations look to screen execution, exercises, and every day work to arrive at the most extensive level of value, by decreasing mistakes and identifying deviations in a way that prompts addressing the requirements of the administration (Dres, 2010). The quality of internal auditing is based on the great execution of the interior control framework, just as the propriety of the applied bookkeeping framework, to arrive at the fitting viability and effectiveness in tasks and limitations on a continuous premise inside the association to serve its targets and ensure resources (Al-Qadi, 2008). The internal and external auditing standards also talked about the necessary factors to determine and ensure the quality of internal auditing. The list of auditing standards No. 65 issued by the American Institute of Certified Public Accountants (AICPA 1991) indicated that the quality factors of the internal audit function include eligibility, which is measured through academic qualification and certificates. Professionalism, objectivity, which is measured by the entity to which internal audit reports are submitted, the entity responsible for appointing and dispensing with internal auditors, and the quality of performing tasks, which are measured through the accuracy and adequacy of audit programs and the scope of the audit. As for the quality factors of the internal audit function according to the standards issued by the Institute of Internal Auditors. It was represented by independence, objectivity, professionalism, and due diligence (IIA, 2003b).

The study problem can be confined to an attempt to answer the following main question:

Does the use of the establishments of corporate administration addressed by divulgence, straightforwardness, responsibility, obligation, reasonableness, freedom, laws and guidelines, affect the nature of inward examining in the modern organizations recorded on the Iraq Stock Trade?

The study is based on the main hypothesis that:

HO There is no statistically significant effect of implementing the foundations of corporate governance represented by disclosure, transparency, accountability, responsibility, fairness, independence, laws and regulations, on the quality of internal auditing in industrial companies listed on the Iraq Stock Exchange.

Research Methods

The main purpose of this paper is to measure the impact of the pillars of governance on internal audit quality. Auditing and account managers in 163 industrial companies listed on the Iraq Stock Exchange are selected based on comfortable sampling. About 750 questionnaires were distributed to managers and after one month, only 645 valid responses were received, with a response rate of approximately 86 percent. A five-point Liker survey response scale was used for each answer. Statistical methods were used within the Statistical Program for Social Sciences (SPSS) to process the data obtained through the field study, as the following statistical methods were used: the arithmetic mean, percentages, and standard deviation, as well as multiple and simple regression analysis with the F-test using the ANOVA table. To ensure the validity of the questionnaire as a tool for collecting the necessary data for the study, and the extent of reliability on it was tested using the Cronbach Alpha coefficient, and the reliability of the questionnaire according to the Cronbach Alpha criterion reached (96.64%), which is an excellent ratio for the approval of the results (Malhotra, 2003). The accepted generalization of the results of such studies is (60%).

Results and Discussion

To test the hypothesis of the study, we must:

First, know the arithmetic mean and standard deviation was used to find out the effect of the foundations of corporate governance (disclosure, transparency, accountability, responsibility, fairness, independence, laws, and regulations) on the quality of internal auditing, which is shown in Table (1)

| Table 1 The Arithmetic Means and Standard Deviations of The Pillars of Governance |

|||

|---|---|---|---|

| governance pillars | arithmetic mean | standard deviation | Level of importance |

| Disclosure | 3.7661 | 0.9652 | High, |

| Transparency | 3.8267 | 0.8887 | High |

| Accountability | 3.7947 | 0.9263 | High |

| Responsibility | 3.8684 | 0.9443 | High |

| Fairness | 3.3087 | 1.1883 | High |

| Independence | 3.5624 | 0.8043 | medium |

| Laws and regulations | 3.9561 | 1.0659 | High |

| The overall average | 3.6947 | 0.9547 | High |

Table No. (1) Indicates that all levels of importance for the pillars of governance had a high level of influence, except for the independent variable, which came at a medium level. The general result in this aspect indicates that there is a high level of influence of the pillars of governance on the quality of internal auditing in the industrial companies listed on the Iraq Stock Exchange from the respondents' point of view, as the general arithmetic mean reached (3.6947), while the standard deviation reached (0.9547). This result is consistent with the outcome of the study of (Issa, 2008), which showed that increasing the objectivity of internal auditors by increasing the degree of governance pillars leads to an increase in the quality of the internal audit function.

Second: Utilizing various straight relapse investigations to discover the impact of the institutional administration columns (exposure, straightforwardness, responsibility, obligation, decency, autonomy, laws, and guidelines) on the nature of inward review.

It is evident from the data contained in Table No. (2) that there is a measurably critical effect of the relative multitude of mainstays of institutional administration (divulgence, straightforwardness, responsibility, obligation, decency, autonomy, laws and guidelines) on the nature of the inward review, as the numerous relationship coefficient R came to (0.647). As for the coefficient of determination, R2, it explained a percentage (0.42) of the variance in the dependent variable, meaning that the value of (42%) of the changes in the quality of internal audit resulted from the change in the corporate governance pillars combined (disclosure, transparency, accountability, responsibility, fairness, and independence Laws and regulations). The significance of this effect confirms the calculated F value of (2.29), which is a function at a significant level (0.05).

| Table 2 Results of Multiple Regression Analysis Of The Pillars Of Corporate Governance And Internal Audit Quality |

||||||

|---|---|---|---|---|---|---|

| Dependent Variable | (R) | (R2) | F Calculated | ß Regression coefficient |

Sig* Indication level |

|

| Internal audit quality | 0.647 | 0.42 | 2.29 | Disclosure and Transparency | 0.262 | 0 |

| Accountability | 0.151 | 0 | ||||

| Responsibility | 0.133 | 0 | ||||

| Fairness | 0.239 | 0 | ||||

| Independence | 0.144 | 0 | ||||

| Laws and regulations | 0.251 | 0 | ||||

The results of the analysis of variance shown in Table No. (3) Confirm the above, as the calculated F value reached (2.999), which is greater than its tabular value of (2.29) at the level of significance (0.05). Accordingly, it rejects the nihilistic hypothesis and accepts the alternative hypothesis which states that there is a statistically significant effect of applying the foundations of institutional governance represented by divulgence, straightforwardness, responsibility, obligation, decency, autonomy, laws and guidelines, on the nature of inward inspecting in mechanical organizations recorded on the Iraq Stock Trade

| Table 3 Results of Anova Analysis Of The Impact Of Institutional Governance Pillars |

||||

|---|---|---|---|---|

| Variable | Computed F Value | Tabular F Value | Level Of Significance Sig | Result |

| Governance pillars | 2.999 | 2.29 | 0 | Refusal |

Results

The most important results of the study can be summarized as follows:

1. Corporate governance represents the confluence of sound practices and procedures, and these procedures and practices operate by binding standards and rules that govern them and aim to ensure that there is no contradiction between the strategic objectives of the company and the method of work of management in achieving those goals.

2. The inside review enhances the organization through the capacities that it has become to perform inside the structure of corporate administration, which incorporates giving data to the board at all levels, assessing the interior control framework, hazard the executives, and the organization's obligation to the standards of administration.

3. The consequences of the investigation demonstrated that the use of the mainstays of corporate administration joined (revelation, straightforwardness, responsibility, duty, decency, freedom, laws and guidelines) affected the nature of inner reviewing in mechanical organizations recorded on the Kuwait Stock Trade, as the estimation of the assurance factor (R2) reached 0.42).

References

- Alamgir, M. (2007). Corporate governance: A risk perspective, paper presented to corporate governance and reform: Paving the way to financial stability and development.

- AICPA. (1991). The auditors' consideration of the internal audit function in an audit of financial statements, statement on auditing standards No. 65. New York, NY: AICPA.

- Al-Essawi, I. (2003). Development in a changing world: A study in the concept of development and its indicators. Cairo: Dar Al-Shorouk Publishing.

- Al-Tamimi, H. (1998). Introduction to auditing: From a theory and practical standards. Amman: Kahlon Books Center.

- Al-Qadi, H. (2008). Internal audit, (First Edition). Damascus: Damascus University Publications.

- Archambeault, D.S. (2002). The relation between corporate governance strength and fraudulent financial reporting: Evidence from SEC enforcement cases. USA: Prentice-Hall International, Inc.

- Carroll, A.B. (2003). The pyramid of corporate social responsibility business ethics and social responsibility. Retrieved from http://www.CSR.

- Catherine, L.K.H., & Sullivan, J.D. (2003). Afforesting the corporate governance in the development and rising and transitional economies. Retrieved from www.cipe.orgtopic/coruption.

- Cohen, J., Krishnamoorthy, G., & Wright, A. (2004). The corporate governance mosaic and financial reporting quality. Journal of Accounting Literature, 43(1), 33-34.

- Dardas, K.W. (2010). The impact of providing internal audit service from external bodies on the quality of internal auditing in companies listed on the Amman stock exchange: Field Study.

- Fatih, D., & Aashi, B.B. (2008). Corporate governance as a tool to ensure the truthfulness of financial information and accounting systems and their impact on the level of market performance. Amman, Jordan: Applied Science Private University.

- Fawzy, S. (2003). Assessment of corporate governance in Egypt. Egypt: The Egyptian Center for Economic Studies.

- Freeland, C. (2007). Basel committee guidance on corporate governance for banks. Paper presented to: Corporate governance and reform paving the way to financial stability and development.

- Gill, A. (2003). Corporate governance in credit Lyonnais S.A (CLSA), Association for investment and Research. Retrieved www.clsa.com.

- Guy, D.M., Alderman, W.C., & Winters, A.J. (1999). Auditing, (5th Edition). USA: Harcourt Brace & Company.

- Hermanson, D.R., & Rittenberg, L.E. (2003). Internal audit and organizational governance. The institute of internal auditors research foundation.

- IIA. (1999). Exposes new internal audit definition. Internal Auditor, 56(1), 13-14.

- IIA. (2003). Simply good business. Retrieved from http://www.theiia.org/ecm/guideframe.

- IIA. (2003b). International standards for the professional practice of internal auditing. Retrieved from http://www.theiia.org/ecm/guideframe.

- Issa, S.K.M. (2008). Factors determining the quality of the internal audit function in improving corporate governance quality: With an applied study. Journal of the Faculty of Commerce for Scientific Research, 1(45), 1-57.

- Jane, F.M. (2003). Independence and objectivity: A framework for research opportunities in internal auditing. The Institute of Internal Auditors Research.

- Japan committee. (2001). Corporate governance forum, japan corporate governance committee, revised corporate governance principles. Retrieved from http:// www.Japan.org.

- Joshua, R. (2006). A proposed corporate governance reform: Financial statements insurance. Journal of Engineering and Technology Management, 23(1-2), 130-146.

- Jumaa, A.H. (2003). Institutional control and dimensions of development in the context of the practice of the internal auditing profession: The Jordanian association of certified public accountants, the fifth professional scientific conference, under the slogan of Institutional Control and Establishment Continuity. Amman, Jordan.

- Khoury, N.S. (2003). The accounting profession between financial stumbling and institutional control in companies. United Arab Emirates: Al Bayan Newspaper.

- Kuwait Stock Exchange. (2010). Public relations department. Annual bulletin.

- Malhotra, N. (2003). Marketing research, (4th Edition). Englewood Cliffs, NJ: Prentice-Hall, Inc.

- Mangena, M., & Pike, R. (2005). The effect of audit committee shareholding, financial expertise and size on interim financial disclosures. Accounting and Business Research, 35(4), 327-549.

- Matar, M. (2003). The role of disclosure of accounting information in promoting and activating institutional arbitration. The Jordanian Association of Certified Public Accountants, the Fifth Professional Scientific Conference. Amman: Jordan.

- Matar, M., & Noor, A.N. (2007). The extent of Jordanian public shareholding companies’ commitment to the principles of corporate governance: a comparative analytical study between the banking and industrial sectors. Jordanian Journal of Business Administration, 3(1), 46-71.

- Messier, Jr W.F. (2000). Auditing & assurance services: A systematic approach, (second edition). New York: McGraw-Hill Companies, Inc.

- OECD. (1999). Principles of corporate governance, organization for economic co-operation and development publications service. Retrieved from http://www.oecd.org.

- Rezaee, Z.K., & Mimmier, G. (2003). Improving corporate governance: The role of audit committee disclosures. Managerial Auditing Journal, 18(6/7), 530-537.

- Saudi organization for certified public accountants, (2007). Professional conduct and ethics guide.

- Williamson, Q.E. (1999). The mechanism of governance. Oxford: Oxford University Press.

- Zewailf, I., & Al-Jawhar, K. (2007). The role of adherence to the elements of internal control in strengthening the pillars of institutional control. Journal of Research and Human Studies, 232-258.

- Zingales, L. (1997). Corporate governance. Retrieved from http://www.theiia.org.