Research Article: 2019 Vol: 18 Issue: 5

Mobile Devices are Friends-In-Hand: Exploring Youths Resistance Behaviour

Takesure Zhowa, Tshwane University of Technology Business School

Zeleke Worku, Tshwane University of Technology Business School

Abstract

Keywords

Mobile Devices, Generation Z Youths, Resistance, Self-Service Banking Innovations.

Introduction

Generation Z (also known as post-millennials or iGeneration) is a demographic cohort born of and raised by Generation X (Levit, 2015; Turner, 2015). Whereas there is no specific period when this cohort begins and finishes, demographers and researchers submit that their birth years start from around mid-1990s (Broadbent et al., 2017). The cohort is idiosyncratic in that it is characterised by their ability to own and operate at least one mobile device, extensive usage of internet and technologies since young age, technologically affluent, and interacting on social media websites for most of their socialisation (McCrindle, 2015). Thus, some researchers have labelled the mobile device as the Generation Z’s “friend-in-hand” (Shambare et al., 2012) that helps this segment escape emotional and mental struggles because of having a “digital bond to the internet” (Broadbent et al., 2017). Based on a recent survey, Broadbent et al. (2017) submit that this cohort spends more time specifically on cell phones than watching television and engaging in sporting activities.

Several previous studies (e.g. Calisir & Gumussoy, 2008; Karjaluoto et al., 2010; Koenig-Lewis et al., 2010) depict this cohort as technologically savvy, educated, and continually searching for first-hand information about the world around them. They are, in particular, continuously searching for new shopping experiences. In fact, researchers that studied this segment describe the usage of mobile devices by this consumer regime as the 21st century addiction (Shambare et al., 2011) which, apart from being socially-inclined, has altered consumers’ lives and espoused new behavioural traits. In light of this exposé, the cohort constitutes a unique and vital consumer segment with the propensity to influence other consumer segments. Some scholars hold that this cohort constitutes consumers of products today and for the future.

In light of high adoption rates of mobile devices by this consumer segment which have reached at least 80% globally, marketers have shifted their marketing efforts towards addressing and even surpassing the specific needs of this consumer segment. Marketers are also targeting this consumer segment by transmitting various communications via social platforms as Facebook, LinkedIn, Instagram, WhatsApp etc. In fact, the extensive usage of mobile devices by this cohort has created an impression to marketers that all consumers have the “brand-in-hand”. Such an assumption by marketers has been disapproved given that there seems to be a significant 20% of consumers that resist the use self-service innovations. Thus, an understanding of resistance behaviour from the viewpoint of youths in Generation Z category makes sense and is important to marketers for strategic positioning and sustainable competitive advantage.

Consistent with the above, there is paucity in the literature in that there appears to be little research attention that examined the remainder (almost 20%). The drivers of resistance behaviour to latest self-service banking innovations by the Generation Z consumer cohort have not been amply researched. A few previous studies such as Ram (1987) and Laukkanen et al. (2007) that examined the phenomenon and developed models depicting the drivers of resistance behaviour towards innovations. While this paper acknowledges the contributions of the latter researchers, the models could be archaic to passably illuminate on the drivers of resistance behaviour that relate to the Generation Z consumer segment. Moreover, the Ram (1987) model is devoid of specificity in terms of the consumer segment that it relates to whereas the Laukkanen et al. (2007) model relates solely to mature consumers. Both works do not specify the type of innovation consumers are resisting. In view of that, the objective of this paper is to determine the drivers of resistance behaviour to self-service retail banking innovations specifically from the view of the Generation Z cohort.

A characterisation of this consumer segment has been provided and the objective of this paper has been highlighted. The next subsection provides a review of literature with specific focus on the concept of consumer resistance behaviour with a focus on drivers of resistance behaviour. A synopsis of methods and techniques for collecting data and analysing data are proffered. The penultimate segment presents the results and discussion of empirical data. The final segment presents conclusions based on results and suggests areas for further inquiry.

Literature Review

Consumer Resistance Behaviour

Consumer resistance behaviour has been a subject of enquiry in marketing literature in recent years (Agwu, 2013; Bagozzi & Lee, 1999; Heidenreich & Handrich, 2015; Laukkanen & Kiviniemi, 2010). Some researchers regard consumer resistance behaviour as situations that are exhibited through discontent, displeasure or distress about a situation that is perceived as dissonant (Claudy et al., 2015). Ram & Sheth (1989) view the concept as “resistance offered by consumers to an innovation, either because it poses potential changes from a satisfactory status quo or because it conflicts with their belief structure”. Other researchers delineate resistance behaviour as an intention or behaviour, as an attitude, or a blend of the two. In line with the multiple conceptualisations, some scholars view resistance as directed against new products (Ram & Sheth, 1989), new services based on technological innovations (Kuisma et al., 2007), and new markets. Innovation resistance is delineated from “not-trying” an innovation into 3 types of resistance behaviour viz.; rejection, postponement and opposition.

Rejection is the outcome of an active evaluation of a product or service which culminates into a strong disinclination to adopt the innovation (Lee & Clark, 1996; Rogers, 2004). Such an act of reluctance is prompted by a suspicion of new and unverified innovations, and a sense of contentment with the status quo. It constitutes the most extreme of resistance where consumers are not willing to try the innovation. In contrast, postponement is a situation where consumers accept an innovation in principle but may decide not to adopt the innovation until a later time or simply delay adoption of an innovation (Brahim, 2015; Calisir & Gumussoy, 2008). In short, postponement is characterised by indecision. With rejection, the consumer simply does not adopt the product but with opposition, the consumer goes further to launch an attack on the innovation. Opposition takes the form of negative word-of-mouth, also referred to as active rebellion or innovation sabotage (Claudy et al., 2015; Coetsee, 1999; Cruz et al., 2009)). It is vital for marketers to understand the drivers of such behaviour.

Drivers of Resistance Behaviour towards Innovations

Ram & Sheth (1989) assert that resistance to innovations can be split into two main types. First, innovations requiring consumers to alter or depart from established behavioural patterns, norms, habits and traditions are likely to be resisted. The latter are developed, shaped and moulded by the society in which the consumer dwells or reference groups. An endeavour to conform to group norms and standards may imply resisting change. Second, innovations which may cause psychological conflict or problem for consumers are also likely to be resisted.

In addition, previous studies contend that resistance behaviour is driven by factors, inter alia: a distinctive set of associations in the consumer’s mind-set based on product category and the manufacturer (i.e. perceived image) (Ram & Sheth, 1989); ever-increasing transmission of information, knowledge and innovations (i.e. information overload); concern that the innovation might be harmful, unhealthy and cause injury (i.e. physical risk); a concern that an innovation might be a waste of economic resources (i.e. economic risk); uncertainty with the performance of the innovation (i.e. functional risk) (Ram & Sheth, 1989; Szmigin & Foxall, 1998) and concern that the innovation might not be accepted by the social circles (i.e. social risk).

Brahim (2015) found that the continued growth of internet raises privacy and security concerns among different consumer groups which ultimately contribute to resistance behaviour. This is because the use of the internet involves using passwords which may be hacked and business information shared on the internet becomes available for public consumption.

Hypothesis

H1: Innovation characteristics has positive impact on use of self-service banking technologies by youths

H2: Consumer perceptions have positive impact on use of self-service banking technologies by youths

H3: Psychological factors have positive impact on use of self-service banking technologies by youths

H4: Perceived risk has positive impact on use of self-service banking technologies by youths

H5: Economic factors positive impact on the use of self-service banking technologies by youths

H6: Social factors have positive impact on use of self-service banking technologies by youths

H7: Attitudes towards existing products has positive impact on use of self-service banking technologies by youths

Research Design

Research Strategy

Using the survey method, quantitative data were collected from youths in the Generation Z consumer segment who are currently studying in tertiary institutions in South Africa. A non-probabilistic sampling method called purposive sampling was used. An interception technique was also employed concurrently as students left their institutions.

Sampling and Sample Size

The study involved youths in the Generation Z category. It was decided on such a population in line with the objective of this paper. The participants’ age range was 17-22 years which yielded a mean=19.5 years and a standard deviation std=2.75. The K-S normality test was not significant (D=1.258, p=0.0036) suggesting the sample followed a normal distribution.

The Instrument

A validated self-service innovativeness scale applicable across several SSTs was adapted from Kaushik & Rahman (2015). It was adapted in line with the objective of paper which focuses on determining the drivers of resistance behaviour to self-service retail banking innovations.

Data Collection

The instrument was piloted to 20 youths in order to refine the items and iron out ambiguities. Thereafter, a total of 500 questionnaires were administered out of which n=388 questionnaires were completed and immediately returned, which yielded a response rate of 78%.

Data Analysis

Descriptive statistics were performed to analyse profiles of participants. Two tests to determine the suitability of a factor analysis were performed. The KMO measure yielded a result of 0.830 confirming the adequacy of the sample to do factor analysis. Bartlett’s test of Sphericity yielded x2=3.510E3; df=210 and p=0.000. Cronbach's alpha was .920 after removing “more secure” and “cover up” variables indicating a high level of internal consistency. Factor analysis involving principal component analysis and varimax rotation was performed, the results of which are presented in the next subsection.

Results and Discussion

A summary of the profiles of participants is presented in Table 1 as follows:

| Table 1 Distribution of the Profiles of Participants | |||

| Variable | Frequency | Percentage (%) | |

| Gender | Male | 269 | 69 |

| Female | 119 | 31 | |

| Age | 17-19 years | 228 | 59 |

| 20-22 years | 160 | 41 | |

| Area of residence | Within a CBD | 98 | 25 |

| Just outside CBD | 88 | 23 | |

| In a township | 110 | 28 | |

| In a rural area | 92 | 24 | |

| Self-service banking innovation (you may select more than 1 option) |

ATM | 56 | 14 |

| EFTPoS | 88 | 23 | |

| Bank cards | 97 | 25 | |

| Laptop | 150 | 39 | |

| Cell phone | 300 | 77 | |

| Tablet | 150 | 39 | |

| Usage of SSTs | Use | 304 | 78 |

| Don’t use | 84 | 22 | |

In analysing profiles of participants, the results show that participants were mostly males (69%) and most participants were in the 17-19 years category (59%). In terms of area of residence, the results show a fair distribution of participants with most participants staying in townships. The type of innovations youths are using in self-service retail banking transactions in order of popularity are as follows: cell phones (77%), laptops (39%), tablets (39%), bank cards (25%), EFTPoS (23%) and ATMs (14%). These results confirm that cell phones, laptops and tablets are more popular due to their mobility and handiness. Participants are fairly and evenly spread in terms of their areas of residence, i.e. residing in CBDs 25%, outside CBD 23%, in townships 28%, and in rural areas 24%. This implies that youths are technologically savvy regardless of the area of residence. In terms of usage of self-service technologies, 78% use self-service technologies while 22% do not. Prior studies confirm that adoption of self-service technologies globally is around 80% while those resisting their usage account for the remainder. It is based on the 22% above not using self-service technologies that subsequent statistical analysis is performed in order to determine the underlying factors contributing to such behaviour.

The principal component analysis (CPA) method extracted 5 factors which had eigenvalues >1. However, the factors had significant cross-loadings in the Component Matrix and that necessitated performing a Rotated Component Matrix using Varimax Rotation in order to derive refined factors. A Varimax Rotation that yielded a 4-factors solution that was extracted based on three criteria. First, it was based on a factor loadings >0.5. Second, at least 4 items clustered together constituted a factor. Third, variables extracted for analysis have eigenvalues>1. The rotation yielded 4-factors solution which is deemed sufficient and apposite to account for resistance to self-service banking innovations by youths in Generation Z, see Table 2.

| Table 2 Factors Contributing to Resistance Towards Self-Service Banking Innovations | |||||

| Variable | Factor 4 | Factor 1 | Communalities | Factor 2 | Factor 3 |

| A2 | 0.727 | 0.806 | |||

| F1 | 0.687 | 0.794 | |||

| F3 | 0.674 | 0.791 | |||

| B3 | 0.608 | 0.639 | |||

| A1 | 0.506 | 0.534 | |||

| A6 | 0.711 | 0.781 | |||

| F2 | 0.632 | 0.777 | |||

| B1 | 0.695 | 0.774 | |||

| B2 | 0.621 | 0.75 | |||

| C3 | 0.785 | 0.87 | |||

| G2 | 0.75 | 0.843 | |||

| G1 | 0.718 | 0.827 | |||

| C1 | 0.522 | 0.562 | |||

| C2 | 0.725 | 0.823 | |||

| A3 | 0.674 | 0.79 | |||

| A4 | 0.616 | 0.755 | |||

| A5 | 0.552 | 0.544 | |||

| Eigenvalues (Total) | 5.72 | 2.687 | 2.245 | 1.555 | |

| % of variance | 58.13 | 27.24 | 12.797 | 10.69 | 7.403 |

Factor 1 consists of five items relating to how consumers perceive the innovation. This factor is consistent with and rejects

H2: Consumer perceptions have positive impact on the use of self-service banking technologies by youths.

The items constituting the factor are as follows: not confident using the innovation; not comfortable with the innovation; not familiar with the innovation; the innovations do not fit my lifestyle; and my habits are not related to using the innovations. Prior studies (Mani & Chouk, 2017) submit that one factor contributing to non-adoption of innovations is because users are not educated enough to operate the innovation. In this case, only educated and technologically affluent consumers were involved. Yet the results show that resistance to innovations is due to lack confidence and feeling uncomfortable using it possibly due to its complexity. Furthermore, the innovation makes users feel out of class or it is out of line with what they are used to do most of the time (habits). In short, these results suggest that youths resist the use of self-service retail banking because of their negative perceptions of self service innovations. Even if the variables constituting this factor may differ to some extent, negative perceptions are consistent with findings by Mani & Chouk (2017).

Factor 2 comprises of 4 variables which are: self-service innovations are not fashionable; do not come with free services; do not have a good integration of a wide range of function and services; and are not as convenient and reliable as human assistance inside retail banks. In line with literature, this factor relates to innovation characteristics. According to Ram & Sheth (1989), these latter variables can be classified under usage, value and risk factors which are functional barriers. Thus, the results suggest that youths resist using self-service banking technologies because of lack of relative advantage, incompatibility, the perceived risk inherent with using such technologies, and the complexity of the innovations given that innovations are constantly changing. These findings reject

H1: An Innovation characteristic has positive impact on the use of self-service banking technologies by youths.

Even though previous studies (e.g. Mani & Chouk, 2017) found variables like communicability, reversibility etc., this study found those variables not specifically relating to youths in Generation Z and self-service innovations.

Factor 3 consists of 4 variables namely; I want solutions to my queries first before I can buy; I fear changes; I am waiting for the right time; and I will wait till it proves beneficial. It was hypothesized the attitudes of youths towards innovations are based on their current experiences with existing products. Such attitudes lead to postponement behaviour, a phenomenon which was identified in related previous studies by Cohen (2017) as a form of consumer resistance behaviour. These results reject the hypothesis:

H7: Attitudes towards existing products has positive impact on the use of self-service banking technologies by youths.

If the innovation is perceived not to address the specific needs of the youths, they do not use it or they are simply satisfied with the status quo. In some instances, while youths have been proven in other studies that they are more adventurous and are curious to understand new things than other consumer segments (Shambare, 2011 & 2013), this study found that some youths likewise wait for other consumer groups to try an innovation before they can decide to own or utilise it.

Finally, Factor 4 comprises 4 variables which are: not for me; do not need; unlikely to use them; and I fear changes. The results suggest that youths resist using self-service retail banking innovations as a result of psychological barriers. Psychological barriers to the adoption of innovations are sometimes a result of conflict with consumers’ previous and current beliefs (Ram & Sheth, 1989). They are put in two categories of traditional and image barriers. The latter variables reject the hypothesis:

H3: Psychological factors have positive impact on the use of self-service banking technologies by youths.

Although not all elements constituting traditional or image barriers from prior studies relate to the findings of this study, these key variables have been confirmed as factors contributing to resistance behaviour by youths.

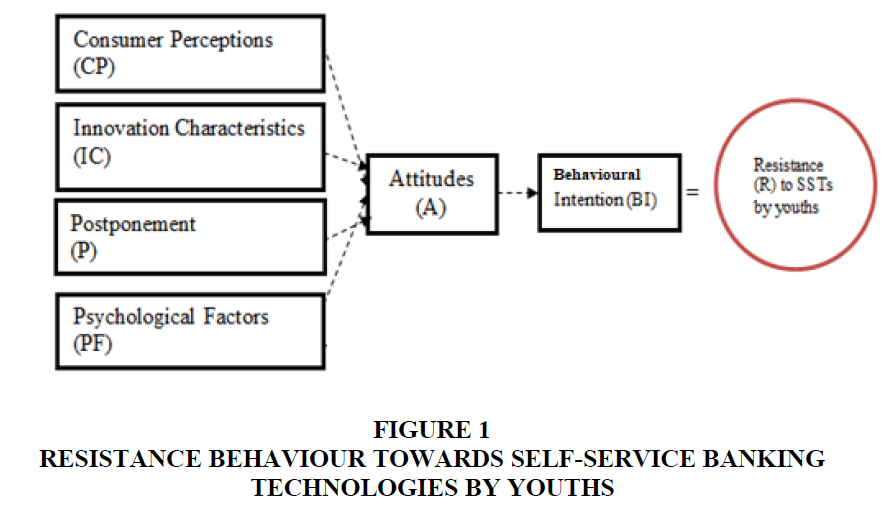

The factors above are summarised in the form of a model depicting (Figure 1) the drivers of resistance behaviour towards self-service banking technologies by youths.

Consumer Perceptions (CP), Innovation Characteristics (IC), Psychological Factors (PF) and Postponement are the factors ultimately contributing to resistance behaviour. Their prevalence leads to the formation of attitudes (A) towards an innovation which influences behavioural intentions (BI) to resist self-service banking technologies (R). Even though it was hypothesised that economic factors, social factors and perceived have negative impact on the use of self-service banking innovations, a factor analysis did not find these to be significant factors and therefore were rejected in subsequent analysis.

Conclusion

The objective of the paper was to determine the drivers of resistance behaviour to the adoption of self-service retail banking innovations by youths in Generation Z category. This study concludes that perceptions, the characteristics of the innovation, psychological factors and postponement are the main factors contributing to resistance behaviour towards self-service banking innovations among Generation Z consumers. Recent studies by Claudy et al. (2015) and Rumanyika (2015) in Ireland and Tanzania respectively reveal that consumers in general resist self-service innovations because of security concerns, i.e. due to characteristics of the innovation. Laukkanen (2016) conducted a study in Finland and found that consumers generally resist innovations due to value barriers. This finding relates well to the finding of this study where perceptions of value derived from the use of the innovation need to be taken into account. In Jordan, Alalwan et al. (2016) concurs with the latter findings and submits that perceived usefulness is the significant contributor to resistance behaviour. In South Africa, a study by Ramavhona & Mokwena (2016) found that consumers resist innovations if the perceived value is not up to certain expected higher level. To a greater extent, there are notable similarities between factors influencing resistance among youths and mature customers. Hence, the summary of factors presented in the form of a model above, to a greater extent, relates to the Theory of Planned Behaviour (TPB) by Ajzen (1991).

However, it is important to accentuate that not all factors contributing to resistance behaviour as revealed in prior studies explain the resistance behaviour of Generation Z consumers. It is important for managers to pay special attention to those factors that relate to both mature consumers and the youths as this assists to focus on current as well future needs. A very specific focus on the needs and expectations of the youths is important because this cohort constitutes consumers of banking innovations now and in the future. Future studies could possibly examine the extent to which each factor influences resistance towards self-service banking services by youths.

References

- Agwu, E. (2013). From reluctance to resistance: Study of internet banking services adoption in the United Kingdom. International Journal of Customer Relationship Marketing and Management (IJCRMM), 4(4), 41-56.

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179-211.

- Alalwan, A.A., Dwivedi, Y.K., Rana, N.P., & Williams, M.D. (2016). Consumer adoption of mobile banking in Jordan: examining the role of usefulness, ease of use, perceived risk and self-efficacy. Journal of Enterprise Information Management, 29(1), 118-139.

- Bagozzi, R.P., & Lee, K.H. (1999). Resistance to innovations: Psychological and social origins.

- Brahim, S.B. (2015). Typology of resistance to e banking adoption by Tunisian. Journal of Electronic Banking Systems, 2015, 1.

- Broadbent, E., Gougoulis, J., Lui, N., Pota, V., & Simons, J. (2017). Generation Z: global citizenship survey. What the World’s Young People Think and Feel, 26-44.

- Calisir, F., & Gumussoy, C.A. (2008). Internet banking versus other banking channels: Young consumers’ view. International Journal of Information Management, 28(3), 215-221.

- Claudy, M.C., Garcia, R., & O’Driscoll, A. (2015). Consumer resistance to innovation—a behavioral reasoning perspective. Journal of the Academy of Marketing Science, 43(4), 528-544.

- Coetsee, L. (1999). From resistance to commitment. Public Administration Quarterly, 204-222.

- Cohen, B.H. (2017). Why the resistance to statistical innovations? A comment on Sharpe (2013).

- Cruz, P., Laukkanen, T., & Muñoz, P. (2009). Exploring the factors behind the resistance to mobile banking in Portugal. International Journal of E-Services and Mobile Applications (IJESMA), 1(4), 16-35.

- Heidenreich, S., & Handrich, M. (2015). What about passive innovation resistance? Investigating adoption?related behavior from a resistance perspective. Journal of Product Innovation Management, 32(6), 878-903.

- Karjaluoto, H., Laukkanen, T., & Kiviniemi, V. (2010). The role of information in mobile banking resistance. International Journal of Bank Marketing, 28, 372-388.

- Kaushik, A.K., & Rahman, Z. (2015). Innovation adoption across self-service banking technologies in India. International Journal of Bank Marketing, 33(2), 96-121.

- Koenig-Lewis, N., Palmer, A., & Moll, A. (2010). Predicting young consumers' take up of mobile banking services. International Journal of Bank Marketing, 28(5), 410-432.

- Kuisma, T., Laukkanen, T., & Hiltunen, M. (2007). Mapping the reasons for resistance to Internet banking: A means-end approach. International Journal of Information Management, 27(2), 75-85.

- Laukkanen, T. (2016). Consumer adoption versus rejection decisions in seemingly similar service innovations: The case of the Internet and mobile banking. Journal of Business Research, 69(7), 2432-2439.

- Laukkanen, T., Sinkkonen, S., Kivijärvi, M., & Laukkanen, P. (2007). Innovation resistance among mature consumers. Journal of Consumer Marketing, 24(7), 419-427.

- Lee, H.G., & Clark, T.H. (1996). Market process reengineering through electronic market systems: opportunities and challenges. Journal of Management Information Systems, 13(3), 113-136.

- Levit, A. (2015). Make way for generation Z. New York Times, 164(56820), 7.

- Mani, Z., & Chouk, I. (2017). Drivers of consumers’ resistance to smart products. Journal of Marketing Management, 33(1-2), 76-97.

- McCrindle M. (2015). Generation Z Inforgraphic.

- Ram, S. (1987). A model of innovation resistance. ACR North American Advances.

- Ram, S., & Sheth, J.N. (1989). Consumer resistance to innovations: the marketing problem and its solutions. Journal of Consumer Marketing, 6(2), 5-14.

- Ramavhona, T.C., & Mokwena, S. (2016). Factors influencing Internet banking adoption in South African rural areas. South African Journal of Information Management, 18(2), 1-8.

- Rogers, E.M. (2004). A prospective and retrospective look at the diffusion model. Journal of Health Communication, 9(S1), 13-19.

- Rumanyika, J.D. (2015). Obstacles towards adoption of mobile banking in Tanzania: a review. International Journal of Information Technology and Business Management, 35(1), 1-17.

- Shambare, R., Rugimbana, R., & Zhowa, T. (2012). Are mobile phones the 21st century addiction?. African Journal of Business Management, 6(2), 573-577.

- Shambare, R. (2011). Cell phone banking adoption in South Africa. Business and Economic Research, 1(1).

- Shambare, R. (2013). Factors influencing the adoption of cell phone banking by South African students. African Journal of Business Management, 7(1), 30-38.

- Szmigin, I., & Foxall, G. (1998). Three forms of innovation resistance: the case of retail payment methods. Technovation, 18(6-7), 459-468.

- Turner, A. (2015). Generation Z: Technology and social interest. The Journal of Individual Psychology, 71(2), 103-113.