Research Article: 2021 Vol: 24 Issue: 1S

Risk Assessment Model of Government-Backed Venture Project Funding: The Case of Russia

Svetlana V. Zemlyak, Financial University under the Government of the Russian Federation

Svetlana Yu. Sivakova, Financial University under the Government of the Russian Federation

Irina E. Nozdreva, Financial University under the Government of the Russian Federation

Abstract

The venture capital market acts as a driver for the development of regional, national and global economies, contributing to the activation of the development of scientific and technological progress. The authors consider the idea of venture financing of innovative projects and develop a risk assessment model on the basis of a dynamic partial differential equations. The authors take into account the fundamental idea of getting the investor a high premium for high risk: financing a risky startup, if it is successful, brings the investor income that is many times higher than the initial investment of the investor. The choice of the research method is due to the complexity of the task, in which the processes take place both in time and transitions between the stages of venture projects. The developed approach enables improving the efficiency of enterprises in traditional sectors of the economy, the development of new industries and the formation of new market niches.

Keywords:

Government, Global Economies, Regional Economies, National Economies

Introduction

In the context of the fourth industrial revolution, innovative technological entrepreneurship is becoming increasingly important in the world economy (Barykin et al., 2020). The work (Kuckertz, Berger & Brändle, 2020) considers the contribution of entrepreneurship to the transformation toward a sustainable bioeconomy which could be treated as innovation based sustainable economy. Taking into account the sustainability, environmental and economic issues for the society the government-backed venture projects could be related with the Circular Economy being a closed loop supply chain which focuses on the restorative and regenerative aspects. Circular Economy venture projects aim to the implementation of the concept of ‘end-of-life’ in the industrial system, eliminating both the use of toxic materials and wastage through the use of the design models, product systems and design of the materials (Rajput & Singh, 2019). The authors of the article agree with the point of view (Kuckertz, 2020) that entrepreneurial activity is a factor facilitating the transformation of economies to the sustainable bio economies. So, entrepreneurs are important actors helping to achieve the bioeconomy goals and making significant contribution to the economic, environmental and social dimension of sustainable development (Filser et al., 2019; Hall, Daneke & Lenox, 2010; Kuckertz & Wagner, 2010).

At the same time, innovative enterprises are quite vulnerable and need to attract funding. Therefore, venture financing is becoming more and more widespread both in the global and domestic market of project financing. The source of venture capital investments in the Russian market is the following categories of investors:

- Private foundations;

- Foreign investment;

- Private investors;

- Corporate investments;

- State funds;

- Accelerators.

The article aims to consider the risk assessment model of government-backed venture project funding on the case of Russia. The authors considering the improvement of the risk management system for venture financing with state participation, propose to form a three-level risk management model for venture financing with state participation, which can be used for innovative projects implemented within the framework of certain Russian Federal target programs.

Methodology

Problems of Venture Financing in Russia

The main task of all participants in the venture capital market that are included in any of the above segments is to invest and assist in the development of such companies that produce various types of high-tech products and provide high-tech services. Subsequently, it is such innovative companies that set the accepted standards for the level of technological development and quality of life around the world. Thus, by financing innovative companies, venture market participants largely determine the course of technological development and innovative development of all sectors of the national and global economy.

The goals of venture capital investment by different types of investors are shown in Figure 1.

Despite the measures taken to support the venture capital and (or) direct investment market, its scale remains small, and there is no positive dynamics in its development in a number of indicators.

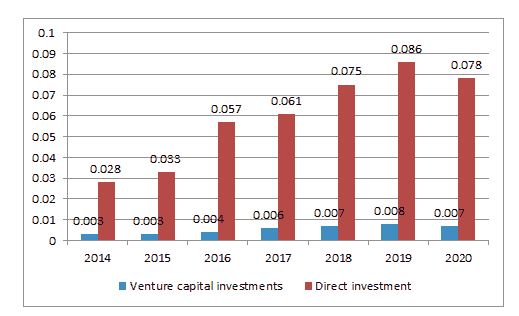

The venture capital investment market is not comparable to the scale of the Russian economy. The share of venture capital investments in 2020 was 0.007 % of gross domestic product (hereinafter – GDP), the share of direct investment-0.078 % of GDP (Figure 2).

The main reason for this situation is the lack of sufficient funds available for investment in the economy, low attractiveness for investors.

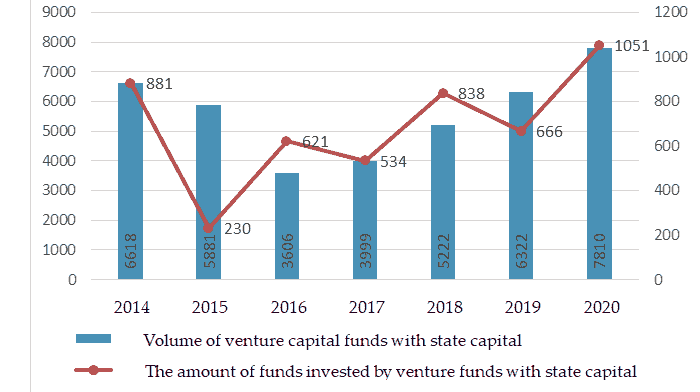

Figure 3 shows the dynamics of the volume of funds and investments of venture funds with state participation.

The use of venture financing mechanisms is provided for in 4 of the 43 state programs of the Russian Federation, including in the framework of the implementation of:

- State program "Development of the pharmaceutical and Medical industry" – with the participation of RVC JSC, a venture fund in the field of pharmaceutical and medical industry was established at the end of 2019;

- The state program "Economic Development and innovative economy" and the national program "Digital Economy of the Russian Federation" - provides for the creation of a venture fund to support promising educational technologies of the digital economy (as of October 1, 2020, the fund was not formed due to the failure to conclude a trilateral agreement with the Ministry of Economic Development of the Russian Federation on the transfer of funds);

- The state program "Information Society", the national program "Digital Economy of the Russian Federation

- JSC "RUSNANO" created a fund for direct and venture investments in the form of the investment partnership "Digital Economy", aimed at supporting projects in the field of information and digital technologies;

- State program "Scientific and Technological Development of the Russian Federation – - JSC" RVC " is allocated subsidies (starting from 2016) for the implementation of projects in order to implement action plans ("road maps») National Technology Initiative.

Risk Assessment Criteria for Venture Financing in Russia

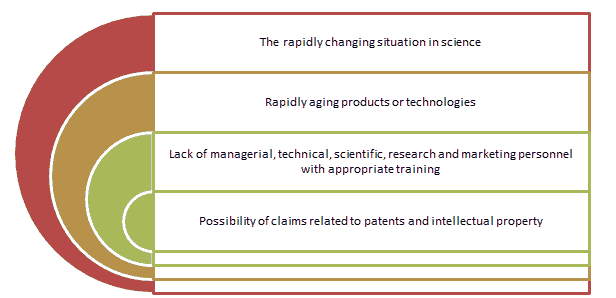

Since venture funds with state participation plan to invest primarily in companies related to innovative technologies, they take into account the specific risks that technology companies face (Figure 4).

In order to fulfill these instructions of the President of the Russian Federation, Federal Law No. FZ-309 of July 31, 2020 "On Amendments to the Federal Law "On Science and State Scientific and Technical Policy"was adopted. The Federal Law establishes the specifics of the implementation of venture or direct financing of innovative projects by development institutions.

Law No. 309 FZ provides for the approval at the level of the Government of the Russian Federation of the rules for evaluating the effectiveness, the specifics of determining the target nature of the use of state support for innovation, the procedure for determining the permissible level of risks and basic criteria for managing them, the requirements for conducting expertise, monitoring the implementation of innovative projects, the conditions and acceptable forms of their financial support.

Risk management at the Institute of innovative development, participating in the implementation of an innovative project using state support funds, is based on the following principles, the procedure for compliance with which is established in the methodology for assessing the risks of implementing an innovative project:

a) Risk management is an integral part of the activities of the institute of innovative development related to the financing of innovative projects;

b) The institute of innovative development maintains a balance between the costs of risk management and the possible consequences in the event of their implementation; c

c) Risk management is based on available information, including information for past periods, analytical materials, forecasts and other information;

d) Risk management complies with the principles set out in international and national risk management standards.

As part of the assessment of innovative projects applying for state support, the Institute for Innovative Development can conduct a risk assessment in the following areas:

- The innovation project team; the market and external conditions for the implementation of the innovation project;

- Technological sphere (risks of the developed technology and the possibility of bringing it to successful samples and the required next stages of the innovation project);

- Financial, legal, regulatory (compliance) risks of the innovation project.

An exhaustive list of risks assessed by the institute of innovative development when making a decision on the implementation of an innovative project at the expense of state support is determined by it independently, taking into account the level of readiness of the technology, the development and (or) use of which is provided for within the framework of the innovative project, the volume and form of its financial support, the degree of participation of the institute of innovative development in the management of the innovative project and other features, and is established by the local regulatory act of the Institute of innovative development, approved by the authorized body of the institute of innovative development.

The basic criteria for risk assessment are:

a) The target nature of the risk assessment - the risk assessment is carried out in relation to a specific project goal;

b) The temporary nature of the assessment - for the assessment, a specific forecast period must be selected, in which the risk is assessed (financial year, quarter, month, as well as the periods of implementation of the strategy of the institute of innovative development or its individual stages, and others);

c) Result-oriented approach - the result of the risk assessment should be an assessment of the impact of risks on the project implementation goal in the following form:

- The probability of achieving the goal, taking into account the assessed risks;

- Prioritization of risks based on their impact on a specific goal.

Within the framework of risk management, the Institute for Innovative Development:

a) Identifies risks and assesses the probability of the impact of risks on the objectives of an innovative project within the investment process at all stages of the project life cycle;

b) Develops risk prevention measures based on one of the following risk management methods:

Risk-Taking

It is advisable to use the method when it is impossible to exclude or minimize the risk.

Reducing the Likelihood or Reduction of Damage through the Implementation of Risk Management Measures.

It is advisable to use the method if the probability and/or impact of the risk can be reduced by implementing measures that reduce the current level of risks.

Risk Transfer

The method is advisable to use if there is no possibility of reducing the probability or damage from the risk (an example of this method is risk insurance).

Risk Avoidance

The method should be applied if the significance of the risk is high, and other options for risk response strategies cannot be applied (risk avoidance may consist in refusing to perform any work related to the risk or refusing to implement the project as a whole).

The Institute of Innovative Development makes a decision on the management of a particular risk of an innovative project within the framework of the risk assessment methodology for the implementation of an innovative project, guided by the following risk management criteria:

a) The significance or impact of the risk on the specific goals of the innovative project;

b) Assessment of the required resources for risk management (including financial, human, legal, organizational, and other resources).);

c) The effectiveness of the proposed risk management method.

The Institute for Innovative Development can use various risk management tools, including:

- Planning, which defines activities and deadlines for their implementation, which may include activities carried out both before and after the risk is realized;

- Control, within the framework of which procedures for monitoring the implementation of planned risk management measures are organized;

- An organization within which those responsible for the implementation of planned risk management activities are identified;

- Other tools if necessary.

Improving the Risk Management System of Venture Capital Financing with State Participation in Russia

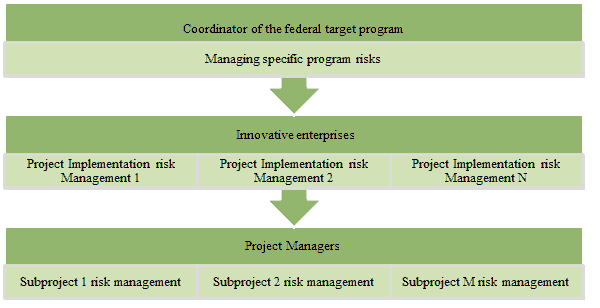

As part of the improvement of the risk management system of venture financing with state participation, it is proposed to form a three-level risk management model for innovative projects implemented using state financing tools as part of the implementation of certain state programs. This model is illustrated in Figure 5.

Figure 5: A Three-Level Risk Management Model for Venture Capital Financing with State Participation

Financing with State Participation

The first level of this model provides for the management of specific program risks by the coordinator of the federal target program. The second level assumes that innovative enterprises that perform work on individual innovative projects within the framework of the implementation of the federal target program manage the risks of implementing specific projects, the responsibility for the implementation of which lies with innovative enterprises. At the third level-the subproject level-the program of prevention and interception of errors of project management is used.

The implementation of the proposed risk management mechanism for venture capital financing with state participation involves the development of a risk forecasting model, discussed in section 2.4.

The Description of the Task

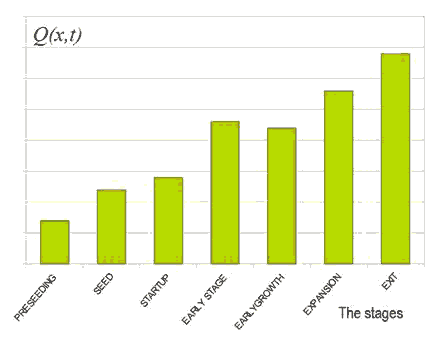

For the purposes of predictive modeling, we used the classification of the stages of the passage of venture projects being widely implemented in different cases. The whole process is divided into stages:

• PRESEEDING STAGE

• SEED,

• STARTUP,

• EARLY STAGE/EARLYGROWTH

• EXPANSION

• MEZZANINE

Authors distinguish between letter investment rounds:

Series A, Series B, ... Series A ', B', ?'......

The authors of the work investigated the process of changing market interest and demand for the result, which are characteristic of identifying the expansion of the preferences of potential consumers for the proposed innovative products.

For effective planning and organization of investment activities, the problem of modeling the processes occurring when entering the innovation market arises (Krasnov et al., 2019). Therefore, a formalized description of the change in the level of demand for innovation when moving along the listed stages is necessary. This will enable predictive planning and sound venture financing based on modeling and appropriate calculations (Golosnoy et al., 2019).

In this regard, the paper proposes an economic and mathematical model for strategic and operational planning for the formation of investment policy, primarily for state venture capital funds.

Theoretical Foundations of the Economic and Mathematical Model

The authors use methods (Barykin et al., 2020) based on dynamic partial differential equations as a basis for modeling. This choice is due to the complexity of the task, in which the processes take place both in time and transitions between the stages of venture projects.

The use of this approach (Shmatko et al., 2021) for the theoretical construction of a description of the technology of the behavior of a venture project, as the continuous activity of its managers and startup developers, is primarily due to the fact that the description of the evolution of interest in the results is inseparable from the quality of the organization of this process. Here we can talk about an integrated indicator of the influence of various factors, such as marketing, service, management, information technology (Sergeev & Kirillova, 2019).

In the coordinate system xOq , on the axis Oq , the quantitative values of the level of demand for innovation are plotted, which are determined by the number Q( x,t ) at a given moment in time; on the axis Ox - the stages (stages) of the passage of the stages of work on venture projects in accordance with the technology of this activity. Note that such a division into stages currently does not have sufficiently clear common features and is based, first of all, on subjective ideas about the activities of each specific research organization, the technologies of which vary depending on the resources involved or due to established traditions (Barykin et al., 2021).

Results

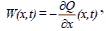

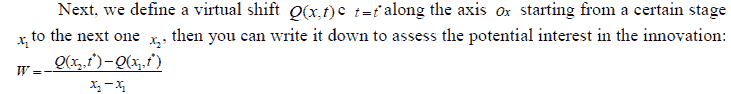

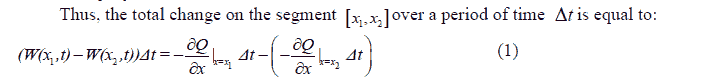

It should be noted that an important factor is the intensity of changes in the level of demand for innovation W as you progress through the stages  which correlates with the

which correlates with the

dynamics of changes in consumer interest in development. Therefore, the "minus" sign is introduced to reflect positive valuesW , which is understood as a value proportional to the intensity of interest as it changes  Accordingly, the more W , the more pronounced the dynamics of interest.

Accordingly, the more W , the more pronounced the dynamics of interest.

Next, an indicator is introduced g(x) that characterizes the effectiveness of the activity of managers and developers of startups at the stage x , numerically equal to the value, it is an integral Q(x,t) indicator of the corresponding division in which the work takes place. Obviously, the higher the value g(x) , the more efficiently the work is organized.

In this case, the change is described by the formula:

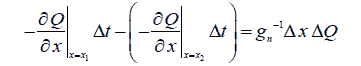

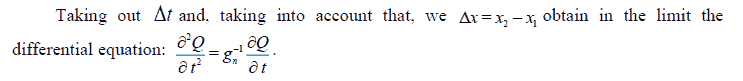

The values of formulas (1) and (2) must be equal. Also, inside the stage Xn , the value g(x) is constant and equal to g(x)= gn

Taking into account the above, we have for the stage n:

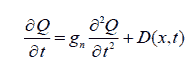

We introduce a function D(x,t)that takes into account the influence of the external market environment, in particular the aggressive policy of other competing developers, changes in legislation, conditions, inflation, etc. and come to the equation of the general case with distributed parameters at the stages of change x :

When formulating a boundary value problem, the constraints of which are the profitability condition, there is a real basis for modeling innovation processes in the form of solving systems of equations of the type (3).

For this class of equations, the type of activity is not of fundamental importance. The model is scalable and, in addition, invariant to the object of research. For example, expanding the field of innovation or adding stages leads to an increase in the dimension of the system.

It is necessary to make a significant remark: in most cases, the initial data can be formed from the Feigenbaum map (Barykin et al., 2021), which is important in the context of a lack of statistical data, both on economic indicators and on the potential landscape of the implementation of innovative developments.

Therefore, having data on the level of demand for innovation, it is possible to restore the processing parameters, as the coefficients of the equation that characterize the investment process at each stage, and thus get a practical tool for planning and forecasting. To apply the simulation results, the decision is made from the SLOPE behavior analysis Q(x,t) using the least squares method. The resulting value is incrementality indicators S it is compared with a previously justified value S *corresponding to the permissible level of riskiness of investments in venture projects of this type. If completed S ≥ S *, a positive investment decision is made.

The Case of Startup Large-Capacity Storage Devices

An example of using this method (Barykin et al., 2021) is a startup that develops a system for mechanical stabilization of high-capacity storage devices. In the case of an effective solution to this problem, the speed of data exchange increases dramatically, as well as the uptime of critical data storage systems is extended. When assessing investment risks, Huawei used this technique, which allowed, using the presented model, to get the following picture (Figure 6):

Figure 6: Change in the Indicator Q(X, T) Depending on the Passage of the Stages of the Venture Project

Next, using the SLOPE add-in, we calculate the value of the incrementality index S using the least squares method (OLS). The result obtained  above the value set for the assessment allowed us to conclude that it is advisable to invest in this startup and the proposed innovative technology.

above the value set for the assessment allowed us to conclude that it is advisable to invest in this startup and the proposed innovative technology.

It is possible to identify the key features of the current approach to risk management in the process of implementing state support for venture financing:

- Low level of methodological elaboration of mechanisms for managing possible risks of venture financing;

- Fragmentation of risk management-separate procedures and elements of risk management are defined, which are not integrated into a single structured system for managing possible risks of venture financing.

In the current practice of implementing regulatory regulation of the implementation of state support for venture financing, which regulates the procedure for financing innovative projects using venture mechanisms and evaluating their effectiveness, it is not assumed that a specialized set of structurally and substantively interrelated and regularly and systematically performed procedures for managing possible risks of venture financing is formed as a subsystem, included in the general mechanism for managing venture activities.

The methods and tools of risk management of venture financing with state participation presented in modern regulatory practice separately cover a fairly wide range of procedures and processes for managing possible risks of venture activity. However, the lack of elaboration of these procedures and processes, the fragmentary use in the practice of managing the implementation of venture financing with state participation, the lack of coherence with the management mechanism of the implementation of state programs that use venture financing mechanisms, the lack of consistency and regularity in their application lead to the conclusion that it is necessary to further actively develop the methodology and practice of risk management of venture financing with state participation.

Discussion

The authors discuss the practical implementation of the suggested system for managing possible risks of government-backed venture projects financing. Taking into account the connection between entrepreneurship and eco-innovation (Viaggi, 2015) the improving assessment models of government-backed venture eco-innovative projects financing requires further theoretical, methodological and empirical development in terms of a set of individual risk management processes, developing the essence and content of the functional roles of all participants in risk management of venture financing with state participation, making changes to existing regulations governing the process of implementing state support for venture activities.

Conclusion

In order to solve the problem of mutual implementation of a comprehensive coordination of all processes within the framework of project management and within the framework of the implementation of the tasks of the implemented federal target programs in the context of managing the risks inherent in these programs, the methodology for implementing compliance risk strategizing can act as a promising management tool in modern conditions.

The proposed methodology can be implemented through a management module as part of the anti-crisis management component, which should be implemented in their project activities by all economic entities that are innovative enterprises. The studying case of Russia proves that developed model could be implemented into the innovative projects with the involvement of venture financing from state development institutions.

For managers of subprojects implemented within the framework of innovative projects, it is recommended to use a program for monitoring errors in the framework of project management, which should be implemented by an innovative enterprise that performs work on a specific innovative project within the framework of the implementation of the federal target program.

The suggested three-level model of risk management of venture financing of innovative projects with state participation, which are implemented within the framework of certain federal target programs, will allow to achieve mutual coordination of risk management procedures that arise at different stages of the implementation of federal target programs and specific innovative projects. The first level of this model provides for the management of specific program risks by the coordinator of the federal target program. The second level assumes that innovative enterprises that perform work on individual innovative projects within the framework of the implementation of the federal target program. The third level assumes managing risks of implementing specific projects, the responsibility for the implementation of which lies with innovative enterprises.

Funding

The article has been prepared based on the results of studies supported by budgetary funds in accordance with the state order for the Financial University under the Government of the Russian Federation on the topic «Development of Mechanisms for Government-Backed Venture Project Funding».

References

- Barykin, S.Y. (2021). Developing the physical distribution digital twin model within the trade network. Academy of Strategic Management Journal, 20(1), 1–24.

- Barykin, S.Y., Kapustina, I.V., Kirillova, T.V., Yadykin, V.K., & Konnikov, Y.A. (2020). Economics of digital ecosystems. Journal of Open Innovation: Technology, Market, and Complexity, 6(124), 16.

- Barykin, S.Y., Kapustina, I.V., Sergeev, S.M., & Yadykin, V.K. (2020). Algorithmic foundations of economic and mathematical modeling of network logistics processes. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 16.

- Filser, M., Kraus, S., Roig-Tierno, N., Kailer, N., & Fischer, U. (2019). Entrepreneurship as catalyst for sustainable development: Opening the black box. Sustainability (Switzerland), 11(16).

- Golosnoy, A.S., Provotorov, V.V., Sergeev, S.M., Raikhelgauz, L.B., & Kravets, O.J. (2019). Software engineering math for network applications. Journal of Physics, Conference Series, 1399(4).

- Hall, J.K., Daneke, G.A., & Lenox, M.J. (2010). Sustainable development and entrepreneurship: Past contributions and future directions. Journal of Business Venturing. Elsevier Inc. 25(5), 439–448.

- Krasnov, S., Sergeev, S., Zotova, E., & Grashchenko, N. (2019). Algorithm of optimal management for the efficient use of energy resources. E3S Web of Conferences, 110.

- Kuckertz, A. (2020). Bioeconomy transformation strategies worldwide require stronger focus on entrepreneurship. Sustainability (Switzerland), 12(7).

- Kuckertz, A., Berger, E.S.C., & Brändle, L. (2020). Entrepreneurship and the sustainable bioeconomy transformation. Environmental Innovation and Societal Transitions, 37, 332–344.

- Kuckertz, A., & Wagner, M. (2010). The influence of sustainability orientation on entrepreneurial intentions - Investigating the role of business experience. Journal of Business Venturing. Elsevier Inc, 25(5), 524–539.

- Rajput, S., & Singh, S.P. (2019). Connecting circular economy and industry 4.0. International Journal of Information Management. Elsevier, 49, 98–113.

- Sergeev, S., & Kirillova, T. (2019). Information support for trade with the use of a conversion funnel. IOP Conference Series: Materials Science and Engineering, 666(1).

- Shmatko, A., Barykin, S., Sergeev, S., & Thirakulwanich, A. (2021). Modeling a logistics hub using the digital footprint method — The Implication for Open Innovation Engineering. Journal of Open Innovation: Technology, Market, and Complexity, 7(59), 16.

- Viaggi, D. (2015). Research and innovation in agriculture: Beyond productivity? Bio-based and Applied Economics, 4(3), 279–300.