Research Article: 2021 Vol: 24 Issue: 4S

Problems of Legal Regulation and Dispute Resolution on Online Loans

Malik Karazhanov, Kazakh Humanitarian-Juridical Innovative University

Almas Kanatov, Academy of Justice under the Supreme Court of the Republic of Kazakhstan

Maigul Matayeva, Kazakh Humanitarian-Juridical Innovative University

Assel Kaishatayeva, Kazakh Humanitarian-Juridical Innovative University

Zhanat Karazhanova, Kazakh Humanitarian-Juridical Innovative University

Anel Yensebayeva, University of Turan-Astana

Citation Information: Karazhanov, M., Kanatov, A., Matayeva, M., Kaishatayeva, A., Karazhanova, Z., & Yensebayeva, A. (2021). Problems of legal regulation and dispute resolution on online loans. Journal of Legal, Ethical and Regulatory Issues, 24(S4), 1-9

Abstract

The article discusses the current legal regulation problems, their consequences, including issues in resolving disputes in the field of online loans, the prospects for their resolution. Despite the active growth of online lending in Kazakhstan, this line of business has been developing chaotically for a long time, practically without state control and legal regulation, driven only by the laws of the “wild” market. The lack of special legal regulation has led to violations of consumer rights, the debt burden of the population, the emergence of disputes in the field of these loans, difficulties in resolving them, conflicts in society. The state took measures to resolve these problems. Despite the measures taken, however, not all online lending problems have been resolved. The study's scientific novelty lies in the fact that it is a unique scientific study of the legal aspects of dispute resolution on online lending. Despite the world's integration processes towards the approximation and unification of legislation, they cannot be comprehensive. They should be adequately studied in the future, taking into account the peculiarities of modern conditions.

Keywords

Loan, Online Credit, Consumer Rights of Financial Services, Arbitration, Alternative Dispute Resolution.

Introduction

Since 2014, in the Republic of Kazakhstan, one of the most widespread and rapidly growing segments of the financial market has become loans provided for small amounts, for short periods, for any purpose, without presenting income certificates, without guarantors, without collateral, using Internet technologies. One of the most common types of consumer micro-crediting are loans provided in small amounts, for short periods, for any purpose, without presenting income certificates, without guarantors, without collateral, using Internet technologies. These loans are called online loans (or payday loans). The first such loan was issued in February 2014 by moneyman.kz (Kazfintech, 2020). Since that time, the Kazakhstani online lending market has been increasing, representing one of the fastest-growing segments of the financial services market. According to unofficial data from the FinTech Association, in 2019, there were about 30 online loan providers on the market (Table 1).

| Table 1 Dynamics of Online Lending in Kazakhstan |

||||||

| Second half of 2014 | 2015 | 2016 | 2017 | 2018 | 2019 (January) | |

|---|---|---|---|---|---|---|

| Loans issued, KZT mln | 302 | 2530 | 8924 | 39754 | 72867 | 6937 |

| Number of loans issued | 945 | 67355 | 239542 | 944000 | 1683000 | 139000 |

Source: Shibutov (2018)

Despite the rapid growth of online loans, nevertheless, for a long time, these loans practically remained outside the zone of legal regulation and control by the state: in the legislation of the Republic of Kazakhstan there were no special legal norms governing the provision of these loans, the activities of companies providing these loans were not subject to control by the authorized body (at that time the National Bank of the Republic of Kazakhstan).

It led to several negative consequences: high debt load of the population, creation of loopholes in legislation, which led to massive violations of consumer rights for this type of financial services, the controversy of many issues, difficulties in resolving them in law enforcement practice, conflicts in society.

Foreign practice of using consumer credit is described in the works of Pollard et al. (1992), Kuchler & Pagel, (2018), so it was taken as a background of the study. Actual problems of consumer lending in the CIS countries (Russia), their prospects solutions in the light of international experience are highlighted in the scientific works of legal scholars like Vishnevsky (2014), Erpyleva (2004), Ivanov (2012), Sarnakov (2009), Fogelson (2010), and economist Chernenko (2000). Scientific works of Vishnevsky (2000 & 2013), where the author conducts a detailed analysis of international experience in the legal regulation of consumer credit, highlights the main stages of its development, reveals the main problems in Russia, and the best approaches to its legal control. In the Republic of Kazakhstan, certain aspects of consumer credit were considered in the works of Suleimenov (2008) and Abzhanov (2008). Directly, the issues of online loans have not been widely studied in scientific, legal literature, both in the Republic of Kazakhstan and in countries of the CIS. We believe this is because online loans are a relatively new phenomenon not only in the Kazakhstani financial services market but also in other CIS countries. Only certain aspects of this problem are covered in the works of Klimkin (2019).

Materials and Methods

During the study, the authors studied the current legislation governing online loans in the Republic of Kazakhstan. The materials of judicial and arbitration practice on resolving disputes on online loans were considered. The official and unofficial articles of the public association representing the interests of companies providing online loans (the FinTech Association of Legal Entities) and the Arbitration Chamber of Kazakhstan were studied. A statistical method was applied (statistics on the dynamics of the growth of online loans, on disputes over online loans), a technique for analyzing tax codes of laws, agreements, documents on online loans were used. An expert survey of judges and arbitrators of arbitration tribunals of the Republic of Kazakhstan, resolving disputes on online loans, as well as the manager of the Association of Legal Entities "FinTech” Glukhov was conducted. The comparative legal research method is widely used. The main approaches, institutions and legal structures of banking law of foreign countries on consumer lending are considered. We reviewed the experience of those European countries whose experience formed the basis for the main approaches and institutions of banking law in foreign countries on consumer lending.

Results and Discussion

The Law "On State Regulation, Control, and Supervision of the Financial Market and Financial Organizations" dated July 4, 2003, in paragraphs 5, 6 of Article 1 defines the concepts of financial market and financial service. But at the same time, the idea of the financial market is defined through the concept of financial assistance, and commercial service is determined by listing an exhaustive list of subjects, among which are not listed organizations that provide online loans. Here the legislator also followed the path of a casual list, that is, a listing of entities whose services, in his opinion, belong to the category of financial ones.

The Law of the Republic of Kazakhstan "On the National Bank of the Republic of Kazakhstan" dated March 30, 1995, among the functions and powers of the National Bank of Kazakhstan (paragraph 19 of article 8) provides for the regulation, control, and supervision of the financial market and financial organizations.

The Law of the Republic of Kazakhstan "On the National Bank of the Republic of Kazakhstan" dated March 30, 1995, among the functions and powers of the National Bank of Kazakhstan (paragraph 19 of article 8) provides for the regulation, control, and supervision of the financial market and financial organizations.

- Interest rates of remuneration–from 1 to 2.5% per day (more than 500-700% per annum);

- The amount of the penalty in case of delay–from 1% to 2.75% for each day of delay;

- A sequence of debt repayment: fine, forfeit; reward; loan amount (Gorbachev and Luengo-Prado, 2017);

- Some agreements provided for norms on non-proliferation of limitation periods for disputes;

- Consideration disputes: in a specific arbitration, court;

- Pre-trial debt collection by a collection company.

As a result of high-interest rates and fines, if the person did not have time to repay the loan on time, then in a few months, this loan grew 5-10 times.

02 July 2018 The Civil Code of the Republic of Kazakhstan was supplemented by Article 725-1, which established requirements for loan agreements provided to individuals (this provision is discussed in more detail below). Nevertheless, even after adopting this article, online loans were often offered in violation of the requirements of this article. Several companies changed their lending terms only in January 2019.

An essential negative consequence was the violation of the rights of consumers of financial services to complete and reliable information (this right is enshrined in paragraph 6 of article 10 of the Civil Code of the Republic of Kazakhstan), violation of the consumer's right to honest, informative advertising.

One of the crucial consequences was the high growth in the number of disputes in state courts and arbitration. The target audience of the payday loan market is borrowers with bad credit history, other persons who are unable to prove their income, or who do not meet other standard requirements of banks.

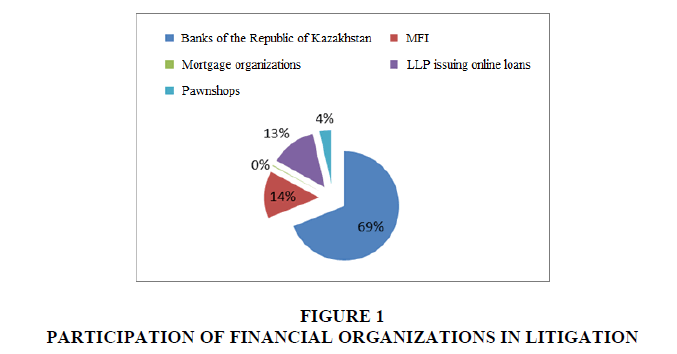

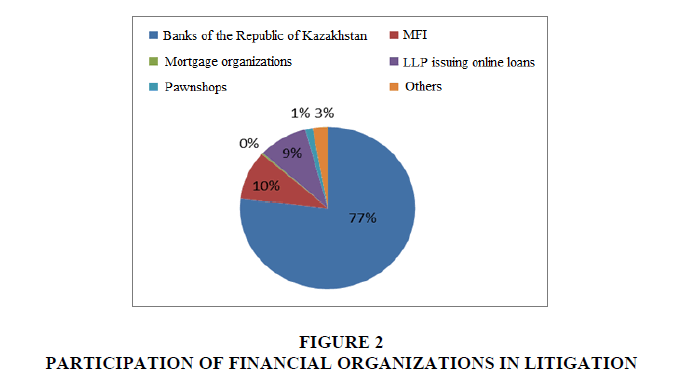

Due to unclear legal provisions, the court and arbitration practice of resolving disputes on online loans were somewhat controversial. Some courts, referring to the fact that the loan agreement was concluded voluntarily, considered that the borrowers should repay the debt following the terms of the loan agreement. According to their inner conviction, other courts did not satisfy claims for the collection of loan amounts that were many times higher than the loan amount, other unfair provisions of agreements, and reduced the number of debt (Figure 1 & 2).

It follows from these data that the most "active" participants in litigation are banks. Online lending organizations and MFIs take the second place. At the same time, the dynamics of a decrease in their activity is observed.

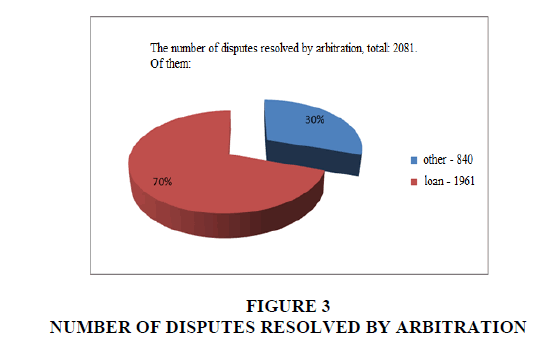

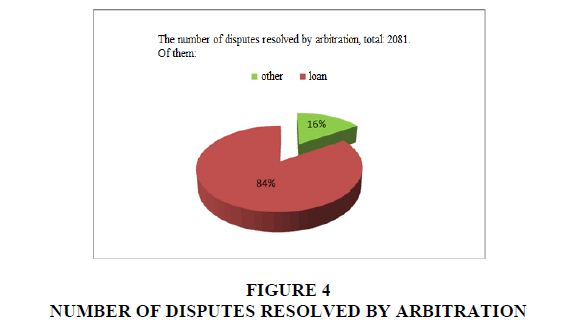

At first glance, the share of disputes on online loans among all litigations on consumer loans was 13% in 2017, 9% in 2018. Does this mean that there is little disagreement between the parties on online loans? Let's turn to the statistics on arbitration (arbitration is an institution for resolving disputes by an independent arbitrator, elected by the parties or appointed under the law and (or) the rules of the relevant arbitration to settle the argument) (Figure 3 & 4).

Organizations providing online loans prefer to seek debt collection not in a state court, but through arbitration. The most important reason is that individual arbitrations are not independent of the lender (Ponce, 2018). According to the official Internet resource of the Arbitration Chamber of Kazakhstan (APC), as of July 2020, 18 permanent arbitration tribunals are members of the APC (Arbitration chamber of Kazakhstan, 2020). Many of them are independent, highly professional arbitrators. However, the independence of individual arbitrations has been questioned. Thus, judges of the Judicial Collegium for Civil Cases of the West Kazakhstan Regional Court, based on an analysis of the materials of the activities of a particular arbitration tribunal, its arbitral awards, give the following arguments that cast doubt on its independence (the name of a particular arbitration tribunal for obvious reasons is not indicated). In this arbitration, disputes were considered on the collection of amounts of debt on claims of a number of companies providing online loans in all regions of Kazakhstan (Dengi Population LLP, Garyz Zaymy LLP, AktivCredit LLP, MFZ LLP, and others). However, the loan agreements of all these companies provide for arbitration clauses to resolve all disputes in the same arbitration, which is located in the city of Kazakhstan, located in the extreme western part of the country, very remote from other cities of the country.

In some cases, it is not possible to clarify this issue. It leads to the subsequent appeal of such arbitral awards in court, non-execution of arbitral awards voluntarily, and the appeal of the plaintiff-company providing online credit. However, according to the legislation, the court cannot review the arbitral award on the merits (part 8 of article 253 of the Code of Civil Procedure of the Republic of Kazakhstan); the grounds for setting aside an arbitral award are exhaustive and somewhat limited (Article 52 of the Arbitration Law). In essence, the award is final. For example, in the West Kazakhstan region (where International Arbitration WKO LLP is located), out of 1792 claims of claimants considered, 1573 were issued a writ of execution for the compulsory execution of an arbitral award, despite clearly unfair arbitral awards (collection from citizens of amounts of 10 multiple or more). The possibility of appealing arbitral awards to a court is not a sufficient guarantee of the consumer's right to a fair resolution of the dispute, since the court, when considering an application for the issue of a writ of execution for the compulsory execution of an arbitral award, shall not have the right to revise the arbitral award on the merits.

These facts testify to the affiliation of organizations (companies providing online loans to the population, arbitration, private enforcement agents), about a well-coordinated scheme on lending to the society at high-interest rates, followed by the collection of unreasonably high amounts of debt through arbitration in the interests of credit companies and the compulsory enforcement of arbitral awards by private bailiffs. In this chain of interaction between commercial structures, the state court is assigned only an "intermediate" role of the state body for issuing a writ of execution without interfering with the content of the arbitral award. We believe, even though there is no direct evidence of the existence of affiliation between these entities; nevertheless, in many cases, this is obvious.

Besides, such problems in arbitration increase the courts (mainly in those courts in whose jurisdiction arbitration tribunals are located, created to resolve disputes over online loans). The proceedings on the issue of issuing a writ of execution for the compulsory execution of an arbitral award takes considerable time and volume of work in the total workload of judges, since such cases are considered in court sessions with the summons of the parties and the issuance of a reasoned ruling on extradition or refusal to extradite. Simultaneously, as the judges point out, this is not sufficiently taken into account in the workload of judges.

The main consequence of such a vicious arbitration practice is that the dispute is not resolved. Slightly, the conflict in society increases, even more, the public's confidence in credit institutions, arbitration, and the state legal system as a whole decrease. This vicious practice of individual arbitration tribunals and arbitrators denigrates the entire system of arbitration courts in Kazakhstan.

The Law of the Republic of Kazakhstan "On amendments and additions in some legislative acts of the Republic of Kazakhstan on the issues of strengthening the protection of property rights, arbitration, optimization of the court burden, and further humanization of criminal legislation" dated on January 21, 2019, amendments were made to the Civil Procedure Code of the Republic of Kazakhstan dated on October 31, 2015 (hereinafter referred to as the CPC) and the Law on Arbitration dated April 8, 2016. According to these laws, an arbitration agreement on the resolution of a dispute under a loan agreement between a commercial organization and an individual who is not an individual entrepreneur is valid if such an agreement was concluded after the grounds for filing a claim have arisen (paragraph 4 of Article 8 of the Arbitration Law). These norms have somewhat improved the situation: the massive transfer of disputes to arbitration has stopped. Simultaneously, given the low level of financial and legal literacy of the population, even with this article, risks of violations of consumer rights are possible: the lender may, in exchange for a temporary delay, persuade the borrower to sign an arbitration agreement.

One of the solutions to this issue is seen in the following exception from Article 253 of the Civil Procedure Code of the Republic of Kazakhstan: in cases where one of the parties is a weak party to the contract (in particular, an individual consumer), the claimant does not have the right to go to court for an extract of the writ of execution at the location of the arbitration, and with such a statement the recovered should apply to the court only at the place of residence of the debtor to provide him with the opportunity to participate in the case.

Conclusion

Given the problems of legal regulation and the practice of providing online loans in the Republic of Kazakhstan, the following measures are proposed to improve online lending:

- To adopt the Law of the Republic of Kazakhstan "On consumer credit" to develop general principles for protecting the rights of consumers of financial services (including the policy of protecting the weak side) and an integral mechanism for resolving (settling) disputes to protect the rights of consumers of financial services.

- To adopt a regulatory ruling of the Supreme Court to resolve disputes in the most common consumer loan disputes.

- In the mechanism for resolving disputes on consumer loans, the central place should be given to the banking ombudsman and mediation institutions, which should become the core of alternative dispute resolution on consumer loans (as is the case in foreign countries).

- To exclude arbitration institutions from the system of bodies resolving disputes on consumer loans (including online loans) was initially intended for the settlement of disputes between equal professional business entities.

- At the legislative level, establish a mandatory requirement for pre-trial settlement of a dispute under consumer loan agreements using alternative methods of dispute resolution (ombudsman, mediation), included.

- To provide measures for the availability of mediator services, since not all citizens will be able to pay for mediators' services.

- To expand the powers of the Republic of Kazakhstan (financial ombudsman), allowing him to consider and make decisions on other consumer loans (along with mortgage loans).

- To create banking ombudsman service (following the example of Great Britain).

- To develop financial literacy and financial education of the population as a strategic task of the state.

- Train employees of financial institutions directly working with clients in the skills of conciliation procedures.

- To create financial organizations, special mediation services to resolve disputes while preserving the borrower's right to choose an independent mediator.

- Include in the composition of the Centers of Reconciliation in the regions of the country, the Offices of Reconciliation in the courts, mediators, lawyers, lawyers, notaries, psychologists, and permanent representatives of financial organizations.

- To provide for the specialization of mediators, to strengthen the requirements for specialized mediators.

- In the Law on Mediation, provide for the specifics of various types of mediation, including, as a separate type, provide for mediation on consumer loans;

- To develop rules of ethics, quality standards for mediators' services, taking into account international experience. Strengthen the responsibility of mediators for poor quality services.

- To regularly improve the qualifications of judges-conciliators in the skills of conciliation procedures;

- Detail the judge's duty to assist the parties in resolving the dispute.

- To widely inform the population and financial organizations about the benefits of mediation in the most common disputes on consumer loans.

References

- Abzhanov, D. (2008). Protection of the weak side in the bank loan agreement. On the specifics of concluding a bank loan agreement. Lawyer, 12(1), 1-9.

- Arbitration Chamber of Kazakhstan. (2020). Register of permanently operating arbitrations and arbitrators, members of the APC. Retrieved from https://palata.org/registry/

- Chernenko, V.A. (2000). Consumer loan in the Russian Federation. A dissertation on sausage for a doctorate in economics. Sankt-Petersburg.

- Erpyleva, N.Y. (2004). International banking law. Moscow: Business.

- Fogelson, Y.B. (2010). Protection of the rights of consumers of financial services. Norm.

- Gorbachev, O., & Luengo-Prado, M. (2017). The credit card debt puzzle: The role of preferences, credit access risk, and financial literacy. Review of Economics and Statistics.

- Ivanov, O.M. (2012). Legal regulation of the cost of consumer loans. Dissertation of the Candidate of Legal Sciences. Moscow.

- Kazfintech. (2020). About the fintech industry in Kazakhstan. Retrieved from https://kazfintech.kz/alternate

- Klimkin, S.I. (2019). Online loan agreements: Mission achievable. Retrieved from https://www.zakon.kz/4992609-dogovory-onlayn-zayma-missiya-vypolnima.html

- Kuchler, T., & Pagel, M. (2018). Sticking to your plan: The role of present bias for credit card paydown. National Bureau of Economic Research, Working Paper No. 24881.

- Pollard, A.M., Passyk, J.G., Ellis K.H., & Daly, J.P. (1992). U.S. banking law. Moscow: Progress.

- Ponce, A., Seira, E., & Zamarripa, G. (2017). Borrowing on the wrong credit card? Evidence from Mexico. The American Economic Review, 107(4), 1335–1361.

- Sarnakov, I.V. (2009). Legal regulation of the consumer credit agreement. Dissertation. Moscow.

- Shibutov, M. (2018). Assessment of the regulatory impact on the online lending market in the Republic of Kazakhstan. Almaty.

- Suleimenov, M.K. (2008). Contract in civil law: Problems of theory and practice. Lawyer, 10(2), 15-20.

- Vishnevsky, A.A. (2000). Banking law of the European Union. Banking Law of England. Moscow: Statute.

- Vishnevsky, A.A. (2013). Modern banking law: Banking-client relations. Comparative legal essays. Moscow: Statute.

- Vishnevsky, A.A. (2014). Modern trends in the development of structure-forming institutions of banking law: A comparative legal study. Dissertation for the degree of Doctor of Law. Moscow.