Research Article: 2020 Vol: 19 Issue: 2

Perception towards the Newly Adopted VAT & SD Act 2012 In Bangladesh: A Strategic Analysis on Tax Practitioners and Experts

Md. Rayhanul Islam, Daffodil International University

Shahana Kabir, Daffodil International University

Farhana Noor, Daffodil International University

Umme Kulsum, Daffodil International University

Md. Mostafizur Rahman, Hajee Mohammad Danesh Science and Technology University

Abstract

Purpose: The prime purpose of the study is to analyze the perceptions of tax practitioners and related experts towards the newly adopted VAT (Value Added Tax) and SD Act 2012 in Bangladesh. Specifically the study investigates the perception regarding three dimensions namely administrative aspect, business organizations & socioeconomic conditions and on government/ public benefits. Finally the study will suggest possible future research in this area.

Design/Methodology/Approach: Purposive random sampling technique has been adopted for the study. Primary data were collected through a structured questionnaire. Data were analyzed using descriptive statistics. Statistical tables were used to display and interpret the research results.

Results/Findings: The overall perception towards the new VAT & SD Act seems to be mixed. The study says that administrative rules regulations need to be modified. This act will have negative impact on socioeconomic condition and VAT/ Gov. revenue collection may fall. Since there is mixed perception towards the VAT act, further study is suggested in this area.

Originality/Value: The research result will be valuable to the policymakers and researchers.

Keywords

Tax Practitioner, Socioeconomic Condition, Perception, Vat, Government Benefits, Bangladesh.

Introduction and Background

Tax is one of the major revenue sources for all the governments of the modern world (Islam, 2016). VAT, a major type of indirect tax is one of the apex sources of government revenue in all the countries and also in Bangladesh. By nature VAT is an expenditure tax which is levied on the basis of the expenditure. James (2011) said, presently VAT has been adopted in more than 140 countries all over the world and VAT alone consists 20% of the global tax revenue. VAT plays major roles for the socioeconomic development no doubt. France is the first country to introduce VAT in limited scale in 1954 while Denmark was able to apply the full VAT system in the national level in 1967 James (2011). Most of the Asian countries including Bangladesh introduced VAT during the mid-1990s. VAT is charged on the increased value of the goods or services at every stage of the production and circulation. VAT has been able to provide highest opportunity to the government of Bangladesh by bringing all the individuals back to the tax system that was exempted from taxation. Due to the nature of being included with the price VAT does not create extra pressure on the individuals paying VAT through buying a goods or services. Although VAT has some limitations, it has become the single largest source of government revenue. Until introducing VAT, sales tax was being collected in Bangladesh under the sales tax act 1951 which was later replaced by sales tax ordinance 1982. With the help of World Bank VAT was enacted in 1991 in Bangladesh. After being passes in the parliament on 9th July 1991 the VAT act 1991 replaced the business turnover tax ordinance 1982 and the sales tax ordinance 1982.

A joint study of World Bank and IMF found gap between theoretical VAT revenue and actual VAT revenue collected by the government of Bangladesh. Since the inception, VAT is contributing well but due to some problems like a long list of items is exempted from VAT or reduced VAT rate and some other systematic problems. As a result contribution of VAT on the economy is not as much as expected. There might be some problems with the fully manual VAT system as well as with the government employees, administration process etc. These problems should be addressed with importance with the expectation of the improvement of the system. A new VAT and SD act- 2012 has been adopted in Bangladesh with broader and better expectation. However different parties have expressed different and mixed opinion regarding this VAT and SD act. To make the act more applicable and suitable this study might contribute. However, VAT is one of the highest contributing indirect tax of a country no doubt and that’s why overall tax system of a country should be designed as per the basic principles of taxes suggested by Adam Smith. If equality, economy, certainty and convenience are ensured, the collection of total taxes including VAT is supposed to increase (Široký & Ková?ová, 2014).

Literature Review and Hypotheses Development

As all the countries need income, all the countries need a good taxation system no doubt. Because tax is a major government revenue sources for all countries. For a developing country like Bangladesh tax administration is important because it reflects the government soundness (Bird & de Jantscher, 1992). Study of Narayan (2003) found that VAT results a decrease in investment and national welfare in Fiji. He further found that VAT system was not cost effective in Fiji which could be recovered by upgrading the tax collection mechanism, he recommended. Despite various efforts in the countries of south Asia including Bangladesh VAT has narrow base which is an important problem besides the cascading of indirect tax problem (Reva, 2015).

A study based on Ukraine and Jamaica found VAT as the best way to impose expenditure tax in a developing country. That’s why in almost all the countries VAT has become powerful source of government revenue source (Bird & de Jantscher, 1992).

The study claimed that, in Portugal, economic growth, consumption, the public deficit, and the level of the reduced and intermediate VAT rates have positive impact on VAT collection, while unemployment has negative impact on it (Silva, 2016).

African countries have to increase tax collection for human and economic development and to them VAT is preferable instrument for the enhanced tax collection which is due to less detrimental impact on the tax payers (Cnossen, 2015).

In the late 1990s the EU pointed out 5 main aspects of a good tax system focusing on the fairness of the operating system, human resources and tax audit of the serious fraud and tax avoidance. Moreover the tax system should make the proper use of updated technology as well as it must ensure good service to the tax payers of the country (Pemberton, 2015).

Fraud of missing trader is allowed by VAT which can be simply prevented by using the technology. This fraud is more common in the transaction of costly price with low volume like computer chips, mobile phone (Ainsworth, 2010). He further pointed out that, the effect of the said fraud maybe huge, however, by RTvat and VNL can reduce this fraud with the help of technology.

Low coverage, many exemptions and existing reduced rates are the lacking of VAT and income tax. Mansur et al. (2011) pointed out that performance of tax system is not good enough. Major reforms were suggested by them through modernization of the VAT administration, eliminating truncated rate and reducing unjustified reduced rates.

VAT was found significant impactful on economic and human development of state based on secondary data analysis but based on primary data VAT seemed to have minimum impact (Unegbu & Irefin, 2011).

Changes in the economic policy especially in VAT policy might be helpful for the management of economic crisis of the present world (Unegbu & Irefin, 2011). So the VAT policy of Bangladesh should be well studied to make it better performing.

Presently corruption is a big challenge in the revenue collection agencies and consequently the government revenue collection is not satisfactory. Based on studies of several countries at least half of the government revenue collection could be lost due to tax evasion and corruption Zuleta et al. (2007).

Due to the strong negative impact on the economic performance, corruption in the tax administration has become a buzzword worldwide. In Greece it seemed to be stronger in tax and public service area, Antonakas et al. (2013). Their study found corruption as a systematic and a successful anti-corruption cell might work to reduce the level of corruption.

In the second half of the 20th century VAT is replacing the sales tax in most of the countries. This is increasing the revenue collection from VAT but simultaneously the complexities associated with VAT are also increasing. Exemptions, incentives and zero or reduced rates are mainly responsible behind the complexities of the VAT administration, (Sokolovska & Sokolovsky, 2015). However the tax practitioner and experts have mixed perception towards the VAT and SD Act 2012. Their perception suggests the following three hypotheses:

The first hypothesis investigates the impact on administrative aspects; second hypothesis investigates the impact on the business organizations, consumers and on socioeconomic condition and the third hypothesis tests the public/government benefits from the VAT and SD Act. The hypotheses are as under:

H1 Administrative aspects of the VAT and SD Act 2012 are strong, sound and well defined

H2 The newly adopted VAT and SD Act 2012 will not have positive impact on business organizations, consumers and on socioeconomic condition

H3 This VAT and SD Act will decrease public/government benefits

Objectives of the Study

Broadly this study aims to analyze the strategies in the newly implemented VAT and SD ACT – 2012 in Bangladesh. Particularly the study will investigate the impact of this act on the related stakeholders including tax payers, government as well as on the socioeconomic condition of the country. Based on the analysis the study aims to provide some recommendations for the further improvement of the VAT system to make the new VAT act more suitable for ensuring higher revenue and smooth operation of the VAT system. The study also intends to recommend further study in the area of taxation system and VAT mechanism of the countries.

Methodology and Nature of the Study

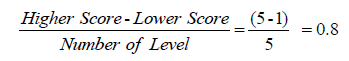

This is a descriptive study where primary data were collected by using a structured questionnaire. The respondents’ perception was quantified by using a five point Likert scale where 1, 2, 3, 4 and 5 denotes strongly agreed, agreed, neutral, disagreed and strongly disagreed respectively. The perception level was classified and considered by using the following formula which was used by Rouf et al. (2018) in conducting a study on customers’ perception.

In the study purposive random sampling method were used for selecting the respondents. The sample of the study includes tax practitioners, university teachers and other relevant experts. Data were analyzed by various statistical tools like mean, standard deviation, p value etc. have been used to analyze and interpret by using SPSS software. Statistical tables have been used to display the outcome of the study. Among the 250 sample 217 respondents provided their response to us. The benchmarks that were used for understanding the mean perception are shown in Table 1.

| Table 1: Measurement Scale | |

| Mean score | Perception level |

|---|---|

| 1.00-1.80 | Strongly agreed |

| 1.81-2.60 | Agreed |

| 2.61-3.40 | Neutral |

| 3.41-4.20 | Disagreed |

| 4.20-5.00 | Strongly disagreed |

Source: Author’s compilation

Analysis and Results

Table 2 shows the perception of the respondents (tax practitioners and other relevant experts) towards the administrative aspect of the newly adopted VAT & SD Act 2012. The overall perception regarding the administrative aspects is “agreed” with a mean of 2.355 and SD of 0.881. Out of eight items respondents are agreed with 6 and neutral with 2 items.

| Table 2: Perception Regarding administrative aspects of the Vat and SD Act 2012 | ||||

| S No. | Statement of the question | Mean | SD | Remarks |

|---|---|---|---|---|

| 1 | VAT and related terms are not clearly defined | 2.751 | 1.155 | Neutral |

| 2 | Huge e-BIN collection will be challenging | 2.156 | 0.888 | Agreed |

| 3 | Online VAT admin will be more complicated | 2.903 | 0.868 | Neutral |

| 4 | Unfair means, bribery and corruption will rise | 2.341 | 1.148 | Agreed |

| 5 | VAT avoiding tendency will grow | 2.101 | 1.166 | Agreed |

| 6 | Government officials will be reluctant to accept the new VAT system | 2.018 | 0.623 | Agreed |

| 7 | The new VAT system will increase transparency | 2.106 | 0.661 | Agreed |

| 8 | It will be simple and taxpayer friendly | 2.465 | 0.544 | Agreed |

| Average | 2.355 | 0.881 | Agreed | |

Source: Author’s compilation

Table 3 displays the perception regarding the business houses, price level commodities and services and socioeconomic condition. Here the average of the means is 2.184 and the SD is 0.779. Among the 8 items the respondents are strongly agreed with 3, disagreed with 2 and agreed with 3 items.

| Table 3: Perception Regarding Organization, Markets Price and Socioeconomic Condition | ||||

| S. No | Statement of the Question | Mean | SD | Remarks |

|---|---|---|---|---|

| 1 | Market Price level of goods and services will increase | 1.175 | 0.55 | Strongly agreed |

| 2 | SME’s will suffer due to high cost of automation | 1.377 | 0.485 | Strongly agreed |

| 3 | Cost of producing goods and services will increase | 1.373 | 0.512 | Strongly agreed |

| 4 | New/small entrepreneurs will face increased problem | 3.424 | 1.192 | Disagreed |

| 5 | It will be a barrier in creating entrepreneurs | 3.428 | 0.874 | Disagreed |

| 6 | Large business organizations will be more benefited | 1.88 | 0.572 | Agreed |

| 7 | The digital VAT system is a prospective threat to job security. | 2.331 | 0.981 | Agreed |

| 8 | Unemployment, snatching, robbery, murder will increase | 2.488 | 1.097 | Agreed |

| Average | 2.184 | 0.779 | Agreed | |

Source: Author’s compilation

Table 4 contains the respondents’ perception regarding the probable govt./public benefit from the VAT & SD Act 2012. Here the overall mean and SD are 2.480 and 1.120 respectively that indicate that the respondents are agreed on the issue. Of the 8 items 5 items fall under the category of agreed, 1 items fall under the category of neutral, 1 item goes to the category of strongly agreed and another 1 item fall under the category of disagreed.

| Table 4: Perception regarding the Impact of the Vat & SD act on Govt./Public benefits | ||||

| S. No | Statement of the Question | Mean | SD | Remarks |

|---|---|---|---|---|

| 1 | Collection of VAT will decrease for government | 2.557 | 1.37 | Agreed |

| 2 | The small businesses will close and shift outside Bangladesh | 2.299 | 1.3 | Agreed |

| 3 | Money laundering will increase | 2.373 | 1.111 | Agreed |

| 4 | NBR/Gov. lack necessary skills to monitor the system | 1.645 | 0.699 | Strongly agreed |

| 5 | VAT administration will not be cost effective | 2.313 | 0.987 | Agreed |

| 6 | In the long run Gov. revenue will further decrease | 3.419 | 1.123 | Disagreed |

| 7 | Govt. image/popularity will decrease | 2.221 | 1.078 | Agreed |

| 8 | Gov. revenue collection will increase | 3.018 | 1.298 | Neutral |

| Average | 2.48 | 1.12 | Agreed | |

Source: Author’s compilation

Table 5 shows the summary of the perception level of the respondents towards the VAT and SD Act 2012. The 2.355 mean and 0.881 SD indicate that most of the respondents do not agree with the hypothesis one. The administrative sides including the concepts and rules regulations are not clearly defined in the newly adopted VAT and SD Act 2012. The administrative sides of the act are more complicated which will increase corruption. The mean of the second dimension 2.184 with a SD of 0.779 and thus it can be mentioned that in the long run the mentioned VAT act have negative impact on the socioeconomic condition. It will increase the price level and create barriers for the entrepreneurs especially for the small and new ones. At the same time it can be said that this VAT act is more beneficial for the large organization and it may decrease the job security. Due to the mentioned things unemployment, robbery, snatching may increase in the society. Thus the second hypothesis becomes true. The third dimension regarding the Govt./public benefit has a mean of 2.2480 and a SD of 1.120. It can be mentioned that due to this act VAT collection and government image both will decrease and at the same time money laundering and cost of goods and services will increase. Further, it will be less cost effective due to the lack of skills of the income tax authority. So, hypothesis three is accepted.

| Table 5: Summary of the Overall Perception Level | ||||

| S. No | Dimension | Mean | SD | Remarks |

|---|---|---|---|---|

| 1 | Administrative aspect | 2.355 | 0.881 | Agreed |

| 2 | Business houses, price level and socioeconomic condition | 2.184 | 0.779 | Agreed |

| 3 | Govt./ Public benefits | 2.480 | 1.120 | Agreed |

| Average | 2.339 | 0.926 | Agreed | |

Source: Author’s compilation

Conclusion

The results of the hypothesis test indicate that the important concepts and administrative rules regulations are not clearly and easily explained in the VAT act although this is a basic principle of a good tax system. These rules regulations may not be easily understandable to the tax payers. The study results also claim that, implementation of the VAT Act 2012 will have negative socioeconomic impacts due to the increase in barriers for the SME and new entrepreneurs, increase of corruption, unemployment etc. Additionally it will increase the inequalities in income and wealth between the large and small business organizations that is not supported by the basic principle of taxation. The study further results that, due to administrative complexities and lack of skills the VAT collection will decrease and consequently Govt. revenue collection will fall. Not only that, image of the government may be hampered because the VAT act is more beneficial for the big organizations. To make the VAT act more implementable it needs to be well studied by the experts and related other stakeholders. Improved technological and human skills might help to overcome some of the identified problems of the act. The rules regulations and technical concepts should be explained simply. Above all, awareness should be created among the stakeholders to eliminate the misconceptions. The study concludes that the more experienced tax practitioners and experts are comparatively less agreed with the VAT act (Table 6). On the other hand Table 7 shows that, respondents with professional qualifications or PhD are less agreed compared to the respondents with graduation or master qualification. Finally, since there is nixed opinion regarding the new VAT act of Bangladesh, the study suggests further researches to identify and solve the problems to conform to the equitability principle of taxation.

| Table 6: Experience and Perception towards Three Dimensions | ||||||

| Experience | N | Admin Aspect | Socioeconomic | Public Benefit | Mean | Remarks |

|---|---|---|---|---|---|---|

| 0-10 years | 183 | 1.426 | 1.487 | 1.656 | 1.529 | Strongly agreed |

| 10 years + | 34 | 2.429 | 1.812 | 2.229 | 2.157 | Agreed |

Source: Author’s compilation

| Table 7: Education and Perception towards Three Dimensions | ||||||

| Education | N | Admin Aspect | Socioeconomic | Public Benefit | Mean | Remarks |

|---|---|---|---|---|---|---|

| Graduation | 19 | 1.368 | 1.541 | 1.578 | 1.496 | Strongly agreed |

| Master | 36 | 1.944 | 1.222 | 1.750 | 1.639 | Strongly agreed |

| PhD | 39 | 1.887 | 1.787 | 2.615 | 2.096 | Agreed |

| Professional CA/CMA/ACCA | 123 | 2.492 | 1.939 | 1.817 | 2.083 | Agreed |

Source: Author’s compilation

References

- Ainsworth, R.T. (2010). VAT fraud-Technological solutions.

- Antonakas, N.P., Giokas, A. E., & Konstantopoulos, N. (2013). Corruption in Tax Administration: Interviews with Experts. Procedia-Social and Behavioral Sciences, 73, 581-589.

- Bird, R.M., & de Jantscher, M.C. (1992). Improving tax administration in developing countries. Washington DC: International Monetary Fund.

- Cnossen, S. (2015). Mobilizing VAT revenues in African countries. International Tax and Public Finance, 22(6), 1077-1108.

- Islam, M.R. (2016). Contribution of indirect taxes on GDP of Bangladesh. Asia Pacific Journal of Research l (XXXVIII), 213-217.

- James, K. (2011). Exploring the origins and global rise of VAT. The VAT Reader (Tax Analysts), 15-22.

- Mansur, A.H., Yunus, M., & Nandi, B.K. (2011). An evaluation of the tax system in Bangladesh. In Conference on Linking Research to Policy: Growth and Development Issues in Bangladesh, Dhaka, December (Vol. 20).

- Narayan, P.K. (2003). The macroeconomic impact of the IMF recommended VAT policy for the Fiji economy: evidence from a CGE model. Review of Urban & Regional Development Studies, 15(3), 226-236.

- Pemberton, J.L. (2015). Models of tax administration-key trends in developed countries. Journal of Tax Administration, 1(1), 102-112.

- Reva, A. (2015). Toward a more business friendly tax regime: Key challenges in South Asia. The World Bank.

- Rouf, M.A., Kamal, M., & Iqbal, M.M. (2018). Customers’ perception of service quality of banking sectors in Bangladesh. International Journal of Law and Management.

- Silva, C.S.F.D. (2016). The determinants of VAT revenues in Portugal. Unpublished doctoral dissertation, Instituto Superior de Economia e Gestão.

- Široký, J., & Ková?ová, A. (2014). Changes in VAT rates during the economic crisis. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, 59(2), 339-346.

- Sokolovska, O., & Sokolovskyi, D. (2015). VAT efficiency in the countries worldwide.

- Unegbu, A.O., & Irefin, D. (2011). Impact of VAT on economic development of emerging nations. Journal of Economics and International Finance, 3(8), 492.

- Zuleta, J.C., Leyton, A., & Ivanovic, E.F. (2007). Combating corruption in revenue administration. The Many Faces of Corruption, 339.