Research Article: 2022 Vol: 21 Issue: 6

Predicting Strategic Management Tools and Techniques Usage Using Number of Trainings Undertaken by Estate Surveyors and Valuers in Lagos, Nigeria: Machine Learning Approach

Adebayo A. Oletubo, Covenant University

Chukwuemeka O. Iroham, Covenant University

Mayowa O. Ajibola, Covenant University

Hilary I. Okagbue, Covenant University

Citation Information: Oletubo, A.A., Iroham, C.O., Ajibola, M.O., & Okagbue, H.I. (2022). Predicting strategic management tools and techniques' usage using number of trainings undertaken by estate surveyors and valuers in Lagos, Nigeria: machine learning approach. Academy of Strategic Management Journal, 21(5), 1-8.

Abstract

Strategic management is needed to ensure long term viability and sustainability of firms and can be applied using strategic management tools and techniques (SMTTs). The application of SMTTs by estate surveying and valuation firms (ESVFs) is rarely discussed despite the importance of strategic management. This paper found no relationship between the number of training (NOT) and SMTTs' usage. Questionnaire was used as an object of data collection, and purposive sampling was used while the respondents were 189 Estate Surveyors and Valuers (ESVs) in ESVFs in Lagos, Nigeria. Furthermore, SMTTs and NOT are not normally distributed. NOT was used to predict SMTTs using eight data mining models. Random forest performed best while neural network was the least using mean square error (MSE), root mean square error (RMSE), mean absolute error (MAE), and coefficient of determination (R2) as model evaluation metrics. Awareness of the importance of SMTTs is urgently needed and strategic management should be incorporated into the various training modules undertaken by ESVs.

Keywords

Correlation, Data Mining, Machine Learning, Property Valuation, Random Forest, Real Estate Appraisal, Statistics, Strategic Management, Strategy.

Introduction

Strategic management in this context, involves the careful formulation, implementation, and evaluation of the major measurable and achievable goals and policies taken by partner(s) or top management staff of estate surveying and valuation firms (ESVFs) based on the consideration of resources, quantitative and qualitative assessments of the internal and external environments in which the firms operate. Strategic management process ensures that stated objectives are achieved using the needed resources (factors of production). Strategic management in real estate appraisal or property valuation is rarely discussed.

The aim of this paper is to predict the usage of strategic management tools and techniques using the number of training undertaken by Estate Surveyors and Valuers (ESVs) in Lagos, Nigeria. Strategic management tools and techniques (SMTTs) are a collection of business strategies that organizations can use to implement their plans and achieve a sustained competitive advantage. Researchers have developed some SMTTs, which are somewhat related but distinct to address unique aspects of strategy crafting, planning, implementation and evaluation. The choice of the use of SMTTs depends on the nature of the strategy, timeline, organizational strengths and weaknesses, and organizational structure of the firm. Several of the most widely used tools are but not limited to the following: mission and vision statements, PEST or PESTLE analysis, SWOT analysis, benchmarking, value chain analysis, VRIO analysis and McKinsey 7s Model. Without SMTTs, it would be challenging to implement, track and evaluate strategy in organizations effectively. Again the use of SMTTs in real estate appraisal or property valuation is rarely discussed.

Literature Review

Strategic Management and Property Valuation

The use of the hedonic pricing model in property valuation or real estate investment appraisal has been a traditional method used by corporations in strategic management decisions in forecasting firm growth, profitability and resource optimization (Reeves et al., 2020). Since the core competencies of ESVFs are property valuation and real estate investment appraisal, most of the strategies lie on implementing policies that will ensure that innovative methods are used, which consequently leads to the attainment of the goals set by them. In terms of innovative methods, research concluded that the application of blockchain technology in real estate appraisal helped in strategic management decisions (Veuger, 2018). The application will help in reducing the effect of unforeseeable disruption in variables used in property valuation and real estate investment appraisal (hedonic pricing model) and thereby assist in determining competitive strength. Although strategic management is a non-financial factor, it is highly needed to make capital budgeting decisions since the long-term viability and sustainability of any firm require the implementation of strategies (Al-Mutairi et al., 2018).

Under normal circumstances, some factors are strategic in the determination of real estate values, and those factors are routinely incorporated in any valuation model (Thanasi Boçe, 2016). These factors work well when the volatility in value is within an acceptable range and can be used to appraise residential and commercial houses, schools, public offices and hospitals (McHugh, 2014). It is common knowledge that volatility in real estate's value poses a challenge to as the volatility induces uncertainties in estimation of property market values, which affects the income and turnover of ESVFs (Botzem & Dobusch, 2017). A long term strategic plan is necessary to mitigate the adverse effects of volatility of real estate pricing. Concessions can be used as strategies in this aspect. Concession works well when the value of the property is affected due to house remodeling, renovation, redevelopment, or refurbishment (Manganelli & Tajani, 2014). Apart from volatility, other factors can present enormous challenges; for instance, resident's dissatisfaction of their properties has high negative impact on real estate valuation (Ferreira, 2016). Neighborhood noise and environmental pollution are also unwelcomed guests in real estate valuations as they strategically help in determining the market value of the property (Szopi?ska & Krajewska, 2016). Examples are houses located close to airports, mines, quarries, harbors, nuclear plants, and manufacturing industries. In the same vein, environmental disasters can alter the strategic plan of any ESVF as the effects are likely to affect the values of properties in the affected areas greatly. Changes in technology and other socio-economic variables can also affect the pricing elasticities of property, and strategic management is needed to confer flexibility in such cases (Baldi, 2013).

Strategic Management and Data Mining

Data mining and machine learning tools have been applied to ensure that strategies are implemented and evaluated to achieve the stated objectives, leading to sound managerial decisions. The ever increasing changes in the business world necessitated by advances in technology and generation of vast amounts of data have led to a demand for a faster, confident and reliable decision making by business owners (Hoffmann Souza et al., 2020). Decisions are now made from analysis of a huge amount of data obtained through strategic or operational management processes (Tang, 2020). Some examples are given. Firstly, data mining techniques were used to model fire danger using information from various factors. The information obtained from the model was used the strategic management of forest fires (Eskandari et al., 2020). Secondly, data mining tools were used to classify safety scenarios in buildings, which can be applied as strategic guidelines in securing office apartments against environmental hazards (Haeri, 2020).

Data mining is used to mine data generated through strategic management and predict the likely outcome of how the objectives will look after the strategic management process is completed. This will help to optimize the resources allocated in the process, thereby reducing uncertainties and pitfalls inherent in the strategic management processes (Dela Cruz et al., 2020). Strategic management processes are often complicated, with a lot of loops and interconnections. Such intricate patterns can be uncovered using data mining models or machine learning tools. For instance, various factors can lead to the reduction of the accuracy of assessing a firm's internal and external environments, which are highly needed in strategic management (Pröllochs & Feuerriegel, 2020). Data mining models can help obtain the pattern of such complex interrelationships, which helps in the smooth implementation of strategies in organizations.

Feedbacks are used as a vital assessment tool to evaluate the state of customer satisfaction on goods and services. The dynamic business environment and availability of big data obtained from customers as feedback are analyzed to facilitate decision making. Data mining tools are robust in handling feedback data. The information obtained from the analysis of feedback data is used in strategic management, which aims to gain a competitive advantage and maintain customer loyalty and improve customer patronage (de Sousa et al., 2020).

Real Estate Valuation and Data Mining

Data mining tools estimate market values of properties better than traditional models. Traditional models fail in the presence of huge data and the presence of a large number of variables. Hence, inaccurate estimates that deviate significantly from the expectations are inevitable by using the traditional models. Data mining models yield estimates that are closer to the anticipated market values of properties and can handle a huge amount of data and variables (Al-Sit & Al-Hamadin, 2020). In addition, data mining tools can handle interactions of variables in valuation models. Artificial neural networks (Iroham et al., 2020; Peter et al., 2020), genetic algorithm (Okagbue et al., 2020), boosted regression tree (Bin et al., 2020), and deep machine learning algorithms (Wang et al., 2019) have been applied in real estate valuation. At times, data mining tools can be used to optimize some parameters (Iroham et al., 2019) or incorporate some factors used in real estate appraisal (Bin et al., 2019).

Materials and Methods

The summary of all the methods and tools used to obtain the results are stated.

Nature of data: A field survey.

Time of survey: The survey was carried out between April and May, 2020.

Target population: Estate Surveyors and Valuers (ESVs) in Lagos, Nigeria.

Sampling frame: The sampling frame is ESVFs in Lagos, Nigeria.

Sampling method: Purposive sampling

Instrument of data collection: Questionnaire.

Sample size used in data analysis: 189

Target variable: SMTT. The respondents were asked to choose as many as possible. Sixty-six (66) SMTT was made available. Some of the SMTT are Cost-benefit Analysis, networking, One-to-one Marketing, analysis of employee satisfaction, Customer Satisfaction Analysis, diversification, Mission and Vision Statements, outsourcing, SWOT analysis and others.

Independent variable: Number of trainings (NOT) undergone by the respondents. Some of the trainings typical of ESVs in Nigeria are MCPD, MBA, entrepreneurship and in-service training.

Nature of variables: The target variable (SMTT) is continuous while the independent variable (NOT) is categorical.

Data analysis tools: Minitab 17.0 and Orange software. The former was used for the bivariate analysis while the later was used for data mining.

Data mining model: Regression

Results

Bivariate analysis was done to determine the relationship between SMTT and NOT and the result is presented in Table 1.

| Table 1 Bivariate Analysis Summary |

|

|---|---|

| Statistic | Value |

| Covariance | 0.790189 |

| Correlation | 0.098022 |

| Coefficient of determination | 0.0096084 |

| T test | 1.3469258 |

| P value (t test) | 0.179634 |

| Jarque Bera test (SMTT) | 386.93* |

| Anderson- Darling test (NOT) | 5.5613* |

Note: *p value < 0.05

Covariance, correlation, and coefficient of determination between the two variables were found to be 0.790, 0.098, and 0.010, respectively. The correlation was not significant at a p-value less than 0.05, and hence, there is no relationship between SMTT and NOT. The weak non-significant positive correlation yielded a near-zero coefficient of determination. The t-test showed that the two variables are from the distributions. Jarque Bera and Anderson- Darling tests showed that the distributions of SMTT and NOT are not from normal distribution.

The data were passed through eight data mining models. The number of training undertaken by ESVs was used to predict the SMTT usage. The model evaluation was presented in Table 2 where it can be seen that random forest (RF) performed better than the other six models using the Mean square error (MSE), root mean square error (RMSE), mean absolute error (MAE) and coefficient of determination (R2) as evaluation metrics. The model performance in decreasing order is RF, linear regression (LR), classification tree (CT) or simply tree, constant model, support vector machine (SVM), KNN (K-nearest neighbor), adaptive boosting (AB) and NN (neural network).

| Table 2 Model Evaluation Of The Data Mining Models |

||||

|---|---|---|---|---|

| Model | MSE | RMSE | MAE | R2 |

| RF | 89.566 | 9.464 | 6.856 | 0.018 |

| LR | 89.997 | 9.487 | 6.870 | 0.014 |

| CT | 90.007 | 9.487 | 6.871 | 0.014 |

| Constant | 92.581 | 9.622 | 7.058 | -0.015 |

| SVM | 96.636 | 9.830 | 6.515 | -0.059 |

| KNN | 100.837 | 10.042 | 7.580 | -0.105 |

| AB | 103.261 | 10.162 | 7.802 | -0.132 |

| NN | 111.269 | 10.548 | 6.892 | -0.219 |

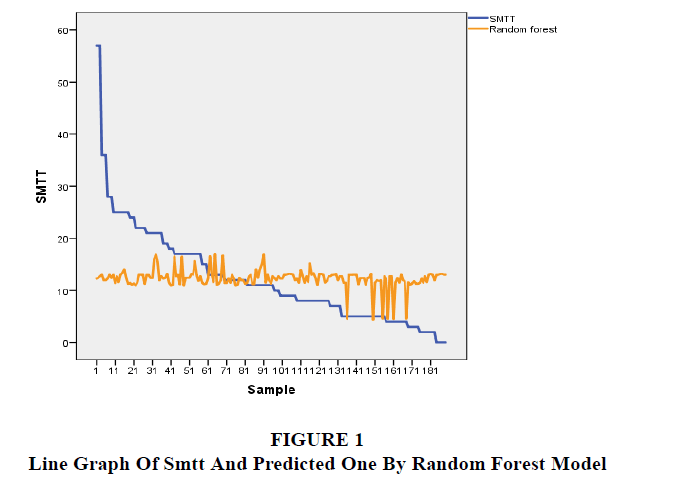

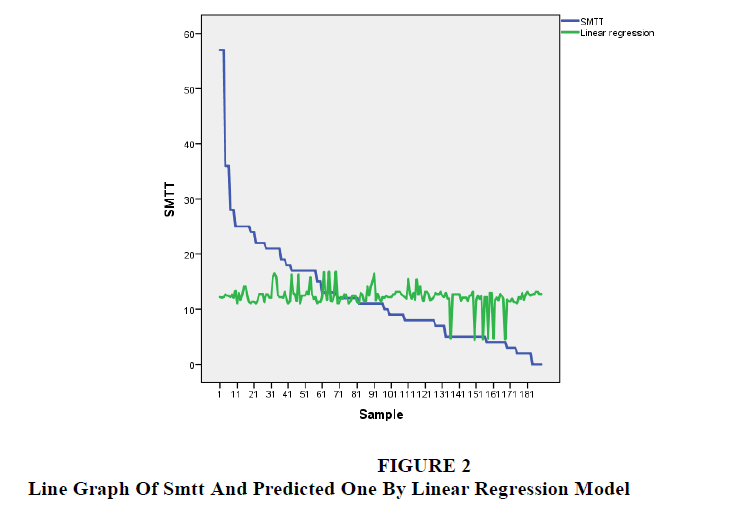

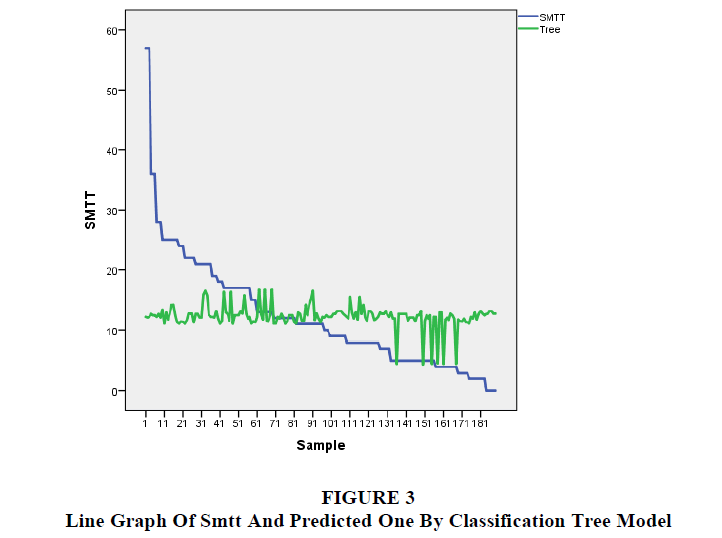

In order to visually understand the performances of the models, the predicted values from the top three models were plotted with the original SMTT data. The plots are for random forest (Figure 1), linear regression (Figure 2) and classification tree (Figure 3). It could be seen that the three plots are similar which collaborates the evaluation results of Table 2.

Conclusion

Although strategic management tools and techniques (SMTT) usage is not related to the number of training (NOT) undergone by Estate surveyors and valuers (ESVs) in Lagos, Nigeria, data mining models have shown that SMTT can be predicted using NOT. Considering the enormous benefits of using SMTT by estate surveying and valuation firms (ESVFs), this work has shown that the number of training by the professionals in Lagos has not led to increased SMTT usage. Awareness of the importance of SMTT is urgently needed, and strategic management should be incorporated into the various training undertaken by ESVs.

Acknowledgement

The authors appreciate the efforts of the anonymous reviewers toward this publication. The financial support from Covenant University, Nigeria is also deeply appreciated.

References

Al-Mutairi, A., Naser, K., & Saeid, M. (2018). Capital budgeting practices by non-financial companies listed on Kuwait Stock Exchange (KSE). Cogent Economics & Finance, 6(1), 1468232.

Indexed at, Google Scholar, Cross Ref

Al-Sit, W.T., & Al-Hamadin, R. (2020). Real estate market data analysis and prediction based on minor advertisements data and locations’ geo-codes. International Journal of Advanced Trends in Computer Science and Engineering, 9(3), 4077-4089

Baldi, F. (2013). Valuing a greenfield real estate property development project: A real options approach. Journal of European Real Estate Research, 6(2), 186-217.

Indexed at, Google Scholar, Cross Ref

Bin, J., Gardiner, B., Li, E., & Liu, Z. (2020). Multi-source urban data fusion for property value assessment: A case study in Philadelphia. Neurocomputing, 404, 70-83.

Indexed at, Google Scholar, Cross Ref

Bin, J., Gardiner, B., Liu, Z., & Li, E. (2019). Attention-based multi-modal fusion for improved real estate appraisal: a case study in Los Angeles. Multimedia Tools and Applications, 78(22), 31163-31184.

Botzem, S., & Dobusch, L. (2017). Financialization as strategy: Accounting for inter-organizational value creation in the European real estate industry. Accounting, Organizations and Society, 59, 31-43.

Indexed at, Google Scholar, Cross Ref

de Sousa, G.N., Guimarães, I.D.S., Viana, J.A.N., Reinhold, O., Junior, A.F.L.J., & Lobato, F.M.F. (2020). Analysis of the Brazilian telecommunications sector: An overview on complaints. RISTI, 2020(37), 31-48.

Dela Cruz, A.P., Basallo, M.L.B., Bere, B.A., III, Aguilar, J.B., Calvo, C.K.P., Arroyo, J.C.T., & Delima, A.J.P. (2020). Higher education institution (Hei) enrollment forecasting using data mining technique. International Journal of Advanced Trends in Computer Science and Engineering, 9(2), 2060-2064.

Eskandari, S., Pourghasemi, H.R., & Tiefenbacher, J.P. (2020). Relations of land cover, topography, and climate to fire occurrence in natural regions of Iran: Applying new data mining techniques for modeling and mapping fire danger. Forest Ecology and Management, 473, 118338.

Indexed at, Google Scholar, Cross Ref

Ferreira, F.A.F. (2016). Are you pleased with your neighborhood? A fuzzy cognitive mapping-based approach for measuring residential neighborhood satisfaction in urban communities. International Journal of Strategic Property Management, 20(2), 130-141.

Indexed at, Google Scholar, Cross Ref

Haeri, A. (2020). Analyzing safety level and recognizing flaws of commercial centers through data mining approach. Proceedings of the Institution of Mechanical Engineers, Part O: Journal of Risk and Reliability, 234(3), 512-526.

Indexed at, Google Scholar, Cross Ref

Hoffmann Souza, M.L., da Costa, C.A., de Oliveira Ramos, G. & da Rosa Righi, R. (2020). A survey on decision-making based on system reliability in the context of Industry 4.0. Journal of Manufacturing Systems, 56, 133-156.

Indexed at, Google Scholar, Cross Ref

Iroham, C.O., Emetere, M.E., Okagbue, H.I., Ogunkoya, O., Durodola, O.D., Peter, N.J., & Akinwale, O.M. (2019). Modified Pricing Model for Negotiation of Mortgage Valuation Between Estate Surveyors and Valuers and Their Clients. Global Journal of Flexible Systems Management, 20(4), 337-347.

Indexed at, Google Scholar, Cross Ref

Iroham, C.O., Emetere, M.E., Okagbue, H.I., Oni, A.S., & Peter, N.J. (2020). Learning analytics: Professional fees equilibrium and ethics between estate surveyors and valuers and clients. International Journal of Advanced Trends in Computer Science and Engineering, 9(3), 4103-4112.

Manganelli, B., & Tajani, F. (2014). Optimised management for the development of extraordinary public properties. Journal of Property Investment and Finance, 32(2), 187-201.

Indexed at, Google Scholar, Cross Ref

McHugh, M. (2014). Real estate planning for population health. Healthcare Financial Management: Journal of the Healthcare Financial Management Association, 68(11), 122-128.

Okagbue, H.I., Peter, N.J., Akinola, A.O., Iroham, C.O., & Opoko, A.P. (2020). Smart review of the application of genetic algorithm in construction and housing. International Journal of Advanced Trends in Computer Science and Engineering, 9(1), 266-273.

Peter, N.J., Okagbue, H.I., Obasi, E.C.M., & Akinola, A.O. (2020). Review on the application of artificial neural networks in real estate valuation. International Journal of Advanced Trends in Computer Science and Engineering, 9(3), 2918-2925.

Pröllochs, N., & Feuerriegel, S. (2020). Business analytics for strategic management: Identifying and assessing corporate challenges via topic modeling. Information & Management, 57(1), 103070.

Indexed at, Google Scholar, Cross Ref

Reeves, T., Mei, B., Siry, J., Bettinger, P., & Ferreira, S. (2020). Effect of working forest conservation easements on surrounding property values. Forest Policy and Economics, 118, 102241.

Indexed at, Google Scholar, Cross Ref

Szopinska, K., & Krajewska, M. (2016). Methods of assessing noise nuisance of real estate surroundings. Real Estate Management and Valuation, 24(1), 19-30.

Tang, Q. (2020). Construction of interactive integrated communication marketing system in big data Era. In Journal of Physics: Conference Series (Vol. 1550, No. 3, p. 032142). IOP Publishing.

Thanasi Boçe, M. (2016). Hedonic appraisal of apartments in Tirana. International Journal of Housing Markets and Analysis, 9(2), 239-255.

Indexed at, Google Scholar, Cross Ref

Veuger, J. (2018). Trust in a viable real estate economy with disruption and blockchain. Facilities, 36(1-2), 103-120.

Indexed at, Google Scholar, Cross Ref

Wang, F., Zou, Y., Zhang, H., & Shi, H. (2019). House price prediction approach based on deep learning and ARIMA Model. Proceedings of IEEE 7th International Conference on Computer Science and Network Technology, Article number 8962443, Pages 303-307.

Received: 30-Jun-2022, Manuscript No. ASMJ-22-12279; Editor assigned: 02-Jul-2022, PreQC No. ASMJ-22-12279(PQ); Reviewed: 16-Jul-2022, QC No. ASMJ-22-12279; Revised: 24-Jul-2022, Manuscript No. ASMJ-22-12279(R); Published: 03-Aug-2022