Research Article: 2022 Vol: 25 Issue: 3S

Regulatory Technology (RegTech) Research: A Bibliometric Analysis of Current Literature

Ishtiaq Ahmed Bajwa, Imam Abdulrahman Bin Faisal University

Shabir Ahmad, Imam Abdulrahman Bin Faisal University

Ali Murad Syed, Imam Abdulrahman Bin Faisal University

Tarig Khidir Eltayeb, Imam Abdulrahman Bin Faisal University

Citation Information: Bajwa, I.A., Ahmad, S., Syed, A.M., & Eltayeb, T.K. (2022). Regulatory technology (RegTech) research: A bibliometric analysis of current literature. Journal of Legal, Ethical and Regulatory Issues, 25(S3), 1-9.

Abstract

Following the global financial crises of 2008, the regulatory environment and technology have changed the landscape of financial markets, services, and institutions. RegTech or the use of regulatory technology is at the core of this change. Although the field is relatively young, the research volume has significantly grown in the past few years creating a need for mapping out the field. In this study, we conducted a bibliometric analysis of RegTech literature. We used the Web of Science database to extract the relevant high-quality studies. The data is analyzed using the HistCite, Biblioshiny, and VosViewer software. We found that the USA, UK, and China are the main contributing countries in RegTech research, whereas the institutions like London School of Economics, Harvard University, and Kings College London are the leading institutions. The ‘Journal of Banking Regulation’, and ‘Technological forecasting, and social change’ have been the main destinations for publishing RegTech research. This article provides further analysis of influential authors, keyword co-occurrences, and RegTech research clusters in addition to discussing the implications, and future research direction.

Keywords

Regulatory Technology, Bibliometric Analysis.

Introduction

The financial sector in recent years is enormously mature compared to what it was a decade ago. The primary source of disruption in the financial industry is the increasing number of technologies introduced by IT firms and the rapid digitalization of the financial sector. Fintech firms and applications have changed the functionality and trends of financial markets. The financial market procedures, the payment system, and the fundraising platforms remained the main target of fintech companies (Gabor & Brooks, 2017). This novel and staggering use of new financial technology have also posed risks for the system and challenges for the regulators. To outfit to these challenges and for financial market players' risk management and compliance activities, the new technological solutions are referred to as RegTech or regulatory technology (Institute of International Finance, 2021). According to Butler and O’Brien (2019), regulatory technology can be considered a new and dynamic dimension of FinTech. However, compared to other financial sector innovations, the development of regulatory technology is in the nascent stages.

According to Arner et al. (2016), RegTech is the use of IT-related technology for regulatory surveillance, compliance, and reporting. It has changed the entire procedures of the regulatory environment. RegTech enables the regulators to have better access and management of data and hence more prudential supervision for financial markets and players. Furthermore, the application of RegTsech facilitates the monitoring of financial market participants who are becoming increasingly fragmented by the emergence of new FinTech start-ups. The importance of RegTech especially increased after the 2008 global financial crisis (Arner et al., 2016).

Though RegTech is quite a young field of research, however, in recent times the literature has grown at a reasonable pace in this area. Especially in the last 10 years, a good number of studies have emerged on the topic. Similarly, few studies have also analyzed this existing situation and literature on RegTech (Arner et al., 2016; Becker et al., 2020). However, there is no detailed bibliometric review available on the topic. Moreover, due to the reasonably growing research in the field a good review may add value to the existing literature by highlighting the current research dimensions on RegTech.

This study attempts to contribute to the existing literature by providing a review of RegTech research by covering 61 articles from the Web of Science (WOS hereafter) database. This study aims to answer the following questions: (1) What are the main areas of RegTech research? (2) What are the leading institutions, countries, journals, and authors in the domain? (3) What are the most influential and articles and topics? What are the key research streams in the RegTech literature? We also applied bibliometric citation analysis in this study, a burgeoning technique mostly used by the review papers in the domain of management and social sciences (Bahoo et al., 2020).

Data and Methodology

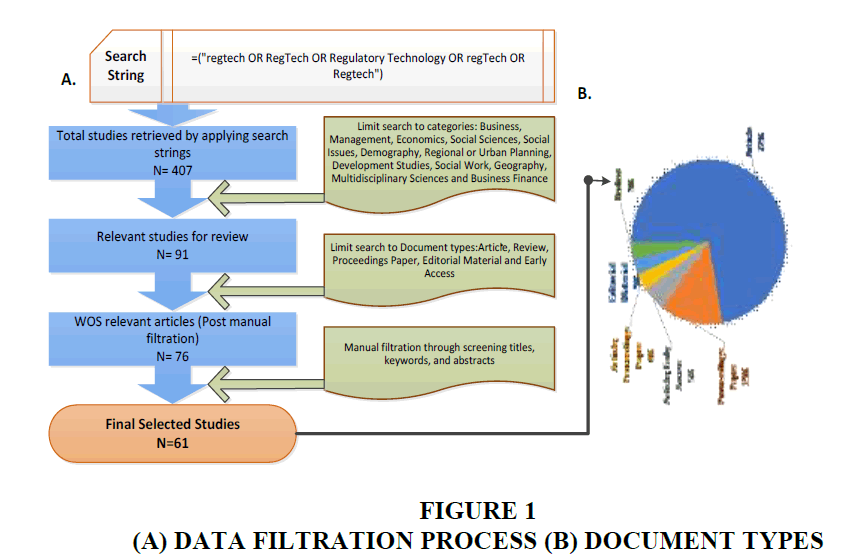

This article aims to conduct a bibliometric analysis of RegTech research. We used WOS database to gather all relevant articles on the topic. WOS is one of the primary databases covering good-quality studies in social sciences like many other disciplines; this database choice is consistent with other studies like Apriliyanti & Alon (2017) and Naatu & Alon (2019). Figure 1 provides a brief overview of the data collection and filtration process. We used the RegTech related keywords to collect the relevant articles. In the first round, 407 articles were extracted. These articles were further filtered in the database, based on disciplines. Finally, the area experts applied the manual filtration process to exclude the irrelevant and incomplete research articles to arrive at a final number of 61 articles for analysis. Our methodology is in line with the standard approaches of meta-analysis in socio-economic fields (Lensink et al., 2018). We conducted an in-depth analysis by carefully examining the published articles to capture the most relevant information. It covers bibliometric citations which is the quantitative perspective of RegTech literature. Following the contemporary techniques for the bibliometric citation analysis, we performed checks on the influential aspects of the subject area, journals' profile, country of origin, institutional affiliations, and authors' eminence in the research area (Bahoo et al., 2020). We highlighted the influential aspects of existing literature: it includes the number of research articles produced each year, the most influential journals, top countries producing the research, and institutions contributing the most within those countries. we further focused on the most productive authors, and finally, the most prominent and trending publications. For this study, we used various bibliometric software to analyze the citation trend and explore relevant networks and clusters among countries and institutions and their preferred research fields. In addition, cocitation, co-authorships, and cartographic analyses were conducted using the software HistCite, VOSviewer and Biblioshiny.

Results and Discussion

RegTech Research Trend and Influential Journals

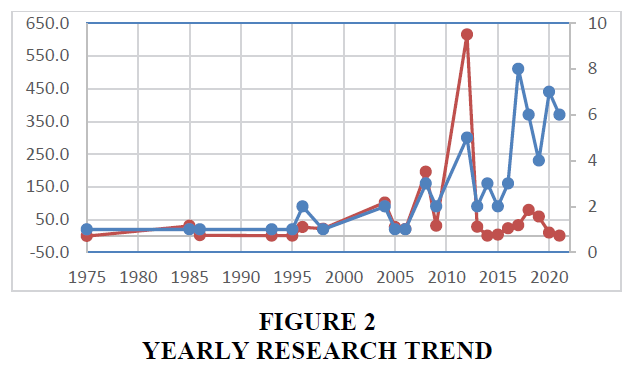

The research trend in RegTech research gained momentum after the 2008 global financial crisis as shown in Figure 2. This is mainly because regulators and regulatory procedures are changing and encourage higher use of technology after the 2008 crisis. This increase in overall research has also increased the number of global citation scores. This citation score represents citations in all domains within WOS as Total Global Citations (TGC). The overall data reports 61 articles on regulatory technology that were published by 49 journals indexed in ISI WOS. These articles were contributed by 136 researchers. Out of these articles, there are mainly 72% research articles, 13% conference proceeding papers, 3% review papers, and editorial material each.

Concerning influential journals, we selected the top journals based on two criteria. First, the journal with a minimum of two publications on RegTech (PRT ≥ 2). Second, based on the highest annual global citation, a citation criterion is given by Histcite. Based on the number of publications, the ‘Journal of Banking Regulation’ and ‘Technological Forecasting and Social Change’ are the two top journals. In comparison, the Academy of Management Journal, Business Strategy and the Environment, Information Systems Research, and few others all share two publications each. Whereas based on Total Global Citations per year (TGC/t), the Ecological Economics, Business Strategy and the Environment, the Journal of Economics and Business remained on the top of the list (Table 1).

| Table 1 Most Influential Journals in Regtech Research | ||||

| Rank | Journal1 | PRT | Journal2 | TGC/t |

| 1 | Journal Of Banking Regulation | 3 | Ecological Economics | 55.6 |

| 2 | Technological Forecasting and Social Change | 3 | Business Strategy and The Environment | 15.0 |

| 3 | Academy of Management Journal | 2 | Journal Of Economics and Business | 10.3 |

| 4 | Business Strategy and The Environment | 2 | Information Systems Research | 7.9 |

| 5 | Energy Tax and Regulatory Policy in Europe: Reform Priorities | 2 | Journal of International Business Studies | 7.1 |

| 6 | European Business Organization Law Review | 2 | Technological Forecasting and Social Change | 4.9 |

| 7 | Information Systems Research | 2 | Academy of Management Journal | 4.7 |

| 8 | Innovation-The European Journal of Social Science Research | 2 | Labour Economics | 4.6 |

| 9 | Journal of Information Technology | 2 | Cogent Business & Management | 3.8 |

| 10 | Regulation & Governance | 2 | Small Business Economics | 3.3 |

| PRT = The number of published papers in the period selected; TGC/t= Total Global Citations per year | ||||

Most Influential Countries in RegTech Research

As most influential journals are published in the USA, it is not surprising to see the USA is the most influential country in terms of the number of publications (PRT). The country has 20 publications in the sample data (Table 2). UK, China, and Australia follow the USA in terms of leading research on RegTech. Moreover, regarding research citations in global contexts, Germany, the USA, and the UK remained on top. These countries are followed by Canada, Belgium, Denmark, and Sweden. Table 2 presents the top 7 countries in terms of the list of publications and their global citation during our sample period.

| Table 2 Most Influential Countries in Regtech Research | ||||

| Rank | Country1 | PRT | Country 2 | TGC |

| 1 | USA | 20 | Germany | 566 |

| 2 | UK | 16 | USA | 336 |

| 3 | China | 5 | UK | 293 |

| 4 | Australia | 4 | Canada | 124 |

| 5 | Canada | 4 | Belgium | 104 |

| 6 | Germany | 4 | Denmark | 58 |

| 7 | Italy | 3 | Sweden | 32 |

| PRT = the number of published papers in the period selected; TGC= Total Global Citations | ||||

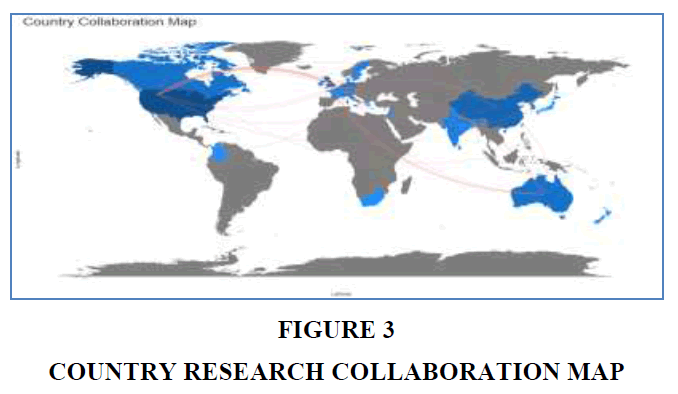

Figure 3 displays the top country research collaboration map by Biblioshiny software based on authors' affiliation in RegTech research. The minimum edge parameter is taken as one. The USA and the UK emerged as top collaborators with five publications. Germany and Switzerland collaborated in 2 publications, whereas the UK and Australia share two publications among themselves.

Most Influential Universities and Authors in RegTech Research

Likewise, the universities of the UK, USA, and Australia are leading institutions in research on RegTech. London School of Economics remained on the top with 4 publications on this infancy field (Table 3). It is followed by, Harvard University, Kings College London, UCL, and the University of Sydney with two publications each. On the other hand, in terms of total global citation score, the Central European Economic Research institute along with the University of Applied Sciences Augsburg remained on the top with the highest 556 citations. Catholic Univ Louvain along with the University of Exeter occupied the second position with 100 global citations. Marshall University along with Queens University remained in the third position with 96 citations. It is worth mentioning here that universities/institutions of first and second authors are considered under this category.

| Table 3 Most Influential Institutions in Regtech Research | ||||

| Rank | Institution1 | PRT | Institution2 | TGC |

| 1 | London School of Economics | 4 | Ctr European Econ Research University of Applied Sciences Augsburg |

556 |

| 2 | Harvard University | 2 | Catholic Univ Louvain University of Exeter |

100 |

| 3 | Kings College London | 2 | Marshall University Queens University |

96 |

| 4 | UCL | 2 | Fed Reserve Board Governors | 83 |

| 5 | University of Sydney | 2 | Imperial Coll London University of Leeds |

45 |

We categorized the top authors in the field based on total global citations per year (TGC/t). Under this categorization, the Jens Horbach from the University of Applied Sciences Augsburg remained on the top. He received a total of 55.6 citations per year for his lone publication in the domain. Pelin Demirel of the Imperial College of London is the second most cited author with 15 citations per year, he is followed by Anagnostopoulos from Kingston Business School, he has received 10.25 citations per year. Table 4 given below provides the list of the top seven influential authors with their number of publications and (PRT) and total global citations per year (TGC/t). Research does not prosper in silos; it is an outcome of academic discourse on unknown factors in real-life situations. We also identify the co-authors' networks in the data sample by employing a criterion of a minimum of 2 co-authored publications. The authors like Jonathan Seddon and Wendy Currie remained most collaborative with two publications in this relatively young domain.

| Table 4 Most Influential Authors in Regtech Research | |||||

| Rank | Name of author* | Name of university/institution** | PRT | TGC | TGC/t |

| 1 | Jens Horbach | University of Applied Sciences Augsburg | 1 | 556 | 55.6 |

| 2 | Pelin Demirel | Imperial College London | 1 | 45 | 15 |

| 3 | Anagnostopoulos | Kingston Business School | 1 | 41 | 10.25 |

| 4 | Régis Coeurderoy | Catholic University Louvain | 1 | 100 | 7.15 |

| 5 | Radhika Santhanam | University of Oklahoma | 1 | 96 | 6.85 |

| 6 | Christopher Gust | Federal Reserve Board | 1 | 83 | 4.61 |

| 7 | Carmen Weigelt | Tulane University | 1 | 23 | 3.83 |

| * Ranking based on first author only. ** Institutions’ ranking is based on Total Global Citations per year (TGC/t) | |||||

Most Influential Studies in RegTech Research

Table 5 lists the articles with a higher impact in terms of total global citation per year in the full sample period. Horbach et al. (2012) published in Ecological Economics is the most cited article per year, on average, in the entire sample period. Horbach et al. (2012) applied an empirical analysis of eco-innovation determinants among German firms. The study found that expected future regulations for all environmental product innovations are an important factor for eco-innovation. Second on the list is the study conducted by Demirel & Kesidou (2019) who suggested that “firms need to renew and realign their capabilities, and ultimately develop distinctive sustainability-oriented capabilities, to meet the rapidly changing regulatory, technology, and market demands.” The study received 15 citations per year. The third study in the list is by Anagnostopoulos (2018) which received 10.25 citations per year. The study raises the issue of regulatory challenges in the wake of technology advancement and Fintech use in the banking and financial sector.

| Table 5 Most Influential Studies in Regtech Research | ||||

| Rank | Author (s) and year 1 | Journal | TGC | TGC/t |

| 1 | Horbach et al. (2012) | Ecological economics | 556 | 55.60 |

| 2 | Demirel and Kesidou (2019) | Business strategy and the environment | 45 | 15 |

| 3 | Anagnostopoulos (2018) | Journal of economics and business | 41 | 10.25 |

| 4 | Coeurderoy and Murray (2008) | Journal of international business studies | 100 | 7.14 |

| 5 | Santhanarn et al. (2008) | Information systems research | 96 | 6.86 |

| 6 | Gust and Marquez (2004) | Labour economics | 83 | 4.61 |

| 7 | Weigelt and Shittu (2016) | Academy of management journal | 23 | 3.83 |

Classification of RegTech Research

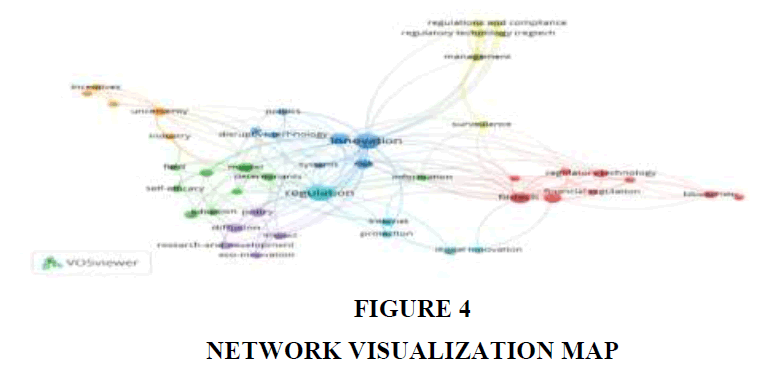

In addition, we employed a thematic clustering analysis to assess the research growth and clusters of studies. A thematic analysis includes an assessment of keyword co-occurrence through a network visualization map. The thematic analysis was performed using the cartography technique in VOSviewer. A total of 321 keywords from 48 articles (with minimum of 2 keywords) were used in the analysis. As shown in Figure 4, the network visualization map revealed 7 main clusters of keyword co-occurrences. The first cluster, ‘Regulation’, the biggest among them as the bubble size indicates, mainly co-occurred with the keywords such as internet, protection, and digital innovation. Likewise, the second cluster is composed of the keywords such as innovation, risk, disruptive technologies, and politics. The third cluster contains fintech, financial regulation, and regulatory technology. Whereas the rest of the clusters (4-7) mainly used the keywords such as regulation & compliance, surveillance, policy, adoption, and uncertainty, respectively. It is noticeable that these clusters of keywords are quite meaningful and relevant to RegTech.

Implications

Globally many new regulatory changes are published by regulators and other supervisory authorities. Not only the total number of regulatory requirements has increased steadily, but the degree of complexity of regulations has also increased (Eggert, 2014). The banks and financial institutions have shown an affirmative response and these institutions are searching for new and innovative solutions to handle this regulatory burden (Becker and Buchkremer, 2018). RegTech is undoubtedly one best solution to handle this situation both for regulators and market players. However, these RegTech solutions are currently at an early stage of implementation as compared to other innovations, like FinTech in the financial industry (Institute of International Finance, 2021).

This study conducted a bibliometric review of RegTech literature using the WOS database. We used the related keywords in the search query in the WOS database and yielded 407 research articles. After applying the necessary filters, 61 most relevant papers were retained for further analysis. The study used biometric software like HistCite, Biblioshiny, and VOSviewer to conduct the analysis. For the meta literature review, we conducted the following types of analysis (i) the influential aspects of RegTech literature, (ii) co-authorship analysis, and (iii) keyword analysis. Although few previous reviews research articles are available on RegTech research, every year new studies add value to existing literature due to the growing nature of literature. Moreover, this study may be useful for future researchers since it provides an overview of the main contributors, institutions, primary sources, and influential and trending articles related to RegTech. We found that although there is a relatively low number of studies on RegTech, the domain is growing in different dimensions with different ideas presented by authors. USA, UK, and China are the leading countries researching in the domain. The institutions like London School of Economics, Harvard University, and Kings College London are the leading institutions. Whereas ‘Journal of Banking Regulation’ and ‘Technological Forecasting and Social Change’ are the main sources publishing on the topic. Regarding the utility of the study, the updated information about various researchers and institutions is useful for RegTech professionals and institutions for future collaboration, testing, and upgrading of ideas across multiple implementations and supervisory stages. For young academic researchers, the information about the main and influential aspects of RegTech is vital. Furthermore, such type of information is useful for future networking for researchers and other interested stakeholders.

Conclusion

This study possesses certain limitations in its scope. We have only used WOS as a database to extract the studies because the leading software used, i.e., HistCite, which only processes WOS data. RegTech is a young and growing domain, and many good pieces of research are available in other databases like Scopus and google scholar. So future research may combine the data from all these databases to conduct a more comprehensive study.

References

Anagnostopoulos, I. (2018). Fintech and regtech: Impact on regulators and banks. Journal of Economics and Business, 100(1), 7-25.

Indexed at, Google scholar, Croos Ref

Apriliyanti, I.D., & Alon, I. (2017). Bibliometric analysis of absorptive capacity. International Business Review, 26(5), 896-907.

Indexed at, Google scholar, Croos Ref

Arner, D.W., Barberis, J., & Buckey, R.P. (2016). FinTech, RegTech, and the reconceptualization of financial regulation. Northwestern Journal of International Law & Business, 37(1), 371-387.

Bahoo, S., Alon, I., & Paltrinieri, A. (2020). Sovereign wealth funds: Past, present and future. International Review of Financial Analysis, 67(1), 101-418.

Indexed at, Google scholar, Croos Ref

Becker, M., & Buchkremer, R. (2018). Ranking of current information technologies by risk and regulatory compliance officers at financial institutions: A german perspective. Review of Finance & Banking, 10(1), 007-026.

Becker, M., Merz, K., & Buchkremer, R. (2020). RegTech-the application of modern information technology in regulatory affairs: Areas of interest in research and practice. Intelligent Systems in Accounting Finance & Management, 27(4), 161-167.

Indexed at, Google scholar, Croos Ref

Butler, T., & O’Brien, L. (2019). Understanding RegTech for digital regulatory compliance. Disrupting Finance Palgrave Pivot, Cham.

Indexed at, Google scholar, Croos Ref

Coeurderoy, R., & Murray, G. (2008). Regulatory environments and the location decision: Evidence from the early foreign market entries of new-technology-based firms. Journal of International Business Studies, 39(4), 670-687.

Indexed at, Google scholar, Croos Ref

Demirel, P., & Kesidou, E. (2019). Sustainability-oriented capabilities for eco-innovation: Meeting the regulatory, technology, and market demands. Business Strategy and the Environment, 28(5), 847-857.

Indexed at, Google scholar, Croos Ref

Eggert, M. (2014). Compliance management in financial industries: A Model-based business process and reporting perspective. Springer Science & Business Media.

Indexed at, Google scholar, Croos Ref

Gabor, D., & Brooks, S. (2017). The digital revolution in financial inclusion: international development in the fintech era. New political economy, 22(4), 423-436.

Indexed at, Google scholar, Croos Ref

Gust, C., & Marquez, J. (2004). International comparisons of productivity growth: The role of information technology and regulatory practices. Labour Economics, 11(1), 33-58.

Indexed at, Google scholar, Croos Ref

Horbach, J., Rammer, C., & Rennings, K. (2012). Determinants of eco-innovations by type of environmental impact-The role of regulatory push/pull, technology push and market pull. Ecological Economics, 78(1), 112-122.

Indexed at, Google scholar, Croos Ref

Institute of International Finance. (2021). Regtech in financial services: Technology solutions for compliance and reporting.

Lensink, R., Mersland, R., Vu, N.T.H., & Zamore, S. (2018). Do microfinance institutions benefit from integrating financial and nonfinancial services? Applied Economics, 50(21), 2386-2401.

Indexed at, Google scholar, Croos Ref

Naatu, F., & Alon, I. (2019). Social franchising: A bibliometric and theoretical review. Journal of Promotion Management, 25(5), 738-764.

Indexed at, Google scholar, Croos Ref

Santhanarn, R., Sasidharan, S., & Webster, J. (2008). Using self-regulatory learning to enhance e-learning-based information technology training. Information Systems Research, 19(1), 26-47.

Indexed at, Google scholar, Croos Ref

Weigelt, C., & Shittu, E. (2016). Competition, regulatory policy, and firms' resource investments: The case of renewable energy technologies. Academy of Management Journal, 59(2), 678-704.

Indexed at, Google scholar, Croos Ref

Received: 11-Sep-2021, Manuscript No. JLERI-21-7956; Editor assigned: 13-Sep-2021, PreQC No. JLERI-21-7956(PQ); Reviewed: 04-Oct-2021, QC No. JLERI-21-7956; Revised: 03-Jan-2022, Manuscript No. JLERI-21-7956(R); Published: 10-Jan-2022