Research Article: 2020 Vol: 19 Issue: 1

Public-Private Partnership and Infrastructural Development: Implications for Economic Diversification in Abuja, Nigeria

Obi-Anike O. Happiness, University of Nigeria

Ofobruku Sylvester Abomeh, Edwin Clark University

Okafor C. Nkiru, University of Nigeria

Abstract

Public Private Partnership as a present-day substitute to the conventional tactic where the government delivers infrastructural facilities and services to its citizens has become a prevalent practice for providing the needed infrastructure in most nations. This study investigates the public-private partnership and infrastructural development as instruments for economic diversification in Abuja. The study adopted the questionnaire survey research method. The data collected for the research was analysed using the bivariate correlation (r) statistics technique. The findings of the study showed that public private projects would improve infrastructure for economic diversification. The study therefore recommends that to ensure a permanent solution to the persistent challenges of the infrastructural deficit that impede economic growth and diversification in Abuja - Nigeria, the government has to boost the involvement of private investors on infrastructural development. This study establishes that infrastructural growth in Abuja is presently in its rudimentary phase, as such, there existed gross shortfall of infrastructure in Abuja; financing infrastructure in Nigeria is currently the government affairs. Therefore, there is an urgent need to use the Public-private partnership strategy for infrastructural development in Abuja, Nigeria.

Keywords

Diversification, Infrastructural Deficit, Infrastructural Development, Infrastructural Finance, Services Deliver, Partnership, Public Private Projects.

Introduction

It is a fundamental fact that the provision of public services and infrastructure has always been the exclusive responsibility of the government, but with the increasing population density, urbanisation and other developmental needs have restrained the government from adequately addressing the much-expected needs of the people (Dominic et al., 2015). This has propelled the Nigerian government to employ public private partnership as a tool for the development of infrastructure. The government of Nigeria over these past years have been making use of public-private partnership strategy in the financing of infrastructural projects, particularly in Abuja which is the new planned federal capital territory. The Nigeria government in the 90s moved the nation capital from the former city, Lagos, to Abuja because of congestion challenges. The congestion challenges currently faced by the city dwellers in Abuja are caused by poor and inadequate infrastructural development.

Due to gross deficiencies and wide funding gaps observed in Nigeria’s infrastructural spheres, new procurement concepts, privatization, and PPPs were adopted as a way to leverage limited public resources to help address the nation’s growing infrastructural needs. Private sector involvement has always been a constituent of economic growth; with growth comes the requirement of infrastructure. The benefits of PPP have been well recognised among practitioners. Over the years, there are arguments in favour of procuring infrastructure projects in Nigeria, but only a few are valid arguments. Basically, PPPs can mobilise additional financing sources for infrastructure and defer payment to the future. Unless there are gains, PPPs do not increase the fiscal space available for infrastructure, it only affects the inter-temporal government budget but there are no gains in discount terms. Obviously, the private sector undertakes the risk of financing public infrastructure projects to make profit (Fadeyi et al., 2016).

The present poor quality of infrastructure development is often stated as the major challenges to economic growth and economic diversification in Nigeria. The adequacy of infrastructure helps to determine the success of one nation from another in the areas of production diversification and trade expansion. Infrastructure development and its associated services are essential in the efficacy of contemporary economy growth and diversification. Infrastructure development is critical to the delivery of essential goods and services that meaningfully improve the nation’s productivity and economic competitiveness. Therefore, government judgements concerning the delivery and distribution of infrastructure have an influence on national advancement and capacity for economic diversification (National policy on public private partnership, 2008).

Although, Public- Private Partnership (PPP) has helped enormously in the accomplishment of several vital infrastructure developments in both develop and developing nations. There exist persistent challenges of the infrastructural deficit that impede economic growth in Nigeria, especially in Abuja. In the work of Osborn (2012), the scholar alluded that public-private partnership is a predetermined treaty that offers a non-governmental actor the duties to deliver certain facilities or services originally delivered by government agencies, such as federal, state, or local government agencies. Recently in most developing nations, it has been observed that the government alone does not have the capacity to put requisite resources to deliver on her infrastructural deficit; therefore, the participation of the non-governmental segment becomes necessary. The Nigeria federal capital territory (Abuja) parades one of such public private partnership (PPP), the Garki hospital in Abuja municipal Area, where the services offered to the public improved when private managers took over the facility. The inability of the Nigeria government alone to effectively redress the numerous critical capital-intensive infrastructural projects and sustain them adequately has been the bane of economic growth and diversification in Nigeria, especially in Abuja (Ofobruku & Nwakoby, 2015).

Studies in developing nations have shown that PPP act as an important part in the financing of infrastructural developments (Hwang et al., 2013; Michael, 2016; Almarri & Abu-Hijleh, 2017). These are evident in the active partnerships that exist between the public and the private segments, which have turned out to be unavoidable both in developing and developed nations. Particularly, one obvious significant solution to the inadequacy of public funds for infrastructure development would therefore be to harness private investment through the use of public private partnership.

In spite of the rapid adoption of PPPs to improve infrastructure development in the country there are numerous issues in infrastructure including poor and insufficient housing, epileptic power supply, inadequate healthcare facilities, dwindling resources, and deteriorating transport sector that have posed serious challenges to economic development in many transitional countries such as Nigeria. The standard conditions in infrastructure have given impetus to private sector participation- other impediments/challenges to the country include economic downturn arising from reduced oil revenue and mismanagement of resources, and population growth.

Therefore, any developing nation, that anticipates an enhanced economic diversification and growth need to take the PPP strategy for funding infrastructural development seriously. A wide gap exists in meeting the needs of the citizens of Abuja Nigeria (in terms of quantity and quality of public service) principally due to a shortage of public funds which impedes sustainable socio-economic development. It is against this background; therefore, this study examines the impact of PPP on infrastructural development in Nigeria and further investigates the implication of PPP for economic diversification in Abuja.

This study contributes to the existing literature on public private partnership and infrastructural development. Currently there is paucity of studies in Abuja that examine alternative sources for providing the needed infrastructure for economic diversification. This study contributes a further dimension in the search for sustainable infrastructural development in Abuja.

Literature Review And Theoretical Framework

The Concept of Public Private Partnership (PPPs)

The public-private partnerships is one the economic strategy amongs others employed by most national governments to avoid the foward capital payment of expenditure for infrastruture and to harness private-sector efficiencies, while the private-sector partners benefits better a return on investment on public infrastructure (Barlow et al., 2013). Given the current shortages in public capital for new infrastructure in some developing nations, the attractiveness of these partnerships governments enjoy continus petronages.

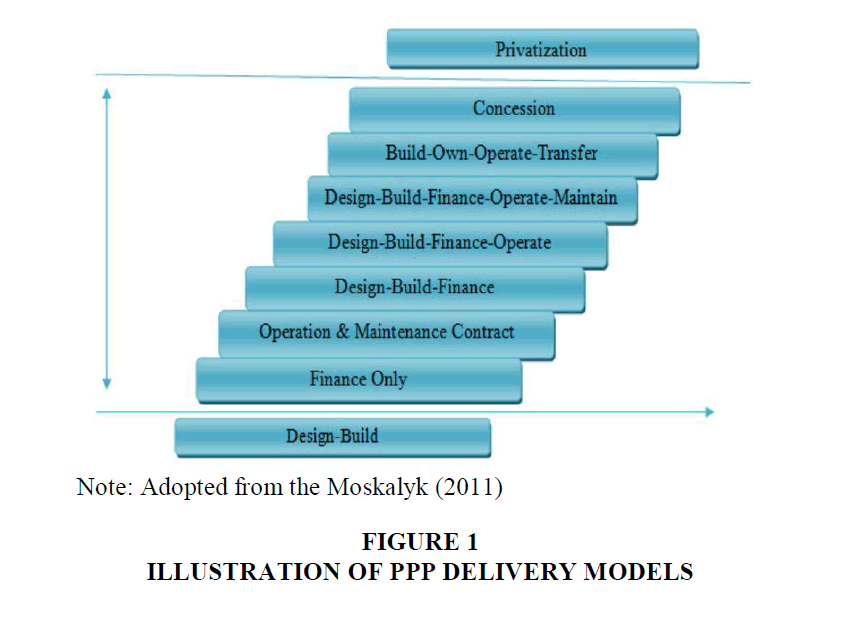

The role of PPPs investment and its efficient utilisation vary from region to regions and nation to nations; they depend on several factors such as, macroeconomic policies, economic incentives, well defined property right, sound judicial system, sound financial system, policy certainty and clarity etc. PPPs is one of the public finance initiatives and is a contractual agreement between the public and the private sectors to share financial, technical and management risks in project development and management (Oluwafemi, 2012). Figure 1 offers the diverse PPP operation models. It is pertinent to note that it is not a whole catalogue of the PPP development this is because the PPP procedures are tremendously dynamic which are firm by the particular situations existing in the environment.

The public private partnership was established by the government of Nigeria, especially in Abuja, to ensure synergy among the private sector and the public sector on key developmental projects, so as to breed trusts among project owners and project executors and also reduce the cost of project delivery. PPP involves a contract between a public sector authority and a private party, in which the private party provides public services or project and assumes substantial financial, technical and operational risk in the project (Khanom, 2010).

Concept of Infrastructure Development

Oluwafemi (2012) asserted that infrastructures are the basic physical structure needed for the operation of a society these may include industries, buildings, roads bridges, health services, and governance, just to mention a few. Infrastructure in developing countries connotes road, electricity networks, sewers and transport infrastructures. Provision of infrastructure has been the conventional responsibility of the government using taxpayer’s money through budgetary allocations. However, with a growing phenomenon world-wide the inability of the government to adequately finance ever-growing infrastructure needs serious consequences in developing countries (Oluwafemi, 2012).

In 2014, Oluwasanmi & Ogidi investigated Public private partnership and the Nigeria economic growth: problems and prospects. According to the study, the soaring demands for infrastructure are increasing geometrically and its satisfaction not being duly met by an existing contracting method in Nigeria. The study further recommends that the stockholders in the areas of PPP should be adequately trained and enabling laws to be domesticated in each state of the federation in order to take advantage of the sensitive nature of public properties and ensure continuity in government.

Mosterpaniuk (2016) investigated the development of the PPP concept in Economic theory. The study adopted structure- function analysis to identify the impact of historical changes in the study on the understanding of the efficiency and necessity of PPP cooperation of different stages of development. The findings show that the basic principles of effective cooperation between the state and business were grounded in the works of classical and modern economist that are relevant even today. The study concludes that efficiency in PPP project will lead to improvement in the development of infrastructure in the economy. On the other hand, Mosterpaniuk (2016) asserted that the understanding of PPP is largely based on the long and complicated process of development of the concept of cooperation between the private and state sector in economic theory.

In the same vein, Almarri & Abu-Hijleh (2017) also observed public private partnership between UAE and UK construction industry. Their findings show the significance of appropriate risk allocation as being the most important allocation factor of the PPP. Again, Fadeyi et al. (2018) examined public private partnership for sustainable infrastructural development in Lagos metropolis: Prospects and challenges. The finding revealed that in spite of the challenges encountered by PPP, if embraced with sincerity and transparency, PPP can improve sustainability and infrastructural development through value for money project assessment and improved delivery performance. The study recommends that there should be sincerity of purpose and transparency on the part of the government in handling the PPP contract process which is key factor if the nation is to experience any meaningful sustainable development.

Ahmad & Ibrahim (2018) examine the Malaysian public private partnership. The study adopted a primary source of data where the interview was conducted with PPP practitioners in Malaysia and likewise, the phenomenological research method was also employed. The findings of the interview explain the five phases of Malaysian PPP projects. Furthermore, the study postulates that Malaysian PPP arrangement comprises of Pre-planning phase, planning phase, construction, operation and transfer phase.

Theoretical Framework

The thrust of this study asserted that a greater level of infrastructural development can be achieved in Abuja, Nigeria, if there is a rigorous consideration by the government to involve the private sector on targeted investment on infrastructure for economic diversification and growth using robust PPP strategy. There exist some theories pertinent to PPPs. these are the system theory, theory of collaborative advantage, governance theory, game theory, x-efficiency theory, public choice theory. The system theory is considered for this research as it is been used to explore the associations existing between the different actors in the PPPs developmental space and to finance infrastructure deficit particularly for developing nations (Liu et al., 2014; Babatunde et al., 2017; 2015).

This study explored the systems theory propounded by Von Bertalanffy (1950) who theorizes the complex nature of society and science. A system is made up of an interrelated and interdependent conglomeration of different parts that are either natural or man-made. The system theory was adopted for this study. Domiciling the mechanism of systems theory within the business setup in a nation, Okoye (1997); Oriarewo et al. (2019) further avowed that organisations in a nation depict a complete system that has interconnected fragments with a single objective. This being the case, any flaw in one segment will absolutely upset the whole system. Expounding further, Okoye indicate the problem and how the subsystems objectives must be compromised in order to achieve the overall nations’ objectives of the entire organisations.

The Nigeria Federal Government inaugurated the infrastructure concession Regulatory commission (ICRC) in late 2008 to drive the program. The ICRC Act 2005 and the public procurement Act 2007, has the overwhelming objective of the PPP policy is to ensure that Nigeria has the requisite infrastructure that meets the needs of a modern economy in the 21st century (National policy on public private partnership, 2008).

PPP has been brilliantly pronounced by several scholars; questions have also been advanced as to the parts PPP could play in financing infrastructures in Abuja, Nigeria. Notwithstanding the abundant benefits inherent in the PPP strategy, there also exist several misperceptions concerning PPP that incite several criticism and rejection without proper evaluation. The argument of the opponents on the effectiveness of PPP in funding public infrastructure and service delivery in Abuja has been criticised along the following lines.

The blueprint produced by the National Assembly set up to work out the modus operandi of PPP is cumbersome, confusing, unyielding and contains certain contradiction in terms of implementation, checks and balances. There is contention that, in 1999 Obasanjo brought Pentascope to manage NITEL, such arrangement was characterized with endemic corruption and inefficiency of a monumental proportion because public funds/organization was placed in the hands of persons not elected or appointed; worst still, those implicated for wrong doing (i.e. failed management organizations) were never punished.

Although, some scholars like Barlow et al. (2013); Zhang et al. (2015); Cui et al. (2018) have shown doubt about the effectiveness of the PPP model, while the studies carried out by Ofobruku et al. (2019); Ofobruku, & Ezeah (2019) has argued that the private sector involvement could be the answer to infrastructural challenge in Abuja, Nigeria. Therefore, to further investigate the findings from the literature, this study framed the hypothesis:

H1 There is significant relationship between public private partnership and infrastructural development in Abuja

Methodology

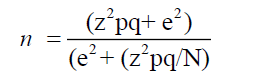

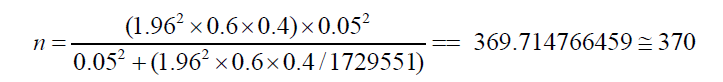

The study utilised questionnaire survey research approach for primary data collection. Both the qualitative information through a wide evaluation of literature was applied for the development of the questionnaire and quantitative data were gathered in order to establish the relationship between public-private partnership and infrastructural development for economic diversification in Abuja. Trek’s (2015) sample formula was utilised. Abuja projected population of 1,729,551 (Nigeria Demographic and Health Survey, 2013) and a confidence level of 95% (0.05) after, a sample size of 370 was calculated for respondents (Table 1). The formula is given by Stat Trek:

| Table 1: Sample Size Calculation Fct, Abuja | |||

| S/N | Names | Population | Sample size Questionnaire |

|---|---|---|---|

| 1 | AMAC | 954846.54 | 204.0 |

| 2 | GWAGWALADA | 195100.14 | 42.0 |

| 3 | KWALI | 105994.02 | 23.0 |

| 4 | KUJE | 119596.59 | 26.0 |

| 5 | ABAJI | 72006.66 | 15.0 |

| 6 | BWARI | 282007.02 | 60.0 |

| Total | 1729551.0 | 370.0 | |

Source: Field Survey by authors.

Substituting in the formula, we obtain:

This means, that the sample size for Abuja residence is 370.

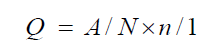

A stratified sampling method was adopted so as to give a fair representation to the designated organizations using the proportionality formula thus:

Validation was done by subjecting the research instrument to face and content validity by, two (2) experts from the industry and three (3) professors from university of Nigeria who are knowledgeable in the field under investigation. They studied the instrument thoroughly to ensure that the content of the instrument adequately represents the issues under investigation and that they are also in line with the hypothesis of the study. In this study, the reliability of the instrument was determined through the use of pilot study; the reliability of responses was checked using Cronbach coefficient alpha, the reliability coefficient of the questionnaire yielded 0.75, indicating that the instrument is reliable. These were computed with the computer aided Microsoft Statistic Program for Social Science (SPSS), the statistical model specified for the analysis presented below:

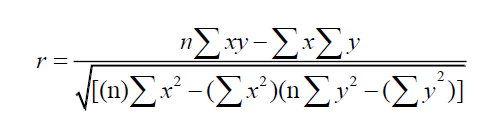

The model specification to test hypotheses is Pearson Product- moment Correlation coefficient:

Data Presentation and Analysis

The analyses were designed to observe whether the hypotheses formulated should be accepted or rejected.

Data Presentation

The respondents were asked about their views if PPP can increase the value for money spent on infrastructure to encourage economic diversification in Abuja (Table 2). Responding, 75 (20%) respondents disagreed and 97 (26%) were undecided, while a total of 198 (54%) respondents agreed and strongly agreed. Responding to the question as to whether PPP provided more efficient and reliable services, respondent answer in the following pattern: 27 (7%) disagree and 29 (8%) were undecided while 314 (85%) agreed. On the question if PPP help to keep public sector budgets deficiencies down, respondents gave the following answers: 85 (23%) disagreed and 29 (8%) were undecided, while 256 (69%) agreed. Another question put before respondents was if PPP allow or enable taxpayers to benefit value for their money on infrastructural services, there responds were: 25 (6%) disagreed, 20 (5%) and 325 (89%) agreed.

| Table 2: Responses From The Public Private Partnership And Infrastructural Development In Abuja | ||||||||||

| Public-Private Partnership | SD | % | D | % | UD | % | A | % | SA | % |

|---|---|---|---|---|---|---|---|---|---|---|

| PPP can increase the “value for money” spent for infrastructural to encourage economic diversification | - | 0% | 75 | 20% | 97 | 26% | 121 | 33% | 77 | 21% |

| PPP providing more-efficient, and reliable services; | 12 | 3% | 15 | 4% | 29 | 8% | 207 | 56% | 107 | 29% |

| PPP helps keep public sector budgets deficiencies down. | - | 0% | 85 | 23% | 29 | 8% | 101 | 27% | 155 | 42% |

| PPP allow the public sector to avoid up-front capital costs | - | 0% | 14 | 3% | 25 | 7% | 165 | 45% | 166 | 45% |

| PPP reduce public sector administration costs | 25 | 7% | 50 | 13% | 97 | 26% | 77 | 21% | 121 | 33% |

| Agreement between public private partnership enables them to work cooperatively towards shared or compatible objectives | 15 | 4% | 21 | 6% | 20 | 5% | 107 | 29% | 207 | 56% |

| PPP enable taxpayers benefits value for money | 5 | 1% | 20 | 5% | 20 | 5% | 198 | 54% | 127 | 35% |

Table 3 above indicates that when the public private partnership was correlated with infrastructural development in Abuja, the significance value produced was 0.000. The significance value of 0.000 was lesser than 0.05. Meaning we reject the null hypothesis and accept the alternative as the relationship between public private partnership and infrastructural development is significant.

Discussion of Findings

A suitable opening theme for this segment, essentially re-joins the main subjects stated in the introduction of this research work on the complicated subject that underscore the relationship between public private partnership and infrastructural development in Abuja, Nigeria. This study revealed that the main challenge affecting infrastructural development in several developing countries is financial limitations. Government agencies specifically, are inhibited by scarcity of resources. This study further revealed that private sector involvement led by public private partnership can be the solution to the current challenge of infrastructural development in Abuja, Nigeria.

The hypothesis one, Ho1, stated that: There is no significant relationship between public private partnership and infrastructural development in Abuja. Table 3 show strong positive correlations between public-private partnership and improved infrastructural development at r = 0.946**.

The significance value from Table 3 is less than 0.05, which means that the variation explained by the model is not due to chance. Based on the result shown in Table 3, we reject the null hypothesis and accept the alternative that there is a significant relationship between public private partnership and infrastructural development. The findings of this research disagreed with the view and position of Barlow et al., 2013; Zhang et al., 2015; Cui et al., 2018, which have shown uncertainty about the effectiveness of the PPP model. The results of this current research agree with some of the earlier studies and are consistent with previous findings of Hwang et al., 2013; Michael, 2016; Almarri & Abu-Hijleh, 2017, where the unique partnership between public and private on infrastructure leads to improvement in infrastructural development.

| Table 3: Result Of Analysis Of The Hypothesis | |||

| Infrastructural Development in Abuja | Pearson Correlation | 1 | 0.946** |

| Sig. (2-tailed) | 0.000 | ||

| N | 370 | 370 | |

| Public Private Partnership | Pearson Correlation | 0.946** | 1 |

| Sig. (2-tailed) | 0.000 | ||

| N | 370 | 370 | |

Source: Authors Computation, 2018

Conclusion And Recommendations

This research empirically examines and analyses the PPP and infrastructural development for economic diversification in Abuja, Nigeria. The current connection between PPP and enhancement of infrastructural development for economic diversification was examined. The practical findings and result show that PPP has positive effects on infrastructural development. Furthermore, the study revealed that improved infrastructural development for economic diversification can be achieved through public-private partnership in Abuja, Nigeria.

Studies regarding financing infrastructural project in Abuja have been conducted in the past years; different approaches from the government to private have been proposed and examined. There is an urgent need for a shift from the current practices to the more practical approach of enhancement of financing infrastructural project in Abuja. This suggested a holistic and appropriate approach involving the use of a public-private partnership strategy to improve the financing of the infrastructural project in Abuja. Additionally, this study is in agreement with the fact that public-private partnership is instrumental for the encouragement of efficiency and effectiveness in infrastructural development in Abuja.

As recognised from this research, infrastructural development in Abuja is still in its elementary phase, as there is some deficit of infrastructure in Abuja, although infrastructural development in Abuja is currently the business of the government. PPP has the capacity to improve infrastructural development in the Abuja, Nigeria since there exist a significant relationship between PPP and infrastructural development in the Abuja, Nigeria. The Nigeria government should put in place structure to coordinate and boost PPP for infrastructural development.

Implications for future research

Due to resources constraints, this research could not investigate specific sectors in Abuja, Nigeria. It is recommended that future research should collect data through mapping of the current situations of infrastructure in Abuja, Nigeria and authenticate primary data with secondary data. The following subjects are therefore recommended for further research:

1. Evaluation of public private partnership on infrastructural growth in Abuja, Nigeria: A Survey of the critical sectors.

2. Effect of public private partnership on improvement of infrastructural development in Abuja, Nigeria: A Survey of selected economic sectors.

References

- Ahmad, U., Ibrahim, Y.B., & Bakar, A.B.A. (2018). Malaysian public private partnership.Academy of Accounting and Financial Studies Journal,22, 1-6.

- Almarri, K., & Abu-Hijleh, B. (2017). Critical success factors for public private partnerships in the UAE construction industry-a comparative analysis between the UAE and the UK.Journal of Engineering, Project & Production Management,7(1).

- Babatunde, S. (2015).Developing public private partnership strategy for infrastructure delivery in Nigeria.

- Babatunde, S.O., Adeniyi, O., & Awodele, O.A. (2017). Investigation into the causes of delay in land acquisition for PPP projects in developing countries.Journal of Engineering, Design and Technology,15(4), 552-570.

- Barlow, J., Roehrich, J., & Wright, S. (2013). Europe sees mixed results from public-private partnerships for building and managing health care facilities and services.Health Affairs,32(1), 146-154.

- Cui, C., Liu, Y., Hope, A., & Wang, J. (2018). Review of studies on the public-private partnerships (PPP) for infrastructure projects.International Journal of Project Management,36(5), 773-794.

- Dominic, M.U., Ezeabasili, A.C.C., Okoro, B.U., Dim, N.U., & Chikezie, G.C. (2015). A review of public private partnership on some development projects in Nigeria.History,4(3).

- Fadeyi, O.I., Kehinde, O.J., Nwachukwu, C., Adegbuyi, A.A., & Agboola, O.O. (2018). Public private partnership for sustainable infrastructural development in lagos metropolis: Prospects and challenges.Research and Science Today, (1), 25.

- Fadeyi, T., Adegbuyi, A., Agwu, E., & Ifeanye, O. (2016). Assessment of public-private partnership on infrastructural development in nigeria: Challenges and prospects. In3rd International Conference on African Development Issues (CU-ICADI 2016).

- Hwang, B.G., Zhao, X., & Gay, M.J.S. (2013). Public private partnership projects in Singapore: Factors, critical risks and preferred risk allocation from the perspective of contractors.International Journal of Project Management,31(3), 424-433.

- Khanom, N.A. (2010). Conceptual issues in defining public private partnerships (PPPs).International Review of Business Research Papers,6(2), 150-163.

- Liu, J., ED Love, P., Smith, J., Regan, M., & Sutrisna, M. (2014). Public-private partnerships: A review of theory and practice of performance measurement.International Journal of Productivity and Performance Management,63(4), 499-512.

- Michael H. (2016). Rise in public-private partnerships in UAE. The National

- Moskalyk, A. (2011).Public-private partnerships in housing and urban development. UN-HABITAT.

- Mostepaniuk, A. (2016). The development of the public-private partnership concept in economic theory.Advances in Applied Sociology,6(11), 375.

- National policy on public private partnership. (2008). Retrieved fromhttps://www.estateintel.com/wp-content/uploads/2016/05/National-Policy-on-Public-Private-Partnership.pdf

- Nigeria Demographic and Health Survey. (2013). Retrieved from https://dhsprogram.com/pubs/pdf/FR293/FR293.pdf

- Ofobruku, S.A., & Ezeah, C. (2019). Modelling the impact of entrepreneurial venture risk taking on solid waste collection capacity in Abuja, Nigeria.World Review of Entrepreneurship, Management and Sustainable Development,15(5), 644-660.

- Ofobruku, S.A., & Nwakoby, N.P. (2015). Effects of mentoring on employees' performance in selected family business in Abuja, Nigeria.Singaporean Journal of Business, Economics and Management Studies,51(2681), 1-22.

- Ofobruku, S.A., Nwakoby, N.P., Omale, M.I., & Okoye, N.J. (2019). Effects of investment climate on entrepreneurial growth in Abuja, Nigeria.Studies,6(1), 77-86.

- Okoye, J.C. (1997). Modern management techniques and development administration.Onitsha: Abbot Books. Ltd.

- Oluwafemi, A.O., (2012). Public Priavte Partnership and infrastructural Provision in Nigeria

- Oluwasanmi, O., & Ogidi, O. (2014). Public private partnership and Nigerian economic growth: Problems and prospects.International Journal of Business and Social Science,5(11), 132-139.

- Oriarewo, G.O., Ofobruku, S.A., & Tor, Z.A. (2019). The implications of emotional intelligence on entrepreneurial performance: A discuss.South Asian Journal of Social Studies and Economics, 1-13.

- Osborn, J.E. (2012), The Role of Public-Private partnerships in rebuilding.

- Soomro, S.A., Soomro, M.A., & Memon, A.H. Assessing country?s readiness for adopting transportation public private partnerships: The case of pakistan.

- Trek, S. (2015). Stat Trek: Teach yourself statistics.

- Von Bertalanffy, L. (1950). An outline of general system theory.British Journal for the Philosophy of science.

- Zhang, S., Gao, Y., Feng, Z., & Sun, W. (2015). PPP application in infrastructure development in China: Institutional analysis and implications.International Journal of Project Management,33(3), 497-509.