Research Article: 2022 Vol: 21 Issue: 3

Modern Trends in the Development of the Automotive Industry in the Developing Countries of the Middle East Region

Denis Paleev, RUDN University

Behzad Saberi, RUDN University

Citation Information: Paleev, D., & Saberi, B. (2021). Modern trends in the development of the automotive industry in the developing countries of the middle east region. Academy of Strategic Management Journal, 21(S3), 1-8.

Abstract

The influence of the quality accounting information on the decisions of financial statement users in Jordanian industrial corporations is examined in this research paper. The survey method is used by industrial enterprises to contribute to the ASE. In order to determine the quality of accounting information and its influence on the judgments of users of financial statements in industrial firms listed on the ASE, the study used a Descriptive and Inferential method. This method is based on identifying the problem's circumstances, components, and dimensions, describing relationships, analyzing data, measuring, and interpreting it, and arriving at an accurate description of the phenomenon or problem in a holistic manner that helps to generalize the facts or knowledge that have been drawn. The findings show that there is no statistically significant relationship between accounting information quality and financial statement users in decision-making in ASE-listed industrial businesses. The quality of accounting information provided by the accounting system and its integrity and dependability in choices made by users of financial statements in industrial businesses listed on the ASE have no statistically significant influence.

Keywords

Automotive Industry, Development Strategies, Middle East Region, Developing Countries.

Introduction

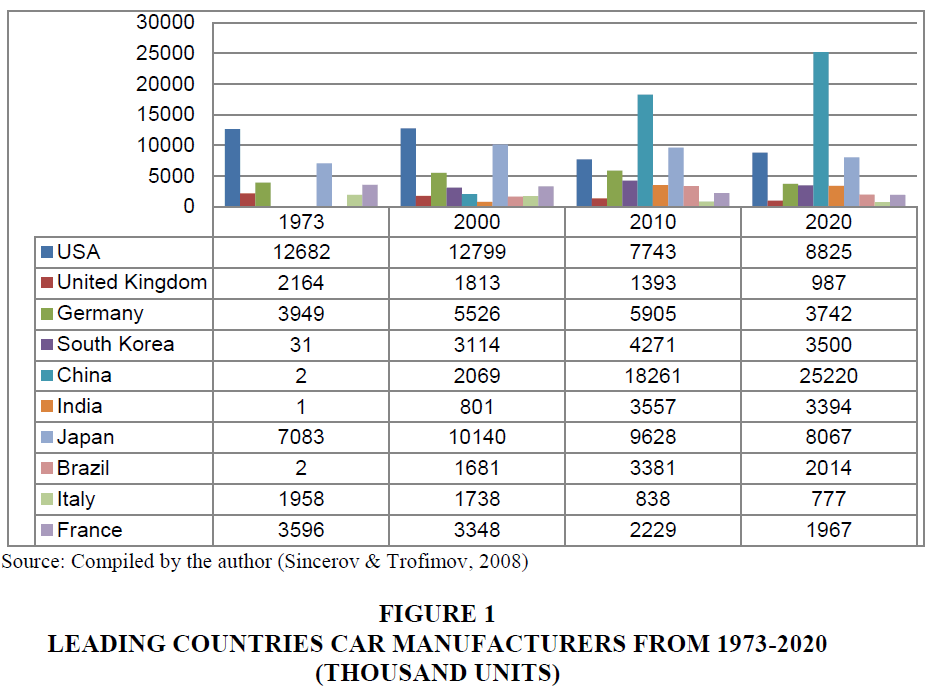

The biggest shift in the modern auto industry is the shift of car wash production from industrialized countries, which form the core of the global auto industry, to developing countries. In the mid-50s of the twentieth century, in the United States annually produced 9-10 million cars, and in Germany - 2-3 million, while the developing countries, taken together, produced no more than 100 thousand cars a year. Until the early 1970s, the share of developing countries in world car production did not exceed 5%, but then the situation began to change rapidly. Already in 1994 Brazil overtook Great Britain, in 2001 Malaysia overtook Sweden, Indonesia, Korea and finally China achieved impressive results (Figure 1).

As can be seen from Figure 1, today the growth pole of the global automotive industry has finally shifted to developing countries, which accounted for about 60% of total production in 2020 (OICA, 2021). Among the 10 countries in the world that produce more than 2 million vehicles per year, four are developing countries. Over the past few years, China has become world leaders, which now produces twice as many cars as the United States and Japan. Its share in the world market has increased from 5 to 32%; on the contrary, developed countries have lost their markets. The forecasts of the early 1990s are coming true, according to which the next round of the global process of motorization will be associated with the transition of an increasing number of Third World countries to the category of “new industrial states”.

It should not be forgotten that the global car production is affected by crises. In 2008, global car production decreased by 15.6% compared to the pre-crisis 2007. The current Covid-19 pandemic has led to a 16% drop in production. At the same time, the share of China only grew. Along with China, India and Brazil are among the countries where the automotive industry is developing rapidly. Emerging markets turned out to be more resilient to crises and the recession there was less significant.

In terms of employment, the shifts in the geography of the automotive industry are also impressive (Sincerov & Trofimov, 2008). Of the 8.4 million people employed in the global automotive industry, developing countries account for about 38%. Half of all auto makers in developing countries work in China. It employs 1.6 million people in the production of automobiles and automotive components, compared with 954,000 in the United States and 725,000 in Japan. The main reasons for this are the low cost of labor and state support.

The developing countries can be divided into two groups in terms of the development strategy of the automotive industry. The first includes countries with a potentially large domestic market, low levels of motorization and fast growing economies. A striking example is Brazil, Russia, China, and India. The second type is countries on the periphery of the main automotive regions: Thailand, Mexico, Malaysia and Indonesia. Although in both groups the development of the auto industry takes place with active state support, there is an important difference between them. The first group of countries is developing a national automotive industry, albeit with the active attraction of foreign investment. After filling the domestic market, they carried out an aggressive policy of entering world markets, ousting its leaders. The second group of countries has no plans to bring the national auto industry to world markets, at least in the short term.

Each of the countries under consideration has its own characteristics. In Brazil (Marklines, 2021; Mohammadi & Hajipoor, 2018), there is an exceptionally high proportion of foreign brands (81%), produced at the localized factories of the world's largest TNCs. In India this figure is about 70%, in China - 50%, and in Russia - about 30%. At the same time, Russia has a high share of imports of finished cars (almost 40% of total sales), while in Brazil - only 19%, in China - 3%, and in India and Mexico - less than 1% (Table 1)

| Table 1 The Structure of the Automotive Market in Developing Countries | |||||

| Brazil | Russia | India | China | Mexico | |

| National production | Less than 1 | 36 | 30 | 51 | Less than 1 |

| Localized foreign production | 81 | 28 | 70 | 46 | 99 |

| Import | 19 | 36 | Less than 1 | 3 | 3 |

| R&D | High | Null | Low | Average | Low |

| Automotive component production | Average | Null | Average | High | Low |

| Main assembly production | High | Low | Average | High | Average |

| Sales | High | Average | Average | High | ?????? |

The development of the auto industry in developing countries is subject to certain logic. The study of the degree of localization makes it possible to identify distinct models of this process for each of them. Thus, China demonstrates a high level of localization, primarily in the production of auto components, assembly and sales. Then comes Brazil, where a fairly high degree of localization of the main production has been achieved. India is approaching the level of localization of Brazil and China thanks to government regulation and strict requirements for foreign companies. In Russia, the low level of localization is explained by the relatively recent arrival of foreign companies on the market, as well as by insufficiently clear regulation of the process of localization of production by the state.

For the development of the national automotive industry, the localization of R&D is of fundamental importance. Before the crisis, 15 thousand people were engaged in R&D in General Motors, in Ford -12, in Chrysler -7 (Aleksandrov, 2014). In order to intensify their own research, large developing countries use the purchase of foreign enterprises. So the Indian “Tata Motors” acquired such well-known brands as “Jaguar” and “Land Rover”, and the Chinese “Geely” - A controlling stake in the Swedish “Volvo”. This made it possible to acquire not only ready-made technologies and production potential, but also entire scientific schools for further independent development.

For most developing countries, active R&D activities are not yet possible, although they see the automotive industry as one of the main mechanisms for “triggering a country's development process”. Their auto industry has shown strong growth in recent decades thanks to liberalization, general economic growth, and increased demand for cars, attracting foreign direct investment, and active government policies to stimulate the industry. However, there are national specificities everywhere. For example, Poland, Ukraine and Uzbekistan took the path of opening up their economies as much as possible and selling a controlling stake in existing car plants to foreign TNCs while retaining the state share in the newly formed joint ventures. The experience of these countries cannot be considered successful yet; it quickly became obvious that cooperation with only one investor, even such a well-known one as Daewoo Motors, can lead to market monopolization with all the ensuing consequences.

Thailand, Mexico, Malaysia, Indonesia, South Africa and other countries also developed their national auto industry with the attraction of external investment, but several TNCs were present in these countries, creating real competition. This approach was most pronounced in China, where strong competition arose between foreign brands assembled in China.

On the other hand, there is a group of countries that initially did not have plans to bring national brands to the world market and were limited to meeting their own needs at the expense of foreign TNCs. Taiwan, Hong Kong and Singapore are prime examples. Their main task is to help exporters to export as much of their products as possible, making their goods more competitive in the international market and at the same time limiting the import of similar goods to the domestic market.

The automotive industry of the Middle East countries largely corresponds to the experience of developing countries, but with its own characteristics. Turkey and Iran have had national brands for a long time, but their production activities are limited to the assembly of machines, and most of the components are made by foreign companies. The Turkish car industry is one of the three largest manufacturing industries. There are 13 major manufacturers and many small and medium-sized suppliers in the country. According to the OICA, Turkey produced 1.3 million vehicles in 2020 and ranked 12th among 45 vehicle-producing countries. Sales and production statistics are presented in Table 2.

| Table 2 The Size of Production and Sales of all types of Cars in Turkey 2005-2020 | ||||||||

| 2005 | 2010 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Production | 879452 | 1,094,557 | 1,358,796 | 1,485,927 | 1695731 | 1550150 | 1461200 | 1297800 |

| Sale | 715212 | 760913 | 1011194 | 1007857 | 980277 | 641550 | 491909 | 796200 |

The automotive industry employs about 400 thousand people (47 thousand directly). There are five main passenger car firms: Renault, Tofa? (Fiat), Toyota, Hyundai and Honda. Ten firms (Anadolu Isuzu, BMC, Ford Otosan, Hyundai, Karsan, M.A.N., Mercedes-Benz, Otokar and Temsa) manufacture trucks and pickups. Nine firms (Anadolu Isuzu, BMC, Karsan, Mercedes-Benz, Hyundai, Otokar, Ford Otosan, Temsa and M.A.N.) are involved in the production of buses and minibuses (RTME, 2012). Turkey's rapid growth in the automotive sector (Black et al., 2020; BRICS, 2020) has been driven by high rents from the domestic secured market. This is the result of a successful bargain between the authorities and international business. If India has developed its auto industry through a gradual capacity building since the 1980s, then the Turkish deal with the EU helped to immediately receive foreign direct investment for the creation of export production and made a huge leap in 20 years. By this time, the national manufacturer had already integrated into global production chains on favorable terms. Having lost ground in car production to foreigners, Turkey retained its component production, which is dominated by independent domestic companies. This has been fueled by significant inward investment, mainly in the form of joint ventures, from major TNCs such as Robert Bosch, Valeo, Delphi Packard and Mannesmann Sachs. The Turkish government offered significant incentives for R&D and today many well-known companies have moved their international design activities to Turkey. Already by 2014, the automotive industry accounted for 18.9% of total R&D spending by the Turkish private sector (Asadollah et al., 2015).

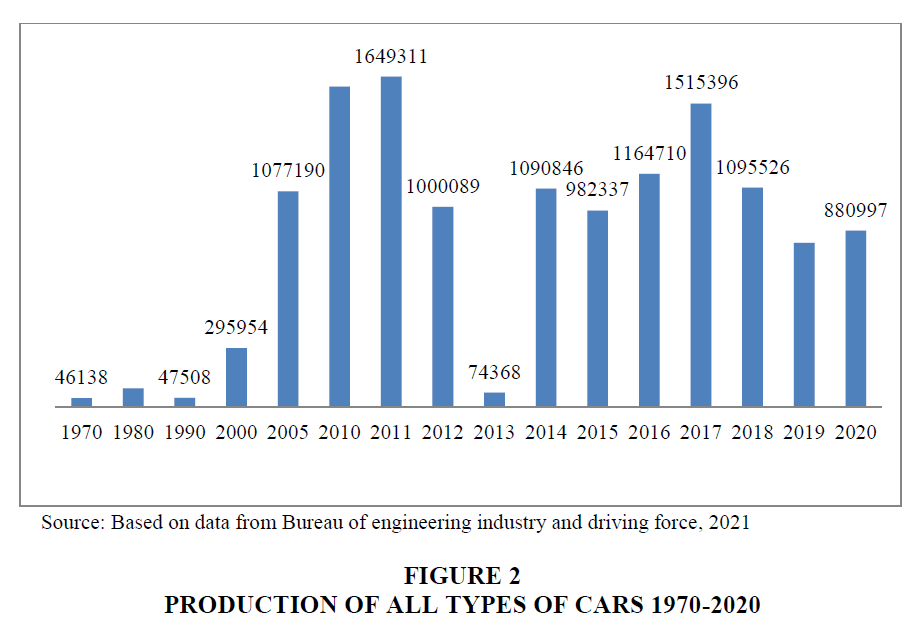

The situation is different in Iran. There are 12 car manufacturers in the country (Analysis of Iran's Automotive Industry, 2015) the largest of them are Iran Khodro and Saipa, as well as several other smaller national brands: Pars Khodro, Kerman Khodro, Bahman Autos, Bonro, Zamyad, Kish Khodro, etc. In addition, Iran has more than 1200 car dealers of other companies. Today its turnover is about 12 billion US dollars (Euro Triade, 2020; Semple, 2019), and the added value of the auto industry is estimated at 40 billion riyals (Analysis of Iran's Automotive Industry, 2009), which provides 19% of all industrial production in the country. More than 149 thousand people are employed in the country's automotive industry (Statistical Center of Iran, 2020), and taking into account indirect employment, the number of employees exceeds 1.5 million people, i.e. about 11.39% of the working population. 1.5 million Cars a year (about 1.5% of world production) is among the top 20 global car manufacturers. The contribution of the automotive industry to the country's GDP reaches 2.5%-3%. Oil and gas industry. Car production in Iran from 1970-2020 provided in (Figure 2).

Statistics show that the development of the industry in the country has no stable dynamics. If in 2005-2011. The average growth rate of the car market was at the level of 10% per year, and then the financial crisis of 2012 caused a significant decline of about 30% per year. Then, in 2014, there is a sharp post-crisis recovery of the market with a growth of 37% and again a decline in 2015. Constant fluctuations strongly undermine the Iranian economy; make long-term planning impossible, and car factories were on the verge of bankruptcy. As the data in Table 3 show, low export rates are correlated with the situation in the automotive industry. This problem is associated not only with sanctions, but also with the low quality of products due to the problems of the entire production chain.

| Table 3 The Volume of Imports and Exports of Cars and Spare Parts 2011-2018. | ||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Import (million $) | 2594.6 | 2119.18 | 2427.98 | 3587 | 2087.19 | 2893.72 | 3099.58 | 2634 1380 |

| Export (million $) | 338.17 | 519.24 | 263.64 | 243.84 | 177.410 | 179.54 | 123.214 | 65 |

A relative advantage of the Iranian auto industry is cheap labor and energy, which could potentially provide a basis for exports, but the weakness of other factors of production, prevents this advantage from being exploited. Protecting the national market, the government imposed high import tariffs and restrictive laws (Iran ranks 34th in imports of cars in the world) (Dehghani, 2017). This allowed increasing production, but sharply reduced competition. In fact, the market was captured by two leading national companies Iran Khodro 53%, Saipa- 42% (Tasnimnews, 2021), which are heavily dependent on imported components and almost do not conduct their own R&D. Iran's automotive industry is not yet able to keep up with global events and move with competitive markets (Iranian Automotive Industry Survey, 2015). Government support against the backdrop of import restrictions does not allow attracting foreign direct investment.

It should be borne in mind that, unlike Turkey, Iran fundamentally cannot count on world markets and is forced to confine itself to the Middle East region. Turkey is a member of the WTO; it is integrated into the production chain of world manufacturers and has a competitive production of auto components. Iran is on the sidelines of this process, but this does not prevent it from taking advantage of the technical achievements of its closest neighbor, for example, in terms of modernizing its element base. Direct acquisition of Western technology is limited by sanctions, and joint ventures with Turkey will help circumvent these restrictions.

The described experience of developing countries shows that in all cases the state key determines the formation of the national automotive industry, it forms industrial policy and the required infrastructure, creates conditions for attracting foreign investment, provides support for highly effective projects, finances fundamental and applied developments in accordance with the priorities adopted by the state. Finances works on verification of product certification within the framework of state regulation in the field of standardization, certification and quality of automotive products, and also supports the restructuring of the automotive industry.

It was government policy that became one of the main factors in the development of the automotive industry and predetermined the main directions for the development of the automotive industry (Chang & Ali, 2014). Almost all developing countries went through two main stages of development: the policy of import substitution and the policy of export-oriented growth. These features of the developing countries of the Middle East region are directly noted by the studies of Azad University in Tehran (???di-Roodsari et al., 2019).

The strategies adopted by automakers seeking to enter global markets can be characterized by the following features:

1. Restrictions on the actions of foreign companies on independent activities and requirements for participation in any activity with an internal company for the production of a joint product;

2. permission for the production of car parts and assembly of the models most demanded in the country of origin;

3. command of experienced foreign managers as supervisors;

4. conditional and planned state support of the automotive industry depending on the achievement of competitive indicators;

5. introduction of mechanisms to stimulate the purchase of domestically produced cars;

6. striving for competition and access to world markets;

7. strategic planning for the production of complex products within the country, improving the quality of national companies according to the adopted "road map";

8. creation of research and development centers in other countries in order to use the experience of engineers in these countries;

9. increasing attention to marketing and customer needs, production of cars of different classes;

10. system planning for the balanced development of industries related to the automotive industry;

11. Branding.

It should be noted that the system of innovation and technology development in developing countries has important differences from the leading industrial countries (Khoshsirat et al., 2019). Developing countries acquire mature technologies from leading countries in the early stages of industry growth or industrialization. This happens through joint ventures or foreign direct investment. In the next phase, manufacturing and design technologies are spread across many national enterprises. Modern domestic companies appear in the country, which create a competitive environment. With the use of local knowledge and internal human resources, the national industry is gradually entering the stage of technology development. Gradually, it becomes possible to make minor changes to imported technologies and products. First it is imitation and copying, and then real improvements and new products. In the future, the country begins to acquire not only ready-made technologies, but also innovations at the early stages of readiness, carrying out their further improvement and introduction into production. Thus, a developing country seeks to independently implement the full cycle of research and production cycle.

To maintain their competitive position, they go to cooperate with competitors, to cooperate with competitors. This phenomenon of cooperation, along with competition, is widely developed among world leaders. For example, there is a partnership between the Japanese company Toyota and the French company Peugeot Citroen in the production of small cars for the European market. Chinese car trucks have been actively cooperating with their German and Japanese competitors for a long time. Despite allegations of infringement of intellectual property rights, Chinese ?hery & Geely are studying foreign experience and are turning to European design consultants to develop their projects. Turkey is using this approach in the national auto industry in the Middle East. Iran also understands the promise of such approaches, but the possibilities of Iranian international cooperation are severely limited by sanctions.

The prospects for Turkish-Iranian cooperation are quite wide: from the economy, industry, energy, foreign policy to transport. Iran, being a friendly country for Turkey, has religious, geographical, transport and cultural proximity, which undoubtedly plays a positive role in the development of relations between countries whose economies are complementary. Sometimes, the political views of Iran and Turkey differ on some issues. However, the countries have great potential for economic cooperation. The prospects for achieving a trade turnover of 35 billion $, 10 billion cubic meters of Iranian gas annually and other opportunities for cooperation allow the parties to make a pragmatic choice not in favor of confrontation, but mutual cooperation (Volkova, 2017).

Analyzing the export structure of Iran and Turkey in the last 5 years (Iranturkeyjcc, 2021) the total trade turnover between the two countries reached 45.88 billion 88 US dollars (Turkey's exports to Iran are 16.598 billion and Iran's exports to Turkey 28.49 billion US dollars). In terms of relations with Turkey, Iran would be interested in establishing broad cooperation in the auto industry as soon as possible. For example, only the export of parts and accessories of motor vehicles in 2015 was worth $ 83.9 million to Iran. Thus, both Turkey and Iran are well aware of the mutual benefit and responsibility for maintaining working relations as a guarantee of stability in the region.

Conclusion

Before our eyes, a new geography of the global automotive industry is being formed. If the trends of recent years persist, the share of developing countries in global car sales may reach 50% by 2030. This is due to low motorization of the population and good prospects for regional sales markets. The auto industry directly affects the stabilization of the economic and social development of the economy.

By studying the experience of the most successful developing countries, it is possible to predict the prospects for the development of the Middle East car market. With all the differences in the situation in the automotive industry in Turkey and Iran, it is these countries that will determine the future of the region. Turkey's achievements in the field of component production and industrial integration with the leaders of the automotive industry create the preconditions for regional leadership. On the other hand, there is neighbouring Iran with cheap energy resources, a long tradition of its own automotive industry and similar claims for regional leadership. Industrial cooperation between these countries may in the future lead to the joint development of the Middle East car market and the ousting of European, Chinese and other manufacturers from it.

References

Afanas'ev, S., & Kondrat'ev, V. (2014). Automotive industry of the BRIC countries. World Economy and International Relations, 9, 55-56.

Aleksandrov, I.A. (2014). Experience in the development of the automotive industry in the People's Republic of China and the possibility of its use in the Russian Federation. Dissertation Moscow, S67-85.

Analysis of Iran's Automotive Industry. (2009). Study department and investment research. Pension organization of the country.

Analysis of Iran's Automotive Industry. (2015). Brokerage company Saderat Bank (in Persian).

Asadollah, H., Makooi, A., & Shahrodi, K. (2015). Modeling the Iranian automotive value chain to achieve a cost leadership strategy. Knowledge of Management, 71, 3-40.

Black, A., Roy, P., El-Haddad, A., & Yilmaz, K. (2020). The political economy of automotive industry development policy in middle income countries: A comparative analysis of Egypt, India, South Africa and Turkey. ESID Working Paper, 14, 35.

Indexed at, Google Scholar, Cross Ref

BRICS Joint Statistical Publication. (2020). Brazil, Russia, India, China, South Africa (2020). Rosstat, 22, 6.

Chang, C.T., & Ali, H.R.M. (2014). Strategy for the formation of the automotive industry in developing countries. Izvestiya MGTU "MAMI”, 4(22), 42-47.

Dehghani, M. (2017). Car production statistics were released in 96.

Euro Triade. (2020). Focus on automotive industry in Iran.

Iranian Automotive Industry Survey. (2015). Economic research department of khavarmiane bank.

Iranturkeyjcc. (2021). Iran-Turkey trade volume report in the last 5 years.

Khoshsirat, M., Sadabadi, A.A., Noruzi, K., & Pakzad, M. (2019). Innovation intermediaries and automotive industry catch-up in developing countries.

???di-Roodsari, M., Tabatabaiyan, H., & Radfar, R. (2019). Global requirements for the automotive industry; A look at the situation in Iran's auto industry. Parliament and Strategy Quarterly, 26(90), 147-194.

Marklines. (2021). Brazil-automotive sales volume.

Mohammadi, M., & Hajipoor, B. (2018). Identifying a cooperation-competitive model in Iran's automotive industry based on a systems approach: A study of the foundation's data. Commercial Reviews, 89, 1-22.

OICA (2021). International Organization of Motor Vehicle Manufacturers.

Pitot, R. (2011). The South African Automotive Industry, the MIDP and the APDP. NAACAM, 1-5.

Semple, J.G. (2019). The Brazil automotive industry: Prospects for 2019-2020.

Sincerov, L.M., & Trofimov, D.A. (2008), The shift of the global auto industry to developing countries. Izvestiya RAN Geographical Series, 2, 43-50.

Statistical Center of Iran. (2020). Results of a census of production shops with 10 or more employees.

Tasnimnews. (2021). Iran Khodro leads in production and supply of car market (In Persian).

The Islamic Republic of Iran Customs Administration (IRICA). (2020).

Volkova, S.L. (2017). Trade and economic relations between Turkey and Irna at the present stage. Proceedings of the Institute of Oriental Studies of the Russian Academy of Sciences, 5, 171-183.

Received: 17-Nov-2021, Manuscript No. ASMJ-21-9835; Editor assigned: 19-Nov-2021, PreQC No. ASMJ-21-9835(PQ); Reviewed: 10-Dec-2021, QC No. ASMJ-21-9835; Revised: 26-Dec-2021, Manuscript No. ASMJ-21-9835(R); Published: 05-Jan-2022