Research Article: 2021 Vol: 24 Issue: 6S

Profitability Index and Its Impact on Short and Long Term Decisions

Naji Shayeb Al-Rikabi, Baghdad College of Economic Sciences University

Abstract

The profitability index plays an important role in helping decision making, whether they are short-term decisions under differential analysis or long-term decisions. The profitability index is used in various ways to help short-term decision making, especially when economic resources are scarce, and it also requires determining the production lines that remain in Work and those production lines that are discontinued based on their profitability. The profitability index is also used in pricing products and in granting incentives to salesmen. Also, the profitability index is used to compare between long-term investment projects that have positive net present value or it has economically feasible, this requires selecting some of them.

Keywords

Absolute Profitability, Differential Analysis, Profitability Index, Relative Profitability, Scarce Resources

Introduction

Decision-makers at all levels need quantitative tools that help them to improve the quality of those decisions, whether short-term or long-term decisions. Among these tools is the profitability index, it affects different degrees on decision makers; in the pricing of goods and services and in the area of trade-offs between production lines and also the trade-off between long-term investment projects; also distinguishes the profitability index that has two formulas to measure the profitability of projects in the short term and the other used to choose a particular project among several investment projects.

Research Problem

The research problem is determined by the fact that the non-use of profitability index in making short-term and long-term decisions leads to low quality decisions regardless of the level and scope of those decisions and the activities in which they are made.

Research Objective

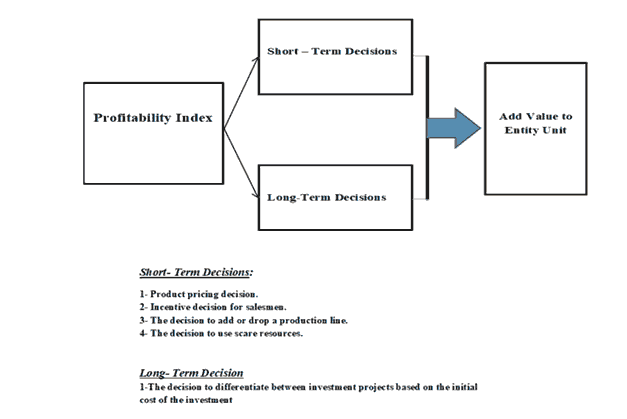

The research goals is to identify the great importance of profitability index and its impact on many decisions used by entity units in order to improve the quality of decisions taken by management in these entity units and add value to them.

Research Importance

The importance of the research is highlighted by clarifying the relationship between the independent variable represented by the profitability index and the dependent variables of as follows:

1. Product pricing decisions.

2. Incentives Decisions for salesmen.

3. The decision to add or drop production line.

4. The decision to use scarce resources.

5. Decision of trade-off between investment projects that have economic feasibility.

Research Hypothesis

The use of the profitability index in a different format has a direct impact on the quality of some decisions made by management at various levels (Figure 1).

Theoretical Framework for Differential Analysis

Differential Analysis Concept

It is the identification of financial data that change from one project to another when making future decisions in choosing a project without the other project, and the data may be revenues or costs, and costs or revenues or both may change when comparing projects in making decisions, For example, when differential project A and B, the data is as follows:

| Table 1 Differential Analysis Concept |

||

|---|---|---|

| Details | Project A | Project B |

| Revenue | 50 million | 45 million dinars |

| Costs | 40 million | 40 million dinars |

| Net income | 10 million | 5 million dinars |

When looking at revenues, they vary from project A to project B and are called differential revenue. Costs are not changed between the two projects and are called non-differential costs. The basic rule of differential analysis is the change of data between different projects regardless of whether the data represent variable or fixed costs or revenues. Data that does not change between projects is called non-differential data, even if costs are variable in naturally. Direct materials are variable in nature, but if it does not change between different projects, it is non-differential or irrelevant costs. Conversely, rental costs are fixed costs, but when it changes between projects, it is differential or relevant costs (Alrikabi & Samurai, 2017).

Base Concepts in Differential Analysis

Relevant and Irrelevant Cost

Relevant costs are elements of costs and revenues that Different from one project to another and are relevant for short-term decisions. Irrelevant costs is costs and revenues that do not differ from one project to another and are not suitable for making decisions as fixed in all projects. It is non-differential.

Avoidable and Non-Avoidable Costs

The Costs that can be avoided are the costs that can be deleted when choosing a project without another project called differential costs or Relevant costs and used in making decisions. The costs which cannot be avoided are the costs incurred by the company in any case when choosing any of the projects, therefore it is not considered differential or relevant costs and not suitable for decision-making because it does not change when differential between projects. For example, if you have two options, first option is going to the mall and shop directly and the second option is ordering the goods delivery, When you choose the first option, you avoid the costs of ordering the item by delivery and vice versa when you choose the second option, you avoid the costs of going to the mall and direct shopping, The costs of each option can be avoided when you choose one project without the other. In contrast, the costs of renting the apartment or house in which the person lives are unavoidable in both options. Therefore, the costs of renting the apartment or house are non-differential and are not suitable for making decisions. The company will be incurred the rental costs in all cases, whether the shopping directly or delivery. Therefore, avoidable costs are called relevant costs for decision-making, while unavoidable costs are irrelevant costs and non-differential (Garrison et al., 2012).

Opportunity Costs

When differential between two projects or options, a project is usually chosen without the other project, in which case the company or the person will lose the potential benefits obtained from the unselected project. Benefits lost as a result of choosing project without another project are called opportunity costs, which are differential costs and are used in decision-making. The opportunity costs may be added to the costs of the selected project or subtracted from the revenues of the selected project. For example, if there are two options, the first is a project to build a private hospital and the second is a project to build a private college, and their details are.

| Table 2 Opportunity Costs |

||

|---|---|---|

| DetailsPrivate college | First option to build a private hospital | Second option to build aPrivate college |

| Costs | 1 billion | 800 million dinars |

| Revenues | 750 million | 600 million dinars |

| Net income | 25 billion | 200 million dinars |

If the first project is selected, will be lost 200 million dinars the net profit of the second option, Conversely, if the second project is selected, will be lost the net profit of the first option, which is 25 billion dinars, this is called the opportunity cost.

Sunk Costs

These are costs that have occurred in the past, and do not affect current or future financial decision making. These are non-differential and irrelevant costs in making decisions. For example, if you have an amount of 100 million dinars used to buy a car; this amount cannot be used in the short term. Because you have already used, this type of cost is called sunk costs.

Steps of the Decision-Making Process

There are seven basic steps in decision-making and management accountants have an important role to play, these steps are:

1. Identify the problem to be clarified the decision problem

2. Determine the criterion

3. Identify the alternatives available

4- Developing the decision-making model

5. Collect the data

6. Select the appropriate alternative or decision

7. Evaluate decision effectiveness (Hilton, 2011).

Other Considerations in Decision Making

There are Two Types of Factors Influencing Decision-Making:

First: Qualitative or Non-Quantitative Factors

There are two sets of factors that influence decision-making. The first set is called quantitative factors, which are quantifiable or critical factors. These factors are easy to measure and express, such as production costs, sales revenue and others. The second set is non-quantitative or qualitative factors. Which is difficult to quantify or expressed in quantities or amounts, for example, if a company made a decision to remove a production line because it does not make profits and here was relied on quantitative factors of costs, revenues and profits in the decision, but did not take into account the impact measurement a for qualitative or non-quantitative factors such as the effect of removal of the production line on the morale of workers and the associated layoffs and related problems such as compensation of workers and thus, non-quantitative factors can be of great importance in making decisions.

Second: The Relationship between Differential Analysis and Costing System Based on Activities

There are problems with the accuracy of allocating Overhead costs to production units or services provided to customers when companies use the traditional costing system. At present time, most companies in the developed world use the activity base costing system. This system helps the companies to decision-makers in making the appropriate decision for each cases of differential analysis. An activity-based costing system adds value to such decisions because they are more accurate and better determine the profitability of a product or customer (Weygandt et al., 2011).

Types of Differential Analysis

The differential analysis includes several short-term decisions as follows:

First: The Decision of Accept or Reject a Special Offer

The decision to accept or reject order is depend on the earned profits. Noting that unavoidable costs not accounted because they are not affected in the case of acceptance or rejection of the offer, noting the following conditions should be met:

1- Acceptance of the order is within the production capacity of the company.

2- The order shall not affect the selling prices of the company's products.

Second: The Decision Makes or Buys

The decision to manufacture within the company or purchase from outside is depend on the cost of each alternatives which one less costs, Taking into consideration the addition of the opportunity costs to the alternative of manufacture without purchase.

Third: The Decision Adds or Drops Production Line

This decision depends on the losses resulting from the removal of the production line and the costs that cannot be avoided when stopping and then compare the company's profits in the case of continuing production despite the loss achieved by the production line which the company intends to stop with the loss incurred by the company when the production line is stopped.

Fourth: The Decision to Sell at the Spilt Off Point or Continue with Additional Manufacturing Processes

Five: The Decision to Use Scarce Resources

Often it happens that the amount of raw materials or the number of working hours of machines or direct working hours or storage space is not enough to meet the demand for production volume, so the company develops an optimal production plan, and its essence depends on the return on the contribution of the scarce resources and not on the return on the contribution of the unit Producer (in the case of the resource is not scare) in order to make the company maximum profit from the use of scarce resource, and is considered a scare resource constraint or constraint on production,There is a theory called the theory of constraints used to process the constraints or limitations experienced by industrial processes in company.

Theory of Constraints

Managerial accounting has many new techniques, such as the theory of constraints that are used in the continuous improvement of “kaizen” company activity, and this theory assumes that there is at least one constraint limits the production capacity of the company and this technique do to process the constraints the company suffers in a simple way to process these constraints one after the other in order to increase the production capacity and achieve the maximum possible revenue for the scarce resource or to these constraints, and at the same time an optimal production plan is taken that best use of scarce resources, (Such as raw materials, hours of operation).

Theory of Constraints Steps to Process the Limitations

1. Determine the constraints or scare resources that the company suffers.

2. Optimal use of the scare resources to achieve the maximum contribution margin for the company.

3. Adapting the other economic resources of the company in the light of the constraints.

4. Take the necessary procedures to activate the role of constraints or scarce resources (Al-Rikabi & Hamoudi, 2011).

Theoretical and Practical Framework of Profitability Index

Companies with various activities always seek to know the profitability of each of its products or a customer of its customers as well as the profitability of the rest of its activities. Also, the company collects data on its activities and divisions to identify the products or sections that make profits and others that make losses. Therefore, the focus is on profitable products and maybe thinking about closing or removing the sections or products that make a loss. Two concepts of profitability should be known: absolute profitability and relative profitability.

Absolute Profitability

The amount of impact on the total profit of a company as a result of adding or removing a particular product line or product or customer without making any other changes. For example, when Baghdad College of Economic Sciences considers the suspension of the work of the Department of Computer Science because it achieves losses or because little profitability compared to other scientific departments, the management of the college will think about the impact on absolute profitability as a result of the suspension of the Department of Computer Science, that the measurement of absolute profitability is by A comparison between the revenues lost by the college as a result of the suspension of this section and the costs avoided by the suspension process. The rest of the other costs are ignored because they do not enter into decision-making and are non-differential and at the same time when making the decision to add a scientific department. To the college, the comparison is made between the differential income derived from the addition of a section and the differential costs incurred by the college as a result.

Differential costs are the appropriate costs that can be avoided while neglecting non-differential costs that do not affect decision-making, since these costs are borne by the college in any case and under any alternative. From the scientific point of view, the determination of the differential and avoidable costs and non-differential costs that do not change by different alternatives any non-differential or inappropriate costs, as the first alternative is the continuation of the departments of the college work despite the loss of one of the second alternative is to stop the Department of Computer Science, which achieves It is not easy to address the costs that cannot be avoided as a result of the discontinuation of the Department of Computer Science, requires cost-based analysis of activities and this helps in determining them more accurately and in order to get to that all the costs should be carefully analyzed to determine whether these costs change Alternatives, ie, to determine the appropriate costs that are suitable for the decision to add or delete the scientific section, and that the closure of the Department of Computer Science requires the study of the costs that cannot be avoided as a result of the suspension of that section and its impact on the profitability of the college and these costs are inappropriate and can only be avoided. The work of all departments of the college or are suspended some of the costs borne by the college in all cases, and should exclude those costs when measuring the absolute profitability of those departments expected to close. It is worth mentioning that colleges in some countries will provide support to staff in those departments that are expected to close.

The Concept of Relative Profitability

Absolute profitability means achieving profitability for all the college while the management of the college wants to know which department achieve the most or least profit, so the relative profitability means knowing the ratio of profitability of each department to the total profitability of the college, in order to determine which of the department achieve high profitability and Then the focus is on these profitable departments without other departments that its profitability is low. The college may continue to work for each department to achieve profitability, regardless of its relative profitability. It may happen that there are constraints facing the work of the college related to supply of scare resources and the requirements of the educational process.

From both determinants, the available spaces or classrooms and working hours are the main constraints of the educational process, which requires from the college to determine the relative profitability in the light of the constraints facing each department, and in general departments that achieve absolute profitability should be followed up and continued.

Relative profitability is measured by dividing the profitability of each department by the absolute profitability of each college, noting the constraints (lack of classrooms, available spaces, professors or working hours) for each department, as shown in table (3).

| Table 3 Shows the Differential Profit and Quantity of Scarce Resource for Each Department |

||

|---|---|---|

| Details | Accounting DepartmentDepartment | Management |

| Differential profit | 200,000 dinars | 100000 dinar |

| Required quantity of scarce resource | 400 hours | 100 hours |

From table (3), the accounting department seems more attractive than the department of business administration because it makes double profits of the department of business administration, but at the same time the accounting department requires four times the amount of scarce resource needed by the department of business administration.

Thus, the profitability of the scarce resource for the accounting department is 200000 ÷ 400 hours=500 dinars, the amount of profit per hour from the scarce resource; while the profit department of business administration is 1000 dinars per one-hour from the scare resource 100000 ÷ 100=1000 dinars.

In other words, if suppose that the number of hours available from the scare resource for the Baghdad College of Economic Sciences 400 hours, is it better used in the accounting department to generate a profit of 200,000 dinars or used in the Department of Business Administration to generate a profit of 100,000 dinars as differential profits, and in general the relative profitability should be measured using profitability index for short-term decisions as follows:

[Profitability Index=Differential Profits for the Department ÷ The Amount of Scarce Resource Required for that Department].

| Table 4 Shows how to Calculate the Profitability Index of Baghdad College of Economic Sciences and Each of the Departments of Accounting and Business Administration. |

||

|---|---|---|

| Details | Accounting Department | Business Administration |

| Differential profit | 200,000 dinars | 100000 dinars |

| The amount of scareresource required foreach department. | 400 Hours | 100 Hours |

| Profitability index | 500 dinars | 1000 dinars per hour |

The profitability index can be used to evaluate long-term projects or investment projects using the following formula:

[Profitability Index of the Project=Net Present Value of the Project ÷ Initial Cost of the Investment Project].

The profitability index is used to differentiate between long-term investment projects when the company or the investor has several long-term investment opportunities and the net present value of these investments are positive, meaning these projects are economically suitable for investment. the differential analysis between the projects have successfully passed the net present value and choosing the best one of them, taking the cost of the investment as factor to determinant the best investment.

Table (5) shows how calculate the profitability index for industrial companies, for example Istanbul company to manufacture kitchen counters for high house when the company uses scare resource to make short-term decisions, Assuming the following information is available: numbers of offers (10), the constraint is time designer for kitchen counter, time required for designer (100) hour, time available for designer all offers are (46) hour.

| Table 5 Istanbul Company Shows the Calculation of the Profitability Index for Each Offer. |

|||

|---|---|---|---|

| Offers Revenue Costs | Differential Profitscare resource | Available hours of profitability index | |

| Differential Profit ÷ hours of scare resource | |||

| First offer | 9180 dinars | 17 hours | 540 dinars per hour |

| Second offer | 7200 dinars | 9 hours | 800 dinars per hour |

| Third offer | 7040 dinars | 16 hours | 440 dinars per hour |

| Fourth offer | 5680 dinars | 8 hours | 710 dinars per hour |

| Fifth offer | 5330 dinars | 13 hours | 410 dinars per hour |

| Sixth offer | 4280 dinars | 4 hours | 1070 dinars per hour |

| Seventh offer | 4160 dinars | 13 hours | 320 dinars per hour |

| Eighth offer | 3720 dinars | 12 hours | 310 dinars per hour |

| Ninth offer | 3650 dinars | 5 hours | 730 dinars per hour |

| Tenth offer | 2940 dinars | 3 hours | 980 dinars per hour |

The Istanbul company arranging offers according to the profitability index table (3) for the scare resource (number hours for design), to get table (6).

| Table 6 Shows Arranging Orders According to their Profitability Index Per Hour from the Scare Resource as Follows |

|||

|---|---|---|---|

| Offers | Profitability Index hours used | Number of hours required | Number of hours used |

| Sixth offer | 1070 dinars per hour | 4 hours | 4 hours |

| Tenth offer | 980 dinars per hour | 3 hours | 7 hours |

| Second offer | 800 dinars per hour | 9 hours | 16 hours |

| Ninth offer | 730 dinars per hour | 5 hours | 21 hours |

| Fourth offer | 710 dinars per hour | 8 hours | 29 hours |

| First offer | 540 dinars per hour | 17 hours | 46 hours |

| Third offer | 440 dinars per hour | 16 hours | 62 hours |

| Fifth offer | 410 dinars per hour | 13 hours | 75 hours |

| Seventh offer | 320 dinars per hour | 13 hours | 88 hours |

| Eighth offer | 310 dinars per hour | 12 hours | 100 hours |

After that the Istanbul Company prepare the optimal production plan use scarce resource to incur the highest profitability index as shown in Table (7).

| Table 7 Shows the Optimal Production Plan for the Istanbul company. Sequence of Offers Differential Profit for Each Offer in the Light of the Scarce Resource |

|

|---|---|

| Sixth offer | 4280 dinars |

| Tenth offer | 2940 dinars |

| Second offer | 7200 dinars |

| Ninth offer | 3650 dinars |

| Fourth offer | 5680 dinars |

| First offer | 9180 dinars |

| Total differential profit | 32930 dinars |

The profitability index depends mainly on the differential profit, and when calculating the differential profit of a particular sector, producer, customer, department, offer, the differential costs of that offer must be taken into account. These costs include differential costs, which costs that can be avoided, whether fixed costs or variable cost. When this offer is dropping, non-differential or irrelevant costs should be ignoring.

Differentiation between Decisions

The profitability index is used to differentiate between the decisions made within the operational budget when scarce resources are not sufficient to meet the production needs, so the company may not be able to meet all the orders on its products and this is called the differentiation between decisions, It depends the trade-off on the margin or profit, Achieved by the scarce resource and not on the normal profit Achieved from the sale of products, and fixed costs usually do not effect on decisions because it aren’t avoidable or non-differential costs.

The formal of Profitability index when differentiation between decisions for short-term is:

[Profitability Index=Contribution Margin per Unit ÷ Quantity of Scarce Resource Needed to Produce One Unit]

The profitability index is identical to the contribution margin per unit of the scarce resource as shown in table (8), shows the Istanbul Company produces three types of kitchens and uses the same scarce resources for production, which is represented by the number of minutes available per week to operate the machines. The number of minutes available is 2200 minutes per week, whereas the company needs to produce kitchens about 2700 minutes per week. This means that the company cannot meet the full demand for its products, so its production is determined on the basis of the contribution margin of the scare resource for each product as explained in step (2) of the Table (8).

The profitability index was calculated as in step (3) of Table (8), the profitability index of the product RY300 is 3 dinars per minute and the profitability index of the product VY200 is 5 dinars per minute while the profitability index of the product SY400 is 5 dinars per minute. The production arrangement According to the contribution margin of the scarce resource as follows:

1- Kitchen type VY200

2- Kitchen type SY500

3- Kitchen type RY400

Then lay out the optimal production plan as in step (4) of Table (8) and it is produced according to the quantity of demand and the time remaining from the scarce resource, thus producing 200 units of kitchens out of the demand of 1000 units of product RY400 and it is extracted by dividing the remaining time from the scarce resource by 5 minutes, the time required to produce one unit of this type of kitchens. The total contribution margin is 8600 dinars is shown in step (5) of table (8). The total contribution margin is 8600 dinars is shown in step (5) of table (8).This Contribution margin is higher than any profit that company get it by production plan and assuming that the fixed costs is not affected by the decision to focus on some types of kitchens.

| Table 8 The Use of Profitability Index in Differentiation Between Decisions on Production Under the Scarce Resource |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Step 1: Production data | ||||||||||||

| Details | Product RY300 | Product VY400 | Product SY400 | |||||||||

| Contribution for unit | 15 | 10 per unit | 16 dinar per unit | |||||||||

| Weekly demand | 300 unit | 400 unit | 100 unit | |||||||||

| Quantity required from scarce resource to produce one unit | 5 minutes | 2 minutes | 4 minutes for unit | |||||||||

| Step 2: Total quantity of scarce resource (minutes) | ||||||||||||

| Details | Product RY300 | Product VY400 | Product SY400 | Total | ||||||||

| Order per week | 300 unit | 400 unit | 100 unit | 800 | ||||||||

| Quantity requested of scarce resource per unit |

5minute | 2minute | 4 minute | |||||||||

| Total quantity required From minutes weekly |

1500 | 800 | 400 | 2700 | ||||||||

| Step 3: Calculate the profitability index | ||||||||||||

| Details | Product RY300 | Product VY400 | Product SY400 | |||||||||

| Contribution per unit | 15 DI per unit | 10 DI per unit | 16 DI per unit | |||||||||

| Quantity required from scarce resource for unit. | 5minute | 2minute | 4 minute | |||||||||

| Profitability index | 3 | 5minute | 4 dinar per | |||||||||

| Step 4: Optimal Production Plan. | ||||||||||||

| Quantity available of scarce resource | 2200 minute | |||||||||||

| Required quantity of scarce resource to produce 400 units of product VY200 | 800 minute | |||||||||||

| Remaining amount (minutes) of the scarce resource | 1400 minute | |||||||||||

| Required quantity of scarce resource to produce 100 units of product SY400 | 400 minute | |||||||||||

| Remaining amount (minutes) of scarce resource | 1000 | |||||||||||

| Remaining amount of scarce resource to produce 200 units of product RY300 remaining amount of scarce resource (minutes) |

1000 minute | |||||||||||

| Step 5: Total contribution margin | ||||||||||||

| Details | Product RY300 | Product VY400 | Product SY400 | Total | ||||||||

| Contribution per unit | 15 per unit | 10 per unit | 16 per unit | |||||||||

| Optimal production plan | 200 unit | 400 unit | 100 unit | |||||||||

| Total Contribution margin | 3000 dinar | 4000 dinar | 1600 dinar | 8600 | ||||||||

Using the profitability index in management decisions

The profitability index can be used in different ways in addition to making short-term decisions (removing a production line) and long-term decisions (Differentiation between investments projects based on the initial costs of the investment). The profitability Index used to choose those high profitable products which salesmen focus on its through determine the high and low profit for products, Usually the salesmen get incentives and commissions on products with highest profitability index, for example if selling price of products as follows:

| Table 9 Using the Profitability Index in Management Decisions |

|||

|---|---|---|---|

| Products | RY300 | VY400 | SY400 |

| Selling Price Unit | 40 | 30 | 35 dinar |

The salesmen get a sales commission based on the total sales, so the salesmen prefer to sell the product RY300 because its price is the highest, but when looking at profitability of products on the basis of scarce resource, the product RY300 is the least profitable among the three products. The profitability index of the scare resource of the product RY300 is 3 dinars per minute, 5 dinars for VY400 and 4 dinars for SY400. This indicate the sales commission should be paid on the basis of the profitability scare resource) rather than sales revenue, which encourages salesmen to sell more profitable products of scarce resource instead of products sold at the highest selling price for unit; salesmen will get reports up-to date, that indicate to quantity scarce resource and profitability index as the following:

| Table 10 Quantity Scarce Resource and Profitability Index |

||||

|---|---|---|---|---|

| Details | Report of marketing |

Data of products | ||

| RY300 | VY200 | SY400 | ||

| Selling Price Unit | 40 | 30 | 35 dinars | |

| Variable cost of the unit | 25 dinar | 20 dinar | 19 dinar | |

| Contribution margin per Unit | 15 | 10 | 16 dinars | |

| Quantity required of scarce source | 5 | 2 | 4 minute | |

| Profitability Index dinar per minute | 3 | 5 | 4 dinar | |

Note: the total amount of scarce resources available is 100 minutes.

The important point, in this case, is that the salesman prefers to sell the product VY200 to get sales at 500 dinar (100 minutes * 5 dinar per minute), while the sales amount for the product RY300 will be 300 dinars and the sales amount for SY400 will be 400 dinars, and based on the total contribution margin the company will provide incentives to salesmen. If every scare resource available (100 minutes) is used in the manufacture of the product VY200 the number of units produced from it will be 50 units (100 minutes ÷ 2 minutes per unit) The total contribution margin is 500 dinar (50 units * 10 dinar) Similarly, the total contribution margin of the above three products will be 500, 400, and 300 dinar, if each scare resource (100 minutes) is used in making those products.

The profitability index also Contribute to determine the price of new products. Suppose that the Istanbul company has designed a new product named DM1000, the variable cost of the unit is 30 dinar, and each unit needs 6 minutes from the scarce resource, the Istanbul company is currently using all its production capacity, the new product will replace one of its products Therefore, the selling price of the new product will cover the variable cost plus the opportunity cost lost as a result of dropping the old product and producing a new product in its place. The Istanbul company will drop the less profitable product, it is the product RY300 has been dropped that product achieves a contribution margin to the scarce resource of 3 dinar per each minute. Therefore, the selling price should be covering at least these costs as follows:

Sale price the new product may be greater than or equal the variable costs of new product+{opportunity costs per unit of scarce resource × amount of scarce resource required to produce unit of new product}= 30 dinar+18 dinars {3 dinars contribution margin on the scarce resource * 6 minutes}

The selling price of the new product DM1000 is 48 dinar at least.

Conclusions and Recommendations

Conclusions

1- The differential analysis provides the advantage of excluding fixed costs when they are not differential or any non-differential costs when making decisions, while non-differential analysis depends on both fixed and variable costs, which leads to low-quality decisions.

2 - The profitability index in most accounting literature is used within the criteria of capital budget and operational budget.

3 - The use of scarce resources in entity units requires the use of constraints theory in processing constraints resulting from the scarce resource.

Recommendations

1- It is necessary to use differential analysis in making short-term decisions in order to contribute effectively to improve the quality of those decisions such as pricing decision; the decision to give incentives to salesmen; the decision to add or drop a particular product and others.

2 - The identification of scarce resources requires that production plans be based on the contribution margin of the scarce resource and not on the basis of the contribution margin of the unit sold.

3 - The criterion of profitability index is of great importance in use as it can be used in more than one formula in short - term and long - term decisions and the appropriate use of it will add value to those decisions and then entity units.

References

- Al-Rikabi., & Hamoudi. (2011). The role of the theory of constraints in improving the production capacity of the general company for leather industries - Baghdad factory. Journal of Technology, 24(9), ‘Baghdad, Iraq’.

- Ebaid, I.E.S. (2021). Incorporating International Financial Reporting Standards (IFRS) into accounting curricula: Perceptions of undergraduate accounting students in Saudi Universities. Journal of Advanced Research in Economics and Administrative Sciences, 2(2), 1-15.

- Al- Rikabi., & Samurai, (2017). Managerial accounting: Decision making tools in business organizations, (First Edition). Dar Al-Kitab Press, ‘Baghdad, Iraq’: BL Books.

- Charles, CH.E., & Charles, E., (2014). Managerial accounting, (Second editions). John Wiley and Sons, Inc., Press, NJ, USA: BL Books.

- Tirupathi, A., Banerjee, A., & Riaz, S. (2020). Factors leading to sustained growth of SMES in the U.A.E: A concept paper. Journal of Advanced Research in Economics and Administrative Sciences, 1(2), 91-105.

- Noreen, G., & Brewer. (2012). Managerial accounting, (Fourth edition). McGraw –hill/Irwin, Press, NY, USA: BL Books.

- Hilton R.W. (2011). Managerial accounting. Creating value in a dynamic business environment, (9th edition). McGraw – hill Irwin, Press, NJ, USA: BL Books.

- Jiambalvo, J. (2010). Managerial accounting, (9th edition). John Wiley and Sons, Inc., Press, NJ, USA: BL Books.

- Abdullahi, S. (2020). Measuring co-movements and linkages between Nigeria and the UAE Stock Exchanges: Is there opportunity for portfolio building? Journal of Advanced Research in Economics and Administrative Sciences, 1(2), 106-122.

- Kiso, W., & Kimmel. (2011). Managerial accounting: Tools for business decision making,(6th edition). John Wiley &Sons, Inc., Press, NJ, USA: BL Books.