Research Article: 2021 Vol: 20 Issue: 6S

Mediating Role of Internal Control among the Perceived Business Risk and Organization Performance

Akmal Shahzad, PMAS Arid Agriculture University

Manzoom Akhtar, University Institute of Management Sciences, PMAS Arid Agriculture University

Sarah Qaim, Foundation University Islamabad

Mumtaz Ali, Federal Urdu University Arts Science and Technology

Numair Ahmed Sulehri, Foundation University Islamabad

Taseer Salahuddin, Government Sadiq College Women University

Abstract

The rapid changes in technology and globalization leads to develop risk management framework. Therefore, in this study author investigate mediation effect of internal controls among the perceived business risk and financial performance of organization. Questionnaire distributed among financial professionals of selected industries. 204 responses received out of 351 distributed questionnaires. The results suggest that performance of organization has a significant positive relationship with all component of perceived Business risk (PBR) such as economic factors, financial indicators, technological change, political uncertainty and market competition. It is also found that internal controls mediate among the component of PBR and organization performance. The findings of this study provide meaningful insights for managers, which used generally by any organization as a guideline to improve the organization performance. In future, this study may also be repeated with secondary data as the perception base measurement of variables may open to bias.

Keywords

Perceived Business Risk, Organization Performance, Internal Controls, Risk Management

Introduction

Business environment is dynamic rather than static. It becoming more complex, nifty and ambiguous in current era as fast revolution in technology, globalization as well as other factors. Therefore, business activity become complex and challenging as compared to last century. The increasing pace of changes and globalization both put risk base control high on the agenda for companies. As per Welch & Welch (2005), inclusive scanning of business indicates that the external business environment for any organization filled with uncertainty and risk. The management has to comprehend the external business environmental factors in order to effectively deal with risk and to improve the organization's performance. Irrespective of sector, organization deal with rapid change in external business environment, which influence firm performance (Hitt, Ireland, Sirmon & Trahms, 2011). Therefore, a comprehensive risk management framework needs to adopt by business organization to survive in market. In current scenario, the management of risk is one among the foremost important issues facing organizations today. The Cadbury Corporate Governance Committee (1992) declare identification of key business risk timely, its impact on business financial and prioritizing resources allocation as key factor for the effectiveness of their system of internal controls. It is therefore, organizations have to perceive, cope and control various variables which contributed to risk and uncertainty. As ability to perceived risk vary from organization to organization depend on risk culture and companies view point toward risk, therefore each organization have different internal controls to balance the risk.

In dynamic business environment, balancing risk is an efficient approach to handle corporate risk (Berinato, 2004). The efficient RM not only reduces the influence of risk on business operation but also generate several beneficial prospects for organizations in uncertainty. The aforesaid motivate the management to dig out different techniques to cope with risk in business operation. A business have to survive in volatile business environment, therefore every organization try to exclude the risk (Renn & Klinke, 2016). It is well established fact that risk only be reduced by different tools and techniques but cannot fully eliminate from business. Akpoviroro (2018) describe the business environment as anything which can affect the business activity e.g. strategy, performance, process and decision. Key component of business environment are political, economical, technological and legal, he added. A business may face various jeopardizes arises from external business environment e.g. technological, political, legal and many other fluctuations (Kannadhasan, Aramvalarthan & Tandon, 2013; Saiful, 2017). In general, notation, uncertainty of the outcomes is risk. In nutshell, it is very important to realize the risk perception phenomena to develop understanding among the managers engage in finance office as well as RM activities to deal with business environment volatility.

The previous researches have conducted either for specific industry or for some particular geographic area. Haque & Ali (2016) has focused on the individual sectors e.g. cellular sector, whereas some other researchers have focused on specific area like Pagach & Warr (2011) worked on US data; Abdullah, Hamid & Yatim (2017) have worked on Malaysian data; Olson & Dash (2010) have worked on Chinese data and Lechner, Gatzert & Paper (2016) have worked on Germany data. A substantial review of theoretical and empirical literature has been conducted to explore the effect of risk management on organization performance in different context. The link between perceived business risk, risk based internal controls and organization performance is completely dynamic which depends upon context of study, more specifically, country and time specific. This relationship also varies across companies and sectors. Management may change their approach to deal uncertain business environment. The perception of risk and risk management based on internal controls in uncertain business environment is main issue of this research as the Pakistan has quite different business environment than developed countries studies earlier. This study added literature to existing in several ways. First, this study is among the first to find the relationship in Pakistan. Secondly, it outlines recommendation for management to improve RM in dynamic business environment by abscessing the management commitment to RM in Pakistan. It also focuses on questions such as how manager in Pakistan perceives business risk, whether they deemed internal controls base RM as strategic activity, and if so how frequently they use RM tools to scan the business environment.

The rest of the paper structured within the following sections. Section 2 explains the underpinnings and hypotheses development while section 3 deals with the identification of method, data, and variables utilized in the empirical analysis. Section 4 discusses the empirical results followed by a conclusion in section 5.

Theoretical Framework and Hypothesis Development

Perceived risk is a crucial factor for organization that influences multiple aspects of their firm’s performance, such as service quality performance, financial performance, and reputation performance. Therefore, perceived risk has gain the center positon among policymakers and researchers for a few decades. Several studies (e.g Carter, Rogers, Simkins & Treanor, 2017; Cendrowski & Mair, 2009; Nottingham & User, 2016) discussed relationship between the risk and risk management. Iwejor (2017) declared the interior control as the organizational plan, methods and procedures. Such procedure was developed by the organization to help in achieving management objectives, ensuring the integrity and efficiency of the implementation of the organization’s work and therefore the application of management policies. Control assists managers to realize required results through effective management of resources (Babk & Hamed, 2011). An honest system internally may be a critical a part of management of an establishment and a cornerstone for its secure and effective transactions (Boateng, Amofa & Owusu, 2017). Ofori (2011) postulated that institutions need internal controls to prevent illegal and mal functioning within the organization and improve the efficiency and effectiveness. This effectiveness of an indoor system caters risk in financial context, which is usually understood to be the potential for loss consequent on incompetence.

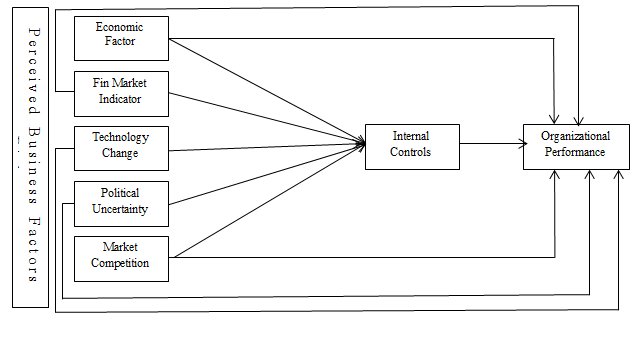

Organization should therefore strengthen the interior control to enhance risk management, which results in enhance organization performance by identifying and mitigating risks. Improve an organization’s capacity to process information, which results in improved organizational performance (Collier, Fishwick & Floyd, 2004; Soin, 2005). Oppong, Owiredu, Abedana & Asante (2016) confirmed that to make sure the efficiency of internal controls, managers need to concentrate to the planning of internal controls. It is important to make sure that internal controls are used to support organization in achieving their objectives by managing risks, while complying with rules, regulations, and organizational policies. Internal controls were used effectively and efficiently to scale back the risks, which will hinder the organization performance additionally to handling any exceptional/undesired event promptly and appropriately as soon because it is noticed (Bongani, 2013). By establishing a sound control system, the organization promotes efficient and effective business processes that are ready to produce quality products/services convenient with the organization's mission. It also preserves resources against loss thanks to waste by ensuring adherence to laws/regulations/ contracts and management directives. Therefore, the interior control systems develop and maintain reliable financial and management data during a timely reporting system (Fadzil, Haron & Jantan, 2005). Coco (1992) provided criteria against which effectiveness of internal controls are often assessed. The effective functioning of components of control provides an inexpensive assurance regarding achievement of one or more of the stated categories of objectives to make sure high level of the organizational performance. Furthermore, high volatility in business environment had negatively associated with preemptive policies whereas passive policies cause positive impact for better performance (Tan & Litschert, 1994). Moreover, organization performance is superior with definite policies. Similarly, internal controls aligned with business environment had significant impact on organization performance (Prescott, 1990). Whereas, Machuki & Aosam (2011) concluded positive and significant impact of volatility in business environment on firm performance. It is clear from literature on risk management, which focused on the association among the uncertainty in business environment and its performance mediated by strategic management controls. Similarly, Ansoff & McDonell (1992) declared that organizational performance was highly affected by uncertainty exist in external business environment factors. He further added that conservative approach to the volatility in business environmental factor causes low performance. Within the light of preceding review of past literature and relevant theoretical background, the proposed framework becomes very apparent; the primary step is to acknowledge the risk; the character of risk could also be altered by the character of business (large, small, manufacturing, and services, Islamic or conventional). The popularity of risk has led the management to line up a system of internal controls. Furthermore, uncertain business environment is considered the most significant factor which influence on organization (Duncan, 1972; Grant, 2016). Jansen, et al., (2018) declared that volatile business environment causes the inconclusive statement about the existence of risk. This uncertainty about the existing of risk leads to concept of perceived risk. Perceived risk is a contextual aspects that managers perceived from volatile and uncertain environment (Bento et al., 2018). PBR is the principal independent variable in current study. Business risk is a part of much wider environment uncertainty, which by and large identifies with casualness in the activities of an association's significant partners, for example, clients, providers, contenders and administrative gatherings. The effect of natural uncertainty on associations has been generally considered dependent on discernment held by administrators of the degree of uncertainty innate in their condition as opposed to real uncertainty. Plum (2015) conducted survey to explore the base for perceive business risk. This survey concluded that diminishing business confidence and regulatory and political uncertainty, increasing competition, and global economic conditions followed by people risk, human resources, business interruption and supply chain risk, property damage, and corporate governance. In the light of review of past literature and relevant theories, the proposed framework shown in Figure 1.

H1:Economic factor have positive impact on organization performance

H2:Financial indictor have positive impact on organization performance

H3: Political uncertainty have positive impact on organization performance

H4: Technological change have positive impact on organization performance

H5: Market competition have positive impact on organization performance

H6: Economic factor have positive impact on internal control

H7: Financial indictor have positive impact on internal control

H8: Political uncertainty have positive impact on internal control

H9: Technological change have positive impact on internal control

H10: Market competition have positive impact on internal control

H11: Internal control mediate economic factor and organization performance

H12: Internal control mediate financial indictor and organization performance

H13: Internal control mediate political uncertainty and organization performance

H14: Internal control mediate technological change and organization performance

H15: Internal control mediate market competition and organization performance

H16: Internal control have positive impact on organization performance

Data and Methodology

The leading industrial sectors are including in this study. Questionnaire distributed among CFOs/ Finance manager/Risk Managers of selected industries. 204 responses received out of 351 distributed questionnaires. Table 1 describes the industry wise response of survey.

| Table 1 Sector Wise Survey Responses |

||

|---|---|---|

| Sector | Selected Companies | Response Received |

| Bank | 35 | 25 |

| Insurance | 45 | 20 |

| Modarabah | 10 | 05 |

| Sugar | 45 | 32 |

| Pharmaceutical | 08 | 03 |

| Cement | 22 | 12 |

| Automobile | 20 | 8 |

| Textile | 140 | 89 |

| Oil & Gas | 20 | 7 |

| Telecommunication | 06 | 3 |

| Total | 351 | 204 |

Survey method may be a useful and bonafide approach to explain and explore variables and construct of interest (Ponto, 2015). In this study author, employed Structural Equation Modeling (SEM) to t is test the proposed model as proposed by Greenfield & Greener (2016). A two-step procedure to test the mediation as described by Prabhu (2007) adopted in this study.

Pilot Testing

This study employed questionnaire to record response on 5-point Likert scale. Confirmatory Correlation Analysis (CFA) was used to confirm the validity of instrument. Scale validity provides adequate support to the instrument in several cultures (Shirali, Shekari & Angali, 2018). This approach to live the intensity of the latent variables (Lewis, 2017). In preliminary investigation, 96 respondents were included. The results of pilot study confirm the validity and reliability of questionnaire used to collect data from respondents (see Table 2 ).

| Table 2 Convergent Validity |

|||||

|---|---|---|---|---|---|

| Economic Factor | Internal Controls | Organizations Performance | |||

| Items | Std. Est. (λ>0.50) | Items | Std. Est. (λ>0.50) | Items | Std. Est. (λ>0.50) |

| EF-1 | 0.71 | IC-1 | 0.73 | PER-1 | 0.67 |

| EF -2 | 0.64 | IC-2 | 0.65 | PER-2 | 0.67 |

| EF -3 | 0.76 | IC-3 | 0.64 | PER-3 | 0.64 |

| EF-4 | 0.74 | IC-4 | 0.77 | PER-4 | 0.61 |

| AVE=2.04 /4 =0.51 | IC-5 | 0.69 | PER-5 | 0.86 | |

| CR=8.12/(8.12+1.96)=0.80 | IC-6 | 0.77 | PER-6 | 0.73 | |

| Financial Market Indicator | IC-7 | 0.75 | PER-7 | 0.66 | |

| Items | Std. Est. (λ>0.50) | IC-8 | 0.64 | PER-8 | 0.77 |

| FI-1 | 0.83 | IC-9 | 0.79 | PER-9 | 0.70 |

| FI-2 | 0.76 | IC-10 | 0.75 | PER-10 | 0.82 |

| FI-3 | 0.59 | IC-11 | 0.75 | PER-11 | 0.79 |

| FI-4 | 0.81 | IC-12 | 0.67 | PER-12 | 0.66 |

| FI-5 | 0.71 | IC-13 | 0.76 | PER-13 | 0.79 |

| FI-6 | 0.60 | IC-14 | 0.76 | PER-14 | 0.75 |

| AVE=3.13/6 =0.52 | IC-15 | 0.79 | AVE=7.38 /14 =0.53 | ||

| CR=18.49/(18.49+2.86)=0.86 | IC-16 | 0.70 | CR=311.87 /(311.87+12.42) =0.96 | ||

| Technological Change | IC-17 | 0.62 | Political Uncertainty | ||

| Items Std. Est. (λ>0.50) | IC-18 | 0.77 | Items Std. Est. (λ>0.50) | ||

| TC-1 | 0.82 | IC-19 | 0.61 | PU-1 | 0.70 |

| TC-2 | 0.72 | IC-20 | 0.75 | PU-2 | 0.69 |

| TC-3 | 0.78 | IC-21 | 0.71 | PU-3 | 0.73 |

| TC-4 | 0.65 | IC-22 | 0.61 | PU-4 | 0.79 |

| TC-5 | 0.71 | IC-23 | 0.67 | PU-5 | 0.67 |

| TC-6 | 0.68 | IC-24 | 0.61 | AVE=2.58/5 =0.51 | |

| AVE=3.13/6 =0.53 | IC-25 | 0.61 | CR=12.88/(12.88+2.41)=0.84 | ||

| CR=18.49/(18.49+2.86)=0.86 | IC-26 | 0.66 | ← | ← | |

| Market Competition | IC-27 | 0.78 | ← | ← | |

| Items Std. Est. (λ>0.50) | AVE=13.46 /27=0.50 | ← | ← | ||

| MC-1 | 0.71 | CR=361.38/(361.38+10.76)=0.97 | ← | ← | |

| MC-2 | 0.79 | ← | ← | ||

| MC-3 | 0.66 | ← | ← | ||

| MC-4 | 0.73 | ← | ← | ||

| AVE=2.09 /4 =0.52 CR=8.3 /(8.3+1.90)=0.81 |

|||||

EF=Market Uncertainty, FI=Financial Uncertainty, TC=Technological Change, MC=Regularity Uncertainty, PU=Political Uncertainty, IC=Internal Control, PER=Performance

According to (Kim, Ku, Kim, Park & Park, 2016), a construct having the factor loadings above 0.5 are considered as practically significant construct. Analysis showed that maximum question included in instrument were found valid in Pakistani scenario. (Hair, Black, Babin & Anderson, 2014) suggested that Average Variance Extracted (AVE) and Construct Reliability (CR) of the construct should be above or adequate to 0.50 and 0.70 respectively. The AVE values of every construct found quite the prior stated acceptance criteria. The CR of the entire construct were greater than aforementioned criteria, it means internal consistency exist.

The Table 3 shows the valid items for the construct of study alongside their source and reliability. Cronbach’sAlpha was employed to live the reliability of constructs suggested by (Hair, Anderson, Tatham & Black, 1998). The results Table 3 shows that each one constructs have value above 0.70, which suggests that instrument wont to collect that for this study is reliable.

| Table 3 Cronbach’s Alpha |

||||

|---|---|---|---|---|

| Variables | Source | Items | Valid Items | Cronbach’s Alpha |

| Economic Factor | Hammad, Jusoh & Ghozali (2013); Mill & Snow (1978) | 6 | 4 | 0.78 |

| Financial Indicator | 9 | 6 | 0.86 | |

| Technological Change | 10 | 6 | 0.81 | |

| Political Uncertainty | 8 | 5 | 0.82 | |

| Market Competition | 8 | 4 | 0.80 | |

| Internal Controls | Ayagre, (2014); KINYUA (2016) | 32 | 27 | 0.96 |

| Organization Performance | Govindarajan (1984); Mia & Clarke (1999) | 14 | 14 | 0.94 |

Empirical Analysis

This study employed various analysis techniques to examine the collected data. Table 4 contains the results of indicators regarding adaptability of model as suggest by Hair, et al., (1998). Results revealed that all criteria mentioned in the table are within the range for proposed study model.

| Table 4 Model Fit Index |

||

|---|---|---|

| Model Fit Criteria | Measurement Model | Acceptable Range* |

| Χ2 | 1.39 | - |

| Χ2/Df | 1.39 | 1-3 |

| GFI | 0.99 | >0.90 |

| AGFI | 0.96 | >0.80 |

| CFI | 0.99 | >0.95 |

| TLI | 0.98 | >0.90 |

| NFI | 0.99 | >0.90 |

| RMR | 0.01 | <0.09 |

| RMSEA | 0.04 | <0.08 |

| PCLOSE | 0.35 | >0.05 |

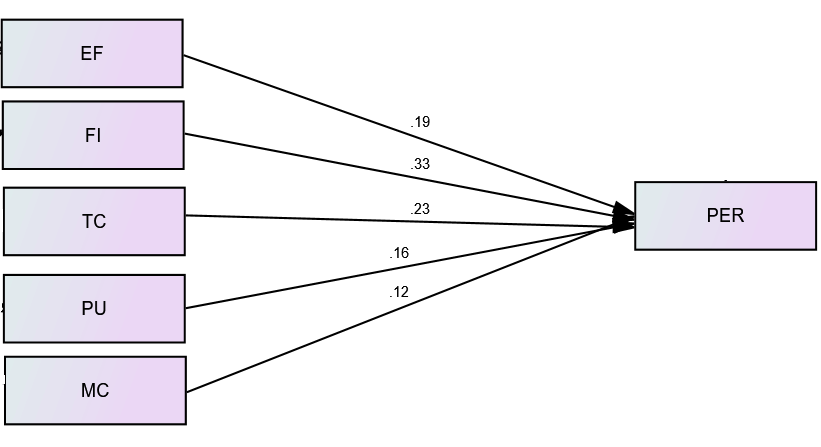

After validating the model, next step was to scrutinize the hypotheses formulated. This study followed (Hunjra, 2018) methodology to check mediation. First, the direct relationships among the dependent and in depended variable is examined. In next step, indirect relationship among independent and dependent variables through the mediating variable was tested. Figure 2 reveals the direct effect of perceived business risk on organization performance.

The results in Table 5 reveals that the entire perceived business risk components (e.g. risk due to economic factors, financial indicators, technological change, political uncertainty and market competition) have significantly positive association with organization performance, which are supporting H1, H2, H3, H4, and H5.,The first hypothesis that describe the association between perceived risk due to economic factors and perceived organization performance (H1). From the result Table 5, depicted that the effect of perceived volatility in economic factors on organization performance is significant and positive. Hence, the result supports the suggested relationship between both variables i.e., there is significant and positive association among perceived economic factor risk and organization performance thus confirm H1. For the hypothesis, H-2, which examined the association between perceived risk due to financial factors and organization performance, was also examined. The statistics of study illuminated the positive association perceived uncertainty in financial factors and organization performance with significant path coefficient. The results confirm implication that perceived uncertainty in financial factors and organization performance associate with each other significantly and positively. Hence, the study result supported the argument H2.

| Table 5 Regression Weights (Direct Effects) |

|||||||

|---|---|---|---|---|---|---|---|

| Variables | Estimates | P-Value | Hypothesis Support | ||||

| PER | ← | Economic Factors | 0.19 | 0.005 | H1 Accepted | ||

| PER | ← | Financial Indicators | 0.33 | *** | H2 Accepted | ||

| PER | ← | Technological Change | 0.23 | *** | H3 Accepted | ||

| PER | ← | Political Uncertainty | 0.16 | 0.005 | H4 Accepted | ||

| PER | ← | Market Competition | 0.12 | 0.017 | H5 Accepted | ||

For the hypothesis, H-3, which examined the association between perceived risk due to political factors and organization performance, was also examined. The statistics of study illuminated the positive association perceived uncertainty in political factors and organization performance with significant path coefficient. The results confirm implication that perceived uncertainty in political factors and organization performance associate with each other significantly and positively. Hence, the study result supported the argument H3.

For the hypothesis, H-4, which examined the association between perceived risk due to technology factors and organization performance, was also examined. The statistics of study illuminated the positive association perceived uncertainty in technology factors and organization performance with significant path coefficient. The results confirm implication that perceived uncertainty in technology factors and organization performance associate with each other significantly and positively. Hence, the study result supported the argument H4.

For the hypothesis, H-5, which examined the association between perceived risk due to market factors and organization performance, was also examined. The statistics of study illuminated the positive association perceived uncertainty in market factors and organization performance with significant path coefficient. The results confirm implication that perceived uncertainty in market factors and organization performance associate with each other significantly and positively. Hence, the study result supported the argument H5.

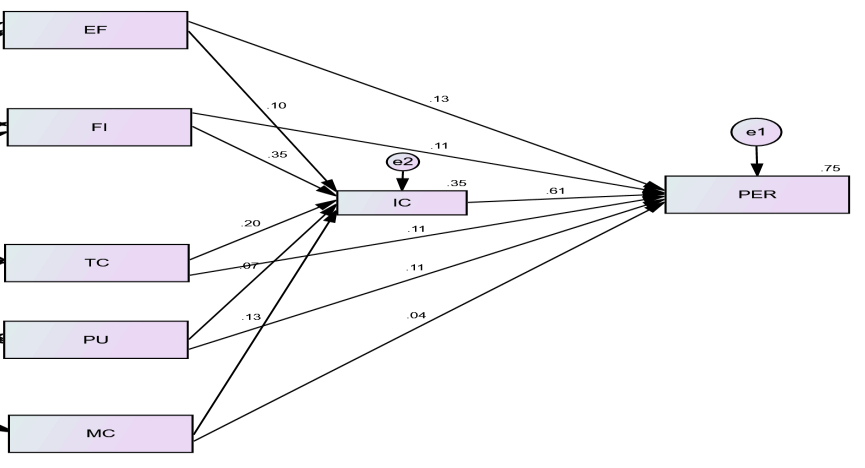

After analyzing the direct relationships, a two steps procedure is employed to see the mediating effect of dividend policy, which is shown in Figure 3.

The relationships between factor of perceived business risk and internal controls show statistically significant in Table 6, which are supporting hypotheses H6, H7, H8, H9 and H10.

| Table 6 Structural Equation Models: Indirect Effects With Mediating Variables |

|||||

|---|---|---|---|---|---|

| Variables | Estimates | P-Value | Hypothesis Support | ||

| Internal Controls | ← | Economic Factors | 0.19 | 0.035 | H6 Accepted |

| Internal Controls | ← | Financial Indicators | 0.33 | 0.020 | H7 Accepted |

| Internal Controls | ← | Technological Change | 0.23 | 0.001 | H8 Accepted |

| Internal Controls | ← | Political Uncertainty | 0.16 | 0.003 | H9 Accepted |

| Internal Controls | ← | Market Competition | 0.12 | 0.010 | H10 Accepted |

| Organization performance | ← | Internal Controls | 0.10 | 0.024 | H16 Accepted |

The sixth hypothesis that describe the association between perceived risk due to economic factors and perceived Internal Controls (H6). From the result Table 5, depicted that the effect of perceived volatility in economic factors on Internal Controls is significant and positive. Hence, the result supports the suggested relationship between both variables i.e., there is significant and positive association among perceived economic factor risk and Internal Controls thus confirm H6. For the hypothesis, H-7, which examined the association between perceived risk due to financial factors and Internal Controls, was also examined. The statistics of study illuminated the positive association perceived uncertainty in financial factors and Internal Controls with significant path coefficient. The results confirm implication that perceived uncertainty in financial factors and Internal Controls associate with each other significantly and positively. Hence, the study result supported the argument H7 in Figure 3.

For the hypothesis, H-8, which examined the association between perceived risk due to political factors and Internal Controls, was also examined. The statistics of study illuminated the positive association perceived uncertainty in political factors and Internal Controls with significant path coefficient. The results confirm implication that perceived uncertainty in political factors and Internal Controls associate with each other significantly and positively. Hence, the study result supported the argument H8.

For the hypothesis, H-9, which examined the association between perceived risk due to technology factors and Internal Controls, was also examined. The statistics of study illuminated the positive association perceived uncertainty in technology factors and Internal Controls with significant path coefficient. The results confirm implication that perceived uncertainty in technology factors and Internal Controls associate with each other significantly and positively. Hence, the study result supported the argument H9.

For the hypothesis, H-10, which examined the association between perceived risk due to market factors and Internal Controls, was also examined. The statistics of study illuminated the positive association perceived uncertainty in market factors and Internal Controls with significant path coefficient. The results confirm implication that perceived uncertainty in market factors and Internal Controls associate with each other significantly and positively. Hence, the study result supported the argument H10.

It further reveals that the connection between internal controls and organization performance is statistically significant; thus, it enables to verify hypothesis H16.

According to Baron & Kenny (1986), to test the mediation effects, compare the estimate of direct and indirect path and significance. In literature, generally this method has been employed by most of the researcher to check the mediation. The researcher also used similar methods in this study in order to check the mediator i.e., internal control influence the relationship among components of perceived business risk and organization performance. It evident from the analysis results described in Table 7 that regression weights have reduced from 0.19, 0.33, 0.23, 0.16 and 0.12 to 0.07, 0.11, 0.14, 0.09 and 0.04 respectively with insignificant relationships. This reduction in regression weight with insignificancy means that there is full mediation exist in the relationship between factors of perceived business risk (e.g. Economic factors, financial indicator, political uncertainty, technological change and market volatility) and organization Performance are supporting the hypothesis H11 to H15.

| Table 7 Comparison of Direct and Indirect Effects (Internal Controls) |

|||||||

|---|---|---|---|---|---|---|---|

| Variables | Direct Effects | Indirect Effects | Hypothesis Support | ||||

| Estimate | P-value | Estimate | P-value | ||||

| PER | ← | Economic Factors | 0.19 | 0.005 | 0.07 | 0.269 | H11 Accepted |

| PER | ← | Financial Indicators | 0.33 | *** | 0.11 | 0.158 | H12 Accepted |

| PER | ← | Technological Change | 0.23 | *** | 0.14 | 0.109 | H13 Accepted |

| PER | ← | Political Uncertainty | 0.16 | 0.005 | 0.09 | 0.097 | H14 Accepted |

| PER | ← | Market Competition | 0.12 | 0.019 | 0.04 | 0.201 | H15 Accepted |

The purpose of this study is to research the conceptual model developed by the researcher. The model is found to be fit, which applies that perceived business risk is contributing to internal controls, which cause organization performance. Environmental factors are long considered critical determinants of organizational control systems. Accordingly, this study reaffirms the findings of Woods (2009); Mu, et al., (2009) in context of Pakistani corporate sector. The businesses which are relatively more profitable, less risky, mature and stable, it means organization have simpler and efficient internal controls as compared to companies that do not develop controls to satisfy the danger. This study finds that perceived business risk features a direct impact on the financial performance also because the mediation role of internal controls with financial performance. Aninternal controls system potentially enhances a firm’s monitoring and reporting processes, also as ensuring compliance with laws and regulations. In this way, effective control features a critical role to play during a firm’s success.

Conclusion

The findings of this study provide meaningful insights for managers of personal sector organizations for achieving higher organizational performance. These insights are often used generally by any organization as a guideline; or they will be specifically applied to the danger perception – organization performance within the private sector during a developing country. With reference to general implications for managers, the first questions proposed by this study were: How does perceived business risk influence organizational performance through control and whether control mediates the perceived business risk-performance relationship? The solution obtained from the results of this study was that perceived business risk definitely influences organizational performance and this relationship is mediated by internal controls. Therefore, to realize higher organizational performance it is vital for organizations that managers should adopt a robust control that are, firstly, according to business goal and, secondly, according to the regulatory guidelines. Therefore, this finding is extremely important for firms to counter business risk. Organizations inevitably have to undergo changes including structural, procedural and managerial. it's important for managers to know the risk perception and control relationship in two ways because both have an enormous impact on organizational performance and that they can't be separated from one another since uncertainty in business environment influences level of control and the other way around. The limitation of this study is measurements for all variables are supported the perceptions of respondents who were senior management. As such, their observations could also be hospitable bias.

References

Abdullah, M.H.S.B., Hamid, A.M., & Yatim, P. (2017). The effect of enterprise risk management on firm value: Evidence from Malaysian technology firms. Management Journal, 49, 3–11. https://doi.org/10.17576/pengurusan-2017-49-01

Akpoviroro, K.S. (2018). Impact of external business environment on organizational performance. Ijariie-issn (O)-2395-4396, 4(3), 498–505. https://doi.org/10.1016/0925-5273(92)90020-8

Bento, R.F., Mertins, L., & White, L.F. (2018). Risk management and internal control: A study of management accounting practice. In Advances in Management Accounting, 30, 1–25. Emerald Group Publishing Ltd. https://doi.org/10.1108/S1474-787120180000030002

Berinato, S. (2004). Risk’s rewards. https://www.cio.com.au/article/181713/risk_rewards/?pp=5

Duncan, R.B. (1972). Characteristics organizational environments and perceived environmental uncertainty. In of source: Administrative Science Quarterly, 17(3).

Fraser, J., & Simkins, B. (2010). Enterprise risk management. Today’s leading research and best practices for tomorrow’s executives. In The British Journal of Psychiatry, 112(483).

Grant, R.M. (2016). Contemporary strategy. In analysis, concepts, techniques, applications. Oxford, Blackwell. John Wiley & Sons Ltd. UK.

Haque, M., & Ali, I. (2016). Uncertain environment and organizational performance: The mediating role of organizational innovation. Asian Social Science, 12(9), 124–138.

Hoque, Z. (2005). Linking environmental uncertainty to non-financial performance measures and performance: A research note. British Accounting Review, 37(4), 471–481.

Jansen, T., Claassen, L., Poll, R., Kamp, I., & Timmermans, D.R.M. (2018). Breaking down uncertain risks for risk communication: A conceptual review of the environmental health literature. Risk, Hazards & Crisis in Public Policy, 9(1), 4–38.

Jusoh, R. (2008). Environmental uncertainty, performance, and the mediating role of balanced scorecard measures use : Evidence from Malaysia. International Review of Business Research Papers, 4(2), 116–135.

Kannadhasan, M., Aramvalarthan, S., & Tandon, D. (2013). Perceived environmental uncertainty & company performance: An effect on strategic investment decisions. International Journal of Accounting and Financial Management Research (IJAFMR), 3(4), 107–118.

Lechner, P., Gatzert, N., & Paper, W. (2016). Determinants and value of enterprise risk management: Empirical Evidence from Germany.

Olson, D.L., & Dash, D. (2010). A review of enterprise risk management in supply chain. Kybernetes, 39(5), 694–706.

Pagach, D.P., & Warr, R.S. (2011). The effects of enterprise risk management on firm performance. SSRN Electronic Journal.

Rasid, S.Z.A., Golshan, N., Mokhber, M., Tan, G.G., & Zamil, N.A. (2017). Enterprise risk management, performance measurement systems and organizational performance in Malaysian public listed firms. International Journal of Business and Society, 18(2), 311–328.

Saiful, S. (2017). Contingency factors, risk management, and performance of Indonesian Banks. Asian Journal of Finance & Accounting, 9(1), 35.

Soltanizadeh, S., Zaleha, S., Rasid, A., Golshan, N., Quoquab, F., & Basiruddin, R. (2014). Enterprise risk management practices among Malaysian firms. Procedia-Social and Behavioral Sciences, 164, 332–337.

Abdullah, M.H.S.B., Hamid, A.M., & Yatim, P. (2017). The effect of enterprise risk management on firm value: Evidence from Malaysian technology firms. Management Journal, 49, 3–11.

Akpoviroro, K.S. (2018). Impact of external business environment on organizational performance. IJARIIE-ISSN(O)-2395-4396, 4(3), 498–505.

Bento, R.F., Mertins, L., & White, L.F. (2018). Risk management and internal control: A study of management accounting practice. In Advances in Management Accounting, 30, 1–25. Emerald Group Publishing Ltd.

Berinato, S. (2004). Risk’s rewards. https://www.cio.com.au/article/181713/risk_rewards/?pp=5

Duncan, R.B. (1972). Characteristics of organizational environments and perceived environmental uncertainty. In source: Administrative Science Quarterly, 17(3).

Fraser, J., & Simkins, B. (2010). Enterprise risk management: Today’s leading research and best practices for tomorrow’s executives. In The British Journal of Psychiatry, 112, 483.

Grant, R.M. (2016). Contemporary strategy. In analysis, concepts, techniques, applications. oxford, blackwell. John Wiley & Sons Ltd. UK.

Haque, M., & Ali, I. (2016). Uncertain environment and organizational performance: The mediating role of organizational innovation. Asian Social Science, 12(9), 124–138.

Hoque, Z. (2005). Linking environmental uncertainty to non-financial performance measures and performance: A research note. British Accounting Review, 37(4), 471–481.

Jansen, T., Claassen, L., Poll, R., Kamp, I., & Timmermans, D.R.M. (2018). Breaking down uncertain risks for risk communication: A conceptual review of the environmental health literature. Risk, Hazards & Crisis in Public Policy, 9(1), 4–38.

Jusoh, R. (2008). Environmental uncertainty, performance, and the mediating role of balanced scorecard measures use : Evidence from Malaysia. International Review of Business Research Papers, 4(2), 116–135.

Kannadhasan, M., Aramvalarthan, S., & Tandon, D. (2013). Perceived environmental uncertainty & company performance: An effect on strategic investment decisions. International Journal of Accounting and Financial Management Research (IJAFMR), 3(4), 107–118. http://www.tjprc.org/view_archives.php?year=2013&id=35&jtype=2&page=3

Lechner, P., Gatzert, N., & Paper, W. (2016). Determinants and value of enterprise risk management: Empirical Evidence from Germany.

Olson, D.L., & Dash, D. (2010). A review of enterprise risk management in supply chain. Kybernetes, 39(5), 694–706.

Pagach, D.P., & Warr, R.S. (2011). The effects of enterprise risk management on firm performance. SSRN Electronic Journal.

Rasid, S.Z.A., Golshan, N., Mokhber, M., Tan, G.G., & Zamil, N.A. (2017). Enterprise risk management, performance measurement systems and organizational performance in Malaysian public listed firms. International Journal of Business and Society, 18(2), 311–328.

Saiful, S. (2017). Contingency factors, risk management, and performance of indonesian banks. Asian Journal of Finance & Accounting, 9(1), 35.

Soltanizadeh, S., Zaleha, S., Rasid, A., Golshan, N., Quoquab, F., & Basiruddin, R. (2014). Enterprise risk management practices among Malaysian firms. Procedia-Social and Behavioral Sciences, 164, 332–337.