Research Article: 2022 Vol: 21 Issue: 1

Mergers and Acquisitions (M&A) in Professional Service Firms (PSF)-Getting Beyond the Go Big or Go Home Approach

Terry Ruhl Infradevco, Colorado State University

Citation Information: Ruhl, T.A. (2022). Mergers and acquisitions (M&A) in professional service firms (PSF) – Getting beyond the “go big or go home” approach. Academy of Strategic Management Journal, 21(1), 1-16.

Abstract

Analyses of mergers and acquisitions (M&A) across industries are prevalent in the literature. And, while professional service firms (PSFs) clearly operate differently as compared to other domains, is the strategy for successful M&A unique to that industry? The research herein provides a model framework for alternative growth strategies and the accommodating antecedents to successful M&A for PSFs, using a specific focus on the architecture/engineering (A/E) industry. Here, talent acquisition and top-line growth through market, service area, geographic, and client complementarity, along with prudent levels of diversification, provide opportunities for firm differentiation, enhanced reputation, and greater shareholder value. However, perhaps the largest driver to the upsurge of M&A activity, not covered in the scientific literature, results from the positive outcomes to both sides of the buyer-seller dyad, through the exchange in price-to-earnings ratios. And, while PSFs have been known to look to diversification strategies as a primary growth driver, A/E PSFs should strive for building on complementary capabilities, using a “simpler is better” approach. Firms need to exercise caution against complex diversification strategies and plans that include significant overlap between firms or stretch the capabilities of senior leadership.

Keywords

Mergers and Acquisitions, Strategy, Professional Service Firms, Post-Merger Integration, P/E Multiples Arbitrage.

Introduction

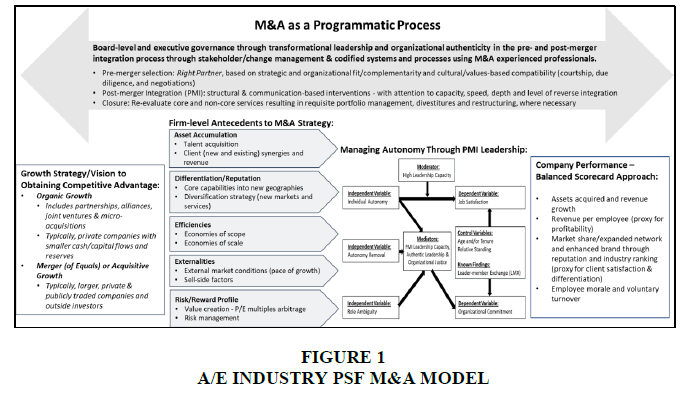

The guiding question of the proposed research is to ask, what is behind successful mergers and acquisitions (M&A) in knowledge-based companies, specifically professional service firms (PSFs), using the architectural/engineering (A/E) domain context. By purposefully reaching out to top industry executives known to have a vast array of industry experience with M&A transactions, the qualitative research contained herein was used in conjunction with additional quantitative research (Ruhl, 2020) to develop the model framework for alternative professional service firm (PSF) growth strategies illustrated on Figure 1.

As articulated by Marks & Mirvis (2011) valuable information exists in the industry largely through the experience of management consultants and other industry professionals; however, a more scientific and rigorous process should be developed with the support of these industry practitioners. Using a semi-structured, open-ended interview approach as portrayed by Bachiochi & Weiner (2004), ten management consultant and industry executives were queried to openly discuss the M&A strategy process. This research served as an additional augmentation step in the final model development and refinement process, as opposed to developing new theory through the more rigorous Grounded Theory approaches (Glaser & Strauss, 1967; Strauss & Corbin, 1990). This allowed the research results to be academically robust, yet practical and pragmatic in nature. In addition, beyond providing alternative means to typical quantitative analyses directed at M&A research, the proposed interview process addresses the recent call for new qualitative research into M&A to go beyond the traditional dialogue surrounding culture and negative employee reactions (Sarala et al., 2019).

Both the scholarly and practitioner literature on M&A have produced results that vary extensively depending on the domain of study (Haleblian et al., 2009). The research summarized herein was based on a thorough, multi-method research program, through both qualitative assessments, the focus of this paper, and quantitative (archival) exploratory analyses of A/E industry-level M&A activity since the last economic recession of 2008 (Ruhl, 2020, for the complete dataset and assessment). Results illustrate there is more commonality with other industry approaches than not, although some unique elements of the A/E PSF industry, beyond the intense focus on individual professional autonomy (Degbey et al., 2020), were noted throughout the research: (1) the pursuit of strategic growth objectives, for publicly traded organizations within the industry, may not be met by organic means given the market landscape and traditional industry employee turnover rates; (2) a lack of significant economies of scale in the A/E domain, largely because of the typical contractual terms employed (i.e., hourly billing rates of individual employees), places even more emphasis on the post-merger integration process to maximize acquirer outcomes; (3) the natural, yet substantive, generational leadership transition challenges taking place has led to target firms driving M&A activity and even strategy in many instances (after all, past cross-industry research has shown the benefits of M&A to the acquired firm’s shareholders); (4) risk management concerns associated with the inherent project-oriented legal, financial, and reputational risk in the industry has led to a number of firm transitions to new ownership, but most important, (5) the clearly defined price-to-earnings multiples arbitrage between large and small firms, combined with the succession challenges of private firms, has led to significant M&A activity in the domain, including a transformation led by private equity participation in the industry since the last major economic recession.

This research paper is organized as follows: first, a review of the literature, specifically as it applies to professional service firm M&A is conducted; then, the methods surrounding the focus group assessment are presented, followed by the detailed qualitative assessment findings, which are augmented by the quantitative results and discussion of the mixed methods assessment (Ruhl, 2020). Finally, the limitations of the study and the overarching conclusions from the research results are presented.

Literature Review

M&A has served as a long-standing organizational development intervention to effectively improve a business enterprise by aggressively obtaining the requisite resources for competitive advantage. Successful transactions include: (1) a long-term firmwide strategy, accounting for the risks and opportunities associated with a changing market landscape and other external and internal factors, which establishes the objectives and requirements for potential M&A; (2) a specific acquisition logic that identifies complementary needs, fit, and justification and considers both financial and non-financial factors; (3) target assessment(s) that include formal due diligence and financial valuation(s) leading to an appropriate deal structure; and, (4) specific target integration planning and implementation consistent with strategic intent to accommodate identified synergies (Epstein, 2005).

Broad-ranging summary analyses of M&A in the services industry are rare. McCann (1996) conducted a review of 174 CEOs that drove M&A activity in a variety of significant service firms (beyond PSFs, including transportation and travel, retail, financial services, and communications/information services). The primary drivers behind the transactions were found to be: (1) increased market share; (2) new service offerings (a distant second), except for PSFs that valued talent acquisition as their second highest rationale in making acquisitions; (3) added name/brand recognition (reputation); (4) more efficient resource allocation, although this was not highly rated by PSFs as they are less capital-intensive and typically desire to be so; and (5) economies of scale. The most significant challenges were: (1) merging disparate cultures; (2) integrating different staff policies (e.g., compensation and benefits); (3) price premiums and the legacy impact; (4) lack of strategic coordination (understanding the need to maximize synergy yet recognizing the need for cost efficiencies); and (5) debt/deal financing (affordability).

Outside the M&A literature, Greenwood and colleagues (2005) similarly identify the unique importance of reputation and brand-building in service-related industry M&A. According to these authors, as PSFs diversify, they must do so in a significant, rather than incremental, manner (e.g., M&A) because of the risks of image contamination and “reputation stickiness” – what matters is how clients perceive the legitimacy of a diversified portfolio. Consequently, diversification strategies have received much attention in the PSF M&A strategy literature that finds managerial capability and capacity constraints significantly limit the opportunity for firm financial performance from both geographic and service area diversification strategies (Hitt et al., 2001).

Most assessments of PSFs in the A/E industry have been conducted throughout Europe and the United Kingdom in particular. Interestingly, Kreitl et al. (2002) also finds that the increase of the firm’s top-line or revenue growth is a strong influence on corporate development, more so than the focus on growth of market share or the growth of profit, and, surprisingly, a focus on enterprise value is even less significant (Kreitl et al., 2002). Kreitl & Oberndorfer (2004) later add that the most important motive for undertaking an acquisition is the penetration of new services and new client markets, followed by the penetration into new geographic markets. Other important motives include the acceleration of the firm’s growth, broadening the client base for existing services, and the acquisition of expert talent. On a global scale, Jewell and colleagues (2014) surmise that strategic decisions relative to growth, and thus M&A activity, are heavily influenced by ownership (capital) structure, a hypothesis that had not been adequately addressed in previous research. Connaughton et al. (2015) extend this line of thought by presenting an elegant method for analyzing growth strategies in A/E PSFs based on the level and willingness for acquisition activity, largely determined by the company’s capital structure. Consistent with global analyst views (Wittmann & Hauke 2017), serial acquirers were expected to be mostly publicly owned, large companies. Even large-scale, privately owned A/E PSFs, especially those viewed as the most successful in terms of their business differentiation, were viewed as conservative in their approach to M&A. Smaller companies, almost always privately owned, typically resorted to organic growth strategies.

The European-based literature, however, rarely mentions enterprise value creation (financial arbitrage), risk factors, or sell-side drivers relative to M&A intentions. Even more, the attainability of economies of scale in the PSF industry has been questioned by industry experts (AEC, 2019). Additional evidence suggests that to differentiate and create competitive advantage, PSFs tend to grow through diversification strategies even when the preponderance of academic literature argues for growth through complementary strategies and synergy-building on core services of the acquirer.

In the United States, many architecture/engineering (A/E) PSFs employed diversification strategies surrounding the 2008 global economic recession as highlighted by the mergers between engineering companies and construction contractors (Gregerson, 2018). And, by 2018, a record level of M&A activity took place (534 transactions), the result of multiple drivers, including technology-driven strategies and ownership succession, in addition to divestitures from larger companies looking to focus on specific markets and services through portfolio management strategies (Parsons, 2019). However, perhaps the biggest change to the dynamic that has been witnessed in the A/E industry, or in broader terms, the engineering and construction (E&C) industry, is through the engagement of private equity and other well-capitalized investment organizations looking to enhance their financial portfolio in industries with resilient and positive earnings histories.

M&A have been a dominant growth strategy during the last 25 years in the A/E industry, and a recent summit of industry CEOs highlights that, in fact, M&A strategies now seem to be providing some evidence of positive financial and other business outcomes at industry and firm levels (Rubin, 2019). Moreover, firms do not appear to be decreasing their M&A interest. In fact, recent surveys of the A/E industry indicate that approximately 75 to 90 percent of CEOs tout their respective acquisitions as marginally or fully successful; thus, while actual success rates will always be open to debate, one thing is clear, the current consolidation trend will likely continue for the foreseeable future (EFCG, 2016, 2017, & 2020).

Methods

Ten North American-based, industry-experienced professionals were solicited as informants for this qualitative study. These executives have operated at the “extreme” ends of the M&A spectrum in the A/E PSF industry. CEOs/COOs (existing or former) of three smaller firms were selected for their experience in working with limited capital resources and how that limitation sets the foundation for any potential company growth strategy. In fact, as summarized below, this largely leads to sell-side considerations within M&A transactions as a potential “acquiree,” although one firm had recently grown to a point where they could consider M&A as a financially feasible growth alternative.

At the other end of the scale, informants from three larger firms, including representation from one of the largest firms in the industry, were selected primarily due to their reputation for being a “serial acquirer”. These firms were either publicly traded or supported financially by private equity. In addition, informants from these firms ranged from the leader of the corporate development function (or organization responsible for all M&A activities) to current board members of the other two firms, both of whom have recently served as industry CEOs. Of the large firms represented, one highlights that their M&A strategy, itself, is their competitive advantage in the industry.

In addition, a private equity investor was also interviewed due to the growing interest in the A/E industry, especially since the economic recession of 2008. A separate informant indicated that private equity has become the “white horse” to the industry which has faced significant succession planning challenges from first- and second-generation private company ownership (a number of A/E companies in the United States and Canada were founded post-World War II). Two other unique perspectives were gained from informants whose companies fiercely rely on independence and organizational autonomy within their operating environment. More important, these individuals have become acutely familiar with the environment surrounding the strategy for future acquisitions, while also having participated in being acquired through a previous acquisition themselves. These leaders consist of one board chair and former CEO, and the other who leads their company’s corporate development, or M&A, function.

The final informant was an industry analyst from one of the most well-respected management consulting firms representing both sell-side and buy-side clients in the A/E PSF M&A process. This individual has first-hand experience with the most significant North American M&A activity in recent years and has insights and understanding of the granular details leading to these eventual M&A outcomes.

The informants were interviewed in casual one-on-one settings, in-person where possible. Six of the ten interviews were conducted face-to-face, usually over a casual meal, while four of the interviews were conducted by telephone. All interviews were recorded. Overall, approximately 8 hours of interviews were conducted and recorded during the month of February 2020, across these ten informants. The average interview duration was 46 minutes and 21 seconds (ranging from approximately 22 minutes to 80 minutes in length), and the resulting transcriptions and field notes amounted to 181 single-spaced pages of information used for analysis. The open-ended interview process focused on two primary questions (the full interview schedule is provided in the Appendix): what have been the current drivers to the M&A process in North America since the economic recession of 2008; and, what feedback can be offered regarding the significant issues surrounding the post-merger integration process in the A/E PSF industry?

Qualitative analysis to identify themes was performed, using constant comparative methods against a pre-established model framework developed from a detailed review of the extant literature. It is important to note that the informants were not shown any materials before or during the interview process; instead, responses were natural and free flowing without the use of any graphical aids or other reference documents. Summary-level results were collected from the qualitative interviews using a content analysis approach focusing on the identification and frequency of themes presented by the informants (Bachiochi & Weiner, 2004; Lee & Lee, 1999; Lee et al., 2018). As suggested by Bachiochi & Weiner (2004), results were summarized manually, using a minimum of two analysts. Inter-rater agreement was determined by comparing and adjusting the resultant summaries until the raters were satisfied that full consensus had been reached.

Findings and Discussion

The primary purpose of performing the qualitative assessment was to provide a comprehensive data source to support anecdotal evidence from M&A experiences that may not be reflected in the scientific and extant literature regarding alternative growth strategies for A/E PSF firms. The openness and transparency of the informants was extraordinary. Much of the M&A literature for the A/E industry has been based on research of the industry in Europe (under what could be referred to as more of a “social mission” strategy – i.e., issues surrounding value creation through financial arbitrage and risk management considerations were somewhat limited, as will be further explained below). What is taking place in North America appears to be much more formidable and robust, and in fact, has been driving the industry, globally, in terms of M&A activity, probably since the economic recession of 2008 (AEC, 2019; EFCG, 2016, 2017, & 2020; Hembrough, 2019a & 2019b).

The last 10 years have also witnessed significant interest from private equity in North America. Private equity has shown interest in what one informant refers to as “secular tailwinds” resulting from the public agency stimulus spending around infrastructure improvements (e.g., transportation and water) available in up- and down P market cycles, making the industry a relatively safe investment, albeit at potentially lower returns than more volatile, higher-margin industries. PSFs are a component of the overall E&C industry, one that involves relatively little capital expenditure for investment, since the primary assets are people as opposed to other resource forms.

While the longitudinal aspects of M&A research have been limited, the extant literature points to post-mortem analyses summarizing lessons learned through individual M&A transactions serving as an effective tool for future strategy development and implementation. In fact, past research shows it is not until a second stage of assessment and restructuring takes place that M&A transactions are often optimized, thus setting the platform for future growth and profitability. Moreover, those firms that are most successful treat M&A as a portfolio management exercise, or long-term program, rather than a “one-off” event that includes the need to “prune” and even divest or restructure business activities for maintaining a competitive advantage (Bachiochi & Weiner, 2004; Barkema & Schijven, 2008). At the same time, M&A should accomplish “balanced scorecard” (Ruess & Voelpel, 2012) goals directed at managing company risk as well as enhancing customer/client satisfaction and employee growth opportunities, beyond the financial metrics, which is often the focus. These views were largely accepted through the informant interview process as well.

Across the qualitative study informants, primary firm-level M&A antecedents aligned with seven themes identified in the extant literature: (1) talent acquisition; (2) broadening or deepening the client base; (3) building on core, or reputational, strengths; (4) diversification strategies; (5) economies of scope; (6) economies of scale; and (7) aggregate market conditions. Importantly, the informants highlighted that many of the “other management factors” cited from previous studies could be broken down into value creation (as a driver, not simply an outcome), risk management, and sell-side antecedents, which may be more critical and prevalent to M&A activity in the PSF industry than what exists in the scholarly literature, at least for A/E PSFs. A more detailed breakdown of the study findings (summarized on Figure 1) is contained below

Organic Versus Acquisitive Growth

Aggregate economic and follow-on A/E market growth creates the most significant M&A opportunities during peak economic periods. Consistent with analyst views (Wittmann & Hauke, 2017), consequential M&A in the A/E industry appears to begin with acquirers of approximately US$100 million in size, but significant activity in terms of the volume of assets acquired (revenue and employees) is accounted for by larger, private – or more often – publicly oriented capital structures where firm revenues are greater than US$1.0 billion. This is not to say that active M&A strategies are unable to be implemented by firms smaller than these thresholds. In fact, smaller, employee-owned, company-sponsored deals account for nearly 60 percent of all A/E M&A PSF transactions during the last 5 years (AEC, 2020). Even then, however, active M&A programs are typically resident with companies of approximately US$50 million in size or greater. According to one industry CEO who owned and operated a smaller firm

INDUSTRY CEO (SMALL FIRM): “It just didn’t seem like we had the critical mass for it. Maybe if we got to 400 people or 500 (approximately $50M to $100M in revenues), maybe that’s when we start feeling we’ve got the critical mass. It’s all a matter of whatever you’re adding – the percentage of that to what you have. Talking as engineers, if you’ve got something that’s got 20 percent of value of what you already have, you’ve got risk associated with 20 percent of the company now. But if it’s 35 or 40 percent, because you’re a smaller firm, it’s too big. The influence on your company is too risky… (An acquisition) could destroy the firm.”

The overriding point is that at some level, even beyond the concept of a revenue-based threshold, successful M&A begins with having an affordable program. Common cross-industry failures in M&A result with individual transactions or broader programs that are not affordable as highlighted by Hitt and colleagues in their seminal assessment of M&A success or failure – affordability is paramount (Hitt et al., 1998).

Asset Accumulation (Top-Line Drivers)

In line with the need to drive value to the firm through top-line growth, including asset accumulation through revenue from client contracts and associated synergies as well as through talent acquisition, larger firms are naturally inclined to have higher levels of M&A activity. This common rationale stems, at least, from the basic tactic of replacing the number of departures from the firm resident in any reasonable industry-wide and firm-specific attrition rates.

Industry Management Consultant

“The only way to grow is to add more people, as long as your business model relies on selling hours. So, if you’re losing 10 percent or 15 percent of your people per year, you have to hire 10 percent or 15 percent to break even. (If) you want to grow at 10 percent or 15 percent per year; you’ve got to hire 30 percent new staff per year, which is practically impossible, particularly for larger firms, given the current ‘war for talent.’ So, at some level (M&A is) the only way you maintain high growth rates as a firm becomes larger.”

In fact, employee and client revenue acquisition were the only significant M&A antecedents that produce statistically relevant results when viewing the panel dataset of industry transactions since the economic recession (Ruhl, 2020). Within the A/E PSF domain, one could argue from the current research that M&A is little more than the quickest means to revenue growth through the accumulation of new client revenue and employee assets, especially during peak periods of industry growth where the need to obtain talent is magnified, independent of the chosen core or diversification strategy.

Differentiation (Bottom-Line Drivers)

Findings from the qualitative study provide additional evidence that North American A/E PSFs attempt multiple core and diversification strategies, searching for innovative means to differentiate themselves to develop enhanced reputation and delivery capacity to provide “win-win” relationships with desired clientele and to attract the requisite talent to achieve desired growth objectives. In fact, the general theme of differentiation through M&A activity is prevalent in the qualitative study, creating value through the reciprocal benefit with the client base they desire.

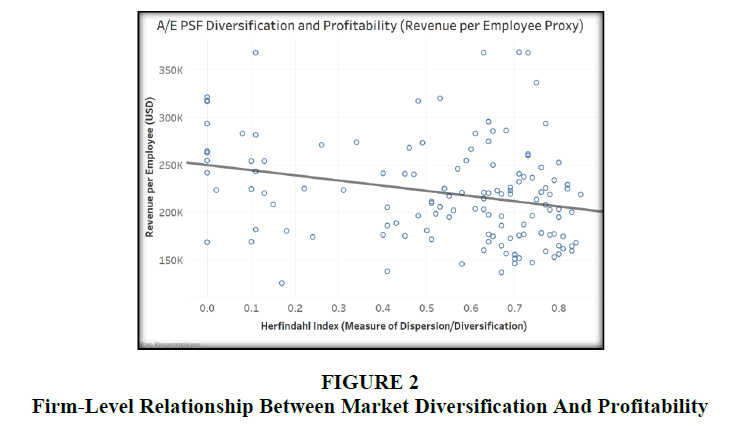

Diversification-based strategies must be operationalized with caution due to the lack of managerial capacity/capability to yield clear benefits from such approaches, which is consistent with years of multi-industry research. At the same time, where the recent research shows some evidence of beneficial return through M&A strategies building on core competencies, it does not provide any clear, significant benefits when compared to simply gaining client revenue and employee resources in the A/E PSF domain. Instead, as a dominant theme in the existing literature across industries, finding complementary opportunities and benefits are key, as opposed to creating new businesses or extending strategies with significant overlap between the acquirer and target firm. When looking at firm-level diversification, clear results are further obtained with regard to market diversification and bottom-line profitability. Here, a linear and negative association highlight a “simpler is better approach” relative to eventual firm-level diversification (Figure 2), similar to the long-standing evidence provided by Wernerfelt & Montgomery (1988) that suggests narrowly diversified firms are less imitable and perform better.

Single- and dual-market firms appear to have clear profitability advantages as measured by revenue per employee, whereas highly diversified firms appear to show greater degradation in profitability. Yet, highly diversified firms are often seen as more resilient to industry volatility. Although less diversified, niche firms have higher profitability levels; the fact that no clear optimum number of markets served has been observed likely means that diversification strategies to yield top-line benefits will continue.

Industry Management Consultant

“Most of the time investors – whether public market investors or private market investors – prefer a simple story. People generally invest in businesses that they can understand. When something has too many pieces, you tend to get a lower valuation, and the sum of those pieces may be worth more than the value of the entire enterprise.” And, “I think there's probably too much diversification in a lot of these firms, which quite frankly hurts performance. Most of the data suggests that single or double market focus firms are more profitable on average. I think there’s a lot of rationale behind that.”

Efficiency-Based Antecedents: Economies of Scale and Scope

Perhaps an additional nuance in the A/E PSF industry is the lack of significant economies of size and scale. While many industries look to M&A to garner advantages regarding economies of scale (e.g., reducing overhead cost redundancies, specifically administrative support services), the A/E industry also looks to economies of scope benefits (e.g., enhanced technology or full-service advantages), although these scope-related factors are not as prominent in the domain and are still in experimental stages at some level (AEC, 2020; EFCG, 2020). Multiple informants in the qualitative study go as far as to suggest that the often-cited economies of scale rationale can be misleading in the A/E PSF industry.

Industry Management Consultant

“And personally, I think that economies of scale are pretty overrated in this industry because at the end of the day, you’re selling time, and whether you have a 100 people 10,000, or 100,000, your unit cost is essentially the same – there’s no economy of scale; the only economy of scale that I think you may be able to get is leveraging some of the overhead functions, but I think there are also some dis-economies of scale that may outweigh that.”

Industry Investment Banker

“(Large public companies) will pay for synergies that financial buyers wouldn’t. This industry doesn’t lend itself to a tremendous amount of (cost) synergies to be honest with you, on a relative scale”.

The qualitative interviews also raise the question as to whether a firm can diversify too much and become too large to be efficient and responsive to both employee and client needs, or whether such firms will look to manage their portfolio and “exchange” lower margin revenue for higher-margin returns from services that are more complementary to their core business scope through a divestiture and acquisition process as witnessed by current industry trends (AEC, 2019). What may hold greater, future value is the innovation through technology and other economies of scope, largely through managing client risk and return by developing new and alternative services that can provide greater profitability than current industry norms, largely related to alternative pricing so firms can appropriately scale revenue. Regardless, the continued drive for economies of scope and scale efficiencies (or revenue and cost synergies) will continue to be key elements of any transaction.

Externalities: External Market Conditions and Sell-side Factors

Overall market growth can have a substantive impact on the drivers for M&A and its associated outcomes in the industry with transactions coinciding with market peaks. The attraction of the industry as “recession-proof” with consistent external growth rates makes it relatively unique, which leads to its overall investor interest level, even from outside the traditional industry acquirers. While the margins may not be leading across industries, the downsides are also minimized. Sell-side drivers, including personal wealth (or financial concerns/threats) and other personal lifestyle choices, and even owner fatigue, have also been cited as well-known externalities leading to significant M&A activity. In fact, relative to firm transition, M&A may be the only way to get fair market value for the firm as opposed to other succession opportunities.

Since the 2008 recession, there is also evidence that financial acumen and leadership courage are taking higher priority in North America, according to many of the qualitative study informants. This is also consistent with the introduction of private equity to the industry, which after all, is designed to be a platform for shareholder value accretion. The second generation of smaller engineering firms is transitioning from engineers-as-managers to more financially orient

Industry CEO and Board Member

“They (PE firms) really didn’t know about our industry and didn’t know how well it fits with their general thesis, which is that they want low-risk, stable industries and companies. Discovering that we (have) as an industry (which) tends to have stable returns albeit somewhat lower than other industries, we were more stable than a lot of other industries. So, we were very attractive because of that. Their objective is that they want to increase EBITDA over their holding period by double or even triple. And, to do that, you can’t do it organically.”

Risk/Reward profile: Risk management and value creation through P/E multiples arbitrage

Beyond the emphasis on value creation and the focus on cash and capital flows, the informants emphasize that risk management is also a primary driver for both small and large firms alike, which is likely different from other professional services industries (accounting, legal, management consulting, etc.). A/E industry firms do indeed face significant reputational and financial (legal) risk because of their project-driven organizations. As pointed out in the qualitative study, one bad project or one bad acquisition can bring a company down or force it into succession through acquisition.

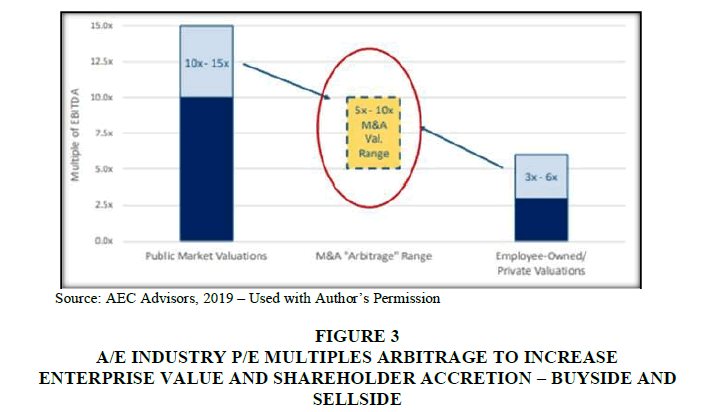

Beyond the higher level of attention to sell-side drivers, the qualitative study offers new information not reflected in extant scholarship. In the case of the informant interviews, there is a relatively unique strategy available to mid-size and larger A/E PSF firms in the industry due to the development and refinement over time of predictable P/E multiple ranges based on firm size Figure 3 (AEC Advisors, 2020).

Figure 3:A/E Industry P/E Multiples Arbitrage To Increase Enterprise Value And Shareholder Accretion ? Buyside And Sellside.

P/E multiples arbitrage occurs when larger or stronger and more versatile organizations with higher P/E ratios acquire smaller, less robust organizations with smaller P/E multiples, thus providing immediate shareholder accretion. It is also the foundational aspect behind what has been defined as a “buy and build” strategy, which further explains the private equity entry to the A/E marketplace. This value creation theme is not only significant for mid-size to larger firms or due to the influence of private equity, but P/E arbitrage and shareholder value accretion can take place without requiring significant economies of scale. The understanding of P/E arbitrage on the sell-side of the equation is equally important as target firms look to increase in size and scope to generate greater earnings and corresponding enterprise value through enhanced P/E multiples.

This approach of acquiring multiple, relatively smaller companies goes against a traditional perspective that posits firms should focus on limited M&A – ones that substantively “move the needle” – to ensure strategic and operational fit are appropriate and to avoid the distractions of multiple acquisitions (Kusewitt, 1985; Harding et al., 2014). Prevalent M&A theory also suggests that large, public firms should be cautious of buying smaller private firms because of organizational differences (e.g., theory of relative standing; Hambrick & Cannella, 1993) and the likelihood of subsequent cultural integration challenges. Perhaps what is taking place in the A/E industry provides another indicator that operational and cultural differences between these related-industry acquisitions may not be as extreme as witnessed within or across other industries. One reason could be the specific occupations that tend to dominate the industry, which are highly professionalized in nature and occupations are known to create rather potent subcultures that can exert more influence than organizational cultures (Dierdorff, 2019). Some management consultants also indicate there are greater risks when merging two complementary firms of similar size due to the lack of arbitrage in earnings multiples, forcing a higher level of revenue and cost synergies (and reductions in staff) required to make the acquisition accretive. Interestingly, this phenomena of systematically acquiring small to mid-size firms has recently been reported in the M&A practitioner literature for other industries as well (Rudnicki et al., 2019) indicating this strategy may be producing greater shareholder returns as compared to alternate strategies; however, the report stops short on the specific rationale behind the value accretion.

Industry Management Consultant

“So, selling the firm becomes the pretty obvious choice, whether or not you wait for the buyer to approach you, or you actively solicit offers; I feel like in most cases, it’s inevitable. I can go down the laundry list of mid-sized firms ($200–$400 million of revenue) who recap at 10X EBITDA and are buying firms in 5–7 times (EBITDA). From my perspective, because there’s such a huge valuation arbitrage, it almost makes a lot of the other strategic questions irrelevant. It doesn’t mean that you don’t want to maximize value from the acquisition, it doesn’t mean that you don’t want to make sure all of the people stay; that stuff is all critical, but you have so much more room for error.”

Former Industry CEO and Board Member on Acquiring Smaller Companies

“You want to make (the smaller firm) acquisitions and then integrate them as quickly as you can without breaking what you just acquired. And so, the philosophy is one of how quick can we effectively integrate versus spending the time to be more thoughtful, (which may be needed for) a much more complicated integration.”

Post-Merger Integration (PMI) Process

As noted in the cross-industry literature, a strong and experienced PMI leadership can have a significant impact on the outcomes of successful M&A transactions (Steigenberger, 2016). Also, leadership drives individual and eventual firm-level outcomes through successful PMI routines in technology-based companies (consistent with Lamont et al., 2019). In addition, quantitative assessments of the PMI process provided evidence that the attention and care given on an individual basis pertaining to autonomy outweigh perceived organizational level changes in autonomy (Ruhl, 2020). This finding further highlights that acquirer firm leadership has a greater probability for success when individual autonomy remains unchanged to the greatest extent feasible for key employees in the combined organization.

Results from the qualitative study support these conclusions as well. Issues surrounding the management of autonomy/independence as well as individual, group-level, and legacy company identity, maintaining strong relationships with front-line supervisors, stellar communications, some level of bi-directional integration reflective of organizational fairness, integration leadership capacity, and appropriate change management processes, all surrounding strong and positive leadership (even references to “servant leadership”) were the general themes mentioned by the industry informants. Moreover, because of the highly technical nature of the industry, occupation-related professionals must show, and must see in others, a level of competence to ensure trust-building. This is reiterated when discussing how one retains a highly desired level of independence and autonomy in the workplace, stating that performance builds trust, which then allows for a higher degree of autonomy.

Industry CEO Who Had Been Part of an Acquired Firm

“Everybody worries about systems…but, I think the thing that is really not seen is the people issues…the failure really are on the cultural integration side. People are not replaceable. it’s part of our value system, I’ve got to treat you with dignity…especially in this business, with anybody you meet, could be our client tomorrow.”

Limitations

While the strength of the study resided in the practical relevancy of the key M&A drivers as identified by seasoned professionals in the industry, as with all qualitative and contextual-based research, there will be limitations in the generalizability, or external validity of the research. The organizational context and even the industry within which A/E PSFs reside can differ significantly in their management behaviors, due to the nature of highly trained professionals providing (sometimes intangible) consulting advice to their clients, and the fact that the recruitment and retention of key staff, who tend to be well-compensated and operate with a high level of intrinsic motivation and autonomy, differ from traditional industrial and other service organizations (Suddaby et al., 2008).

In addition, the qualitative survey was based entirely on self-reporting from individual experiences; however, it should also be noted that some informants provided additional published information and data sources with verifiable examples to support their claims made during the interview process. Another factor to control the impact of potential self-reporting bias resides in the fact that much of the information provided could be closely corroborated between informants, or through data that has been published through practitioner-based publications or other scholarly literature, enhancing reliability.

Moreover, the informants’ provided limited response to leadership egocentrism (or overconfidence) or other managerial herding or envy considerations (peer pressure) that may be foundational to the understanding of M&A (Haleblian et al., 2009). Relative to this matter, it is interesting to note that these concerns and issues were noted as being present in the industry; however, there was general acknowledgement that these are simply factors of the human condition or environmental landscape that can be difficult to control or manage and may not be as valuable to those managers in charge of developing M&A strategy.

Summary

M&A in A/E PSFs essentially comes down to a significant mass hiring event that blends internal human capital, respective client networks, and contract assets. Taken collectively, the recent research indicates that: (1) there appears to be a capital structure and threshold of firm size that serves as a defining limitation for affordable growth through meaningful M&A; (2) there are 10 primary antecedents, beyond price considerations, that contribute most to the strategy decisions surrounding M&A; (3) revenue gains from client contracts and associated employee acquisition, leading to greater increased earnings potential, appear to be the most prevalent and consistent strategies in A/E PSF M&A; (4) this qualitative study provides new evidence for themes surrounding P/E multiples arbitrage, risk management, and sell-side factors that are more prevalent than what has been contained in the existing, scholarly PSF literature; and, (5) the M&A/PMI process within A/E PSFs tends to surface many of the same issues witnessed across various industries in terms of both operational synergies (revenue and cost) and cultural compatibility.

Comparing against recently published literature that stresses advantages to acquiring firms resulting from the overlap in human capital resources through significant diversification strategies in cross-industry M&A, the M&A strategy associated with PSFs is, in fact, just the opposite – commonality and complementarity, yet lack of overlap, tend to outperform more complex M&A strategies. And, while the industry and organizational context for A/E PSFs can differ significantly from other industry and PSF peers, the resulting model contained on Figure 1 may, in fact, serve as a basis for additional multi-industry.

Appendix: Script/Schedule

Preamble/Informed Consent

Thank you for agreeing to participate in the following interview. You are free to discontinue this interview at any time, no questions asked. To be respectful of your time, the anticipated survey length will be less than 60 minutes. I am recording this interview for accuracy and to compile the collection of resultant data themes. The specific responses will not be shared with others, and I will ask that you review the transcribed notes for accuracy. Please let me know if you have any questions, and if not, we will begin. Please answer each question with honest, candid answers; to the extent you are comfortable. There is no right answer, and do not hesitate to go back and clarify or expand on your previous answers. You are also free to pass on any probing questions I may ask.

Introduction

The existing literature suggests there are a number of factors that drive the mergers and acquisitions process in the architectural/engineering (A/E) professional services industry. For example, company ownership (capital structure), size (in terms of annual revenue or employee size), and overall company financial “health” issues play a role in the strategy of companies looking to grow to meet company financial and other objectives. Primary antecedents for M&A in A/E PSFs include talent acquisition, or “the war for talent,” the growth of core and complementary services, diversification (new markets, geographies, and services), or the pursuit of economies of scope and scale. Moreover, sometimes these strategies lead to divestitures and divestments, in addition to mergers or acquisitions, to achieve longer-term strategic plans.

Primary Interview Question(s)

In this interview, I would like to obtain your general and specific impressions of M&A (and divestitures, if appropriate) strategies in A/E PSFs, not only covering the above, but also getting your thoughts on other factors that play a role in the process. And, once the strategy is defined, what do you feel are best practices for the post-merger integration process that effectively lead to performance-based success?

Guiding Questions – Overall Strategy

1. What are your impressions of the A/E industry over the last 10 years, and how has M&A evolved over time?

2. Why does your firm pursue mergers and acquisitions (and divestitures, if appropriate)?

3. What is your approach to mergers and acquisitions (and divestitures, if appropriate), and how does that fit within overall company growth strategies?

4. What other external factors may play a role? (Other factors, such as the overall GDP or economic growth, A/E industry or construction industry growth, including the aggregate number of M&A transactions in a given year as well as interest rates that could impact a company’s cost of capital, or even tax consequences, which could pressure firm management into M&A activity, will be queried, if not provided naturally. Also, those factors that account for significant elements of the M&A strategic rationale, but cannot be directly measured quantitatively, will be clarified: e.g., defensive posturing; planned, intermittent and periodic acquisitions; shareholder/leadership pressures; sell-side drivers such as inadequate succession planning or other financial obstacles; hubris or personal wealth decisions; and managerial herding/envy will be queried through the open-ended discussion.)

Guiding Questions – Post-merger Integration (PMI)

1. How do you approach the post-merger integration process?

2. What factors play a role in how you decide to integrate the companies?

3. What strategies, or factors, have been most successful?

4. What strategies, or factors, have been least successful?

Guiding Questions – Performance and Results

1. What are your overarching lessons learned (what works, what doesn’t work, where have you succeeded and where have you failed)?

2. What have you found relative to the time element of the M&A process, especially as it relates to post-merger integration (e.g., is it better to go fast or slow; are time-related issues different for operations and back office support/systems functions, etc.)?uiding Questions – Performance and Results

Conclusion

The primary research question (above) will be repeated to ensure all ideas have been considered. In addition, recommendations for other ideas for future discussions will be queried from the informants. For smaller firms that are usually in a position of being concerned with inbound offers, the above will be repeated, only from the seller’s side view of M&A (if not already covered). For example, #2 would be reclassified as what does your firm succession planning process look like in the event of considering a sale or request for M&A from an outside firm, and #3 would be changed to what does your firm do in response to outside queries regarding the sale of the firm?

References

AEC Advisors. (2019). State of the AEC industry analysis & insights: 2019 KPI survey results & AEC advisors? chief executive summit conference summary. Mandarin Oriental Hotel. New York City

AEC Advisors. (2020). State of the AEC industry analysis & insights: Full report. Chief Executive Summit. New York.

Bachiochi, P.D., & Weiner, S.P. (2004). Qualitative data collection and analysis, handbook of research methods in industrial and organizational psychology.SG Rogelberg: Blackwell Publishing.

Barkema, H.G., & Schijven, M. (2008). Toward unlocking the full potential of acquisitions: The role of organizational restructuring.Academy of Management Journal,51(4), 696-722.

Connaughton, J., Meikle, J., & Teerikangas, S. (2015). Mergers, acquisitions and the evolution of construction professional services firms.Construction Management and Economics,33(2), 146-159.

Degbey, W.Y., Rodgers, P., Kromah, M.D., & Weber, Y. (2021). The impact of psychological ownership on employee retention in mergers and acquisitions.Human Resource Management Review,31(3), 100745.

Dierdorff, E.C. (2019). Toward reviving an occupation with occupations.Annual Review of Organizational Psychology and Organizational Behavior,6, 397-419.

Environmental and Financial Consulting Group (EFCG). (2016). Annual CEO Reports. New York.

Environmental and Financial Consulting Group (EFCG). (2020). Insight Report: Surviving the Make or Break Moments. Environmental Analyst (London)

Epstein, M.J. (2005). The determinants and evaluation of merger success.Business Horizons,48(1), 37-46.

Greenwood, R., Li, S.X., Prakash, R., & Deephouse, D.L. (2005). Reputation, diversification, and organizational explanations of performance in professional service firms.Organization Science,16(6), 661-673.

Gregerson, J. (2018). Momentum for Industry Mergers and Acquisitions Continues to Grow. Engineering News-Record.

Haleblian, J., Devers, C.E., McNamara, G., Carpenter, M.A., & Davison, R.B. (2009). Taking stock of what we know about mergers and acquisitions: A review and research agenda.Journal of Management,35(3), 469-502.

Harding, D., Shankar, S., & Jackson, R. (2013). The renaissance in mergers and acquisitions: The surprising lessons of the 2000s.Bain & Company.

Hembrough, A. (2019a). Insight Report: Strategic Imperatives from Diversity to Digitalisation Dominate AEC CEO Summit. Environmental Analyst (London).

Hembrough, A. (2019b). Global Megatrends in Environmental Consulting 2019.Environmental Analyst (London).

Hitt, M., Harrison, J., Ireland, R.D., & Best, A. (1998). Attributes of successful and unsuccessful acquisitions of US firms.British Journal of Management,9(2), 91-114.

Hitt, M.A., Bierman, L., Shimizu, K., & Kochhar, R. (2001). Direct and moderating effects of human capital on strategy and performance in professional service firms: A resource-based perspective.Academy of Management Journal,44(1), 13-28.

Jewell, C., Flanagan, R., & Lu, W. (2014). The dilemma of scope and scale for construction professional service firms.Construction Management and Economics,32(5), 473-486.

Kreitl, G., & Oberndorfer, W. J. (2004). Motives for acquisitions among engineering consulting firms.Construction Management & Economics,22(7), 691-700.

Kreitl, G., Urschitz, G., & Oberndorfer, W.J. (2002). Corporate growth of engineering consulting firms: a European review.Construction Management & Economics,20(5), 437-448.

Kusewitt Jr, J.B. (1985). An exploratory study of strategic acquisition factors relating to performance.Strategic Management Journal,6(2), 151-169.

Lamont, B.T., King, D.R., Maslach, D.J., Schwerdtfeger, M., & Tienari, J. (2019). Integration capacity and knowledge-based acquisition performance.R&D Management,49(1), 103-114.

Lee, K.H., Mauer, D.C., & Xu, E.Q. (2018). Human capital relatedness and mergers and acquisitions.Journal of Financial Economics,129(1), 111-135.

Lee, T.W., & Lee, T. (1999).Using qualitative methods in organizational research. Sage.

Marks, M.L., & Mirvis, P.H. (2011). Merge ahead: A research agenda to increase merger and acquisition success.Journal of Business and Psychology,26(2), 161-168.

McCann III, J.E. (1996). The growth of acquisitions in services.Long Range Planning,29(6), 835-841.

Parsons, J. (2019). Recent Mergers Driven by Technology Needs. Engineering News-Record, 60-63.

Rubin, D.K. (2019,). Industry CEOs note looming downturn, Lagging Diversity.

Rudnicki, J., Siegel, K., & West, A. (2019). How lots of small M&A deals add up to big value.McKinsey Quarterly.

Ruhl, T.A. (2020). Growth strategies through mergers and acquisitions in knowledge-based companies?The case for architect/engineer (A/E) professional service firms (PSFs).

Steigenberger, N. (2017). The challenge of integration: A review of the M&A integration literature.International Journal of Management Reviews,19(4), 408-431.

Strauss, A., & Corbin, J. (1990).Basics of qualitative research. Sage publications.

Suddaby, R., Greenwood, R., & Wilderom, C. (2008). Introduction to the Journal of Organizational Behavior's special issue on professional service firms: where organization theory and organizational behavior might meet.Journal of Organizational Behavior,29(8), 989-994.

Wernerfelt, B., & Montgomery, C.A. (1988). Tobin's q and the importance of focus in firm performance.The American Economic Review, 246-250.

Wittmann, A.J., & Hauke, J.P. (2017). The Equity Analyst?s View, E&C Industry Overview, Baird.