Research Article: 2021 Vol: 20 Issue: 3

Predicting Fraudulent Financial Statements Using Fraud Detection Models

Mousa Mohammad Abdullah Saleh, Al-Balqa Applied University

Mohammad Aladwan, University of Jordan

Omar Alsinglawi, University of Jordan

Mohammad Odeh Salem Almari, Al- Balqa Applied University

Abstract

The key purpose of the research is to provide scientific data on the association between fraud causes and false financial statements. The paper gave further insight into the applicability of Altman's z-score and Dechow f-score to the exposure of false financial statements by Jordanian industrial owners. The duration of research included the years from 2015 to 2019. The Dependent variable in the analysis was the false financial statement, while the separate fraud factors were financial security, external strain, financial priorities and the essence of the business. The analysis of the research takes a methodological model utilizing a multiple regression procedure to evaluate the theories of the study. The final findings of the analysis presented conclusive proof that Jordanian manufacturing firms were engaged in the conduct of false financial statements; while some of the triangle fraud variables were identified without any correlation with fraudulent financial reports; other factors were found to be strongly associated with fraud. As regards the accuracy of the fraud models, the findings of the analysis confirmed the validity and specificity of all the fraud detection models adopted in the study.

Keywords

F-score Model, Z-score Model, Fraud.

Introduction

Financial accounts are deemed the basic and ultimate result of accounting tasks and are often the main source of financial knowledge that benefits a wide range of users who have direct or indirect regulatory access to organizations such as administrators, lenders, auditors, supervisory bodies, government agencies and prospective buyers. According to the accounting technical structure, such financial statements can have good quality evidence that is valuable for decision-making. Qualifications of these data are required to satisfy the expectations of consumers by allowing them to make informed judgments on the basis of reliable, clear and sensitive data that are equally reflective of the real economic content.

In auditing and accounting literature, deception is known to be a conceiving term or an illegal procedure for disclosing financial facts, but this act is also unrecognizable only after a time of financial reporting. The Institute of Internal Auditors has claimed that fraud is any criminal act marked by deception, concealment or lack of confidence. Such activities shall be carried out by staff or management with a view to concealing or stealing capital, property or services; preventing fees, lack of services; or securing a personal or business advantage.

For many decades, fraud has gradually been recognised as a major concern to entities around the globe, according to many research studies by the Association of Certified Fraud Examiners (ACFE) fraud, fraud has risen considerably over the past 20 years and is expected to continue to grow in the future if entities refuse to develop successful prevention mechanisms to secure their investment (ACFE 2014, 2010 & 2012). The last great fraud cases in the world have addressed the question of how to uncover and avoid or at least minimize fraud. Detecting fraud in order to shield businesses from negative fraud impacts and to preserve the degree of market efficiency needed, many large fraud detection models have been established by academics to detect fraud; nearly all of these models have centered on calculating and evaluating financial ratios as an efficient way to detect fraud (Bai et al., 2008; Subramanyam & Wild, 2009; Dalnial et al., 2014). In the other side, several other scholars, such as Kaminski et al. (2004), identified limits on the use of financial ratios to identify fraud.

The approach of our research incorporates two of the most known mathematical models for fraud detection; the Dechow F-score and the Altman z-score models, each of which are considered to be most prominently tools for fraud detection methods. A variety of recent experiments have found these two models to be capable of revealing fraud of financial statements. Despite their utility in exposing financial statements abuse found by a variety of previous researchers in developing countries, the capabilities of the models have not yet been verified in deferentially less developed environments (Nwoye et al., 2013; Omar et al., 2014). Therefore, the originality of our research derives from its goal of offering further resources and further data that supports the potential of these models to identify fraud in developing markets such as Jordan. Generally, our research is intended to answer a significant theoretical problem in accounting and auditing, and its primary purpose is to investigate whether or not fraud occurs in the Jordanian sense.

The theoretical history and the evolution of the theory are presented in the second section of the analysis and the third part focuses on methods and data collection. The fourth section, Display Outcomes and Debate, and the final part, Observations and Suggestions.

Literature Review

Fraud Concept

Conceptually, fraud is deemed deliberate regardless of factual misstatement in the financial report. According to Asare (2006), while fraud does not have an exact legal definition, it can be described as “a circumstance in which an individual is unlawfully benefiting or deceiving property belonging to another with the purpose of permanently depriving the other person of that property”. Similarly, some have indicated that the word “fraud” is a deliberate act of lying or doing damage to others with the purpose of securing an unethical or illegal benefit (KPMG, 2016; ACFE, 2008).

Historically, the first statement on the definition of fraud relates to the work of Cressey's (1953), and Cressey points out that fraud is made up of three elements that are often present in the act of fraud, namely coercion, incentive and rationalization, and these three factors have been known as the triangle of fraud. According to Cressey's fraud triangle, these conditions are known to be risk factors that increase concern of fraud in different circumstances. The Cressey fraud model has traditionally been used as the most commonly known model for understanding why people commit fraud, and in addition, this model was a form of criminologist study centered on embezzlers – people he named “trust violators” (Cressey, 1953).

Fraud Detection Literature

Arguments about prevention or detection of fraud are not only the responsibility of internal and external auditors but a joint responsibility of all stakeholders inside and outside the entity. According to Centre for Audit Quality (CAQ, 2010) the rapid asset growth, increased cash needs and the requirements to raise external financing all raise the possibility of fraud and thus requires methods to overcome the problem.

A considerable amount of prior research on fraud particularly triangle factor revealed that financial statement fraud can be detected from some of the indications in companies’ financial statements (Dechow, 2011; Persons, 1995). Some studies stated that opportunity is one of the factors that mostly affect the financial statement fraud (Beasley, 1996; Beasley et al., 2000 & 2010; Hogan et al., 2008; Person, 2011). Only five proxies of the pressure factor and two proxies of the opportunity factor were effective in predicting and detecting financial statement fraud. Many of previous research on fraud prediction were aimed to determine the factors that can be used to predict fraud. Prior research includes testing fraud hypotheses by applying fraud detection model on earning management through employing financial ratios (Beasley, 1996; Dechow et al., 1996; Summers & Sweeny, 1998; Beneish, 1997 & 1999; Sharma, 2004; Lennox & Pittman, 2010; Feng et al., 2011; Perols & Lougee, 2011; Caskey & Hanlon, 2013; Armstrong et al., 2013; Markelevich & Ronser, 2013). Other studies also on fraud detection followed models that focus on accrual adjustment in order to identify violations of financial statements (DeAngelo, 1986; Friedlan, 1994; Jones, 1991; and Dechow et al., 2011).

Models on Fraud Detection, and Hypotheses Development

Developed models for the identification of fraud are commonly contained in a variety of previous studies; nearly all of these models based on the study of financial ratios for the discovery of fraud. These research ratios indicate that it is a good method for access to market loss and performance assessment (Green & Calderon, 1995; Green & Choi, 1997; Guan et al., 2007; Omoye & Eragbhe, 2014; Dalnial et al., 2014). Some scholars also proposed a series of financial ratios that may implicitly involve fraud; examples of such ratios, financial leverage, profitability, asset composition, and liquidity.

Several models that analyze financial loss and fraud identification using financial ratios have recently been developed by a variety of empirical researchers; many of these models have particularly tended to forecast various market occurrences such as fraud, earnings manipulation, earnings control and bankruptcy; samples of these models are: Beneish model, Jones model, Altman Z-Score model and Dechow F-score model (Jansen et al., 2012). In this article, we are attempting to use two of the most admired methods to identify fraud: The Altman Z-Score model and the Dechow F-score model. The following literature offers a description of the two versions.

Z-Score Model and F-Score Model

As mentioned above, fraud models are fundamentally focused on the usage of financial ratios for the identification of fraud. According to previous research, these ratios are commonly used and proposed to be a valuable method in market loss forecasting, fraud identification and success measurement (Green & Calderon, 1995; Green & Choi, 1997; Guan et al., 2007; People, 2011; Omoye & Eragbhe, 2014; Dalnial et al., 2014; Hung et al., 2017; Tapanjeh & Tarawneh, 2020).

The first model, the Z-Score model, was developed by Altman (1968) in order to provide insight to the probability of an institution going bankrupt within the next two years; the primary purpose of the system is also to analyze the financial stability of the entity. Several previous experiments have been performed to test the efficacy of this model, such as: Loebbecke et al. (1989) and Summers & Sweeney (1998); the findings of these studies have verified the consistency of this model in the identification of financial deficiencies believed to be one of the primary driving factors that encourage fraudulent behavior.

For example, a variety of authors have shown the consistency of the z-score model; Summers & Sweeney (1998) after updating the model found that estimated that 66 per cent of companies would go bankrupt, and 78 per cent of businesses would not go bankrupt a year ago. In a related report, Drábková (2014) analyzed five of the many statistical and quantitative models available for fraud detection; his findings revealed that the Altman and Beneish models were able to classify the financial stability of the chosen case sample.

The second distinguished model for fraud identification is the F-score model; this model was established by Dechow et al. (2011) to calculate the probability of identifying and forecasting material violations in the financial statements, the essence of this model is focused on the risk estimation of fraud indicators (Subramanyam & Wild, 2009). The importance of the Dechow model was also reinforced by a high number of quotes obtained from other models in this area. Several scholars have recently followed and evaluated certain variables of the Dechow model, the findings of which are empirically supported by the usage of this model (Cecchini et al., 2010; Lennox & Pittman 2010; Price III et al., 2011). The Price III et al. (2011) analysis firmly favored the Dechow model rather than the Beneish model on the grounds of the consistency of the two versions. Other previous research used the Dechow F-Score model and has showed that this model was successful in detecting fraud. As an example of analysis, Aghghaleh et al. (2016) observed that Dechow Model was successful in forecasting fraud and non-fraud firms with an average precision of 73.17% and 76.22%.

In the philosophy of fraud as indicated by Cressey, pressure is known to be a significant motivation for fraud. Financial pressure is one of the essential forms of pressure; this burden cause’s management behave in a number of unethical ways to meet the performance of the stockholders. Threat variables, such as financial stability, external stresses and financial targets, have traditionally been described as the most important determinants of fraud (Daniel & Hardika, 2015; Amin, 2018). Financial success metrics such as ROA (Return on Investment) and ROE (Return on Equity) typically reflect how big and efficient assets are used to operate the company's activities. Ge et al. (2007); Dechow (2011) concluded that there is a link between the profitability of the business and the degree of exploitation of the company; thus, management is more prone to override financial statements while the level of organizational financial performance is poo

In their claim, Wolfe & Hermanson (2004) concluded that the offenders of fraud would not commit fraud until all causes of fraud are available. Several reports have previously indicated that deception in the financial report may be identified by investigating the fraud triangle of signs contained in the company's financial statements (Dechow, 2011; Persons, 1995). In addition to financial distress, a variety of previous reports have shown that this incentive is indeed one of the important factors impacting the abuse in the financial statements (Beasley, 1996; Beasley et al., 2000; Person, 2005). Numerous research, such as Hernandez & Groot (2007) and Hogan (2008) have indicated a variety of fraud variables that may be used by criminals to participate in fraudulent practices, such as income identification, accounting forecasts, active business management credibility, fairness and ethics.

In addition to the pressure element, incentive is often proposed as the second main factor contributing to fraud in the financial statement (Cressey, 1953). Companies with poor internal controls seem to provide more ways for managers to alter financial statements. Beasley (2000) claimed that effective corporate governance structures can reduce the opportunity for deception in financial statements. Similarly, Farber (2005) claimed that corrupt companies typically have weak governance in the year previous to the discovery of fraud. Other Previous research conducted by Tiffani & Marfuah (2016); Sihombing & Rahardjo (2014) have reported that incentive is a critical source of financial statements fraud.

Centered on the literature previously mentioned, the hypotheses assumed in the present analysis are:

H1 There is a substantial association between the elements of fraud (Financial Stability) and false financial results for businesses that project a strong risk of bankruptcy.

H2 There is a substantial association between the elements of fraud (External Pressure) and false financial results for businesses that predict a high risk of bankruptcy.

H3 There is a substantial association between the elements of fraud (Financial Target) and false financial results for businesses that expect a high risk of bankruptcy.

H4 There is a substantial association between the elements of fraud (industry nature) and false financial results for businesses that predict a strong risk of bankruptcy.

H5 There is a substantial association between the elements of fraud (Financial Stability) and false financial results for businesses that project a low risk of bankruptcy.

H6 There is a substantial association between the elements of fraud (External Pressure) and false financial results for businesses that expect a low risk of bankruptcy.

H7 There is a substantial association between the elements of fraud (Financial Target) and false financial results for businesses that expect a low risk of bankruptcy.

H8 There is a substantial association between the elements of fraud (industry nature) and false financial results for businesses that project a low risk of bankruptcy.

Methodology

Sample and Data

The research sample consisted of manufacturing firms listed on the Amman Stock Exchange (ASE) for the years 2015-2019. The number of businesses sampled was 53. The data from the analysis is secondary data obtained from the annual reports released on (ASE). The overall number of financial results was 238, minus those that were not included in the research timeframe and that did not satisfy the criteria of the study. In order to achieve the goal of the report and to promote the review phase to be carried out in compliance with Altman z-score, we have divided the sampled financial statements into three groups; firstly, the financial statements of the companies predicted to experience financial loss, the second category, the financial statements of the companies which have no evidence of financial failure and, ultimately, the third group. Following the grouping of the sampled firms, the overall sample compromised 130 financial statements, split into 78 statements for companies that are likely to experience financial failures and 52 statements for companies with little evidence of financial fraud.

Methods

The research follows a comprehensive analytical approach by using the Altman z-score model in order to identify bankruptcies in firms and thereby to detect deception in financial statements. This model, in general, and according to its originator, Altman (1968), will accurately forecast the financial collapse of 95% of companies 1 year prior to their disappearance. Altman (1968) postulates that 2 years until insolvency, precision is decreased to 72% and 3 years to 52%. The Altman Z-score formula contains the following variables: (1) the proportion of inventory to sales; (2) the proportion of gross debt to total assets; (3) the proportion of net benefit to total assets; and (4) the sum of capital attributable to suffering (Z-score).

The current research applies the updated Altman z-score formula developed by Subramanyam & Wild (2009); and according to this model, bankruptcy (z-score) is determined on the basis of the following equation:

Z-score = 0.717 x1 + 0.847 x2 + 3.107 x3 + 0.420 x4 + 0.998 x5

Where the ratios in the model are: x1 = Working capital/Total assets, x2 = Retained earnings/Total assets, x3 = Earnings before interest and taxes/Total assets, x4 = Shareholders’ equity/Total liabilities, and x5 Sales/total assets.

Altman's updated model indicates that, if the outcome of z-score was above 2.9, the risk of business bankruptcy is too poor, whereas if z-score was accepted below 1.2, the bankruptcy of the company is high; but if the score was between 1.2 and 2.9, it is impossible and questionable to forecast bankruptcy.

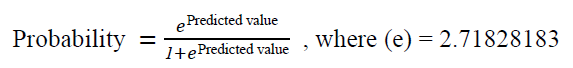

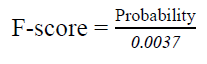

In addition to Altman's z-score analysis, Dechow f-score was used to analyze the distortion of fiancial statements. According to Dechow et al. 2011 model, if the F-Score result is less than 1 (<1), this suggests that there is no corruption in the company's financial statements; while if the F-Score is higher than 1 (>1), it is an indication of deception in the company's financial statements, however if F-Score is shown to be 1 (F-Score = 1) this implies that the company has the same probability of misstatement (the possibility of an event will end with certain results regardless of other conditions that may exist). If the F-score is greater than 1 (F-Score>1) than it may indicate a higher likelihood of error since the expected probability is higher than the unconditional probability. It can also mean that the company's financial records have been updated. The following equation describes the model of f-score:

F–score = –7.893 + (0.790 x RSST) + (2.518 x ΔREC) + (1.191 x ΔINV) + (1.979 x SOFTASSETS) + (0.171 x ΔCASHSALES) – (0.932 x ΔROA) + (1.029 * ISSUE).

Unconditional probability = 0.0037

Where, RSST is RSST Accruals, which refers to a metric used to calculate increases in current assets without including currency, used to remove changes in current liabilities and depreciation without including short-term debt. ΔREC is the difference in recei ables, which applies to adjustments in receivables estimated from the preceding year to the present year as determined by estimates of gross assets. ΔINV is a reduction of in entor , which applies to adjustments in inventories from the preceding year to the present year as calculated by estimates of gross stocks. SOFTASSETS is a soft asset that corresponds to a formula that determines net assets minus the amount of the EPP and cash equivalents as determined by the averages of total assets. ΔCASHSALES is a difference in cash sales that applies to a calculation presented as a percentage change of cash sales from the preceding ear to the current ear. ΔROA is a ariation in ROA that applies to a calculation that is calculated as a proportion of net earnings for the division of total assets in the prior year, and is less than the same measure in the current year. Problem is the real stock issue calculated by the dummy indicator. By law, it is always 1, whenever new shares are introduced during the handling year. However, if no protection is included, the value is 0; Table 1 represents the calculation for f-score independent variables

| Table 1 Calculation for F-Score Independent Variables | |

| Variables | Calculation |

| RSST | = ΔWC + ΔNCO + ΔFIN) /Average total assets where WC = [Current Assets– Cash and Short-term Investments] – [Current Liabilities – Debt in Current Liabilities] NCO = [Total Assets – Current Assets – Investments and Advances] – [Total Liabilities – Current Liabilities –Long-term Debt] FIN=[Short-term Investments +Long-term Investments]–[Long-term Debt + Debt in Current Liabilities + Preferred Stock] |

| Δ REC | =? Accounts Receivable ÷ Average total assets |

| Δ INV | = Inventory ÷ Average total assets |

| SOFTASSETS | = [Total Assets – PP&E – Cash and Cash Equivalent] ÷ Total Assets |

| Δ CS | = [Sales – Δ Accounts Receivable] |

| Δ ROA | =[Earnings t ÷ Average total assets t ] – [Earnings t-1 ÷ Average total assets t-1] |

| ISSUE | An indicator variable coded 1 if the firm issued securities during year t, if not coded 0. |

In order to specify and distiguish between fraudlent companies and non-fraudlent ones and prior conducting f-score test, dummy variables were used to examine financial statement for every year, if the F-value for specific financial statement is found <1 then the company is categorized as fraudlent company while if the value found>1 then this statement is marked as fraudlent statement.

Results and Discussion

Findings and Discussion

Until analyzing and explaining the regression findings, a systematic analysis was performed to screen the amount and ratios of financial statements among all organizations that are expected to have financial failures (fraudulent financial statements) and those that are expected to be free from fraudulent financial statements. The findings in Table 2 reveal that the overall amount of businesses with unexpected financial failures was 52. 14 businesses with a percentage (26.9 per cent) of false financial statements and 38 companies with a percentage (73.1 per cent) tend to be exempt from fraudulent financial statements. As for the second group; the companies which do not have a financial loss, the findings shown in Table 2 indicate that the total number of these companies was 78. The findings of this group's false financial statements reveal that 53 (67.9 per cent) businesses had no indicators of wrongdoing, while 25 (32.1 percent) corporations tend to have fraudulent financial statements. It emerges from previous results that businesses with expected loss are more likely to be implicated in false financial statements.

| Table 2 Frequency for Dependent Variable Financial Statement Fraud | |||

| Dependent variable | Frequency | Percent | |

| Financial statement for companies that are predicted to not bankrupt (z-score more than 2.9) | Fraudulent financial statements | 14 | 26.9% |

| Non- Fraudulent financial statements | 38 | 73.1% | |

| Total | 52 | 100% | |

| Financial statement for companies that are predicted to bankrupt (z-score less than 1.2) | Fraudulent financial statements | 25 | 32.1% |

| Non- Fraudulent financial statements | 53 | 67.9% | |

| Total | 78 | 100% | |

Multiple Regression Results Discussion

Until explaining the independent variable regression findings, it should be remembered that the multicollinearity was checked between the independent variables for the two sampled classes of firms. The findings of the correlation provided in Table 3 indicated a strong correlation between the return on assets (ROA) and the return on equity (ROE). For the first category of businesses (z-score higher than 2.9) the outcome was 0.931, which is above 0.8 the appropriate multi-collinearity ratio (Hair et al., 2010). Despite this finding, no problems will occur while the regression is carried out, since these two variables will be included independently in the logistic regression when calculating the financial goal. As for the second category of companies with (z-score less than 1.2), the findings in Table 4 indicates that all the association results are below 0.8, so no multi-collinearity is predicted between the independent variables.

| Table 3 Correlation Between Independent Variables for Companies That Have Z-Score more than 2.9 | |||||||

| Change in total assets | Total assets turnover | Leverage ratio | Return on assets ratio (ROA) | Return on shareholders’ equity ratio (ROE) | Account Receivables to net sales ratio | Inventory change ratio | |

| Change in total assets | 1 | ||||||

| Total assets turnover | 0.415** | 1 | |||||

| Leverage ratio | 0.521** | 0.669** | 1 | ||||

| Return on assets ratio (ROA) | 0.743** | 0.455** | 0.418** | 1 | |||

| Return on shareholders’ equity ratio (ROE) | 0.697** | 0.485** | 0.477** | 0.931** | 1 | ||

| Account Receivables to net sales ratio | 0.215 | -0.136- | 0.184 | -0.016- | -0.047- | 1 | |

| inventory change ratio | 0.299** | 0.017 | 0.179 | 0.305 | 0.211 | -0.049- | 1 |

** Correlation is significant at the 0.01 level (2-tailed)

| Table 4 Correlation Between Independent Variables for Companies that Have Z-Score less than 1.2 | |||||||

| Change in total assets | Total assets turnover | leverage ratio | Return on assets ratio (ROA) | Return on shareholders’ equity ratio (ROE) | Account Receivables to net sales ratio | Inventory change ratio | |

| Change in total assets | 1 | ||||||

| Total assets turnover | 0.319* | 1 | |||||

| Leverage ratio | -0.150- | 0.006 | 1 | ||||

| Return on assets ratio (ROA) | 0.638** | 0.225** | -0.209- | 1 | |||

| Return on shareholders’ equity ratio (ROE) | 0.188 | -0.113- | -0.216- | 0.391** | 1 | ||

| Account Receivables to net sales ratio | 0.163 | -0.427-** | 0.339** | -0.219- | 0.071 | 1 | |

| Inventory change ratio | 0.612** | 0.473** | 0.013 | 0.382** | 0.111 | 0.036 | 1 |

Similar to previous models of financial loss, multiple regression models have been set with independent proxy-based variables in order to assign the better suited one. Previous research used ROA to catch the burden element as a motivator of financial crime, while other studies used ROE instead of ROA. And in order to find the required model independent variables have been introduced into the regression separately, the pressure factor reflecting the financial goal will be checked twice with ROA and twice with ROE. To be sure, the strongest metric that reflects financial stability is the shift in gross assets and the total loss in assets used to calculate financial stability. As for the essence of the business as an indicator of opportunity, two indicators tested the receivables' net revenue ratio and the inventory transition ratio. Previous research agreed that the leverage ratio is the strongest predictor for the external pressure factor; thus, this ratio would be included on an ongoing basis in all regression models. Based on the previous topic 8 models is constructed with four pressure variables, i.e. financial goal, financial stability, external pressure and the design of the market, the 8 fitness models would be tested using Hosmer and Lemeshow's Goodness of Fit, where the model is measured by fitness if its sig is greater than 0.05 and the better fitted model is the one with the lowest.

Table 5 displays the findings of the preliminary regression study for the 8 model for businesses with no evidence of financial loss (z-score higher than 2.9), according to the table, the results of Hosmer and Lemeshow's Goodness of Fitness.

| Table 5 Comparison Between 8 Models for Companies that have Z-Score more than 2.9 | ||||||||||

| Fraud elements | Motivators | Proxies | Model 1 |

Model 2 |

Model 3 |

Model 4 |

Model 5 |

Model 6 |

Model 7 |

Model 8 |

| Pressure | Financial stability | change in total assets | × | × | × | × | ||||

| total assets turnover | × | × | × | × | ||||||

| External pressure | leverage ratio | × | × | × | × | × | × | × | × | |

| Financial target | return on assets (ROA) | × | × | × | × | |||||

| return on equity (ROE) | × | × | × | × | ||||||

| Opportunity | Nature of industry | Account Receivables to net sales ratio | × | × | × | × | ||||

| inventory change ratio | × | × | × | × | ||||||

| Hosmer and Lemeshow's Goodness of Fit(sig.) | 0.227 | 0.519 | 0.048 | 0.069 | 0.592 | 0.833 | 0.469 | 0.922 | ||

| -2 Log Likelihood | 57.10 | 36.90 | ------- | ------- | 31.18 | 51.16 | 58.33 | 46.44 | ||

| Cox & Snell R Square | 0.177 | 0.388 | ------- | ------- | 0.465 | 0.308 | 0.155 | 0.279 | ||

We find that 6 out of 8 models are acceptable and fit except for 3 & 4 models, because their meaning is less than 0.05, and thus they will be omitted from the appropriate models. In the same graph, Model 5 tends to be the better fitted model out of sex variants; Model 5-2 Log Probability was the lowest with a ranking of 31.18 per cent. This finding means that Model 5 will justify adjustments in dependent variables according to Hosmer and Lemeshow's Goodness of Fit by 59.2 per cent, whereas the same model describes changes in dependent variables by 46.5 per cent according to Cox & Snell R Square. As a result, Model 5 is the most suitable regression model for evaluating businesses that have no indication of financial loss.

Table 6 shows the findings of the measure of health of the 8 model for businesses who have an indication of financial loss (z-score less than 1.2). The findings in Table 6 defined the configured models and the suitable model, first Hosmer and Lemeshow's Goodness of Fit proves that all models were fit with a score above 0.05; second, the best fitting model was Model 6 with a-2 Log Probability score of 72.15 per cent. This finding implies that Model 6 describes the changes in dependent variables according to Hosmer and Lemeshow's Goodness of Fit by 86.1 per cent, and the same model was also the highest model to explain changes in dependent variables by 22.4 per cent according to the Cox & Snell R Square ranking. As a consequence, Model 6 is the best regression model to be applied to the analysis of firms with signs of financial loss.

| Table 6 Comparison Between 8 Models for Companies that have Z-Score less than 1.2 | ||||||||||

| Fraud elements | Motivators | Proxies | Model 1 |

Model 2 |

Model 3 |

Model 4 |

Model 5 |

Model 6 |

Model 7 |

Model 8 |

| Pressure | Financial stability | change in total assets | × | × | × | × | ||||

| total assets turnover | × | × | × | × | ||||||

| External pressure | leverage ratio | × | × | × | × | × | × | × | × | |

| Financial target | return on assets (ROA) | × | × | × | × | |||||

| return on equity (ROE) | × | × | × | × | ||||||

| Opportunity | Nature of industry | Account Receivables to net sales ratio | × | × | × | × | ||||

| inventory change ratio | × | × | × | × | ||||||

| Hosmer and Lemeshow's Goodness of Fit(sig.) | 0.718 | 0.210 | 0.685 | 0.595 | 0.312 | 0.861 | 0.419 | 0.779 | ||

| -2 Log Likelihood | 78.11 | 80.99 | 84.38 | 80.33 | 79.47 | 72.15 | 76.02 | 75.96 | ||

| Cox & Snell R Square | 0.113 | 0.161 | 0.155 | 0.138 | 0.179 | 0.224 | 0.119 | 0.171 | ||

Taken together, the findings of Tables 5 & 6 indicate that factors, net revenue ratio receivables, equity returns, gross asset turnover and debt ratio are the best predictors of fraud for both classes of firms.

Depending on the two previously selected models for each category of companies and for further analysis of abuse in the Jordanian company's financial statements, the two models were implemented separately, it is worth noting that Model 5 was chosen for companies with a z-score value of more than 2.9 and Model 6 for companies with a z-score value of less than 1.2. Tables (7, 8, 9, and 10) display the regression findings for both versions. Tables 7 and 8 reflect the consistency of Model 5 for the identification of false financial statements by implementing the Dechow et al. (2011) F-score model for businesses that are likely to participate in financial statements fraud. The findings in Table 7 reveal that the total number of businesses are 52 classified into two categories, 14 companies that are expected to execute false financial statements and 38 companies with no proof of fraudulent financial statements; in the same table it shows that the average percentage of accuracy of Model 6 was 86.3 per cent; in comparison, the accuracy of the model for Non-Fraudulent Entities was 89.4 per cent.

| Table 7 Classification Table for Model Number 5 for Companies that have Z-Score more than 2.9 | ||||

| Observed | Predicted | |||

| Financial Statement Fraud | Percentage Correct | |||

| Non-Fraudulent Firms | Fraudulent Firms | |||

| Financial Statement Fraud | Non-Fraudulent Firms (38) |

34 | 4 | 89.4 |

| Fraudulent Firms (14) |

3 | 11 | 78.5 | |

| Overall Percentage | 86.3 | |||

| Table 8 Logistic Regression Result for Model (5) – The Companies that have Z-Score more than 2.9 | ||||||

| B Coefficients | S.E. | EXP(B) | Significance | |||

| Pressure | Financial stability | Total assets turnover | 6.639 | 2.115 | 860.444 | 0.000** |

| External pressure | Leverage ratio | -13.217 | 10.711 | 0.000 | 0.372 | |

| Financial target | Return on equity (ROE) | -1.967 | 5.287 | 0.183 | 0.591 | |

| Opportunity | Nature of industry | Account receivables to net sales ratio | -12.057 | 6.331 | 14370.669 | 0.002** |

| Table 9 Classification Table for Model Number 6 for Companies that have Z-Score less than 1.2 | ||||

| Observed | Predicted | |||

| Financial Statement Fraud | Percentage Correct | |||

| Non-Fraudulent Firms | Fraudulent Firms | |||

| Financial Statement Fraud | Non-Fraudulent Firms (53) | 48 | 5 | 90.5 |

| Fraudulent Firms (25) | 13 | 12 | 52.0 | |

| Overall Percentage | 81.3 | |||

| Table 10 Logistic Regression Result for Model (6) – the Companies that have Z-Score less than 1.2 | ||||||

| B Coefficients | S.E. | EXP(B) | Significance | |||

| Pressure | Financial stability | Total assets turnover | 3.399 | 0.865 | 7.433 | 0.001** |

| External pressure | Leverage ratio | 5.104 | 1.022 | 63.845 | 0.000** | |

| Financial target | Return on Assets (ROA) | 3.720 | 1.412 | 113.003 | 0.279 | |

| Opportunity | Nature of industry | Inventory Change Ratio | 0.764 | 0.834 | 1.210 | 0.304 |

| Table 11 Hypotheses Decisions | |||||||

| Hypothesis | Fraud factor | Measures | Coef. | EXP(B) | Sig | Decision | |

| H1 | Pressures | Financial stability | Total assets turnover | 6.639 | 860.444 | 0.000** | Accepted |

| H2 | External pressure | Leverage ratio | -13.217 | 0.000 | 0.372 | Rejected | |

| H3 | Financial target | Return on equity (ROE) | -1.967 | 0.183 | 0.591 | Rejected | |

| H4 | Opportunity | Nature of industry | Account receivables to net sales ratio | -12.057 | 14370.669 | 0.002** | Accepted |

| H5 | Pressures | Financial stability | Total assets turnover | 3.399 | 7.433 | 0.001** | Accepted |

| H6 | External pressure | Leverage ratio | 5.104 | 63.845 | 0.000** | Accepted | |

| H7 | Financial target | Return on Assets (ROA) | 3.720 | 113.003 | 0.279 | Rejected | |

| H8 | Opportunity | Nature of industry | Inventory Change Ratio | 0.764 | 1.210 | 0.304 | Rejected |

Table 8 indicates the consistency of the effects of Model 5 in estimating the extent of the scam, as seen in Table 8. Both the gross assets turnover and the net asset receivables ratio are strongly associated with the financial statements fraud. According to these results, the risk of fraud by this category of firms is increased by approximately 860 times if the gross assets turnover rises by one degree; additionally, the likelihood of fraud is increased by 14370 when the net assets ratio of the accounts receivables declines by one degree. As a result, we assume that both the financial resilience measured by the overall turnover of inventory and the nature of the business measured by the ratio of accounts receivables to net assets are good fraud estimators for businesses that have expected no signs of fraud. The same findings in Table 8 also show that, whilst the model variable chosen is; the leverage ratio and the return on equity have proven fit to uncover fraud in the selection of the best fitting model; yet interestingly, they have not been able to create a connection between external pressure and the financial target and the fraudulent financial statement for this category of businesses.

Tables 9 & 10 demonstrate the regression results for Model 6 that had previously been chosen as the best suited model for forecasting fraud for the second category of companies with (z-score less than 1.2). The findings in Table 9 reveal that the total number of firms was 78 classified into two categories, 25 of which expected fraudulent financial statements and 53 of which there were no signs of fraudulent financial statements. The findings of the same table reveal that the average percentage accuracy of Model 5 was 81.3 per cent; in comparison, the accuracy of the Model for Non-Fraudulent Firms was 90.5 per cent, while the accuracy for Fraudulent Firms was 52 per cent.

Table 10 sets out the precision of the effects of Model 6 in estimating the scale of the scam, as seen in Table 10, which indicates that both the overall assets turnover and the debt ratio are strongly positive compared with the financial statements fraud. According to these figures, the risk of fraud by this category of firms is increased by approximately 7.4 times if the overall assets turnover is increased by one degree; additionally, the likelihood of fraud is increased by approximately 63.8 times the overall ratio by one degree. As a consequence, we assume that both the financial stability measured by total asset turnover and the external pressure measured by the leverage ratio are good fraud estimators for businesses forecasting fraud. The same findings in Table 10 also indicate that the other model variable selected; asset returns and inventory shift ratios that are expected to be acceptable for fraud exposure when selecting Model 6; find to be negligible for this category of companies concerned with false financial statements; thus, the financial target and existence of the sector are omitted as fraud estimators.

Overall, our findings indicate that Jordanian industrial firms are partly engaged in the conduct of false financial statements; according to the results of the analysis, while certain of the fraud triangle causes have not been shown to be consistent with fraudulent financial reports; other factors have been found to be strongly correlated with fraud; thus, the study decisions pre-assumed the hypothesis. As regards the consistency of the fraud models, the thorough findings ensured the efficacy and accuracy of all the fraud detection models adopted in the study; the Altman z-score model was found to be very helpful in the disclosure of the bankruptcy of the organization and hence the fraud factors. Likewise, the F-score model has already been shown to be important in identifying fraud variables and hence highly appreciated in identifying false financial statements.

Conclusion

This thesis was an effort to add to accounting literature by investigating the connection between fraud causes and false financial statements. The research also sought to provide further information into the applicability of Altman's z-score and Dechow f-score to the exposure of false financial statements by Jordanian industrial owners. Fraudulent financial statements have been used as the dependent variable of the analysis while the factors of fraud, including financial performance, external pressure, financial priorities and the existence of the business, have been used as independent variables. The research technique adopted a quantitative framework utilizing a multiple regression procedure to evaluate the eight pre-assumed study hypotheses.

The final findings of the report presented clear proof that Jordanian manufacturing firms are commonly engaged in illegal financial practices. The detailed findings of the analysis showed mixed results about the association between fraud triangle variables and fraudulent financial reports; for example, in the first regression model for businesses with forecasted fraudulent financial statements, financial stability and the existence of the business are the only fraud factors that appear to be linked to fraudulent financial statements. For the second category of businesses with non-fraudulent financial statements, the regression findings have only demonstrated that financial health and external pressure are only major fraud causes.

As regards the consistency of the used fraud models, the findings of the analysis verified the validity and accuracy of all the fraud detection models used in the study; the Altman z-score model was found to be very helpful in the disclosure of the bankruptcy of the organization and hence the fraud factors. Likewise, the F-score model has already been shown to be important in resolving fraud causes and in identifying false financial statements.

The findings of the thesis will have distinguished consequences for the functional advantages of studying the applicability of fraud detection models:

• Stock information offers valuable information to businesses, private customers, the general public, the government and analysts, which is useful for analyzing financial reports and is a mechanism to expose some doubtful misstatement of financial results. The omission of such knowledge to the public, on the other side, raises confusion in decision-making.

• Generally, fraud identification models can be implemented as a substantial means of revealing the compilation of financial results and preventing the management and compliance of the accounting officer's adherence to acceptable accounting standards.

Limitations, Recommendations and Future Research

The report reveals certain drawbacks that did not, however, impact the outcome of the analysis. One drawback concerns the shortage of details for a variety of listed firms. The second restriction referred to the analysis sample; while the amount of studies covered five years with 130 observations, this number in some testing settings is deemed too limited to generalize the results.

As far as suggestions and future studies are concerned, the results of the analysis propose many courses of action for investors, businesses, decision makers and academics:

1. Constant usage of the fraud identification model to investigate all new suspicious conduct. 2. Hire such discrete factors such as personal financial needs as personal opportunities and corporate framework. 3. Divide the pressure factor into internal and external pressure. 4. Focus further on the third aspect of the triangle of fraud, which is rationalization; and follow another new factor of fraud, such as that implied by the diamond principle.

References

- ACFE. (2008). Report to the nation on occupational fraud and abuse. Austin, Texas: Association of Certified FraudExaminers Austin, TX.

- ACFE. (2010). Report to the nation on occupational fraud and abuse. Austin, Texas: Association of Certified FraudExaminers Austin, TX.

- ACFE. (2012). Report to the nation on occupational fraud and abuse. Austin, Texas: Association of Certified FraudExaminers Austin, TX.

- ACFE. (2014). Report to the nation on occupational fraud and abuse. Austin, Texas: Association of Certified FraudExaminers Austin, TX.

- Aghghaleh, S.F., Mohamed, Z.M., & Rahmat, M.M. (2016). Detecting financial statement frauds in Malaysia: comparing the abilities of beneish and dechow models. Asian Journal of Accounting and Governance, 7, 57-65.

- Altman, E.I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589-609.

- Amin, M.N. (2018). Fraud detection of financial statement by using fraud diamond perspective. International Journal of Development and Sustainability, 7(2), 878-891.

- Armstrong, C.S., Larcker, D.F., Ormazabal, G., & Taylor, D.J. (2013). The relation between equity incentives and misreporting: The role of risk-taking incentives. Journal of Financial Economics, 109(2), 327-350.

- Asare, T. 2006. Beating occupational fraud through awareness and prevention: African foundation building capacity.

- Bai, B., Yen, J., & Yang, X. (2008). False financial statements: Characteristics of China’s listed companies and CART detecting approach. International Journal of Information Technology & Decision Making, 7(2), 339-359.

- Beasley, M.S. (1996). An empirical analysis of the relation between the board of director composition and financial statement fraud. Accounting Review, 443-465.

- Beasley, M.S., Carcello, J.V., Hermanson, D.R., & Lapides, P.D. (2000). Fraudulent financial reporting: Consideration of industry traits and corporate governance mechanisms. Accounting Horizons, 14(4), 441-454.

- Beasley, M.S., Hermanson, D.R., Carcello, J.V., & Neal, T.L. (2010). Fraudulent financial reporting: 1998-2007: An analysis of US public companies.

- Beneish, M. (1997). Detecting GAAP violation: Implications for assessing earnings manage - ment among firms with extreme financial performance. Journal of Accounting and Public Policy, 16(3), 271-309.

- Beneish, M.D. (1999). Incentives and penalties related to earnings overstatements that violate GAAP. The Accounting Review, 74(4), 425-457.

- Caskey, J., & Hanlon, M. (2013). Dividend policy at firms accused of accounting fraud. Contemporary Accounting Research, 30(2), 818-850.

- Cecchini, M., Aytug, H., Koehler, G.J., & Pathak, P. (2010). Detecting management fraud in public companies. Management Science, 56(7), 1146-1160.

- CAQ: Centre for Audit Quality. (2010). Deterring and detecting financial reporting fraud: A platform for action. Retrieved from: https://www.thecaq.org/deterring-and-detecting-financial-reporting-fraud/

- Cressey, D.R. (1953). Other people's money. A study of the social psychology of embezzlement.

- Dalnial, H., Kamaluddin, A., Sanusi, Z.M., & Khairuddin, K.S. (2014). Detecting fraudulent financial reporting through financial statement analysis. Journal of AdvancedManagement Science, 2(1).

- Dani, R.M., Dickson, P.P., Sembilan, N., Ismail, W.A.W., & Kamarudin, K.A. (2013). Can financial ratios explain the occurrence of fraudulent financial statements?. Paper presented at the 5th International Conference on Financial Criminology (ICFC): Global Trends in Financial Crimes in the New Economies.

- Daniel, T., & Hardika, L. (2015). Analysis of factors that influence financial statement fraud in the perspective fraud diamond: Empirical study on banking companies listed on the Indonesia stock exchange year 2012 to 2014”, International Conference on Accounting Studies (ICAS) 2015, pp. 17-20.

- DeAngelo, L.E. (1986). Accounting numbers as market valuation substitutes: A study of management buyouts of public stockholders. Accounting Review, 61(3), 400-420.

- Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1996). Causes and consequences of earnings manipulation: An analysis of firms subject to enforcement actions by the SEC. Contemporary Accounting Research, 13(1), 1-36.

- Dechow, P.M., Ge, W., Larson, C.R., & Sloan, R.G. (2011). Predicting material accounting misstatements. Contemporary Accounting Research, 28(1), 17-82.

- Drábková, Z. (2014). Possibilities of identifying manipulated financial statements. In The International Scientific Conference INPROFORUM, ?eské Bud?jovice.

- Erickson, M., Hanlon, M., & Maydew, E.L. (2006). Is there a link between executive equity incentives and accounting fraud?. Journal of Accounting Research, 44(1), 113-143.

- Farber, D.B. (2005). Restoring trust after fraud: Does corporate governance matter?. The Accounting Review, 80(2), 539-561.

- Feng, M., Ge, W., Luo, S., & Shevlin, T. (2011). Why do CFOs become involved in material accounting manipulations?. Journal of Accounting and Economics, 51(1-2), 21-36.

- Friedlan, J.M. (1994). Accounting choices of issuers of initial public offerings. Contemporary Accounting Research, 11(1), 1-31.

- Ge, W., Larson, C., & Sloan, R. (2007). Predicting material accounting manipulations. Working paper, University of California, Berkley, University of Washington, University of Michigan, and Barclays Global Investors.

- Green, B.P., & Calderon, T.G. (1995). Analytical procedures and auditors’ capacity to detect management fraud. Accounting Enquirie, 5(1), 1-48.

- Green, B.P., & Choi, J.H. (1997). Assessing the risk of management fraud through neural network technology. Auditing-A Journal Of Practice & Theory, 16(1), 14-28.

- Guan, L., Kaminski, K.A., & Wetzel, T.S. (2007). Can investors detect fraud using financial statements: An exploratory study. Advances in Public Interest Accounting, 13, 17-34.

- Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2010). Multivariate data analysis. Pearson, Vectors, NJ.

- Hernandez, J.R., & Groot, T.L.C.M. (2007). How trust underpins auditor fraud risk assessments. ARCA, Amsterdam Research Center in Accounting.

- Hogan, C.E., Rezaee, Z., Riley Jr, R.A., & Velury, U.K. (2008). Financial statement fraud: Insights from the academic literature. Auditing: A Journal of Practice & Theory, 27(2), 231-252.

- Hung, D.N., Ha, H.T.V., & Binh, D.T. (2017). Application of F-Score in predicting fraud, errors: Experimental research in Vietnam. International Journal of Accounting and Financial Reporting, 7(2), 303.

- Jansen, I.P., Ramnath, S., & Yohn, T.L. (2012). A diagnostic for earnings management using changes in asset turnover and profit margin. Contemporary Accounting Research, 29(1), 221-251.

- Jones, J. J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193-228.

- Kaminski, K.A., Wetzel, T.S., & Guan, L. (2004). Can financial ratios detect fraudulent financial reporting? ManagerialAuditing Journal, 19(1), 15-28.

- Kanapickien?, R., & Grundien?, ?. (2015). The model of fraud detection in financial statements by means of financial ratios. Procedia-Social and Behavioral Science, 213, 321-327.

- KPMG. (2016). Global profiles of fraudster: Technology enables and weak controls fuel the fraud. KPMG International.

- Kusumawardhani, P., & Kusumaningtias, R. (2013). Detection of financial statement fraud with fraud triangle analysis on banking companies listed on the IDX. Journal of Educational Technology Students, 1 (3).

- Lennox, C., & Pittman, J.A. (2010). Big five audits and accounting fraud. Contemporary Accounting Research, 27(1), 209-247.

- Loebbecke, J.K., Eining, M.M., & Willingham, J.J. (1989). Auditors experience with material irregularities-frequency, nature, and detectability. Auditing-A Journal of Practice & Theory, 9(1), 1-28.

- Markelevich, A., & Rosner, R.L. (2013). Auditor fees and fraud firms. Contemporary Accounting Research, 30(4), 1590-1625.

- Nia, S.H. (2015). Financial ratios between fraudulent and non-fraudulent firms: Evidence from Tehran Stock Exchange. Journal of Accounting and Taxation, 7(3), 38-44.

- Nwoye, D., Okoye, E.I., & Oraka, A.O. (2013). Beneish model as effective complement to the application of SAS No. 99 in the conduct of audit in Nigeria. Management and Administrative Sciences Review, 2(6), 640-655.

- Omar, N., Koya, R.K., Sanusi, Z.M., & Shafie, N.A. (2014). Financial statement fraud: A case examination using Beneish Model and ratio analysis. International Journal of Trade, Economics and Finance, 5(2), 184.

- Omoye, A.S., & Eragbhe, E. (2014). Accounting ratios and false financial statements detection: evidence from Nigerian quoted companies. International Journal of Business and Social Science, 5(7), 206-215.

- Perols, J.L., & Lougee, B.A. (2011). The relation between earnings management and financial statement fraud. Advances in Accounting, 27(1), 39-53.

- Persons, O.S. (1995). Using financial statement data to identify factors associated with fraudulent financial reporting. Journal of Applied Business Research (JABR), 11(3), 38-46.

- Price III, R.A., Sharp, N.Y., & Wood, D.A. (2011). Detecting and predicting accounting irregularities: A comparison of commercial and academic risk measures. Accounting Horizons, 25(4), 755-780.

- Sharma, V.D. (2004). Board of director characteristics, institutional ownership, and fraud: Evidence from Australia. Auditing: A Journal of Practice & Theory, 23(2), 105-117.

- Sihombing, K.S., & Rahardjo, S.N. (2014). Fraud diamond analysis in detecting financial statement fraud: an empirical study of manufacturing companies listed on the Indonesia Stock Exchange (BEI) 2010-2012. Unpublished doctoral dissertation, Faculty of Economics and Business.

- Subramanyam, K., & Wild, J.J. (2009). Financial statement analysis. 10th edition. New York: McGraw Hill.

- Summers, S.L., & Sweeney, J.T. (1998). Fraudulently misstated financial statements and insider trading: An empirical analysis. Accounting Review, 131-146.

- Tapanjeh, A.M.A., & Tarawneh, A.R.A. (2020). Applicability of forensic accounting to reduce fraud and its effects on financial statement of jordanian shareholding companies from the perspective of judiciary and certified public accountant. International Journal of Financial Research, 11(2).

- Tiffani, L., & Marfuah, M. (2016). Fraud detection financial reports analysis of the fraud triangle in manufacturing companies listed on the indonesian stock exchange. Indonesian Journal of Accounting and Auditing, 19(2), 112-125.

- Wolfe, D.T., & Hermanson, D.R. (2004). The fraud diamond: Considering the four elements of fraud.