Research Article: 2019 Vol: 22 Issue: 4

Money Laundering in Ecuador: Profile of the Involved Person and the Socio-Economic Impact

Irene Buele, Universidad Politécnica Salesiana

Jessica Nieves, Universidad Politécnica Salesiana

Fabián Cuesta, Universidad Politécnica Salesiana

Abstract

Money Laundering constitutes a serious socio-economic problem that involves people from different social levels, who try to mask, as legal, the money that comes from illegal activities, generally related to drug dealing, illegal selling of guns, human trafficking, and others. Several institutions, with social purposes, are pursuing mechanisms to prevent and fight these types of crime form different edges. The present research analyzes the profiles of the involved people regarding money laundering in Ecuador, during the years 2006-2014, and the impact provoked from a social-economic point of view at national level. The present project provides with general guidelines regarding the people involved and the operation methods. This information might guide to the creation of controls, which minimize the execution of this type of crime, especially in activities related to business environment, where an accountant is in exercise of his profession, and whose ethics depend on the majority of the economic and financial processes. The applied methodology is based on the extraction of qualitative and quantitative variables of the verdicts emitted in Ecuador, from 2006 to 2014, and published by the Financial Action Task Force of Latin America (its Spanish acronym GAFILAT) for its descriptive analysis and hypothesis tests. Through the attained results, it can be observed that the implied people, regarding money laundering, are mainly foreign males. Under this type of crime, the men are the ones who enter a higher amount of money to the country; approximately 42 times more than the women. The money enters the country through international flights, and in some reported cases, the involved people have been arrested at the airport. The money that circulates thanks to money laundering is about 2.5 to 6.3% of the PIB in Latin America, and the purchases made to ghost companies, according to the Internal Revenue Service (SRI standing by the acronym in Spanish) in Ecuador, get to $200,000 approximately.

Keywords

Ecuador, Financial Risk, Fraud, Money Laundering, Organized Crime, White-Collar Crime.

Introduction

Professional and personal ethics must be based on the execution of every economic activity. The professionals who work in any business are responsible of the decisions that can be made for the persecution of their general welfare. Concerning the business environment, the experience and education background of a public accountant is of great importance (Wong and Salcedo, 2014). The confidence and welfare of a business is in the hands of the accountant, and the honesty and ethics, which involve all the activities that the business makes, are his entire responsibility.

“To be ethical, it is not enough to have ethics, but to behave and have attitudes in concordance to these principles” (Calleja and Marcos, 2013)..

The principles that govern the ethics of these professionals should:

“Mark the knowledge and skills that will be used to provide with good service to their customers, justifying, in this way, their labor” (Cobo, 2001).

The lack of ethics in a person can cause problems not only in the entity, but also in the entire society. One of the most fraudulent practices in the business environment is money laundering. This act:

“Represents a complex problem for the world community, because it carries negative consequences for the economy, the government, and the social welfare for the nations” (Perotti, 2009).

Around the world, several organizations join their efforts to fight money laundering. Among them, there is the Financial Action Task Force of Latin America (its Spanish acronym GAFILAT). This is a regional group, which belongs to the international network of organizations dedicated to the prevention and combat of money laundering and the finance of terrorism. The GAFILAT defines asset laundering as the way through which criminals process money with the purpose of covering its illegal origin (GAFILAT, 2017). Another organization that is joint against this type of crime is the Financial Crimes Enforcement Network of the Treasure Department of the USA (FINCEN). The mission of the FINCEN is to protect the financial system against the illicit use of money and to fight money laundering to promote national security through the compilation, analysis and diffusion of the financial intelligence and the strategic use from the financial authorities. The FINCEN defines asset laundering as the covering up of the illicit activities, so that they could be masked in the legal market without being discovered (FINCEN, 2017).

Through money laundering:

“Delinquency transforms the economic incomes derived from criminal activities into funds of apparently legal sources. The criminal activities can vary from drug dealing, gun traffic, administrative corruption, and any other type of organized crime” (Rozas, 2008).

The money coming from asset laundering generally arises from illegal activities, some of them considered as the most profitable of the world, for example, the clandestine manufacture and sale of arms, market of organs and drugs, illicit enrichment from public resources; markets where plagiarized items are offered instead of the original ones, etc. (Andrade, 2009).

A method used to legalize money coming from asset laundering:

“Generally implies a business capable of facilitating the introduction of illicit funds in the financial area; however, the businesses involved, do not exercise any legitimate activity because they only exist to cover the deposits of illicit money” (Gilmour, 2015).

Money laundering is one of the major obstacles to maintain an efficient international financial system. The implications that this crime causes, not only affect a specific area, but also worldwide:

“This can carry to significant costs for the economy when damaging the economic operations and promoting weak economic policies” (Normah et al., 2014).

In the report published by the Financial Information and Analysis Unit (UIAF) from Colombia,

“It was indicated that the total laundering amounts reached about the 2% of the Gross Domestic Product (GDP) worldwide” (UIAF, 2014). Through time, money laundering has presented superiority in its perpetration. For this reason, nowadays, several organizations fight this crime, “even efforts in fighting money laundering started in an early stage, the solutions seem to be restricted to a strategic level” (Luo, 2014).

The establishment of regulations against money laundering has become the weapon of governments to fight crime and crimes, these laws pressure companies to keep constant information on their economic transactions (Hopton, 2016). In Ecuador, the Organic Law of Prevention, Detection and Eradication of Asset Laundering Crime and Finance of Crimes, which institutes the Financial Economic Analysis Unit (its Spanish acronym UAFE), as the technical entity responsible of the compilation of information, viability of reports, execution of policies and national strategies of prevention and eradication of asset laundering and crime finance. Among its functions are, according to the Organic Law on Prevention, Detection of the Eradication of the Crime of Money Laundering and the Financing of Crimes (2016) in article 12: detect unusual or unjustified economic operations and send them to the State Attorney General's Office intervene in criminal proceedings, promote and execute international cooperation, maintain a database of their operations and impose sanctions.

Within the statistical data, in the year 2018 the UAFE attended at its help desk 44,800 technical assistance, between phone calls and emails, the number of subjects required to report was 7,266, the reports of financial statements on the $10,000 was 31,232 of which 45% corresponded to Construction Companies. Of the 787 investigation requests made by the General Prosecutor of Ecuador, 26% corresponded to Money Laundering (Accountability Report, 2019).

The perpetrators of asset laundering, to conceal their activities, in ghost companies, will surely emit fraudulent financial statements, whose consequences:

“Are significant because they affect the market value of a company, its reputation, and they denote the lack of ability of their administrators to reach their strategic objectives” (Rozas, 2009).

The companies should have controls, which allow them to distinguish these types of activities early:

“Given that these controls have to be adequately managed, if we pretend to correct deviations of the different objectives and entrepreneurial management levels with them” (Eslava, 2013).

A method used for the prevention and detection of asset laundering is the “forensic auditing” (Bareño, 2009). The forensic auditing is:

“A science that allows to gather and to present financial, countable, legal, and administrative tax information, in a way that it has to be accepted by a Jurisprudence Court against the perpetrators of an economic crime” (Calderón, 2017).

This research identifies the profile of the perpetrator of asset laundering to give the organizations the necessary guidelines, which allow the generation of internal and external controls, which impede the execution of these crimes.

Methodology Used In Research

To determine the profile of the individual involved in money laundering, a qualitative and quantitative research was carried out, based on the sentences issued in 2006-2014 in Ecuador and published later by the Financial Action Task Force. GAFILAT gathers data from the State Attorney General's Office and the Council of the Judiciary of Ecuador and presents 16 legible sentences for money laundering on its website.

Through a diagnosis and descriptive analysis, variables such as nationality, gender, age, level of education, province and money amounts were detected, and the following hypotheses were formulated:H1 Foreigners’ participation in Money Laundering in Ecuador is higher than Ecuadorians.

H1 Foreigners’ participation in Money Laundering in Ecuador is higher than Ecuadorians.

H2 Male participation is higher both in the prosecuted people of foreign and Ecuadorian nationality.

H3 Male people are those who load funds to the country for money laundering.

H4 The provinces of the Coast region have the highest percentage of cases sentenced for money laundering.

It is important to emphasize the difference between the people involved and the ones prosecuted for money laundering. The former refers to the individuals who are in the list issued by the Judicial Council according to the process number, while the latter are the people who had the sentence for money laundering.

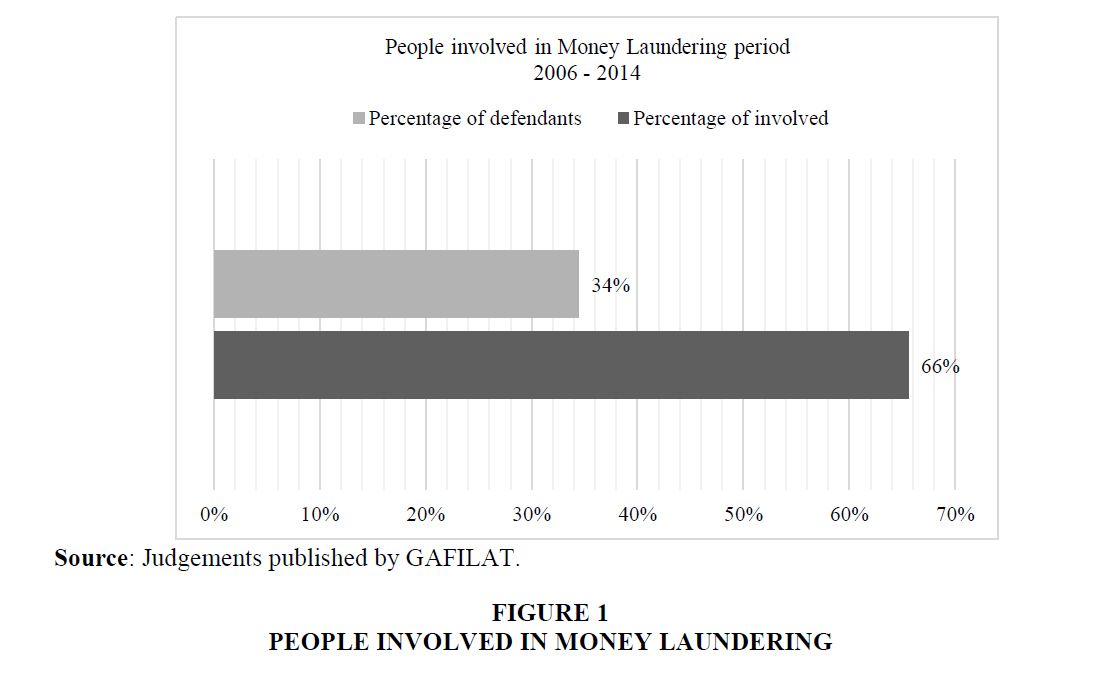

In addition, to determine the socio-economic impact of money laundering, the following has been taken as a reference: increase of crime and corruption, weakening of the private sector and loss of income from taxes. These subjects were compared with the reality of Ecuador, according to the reports issued by the official organisms. Figure 1 involved in money laundering.

Results Of The Investigation

Characteristics of the Person Involved in Money Laundering

To determine the characteristics of those involved in money laundering, variables such as nationality, gender, age, amounts of money, occupation, level of education, among others, were analyzed.

Figure 1 shows the percentage of people who were prosecuted due to money laundering in Ecuador. 34% of those involved submitted to a trial process, while 66% were not prosecuted. People prosecuted for money laundering were between 20 and 47 years old, and 75% of them had secondary education.

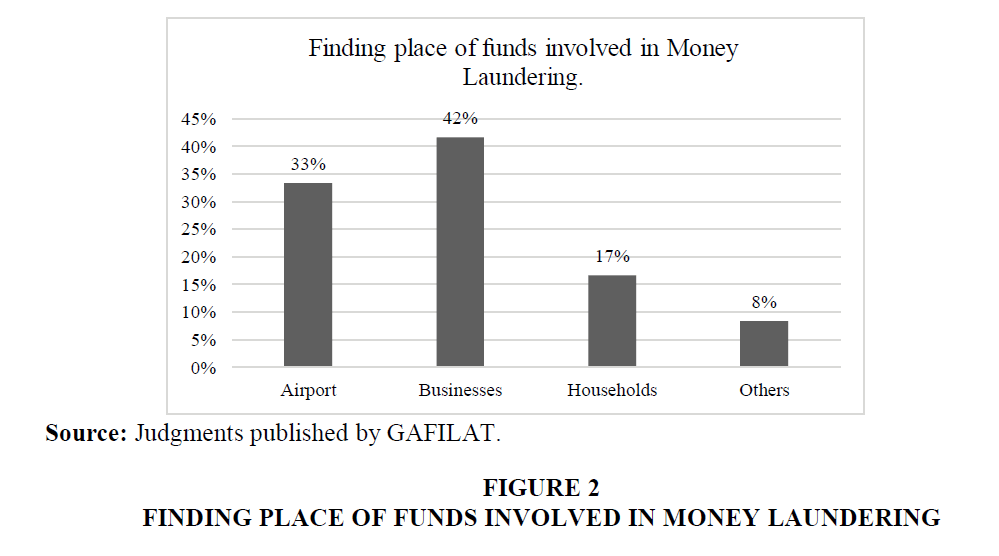

Figure 2 shows that people prosecuted for money laundering use shops as the most suitable place to camouflage their money. Most businesses are legally constituted shell-companies. Among these companies, there are frame shops, shrimp farms, artistic spectacles companies, among others.

The findings made in shell-companies were given thanks to the joint controls carried out by the Internal Revenue Service (SRI, its acronym in Spanish) and the General Attorney Office of Ecuador. The shell-companies:

"Create a Unique Registry of Taxpayers (RUC, in Spanish), addresses in which presumably the economic activities are carried out; however, after reviewing those addresses, nonexistent places were verified that would not allow to carry out large commercial operations" (Servicio de Rentas Internas, 2017).

Stated Hypotheses Verification

The hypotheses were made based on the generalizations that citizens usually make about people involved in money laundering activities.

H1 The participation of foreigners in Money Laundering in Ecuador is higher than Ecuadorians.

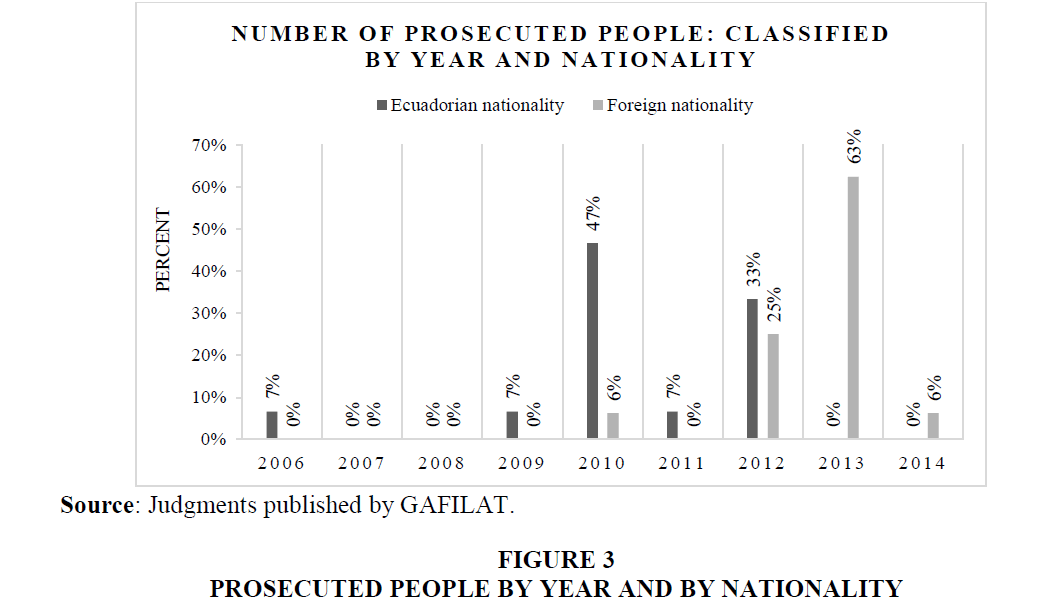

In the group of people prosecuted for money laundering, people from different nationalities were found, such as Colombian, Mexican and Greek and, of course, Ecuadorian. Foreigners reach a 52% participation in the crime of money laundering, while Ecuadorians represent 48%. Figure 3 shows that the year with the highest percentage of foreigners’ participation was 2013, with 63% of prosecuted people. No information is recorded since the year 2007 to 2008.

Therefore, hypothesis 1 is accepted: The participation of foreigners prosecuted in money laundering in Ecuador is higher than Ecuadorians’. These figures could be linked to the facility that foreign persons must enter the country. The only requirements to do so is to have a valid passport (6 months of validity) or ID card for South America citizens, and people do not have to belong to the countries that are in the following list: Afghanistan, Bangladesh, Cuba, Republic Democratic People's Democratic Republic of Korea, Eritrea, Ethiopia, (Ministry of Interior, 2016) since it is necessary for those countries to have a visa before entering the country.

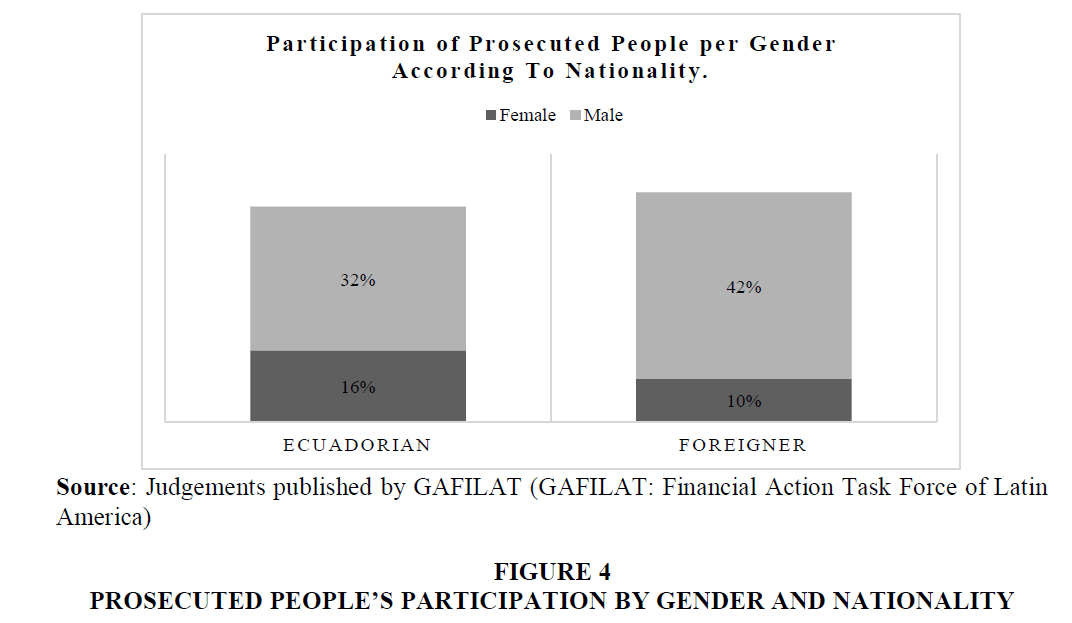

H2 Male participation is higher both in the prosecuted people of foreign and Ecuadorian nationality.

The male gender predominates in those prosecuted with a total participation of 74%. In Ecuador, according to the Statistical Information of Centers of Liberty Deprivation-Persons Deprived of Liberty (Figure 4), in 2014 the number of persons deprived of liberty was 26,821, including men and women. Persons deprived of their liberty are 91% of the male gender and 9% are female (Ministry of Justice, 2014).

Therefore, hypothesis 2 states that the participation of the male gender is higher among the prosecuted of different nationalities. This fact is accepted due to the superiority found by the male gender committing this crime. At present, several investigations related to criminology and gender. Fuller states that the differences between men and women.

"Are not a direct result of biology since each era elaborates features on anatomical differences. For this reason, it is doubtful that there are innately feminine or masculine criminal behaviors and it is sought to understand when opportunities produce different styles of criminality for each gender "(Fuller, 2008).

H3 Males are the ones who mostly enter the country funds on money laundering.

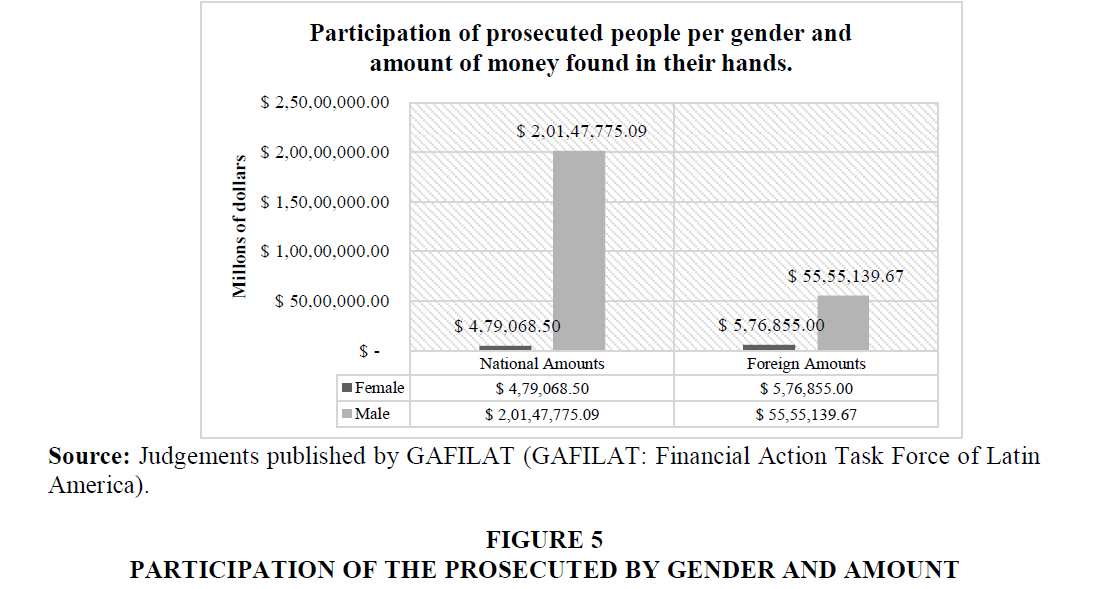

Figure 5 shows that the highest amounts of money have been found in the hands of a male person, reaching 96% of the money related to this crime. Meanwhile the female gender was related to only a 4% of the money found.

Hypothesis 3: Males are the ones who mostly enter the country funds on money laundering, which is accepted. A 78% of the total amount, equivalent to $ 20,147,775.09 was found with Ecuadorian male prosecuted ones. A 22%, equivalent to $ 5,555,139.67, correspond to male prosecuted ones from foreign countries.

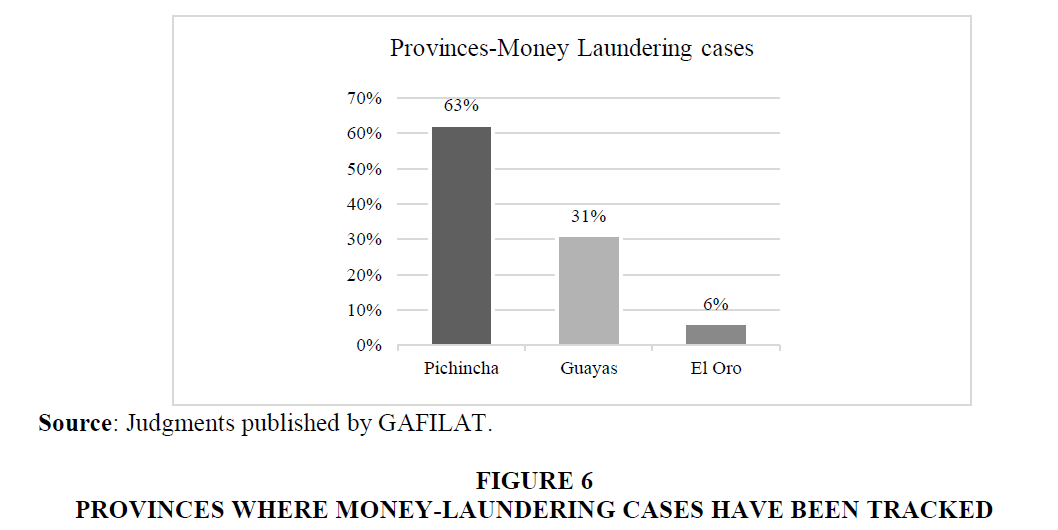

H4 The provinces of the Coastal Region evidence the highest percentage of cases sentenced for money laundering.

Sentences evidence several provinces in which cases for money laundering was found, they are Pichincha, Guayas and El Oro. Most of these cases were tracked in airports. A 25% of cases were found in Pichincha. People entering the country carried this money in their suitcases and did not justify its origin (Figure 6).

Hypothesis 4: Provinces from the Coastal Region are the ones that evidence the highest percentage of sentenced cases for money laundering, which is rejected. Graph 6 shows that the province with the highest number of cases of money laundering is Pichincha with 63%, which is consistent with the results issued by the State Attorney General's Office in its Criminological Profile report.

Socioeconomic Impact of the Amounts Entered the Country due to Money Laundering

Given the clandestine nature of money laundering, it is difficult to measure the magnitude of its economic repercussions; "For Latin America, a gross estimate of money laundering in the region seems to place it between 2.5% and 6.3% of the annual regional GDP" (Inter-American Development Bank, 2017). This is a harm that directly affects the economy and society of the place where it develops. It is "one of the most complex crimes, because it cannot be determined clearly and precisely, for it demands deep research tasks" (Esteban et al., 2012).

Money laundering not only affects the people who carry it out, but also "has serious socioeconomic repercussions; it allows illicit activities to flourish, which leads to greater social problems. There is an obvious link between the magnitude of money laundering and the level of internal corruption in a country" (Inter-American Development Bank, 2017). Money laundering produces negative effects which tend to increase in places where there is no stable financial system, or even worse, there are not strong banking regulations. In addition, it also produces other consequences such as the increase of corruption and crimes. Also, the private sectors weakens and in the public-sector loss of income from taxes take place (Soto, 2014).

Another consequence previously mentioned is the weakening of the private sector. This consequence is directly related to shell corporations. According to the Regulation for the Application of the Law of Internal Tax Regime (LORTI), article 25, it is mentioned that these are companies that have been created by means of a false declaration of intent, which pretends the existence of an economic activity to be able to justify the transactions and hide the benefits produced from that supposed activity (National Assembly of Ecuador, 2010). According to figures reported by the SRI (Internal Revenue Services) (2017), until March 17, 2017 in Ecuador, there is an amount of $218,683,774 recovered from purchases made to this type of corporations that were suppliers on both, public and private sectors.

Conclusions

The analysis of the judgments on cases for money laundering determined that foreigners have a greater intervention in operations for such cases in Ecuador with a percentage of participation of 52%. Lacking rigorous requirements in the policies of Ecuador at accepting foreigners who enter the country has just made this easier. It is also observed that the majority of people who money launders are of male gender with a 74% of participation. Likewise, the ones who enter higher sums of money to the country are of male gender.

People who launder money have reinvented the way they camouflage money, which means, they do not keep a single method to legalize it. One of the methods used to enter the money takes place at international airports in the largest provinces of Ecuador.

Another of the most used methods is the creation of businesses and shell corporations that serve to disguise the funds coming from illegal sources. Currently, the SRI is the organization responsible for regulating and monitoring that this type of acts is not committed. As a result, up to 2016, 508 registered shell corporations have been found countrywide. (Internal Rents Service, 2017).

Money laundering brings serious consequences on the economy of a country and its inhabitants. This offence implies other crimes that cause suffering and even death among those involved. Other consequences include the rise of crime, loss of income for the public sector and the weakening of the private sector. It is important to create a culture of prevention as well as to set control and cautionary measures; they are necessary to minimize and even eradicate this issue in the world.

References

- Accountability Report. (2019). Quito: Financial and economic analysis unit. Retrieved from https://www.uafe.gob.ec/wp-content/uploads/downloads/2019/Informe%20de%20Gesti%C3%B3n%202018%20.final.pdf

- Andrade, J. (2009). Money laundering in Ecuador: The prada case. Retrieved from http://67.192.84.248:8080/bitstream/10469/890/7/TFLACSO-JA2009.pdf

- Bareño, D.S. (2009). Accounting mechanisms to prevent and detect money laundering. Bogotá: Cuadernos de Contabilidad.

- Calderón, J.E. (2017). Auditoria forense. Posibles tendencias de las investigaciones. Revista Publicando, 4(10), 383-390.

- Calleja, E.C., & Marcos, L.D. (2013). Business ethics. Madrid: Editorial Universitaria Ramón Areces.

- Cobo, J.M. (2001). Professional ethics in human and social sciences. Madrid: Huerga y Fierro Editores, S.L.

- Eslava, J. (2013). Company control management. Madrid: ESIC, Business&MarketingSchool. Retrieved from https://books.google.es/books?hl=es&lr=&id=XWi8AQAAQBAJ&oi=fnd&pg=PA9&dq=importancia+de+los+controles+en+una+empresa&ots=SKOuvbD4go&sig=dY3Mu5-T5QjmA1zslB8jOndETpA#v=onepage&q=importancia%20de%20los%20controles%20en%20una%20empresa&f=false

- Esteban, H., Robledo, J., Capra, M., & Pérez, P. (2012). Money laundering: social economic impact and professional role in economic sciences. Argentina: Thesis to obtain the title of National Public Accountant and Partisan Expert in the Faculty of Economic Sciences of the National University of Cuyo. Retrieved from http://bdigital.uncu.edu.ar/objetos_digitales/5213/capratesislavadodefinitiva.pdf

- FINCEN. (2017). Financial crimes enforcement network. Retrieved from https://www.fincen.gov/history-anti-money-laundering-laws

- Fuller, N. (2008). The gender perspective and criminology: A prolific relationship. Tabula Rasa, 8(1), 97-110.

- GAFILAT. (2017). Latin American financial action task force. Retrieved from http://www.gafilat.org/content/quienes/

- Gilmour, N. (2015). Understanding the practices behind money launderine A rational choice interpretationg. International Journal of Law, Crime and Justice, 20(1), 1-13.

- Hopton, D. (2016). Money laundering. London: Gower.

- Inter-American Development Bank. (2017). Money laundering in Latin America:What do we know about him? In B. I. Development. Retrieved from http://www.iadb.org/res/publications/pubfiles/pubB-2005S_7696.pdf

- Internal Rents Service. (2017). Retrieved from https://www.sri.gob.ec

- Luo, X. (2014). Suspicious transaccion detection for anti-money laundering. International Journal Of Security And Its Applications, 8(2), 157-166.

- Ministry of Interior. (2018). Requirements to enter Ecuador. Retrieved from https://www.ministeriointerior.gob.ec/requisitos-para-ingresar-a-ecuador/

- Ministry of Justice. (2014). Ministry of justice human rights and cults Ecuador.

- National Assembly of Ecuador. (2010). Organic law of internal tax regime: LORTI. Quito-Ecuador.

- Normah, O., Amirah, J., & Roshayani, A. (2014). Money laundering-FATF special recommendation VIII: A review of evaluation reports. Procedia-Social and Behavioral Sciences. Retrieved from https://www.researchgate.net/publication/275544238_Money_Laundering_-_FATF_Special_Recommendation_VIII_A_Review_of_Evaluation_Reports

- Perotti, J. (2009). The problem of money laundering and its global effects: A look at international initiatives and Argentine policies UNISCI. Madrid: Discussion Papers. Obtained from http://www.redalyc.org/articulo.oa?id=76711408007

- Rozas, A. (2009). Forensic audit. Quipukamayoc, 16(32), 67-93.

- Rozas, A.E. (2008). The role of the audit before money laundering. Quipukamayoc, 2(1), 73-92.

- Servicio de Rentas Internas. (2017). The ghost companies in Ecuador. Ecuador: Servicio de Rentas Internas. Retrieved from http://www.sri.gob.ec/DocumentosAlfrescoPortlet/descargar/0f670b33-da22-40a2-889e-75bff31b6e0e/INVESTIGACIO%B4N+A+PRESUNTAS+EMPRESAS+FANTASMAS.pdf

- Soto, L. (2014). Economic and social consequences of money laundering. Retrieved from http://www.lacordillera.net/index.php?option=com_content&view=article&id=7079:c

- UIAF. (2014). The economic dimension of money laundering. Bogota: García Solano y Compañía SAS-Caliche Impresores. Retrieved from http://www.urosario.edu.co/observatorio-de-lavado-de-activos/Archivos_Lavados/La-dimension-economica-del-LA.pdf

- Wong, Z., & Salcedo, L. (2014). Challenges of the accountant today. Quipukamayoc, 15(30), 67-72.