Research Article: 2019 Vol: 18 Issue: 4

Modern Challenges of Monetary Policy Strategies: Inflation and Devaluation Influence on Economic Development of the Country

George Abuselidze, Batumi Shota Rustaveli State University

Abstract

Keywords

Inflation, Devaluation, Monetary Policy, Welfare, Economical Activity, Economic Development, Georgia.

Introduction

Among the last economic reforms implemented for overcoming of the world financial and economic recessions the special emphasis is made to macroeconomic stabilization (Abuselidze, 2018a) and socioeconomic strengthening of the country is recognized one of the imperatives, what cannot be well-reasoned without monetary policy. Operation of Monetary policy plays the important role in promotion of economic activities and growth of production volume, further socioeconomic development of the country.

Because of recent developments in the world, we can say that today the main players are not the governments of the countries, but the national banks and action programs developed by them. Starting from the beginning of current year, the monetary policy carried out among important trade partners by central bank of Georgia, served two main purposes: on the one hand, to encourage activities of weakened economy and on the other hand, to prevent the inflationary processes caused by depreciation of the local currency.

Literature Review

The molded approach is kept in the world’s leading development economies to support economic activity and to increase the level of inflation to the targeted index. There is a different situation in most of developing countries, where local currency depreciation causes inflationary pressure and generates necessity of strict policy. It is phenomenon that we are fighting against inflation and at the same time we are cautious, since its opposite occurrence deflation has no less destructive effect for the economy. This is a bit paradoxical, but that is exactly the difficulty of monetary policy. Perhaps the way out of this difficult situation would be a golden midpoint, but finding it is very difficult, as well as maintaining.

If we agree to 1996 Nobel Prize laureate in economics, Robert Lucas, we should say that this phenomenon is much more trouble for society than unemployment, since unemployment is harmful for those who do not work when the inflation affects whole society (Forbs, 2013).

It is natural that inflation, due to its negative outcome, is causing negative emotions in society. Negative aspects of high inflation are: expenditure increases, that has strong influence on whole society and especialy low-income families; decrease of purchasing power of national currency; real profit decrease in business; production volume decrease; unemployment increase; increase of interest rates, which increases the credit, which results in disability of small farmers getting loans. All of these increases the number of bankrupt enterprises and exacerbates economic crisis; at the same time, if the level of inflation is higher in the country, than in its trade partner countries, the product competitiveness is falling, that hinders the growth of the economy. The necessity of regulating the inflation process has led to an interest in this issue.

Methodology

The research methodology includes the the following stages: theoretical discussionreviewing the theories about inflation processes, analysis of the practice-inflational processes’ review in dynamics, approval of hypothesis-justification of the conclusions by practical examples and statistical data. In this top-down study the empirical material is collected from official documents and public statements made by centrally placed politicians and administrators in Georgia. Furthermore as well as research conducted by international organizations in Georgia.

The research database is the legislative and normative acts adopted by the Georgian government at the modern stage, the National Statistics Office of Georgia, the Economic Development and Finance Ministries, the National Bank Georgia and other departments.

We have used opinions of Georgian scientist and economists about inflational processes, as well as economic periodicals, newspaper articles, economists’ reports, etc.

The study uses dynamic data from different countries (including the post-socialist countries, which are members of the EU), most studies would find Czech monetary policy as the most successful in establishing it credibility as well as raising forward-lookingness of inflation expectations, followed by Slovakia (now a Eurozone member), followed by Poland and Hungary (Arestis & Mouratidis, 2005; Baxa et al., 2015). However, a recent study of Sousa & Yetman (2016) provides evidence that, in four C.E.E. countries (Czech Republic, Hungary, Poland and Romania), inflation expectations have already been fairly firmly anchored, which speaks in favour of monetary policy credibility.

Methodologies that have been used so far in order to test inflation convergence are quite scant in the literature. Indeed, most of them rely on a class of Panel Unit root tests (see for some examples, Breitung & Das, 2005; Breitung, 2001; Chang, 2002: 2004; Levin et al., 2002; Im et al., 2003) which are known as useful longitudinal tools in testing whether relative rates of inflation follow a stationary process and converge to an equilibrium.

Results and Discussion

Survey

Georgia’s economy, as a small open economy is sensitive to regional and global challenges. On background of evolving integration and tough economic ties, negative impacts of foreign shocks are continuing, that besides global factors was caused by unfavorable economic situation in trade partner countries, euro’s global sustainability trend, dollar’s instability and the depreciation of national currency in the region countries.

The econonmic development problems of Georgia are reflected in the Lari devaluation, rising prices and decrease in economic growth. It is obvious that in case of currency crisis and inertness, it possibly convert into financial crisis and especially in the collapse of currency.

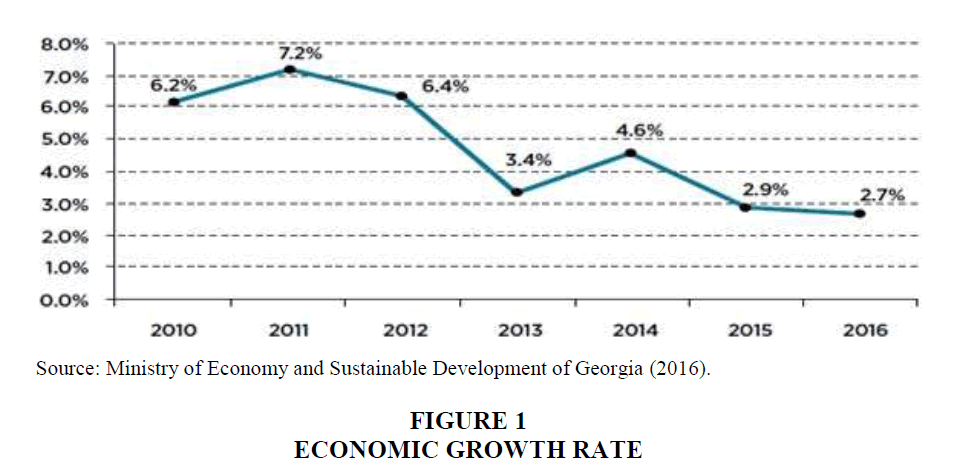

Before fall, 2016 the government predicted, that the annual economic growth would be 3%, but in the end this forecast was reduced to 2.7% and according to the results published by the Nationa Statistics Office of Georgia, this forecast was completed by the end of the year (Figure 1).

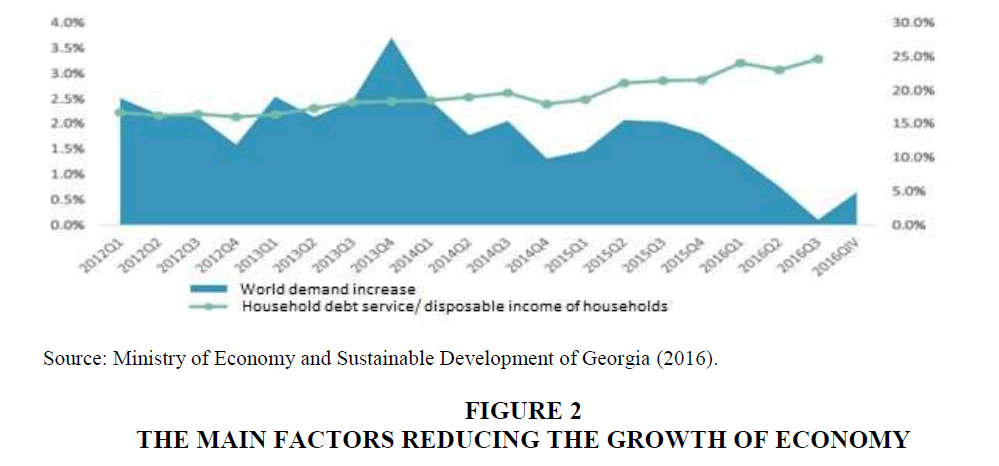

2.7% is the low rate gor the developing country-at this speed the country’s economy will double in about 25 years (World Economic Outlook, 2017). The government considers that objective reasons for low rate are: difficult situation in region (weakening foreign demand) and strengthening euro, reduction of disposable income due to increased cost of loans resulting from dollar instability.

The international Monetary Fund estimates that Russian economy in 2016 decreased by 0.2 %, and Azerbaijan’s 3.8%, that had negative impact on Georgia (Figure 2). There were slowdowns in other neighbouring countries’ economic growth as well, in Armenia growth 0.2 %, Turkey 2.9%. During last year Ukraine’s economy started growing and reached 1.5 %. It is noteworthy that Turkey achieves higher economic growth than Georgia despite various political problems and frequent terroristic acts.

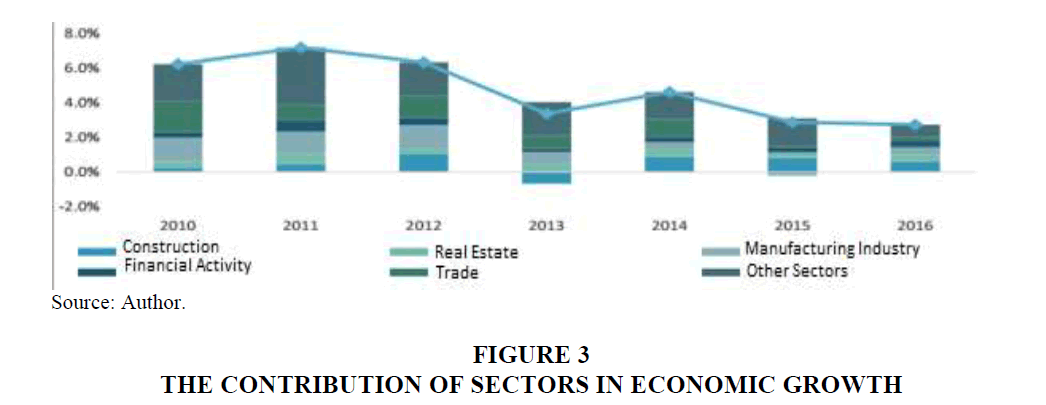

The growth of Georgian economy up to 2.7% was provided by the following sectors: construction (growth 25%), real estate (18%), manufacturing industry (growth 17%), ginancia activity (11%) and trade (9%). In 2016 compared to previous years the share of the manufacturing industry in economic growth increased, while transport and agriculture sectors were reduced (Figure 3). Economic growth was also hindered by the decrease in export of goods.

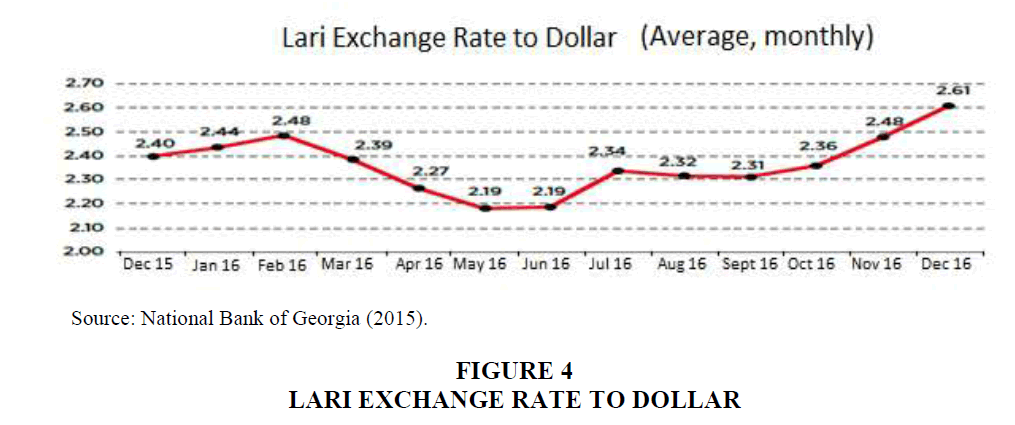

Already for several years, along with decreasing economic growth, the depreciation of the Lari is one of the most important problems for the Georgian economy. Depreciation of Lari started in November, 2014 and reached all-time depreciation by the end of 2016. At the beginning 2016 rate of Lari to dollar was 2.40. It reached 2.50 at the end of January, and during spring and summer was firming up and starting end of August kept to depreciate again (Figure 4). In autumn, the National Bank sold 180 mln dollars to stop rate drop (Gelantia, 2016), but Lari depreciation did not stop and got away from 2.7.

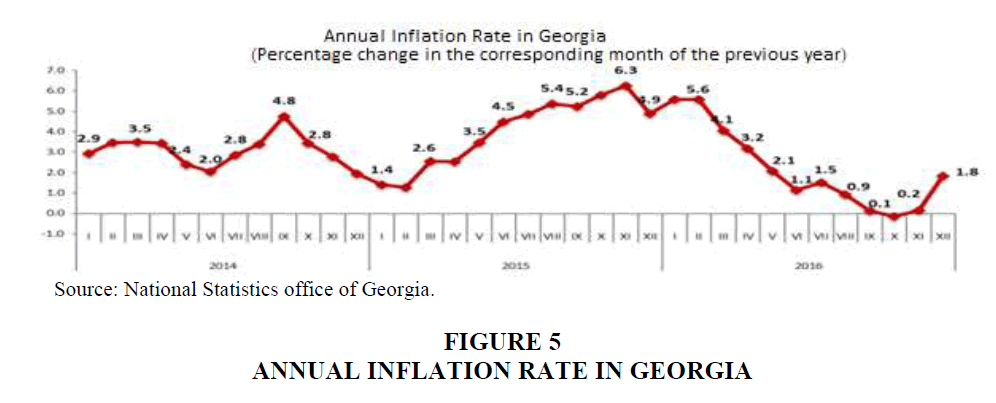

It should be noted that despite the above mentioned factors, the level of inflation was not the highest in 2016. According to Geostat, the annual inflation rate was 1.8% (Figure 5) and was kept bellow the target of the National Bank (Economic Policy Research Center, 2011) that largerly was caused by weak aggregate demand, decreased prices on commodity groups on international markets and in some trade partner countries due to depreciation of currency, weak import. From the beginning of the year sharp decrease of inflation was partially caused by Lari depreciation to US dollars in 2015, as a result the burden of service of foreign currency loands to companies and the occasional increase in prices has been gradually expired in annual inflation.

However, it should be noted that in the last few months since the beginning of 2017, the Consumer Price Index has grown significantly and the annual inflation rate as of May 2017 compared to previos year was 6.6%. Growth of inflation was mainly caused by single-time factors. Excise tax increase, as well as oil and food commodity price increase, affected reflected in the consumer prices. However, consumer price increase was partially balanced by Lari exchange rate firming (Tavkhelidze, 2011).

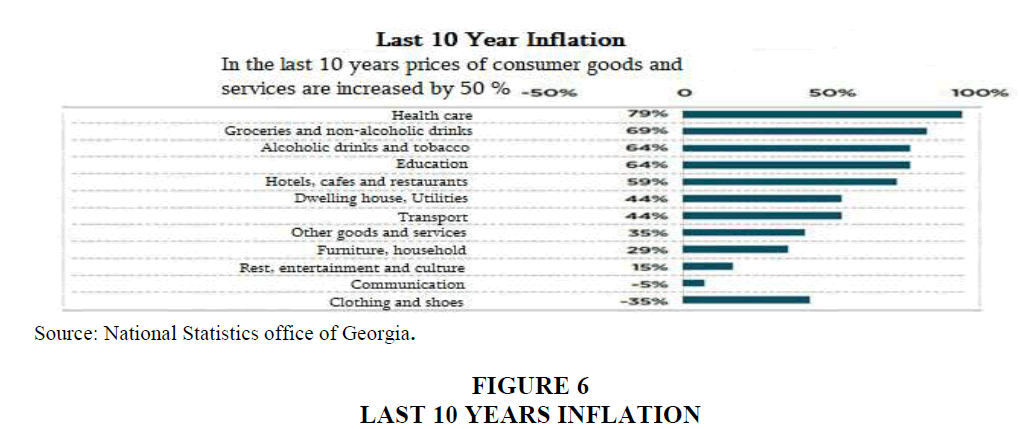

We discussed inflation for last one year (from May 2016 to May 2017). If we compare few years’ indexes, prices are significantly increased (Kakulia, 2011). During last ten years, from the end of 2006 to the end of 2016, consumer good and service prices are increased by 50 %. Most of all is increased health-care related goods and services by 79%. Groceries are increased by 69%, education by 64%. Clothing and shoes prices have been reduced by 35% and communications by 5% (Figure 6).

Since the dollarization rate of Georgia’s economy is high, accordingly depreciation of Laro to dollar has huge influence on different economical processes and on population welfare. It is widely known that regulation inflation level is one of the most important problems for macroeconomic stabilization. After the recession of 2007-2009, in the post-crisis recovery period, Western governments refer to both Keynesian and Monetary (Friedman) approaches. Cecchetti & Debelle (2006) argue that the most important source of inflation persistence lies in inflation expectations. As inflation expectations can be influenced by the monetary policy, some studies investigate (and find positive) the role of following the inflation targeting strategy and of overall monetary policy credibility for bringing inflation persistence down (Sargent, 1999; Erceg & Levin, 2006; Orphanides & Williams, 2005). The tools used by western countries are different from each other depending on the level of inflation, the economic situation and the economic mechanism in the country.

The Central and Eastern European (CEE) experience with centrally-planned economies, usually rapid transitions and subsequent rapid economic integration with the EU, must have affected the process of forming inflation expectations in these countries. The process of forming forward-looking inflation expectations takes time and is largely dependent upon monetary policy credibility (Gajewski, 2018).

Baranowski & Gajewski (2016) show that the National Bank of Poland put its monetary policy to a credibility test in 2013 and 2014 by launching forward guidance, and this test can be considered as passed. All this most recent evidence would suggest that CEE monetary policies are advanced in the process of credibility-building, although the finding of Franta et al. (2010), who show that backward-looking behaviour may be more important in explaining inflation dynamics in CEE countries than in “old” EU member states, will probably remain valid for some time. Vaona & Ascari (2012), show that, economically, inflation persistence is indeed statistically different across Italian provinces and that backward regions display greater inflation persistence.

There is a logical question, how does orientation of the National Bank Of Georgia (2016a) on stability of target inflation rate, respond to the demands of the society on the background of this economic situation instead of the stability of the Lari rate? A positive outcome of inflation targeting is more or negative result due to currency devaluation? Different countries effectively use the method of inflation targeting, but the question is whether it is acceptable for Georgian reality? There are no substantiated answers to these questions. The challenges that Georgian economy faces today are: the high dollarization of the economy, the dependence on import and pure production potential, as well as the denomination of the state and domestic debt in foreign currency. These are the factors that limit the maximum benefit by the inflation targeting. The loss caused by named factors is much higher compared to the benefits from inflation targeting.

The impact of monetary policy instruments on economic variables can be expresse with a scheme.

One of the key instruments of the National Bank’s monetary credit policy is the monetary policy rate (refinancing rate), which is kind of indicator for market rates.

The dynamics (Figure 7) of the monetary policy rate (refinancing rate) over the years (2008-2017) is as follows:

As the graph shows, the monetary policy rate is 10% in the last month of 2008, but it reached its maximum in April 2008 and amounted 12%, while the minumim value was 3.75% in 2013. Nowadays it is 7%.

In 2016 the Nationa Bank of Georgia started to withdraw from the strict monetary policy. From April 2016 until the end of the year, the National Bank held toned down monetary policy. This was due to reduced inflation expectation and joing demand. During the year, inflation remained at the bottom of the target, which allowed the National Bank to gradually reduce the refinancing rate. However, it should be noted that in the end of 2016 and the beginning of 2017 inflation expectations have changed and in January 2017 the National Bank increased the rate of monetary policy.

It is noteworthy that according to Geostat data, the growth rate of Georgia’s economy has started to decline since September 2016. In particular, the average economic growth rate of the third quarter was 3% and in the fourth quarter-1.2%. Against this background, monetary policy tightening was no desirable, but the country had to face financial stability. The step towards stability is the right choice, because iIcountry loses financial stability, instead of economic growth, the recession will start.

The tightening of monetary policy makes it difficult to achieve high economic growth rates, but does not exclude. Economic growth depends on may others factors as well.

There is a direct propotional attitude between the monetary policy and the economic growth rate (Table 1). It is interesting why it is so, when the monetary policy tightening generally follows hindering of economic growth?

| Table 1: Monetary Policy And Economic Growth Dinamics In 2009-2016 Years | ||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|---|---|---|

| Monetary policy rate | 6.00% | 6.25% | 7.50% | 5.25% | 3.75% | 4.00% | 6.00% | 7.09% |

| Economic growth | -3.80% | 6.30% | 7.20% | 6.20% | 3.30% | 4.80% | 2.90% | 2.70% |

Source: Author.

According to Goodhart (1999) and Greenspan (2003), effective monetary policy purposes prevail as reliable, easy-to-update, and accurate measures of inflation uncertainty.

We often talk about different economic processes and events, but rarelu consider the country’s economic model and structure. According to Zivkovic (2017) the role of monetary policy is not only to assure the general and unrestrained convertibility of monies within the national economy, but also that of domestic against foreign currencies, for the purposes of international transactions, through different exchange rate regimes; and in the face of international capital movements, which can result in the devaluation of the national currency and alter the conditions of convertibility between equivalents. For example, we say and are taought that lari devaluation is good for export competitiveness, we say, that floating exchange rate is good, but we do not consider the most important factor-dollarization of the country’s economy. Due to the high dollarization, the increase in export competitiveness by falling in the rate of lari is insignigicant compare to losses that for example is caused by foreign currency loan service. The dollarization is the key factor, why toughening the monetary policy, does not influence or impact economic growth in Georgia.

The higher the level of dollarization, the lower the effectiveness of the monetary policy, i.e. its impact on economic processes. By monetary policy the National Bank of Georgia affects on amount of money supply, but its impact is “limited” only on the lari supply, because of high dollarization National Bank affects only on small portion of money supply (including foreign currency) and accordingly, its policy impact on entire economy is lowers.

Thus, despite the tightening of the monetary policy by the National Bank has negative influemce for certain amount people’s pockets, it is necessary. According to economist expert, otherwise the country will face serious inflation risk.

It also should be noted that the fiscal policies held by government should mitigate monetary policy strengthening effect. In particular, when National Bank tightened monetary policy to ensure the stability of the currency and the exchange rate, the government must significantly stimulate business development, i.e., promotion of goods and services. Catalyzing production growth is possible by introducing optimal tax burden (Abuselidze, 2012). In order to achieve this goal, the government can reduces taxes and regulations, that will reduce production costs and will not allow decrease of production output (Abuselidze, 2018b), i.e., monetary and fiscal policy approaches are approaching. If dosage of measure combinations is selected correctly, then we get the best results: total employment, stabilized prices, balance of payment equilibrium, money supply decrease, budgetary deficit elimination, high interes rate. It is also necessary to stimulate internal investments and attract as more foreign investments as possible, that will help not only increase the growth rate of economic growth but also will help to strengthen the rate of lari.

In addition, we should not forget that the use of official reserves of National Bank is not desirable, as the reserves are guarantee of country’s financial stability and they should be spent only in extreme cases.

Conclusion

The current paper analyzed inflation and devaluation convergence in Georgia over the period of 2009-2016 by adopting existing methodologies and a relatively new methodology. The outcomes of the research can be summarized in two parts.

First, inflation disparities have declined over time, especially during the post-crisis period after 2010. The inflation targeting policy has also contributed to this process. These results are confirmed using several methodologies and they seem consistent with the existing literature.

Second, in addition to the findings in the literature, we found that national bank change their relative inflation rate positions quite often. Monetary policy of National Bank in conditions of exchange market controls money supply. When exchange market experiences dollarization then monetary policy does not control properly money supply.

All these results imply several policy suggestions:

1. First, achieving inflation convergence is a harder task than initially understood, as it seems to be random behavior. The economic drivers behind this should be carefully analyzed by policy makers.

2. Second, in order for the Lari course to withstand small shocks and in the longterm to stabilize, Georgia needs as high economic growth as possible, increase productivity and investments. The high economic growth increases the trust of population to national currency, which is the prerequisite for long-term stability of the Lari course. This requires a better business environment, production of competitive products and stable political environment.

3. Third, the fastest way to stabilize is to maintain a strict monetary policy by the National Bank and simultaneously implement the governmet’s correct fiscal policy-“non-production” cost deacrease, attract foreign investments and stimulate internal investments by reducing taxes and regulations.

This provides the following conclusion: by the help of correct, scientifically substantiated Monetary-Fiscal combination establishment, the government of Georgia, with interest rate manipulation, can increasin purchasing power of aggregate demand to the level, that corresponds to full employment (natural rate of unemploymenet), in low inflation rate conditions. As far as interest rate affects the balance of payment, its positive or negative balance can be recovered by aggregate demand regulation.

Therefore, the modern Georgian economy should implement a combination of Keynesianism and Monetarism as well as unconventional (non-traditional) monetary policy methods. This is the cohabitation of Orthodox and Heterodox monetary approaches and their coordination in the financial practice. In other words, MP-Plus (Monetary Policy Plus) should be implemented. At this time, monetary and fiscal policy approaches are getting closer reducing the difference between them, which is the beginning of a new global economic paradigm in the history of the world finances.

References

- Abuselidze, G. (2012). The influence of optimal tax burden on economic activity and production capacity. Intellectual Economics, 6(4), 493-503.

- Abuselidze, G. (2018a). Optimal fiscal policy-factors for the formation of the optimal economic and social models. Journal of Business and Economics Review, 3(1).

- Abuselidze, G. (2018b). Fiscal policy directions of small enterprises and anti-crisis measures on modern stage: During the transformation of Georgia to the EU. Science and Studies of Accounting and Finance: Problems and Perspectives, 12(1).

- Arestis, P., & Mouratidis, K. (2005). Credibility of monetary policy in four accession countries: A Markov regime-switching approach. International Journal of Finance & Economics, 10(1), 81-89.

- Baranowski, P., & Gajewski, P. (2016). Credible enough? Forward guidance and perceived national bank of Poland?s policy rule. Applied Economics Letters, 23(2), 89-92.

- Baxa, J., Plasil, M., & Vasicek, B. (2015). Changes in inflation dynamics under inflation targeting? Evidence from Central European countries. Economic Modelling, 44, 116-130.

- Breitung, J. (2001). The local power of some unit root tests for panel data. In Nonstationary panels, panel cointegration, and dynamic panels (pp. 161-177). Emerald Group Publishing Limited.

- Breitung, J., & Das, S. (2005). Panel unit root tests under cross-sectional dependence. Statistica Neerlandica, 59(4), 414-433.

- Cecchetti, S.G., & Debelle, G. (2006). Has the inflation process changed? Economic Policy, 21(46), 311-352

- Chang, Y. (2002). Nonlinear IV unit root tests in panels with cross-sectional dependency. Journal of Econometrics, 110(2), 261-292.

- Economic Policy Research Center. (2011). Inflation in Georgia-Causes and ways of overcoming. Annual report.

- Erceg, C., & Levin, A. (2006). Optimal monetary policy with durable consumption goods. Journal of Monetary Economics, 53(7), 1341-1359.

- Forbs, S. (2013). Bankrupcy of modern economy.

- Franta, M., Saxa, B., & Smidkova, K. (2010). The role of inflation persistence in the inflation process in the new EU member states. Finance an Uver-Czech Journal of Economics and Finance, 60(6), 480-500.

- Gajewski, P. (2018). Patterns of regional inflation persistence in a C.E.E. country. The case of Poland. Economic Research, 31(1), 1351-1366.

- Gelantia, T. (2016). What is wronge with GEL? Retrieved from http://forbes.ge

- Goodhart, C.A. (1999). Central bankers and uncertainty. Bank of England Quarterly Bulletin, 39(1), 102-21

- Greenspan, A. (2003). Testimony before the committee on banking, housing, and urban affairs.

- Im, K.S., Pesaran, M.H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115(1), 53-74.

- Kakulia, M. (2011). Anatomy of inflation.

- Levin, A., Lin, C.F., & Chu, C.S.J. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics, 108(1), 1-24.

- Ministry of Economy and Sustainable Development of Georgia, (2016). Overview of Georgian Economy. Retrieved from www.economy.ge.

- National Bank of Georgia: (2015). Overview of inflation. Retrieved from www.nbg.ge

- National Bank of Georgia: (2016a). Monetary policy report. Retrieved from www.nbg.ge

- National Bank of Georgia: (2016b). Annual report. www.nbg.ge

- Orphanides, A., & Williams, J.C. (2005). Imperfect knowledge, inflation expectations, and monetary policy. Inflation-Targeting Debate, 32, 201-246

- Sargent, T.J. (1999). The conquest of American inflation. Princeton: Princeton University Press

- Sousa, R., & Yetman, J. (2016). Inflation expectations and monetary policy. BIS Papers, 89, 41-67.

- Tavkhelidze, M. (2011). Inflation-inherited sin of government, periodical tabula?.

- Vaona, A., & Ascari, G. (2012). Regional inflation persistence: Evidence from Italy. Regional Studies, 46(4), 509-523.

- World Economic Outlook, (2017). International monetary funds.

- Zivkovic, A. (2017). Financialisation in the post-yugoslav region: Monetary policy, credit money and dollarization. World Economy Magazine, 46, 117-134.