Research Article: 2022 Vol: 21 Issue: 3

Millenials in Islamic Digital Economy Sustainability

Juju Zuhriatusobah, Universitas Islam Nusantara

Yulianita Rahayu, Universitas Islam Nusantara

Citation Information: Zuhriatusobah, J., & Rahayu, Y. (2022). Millenials in islamic digital economy sustainability. Academy of Strategic Management Journal, 21(S3), 1-9.

Abstract

Millennials have important relevance to Islamic economics especially in trade financing where goods are transported from a surplus economy to a deficit economy. In addition, millennials are more creatively engaged in entrepreneurial activities such as e-commerce which leads to strong trade finance growth. At the same time, they have their own attitudes and perceptions towards the halal industry or halal trade finance including, halal culinary, halal tourism, simple clothing and Islamic finance. Millennials' perceptions and behaviors will have a significant impact on the Islamic trading ecosystem in the future and in turn will have a major impact on global welfare. This study aims to get an idea of how the millennial generation plays a role in the development of the digital Islamic economy, so that the digital Islamic economy will contribute to economic sustainability in Indonesia along with the emergence of millennials as a new market segment. In this study, the framework for the sustainability of the digital Islamic economy is the Human Development Index (IPM), the Islamic Financial Literacy Index, the Islamic Financial Inclusion Index, and the Inclusive Economic Development Index. To answer the research objectives, the research method used in this research is descriptive quantitative, the data will be processed through R software. Statistical results show that the number of millennials has a negative influence on the Human Development Index (IPM) and the Inclusive Economic Development Index. And the number of millennials has no effect on the Islamic Financial Literacy Index and the Islamic Financial Inclusion Index.

Keywords

Millennial, Islamic Finance, Human Development Index.

Introduction

Digital information technology greatly affects the lifestyle and mindset of today's society. The internet has become an integral part of everyday life. The Central Statistics Agency (BPS) stated that in the last five years, there has been a significant increase in the percentage of people accessing the internet. Data from the 2018 National Socio-Economic Survey explains that 50.92 percent of people in urban areas and 26.56 percent in rural areas aged five years and over have accessed the internet during the last three months. Most of the active internet users are the millennial generation.

The development of the sharia economy in Indonesia must pay attention to the profile of future consumers. In this regard, the millennial generation plays a strategic role in economic development around the world. They are the most powerful economic power in the 21st century.

Millennial potential reaches 140 million people in Indonesia, representing 62.98 percent of Indonesia's population. The portion of millennials reaches 33.75 percent and 29.23 percent is the centennial generation or generation Z. In addition, 87 percent of Indonesia's population is Muslim, which occupies 12.5 percent of the world's Muslim population.

According to The Future of World Religion and PEW Research Center, the Muslim population will reach 29.7 percent by 2050. The Global Islamic Economy Report 2018-2019 by Thomson Reuters also states that the Islamic economy is growing steadily as it is driven by the Muslim millennial population which continues to increase and is expected to reach three billion people by 2060, and the Muslim population in 2050 will reach 29.7 percent. The Global Islamic Economy Report 2018-2019 by Thomson Reuters also states that the Islamic economy is growing steadily due to the growing Muslim millennial population and is expected to reach three billion people by 2060.

Meanwhile, based on the 2017 Startup Report (DailySocial.id), Indonesia is the largest consumer market for digital products in Southeast Asia which is expected to continue to grow. On the industrial side, the growth of Indonesian digital startups also shows an increasing trend every year. In fact, Indonesia is ranked sixth as the country with the highest number of startups in the world ( Sidiq et al., 2021; Republika.co.id, 2020; Hassan et al., 2019)

Based on the 2019 Indonesia Millennial Report survey released by the IDN Times, non-cash finance is mostly owned by the millennial generation and debit cards are still the favorite at the top with a percentage of 64.2 percent. The existence of non-cash finance makes any payment easier and the transaction value of the digital economy in Indonesia is increasing.

It is also interesting to note that millennial have important relevance to Islamic economics especially in trade finance where goods are transported from a surplus economy to a deficit economy. In addition, millennial are more creatively engaged in entrepreneurial activities such as e-commerce which leads to strong financial trade growth. At the same time, they have their own attitudes and perceptions towards the halal industry or halal trade finance including, halal culinary, halal tourism, simple clothing and Islamic finance.

Meanwhile, the most active Islamic economic sector for Millennials is Islamic Finance (157 thousand interactions), Modest Fashion (101 thousand interactions) and Media or creation recorded 99 thousand Facebook interactions in the same interaction sample.

The demographic bonus will become a pillar of increasing the productivity of a country and become a source of economic growth through the use of productive human resources in the sense that the productive age population is actually able to generate income to meet their consumption needs and have savings that can be mobilized into investment.

If you refer to the 2019 BPS data, the total population of Indonesia in 2020 is projected to reach 270 million people. Of this number, the Muslim population is 229.62 million. Of this number, 66.07 million people aged 0-14 years and 15-64 years old amounted to 185.34 million people. In 2020, it is estimated that the productive age of 15-64 years is 68.75%. This is a potential group. These young people (millennials) have a decisive role and contribution (Nurhidayat, 2020).

Indonesia is a country with a Muslim population reaching 87.18 percent of a population of 232.5 million people. This is a very large measure of the market share of products and services based on the Islamic economy. According to the same report, Indonesia is among the top 10 consumers in every sub-sector in the halal industry. The details are as follows:

1. Ranked first in the top Muslim food expenditure.

2. Ranked fifth in the top Muslim travel expenditure category.

3. Third place in the top Muslim apparel expenditure

4. The fifth rank in the top Muslim media expenditure.

5. The sixth rank in the top Muslim pharmaceuticals expenditure.

However, in the five industries, Indonesia ranks in the top 10 according to the Global Islamic Economy (GIE) Index ranking only in the categories of halal tourism and Muslim fashion.

From the Indonesian Telecommunications Statistics, BPS explains that the purpose of internet use is dominated by the use of social media and getting information or news with a percentage of about 79.13% and 65.97%, respectively.

Meanwhile, the other purpose of using the internet is for entertainment (45.07%), doing schoolwork (25.87%), sending or receiving emails (21.10%), buying or selling online goods and services (10.82%), facilities financial (5.08%), and others (12.84%).

The Islamic economic movement in Indonesia since thirty years ago, has not found significant results, when viewed from the ratio of the number of Indonesian Muslims to Islamic financial institutions. Muslims still do not have the knowledge and awareness about the importance of Islamic economics. The role and contribution of Muslims is still small in the Indonesian economic movement.

Millennials' perceptions and behaviors will have a significant impact on the Islamic trading ecosystem in the future and in turn will have a major impact on global welfare. With this background, this study formulates a research problem to get an idea of how the millennial generation plays a role in the development of the digital Islamic economy, so that the digital Islamic economy will contribute to economic sustainability (sustainability) in Indonesia along with the emergence of millennials as a new market segment.

Based on the formulation of the problems that have been described, the objectives of this study are: 1) To determine the role of the millennial generation in the digital Islamic economy, 2) To determine the impact of the digital Islamic economy on economic sustainability, and 3) To determine the role of the millennial generation towards economic sustainability (sustainability).

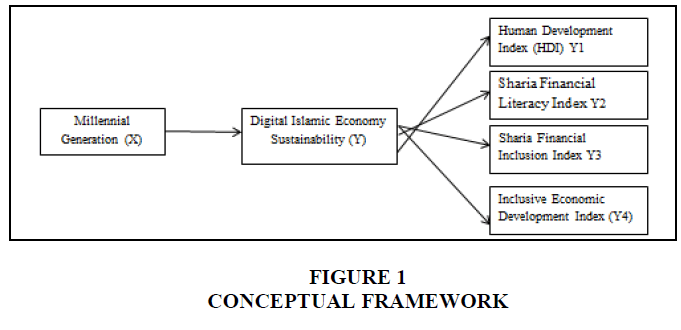

The research variables used in this study consisted of independent variables (variable X) and dependent variables (variable Y). The dependent variable in this study is the Islamic Digital Economy Sustainability as measured by the Human Development Index (HDI), the Islamic Financial Literacy Index, the Islamic Financial Inclusion Index, and the Inclusive Economic Development Index. While the independent variable in this study is the millennial generation, which is measured by the number of millennial generation residents spread across 34 provinces in Indonesia, during the 2016 and 2019 periods.

Methods

This study uses a descriptive quantitative approach. A quantitative approach is used to measure how big the role and contribution of the millennial generation to the sustainability of the sharia digital economy in Indonesia and to find out the factors that shape the sustainability of the sharia digital economy. Through a descriptive approach, it aims to describe phenomena related to the millennial generation and the sustainability of the sharia digital economy in the current state of the data collected.

The millennial generation in this study is aged between 20-35 years spread across 34 provinces in Indonesia. The limitation of respondents' criteria in terms of age is rational because the generation trend at that age is the most dominant user of digital access (Geissdoerfer et al., 2017; Haming et al., 2019).

The data used in this research is secondary data. Secondary data in this study are annual reports obtained from the official website of BPS (Central Statistics Agency) Indonesia, BPS in every 34 provinces, OJK (Financial Services Authority), and Bappenas (National Development Planning Agency), during the period 2016 and 2019. Currently, the Financial Services Authority (OJK) conducts a national survey of Islamic financial literacy and Islamic financial inclusion only in 2016 and 2019. Therefore, to get proper research results, all data in this study uses two periods, namely 2016 and 2019. All variables are in the form of panel data, which is a data set with several cross sections and time series data.

The research variables used in this study consisted of independent variables (variable X) and dependent variables (variable Y). The dependent variable in this study is the Islamic Digital Economy Sustainability as measured by the Human Development Index (HDI), the Islamic Financial Literacy Index, the Islamic Financial Inclusion Index, and the Inclusive Economic Development Index. While the independent variable in this study is the millennial generation, which is measured by the number of millennial generation residents spread across 34 provinces in Indonesia, during the 2016 and 2019 periods.

To answer the research objectives, namely to measure how big the role and contribution of the millennial generation to the sustainability of the sharia digital economy and to find out the factors that shape the sustainability of the sharia digital economy (Islamic digital economy sustainability); and describe phenomena related to the millennial generation and the sustainability of the sharia digital economy in Indonesia, the researchers used panel data regression analysis with R software. Through this analysis, it was possible to determine whether an increase/decrease in an independent variable could affect an increase/decrease in the dependent variable (Figure 1).

Results and Discussion

The Influence of Millennial Generation on Human Development Index/HDI (Y1)

For the effect of variable X on Y1 (Human Development Index) it is found that variable X has a negative effect on Y1, based on the p-value of variable X (0.005369) < (0.05) and has a coefficient value of -1.14021. So for every 1 unit increase in the variable X (millennial) the variable Y1 (HDI) will decrease by 1.14021 units. The R-square value is 0.4053 which means that the Y1 variable can be explained by the X variable by 40.53%, while the rest is explained by other variables.

The Influence of the Millennial Generation on the Islamic Financial Literacy Index (Y2)

For the effect of the variable X on Y2 (Islamic Financial Literacy Index), the variable X has no effect on Y2, based on the p-value of the variable X (0.6885) > (0.05) and the coefficient value of -1.939. So for every 1 unit increases in the variable X (millennial) the variable Y2 (Islamic Financial Literacy Index) will decrease by 1,939 units. The R-square value is 0.0024, which means that the Y2 variable can be explained by the X variable by 0.24%, while the rest is explained by other variables.

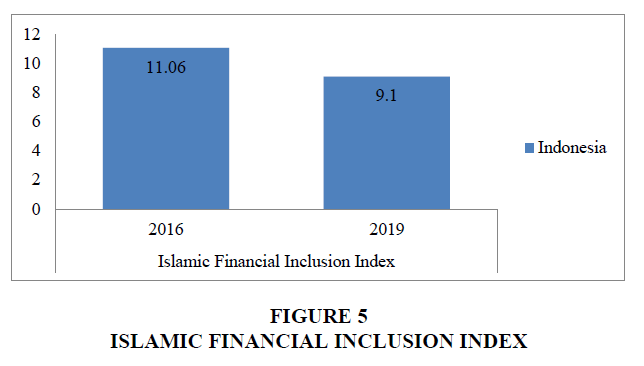

The Influence of the Millennial Generation on the Islamic Financial Inclusion Index (Y3)

For the effect of variable X on Y3 (Islamic Financial Inclusion Index) it is found that variable X has no effect on Y3, based on the p-value of the variable X (0.7880) > (0.05) and the coefficient value is 0.1363. So for every 1 unit increases in the variable X (millennial) the variable Y2 (Islamic Financial Inclusion Index) will increase by 0.1363 units. The R-square value is 0.0011, which means that the Y3 variable can be explained by the X variable by 0.11%, while the rest is explained by other variables.

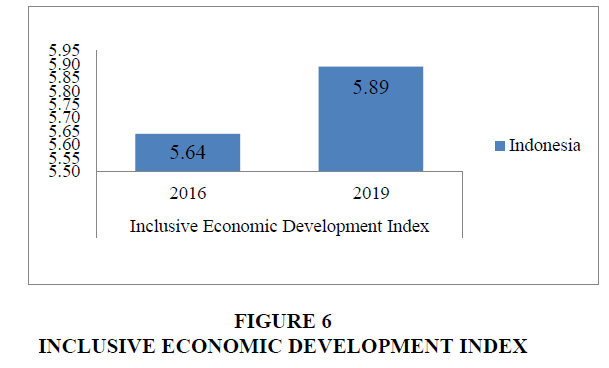

The Influence of Millennial on the Inclusive Economic Development Index (Y3)

For the effect of variable X on Y4 (Inclusive Economic Development Index) it is found that variable X has a negative effect on Y4, based on the p-value of the variable X (0.00302) < (0.05) and the coefficient value is -0.1769. So every 1 unit increase in the variable X (millennial) variable Y4 (Inclusive Economic Development Index) will decrease by 0.1769 units. The R-square value is 0.3376, which means that the Y4 variable can be explained by the X variable by 33.76%, while the rest is explained by other variables.

Based on the results of panel data regression calculations using Software R, it can be seen that the millennial generation has a negative influence on the HDI/Human Development Index (Y1) and the Inclusive Economic Development Index (Y4).

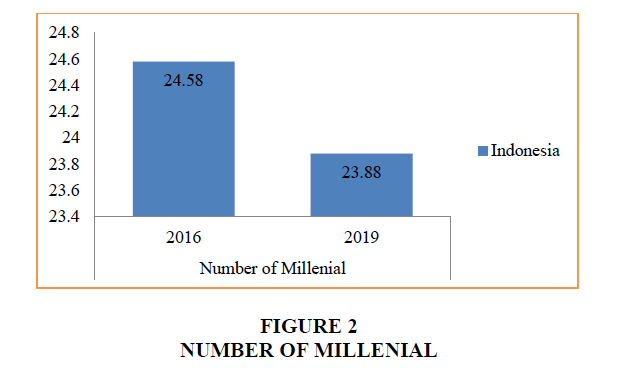

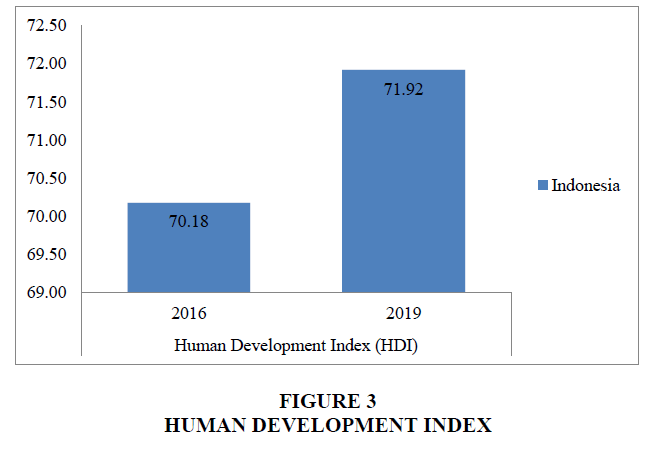

To describe the phenomenon of the millennial generation descriptively, the Human Development Index (IPM), the Islamic Financial Literacy Index, the Islamic Financial Inclusion Index, and the Inclusive Economic Development Index, are seen from the graph below (Figure 2 & Figure 3):

HDI is the relationship between humans and the surrounding development. So that the denser the population in an area, the HDI figure must be taken into account.

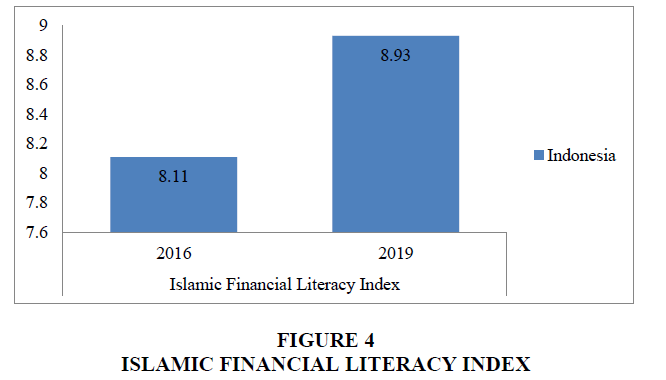

Humans are not only objects of development but are expected to become subjects, so that they can make a useful contribution to the progress of a region that on a macro level becomes the progress of a country. The success of development is measured by several parameters, and the most popular today is the Human Development Index (HDI) or Human Development Index (HDI) (Pratowo, 2011; Prasarti & Prakoso, 2020) (Figure 4).

Citing research from (Ningtyas, 2019; Maharani & Ulum, 2019), that several previous studies have tested the level of financial literacy in young people. The results show that the level of financial literacy of young adults is still very low even though they are classified as financially active—as evidenced by credit card ownership. The level of financial literacy will increase along with the increase in education. Among other generations, millennials show the lowest level of financial literacy—only 24% of respondents can answer the questions asked correctly (Indahingwati et al., 2019).

Based on research conducted by Said & Amiruddin (2017) that the general public still does not know widely about Islamic finance and gender influences the level of financial literacy. The results showed that the level of financial literacy among men was lower than that of women (Said & Amiruddin, 2017; Rachmawati & Gunawan, 2020) (Figure 5).

Inequality of access to banking between urban and rural areas causes low levels of financial inclusion and literacy. The factor that most influences the level of financial inclusion in Indonesia is public accessibility to banking.

Inclusive finance must be able to remove all barriers to financial access to all levels of society in all places. Barriers to financial access can occur from access to savings, credit and other financial services such as payment systems, insurance and other services from the banking world. What often happens in the community after being able to access financial services in the form of savings and other services, the community, especially the lower class people, still have difficulty accessing credit or financing services. There is even a general opinion in the community that the existence of banks in their eyes is only to collect their funds, but not to access credit services. So financial inclusion is a solution to remove this barrier. The success of financial inclusion if access to banking services can be enjoyed from all aspects, both savings, services and credit (Susilo, 2015; Slaper & Hall, 2011; Setiawan & Hakim, 2013) (Figure 6).

From the picture above, it can be seen that the population growth rate of the millennial generation in Indonesia from 2016 to 2019 has decreased. However, the Human Development Index, Islamic Financial Literacy Index, and Inclusive Economic Development Index increased in the same year, only the Islamic Financial Inclusion Index decreased. This is seen to be linear with the results of statistics using R software.

Conclusion

Based on the quantitative method approach, the millennial generation does not have a positive influence on the Human Development Index (HDI), the Islamic Financial Literacy Index, the Islamic Financial Inclusion Index, and the Inclusive Economic Development Index. This is also supported by a descriptive picture that with the decline in the number of millennials, there is an increase in the Human Development Index (HDI) and the Inclusive Economic Development Index.

The results of this study are not completely absolute, because basically there are many factors that can form the framework of the sustainability of the digital Islamic economy, and there are no standard indicators to calculate the sustainability of the digital Islamic economy.

Currently, Indonesia is entering the era of demographic bonus, where the population of productive age is more than that of unproductive age. The demographic bonus needs to be handled wisely because it will be like a ticking time bomb if not prepared properly. Especially the millennial generation who will make a positive and significant contribution to the development of the digital Islamic economy in Indonesia?.

References

Geissdoerfer, M, Savaget, P, Bocken, N.M, & Hultink, E.J. (2017). The circular economy–a new sustainability paradigm?Journal of Cleaner Production,143, 757-768.

Indexed at, Google Scholar, Cross Ref

Haming, M., Murdifin, I, Syaiful, A.Z, & Putra, A.H.P.K. (2019). The application of SERVQUAL distribution in measuring customer satisfaction of retails company.Journal of Distribution Science,17(2), 25-34.

Indexed at, Google Scholar, Cross Ref

Hassan, F., Osman, I., Kassim, E.S., Haris, B., & Hassan, R. (2019).Contemporary Management and Science Issues in the Halal Industry. Springer.

Indahingwati, A, Launtu, A, Tamsah, H, Firman, A, Putra, A.H.P.K., & Aswari, A. (2019). How digital technology driven millenial consumer behaviour in Indonesia.

Maharani, S., & Ulum, M. (2020).Digital economy: Future opportunities and challenges for the islamic economy in Indonesia.InConference on Islamic Studies FAI 2019(pp. 1-11).

Ningtyas, M.N. (2019).Financial literacy in millennial generation.Scientific Journal of Asian Business and

Nurhidayat, N. (2020).Millennial Muslims and the Indonesian Islamic economic movement.Mizan: Journal of Islamic Law,4(1), 131-140.

Prasarti, S., & Prakoso, ET (2020).Millennial character and behavior: Demographic bonus opportunities or threats.Consilia: Scientific Journal of Guidance and Counseling, 3(1), 10-22.

Pratowo, N.I. (2012).Analysis of the factors that influence the Human Development Index.Journal of Indonesian Economic Studies,1(1), 15-31.

Rachmawati, RR, & Gunawan, E. (2020). The role of millennial farmers in supporting the export of agricultural products in Indonesia.InAgro-Economic Research Forum(Vol. 38, No. 1, pp. 67-87).

Said, S., & Amiruddin, AMA (2017).Islamic financial literacy in Islamic religious colleges (case study of UIN Alauddin Makasar).Al-Ulum: Journal of Islamic Studies,17(1), 44-64.

Setiawan, MB, & Hakim, A. (2013).Indonesia's human development index.Journal of Economia,9(1), 18-26.

Sidiq, R., Sofro, S., Jalil, A., & Achmad W.R.W. (2021). Virtual world solidarity: How social solidarity is built on the crowdfunding platform kitabisa.com.Webology,18(1).

Slaper, T.F., & Hall, T.J. (2011). The triple bottom line: What is it and how does it work.Indiana business Review,86(1), 4-8.

Susilo, E. (2015). Eradicating poverty and ignorance of the ummah through sharia financial inclusion. Building Indonesia Based on Religious Values, 1-18.

Received: 14-Dec-2021, Manuscript No. ASMJ-21-10456; Editor assigned: 16-Dec-2021, PreQC No. ASMJ-21-10456(PQ); Reviewed: 30-Dec-2021, QC No. ASMJ-21-10456; Revised: 08-Jan-2022, Manuscript No. ASMJ-21-10456(R); Published: 19-Jan-2022