Research Article: 2022 Vol: 21 Issue: 3

Ownership Structure of Treasury Bills and the Nigeria Economy: A Pre-covid 19 Era VAR Analysis

Onalo Ugbede, Federal Polytechnic, Idah Nigeria

Ugwu James Ike, Godfrey Okoye University, Enugu Nigeria

Odo John Onyemaechi, Godfrey Okoye University, Enugu Nigeria

Ugwu Osmund Chinweoda, University of Nigeria, Enugu Campus

Citation Information: Onalo, U., Ugwu, J.I., Odo, J.O., Ugwu, O.C., Agbo, E.I., Nwankwo, S.N.P., (2022). Ownership structure of treasury bills and the Nigeria economy: A pre-covid 19 era VAR analysis. Academy of Strategic Management Journal, 21(3), 1-14.

Abstract

This study was designed to investigate the impact of ownership structure of treasury bills on the Nigeria economy. Secondary data about Nigeria Gross Domestic Product (GDP) (dependent variable) and Central Bank of Nigeria Holding (CBNH), Deposit Money Banks Holding (DMBH) and Non-Banking Public Holding (NBPH) (independent variables) spanning over a period of 39 years (1981-2019) sourced from CBN statistical bulletin were used for this investigation. Since Trace unrestricted cointegration rank test and Maximum Eigenvalue unrestricted cointegration rank test collective results established the absence of cointegration equation(s), this study estimated Basic Vector Auto Regression (VAR) Model. Findings based on VAR model revealed contradictory relationship between dependent and independent variables based on different time lags. Particularly, while CBNH exhibited one year lag significant negative relationship with Gross Domestic Product (GDP), CBNH exhibited two year lag non-significant positive relationship with GDP. Also, while NBPH exhibited one year lag significant negative relationship with GDP, NBPH exhibited two year lag significant positive relationship with GDP. Finally, while DMBH exhibited one year lag non-significant positive relationship with GDP, DMBH exhibited two year lag non-significant negative relationship with GDP. Granger Causality tests results equally established that while NBPH and DMBH significantly Granger Cause GDP, CBNH does not Granger Cause GDP. Findings have both theoretical and practical implications. Theoretically, this investigation as a pioneer adds to existing literature on treasury bills and economies. Practically, findings suggested that treasury bills owned by CBN and DMB are not adequate enough to contribute to the growth of Nigeria economy. This study therefore recommended that to expand the Nigeria economy, CBN and Nigeria deposit money banks should increase their holding of or investment in treasury bills.

Keywords

Economy, GDP, Treasury Bills, CBN, Deposit Money Bank, Non-Bank Public.

Introduction

Treasury bills occupy similar if not higher prominence in terms of the most traded and celebrated instrument in the money market as equity do in the capital market. Particularly, for Nigeria, treasury bills over the years account for the bulk of transactions in the Nigeria money market since it is the most traded instrument in the market. Specifically, while treasury bills represented far above 50% of all the instruments traded in the Nigeria money market between 1981 and 2005, from 2016 to 2019, treasury bills topped every other money market instruments since more than 30% of the value of money market instruments traded within this period was for treasury bills (CBN, 2019; Peter & Mansi, 2017).

As money market and capital market most celebrated and traded instruments/securities, treasury bills and equity stock are commonly owned by several investors including states or governments, management of firms, families, institutions, international/foreign investors and individual investors. Without gainsaying, these investors are commonly interested in returns from investing in these instruments/securities. Hence, since returns to owners of treasury bills is dependent on the performance of the entire economy (Peter & Mansi, 2017; Umasom, 2018), our study conjectured that ownership structure or different categories of owners of treasury bills will affect differently the performance of economies. With emphasis on Nigeria, this assumption is further supported by the fact that out of the three categories (Central Bank of Nigeria, deposit money banks and non-bank public) of owners/holders of Nigeria treasury bills, two categories; institutional owners (Central Bank of Nigeria and deposit money banks) are by their respective legal mandate responsible for the efficient and effective functioning of the Nigeria economy.

It is against this background that this study is launched to investigate the impact of ownership structure of treasury bills on the Nigeria economy. In other words, this study is designed to investigate the varying capabilities of Central Bank of Nigeria, deposit money banks and non-bank public respective holdings/ownership of treasury bills to improving the Nigeria economy. Added justification of this study is that findings of this study will be of immense benefits to Nigeria economic actors including policing makers and implementers since Nigeria economy like economies of developing nations is further weakened by the negative effects of the dreadful COVID-19 scourge.

Vast studies on ownership structure of securities have been conducted by scholars. For instance ownership structure and performance of firms (Abdulsamad & Yusoff, 2016; Al-Daoud et al., 2016; Foroughi & Fooladi, 2011; Rasyid & Linda, 2019; Sahibzada & Siti, 2018), ownership structure and value of firms (Abdullah et al., 2017; Lin, 2013; Rapaport & Sheng, 2010; Varghese & Sasidharan, 2020), ownership structure and firms corporate governance, ownership structure, investment opportunities, profitability and company growth, ownership structure and financial performance (Lawal et al., 2018), ownership structure and earnings management, ownership structure and dividend policy (Elijah & Famous, 2019), ownership structure and capital structure (Rasyid & Linda, 2019), ownership structure and accounting method choice and ownership structure and corporate social responsibility (Sahasranamam et al., 2020).

Against expectation, however, it is evident from the review of the above studies that investigations generally were in the setting of ownership structure of equity/shares in relation to firms and capital markets. In other words, investigations on ownership structure of treasury bills as money market most traded instrument (Peter & Mansi, 2017), were ignored in the literature. Also, while few specific academic investigations conducted on Nigeria treasury bills by Nyawata (2012), Eze & Onoh (2018) and Yitbarek (2013) were on Nigeria treasury bills in relation to different issues relating to the banking sector, Yi (2014) studied Nigeria treasury bills in relation to monetary policies. Revelations from these studies again, were further proves that scholarly investigations on ownership structure of treasury bills, and particularly, in terms of the effective and efficient functioning of economies is a remarkably an unexplored field of research.

In view of the above discussion, the broad objective of this study is to investigate the impact of ownership structure of treasury bills on the Nigeria economy. Specifically, this study is designed to investigate:

i) The impact of Central Bank of Nigeria holding/ownership of treasury bills on the Nigeria Economy ii) The impact of Deposit Money Bank holding/ownership of treasury bills on the Nigeria Economy iii) The impact of non-bank public holding/ownership of treasury bills on the Nigeria Economy

Literature Review

This section discusses conceptual issues on ownership structure of investment securities or instruments. Also, theoretical and empirical reviews of this study are discussed in this section.

Conceptual Clarification

Umasom (2018) defined treasury bills as short-term debt instruments used commonly by governments of nations to borrow short-term funds with maturity date of ninety (90), one hundred and eighty (180) and three hundred and sixty (360) days with the view to cushioning temporary economic imbalances. Focusing on Nigeria, Peter & Mansi (2017) who described treasury bills as promissory notes or financial bills issued by the CBN and used by the Federal Government of Nigeria to borrow from the public to stabilizing economic disequilibrium, adduced the popularity of treasury bills to safety, zero-risk and short maturity period.

While Al-Matari et al. (2013) and Pfeffer & Slanick (1979) defined ownership as a source of authority that can be utilized to support or to go against management, according to the level of concentration and use, ownership structure according to Mccann & Vroom (2009) and Abdulsamad & Yusoff (2016) is defined as the relative amount of ownership claims held by insiders (managers) and outsiders (investors with no direct relationship with the management of the company). Emphasising on Nigeria treasury bills, the insider mangers include the CBN that determines the appropriateness in terms of value and timing of the issue of treasury bills on behalf of the Federal Government of Nigeria (Peter & Mansi, 2017; Umasom, 2018) and deposit money banks that also play significant role in the Nigeria economic scene (Al-Daoud et al., 2016). The non-bank public in this context represent the outsiders or owners/holders of treasury bills with no direct relationship with CBN and deposit money banks (Lawal et al., 2018).

Ownership structure, particularly, in terms of capital market and equity is a fundamental factor in determining the value of firms (Mccann & Vroom, 2009). Similarly, since the issuer of Nigeria treasury bills (CBN) is a key economic player (Al-Daoud et al., 2016; Lawal et al., 2018) and the issuance of and returns on treasury bills depend on the functioning of economies of nations, there is a logical sense to conjecture that ownership structure of treasury bills will impact significantly on economies of nations, particularly, Nigeria economy. Gross Domestic Product (GDP) was used to proxy for the Nigeria economy. As the amount of stuff produced in the whole economy or total currency value of all final goods and services produced in an economy over some time period. Therefore, aligning with Khramov & Lee (2013) assertion that GDP represents the most comprehensive, accurate, reliable, acceptable and representative way to understanding an economy, this study is launched to investigate the impact of ownership structure of treasury bills on the Nigeria economy.

Theoretical Review

Our investigation is based on an American economist, Harry Markowitz theory of “portfolio choice” developed in the 1950s and today known as the Modern Portfolio Theory (MPT). According to Omisore et al. (2011), “this investment theory attempted to maximize portfolio expected return for a given amount of portfolio risk, or equivalently minimize risk for a given level of expected return, by carefully choosing the proportions of various assets”. However, this theory emphasizes on risk factor (the likelihood that actual return from an investment may differ from expected return) in investment analyses and returns to owners of securities. This theory specifically established that expected returns to owners on a given amount of portfolio is generally affected by market risk, that is the risk of one security/portfolio relative to market risk (Omisore et al., 2011). Thus, this theory endogenic ownership structure as an important factor that maximizes expected returns on investment in portfolios/securities (Al-Matari et al., 2013; Demsetz, 1983).

Treasury bills, an example of portfolio are generally issued by governments to cushion economic imbalances. For Nigeria, investors or holders or owners of treasury bills include Central Bank of Nigeria, deposit money banks (institutional owners) and non-bank public (individual or private owners). These owners like every rational investor; all things being equal are interested in maximizing their returns for investing in or holding treasury bills. Though the money markets remain the market for transacting in treasury bills, the risk of this market is greatly dependent on the workings of the entire economy. Particularly, Umasom (2018) and Peter & Mansi (2017) established that the issuance of treasury bills by governments and expected returns from holding treasury bills are all dependent on the workings of the economy. Therefore since there is a theoretical link between expected returns to owners of portfolio (including treasury bills), market risk (normally affected by the overall functioning of economies for treasury bills), and our investigation on the impact of ownership structure of treasury bills on the Nigeria economy is anchored on Modern Portfolio Theory.

Empirical Review

Studies on ownership structure of portfolio or securities have been conducted and results documented in the literature. Table 1 presents list of studies on ownership structure of portfolio or securities reviewed.

| Table 1 List Of Studies Reviewed On Ownership Structure Of Portfolio Or Securities |

||||

|---|---|---|---|---|

| S/no | Investigators | Dependent Variable | Regressors | Investigation |

| 1 | Rapaport & Sheng (2010) | Ownership structure | Firms’ value | Used a sample of Brazilian firms listed in Bovespa between period 2006 to 2008 to investigate the relationship between ownership structure and firms’ value. |

| 2 | Lin (2013) | Ownership structure (board ownership) | Firms’ value | Used a panel of 504 Taiwanese listed firms during a 10-year period (2002-2011) to examine the impact of ownership structure (board ownership) on firms’ value. |

| 3 | Abdullah et al. (2017) | Ownership structure (managerial ownership) | Firms’ value and growth opportunities | Used a sample of 240 listed companies on the main board of Bursa Malaysia in 2013 to investigate the association between ownership structures (managerial ownership) with firms’ value including the moderating effect of growth opportunities. |

| 4 | Varghese & Sasidharan (2020) | Ownership structure and board characteristics | Firms’ value | Used a sample of 1042 firms listed in NSE of India and 450 firms listed in SSE of China to examine the impact of ownership structure and board characteristics on firms’ value. |

| 5 | Abdulsamad & Yusoff (2016) | Ownership structure | Firms’ performance | Used secondary data from annual reports of 369 listed Malaysia companies’ for period from 2003 to 2013 to investigate the relationship between ownership structure and firms’ performance. |

| 6 | Foroughi & Fooladi (2011) | Corporate ownership structure | Firms’ performance | Used listed firms on Tehran Stock Exchange to investigate the relationship between corporate ownership structure and firms’ performance. |

| 7 | Sahibzada & Siti (2018) | Ownership structure | Firms’ performance | Used 50 companies registered in Bombay stock exchange from period 2011 -2015 to examine the impact of ownership structure on firms’ performance in India. |

| 8 | Al-Daoud et al. (2016) | Ownership structure | Firms’ performance | Used Jordanian firms to investigate the relationship between ownership structure and firms’ performance. |

| 9 | Sitisuziyati et al. (2016) | Ownership structure | Firms’ performance | Used 50 Indian companies listed under Bombay Stock exchange for period 2011-2015 to investigate the impact of ownership structure on firms’ performance. |

| 10 | Lai (2017) | Ownership structure | Firms’ performance | Used a sample of 76 manufacturing companies listed on the Ho Chi Minh Stock Exchange (HOSE) during 2007-2015 to investigate the effects of ownership structure on firms’ performance in the Vietnamese stock. |

| 11 | Dakhlallh et al. (2019) | Ownership structure | Firms’ performance and board independence | Investigated using Jordanian public shareholders companies, the effect of ownership structure on firms’ performance. |

| 12 | Fauzi & Locke (2012) | Ownership structure | Firms’ performance and boar structure | Investigated the role of board structure and the effect of ownership structure on firms’ performance in the context of New Zealand's listed firms. |

| 13 | Neneng et al. (2019) | Ownership structure | Firms’ values and financial decisions | Used 14 of 20 state-owned BUMN enterprises for period from 2015 to 2017 to investigate the implication of ownership structure on firms’ values with financial decisions as the intervening variable. |

| 14 | Elvin & Hamid (2016) | Ownership structure | Firms’ performance and corporate governance practices | Used non-financial public firms listed in the main market of Bursa Malaysia for period 2010-2014 to investigate the relationship between ownership structure, corporate governance practices and firms’ performance. |

| 15 | Xiaonian & Wang (1997) | Ownership structure | Firms’ performance and corporate governance mechanisms | Investigated the effects of ownership structure on corporate governance mechanisms and Performance of publicly-listed companies in China. |

| 16 | Ukaegbu et al. (2014) | Ownership structure | Firms’ performance and capital structure | Used selected Nigerian large non-financial firms to investigate the impact of ownership structure on capital structure and firms’ performance. |

| 17 | Rasyid & Linda (2019) | Ownership structure | Firm performance and capital structure | Used 30 manufacturing companies listed in Indonesia Stock Exchange from 2010 to 2016 to investigate the significant relationships among ownership structure, capital structure and firms’ performance. |

| 18 | Zhang (2013) | Ownership structure | Capital structure | Examined the impact of ownership structure on capital structure of non-financial Chinese listed firms from 2007 to 2012. |

| 19 | Shoaib & Yasushi (2015) | Ownership structure (managerial equity ownership) | Capital structure | Used non-financial firms listed on the Karachi Stock Exchange in Pakistan between 2008 and 2012 to investigate the effect of ownership structure (managerial equity ownership) on capital structure. |

| 20 | Lawal et al. (2018) | Ownership structure | Financial performance | Used insurance firms listed on the Nigerian Stock Exchange for period from 2011 to 2016 to examine the effect of ownership structure on financial performance. |

| 21 | Elijah & Famous (2019) | Ownership structure | Dividend policy | Used 70 listed Nigerian companies to examine the relationship between ownership structure and dividend policy in Nigeria. |

| 22 | Sahasranamam et al. (2020) | Ownership structure | Corporate social responsibility | Used Indian firms for the period of 2008–2015 to examine how ownership structure in firms from emerging markets influences community-related CSR. |

Source: Compiled by the Researchers, 2021

Table 1 revealed that available studies on ownership structure of portfolio or securities were particularly, in the setting of ownership structure and firms’ value, ownership structure and firms’ performance, ownership structure and corporate governance mechanism and practices, ownership structure and capital structure, ownership structure and financial decisions, ownership structure and profitability, ownership structure and company growth and investment opportunities, ownership structure and accounting method choice, ownership structure and dividend policy and ownership structure and corporate social responsibility.

Essentially, these aspects of investigations were in the context of particularly, equity security and largely, capital markets. Like equity for capital markets however, the importance of treasury bills in the money market of nations is highly noted in the literature (Peter & Mansi, 2017; Umasom, 2018). Yet, existing studies failed to examine ownership structure of treasury bills, particularly, in relation to the functioning of nations’ economies. This is the major gap that our study is designed to fill.

Also, focusing on Nigeria treasury bills, few specific academic investigations have been conducted. Table 2 presents studies on the Nigeria treasury bills.

Again, as a gap, while Nyawata (2012); Eze & Onoh (2018) and Yitbarek (2013) investigated treasury bills in relation to different issues in the banking sector, treasury bills in the setting of monetary policies. In other words, Table 2 further revealed that academic investigations on ownership of treasury bills in the setting of economies of nations are scarce. Hence our study is designed to investigate the impact of ownership structure of treasury bills on economies of nations, with particular emphasis on the Nigeria economy.

| Table 2 Academic Studies On The Nigeria Treasury Bills |

||

|---|---|---|

| S/no | Author | Investigation |

| 1 | Nyawata (2012) | Discussed the all-time challenging question of the use of treasury bills/Central bank bills by Central banks to draining excess liquidity in the banking sector. |

| 2 | Eze & Onoh (2018) | Investigated the role of financial statements in treasury bill investment in Nigerian banks. |

| 3 | Yitbarek (2013) | Investigated treasury bills behaviour in bank asset portfolio by performing dynamic and multivariate analysis. |

Source: Compiled by the Researchers 2021.

Methodology

This section presents discussion on the sources, types and period of data used in this investigation. Also, discussions on specification of model used in this study are equally given in this section.

Model Specification

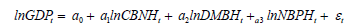

The model of this study was adapted from Rasyid & Linda (2019) whose investigation was on institutional and private or individual ownership structure. In the setting of our investigation, and according to Al-Daoud et al. (2016) while Central Bank of Nigeria (CBN) and deposit money bank (DMB) are institutional owners/holders of treasury bills, individuals/private owners/holders constitute the non-bank public owners/holders of treasury bills. Therefore, this study specified a model with GDP as the dependent variable and CBNH, DMBH and NBPH as independent variables to investigate respectively the relationship between Central Bank of Nigeria holding/ownership, deposit money bank holding/ownership and non-bank public holding/ownership of treasury bills and the Nigeria economy. Hence, this study model is given as:

Where:

ln GDPt= Natural log of gross domestic product;

lnCBNH t = Natural log of Central Bank of Nigeria holding/ownership of treasury bills;

lnDMBH t= Natural log of Deposit Money Bank holding/ownership of treasury bills.

lnNBPHt = Natural log of Non-bank public holding/ownership of treasury bills.

εt = White noise error term, with the usual stochastic assumptions.

This study used log transformation for all variables.

Sources of Study Data

This study used four (4) variables including GDP (dependent variable) and CBNH, DMBH and NBPH (independent variables). Hence, secondary data about these variables (Nigeria GDP, CBNH, DMBH and NBPH) spanning over a period of 39 years (1981-2019) sourced from CBN statistical bulletin were used for this investigation. Data period of 1981 to 2019 corroborated the period of emphasis of this study (pre-COVID-19 era analysis).

Discussion of Results

This section broadly presents analyses of data and discussion of results. Specifically, in order to avoid generating spurious results, test of stationarity was performed. Also, lag length selection test and cointegration test were executed. Essentially, unrestricted VAR and pairwise Granger causality test were performed to investigate the relationship between ownership structure of treasury bills and the Nigeria economy. Procedural steps in achieving this objective are given below

Augmented Dickey Fuller Stationarity Statistics

This study first used Augmented Dickey-Fuller method to conduct unit root test for all series with the view to ensure that variables used in this investigation had no unit root. Associated results at level and intercept are provided in Table 3.

| Table 3 Stationarity Test Results At Level And Intercept |

|||||

|---|---|---|---|---|---|

| Series | Test Type | t-Statistic | Prob* | Decision | |

| GDP | Augmented Dickey Fuller test statistic | -1.731125 | 0.4078 | At level and intercept, hypothesis that GDP has a unit root was accepted | |

| Test critical values | 1% level | -3.621023 | |||

| 5% level | -2.943427 | ||||

| 10% level | -2.610263 | ||||

| CBNH | Augmented Dickey Fuller test statistic | -4.073399 | 0.003 | At level and intercept, hypothesis that CBNH has a unit root was rejected | |

| Test critical values | 1% level | -3.615588 | |||

| 5% level | -2.941145 | ||||

| 10% level | -2.609066 | ||||

| DMBH | Augmented Dickey Fuller test statistic | 1.777215 | 0.9995 | At level and intercept, hypothesis that DMBH has a unit root was accepted | |

| Test critical values | 1% level | -3.67017 | |||

| 5% level | -2.963972 | ||||

| 10% level | -2.621007 | ||||

| NBPH | Augmented Dickey Fuller test statistic | 0.821595 | 0.9931 | At level and intercept, hypothesis that NBPH has a unit root was accepted | |

| Test critical values | 1% level | -3.626784 | |||

| 5% level | -2.945842 | ||||

| 10% level | -2.611531 | ||||

Source: Computed by the Researchers, 2021

Stationarity test results of series presented in Table 3 revealed that while three (3) series (GDP, DMBH and NBPH) had unit root at level and intercept, only CBNH had no unit root at the same level and intercept. Accordingly, unit root test of GDP, DMBH and NBPH was further conducted at 1st difference and intercept. Related results are offered in Table 4.

| Table 4 Gdp, Dmbh And Nbph Unit Root Test Results At 1st Difference And Intercept |

|||||

|---|---|---|---|---|---|

| Series | Test Type | t-Statistic | Prob* | Decision | |

| GDP | Augmented Dickey Fuller test statistic | -11.59991 | 0 | At 1st difference and intercept, hypothesis that GDP has a unit root was rejected | |

| Test critical values | 1% level | -3.621023 | |||

| 5% level | -2.943427 | ||||

| 10% level | -2.610263 | ||||

| DMBH | Augmented Dickey Fuller test statistic | -8.011304 | 0 | At 1st difference and intercept, hypothesis that DMBH has a unit root was rejected | |

| Test critical values | 1% level | -3.626784 | |||

| 5% level | -2.945842 | ||||

| 10% level | -2.611531 | ||||

| NBPH | Augmented Dickey Fuller test statistic | -7.050242 | 0 | At 1st difference and intercept, hypothesis that NBPH has a unit root was rejected | |

| Test critical values | 1% level | -3.639407 | |||

| 5% level | -2.951125 | ||||

| 10% level | -2.6143 | ||||

Source: Computed by the Researchers, 2021

In all, unit root test for series results given in Tables 3 and 4 established that while hypothesis that series has a nit root was rejected for CBNH at level and intercept, it was at 1st difference and intercept that the same hypothesis was rejected for GDP, DMBH and NBPH. Interestingly, since series has good fit at level and intercept and 1st difference and intercept, this study further estimated optimal lag for series used in this investigation.

Lag Length Selection Test

After executing lag structure, associated results of lag length selection test criteria presented in Table 5 were contradictory. While sequential modified LR test statistic (each test at 5% level) and final prediction error (FPE) selected optimal lag period of four (4), Akaike information criterion (AIC) and Hannan-Quinn information criteria selected optimal lag period of five (5). To the extreme, Schwarz information criterion selected one (1) year lag period. On the whole this study went with five (5) year lag period as selected by Akaike information criterion (AIC) and Hannan-Quinn information criterion.

| Table 5 Var Lag Order Selection Criteria |

||||||

|---|---|---|---|---|---|---|

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | -534.4781 | NA | 5.95E+11 | 38.46272 | 38.65304 | 38.5209 |

| 1 | -475.9044 | 96.22819 | 2.89E+10 | 35.42175 | 36.37332* | 35.71265 |

| 2 | -464.2738 | 15.78446 | 4.27E+10 | 35.73384 | 37.44668 | 36.25747 |

| 3 | -448.691 | 16.69581 | 5.44E+10 | 35.76364 | 38.23774 | 36.52 |

| 4 | -409.1909 | 31.03579* | 1.63e+10* | 34.08507 | 37.32042 | 35.07415 |

| 5 | -379.8702 | 14.66035 | 1.72E+10 | 33.13359* | 37.1302 | 34.35539* |

Source: Computed by the Researchers, 2021

Cointegration Test

After selecting five (5) year lag period based on Akaike information criterion (AIC) and Hannan-Quinn information criterion, this study further performed Johansen Cointegration test to reveal the presence or absence of cointegration equations(s). Results of Trace unrestricted cointegration rank test and Maximum Eigenvalue unrestricted cointegration rank test as respectively offered in Tables 6 & 7 collectively established the absence of cointegration equation(s).

| Table 6 Results Of Trace Unrestricted Cointegration Rank Test |

||||

|---|---|---|---|---|

| Unrestricted Cointegration Rank Test (Trace) | ||||

| Hypothesized No. of CE(s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob** |

| None | 0.311345 | 30.20196 | 47.85613 | 0.7086 |

| At most 1 | 278014 | 17.51944 | 29.79707 | 0.6016 |

| At most 2 | 0.156441 | 6.443945 | 15.49471 | 0.643 |

| At most 2 | 0.019216 | 0.659693 | 3.841465 | 0.4167 |

Source: Compiled by the Researchers, 2021

Note: Trace test indicates no cointegration at the 0.05 level

*denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

| Table 7 Results Of Maximum Eigenvalue Unrestricted Cointegration Rank Test |

||||

|---|---|---|---|---|

| Unrestricted Cointegration Rank Test (Trace) | ||||

| Hypothesized No. of CE(s) | Eigenvalue | Max-Eigen Statistic | 0.05 Critical Value | Prob** |

| None | 0.311345 | 12.68252 | 27.58434 | 0.9017 |

| At most 1 | 278014 | 11.0755 | 21.13162 | 0.6398 |

| At most 2 | 0.156441 | 5.784251 | 14.2646 | 0.6411 |

| At most 2 | 0.019216 | 0.659693 | 3.841465 | 0.4167 |

Source: Compiled by the Researchers, 2021

Note: Max-eigenvalue test indicates no cointegration at the 0.05 level

*denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values .

The absence of cointegration equation(s) as established by both Trace and Maximum Eigenvalue unrestricted cointegration rank tests made this study to estimate unrestricted VAR (the basic VAR) model.

Estimation of Unrestricted VAR (Basic VAR) Model

One year lag and two year lag relationship between GDP as dependent variables and CBNH, DMBH and NBPH as independent variables was estimated using Vector Autoregression model. Vector Autoregression model results of relationship among series are offered in Table 8.

| Table 8 Vector Autoregression Estimates |

||||

|---|---|---|---|---|

| Series | GDP | CBNH | DMBH | NBPH |

| GDP (-1) | 0.245873 | -20.82002 | 97.29952 | 1.889709 |

| -0.16308 | -21.2095 | -70.8361 | -5.32111 | |

| [1.50764] | [-0.98164] | [1.37359] | [0.35513] | |

| GDP (-2) | 0.228778 | 16.41754 | -10.43312 | 1.196384 |

| -0.15311 | -19.9128 | -66.5054 | -4.9958 | |

| [1.49416] | [0.82447] | [-0.15688] | [0.23948] | |

| CBNH (-1) | -0.003266 | 0.410506 | -1.114747 | -0.035328 |

| -0.00153 | -0.19906 | -0.66483 | -0.04994 | |

| [-2.13348] | [2.06222] | [-1.67674] | [-0.70741] | |

| CBNH (-2) | 0.001479 | -0.071305 | 0.923144 | -0.012106 |

| -0.00163 | -0.21261 | -0.7101 | -0.05334 | |

| [0.90469] | [-0.33537] | [1.30003] | [-0.22696] | |

| DMBH (-1) | 0.000252 | 0.072352 | 0.393821 | -0.026751 |

| -0.00052 | -0.06812 | -0.22751 | -0.01709 | |

| [0.48041] | [1.06212] | [1.73101] | [-1.56528] | |

| DMBH (-2) | -5.51E-05 | -0.111029 | 0.137363 | 0.026052 |

| -0.00053 | -0.06894 | -0.23026 | -0.0173 | |

| [-0.10390] | [-1.61044] | [0.59656] | [1.50619] | |

| NBPH (-1) | -0.013644 | 0.322621 | 4.429063 | 0.915464 |

| -0.00598 | -0.7774 | -2.59638 | -0.19504 | |

| [-2.28252] | [0.415001] | [1.70586] | [4.69381] | |

| NBPH (-2) | 0.017043 | 0.221502 | -2.310968 | 0.12352 |

| -0.00673 | -0.87486 | -2.92187 | -0.21949 | |

| [2.53359] | [0.25319] | [-0.790921] | [0.56277] | |

| C | 1.823066 | 9.613802 | -397.9199 | -3.06954 |

| -0.76304 | -99.234 | -331.425 | -24.8962 | |

| [2.38923] | [0.09688] | [-1.20063] | [-0.12329] | |

| R-squared | 0.604778 | Adj. R-squared | 0.478307 | |

| F-statistic | 4.781955 | |||

Source: Compiled by the Researchers, 2021 .

Particularly, results offered in Table 8 revealed that while one year lag respective relationships between CBNH and NBPH and GDP were significantly negative, one year lag relationship between DMBH and GDP was non significantly positive. Results also showed that while two year lag respective relationships between CBNH and NBPH and GDP were positive, the two year lag relationship between DMBH and GDP was negative. Only two year lag positive relationship between NBPH and GDP was statistically significant. Interestingly, the combined one year lag significant negative effect of CBNH and NBP of -0.01691 (CBNH-0.003266, NBPH-0.013644) on GDP was made good by the significant positive two year lag effect of NBPH (0.017043) on GDP. In other words, collective ownership of treasury bills by CBN, DMB and NBP adequately stimulated Nigeria economic growth.

| Table 9 Different Time Lags Contradictory Relationship Between Variables |

||

|---|---|---|

| Independent and Dependent Variables | One Year Lag Relationship between Dependent and Independent Variables | Two Year Lag Relationship between Dependent and Independent Variables |

| CBNH and GDP | CBNH exhibited one year lag significant negative relationship with GDP. | CBNH exhibited two year lag non-significant positive relationship with GDP. |

| NBPH and GDP | NBPH exhibited one year lag significant negative relationship with GDP. | NBPH exhibited two year lag significant positive relationship with GDP. |

| DMBH and GDP | DMBH exhibited one year lag non-significant positive relationship with GDP. | DMBH exhibited two year lag non-significant negative relationship with GDP. |

Source: Compiled by the Researcher 2021

Summary of contradictory relationships between variables based on different time lags are clearly presented in Table 9.

As a pioneer, results from this investigation provided new but significant revelation in the literature on how non-bank public holders of treasury bills contribute significantly to the growth of Nigeria economy. Results further validated Igbinosa & Aigbovo (2015) and Marshal & Solomon (2015) submissions that investment in treasury bills is generally linked with salubrious economic effects. R-squared of 60.5% indicated that annual variations in GDP all things being equal are explained by Central Bank of Nigeria holding/ownership, deposit money bank holding/ownership and non-bank public holding/ownership of treasury bills. Also, R-squared of 0.604778 and Adj. R-squared of 0.478307 established that the model has a good fit. F-statistic of 4.781955 further validates that the model does not just have a good fit but significantly healthy and hence, authenticated reliability of our results.

Pairwise Granger Causality Tests

To further explore relationships among variables, this study also performed Granger Causality test. Results of Granger Causality test are offered in Table 10.

| Table 10 Results Of Pairwise Granger Causality Test |

||||

|---|---|---|---|---|

| Null Hypothesis: | Obs | F-Statistic | Prob | Conclusion |

| CBNH does not Granger Cause GDP | 37 | 0.78081 | 0.4666 | None |

| GDP does not Granger Cause CBNH | 1.04598 | 0.3631 | ||

| DMBH does not Granger Cause GDP | 37 | 3.99457 | 0.0283 | Unidirectional |

| GDP does not Granger Cause DMBH | 0.76523 | 0.4736 | ||

| NBPH does not Granger Cause GDP | 37 | 4.93066 | 0.0143 | Unidirectional |

| GDP does not Granger Cause NBPH | 0.51914 | 0.6005 | ||

| DMBH does not Granger Cause CBNH | 37 | 8.09705 | 0.0014 | Unidirectional |

| CBNH does not Granger Cause DMBH | 1.92483 | 0.1624 | ||

| NBPH does not Granger Cause CBNH | 37 | 3.08601 | 0.0609 | None |

| CBNH does not Granger Cause NBPH | 0.17006 | 0.8444 | ||

| NBPH does not Granger Cause DMBH | 37 | 3.84687 | 0.033 | Unidirectional |

| DMBH does not Granger Cause NBPH | 1.85127 | 0.1751 | ||

Source: Compiled by the Researchers, 2021 .

Generally, results of VAR and Granger Causality tests are similar. Particularly, while NBPH and DMBH significantly Granger Cause GDP, CBNH does not Granger Cause GDP. Also, while DMBH significantly Granger Cause CBNH, NBPH significantly Granger Cause DMBH. Thus, significant positive relationship between NBPH and GDP and non-significant positive association between DMBH and GDP based on VAR model were further authenticated by Granger Causality test results.

Conclusion

The battered world economies basically due to the adverse effect of COVID-19 pandemic should be of great apprehension to policy makers and researchers world over. Since treasury bills which are commonly owned by economic actors (CBN, DMB and NBP) over the years, accounts for the bulk of transactions in the Nigeria money market, this study was launched to investigate the impact of ownership structure of treasury bills on the Nigeria Economy. VAR model was used for this investigation. Results revealed that investment in or holdings of treasury bills by institutional owners (CBN and DMB) were not sufficient to grow the Nigeria economy. On the other hand, results further revealed that the volume of treasury bills held by non-bank public was sufficient to catalysing the growth of the Nigeria economy. In other words, while institutional owners (CBN and DMB) of treasury bills negatively affected the growth of the Nigeria economy, holdings of treasury bills by non-bank public owners significantly grew the Nigeria economy. Findings have both theoretical and practical implications. Theoretically, in addition to adding uniquely to existing literature by exposing that ownership structure of treasury bills impact differently on economic growth, results also authenticated previous related findings. Based on findings, this study recommended that Central Bank of Nigeria and deposit money banks should improve their holdings of or invest more in treasury bills if growing the economy is of national concern.

References

Abdullah, N.A.I.N., Ali, M.M., & Haron, N.H. (2017). Ownership structure, firm value and growth opportunities: Malaysian evidence.Advanced Science Letters,23(8), 7378-7382.

Abdulsamad, A.O., & Yusoff, W.F.W. (2016). Ownership structure and firm performance: A longitudinal study in Malaysia.Corporate Ownership & Control,432.

Al-Daoud, K.I., Saidin, S.Z., & Abidin, S. (2016). The relationship between ownership structure and performance in Jordan: A conceptual model. International Journal of Current Research, 8(11), 41328-41334.

Al-Matari, E.M., Al-Swidi, A.K., & Fadzil, F.H. (2013). Ownership structure characteristics and firm performance: a conceptual study.Journal of Sociological Research,4(2), 464-493.

CBN. (2019). Central bank of Nigeria statistical bulletin. Statistical Bulletin.

Dakhlallh, M.M., Rashid, N.M., Abdullah, W.A.W., & Dakhlallh, A.M. (2019). The effect of ownership structure on firm performance among Jordanian public shareholders companies: Board independence as a moderating variable.International Journal of Academic Research in Progressive Education and Development,8(3), 13-31.

Demsetz, H. (1983). The structure of ownership and the theory of the firm.The Journal of Law and Economics,26(2), 375-390.

Elijah, A., & Famous, I. (2019). Ownership structure and dividend policy in nigerian quoted companies.European Journal of Accounting, Auditing and Finance Research,7(2), 1-16.

Elvin, P., & Hamid, N.I.N.B.A. (2016). Ownership structure, corporate governance and firm performance.International Journal of Economics and Financial Issues,6(3S), 99-108.

Eze, G.P., & Onoh, J.O. Roles of Financial Statements in Treasury bill Investments in Nigerian Banks. Journal of Business and African Economy, 4(2), 19-34.

Fauzi, F., & Locke, S. (2012). Board structure, ownership structure and firm performance: A study of New Zealand listed-firms. Asian Academy of Management Journal of Accounting of Finance, 8(2), 43-67.

Foroughi, M., & Fooladi, M. (2011). Corporate ownership structure and firm performance: evidence from listed firms in Iran. InInternational Conference on Humanities, Society and Culture (ICHSC) Kuala Lumpur, Malaysia, November(pp. 4-6).

Igbinosa, S.O., & Aigbovo, O. (2015). The Nigerian money market and national economic development.Journal of Business & Value Creation, 4 (2).

Khramov, M.V., & Lee, M.J.R. (2013).The Economic Performance Index (EPI): An intuitive indicator for assessing a country's economic performance dynamics in an historical perspective.

Lai, T.H. (2017). Ownership concentration, state ownership and firm performance?: Empirical evidence from the Vietnamese stockmarket. Lincoln University.

Lawal, O.D., Agbi, E.S., & Mustapha, L.O. (2018). Effect of ownership structure on financial performance of listed insurance firms in Nigeria. Journal of Accounting, Finance and Auditing Studies, 4(3), 123-148.

Lin, F.L. (2013). Board ownership and firm value in Taiwan-A panel smooth transition regression model.Journal for Economic Forecasting, (4), 148-160.

Marshal, I., & Solomon, I.D. (2015). The nexus between money market operations and economic growth in Nigeria: An empirical investigation.IIARD International Journal of Banking and Finance Research,1(8), 117-129.

McCann, B.T., & Vroom, G. (2009). Ownership structure, profit maximization, and competitive behavior. InAcademy of Management Proceedings(Vol. 2009, No. 1, pp. 1-6). Briarcliff Manor, NY 10510: Academy of Management.

Indexed at, Google Scholar, Cross Ref

Neneng, S., Azhar, A., & Aldrin, H. (2019). Implications of ownership structure on firm value with financial decision as intervening variable (State-owned enterprise sector of Indonesia stock exchange). International Journal of Innovation, Creativity and Change, 9(12), 347-363.

Nyawata, M.O. (2012).Treasury bills and/or central bank bills for absorbing surplus liquidity: the main considerations.

Omisore, I., Yusuf, M., & Christopher, N. (2011). The modern portfolio theory as an investment decision tool.Journal of Accounting and Taxation,4(2), 19-28.

Indexed at, Google Scholar, Cross Ref

Peter, E.G., & Mansi, N. (2017). Money market and economic growth in Nigeria: A causality analysis. Online Journal of Arts, Management and Social Sciences, 2(1), 140-163.

Pfeffer, J., & Slanick, G.R. (1979). The external control of organizations: A resource dependence perspective. Contemporary Sociology, 8(4), 612-623.

Rapaport, M., & Sheng, H.H. (2010). Ownership structure and firm value in Brazil.Academia. Revista Latinoamericana de Administración, (45), 76-95.

Rasyid, R., & Linda, M.R. (2019). Ownership structure, capital structure and firm performance: A case in Indonesia.Advances in Economics, Business and Management Research,97, 766-776.

Sahasranamam, S., Arya, B., & Sud, M. (2020). Ownership structure and corporate social responsibility in an emerging market.Asia Pacific Journal of Management,37(4), 1165-1192.

Indexed at, Google Scholar, Cross Ref

Sahibzada, M.H., & Siti, S.S. (2018). The impact of ownership structure on firm performance: A study on bombay stock exchange in India. International Journal of Accounting and Business Management, 6(1), 21-38.

Shoaib, K., & Yasushi, S. (2015). Capital structure and managerial ownership: Evidence from Pakistan.Business and Economic Horizons (BEH),11(1232-2016-101199), 131-142.

Sitisuziyati, S., Abdul, B., & Sahibzada, M.H. (2016). The impacts of ownership structure on firm performance. International Journaal of Accounting & Business Management, 4(2), 261-271.

Ukaegbu, B., Oino, I., & Dada, F.B. (2014). The impacts of ownership structure on capital structure and firm’s performance in Nigeria.Research Journal of Finance and Accounting,5(15), 82-89.

Umasom, P. (2018). Money market instruments and Nigeria inflation rate: A time series study.Asian Finance & Banking Review,2(2), 1-13.

Indexed at, Google Scholar, Cross Ref

Varghese, G., & Sasidharan, A. (2020, November). Impact of ownership structure and board characteristics on firm value: Evidence from China and India. InFinancial Issues in Emerging Economies: Special Issue Including Selected Papers from II International Conference on Economics and Finance, 2019, Bengaluru, India. Emerald Publishing Limited.

Indexed at, Google Scholar, Cross Ref

Xiaonian, X., & Wang, Y. (1997). Ownership structure, corporate governance and firms’ performance: the case of chinese stock companies.

Yi, J. (2014). Treasury bills and central bank bills for monetary policy.Procedia-Social and Behavioral Sciences,109, 1256-1260.

Indexed at, Google Scholar, Cross Ref

Yitbarek, T. (2013). A dynamic and multivariate analyses of treasury bill behaviour in a bank asset portfolio. European Scientific Journal, 9(7), 275-287.

Zhang, L. (2013). The impact of ownership structure on capital structure: Evidence from listed firms in China.

Received: 07-Jan-2022, Manuscript No. ASMJ-22-11394; Editor assigned: 01-Dec-2021, PreQC No. ASMJ-22-11394(PQ); Reviewed: 22-Dec-2021, QC No. ASMJ-22-11394; Revised: 25-Jan-2022, Manuscript No. ASMJ-22-11394(R); Published: 24-Feb-2022