Research Article: 2017 Vol: 16 Issue: 2

Public-Private Partnership in the Social Infrastructure of the Russian Federation: Features, Problems, Strategic Directions for Implementation

Leontii Mesropovich Badalov, Plekhanov Russian University of Economics

Nadezhda Vasilievna Sedova, Plekhanov Russian University of Economics

Marina Vasilievna Mishagina, Plekhanov Russian University of Economics

Keywords

Public-Private Partnership, Social Infrastructure, Infrastructure Bonds, State Regulation, Energy.

Introduction

The intensification of the development of the Russian economy, sustainable improvement of the well-being of the country's population and strengthening of Russia's position in the global community are impossible without high efficiency of public administration and dynamic use of available resources in the economy. The most progressive way to increase the efficiency of the execution of public functions by the government is PPP, which involves the transfer to the private business of part of the economic, organizational and managerial functions in the production of public goods, public services and management of state property. In this article, the features of implementation of projects of public-private partnership are for the first time reflected in branches of social infrastructure, the statistical information on these objects and the specifics of their realization in the Russian Federation are analysed. In the prevailing conditions, the private business plays an important role in solving social and economic problems. The need for partnership between the state and the business arises, first of all, in the social sectors for which the state is responsible (Essig & Batran, 2005). By attracting private investment in socially important projects, the state decides on their financing. In turn, for business there is an opportunity to expand the sphere of profitable capital application, enhancing the interest of entrepreneurs to cooperate with the state. Owing to this mutual interest, various forms of interaction between the state and the business emerged, namely PPP (Scharle, 2002). According to the definition by the World Bank, PPP is characterized by an agreement between public and private partners seeking to produce and provide infrastructure services, seeking to improve the efficiency of budget financing and attract investment (Avtsinov, 2014).

Methods

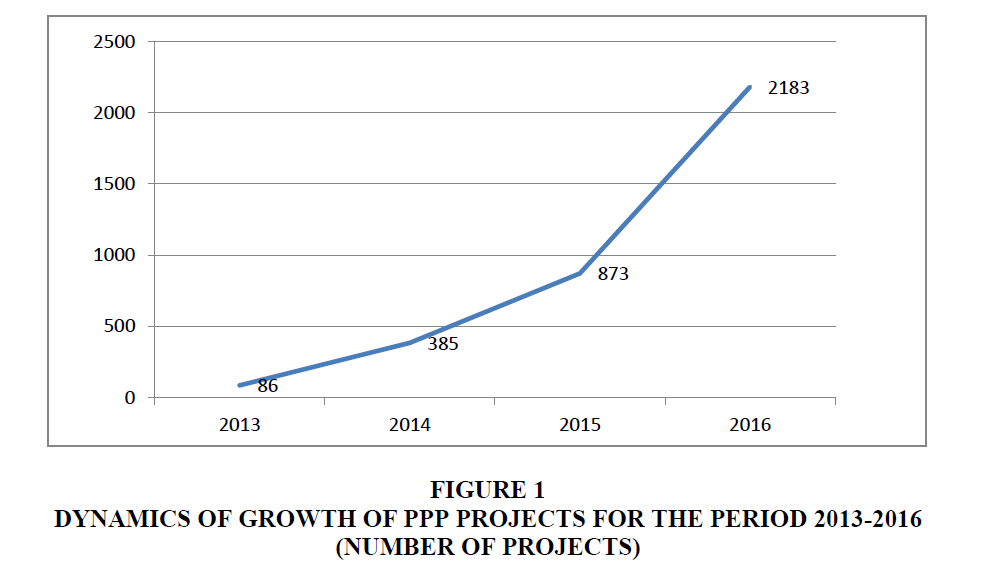

PPP as an instrument of economic policy involves the private sector to partially or fully perform the functions of the operator for services traditionally being the sphere of state responsibility, including the transport infrastructure. At the same time, this institution performs multiple functions in the national economy at a certain stage. The following methods of research have been used in this article: Statistical, correlation and regression and competitive analysis, expert estimates. Also, the base of this research is made by various provisions of the system analysis. The potential of PPPs in Russia in addition to modernization and development of infrastructure is also associated with improving the efficiency of state property management and increasing financial returns from state-owned economic assets, but, unlike privatization policy, without losing state ownership of such facilities (Avtsinov, 2014). According to expert estimates, in order to implement the scenario of accelerated infrastructure development, the regions need investments in the road sector until 2020 about 20 trillion roubles and it is extremely difficult to cover this need only at the expense of budgetary funds (even with federal co-financing) (Salamzadeh et al., 2015). In this regard, the urgency of using PPP mechanisms in the construction and reconstruction of regional road infrastructure is more a necessity than an alternative and the efforts made by the Ministry of Transport to establish mechanisms for financial support for regional PPP projects are fully justified (Anfimova, 2014; Osborne, 2000). Currently, PPP projects in the social sector are more focused on reimbursing the investor's expenses for construction/reconstruction of facilities than improving the quality of the service provided via the operator's competencies. However, market players are making attempts to form a "quality infrastructure" in these sectors (Ashinova, 2013; Rosenau, 1999). Figure 1 shows that the number of PPP projects that have passed the stage of commercial closure is steadily growing. On average, the annual increase is 124.5%. The growth of the PPP market in 2016-2017 will be owing to the fact that signing of concession agreements and financial closure of large infrastructure projects that were launched in 2015 are expected in the near future.

In 2016, there was positive dynamics in the growth in the PPP project market also in monetary terms. The bad trend of 2015 of the negative dynamics of attracting private investment in infrastructure projects was overcome. Also, it can be said about overcoming the negative factors of the post-crisis period, which influenced the market of PPP projects in 2015. According to representatives of the constituent entities of the Russian Federation, the level of profitability of PPP projects averages about 10-12% (Blokhina, 2009).

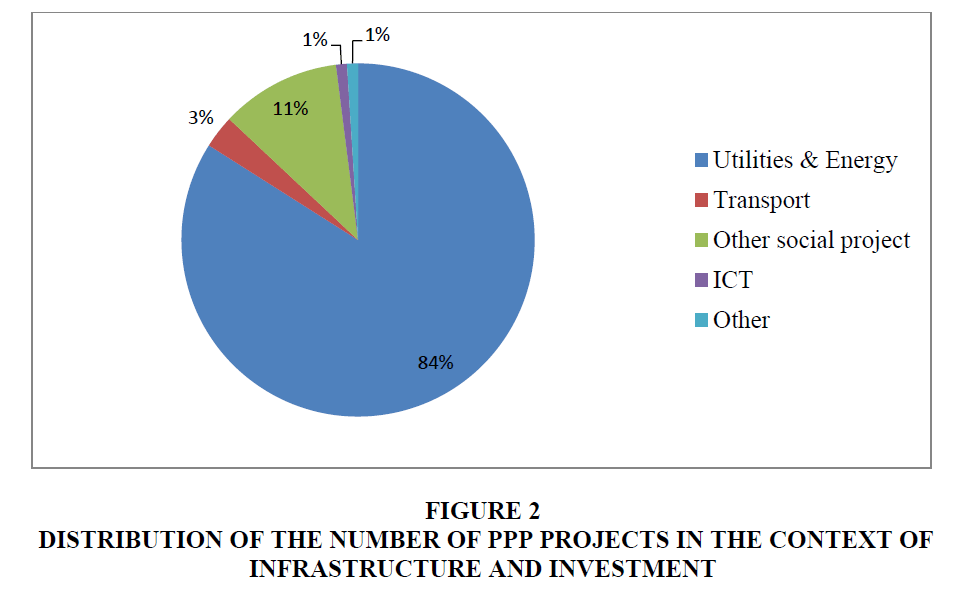

In Figure 2, we can see the distribution of the number of PPP projects in terms of infrastructure and investment volume. The leading position is occupied by housing and communal services projects, followed by other social projects (education, tourism, healthcare, etc.), followed by the transport sector. But in the study by Ernst & Young "On the sectorial attractiveness of PPP in the next 5-10 years" the leading position is taken by the transport infrastructure, followed by the utilities and electric energy sector. The leading position of transport infrastructure in the future is owing to the fact that PPP projects in the transport sector are concluded for an average of 12.7 years and housing projects-up to 10 years. The longest term of a PPP contract in the transport sector is 20 years and in the housing and communal services sector-15 years. To improve the quality of services and save the federal budget’s funds, it is necessary to develop communal, energy and transport infrastructure. After all, insufficient infrastructure development, that is, infrastructure constraints, undermines economic growth at the regional level, which will lead to a curbing of economic growth in the entire country.

Results

The main reasons for the infrastructural limitations are: 1. Lack of financing of infrastructure from budget sources; 2. Mistakes of state and municipal planning and management, misallocation of public resources leading to the selection of infrastructure projects that are less effective in terms of economic growth; 3. Overstating the timing of project implementation and financing, as well as the use of obsolete technologies in the construction of infrastructure facilities; 4. Low efficiency and quality of infrastructure facilities management. 5. Using the PPP mechanisms, it is possible to attract additional financial investments in projects from off-budgetary sources. So the PPP tools will enable not only to attract additional financial resources, but also ensure that investors receive a low, but stable return on investment. In this study, the authors analysed for the first time various projects in the sphere of social infrastructure in the federal districts of the Russian Federation. On the ground of the analysis of PPP projects in the road sector in the federal districts, it is necessary to put forward a number of proposals, which, in the authors' opinion, will contribute to the development of this mechanism in the transport industry and directly in the road sector. First, it is necessary to introduce the methodology and qualitative criteria of project evaluation at the legislative level, which will contribute to identifying risks, analysing the consequences of the project implementation and indicating other positive and negative aspects of the agreement for both public and private partners. Second, it is necessary to pay special attention to improving the sectorial legislation on PPP and creating the most comfortable conditions for business with the purpose of attracting private investments in the development of road infrastructure. Third, it is necessary to increase the participation of Russian business in the planning, management and financing of transport infrastructure, as well as to increase the share of private sector investments as compared to public investments. Also, there are problems in the development of PPP projects not only from the private sector, but also from the government. An example of such a problem is long terms for the coordination by federal executive bodies of the issues related to the implementation of projects. This problem is not so obvious in large cities such as Moscow and St. Petersburg, but at the regional level PPP projects are often easily confused with government procurement, since regional executive bodies do not have sufficient competence to make projects. Regional executive authorities need retraining of personnel responsible for introduction and implementation of PPP projects. Also, investors note the high cost of the pre-project stage. Hence, the following problem emerges-the lack of high competition. PPP projects are often implemented by the same players, which in turn affects the quality of projects. An additional barrier is the lack of awareness of the business community about the legal forms of PPP, as well as low legal protection of private investors and lenders in the implementation of regional and municipal infrastructure projects.

Discussion

The state and the business need universal mechanisms of long-term guarantees and the legislator does not provide such mechanisms. All this negatively affects the investment attractiveness of the infrastructure business (potential investors are at risk of negative changes in legislation/adoption of individual regulations that significantly worsen the conditions for their activities). The implementation of public tasks with the help of infrastructure projects (enhancement of infrastructure attractiveness and, as a result, business and social climate and particular areas) is under the threat of risk. (Bortalevich, 2011) Since the average yield of PPP projects is 10-12% and investors receive a discounted profit over time, while the risks of not making a profit are high, the profitability of PPP projects on average can be regarded as a deposit in the bank, but including a greater default risk than a common deposit. Similarly, when investors note that federal authorities spend a lot of time approving a project, they raise such a problem as the lack of structuredness and thoughtfulness of projects that are proposed for implementation in PPP (Kondratyeva, 2015). The lack of structuredness does not allow the government to verify the investor's financial capacity to implement this PPP project to the fullest extent. The practice shows that despite the problems, projects in the energy, transport, housing and communal services have investment attractiveness, which proves the dynamics of the growth in the number of projects and the amount of their financing. It is due to long terms of project approval that there is a sharp jump in the number of concession agreements in 2016, as the projects that were considered in 2014, 2015 were signed in 2016. In the energy sector, the use of the concession mechanism is not entirely feasible, since most of the assets are privatized. So conventional concession projects are difficult to apply to the energy infrastructure, which slows down the growth in the number of projects and the amount of cash invested (Kryukova & Lemyeva, 2016). It is worth noting that the transport infrastructure, among the housing and communal and the energy sectors, is the most attractive, which is demonstrated by the forecasted growth in the dynamics of projects and their financing. Despite the fact that concession agreements are often applicable in housing and communal and transport infrastructures, in energy infrastructure, their use becomes problematic. This is due to the use of basic tools for raising funds (Kryukov, 2013). One of the tools for the successful development of PPP in Russia in the energy sector can be infrastructure bonds, through which it is possible to obtain more large-scale investments from conservative investors, primarily pension funds. Issuing infrastructure bonds will allow meeting the needs of the state and the private business in investment resources and sustainable projects and also offer the market a type of a security that "works" for a long period and is sufficiently profitable (Blokhina, 2009). But infrastructure bonds in Russia have not yet developed due to the undeveloped legislative base. Infrastructure bonds are bonds issued by a Special Purpose Vehicle (SPV) to attract funds intended for financing the creation or reconstruction of infrastructure facilities (road, port, railway, airport, power lines, etc.), the fulfilment of obligations under which is secured in the amount and manner prescribed by law (Petrikova & Korzina, 2011). Infrastructure bonds have long been issued abroad in countries such as the United States, India, Australia, etc. Infrastructure bonds are issued for the purposes of a particular project, while investing in infrastructure bonds, the investor bears the risks solely related to this project (Delmon, 2009). In the energy sector, subject to the allocation and prevention by the state of a number of risks, infrastructure bonds would be in demand in those areas where projects are made to be implemented in the medium to long term. Thus, the risk of loss of financial resources is minimized and the guarantor of payment of financial resources appears. An example of such projects is projects in the Far East and Transbaikalia.

Conclusion

Thus, the state regulation of PPP implies the use of a set of legal, organizational, economic and administrative methods that are inseparable from each other and only in aggregate can guarantee the achievement of the desired results from the implementation of any PPP project. PPP, in the authors’ opinion, can and should be considered as an accelerator of innovative development of the economy. Infrastructure bonds can become an important and new instrument of implementation of projects of public-private partnership in the Russian Federation. Infrastructure bonds are a way to provide regions and local people with more opportunities to work with the private sector, not giving up the advantage of subsidizing the federal government. The issuers of bonds are most often government bodies of various levels. Thus, the implementation of a balanced investment policy using the strengths of the public and private sectors will allow achieving qualitative results in the implementation of the model of PPP in Russia.

References

- Anfimova, M. (2014). Regionalnyi analiz finansirovaniya proektov v forme gosudarstvenno-Chastnogo partnerstva v Rossii [Regional analysis of financing ppp projects in Russia]. Biznes v zakone, 4. Retrieved August 12, 2017, from http://cyberleninka.ru/article/n/regionalnyy-analiz-finansirovaniya-proektov-v-forme-gosudarstvenno-chastnogo-partnerstva-v-rossii

- Ashinova, M.A. (2013). O roli gosudarstvenno-chastnogo partnerstva v protsessakh formirovaniya ekonomicheskikh klasterov [On the role of PPP in the processes of economic clusters formation]. Novye tekhnologii, 1. Retrieved November 25, 2016, from http://cyberleninka.ru/article/n/o-roli-gosudarstvenno-chastnogo-partnerstva-v-protsessah-formirovaniya-ekonomicheskih-klasterov

- Avtsinov, O.I. (2014). Osobennosti realizatsii proektov gosudarstvenno-chastnogo partnerstva v Rossii [Specifics of PPP projects implementation in Russia]. Vestnik Tambovskogo gosudarstvennogo tekhnicheskogo universiteta, 4. Retrieved November 21, 2016, from http://cyberleninka.ru/article/n/osobennosti-realizatsii-proektov-gosudarstvenno-chastnogo-partnerstva-v-rossii

- Blokhina, I. (2009). Institut infrastrukturnykh obligatsii: Tseli vvedeniya i mekhanizm realizatsii [Institution of corporate bonds: Goal of introduction and realization mechanism]. Korporativnyi yurist, 5. Retrieved August 12, 2017, from www.vegaslex.ru/db/msg/13211

- Bortalevich, S.I. (2011). Innovatsionnye protsessy v energetike [Innovative processes in the energy sector]. Vestnik ChelGU, 36. Retrieved August 12, 2017, from http://cyberleninka.ru/article/n/innovatsionnye-protsessy-v-energetike

- Delmon, J. (2009). Private Sector Investment in Infrastructure: Project finance, PPP project and risk. The Word Bank and Kluwer Law International.

- Kondratyeva, U.D. (2015). Planirovanie riskov realizatsii proektov gosudarstvenno-chastnogo partnerstva [Planning of risks of implementation of PPP projects]. Upravlencheskoe konsultirovanie, 6(78). Retrieved August 12, 2017, from http://cyberleninka.ru/article/n/planirovanie-riskov-realizatsii-proektov-gosudarstvenno-chastnogo-partnerstva

- Kryukova, I.V. (2013). Chastno-gosudarstvennoe partnerstvo kak osnova razvitiya regiona na primere Vologodskoi oblasti [Public-private partnership as the basis of a region’s development: Case study of Vologda oblast (Region). Yaroslavskii pedagogicheskii vestnik, 1. Retrieved November 25, 2016, from http://vestnik.yspu.org/releases/2013_1g/14.pdf

- Kryukova, Y.L. & Lemyeva, I.V. (2016). Tendentsii razvitiya gosudarstvenno-chastnogo partnerstva [Trends of development of public-private partnership]. Gosudarstvenno-chastnoe partnerstvo, 3(1), 53-62.

- Petrikova, E.M. & Korzina, E.A. (2011). Vozmozhnosti regionalnykh i mestnykh byudzhetov po realizatsii mekhanizmov gosudarstvenno-chastnogo partnerstva (GCP) [Opportunities of regional and local budgets in connection with the implementation of PPP Tools]. Finansy i kredit, 251, 28-32.

- Ke, Y., Wang, S., Chan, A.P. & Lam, P.T. (2010). Preferred risk allocation in China's Public-Private Partnership (PPP) projects. International Journal of Project Management, 28(5), 482-492.

- Scharle, P. (2002). Public-Private Partnership (PPP) as a social game. Innovation. The European Journal of Social Science Research, 15(3), 227-252.

- Essig, M. & Batran, A. (2005). Public-private partnership-development of long-term relationships in public procurement in Germany. Journal of Purchasing and Supply Management, 11(5), 221-231.

- Rosenau, P.V. (1999). Introduction: The strengths and weaknesses of Public-Private Policy Partnerships. American Behavioural Scientist, 43(1), 10-34.

- Salamzadeh, A., Farsi, J.Y., Motavaseli, M., Markovic, M.R. & Kesim, H.K. (2015). Institutional factors affecting the transformation of entrepreneurial universities. International Journal of Business and Globalisation, 14(3), 271-291.

- Osborne, S.P. (2000). Public-Private Partnerships: Theory and Practice in International Perspective. London: Routledge.

- This article was originally published in a special issue, entitled: “Innovative Technologies, Industrial Development, Agrarian Policies, Resource Management and Sustainable Strategies towards the Economic Growth of the Russian Federation", Edited by Grigorios L Kyriakopoulos