Research Article: 2018 Vol: 17 Issue: 5

Ownership Structure and Corporate Performance of Multinational Banks: Evidence from Nigeria

Olugbenga Jinadu, Covenant University

Uwalomwa Uwuigbe, Covenant University

Olubukola Ranti Uwuigbe, Covenant University

Osariemen Asiriuwa, Covenant University

Sylvester Eriabie, Covenant University

Ajetunmobi Opeyemi, Covenant University

Ilogho Simon Osiregbemhe, Covenant University

Abstract

This study investigated whether a significant relationship exists between ownership concentration and corporate performance of Nigerian multinational banks. The corporate annual reports for the periods 2010-2014 were utilised as the main source of secondary data. In testing the research hypotheses, the study adopted the use of panel least square regression method to analyse the data collected from annual reports of the Nigerian multinational banks. Also, the study made use of correlational research design for testing the expected relationship between the variables. Findings revealed a significant negative relationship between ownership concentration and corporate performance of Nigerian multinational banks. In addition, an insignificant positive impact of foreign ownership on corporate performance exists. We also found a significant negative impact of domestic ownership on corporate performance. The study recommends that Nigerian multinational banks should reduce ownership concentration and domestic ownership in order to increase the level of corporate performance. In addition, foreign ownership should be encouraged as a result of its technical expertise and financial support that improve corporate performance.

Keywords

Corporate Governance, Domestic Ownership, Foreign Ownership and Ownership Concentration.

JEL Classification: M41, G21.

Introduction

The relationship between ownership structure and corporate performance has been a topical issue within the framework of corporate governance. The agency theory predicts that ownership is a significant determinant of corporate performance (Hu & Izumida, 2008; Akman et al., 2015). Also, ownership structure is a mechanism to reduce agency cost (Kangarlouei et al., 2012). In addition, it is widely accepted that concentrated ownership has the potential to limit the agency problem, and therefore enhances performance (Hu & Izumida, 2008; Kangarlouei et al., 2012). They further opined that if concentrated ownership has a positive effect on corporate performance, it may be as a result of better monitoring by large shareholders. Ownership concentration, therefore, can be described as the amount of stock owned by individual investors and large shareholders. These large shareholders are investors that hold at least 5% of equity ownership within the firm (Zingales, 1994 as cited in Santos, 2015). A higher level of ownership concentration suggests a stronger monitoring power from shareholders over a firm managerial decision because of the greater incentives for these owners in order to proactively safeguard their investment. Owners with a significant amount of shares may take aggressive actions, either directly or indirectly, over firm decisions on accounting, auditing, reporting process, the election of board members, poor management with their voting right. As such, ownership concentration can be an internal governance mechanism that helps to ensure accountability and corporate performance (Adams, 2004).

Similarly, shareholders with a large stake in the company show more willingness to play an active role in corporate decisions because they partially internalise the benefits of their monitoring effort (Hu & Izumida, 2008). In contrast, banks with a low level of ownership concentration might indicate weaker governance power because investors with fewer ownership interests might have little incentive to closely monitor the behaviours of top management and the performance of the organisation (Son et al., 2015). Thus, the development of robust stakeholder involvement (ownership structure), as advocated by the Institute of Social and Ethical Accountability (1999) will help to mitigate the ownership-performance gap in order to strengthen corporate governance, transparency and disclosure levels. To this end, ownership structure’s variables are an important subject in the field of financial management (Ezazi et al., 2011) for analysing the relationship, impact and differences in corporate performance. Therefore, ownership structure is considered as being concentrated ownership, foreign ownership, domestic and state ownership (Javid & Iqbal, 2008; Peong et al., 2012; Kiruri, 2013; Gugong et al., 2014; Son et al., 2015). Ownership concentration is the percentage of shareholders having 5% or more holdings, while the percentage of the entire worth of stocks held by investors outside Nigeria represents the foreign ownership. In addition, a domestic ownership is a percentage of total value of shares held by individuals resident in the country where the business operates; while state ownership is the percentage of the total value of shares held by the government for the interest of the public or a community.

However, with the growing need for stakeholder engagement in the governance system, research on ownership structure and corporate performance has been dominated by studies conducted in developed countries (Munday et al., 2003; Douma et al., 2006; Hu & Izumida, 2008; Akman et al., 2015). However, this is not the same in developing countries (e.g. Nigeria) where there is weighty pressure for stakeholder involvement in ensuring proper monitoring and improvement in corporate performance of firms. In addition, many findings on the impact of ownership structure on corporate performance have shown mixed results (Yudaeva et al., 2003; Barbosa & Louri, 2005; Hu & Izumida, 2008; Gurbuz & Aybars, 2010; Kiruri, 2013). Also, the development of robust stakeholder engagement mechanisms at all stages of accounting and governance process as advocated by the Institute of Social and Ethical Accountability (ISEA) is yet to be adopted in the developing countries (Adams & Kuasirikun, 2000; Adams, 2004) as bank crises are linked to ownership structure (Ezugwu & Itodo, 2014).

In view of these problems, the study basically investigated whether a significant relationship exists between ownership concentration and corporate performance of Nigerian multinational Banks. To achieve this objective, the study restricted its ownership structure to ownership concentration, foreign ownership and domestic ownership in Nigerian multinational Banks. In addition, corporate performance was measured by return on assets and return on equity.

Literature Review

Theoretical Framework

The theory underpinning this study is hinged on Agency theory. This is defined by Urhoghide & Emeni (2014), as the contractual relationship that exists between the manager and the shareholders in which shareholders authorise the manager to run their business activities. In so doing, investors employ the services of managers (based on their managerial expertise) to invest their surplus funds in profitable ventures in order to generate good returns and the managers are rewarded for their services. However, low levels of governance are likely to attract costs thereby lowering profitability (Core et al., 2006). As a result, management that is dedicated to the entity’s interest will try to lower transaction/agency costs in order to increase performance results. On the basis of this, Jensen & Meckling (1976) describe this as an agency relationship, where the management is accountable to all stakeholders and must be able to safeguard their interest. Thus, the managers’ propensity to increase corporate performance depends on ownership structure (Oyerogba et al., 2014).

Review of Related Literature

Many researchers have recently investigated the relationship between ownership structure and corporate performance of firms. This is assumed to have occurred as a result of the increase in the amount of foreign investment in world economies arising from the influence of increased globalisation. Nevertheless, despite the increase in prior studies, there seems to be no consensus despite the plethora of empirical literature. According to Gomes & Ramaswamy (1999), as cited in Gurbuz & Aybars (2010), the costs of internationalization which have often been neglected in prior studies have been adduced to have accounted for the lack of consistent findings.

Prior studies that investigated the relationship between foreign ownership and firm performance have observed that foreign ownership had a significant positive influence on firm’s performance. This is, however, contrary to the results from prior studies on domestic ownership (Akman et al., 2015, Sueyoshi et al., 2010; Douma et al., 2006). Similarly, Douma et al. (2006) in an attempt to explain the impact of firm performance in emerging markets by integrating agency-institutional and resource-based theories espoused a multi-theoretical viewpoint in providing answers. They averred that with concentrated foreign ownership, foreign direct investments that could bring additional financial support and improved managerial technique. In addition, they observed as part of their findings that firms with foreign shareholders coupled with strategic business interests had better performance profile. In the same vein, Huang & Shiu (2009) in a related study observed a significant positive effect of foreign ownership on firm performance in Taiwan. Likewise, Bjuggren et al. (2007) in a related study among Swedish firms observed that foreign ownership had a significant positive influence on firm performance.

Furthermore, a research study performed by Yudaeva et al. (2003) examined the differences between the foreign and domestic-owned productivity of firms in Russia. In their findings, they observed that due to the benefits accruing from the presence of foreign owners in terms of managerial expertise, investment in research and development, effective distribution networks and ease of access to foreign credit markets, firms dominated by foreign owners performed better compared to domestic ones. Micco et al. (2004) in a related study observed a significant positive association between ownership structure and firm performance. They further observed that a low profitability among state-owned banks compared to banks that were privately owned. In addition, Douma et al. (2006) using Return on Assets (ROA) and Tobin’s Q observed that foreign firms perform better than domestic ones. Hence, they concluded that there was a significant relationship between foreign ownership the two performance measures. Contrary to these outcome, Barbosa & Louri (2005) observed that the performance of firms in Portugal did not have any significant impact on foreign ownership. However, they observed that foreign ownership had a significant positive impact on the return on assets of firms in Greece.

Prior studies by Zeitun & Tian (2007) and Claessens et al. (1997) as cited in Aburime (2008) on the relationship between ownership concentration and bank profitability observed a strong positive relationship between ownership concentration and profitability of listed banks on the Prague Stock Exchange over the period 1992-1995. In addition, Antoniadis et al. (2010) found that a higher level of ownership concentration leads to an increase in bank performance. Kiruri (2013) in a study conducted in Kenya examined the effect of ownership structure on bank profitability. It was observed that a negative relationship existed between the structure of ownership concentration and the profitability of firms. Relatedly, Oyerogba et al. (2014) carried out a study on the effect of ownership concentration on firm value in Nigeria. The result showed that a positive significant relationship exists between ownership concentration and firm value. Also, in a study carried out by Akman et al. (2015) on the effect of corporate ownership concentration on firm performance, findings revealed a positive relationship between domestic and foreign ownership and market performance during the period. Similarly, a study by Hu & Izumidah (2008) examined the causal relationship between ownership concentration and corporate performance in Japan, findings revealed that ownership concentration has a significant effect on corporate performance. More so, Kobeissi & Sun (2010) in their study observed that ownership structure had a strong impact on the performance of bank. In the same vein, it was observed that banks owned foreigners had higher performance indicators than the domestic banks in the Middle East and North Africa Region. Similarly, Uwuigbe & Olusanmi (2012) also observed that foreign ownership has a significant positive impact on firm performance. In the same vein, a study by Gugong et al. (2014) and Douma et al. (2006) examined the impact of ownership structure on the financial performance of listed insurance firms in Nigeria. The findings revealed a significant positive relationship between ownership structure and financial performance as measured by return on assets and return on equity.

However, from the work of Aburime (2008) on the impact of ownership structure on bank profitability in Nigeria, findings, with the use of regression and t-test methods of data analysis, revealed no significant effect of ownership structure on bank profitability using return on assets as profitability measure. In the same vein, Yurtoglu (2000) observed that concentrated ownership characterized by domestic shareholdings had a significant negative influence on the performance of firms. Correspondingly, Gursoy & Aydogan (2003) observed a similar observation though not statistically significant as domestic ownership had a positive effect on accounting performance. In the same vein, Kosak & Cok (2008) observed a very little difference between the performance indicators of foreign-owned banks and domestic banks. Similarly, Douma et al. (2006), in their submissions observed that the increase in firms operating efficiency was accounted for by the percentage increase in foreign shareholding. However, they observed that foreign shareholding percentage and operating efficiency had a non-linear association. Furthermore, Wen (2010) examined the relationship between ownership concentration and performance of Banks in China. His result depicted no correlation between ownership concentration and Bank performance with the use of return on assets and return on equity.

On the basis of prior studies, some considerable amount of literature exists on ownership structure and corporate performance in developed economies, notably United Kingdom, Japan, Greece and Taiwan. However, same is not true in developing economies like Nigeria where there is a relative dearth of literature in this area, hence, the need to study whether corporate performance of Nigerian multinational Banks is affected by ownership structure.

Hypotheses

Given the influence of ownership concentration, foreign ownership and domestic ownership on corporate performance from the extant literature, the hypotheses to be tested in this study are stated below in their null forms:

H1: There is no significant relationship between ownership concentration and corporate performance of Nigerian multinational Banks.

H2: There is no significant impact of foreign ownership on corporate performance of Nigerian multinational Banks.

H3: There is no significant impact of domestic ownership on corporate performance of Nigerian multinational Banks.

Methodology

This study adopted the use of secondary method of data collection from the annual reports of multinational Banks in Nigeria. This is due to the fact that annual reports are audited, reliable, a regular medium to generate reliable information and also communicate in a systematic manner with stakeholders (Emmanuel et al., 2018; Gugong et al., 2014; Belal et al., 2015; Uwuigbe et al., 2016; Asiriuwa, et al., 2015). A correlational research design was used to analyse the statistical relationship between dependent and independent variables and to make predictions regarding these relationships (Creswell, 2008). A total of 8 multinational banks in Nigeria that consist of the population were covered in this study (Appendix 1). The choice of multinational Banks arises because of the nature of their activities and agitations for stakeholder involvement in governance systems in the banking industry. The annual reports of the multinational Banks within the period 2010-2014 were used due to data availability, accessibility and greater comparability of results.

To achieve this purpose, the panel least square regression method of data analysis was adopted. This is due to the fact that this method is most commonly used for analysing the impact of ownership structure on corporate performance in annual reports (Kiruri, 2013; Gugong et al., 2014; Oyerogba et al., 2014; Uwuigbe et al., 2017). In addition, it helps to conduct an analysis of many firms overtime (Gurbuz & Aybars, 2010). The validity of the annual reports was confirmed by experts and a reliability test for a measure of internal consistency was also carried out based on Cronbach’s Alpha of 0.769 on five numbers of items as displayed in (Appendix 2).

Model Specification

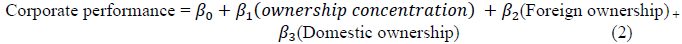

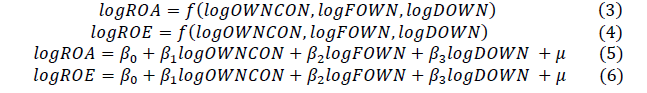

For the purpose of measuring the relationship between dependent and independent variables, an econometric model adapted from the study of Gugong et al. (2014) is hereby specified:

Corporate performance=f (ownership structure) (1)

The functional form of the model could be presented explicitly as:

Where,

ROA=Return on Assets used as a proxy for corporate performance (where ROA is measured as the profit before tax divided by total assets as at the end of the fiscal year under consideration).

ROE=Return on Equity used as a proxy for corporate performance (where ROE is measured as the profit after tax divided by shareholders’ fund).

OWNCON=Ownership concentration is used as a proxy for ownership structure (measured by the percentage of shareholders with at least 5% holdings)

FOWN=Foreign ownership is used as a proxy for ownership structure (measured by the percentage of shares held by foreign owners).

DOWN=Domestic ownership is used as a proxy for ownership structure (measured by the percentage of shares held by local owners).

β0=Represents the intercept of the regression line, regarded as constant;

β1-3=Describes the slope of the regression line or independent variables or behaviour parameters.

μ=Represents the stochastic random error term that represents other independent variables that affect the model but not captured.

The model specified above captured corporate performance (ROA, ROE) as the dependent variable, while ownership structure (OWNCON, FOWN, DOWN) as independent variables. This study employs ROA and ROE to measure corporate performance. However, Tobin's Q (the ratio of market value of equity to replacement cost of assets) that was used by many researchers in the empirical literature, as another proxy for measuring corporate performance could not be used in this study since it was difficult to obtain an estimate of replacement cost for used equipment in the annual reports. Based on the large figures derived, all variables were logged.

Results And Discussions

Findings relating to the descriptive statistics for the multinational banks as depicted in Table 1 indicate that the mean and standard deviation of the variables are: ROA (0.98, 0.92), ROE (2.71, 0.59), OWNCON (3.86, 0.69), FOWN (4.12, 0.95) and DOWN (4.30, 0.63) respectively. The mean values of ROE (2.71) as compared to ROA (0.98) depicts that on an average the sampled firms structure contributes more values to the equity than the assets. Furthermore, on an aggregate, the presence of local investors in the company occupies more shareholdings of the firms as compared to the foreign investors. Consequently, about 3.8% of the sampled firm’s investors have at least 5% stakes in the establishment. However, the whole variables are negatively skewed and achieved the test of normality as they are close to zero. The Jarque-Bera test rejects the normality of ROA at 1% level since 85.20 is higher than the X2 value of 23.27 and 19.23 at 5% and 1% respectively. However, ROE (10.81), OWNCON (5.13), FOWN (4.13) and DOWN (0.73) suggest normality.

| Table 1 Descriptive Statistics |

|||||

| VARIABLES | ROA | ROE | OWNCON | FOWN | DOWN |

| Mean | 0.9813 | 2.7084 | 3.8629 | 4.1231 | 4.2994 |

| Median | 1.0800 | 2.9000 | 4.1000 | 4.4100 | 4.6100 |

| Maximum | 2.8400 | 3.3900 | 4.6100 | 4.6100 | 4.6100 |

| Minimum | -1.9700 | 1.0200 | 2.6200 | 1.0600 | 2.9000 |

| Std. Dev. | 0.9180 | 0.5940 | 0.6865 | 0.9537 | 0.6276 |

| Skewness | -0.9992 | -1.0562 | -0.3487 | -2.4567 | -1.6861 |

| Kurtosis | 4.7344 | 3.2522 | 1.5086 | 7.9968 | 4.0476 |

| Jarque-Bera | 11.0871 | 7.1653 | 3.9528 | 32.7400 | 17.1457 |

| Probability | 0.0039 | 0.0278 | 0.13856 | 0.0000 | 0.0002 |

| Sum | 37.2900 | 102.9200 | 135.2000 | 65.9700 | 141.8800 |

| Sum Sq. Dev. | 31.1872 | 13.0545 | 16.0253 | 13.6443 | 12.6034 |

| Observations | 40 | 40 | 40 | 40 | 40 |

Source: Authors’ computation from E-view 7.

The results of the correlation matrix in Table 2 show high data correlations among the variables. These high pair-wise correlation coefficients show the absence of multicollinearity among the variables. This implies the presence of a perfect linear relationship among all the variables of the regression model.

| Table 2 Correlation Matrix |

|||||

| ROA | ROE | OWNCON | FOWN | DOWN | |

| ROA | 1.000 | ||||

| ROE | 0.957 | 1.000 | |||

| OWNCON | 0.019 | 0.079 | 1.000 | ||

| FOWN | -0.159 | -0.116 | 0.941 | 1.000 | |

| DOWN | -0.223 | -0.294 | -0.975 | -0.870 | 1.000 |

Table 3 shows the results of the regression model used for the three assumptions. The first assumption is that (there is no significant relationship between ownership concentration and corporate performance of Nigerian multinational banks). Findings, as disclosed in Table 3 above, are in contrast with the first hypothesis, showing that a significant association exist amid ownership concentration and corporate performance. However, this is evident with the t-statistics and p values of (-3.46 and 0.01) respectively. Thus, an inverse relationship exists amid ownership concentration and corporate performance, this is proved by the coefficient of (-8.12) implying that a percentage increase in ownership concentration would result in the decrease of corporate performance of these sampled banks. The result collaborates with the work of (Kiruri, 2013; Kobeissi & Sun, 2010). They found a significant adverse association amid construct. However, the result contradicts the work of Wen (2010) where ownership concentration has no significant relationship with corporate performance.

| Table 3 Panel Least Square Regression Results Based On Return On Assets |

||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| LOGOWNCON | -8.122794 | 2.348845 | -3.458207 | 0.0181 |

| LOGFOWN | 0.191958 | 0.325327 | 0.590046 | 0.5808 |

| LOGDOWN | -3.866252 | 0.802140 | -4.819921 | 0.0048 |

| C | 47.75378 | 11.44232 | 4.173436 | 0.0087 |

| Weighted Statistics | ||||

| R-squared | 0.871187 | Mean dependent var | 1.306667 | |

| Adjusted R-squared | 0.793899 | S.D. dependent var | 0.608646 | |

| S.E. of regression | 0.276315 | Akaike info criterion | 0.566552 | |

| Sum squared residual | 0.381750 | Schwarz criterion | 0.654208 | |

| Log likelihood | 1.450515 | Hannan-Quinn criter. | 0.377392 | |

| F-statistic | 11.27199 | Durbin-Watson stat | 2.116801 | |

| Prob (F-statistic) | 0.011559 | |||

Source: Authors’ computation from E-view 7.

Consequently, the second assumption is that (there is no significant impact between foreign ownership and corporate performance of Nigerian multinational banks). The outcomes as shown in Table 3 above align with the aforementioned assumption. This is evident in the tstatistics and p values of (0.59 and 0.58) greater than 5% level of significance respectively. Thus, a positive association exist amid foreign ownership and corporate performance. The outcome is clearly seen by the coefficient of (0.191) implying that as foreign ownership increase, corporate performance is enhanced but this impact is insignificant. This finding resonates to existing research conducted by (Gursory & Aydogan, 2003; Barbosa & Louri, 2005). However, this in contrast with the result of Uwuigbe & Olusanmi (2012), who opined that foreign ownership, has a significant impact on firm performance.

Finally, the third assumption stands as (there is no significant impact between domestic ownership and corporate performance of Nigerian multinational banks). The results as shown in Table 3 above compliment the assumption stated. This is evident in the t-statistics and p values of (-4.81 and 0.00) greater than 5% level of significance respectively. Thus, a pessimistic association exist amid domestic ownership and corporate performance, this is proved by the coefficient of (-8.12) implying that a percentage increase in local investors would result in the decrease of corporate performance of these sampled banks. The findings align with the work of Yurtoglu (2000), who opined that domestic shareholdings have a negative impact on firm performance when measured by return on assets and return on equity. However, the result contradicts the work of Gursory & Aydogan (2003) where domestic ownership has an insignificant positive effect on firm performance as measured by accounting performance.

Conclusion

The study basically investigated the relationship between ownership structure and corporate performance of Nigerian multinational banks. The study used three hypotheses in testing the relationship and impact of the independent variables (i.e. ownership concentration, foreign ownership and domestic ownership) on the dependent variables (i.e. return on assets and return on equity). The study found that ownership concentration has a significant negative relationship with corporate performance of Nigerian multinational banks. This concludes that a higher ownership concentration leads to the lower performance of Nigerian multinational banks. Therefore, as the number of large shareholders rises in a bank, performance falls and as the number falls, performance increases.

The study also concludes that a lower foreign ownership leads to higher performance of Nigerian multinational banks. In respect of the domestic ownership, the study concludes that higher domestic ownership leads to lower performance of Nigerian multinational banks. This means that as the ownership of local investors rises, the performance of the multinational banks reduces. It could, therefore, be concluded that the performance of the Nigerian multinational banks varies with different types of ownership structure.

Recommendations

On the basis of the foregoing, the study recommends that Nigerian multinational banks should reduce concentrated ownership in order to improve the level of corporate performance. Secondly, Nigerian multinational banks should encourage foreign investors because of their technical expertise and financial support that increase performance. Finally, Nigerian multinational banks should reduce higher levels of domestic ownership so as to improve corporate performance.

Further Studies

Noting the fact that only the annual reports of multinational banks within the period 2010-2014 were considered for this study is a major limitation. Hence, this study suggests that future research in this area could address this salient limitation by examining listed firms in other sectors of the economy. In addition, future research could also consider the period 2017 based on the availability of data.

Acknowledgements

Authors in this research acknowledge Covenant University who has solely provided the plate form for this research and has also partially financed the publication of this research work.

Appendix

| Appendix1 List Of Multinational Banks In The Banking Industry In Nigeria |

|

| S/N | Multinational Banks |

| 1 | Citibank Nigeria |

| 2 | Eco bank Nigeria |

| 3 | First Bank Nigeria |

| 4 | Guaranty Trust Bank Nigeria |

| 5 | Stanbic IBTC Bank Nigeria |

| 6 | Standard Chartered Bank Nigeria |

| 7 | United Bank for Africa, Nigeria |

| 8 | Zenith Bank Nigeria |

Source: Corporate Annual Report (2014)

| Appendix 2 Reliability Statistics |

|

| Cronbach's Alpha(a) | No. of Items |

| 0.769 | 5 |

References

- Aburime, U.T. (2008). Impact of ownership structure on bank profitability in Nigeria.

- Adams, C.A. (2004). The ethical, social and environmental reporting-performance portrayal gap. Accounting, Auditing & Accountability Journal, 17(5), 731-757.

- Adams, C.A., & Kuasirikun, N. (2000). A comparative analysis of corporate reporting on ethical issues by UK and German chemical and pharmaceutical companies. European Accounting Review, 9(1), 53-79.

- Akman, N.H., Mugan, C.S., & Akisik, O (2015). Ownership concentration effect on firm performance in Turkey. Journal of Accounting Science Dunyasi (World of Accounting Science), 17(1), 33-56.

- Antoniadis, I., Lazarides, T., & Sarrianides, N. (2010). Ownership and performance in the Greek banking sector. In International Conference on Applied Economics, 3 (4), 11-21.

- Barbosa, N., & Louri, H. (2005). Corporate performance: Does ownership matter? A comparison of foreign-and domestic-owned firms in Greece and Portugal. Review of Industrial Organization, 27(1), 73-102.

- Belal, A.R., Abdelsalam, O., & Nizamee, S.S. (2015). Ethical Reporting in Islami Bank Bangladesh Limited (1983-2010). Journal of Business Ethics, 129(4), 769-784.

- Bjuggren, P.O., Eklund, J.E., & Wiberg, D. (2007). Ownership structure, control and firm performance: The effects of vote-differentiated shares. Applied Financial Economics, 17(16), 1323-1334.

- Claessens, S., Djankov, S., & Pohl, G. (1997). Ownership and corporate governance: Evidence from the Czech Republic, 1737. World Bank Publications.

- Core, J., Guay, W., & Rusticus, T. (2006). Does weak corporate governance cause weak stock returns? An examination of firm operating performance and investors’ expectations. The Journal of Finance, 62(2), 665-687.

- Creswell, J. (2008). Educational research: Planning, conducting, and evaluating quantitative and qualitative research. New Jersey: Pearson: Merrill Prentice Hall.

- Douma, S., George, R., & Kabir, R. (2006). Foreign and domestic ownership, business groups, and firm performance: Evidence from a large emerging market. Strategic Management Journal, 27(7), 637-657.

- Ezazi, M.S., Sadeghisharif, S.J., Alipour, M., & Amjadi, H. (2011). The effect of ownership structure on share price volatility of listed companies in Tehran Stock Exchange: An empirical evidence of Iran. International Journal of Business and Social Science, 2(5), 163-169).

- Ezugwu, C.I., & Itodo, A.A. (2014). Impact of equity ownership structure on the operating performance of Nigerian banks (2002-2011). Standard Global Journal of Business Management, 1(4), 061-073.

- Gomes, L., & Ramaswamy, K. (1999). An empirical examination of the form of the relationship between multinationality and performance. Journal of International Business Studies, 30(1), 173-187.

- Gugong, B.K., Arugu, L.O., & Dandago, K.I. (2014). The impact of ownership structure on the financial performance of listed insurance firms in Nigeria. International Journal of Academic Research in Accounting, Finance and Management Sciences, 4(1), 409-416.

- Gurbuz, A.O., & Aybars, A. (2010). The impact of foreign ownership on firm performance, evidence from an emerging market: Turkey. American Journal of Economics and Business Administration, 2(4), 350-359.

- Gursoy, G., & Aydogan, K. (2003). Equity ownership structure, risk-taking and performance, an empirical investigation in Turkish listed companies. Emerging Markets Finance and Trade, 38(6), 6-25.

- Hu, Y., & Izumida, S. (2008). Ownership concentration and corporate performance: A causal analysis with Japanese panel data. Corporate Governance: An International Review, 16(4), 342-358.

- Huang, R.D., & Shiu, C.Y. (2009). Local effects of foreign ownership in an emerging financial market: Evidence from qualified foreign institutional investors in Taiwan. Financial Management, 38(3), 567-602.

- Javid, A.Y., & Iqbal, R. (2008). Ownership concentration, corporate governance and firm performance: Evidence from Pakistan. Pakistan Development Review, 47(4), 643-659.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Kangarlouei, S.J., Abbaszadeh, S., & Motavassel, M. (2012). Comparative investigation of difference between ownership structure and cost of capital in capitalized and levered companies of Tehran stock exchange (TSE). International Journal of Finance and Accounting, 1(2), 7-13.

- Kiruri, R.M. (2013). The effects of ownership structure on bank profitability in Kenya. European Journal of Management Sciences and Economics, 1(2), 116-127.

- Kobeissi, N., & Sun, X. (2010). Ownership structure and bank performance: Evidence from the Middle East and North Africa Region. Comparative Economic Studies, 52(3), 287-323.

- Kosak, M., & Cok, M. (2008). Ownership structure and profitability of the banking sector: The evidence from the SEE region. Journal of Economics and Business, 26 (1), 93-122.

- Micco, A., Panizza, U., & Yañez, M. (2004). Bank ownership and performance.

- Munday, M., Peel, M. J., & Taylor, K. (2003). The performance of the foreign?owned sector of UK manufacturing: Some evidence and implications for UK inward investment policy. Fiscal Studies, 24(4), 501-521.

- Asiriuwa, O., Aronmwan, E.J., Uwuigbe, U., & Uwuigbe, O.R. (2015). Audit committee attributes and audit quality: a benchmark analysis. Business: Theory and Practice, 19, 37-48.

- Emmanuel, O., Uwuigbe, U., Teddy, O., Tolulope, I., & Eyitomi, G.A. (2018). Corporate diversity and corporate social environmental disclosure of listed manufacturing companies in Nigeria. Problems and Perspectives in Management, 16(3), 229-244.

- Oyerogba, E.O., Olaleye, O.M., & Solomon, A.Z. (2014). The effect of ownership concentration on firm value of listed companies. IOSR Journal of Humanities and Social Science (IOSR-JHSS), 19, 90-96.

- Peong, K.K., Devinaga, R., & Rahayu, B.T. (2012). A review of corporate governance: Ownership structure of domestic-owned banks in term of government connected ownership, and foreign ownership of commercial banks in Malaysia. Journal of Organizational Management Studies, 2012(1), 1-18.

- Santos, M.A. (2015). Integrated Ownership and Control in the GCC Corporate Sector (No. 15-184). International Monetary Fund.

- Son, N.H., Tu, T.T.T., Cuong, D.X., Ngoc, L.A., & Khanh, P.B. (2015). Impact of ownership structure and bank performance-an empirical test in Vietnamese banks. International Journal of Financial Research, 6(4), 123.

- Sueyoshi, T., Goto, M., & Omi, Y. (2010). Corporate governance and firm performance: Evidence from Japanese manufacturing industries after the lost decade. European Journal of Operational Research, 203(3), 724-736.

- Urhoghide, R., & Emeni, F.K. (2014). The effect of client characteristics on audit fee: Evidence from Nigeria. Global Journal of Accounting, 4(1), 48-58.

- Uwuigbe, U., Agba, L.U., Jimoh, J., Olubukunola, R.U., & Rehimetu, J. (2017). IFRS adoption and earnings predictability: Evidence from listed banks in Nigeria. Banks and Bank Systems, 12(1), 166-174.

- Uwalomwa, U., Francis, K.E., Uwuigbe, O.R., & Ataiwrehe, C.M. (2016). International financial reporting standards adoption and accounting quality: Evidence from the Nigerian Banking Sector. Corporate Ownership and Control, 14, 287-294.

- Uwuigbe, U., & Olusanmi, O. (2012). An empirical examination of the relationship between ownership structure and the performance of firms in Nigeria. International Business Research, 5(1), 208.

- Wen, W. (2010). Ownership structure and banking performance: New evidence in China. Working paper.

- Yudaeva, K., Kozlov, K., Melentieva, N., & Ponomareva, N. (2003). Does foreign ownership matter? The Russian experience. Economics of Transition, 11(3), 383-409.

- Yurtoglu, B.B. (2000). Ownership, control and performance of Turkish listed firms. Empirica, 27(2), 193-222.

- Zeitun, R., & Gang Tian, G. (2007). Does ownership affect a firm's performance and default risk in Jordan? Corporate Governance: The International Journal of Business in Society, 7(1), 66-82.

- Zingales, L. (1994). The value of the voting right: A study of the Milan stock exchange experience. Review of Financial Studies, 7(13), 125-148.