Research Article: 2021 Vol: 20 Issue: 6S

Policy Implications Improving Capital for Sustainable Economic Growth: The Case from Dong Nai Province in Vietnam

Do Thi Lan Dai, Lac Hong University (LHU)

Hoang Thi Thanh Hang, Banking University of Ho Chi Minh City (BUH)

Keywords

Attracting, Investment, Capital, Sustainable, Economic, Growth, BUH and LHU

Abstract

Sustainable economic growth in the long term depends on scientific and technological progress and the interaction between countries as the world economy has become increasingly interdependent. This interaction showed in the exchange of goods traded between countries and in the capital flowing from one country to another; in other words, capital investment abroad. The attraction of investment capital should increase labor productivity, create jobs, raise workers’ income, and transfer foreign technology advancements. The article surveyed 1.000 managers related to enterprises with investment capital in Dong Nai province, but 939 samples were processed and answered 39 questions. The result had eight factors that are affecting the investment capital attraction with 5% significance. After that, the authors had eight policy implications for improving investment capital attraction.

Introduction

According to Snieskaa & Tykiene (2019); Abdoulaye, Xie, Oji-Okoro (2014), sustainable economic growth is one of the core issues of economic development theory. Sustainable economic growth and development are the top targets of all countries globally, the primary measure of progress for each stage. The overall goal of Vietnam’s 2020 - 2025 socio-economic development plan is “Sustainable economic growth, achieving an essential change in efficiency and sustainability. Development, soon bringing Vietnam out of underdevelopment. Significantly improve the cultural and spiritual life of the people. To step up industrialization, modernization, and development of the knowledge economy, creating a foundation for our country to become a modern-oriented industrial country by 2030. To maintain political stability and order, Social security. Healthy guard independence, sovereignty, territorial integrity, and national security. Enhance the position of Vietnam in the region.

However, Dong Nai province, among many measures to promote foreign direct investment in the region recently, many influencing factors analyzed. However, it is urgent to discover new barriers, inhibitors, or potentials to continue creating motivation to attract capital investment in Dong Nai province sustainable economic growth, thereby promoting economic, social, and environmental development. Dong Nai needs to effectively implement solutions to mobilize domestic and foreign capital sources and encourage economic sectors to boldly raise capital for themselves and the region and the country. Therefore, the authors proposed policy implications improving capital for sustainable economic growth in Dong Nai province, Vietnam.

Literature Review

Sustainable Economic Growth (SEG)

According to Sebastian (2018) showed that Sustainable economic growth is economic development that attempts to satisfy the needs of humans but in a manner that sustains natural resources and the environment for future generations. The ecosystem provides the production factors that fuel economic growth: land, natural resources, labor, and capital (created by labor and natural resources). Sustainable economic growth manages these resources not to be depleted and will remain available for future generations.

According to Parateg & Uma (2013); Adams (2018), GDP growth and the public debt ratio are the most critical indicators to evaluate whether the economy is sustainable or not. From a macro perspective, it will develop sustainably. There is a need to shift economic structure, shift from a weak economy to a more efficient one. For the economy to grow sustainably, it is necessary to effectively change the economy’s system to increase the proportion of investment and development of the production and business sectors while reducing the regions’ investment capital - a weak economy.

Investment Capital Attraction (ICA)

According to Alvarado, Iñiguez & Ponce (2017); Alvarado, Iñiguez & Ponce (2017) showed that investment attraction is at the top of the agenda for state organizations, municipalities, and private entities. We will analyze the investment offering during our investment attraction service, identify investor profile and country, introduce your offering to the potential investors, and empower the negotiations.

On the other hand, Ngwen (2017); Amanda (2017) showed that foreign investment also creates jobs, reduces unemployment rates for countries receiving investment. For these reasons, many economists advise governments of less developed countries to favor foreign investment policies. Foreign investment is one of the activities of the current open economy. Attracting foreign investment capital is an issue of great concern to developing countries, significantly underdeveloped countries. It is one of the crucial factors contributing to economic growth in the long run.

Infrastructure (IN)

According to Donna (2018); Ngwen (2017), infrastructure is a fundamental and essential element for any company’s production and business. These factors include imperative infrastructure factors such as electricity, water, transport, site, and technical infrastructure elements such as communications and banking. Therefore, infrastructure has a positive impact on investors’ capital attraction. In contrast, an underdeveloped infrastructure system is a significant hindrance to development. In many developing countries, insufficient and weak infrastructure has caused stagnation in the rotation of resources, difficulty to absorb, investment capital, causing “bottlenecks of infrastructure” that directly affect economic growth by Nasa, Bogachev & Melnichuk (2018). With those as mentioned above, the researchers have hypothesis following:

Hypothesis H1: Infrastructure has a positive impact on the investment capital attraction in Dong Nai province

Investment Policies (IP)

The policy affects the change of institutions, and institutions affect the application of policies. Reasonable tax policy harmonizes the benefits between enterprises and the State and can forecast future investment, production, and business plans by Michael & Serhiy (2020). According to Elena (2015) showed that reform and strengthen the capacity and effectiveness of institutions and sanctions, the economy, the administration, and the national and local judiciary to protect the interests of the State and enterprises effectively. For the things mentioned earlier, the researchers have hypothesis following:

Hypothesis H2: Investment policy has a positive impact on the investment capital attraction in Dong Nai province

Working and Living Environment (WLE)

When enterprises investing in investment-attracting localities, foreign investors are very interested in the living and working environment in the host country because FDI is a long-term activity. And investors often have to live and work in this place, even bring the whole family to invest in living. Therefore, the authors should carefully consider the host country’s social services and facilities to ensure that they can meet their living needs by Glenn (2017). The researchers have hypothesis following:

Hypothesis H3: Working and living environments have a positive impact on the investment capital attraction in Dong Nai province

Public Service Quality (PSQ)

Cronin & Taylor (1992) showed that an investor with a good quality of public service could easily comply with government policies, saving time and money in handling necessary administrative procedures in investment and production activities. Business and benefit from the State’s support in areas where the State has an advantage and is difficult for enterprises to access by themselves. It is necessary to provide investors with quality public services such as quick customs clearance, support for import and export information, advertising; Industrial property; trade promotion. Therefore, the quality of local public services positively impacts investors’ capital attraction in this locality. The mentioned above, the researchers had hypothesis following:

Hypothesis H4: Public service quality has a positive impact on the investment capital attraction in Dong Nai provin

Regional Connectivity (RC)

According to Glenn (2017); Michael, Daniel Ofori & Jacob (2019) showed many types of regional linkages, including natural forms of the development process, prominent being the pervasive type, which occurs naturally. Objectivity in the development process. The main actors of this type of association are enterprises, non-business units, families, and individuals. This factor is a type of link between entities located in different regions (horizontally linked) and highly marketable, including purchase and sale transactions, types of contracts, company shares... According to Manasa (2015) showed that regional economic linkage is essential “the connection between different economic actors in a region, based on economic interests, to promote comparative advantage, creating higher economic competitiveness. The mentioned above thing, the authors had hypothesis following:

Hypothesis H5: Regional connectivity has a positive impact on the investment capital attraction in Dong Nai province

Human Resources (HR)

According to Lal (2017); Globerman & Shapiro (2012), the labor source is both a factor to attract and efficient use of foreign investment capital. Labor qualifications suitable for requirements, high management capacity will create high labor productivity. Besides, foreign investors will partially reduce training costs and reduce training time, so projects’ progress and effectiveness will meet the set targets. Therefore, the host country must actively improve its intellectual level to enhance its access to advanced technologies and techniques and improve economic management techniques. The mentioned above thing, the authors had hypothesis following:

Hypothesis H6: Human resources have a positive impact on the investment capital attraction in Dong Nai province

Technology (TE)

Hezron & Pauline (2016); Isusic & Susic (2019) showed that technology reflected in inventions and production improvements. Scientific and technical progress increases investment capital efficiency, helps exploit natural resources well, and increases labor productivity. Moreover, it also contributes to improving quality and lower production costs. Today, the speed of technology development, especially information technology, biotechnology, new material technology had contributed to increasing production efficiency. However, to obtain such results, investment is required in research and development. The mentioned above thing, the authors had hypothesis following:

Hypothesis H7: Technology has a positive impact on the investment capital attraction in Dong Nai province

Investment Costs (IC)

According to José & Campos (2019); KalIappana, Khamis & Ismail (2015) showed that competitive input costs are a vital factor directly related to an enterprise’s investment efficiency. Enterprises can increase competitiveness or seek higher profit margins when input costs are low. A guaranteed service product quality must always accompany a competitive cost in addition to a reasonable price. Therefore, competitive input costs will have a positive impact on investors’ capital attraction. Therefore, competitive input costs will positively impact investors’ capital attraction by Khorrami & Fakhimi (2017). The mentioned above thing, the authors had hypothesis following:

Hypothesis H8: Investment costs have a positive impact on the investment capital attraction in Dong Nai province

Methods of Research

In this study, the authors used qualitative research. It is an approach to seek to describe and analyze the research sample’s characteristics and experts and enterprise leaders’ behavior from the researcher’s perspective by Hair, Anderson, Tatham & Black (2010).

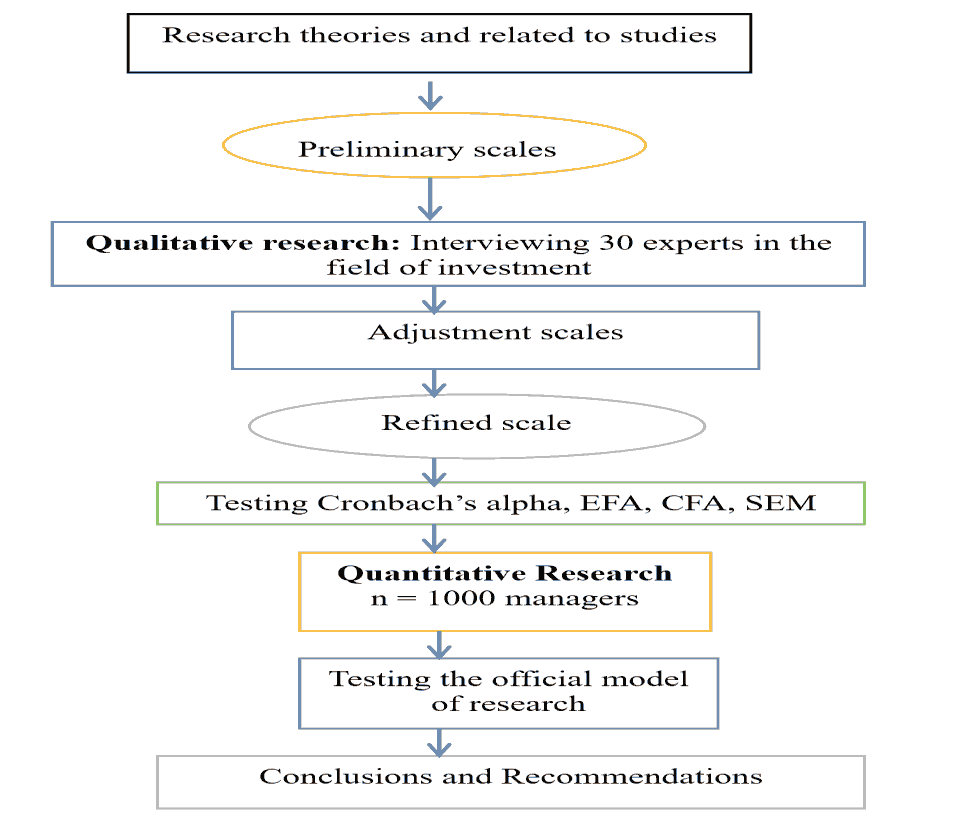

Figure 1: A Research Process For Factors Affecting The Sustainable Economic Growth In Dong Nai Province In Vietnam

(Source: Researchers proposed)

According to Hair, Anderson, Tatham & Black (2010), the research process done through steps: The authors researched and synthesized the theoretical basis and related studies at home and abroad, thereby building the research model. After having a research model, the authors formed an expected scale, examined the model and scale, and collected preliminary data to assess the scale’s reliability and value preliminarily. After developing a primary scale, the authors collected official data to test the research model and hypothesis. Finally, the authors make conclusions and suggested policy implications to attract investment capital. The article used the scale development research process performed through the following steps:

Step 1: The authors determined conceptual content based on a theory.

In step 1, the research conducted three contents: (1) theoretical overview to study related concepts such as capital, capital attraction, and sustainable economic growth. Factors affecting sustainable economic growth; (2) Determine the relationship between the research model’s concepts; (3) Building the initial scale for the research concepts that have a scale, namely the scale of factors affecting sustainable economic growth.

Step 2: The authors continued to build variables to measure concepts through empirical research and group discussion of 30 managers related to capital attraction.

In this step, there are two specific tasks: (1) Adjusting and supplementing the scale of concepts that have scale; (2) Build a set of variables on the scale of new images included in the model.

In the preliminary research to adjust and supplement the initial scales through focus group discussions. Focus group interviews were conducted. Some groups were established and interviewed (the group of business directors and leaders of departments). As a result of this step, the original scale is adjusted and is called the adjustable scale.

Step 3: Collect data: The authors conducted preliminary quantitative research, using direct interviews with personal customers with the questionnaire built at the end of step 2. The sample size for collecting is n=300 business leaders who participate in Dong Nai province interviews.

Step 4: Preliminary assessment of the scale with confidence coefficients of Cronbach’s alpha and EFA analysis on the database collected in step 3.

The adjusted scale was assessed through preliminary quantitative research with a sample of size n=300 business leaders, random sampling method. These scales were adjusted through main techniques: (1) Cronbach’s alpha’s reliability coefficient method and (2) exploratory factor analysis (EFA) method.

Cronbach Alpha coefficient analysis used to determine the reliability of the scale. The scale achieves reliability when this coefficient is more significant than 0.6. The population variable correlation coefficient is the correlation coefficient of a variable with the mean of other variables on the same scale. The higher the coefficient, the more the correlation of variables with other variables in the group. Variables with item-total correlation must be greater than 0.3. According to Hair, et al., (2010), variables with total variable correlation coefficients of less than 0.3 are considered garbage variables and, of course, removed from the scale.

The authors analyzed the discovery factor (EFA) used to test the concepts’ scale validity. Because after exploring EFA, the authors continued to perform CFA and SEM analysis, so it is essential to pay attention to the scale structure and the distinction between the factors. So, the authors have been performing an EFA analysis; the performance standards are as follows: (1) Using Principal Axis Factoring extraction method, rotation Promax1; (2) Criterion 2: Coefficient Factor Loading maximum of each variable ≥ 0.4; (3) Criteria: At each variable, Factor Loading most significant and factor Loading any must be ≥ 0.3 to ensure factor differences (Jabnoun & Al-Tamimi, 2003). Total variance extracted ≥ 50% by Gerbing & Anderson (1988). KMO ≥ 0.5, Bartlett test is statistically significant (Sig<0.05). After evaluating Cronbach’s Alpha coefficients and EFA analysis, the authors used the official quantitative research questionnaire’s remaining variables.

Step 5: Continue to collect data: In this step, the authors conducted research officially in Dong Nai province. The object of the survey to collect data is business leaders in Dong Nai province. The method of information collection is direct interview through a prepared questionnaire, the size of the sample is n=1,000 business leaders: probability fee sampling method, random sampling technique for evaluation. Data put into encryption, data entry, cleaning, and data analysis with SPSS version 20.0 software, AMOS software, after being collected.

Step 6: Evaluate the scales’ reliability with Cronbach’s alpha on the database collected in step 5. In this step, the authors re-tested the reliability of the scales through the evaluation of coefficients. Cronbach’s alpha is based on data collected in official research.

Step 7: The authors evaluated the scale value using the combination of EFA analysis and CFA analysis in the SEM model. As mentioned, the authors combined EFA and CFA analysis in the SEM model to replace step 7 in the procedure suggested by Hair, et al., (2010). EFA analysis was done based on a scale that was reliably assessed through Cronbach’s alpha coefficients performed in step 6 and data collected in the official study in step 5. Methods of analysis CFA is used to verify the validity of the scales.

Step 8: The authors determined the standard scale, analyzes the SEM structure to test the model and research hypotheses. SEM structural analysis method is used to test the adaptability of theoretical models and established research hypotheses.

Step 9: Based on model test results, the authors proposed policy implications.

In summary, in the article, the authors researched and synthesized the theoretical basis and related research at home and abroad, thereby building the research model. After having a research model, the authors formed an expected scale, examined the model and scale, and collected preliminary data to assess the scale’s reliability and value preliminarily. After primary completion, the authors collected official data to test the research model and hypothesis. Finally, the authors give conclusions and suggested policy implications to improve investment capital attraction for sustainable economic growth by Hair, et al., (2010).

Research Results

| Table 1 Factors Affecting The Investment Capital Attraction In Dong Nai Province In Vietnam |

|||||||

|---|---|---|---|---|---|---|---|

| Relationships | Coe. | Standardized Coefficient | SE. | CR. | P | ||

| ICA | <--- | IP | 0.236 | 0.100 | 0.051 | 4.630 | *** |

| ICA | <--- | IN | 0.149 | 0.089 | 0.049 | 3.059 | 0.002 |

| ICA | <--- | PSQ | 0.158 | 0.115 | 0.033 | 4.712 | *** |

| ICA | <--- | WLE | 0.077 | 0.089 | 0.024 | 3.197 | 0.001 |

| ICA | <--- | RC | 0.178 | 0.175 | 0.031 | 5.810 | *** |

| ICA | <--- | HR | 0.092 | 0.105 | 0.025 | 3.703 | *** |

| ICA | <--- | IC | 0.102 | 0.108 | 0.028 | 3.625 | *** |

| ICA | <--- | TE | 0.475 | 0.531 | 0.027 | 17.624 | *** |

(Source: Data processed by SPSS 20.0 and Amos)

Table 1 showed that column “P”<0.01 with significance level 0.01. This result indicated eight factors affecting the investment capital attraction with a significance level of 0.01.

Conclusion and Policy Implications

Conclusions

Dong Nai province’s capital attraction results are modest compared to some other localities. There has been a relatively good trend of increase compared to the early years of implementing investment attraction policies. The province is continuing to focus on improving the quality of the investment and business environment with enterprises. This attraction is also a cross-cutting target, attracting the participation of all levels and branches. Therefore, this study aims to identify factors affecting the investment capital attraction for sustainable economic growth in Dong Nai province. The study surveyed 1.000 managers related to enterprises with investment capital in Dong Nai province, but 939 samples processed and answered 39 questions. The authors tested Cronbach’s Alpha, confirmatory factor analysis (CFA), and structural equation (SEM). Based on the research results, the authors propose policy implications for attracting investment capital to improve Dong Nai province.

Policy Implications

Based on the results mentioned above, improving the investment capital attraction and sustainable economic growth in Dong Nai province in Vietnam.

(1) Policy implication for technology (TE). Dong Nai province needs to create favorable conditions and support businesses to be encouraged to transfer advanced, modern, environmentally friendly machines, equipment, and lines that consume less energy and be inspired to promote the transfer of technical know-how and technological know-how. Besides, the province also needs to have technology plans and processes; solutions, specifications, drawings, technical diagrams; formulas, computer software, and data information; solutions to rationalize production; and innovative technology in many different forms for enterprises. Besides, Dong Nai province creates opportunities for businesses and investors to be encouraged to contribute capital with technology, franchising, and transferring intellectual property rights; training for domestic enterprises (technology recipients) to master and master the technology; appointing technical consultants to the transferee of the technology, applying the technology and operating it to achieve the agreed product quality and progress targets. Besides, Dong Nai province should research, use and transfer environmental technologies in industrial parks and industrial clusters, apply clean and environmentally friendly technologies, develop technologies for treatment, recycling, and reusing waste. Build and replicate cleaner production models; forming and developing an environmental industry, creating markets, promoting environmental services enterprises, developing an ecological economy.

(2) Policy implication for regional connectivity (RC). The province proposes to the Government to speed up the expressway projects: Ben Luc - Long Thanh, Dau Giay - Lien Khuong, Phan Thiet - Dau Giay, to expand the expressway of Ho Chi Minh City - Long Thanh - Dau. In parallel with traffic, Dong Nai has actively planned land resources for new industrial zones to anticipate investment movement in the following years. Therefore, the province approved to add two more industrial zones, Phuoc An, with 330 hectares, and Phuoc Binh 2, with 590 hectares, into the provincial industrial park development plan until 2020. Along with improving transport infrastructure, Dong Nai should promote the potentials, advantages of location, population, geology, and efforts to enhance provincial competitiveness and improve the early environment. Investing in administrative reform, actively listening to, and accompanying businesses has helped Dong Nai achieve high attracting investment results. Regarding mechanisms and policies, perfect both the vertical and the horizontal instruments in the linkage (including economic regions’ connection and the integration of the organizational apparatus). For flat links (voluntary), there should also be a framework for regulating benefits, a cooperation mechanism as a basis for adjusting and implementing clear delineation when participating in these linking activities.

Dong Nai clearly defines subjects, ranks, and accompanying sanctions activities clearly and transparently (avoiding the situation of “flexible” understanding, “Soft blanket” in legal documents) to ensure transparency and not push responsibility in the implementation of legal documents.

(3) Policy implication for public service quality (PSQ). The Dong Niprovince implements the interconnected one-door model towards the modern one-door (electronic one-door) model. Because the contemporary one-door model is critical in administrative reform in general and administrative reform, it is to implement the current one-door model. It is necessary to invest in renovating and upgrading the reception department’s office and return results by promoting standardized software using ISO 9001 processes: 2008. Dong Nai’s Committee should continue to inspect and direct state administrative agencies in the city to implement Decision No effectively. 09/2015/QD-TTg dated March 25, 2015, of the Prime Minister. It is on promulgating regulations on the implementation of the one-door mechanism, the inter-agency one-door mechanism at local state administrative agencies and Decision No. 3677/ QD-UBND dated July 28, 2015, the Dong Nai’s Committee on the implementation of the one-door mechanism, the inter-agency one-door mechanism at state administrative agencies in Dong Nai province. Besides, The Dong Nai province continues to implement the state administrative reform direction in the period 2020 - 2025 to permit the applicant IT in state agencies’ operations to promote direct public services online. Promote IT’s an application in association with promoting online public services at all government levels, proceeding to build e-government to create a breakthrough in service successfully. Dong Nai right. Dong Nai needs to implement technical solutions - technology, improve the efficiency of IT application. Dong Nai continues to upgrade and complete IT infrastructure at agencies, units, and localities. Most are in communes, wards, and towns in the city (especially to study and direct the construction of electronic information portals of commune-level authorities in Dong Nai province). Public services must be increased, and the level of online public services must be increased towards the roadmap where all public services provided by state agencies of the city must reach level 4. When the people of the province need public assistance, people only need to download the documents and forms on state agencies’ websites, fill out the information, and submit them online. Document form to the service provider agency, organization, and transactions in processing records and providing services are performed.

(4) Policy implication for Investment Costs (IC). The Dong Nai province improves the business environment, investment environment, and competitiveness of the city’s economy to adapt to the new production industry in the industrial revolution 4.0. Increasing rapidly in many newly established businesses; reduce the rate of business dissolution, shutdown; reducing input costs, opportunity costs, and informal costs for businesses and citizens; contribute to the successful implementation of the city’s socio-economic development. Besides, the province continues to support, inspect, and evaluate the situation and results of the main tasks’ performance and solutions to improve the unit’s business environment. Besides, Dong Nai proactively coordinates with the Ministries, central agencies, the Chamber of Commerce and Industry of Vietnam to connect with relevant international organizations. Again, Dong Nai provides and updates all necessary information to ensure objective and accurate reviews and ratings, implementing external information to introduce evaluation results, annual ranking. Besides, the province supports enterprises in innovating technology, applying information technology to production and business activities, improving the competitiveness of the region’s profitable products, and improving vocational training quality to meet the province’s labor demand and development orientation.

(5) Policy implication for Human Resources (HR). The Dong Nai province focuses on perfecting the management apparatus for human resource development, renewing management methods, improving the management apparatus’s capacity, effectiveness, and efficiency for human resource development. Reform policies, mechanisms, and tools for human resource development and management, including work environment, employment policy, income, insurance, social protection, and housing conditions. and living conditions, settlements, attention to guidelines for high-quality human resources, talent. Besides, the province continues signing cooperation agreements with universities in training human resources for socio-economic development. Based on the socio-economic development planning, the development of vital industries, and the need to use local enterprises’ human resources, the province should “order” training institutions to organize training. They were creating industries that businesses inside and outside the region and companies are thriving in Dong Nai. Besides, The Dong Nai province continues to allocate and use the Province Budget for quality human development up to 2025. It is necessary to develop a plan to distribute the state budget to promote training programs and projects to prioritize and achieve social justice. To step up socialization to increase the mobilization of capital sources for human development. The State has mechanisms and policies to mobilize people’s capital to invest and contribute to human resource development in the form of (i) Direct investment in building education, training institutions, Department of health, culture, sport; (ii) Establish funds to support human resource development, mobilize and promote the role and contribution of enterprises to human development; (iii) Promote and create a suitable mechanism to attract foreign capital for human development in Vietnam. Efficient use of foreign capital sources for human resource development (ODA) assistance; (iv) Attract foreign direct investment (FDI) for human resource development (direct investment in the construction of educational institutions, training institutions, hospitals, sports centers).

(6) Policy implication for Investment Policies (IP). The Dong Nai province continues to review the overall financial policies, especially the tax policies to attract FDI currently being applied, adjust, amend and supplement accordingly towards building a system. Good tax with low compliance cost. Besides, The Dong Nai province continues reviewing the comprehensive list of sectors, occupations, and investment incentive areas associated with evaluating the effectiveness of investment incentive policies in general and financial policies, particularly in terms of scale. Invested capital, realized capital, the ratio of recognized capital to invested capital, number of jobs created, export turnover, localization rate, and concerning tax costs (reduction of state budget revenue). Tax incentives should be selected to encourage businesses to make long-term investments and reduce the beneficiaries of tax exemptions and reduce tax exemption and reduction periods. Besides, The Dong Nai province continues perfecting the legal system of anti-transfer pricing and the phenomenon of “thin capital.” Again, Dong Nai promotes inspection and examination for enterprises that arose from associated transactions. It including FDI and domestic enterprises. Dong Nai focuses on enterprises that have lost many years but continue to expand production and business activities. In outsourcing, manufacturing, and assembling according to overseas associates’ orders, corporations have many member enterprises. The Government needs to perfect the legal system and foreign investment administrative procedures towards synchronous, consistent, easy to understand, and easy to follow. Investment incentive policies need to ensure uniformity of regulations on criteria and standards for evaluating and selecting investment projects licensed to enter economic zones or hi-tech zones or enjoy preferential treatment, tax, land rental.

(7) Policy implication for Infrastructure (IN). The Dong Nai province continues to improve the traffic infrastructure and has the most substantial influence on attracting domestic investment in Dong Nai province. To enhance the information and transport infrastructure system, in the coming time, the authorities need to: Build a widespread and fast communication infrastructure system and ensure the development of information infrastructure. Until 2025 synchronously; Promote regional planning and planning management; Fully implement and apply the mechanisms and policies issued by the State to attract capital in a direction beneficial to investors, especially for projects with significant investment capital and sectors and fields that the province encourages investment. Besides, the Dong Nai province supports the unit managing and operating the high-voltage grid in preventing incidents. Similarly, Dong Nai should ensure the power grid works safely and continuously, serv economic development; to exploit and strongly develop solar power sources in Dong Nai, contributing to the protection of the environment and national resources. Besides, the asynchronous and modern development of infrastructure systems will promote economic growth, improve the economy’s productivity and efficiency, and solve social problems. In contrast, an underdeveloped infrastructure system is a significant hindrance to development. In many developing countries today, insufficient and weak infrastructure has caused stagnation in the rotation of resources, difficulty absorbing, and investment capital, causing “bottlenecks of infrastructure” that directly affect economic growth.

(8) Policy implication for Working and Living Environment (WLE). The Dong Nai province improves synchronously, implementing mechanisms, procedures, and solutions to develop human resources, especially high-quality human resources in significant branches and fields. Besides, Dong Nai enhances the quality of human resources associated with rapid labor structure transformation, especially in rural areas. Diversifying forms of labor supply-demand connection, effectively implementing the Labor Code. To adopt an appropriate mechanism to select, foster and appreciate talents, to build a contingent of intellectuals in the new era. Besides, the province continues improving the non-polluted living environment with a sound health system that investors are very concerned about developing human resources. Therefore, to improve the living environment to attract FDI investors, Dong Nai needs to resolutely not license projects with the risk of causing environmental pollution, focusing on improving the system’s quality. Health care system, improving the design of environmental sanitation, urban landscape and ensuring security and order in the investment area in particular and Dong Nai province in general. The Dong Nai province continues to build the cultural environment is about the values, norms of behavior, behavior, labor, organization, leadership, and social management that exist around us, often directly impacting each of them. We aim to establish a close relationship between people and humans to promote endogenous strength in society’s sustainable development. In that spirit, the XII Congress of the Party’s Resolution affirms that it must create the environment and conditions for personality, morality, intelligence, creative capacity, physical, soul, social responsibility, civic obligations, sense of law observance.

References

- Abdoulaye, O.B., Xie K., & Oji-Okoro I. (2014). Strategies and determinants of Foreign Direct Investment (FDI) attraction. International Journal of Management Science and Business Administration, 1(5), 81-89.

- Adams, A. (2018). Technology and the labor market: The assessment. Oxford Review of Economic Policy, 34(3), 349-361.

- Alvarado, R., Iñiguez, M., & Ponce, P. (2017). Foreign direct investment and economic growth in Latin America. Economic Analysis and Policy, 56(3), 176-187.

- Amanda, H. (2017). Regional determinants of foreign direct investment - A study of eastern China. Contemporary Economic Policy, 9(3), 336-346.

- Cronin, J.J., & Taylor, S.A. (1992). Measuring service quality: A reexamination and extension. Journal of Marketing, 56(3), 55-68.

- Donna, T.J.R. (2018). Conservation capital and sustainable economic growth. Environmental and Resource Economics, 6(4), 341-358.

- Elena, C.D. (2015). Promoting and attracting foreign direct investment. International Journal Of Economics And Finance Studies, 4(3), 13-19.

- Fereshteh, M.M. (2018). Assessment of factors affecting the foreign investment attraction in Iran. Baltic Journal of Real Estate Economics and Construction Management, 6(1), 193-200.

- Glenn, E.S. (2017). Human capital for sustainable economic development. The American Economic Review, 51(5), 1-12.

- Globerman, S., & Shapiro, D. (2012). Global foreign direct investment flows the role of governance infrastructure. World Development, 30(11), 1899-1919.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (2010). Multivariate data analysis with readings. US: Prentice-Hall: Upper Saddle River, NJ, USA.

- Hezron, M.O., & Pauline W.K. (2016). Role of foreign direct investment on technology transfer and economic growth in Kenya: A case of the energy sector. Journal of Innovation and Entrepreneurship, 5(31), 1-25.

- Isusic M.S.T., & Susic, M. (2019). Foreign direct investments and their impact on the economic development of Bosnia and Herzegovina. Materials Science and Engineering, 3(2), 1-16.

- José, J., & Campos, A. (2019). Background analytical study: Forests, inclusive and sustainable economic growth, and employment. United Nations Forum on Forests, 1(1), 1-52.

- KalIappana, S.R., Khamis, K.M., & Ismail, N.W. (2015). Determinants of services FDI inflows in Asian countries. International Journal of Economics and Management, 9(1), 45-69.

- Khorrami, F.S., & Fakhimi, A.S. (2017). The factors affecting the attraction of foreign investors in construction and development of industrial towns in east azerbaijan province. International Journal of Economics & Management Sciences, 6(5), 1-10.

- Lal, A.K. (2017). Foreign direct investment, trade openness, and GDP in China, India, and Mexico. The Singapore Economic Review, 62(5), 1059-1076.

- Manasa, K.H. (2015). FDI, Information technology and economic growth in the MENA region. Journal of International Economics, 33(1), 57-76.

- Michael A., Daniel, O., & Jacob, A. (2019). Analysis of the determinants of foreign direct investment in Ghana. Journal of Asian Business and Economic Studies, 26(1), 56-75.

- Michael G., & Serhiy, M. (2020). Regional development and foreign direct investment in transition countries: a case-study for regions in Ukraine. The Journal of post-communist economies, 32(6), 813-832.

- Nasa M.A., Yu, S., Bogachev., & Melnichuk, M.V. (2018). Identifying the factors that contribute to sustainable development of the national economy. European Research Studies Journal, 11(2), 411-425.

- Ngwen, N. (2017). Infrastructure factors of foreign direct investment attraction in developing countries. International Journal of Economics, Commerce and Management, United Kingdom, 4(12), 98-111.

- Nor, A.A.B., Siti, H.C.M., & Mukaramah, H. (2012). The impact of infrastructure on foreign direct investment: The case of Malaysia. Social and Behavioral Sciences, 65(1), 205-211.

- Parateg, C.O., & Uma, K.E. (2013). Effects of macroeconomic variables on foreign direct investment in a liberalized economy: The case of Nigeria. Journal of Economics and Finance, 1(4), 12-20.

- Sebastian, T. (2018). Determinants of foreign direct investment: A review. Review of Economics and Business Studies, 11(1), 165-196.