Research Article: 2020 Vol: 19 Issue: 5

Risk Impact besides Capital Structure and Investment Valuation into Public Housing Projects Investment Rate

Erman Sumirat, Univesitas Padjadjaran

Sulaeman Rahman Nidar, Univesitas Padjadjaran

Aldrin Herwany, Univesitas Padjadjaran

Sudarso Kaderi Wiryono, Institut Teknologi Bandung

Abstract

Almost 38 % from Indonesian National Budget is spent heavily on economy and medical recoveries during Covid 19 Pandemic so government has reduced some spending including public housing project as part of infrastructure even though number of backlog is still higher. The possible solution to catch backlog is engaging private sectors to involve in the public housing project under the scheme of public private partnership (PPP). Nevertheless, some risks may expose to private sectors and it will have an impact to investment rate

The risk impact to the investment rate will be explored alongside the effect from capital structure and investment valuation. If capital structure, investment valuation and risk have simultaneously impact investment rate, the possible mitigation risk strategy must be designed in advance with the support from the government. Those parameters must be managed properly in order to attract public housing project under PPP scheme.

The research has used multiple regression with time series from 2009 until 2018, 10 years data with all samples taken from companies that listed in the Indonesian Stock Exchange (IDX) under the industry of property and construction. The independent variables consist of debt, debt to equity ratio, stock issuance, retained earnings, sales, opex, capex, discounted cash flow, sales volatility, material price volatility and operational risk volatility with IRR and ROE as dependent variables. The risks is measured by the concept adopted from Value at Risk which heavily counts on volatility as a quantitative method. The measurement of risk variables in other research has commonly used tools like analytic hierarchy process (AHP) while this study used risk volatility measurement with Value at Risk (VaR) tools. The research framework also align with risk return theory that accommodates risk factors into investment rate model simultaneously with capital structure and invesment valuation

The designed hypothesis was capital structure, investment valuation and risk impact investment rate for public housing simultaneously. The findings has showed that business risk negatively impact investment rate while most of capital structure variables as well as investment valuation positively impact investment rate. Those three main variables influence IRR almost 50 percent by adjusted R squared, higher than ROE, which is influenced by 31.5 % from variables of capital structure, investment valuation and risk. By the risk analysis based on multiple regressions, it can be concluded that sales volatility, as a business risk predictor must be prioritized rather than material price volatility and operational cost volatility. The companies must be managing debt not too over levered, securing sales and managing business risk by diversifying streams of revenues and involving government to support with incentives, support and subsidy to minimize business risk. All initiatives will be taken to meet the average required investment rate, i.e. target ROE by 10 % and IRR by 14% as found from historical data of 2009-2018.

Time period for this research only captured 10 years data from 2009 to 2018. Different and longer time frame may change the research findings. The next study can capture data which showed financial crisis like during 1997-1998 or property bubble/sluggish period, seeing the impact of those event as a risk phenomenon and analyzing the impact to investment rate in public housing project by conducting event study. Other methodology like mixed-method research to explore qualitative aspect could also enrich the findings for research improvement in the future.

The paper has a significant contribution to make a financial policy in PPP for Public Housing between government and private sectors, the target of ROE can be set by minimum 10 % with target IRR by 14%. Besides that private sectors can discuss with government for securing property sales by receiving government guarantee, diversifying revenue by doing mixed used buildings and asking Viability Gap Fund (VGF) if actual IRR and ROE is still below the target as a last resort. Those efforts can be taken as part of risk mitigation to reduce business risk volatility as measured by this study.

Keywords

Capital Structure, Investment Valuation, Risk, Volatility, Investment Rate, Public Housing, Public Private Partnership.

Introduction

Public Private Partnership (PPP) implementation in Indonesia accomodates some financial factors like capex, opex and business risk into financial model projections which result in IRR. If IRR is high then private sectors will have to pay clawback or sharing to government, while if the IRR is low then private sectors need support from government. Typically subsidized public housing resulted in low IRR especially during covid 19 pandemy as customer purchasing power is declining. Assuming normal property price in big cities like Jakarta, Bandung and Surabaya is around 500 million IDR (around 35,000 USD), simulation from National Property Bank in Indonesia (BTN, 2020) showed that the installment would be 3,3 million IDR per month (230 USD) while the wages for customers is only maximum 5 million IDR (350 USD). This means purchasing power of people is limited, the bank installment must be maximum 40 % from total wages, so people can not afford to buy a house due to rising property price. To tackle the problem, government tries to subsidize interest rate to make the payment lighter such as down payment can be 1 %, interest rate of 5% (lower 5-7% from normal commercial rate) flat per annum, installment can be paid for 20 years, free from VAT and insurance premium. The other solution is to conduct PPP scheme with availability of payment (AP). Under AP, private sectors and government agreed the amount of capital expenditure (construction cost) for the property projects. Then, if they already agreed and win the tender process, private sectors will act as contractors and government will pay an annual installment to private sectors with the scheme of DBF (Design Build Finance). Assuming the property utilized the idle land or government owned land, the land banking cost is not counted on calculation, only construction cost is relevant in public housing project. If government wants to build high rise building with more than 100,000 units, the total construction capex would be around 900 Billion USD (62 million USD). If assuming AP scheme is used with the IRR of minimum 14 % property project with 20 years, government must pay annual installment about 136 Billion IDR (almost 9,5 million USD). This calculation only covers 100,000 units while Indonesia wants to build 1,000,000 units for LIG to catch the property backlog of 13 million units. The cost of installment therefore can absorb 1 to 10 % from government budget. Current situation also harder to tackle this problem, as government budget now is spending heavily on covering health and economy recoveries during COVID 19 pandemy. From national budget of 1,760.9 trillion IDR (121 billion USD), government spend almost 677.2 trillion IDR or 38.5 % (46 billion USD) for covid 19 treatment in both health and economy recoveries. This means the Indonesia government currently focus on the recoveries and it has to reduce some fiscal spending including the idea of how government pays private sectors under availability payment (AP) spesifically for public housing projects. PPP funding scheme by AP becoming not sensible at the moment.

The government actually can assign the big four main contractors which is very big and also part of state-owned entreprises namely Wijaya Kaya (wika), Adhi Karya (Adhi), PTPP and Waskita (wskt).

The Table 1 has shown that all major big contractors which are state owned enterprises have overlevered condition with small return on asset and declining performance of return on equity (except for WIKA). Return was small due to high burden in interest expense payment that coming from high bank loan and bond issuance. Under this situation, it is also hard for government to assign major contractors in developing public housing project for LIG. For companies, problem will arise if debt is used heavily; this will reduce profitability and project feasibility as it gives pressure to credit rating. Overlevered can create financial risk as well as credit risk to companies even though property for retail investors is perceived to have low risk investment than financial securities instrument like bonds (default risk) and stock (market risk). Property can typically increase in value and seldom default, it also rarely exposes to market risk volatility like bonds and stocks. Theoritically speaking, there are gap between Pecking Order Theory (Donaldson, 1961) versus Trade Off Theory (Maljuf, 1984), most contractors/developers creates property using high debt rather than equity, but too much debt can generate distress even default. The other gap is Capital Budgeting (Fabozi, 2002) versus Housing Finance (Chan, 1999) which stimulates property capital budgeting must be feasible, then IRR must be higher than WACC (cost of capital) while housing finance for LIG suggests that the property price must be affordable, somehow affordable prices makes low profitability hence the project is not feasible (i.e. low IRR) and it will not be attractive anymore for private sectors investment in PPP for public housing. The last one is theory gap between Modern Portfolio Theory (Markowitz, 1952) versus Strategic Risk Taking (Damodaran, 2010). Retail investors have diversification strategy in their asset allocation portfolio following Markowitz (1952) and property has good return with modest risk rather than bonds and stock while high rise building property for developers is perceived riskier than landed housing. Meanwhile due to land limitation in big cities, government prefers high rise building than landed housing. This policy generates strategies risk taking (Damodaran, 2010) which make private sectors expose to some risks while for retail investor, risk can be diversified away because they have basket of asset allocation strategy to minimize risk with diversification.

| Table 1 DER, ROA and ROE for the Indonesian Major State Owned Contractors | ||||||||||||

| WIKA (%) | ADHI (%) | PTPP (%) | WSKT (%) | |||||||||

| 2017 | 2018 | 2019 | 2017 | 2018 | 2019 | 2017 | 2018 | 2019 | 2017 | 2018 | 2019 | |

| DER | 212 | 244 | 223 | 383 | 379 | 434 | 193 | 222 | 241 | 330 | 331 | 321 |

| ROA | 2.63 | 2.92 | 3.68 | 1.82 | 2.14 | 1.82 | 3.48 | 2.86 | 1.57 | 3.97 | 3.19 | 0.77 |

| ROE | 8.22 | 10.05 | 11.89 | 8.78 | 10.25 | 9.71 | 10.20 | 9.21 | 5.37 | 17.06 | 13.72 | 3.22 |

As government has limited capacities in financing public housing and also difficult to assign major government owned contractors to develop public housing, the other solution is PPP with the scheme of Build Operate Transfer (BOT) so the risks are transferred to private sectors. Private sector will do the financing then build the project; operate the project to create revenue as well as profit and after concessional period is ended then transfer the ownership back to government.

Literature Review

Irrelevant Theory (Modigliani & Miller, 1958) stated that corporate value will depend on investment decision but as the perfect world is not existed yet, capital structure will be important as argued by Donaldson (1961) as well as Myers & Maljuf (1984). It is important to analyze capital structure component like the composition of retained earnings, interest bearing liability (loan and bonds) as well as stock issuance. Companies as well as investors in the investment expect to have a minimum return close to required return as developed in the Capital Asset Pricing Model (CAPM) by Sharpe (1964). So capital structure in public housing project in which private sectors make investment under PPP is also relevant besides investing decision as Damodaran (2010) exhibited that corporate finance jobs must maximize value of the business with three important decisions namely investment; financing; as well as dividend decision.

Private Sectors must also consider risk and return Trade Off Theory (Fama & French, 1993) and Strategic Risk Taking (Damodaran, 2007). In the property project with long term BOT concession, besides return that measured by proftability metrics like ROE and IRR, private sectors must also consider risks associated with the projects. Some risks like market risk, business risk, financial risk, operational risk and even political risk can have an impact to the public housing projects.

PPP can take the scheme of BOT as argued by Carbonara et al. (2014 a & b). However Babatunde et al. (2017) exposed that in public housing, it may have risks in development due to late delivery in the process of credit; creating operational risk. Van Eijck & Lindeman (2014) also supported the arguments that government role and support is critically important even though the risks are already transferred from government to private sectors during concessional BOT period. Kwofie et al. (2016) also explained the successful project in PPP that needs government support in terms of guarantee like subsidy; competitive and fair tender; project legal status; macro economy policy as well as support from financial industry. Government Subsidy also can be found in Thailand as studied by Trangkanont & Charoengam (2014).

For the private sectors, PPP in public housing must use investment rate metrics like ROE and IRR. The investment rate will depend on capital structure, investment valuation and business risk. Capital Structure discussed by Myers (1984) as well as Damodaran (2010). While for Investment Valuation variables like capex, opex and revenue, those were argued by Damodaran (2010). Those investment valuations will be a basis to measure feasibility in using discounted cash flow (DCF) as exhibited by Brealey & Myers (2003 & 1981). Meanwhile, Stulz (1996) exposed risk factors. In relation of risk, DCF model can be simulated to assess uncertainty by the usage of Monte Carlo simulation. Risk in PPP is explored more in study from Dey (2002); McGrath et al. (2004); Zavadskas et al. (2009); Brown & Young (2011). The measurement of risk can use maximum probable loss concept by applying Value at Risk (VaR) as suggested by Crouhy (2005). VaR is widely used in banking industry but in this research, VaR will be applied to measure business risk volatility in property industry as most of the researches have measured risk by using tools like analytic hierarchy process (AHP). This study will measure business risk, market risk and operational risk using VaR as VaR can measure the volatility from standard deviation of the exposure with certain times and confidence level as suggested by Crouhy (2005) so in the case of public housing, project owners can measure maximum probable loss caused by business risk, market risk and operational risk by detecting the amount of exposure, calculating standard deviation to capture volatility with certain degree of confidence level by considering error rate. From the above reasons, this study measured risk variables by implementing VaR due to its formula that considers volatility measured by standard deviation of exposures.

For the profitability as metrics, most of the studies has chosen ROE and IRR for project feasibility in long term investment as suggested by Demirag (2011) and Zhang & Rasiah (2016) while Liang et al. (2014) used quantitative model with data panel model to see property financial performance in China during 2006-2010 and found that capital structure, leverage and profitability have positive impact to investment rate. The same conclusion can be found from findings developed by Chiang et al. (2010).

From the Table 2 above, some researchers have identified five major risks that associated with public housing project with PPP scheme namely business risk, financial risk, operational risk, social risk and reputational risk. As risk transfer concept applies, there are risk sharing between government and private sectors. Business risk, market risk and operational risk must be mitigated by private sectors especially during construction and concessional operating periods while government should mitigate the social and reputational risk of the project including legal status of land as well as the project itself that may affect social and reputational risk. Business risk used volatility from sales, market risk used volatility from material price instead of interest rate and currency fluctuations as subsidized public housings have applied fixed subsidy interest rate and some materials in majority have produced domestically so there is no relevant foreign exchange issue. For the operational risk variables, it is measured by volatility in operational expense. The volatility in statistics measured by standard deviation as major component of VaR. Literature studies have showed that risks are also considered important and it will impact investment return in PPP for public housing besides capital structure (financing) and investment valuation. Those variables will be a basis for developing hypotheses in this study.

| Table 2 Type of Risk in Public Housing with PPP Scheme | |||||

| Previous Research(s) | Business risk | Financial risk | Operational Risk | Social Risk | Reputational Risk |

| Dey (2002) | X | X | X | X | |

| Zavadskas et al. (2009) | X | X | |||

| Brown & Young (2011) | X | ||||

| McGrath et al. (2004) | |||||

| Meins & Sager (2015) | X | X | X | ||

Methodology

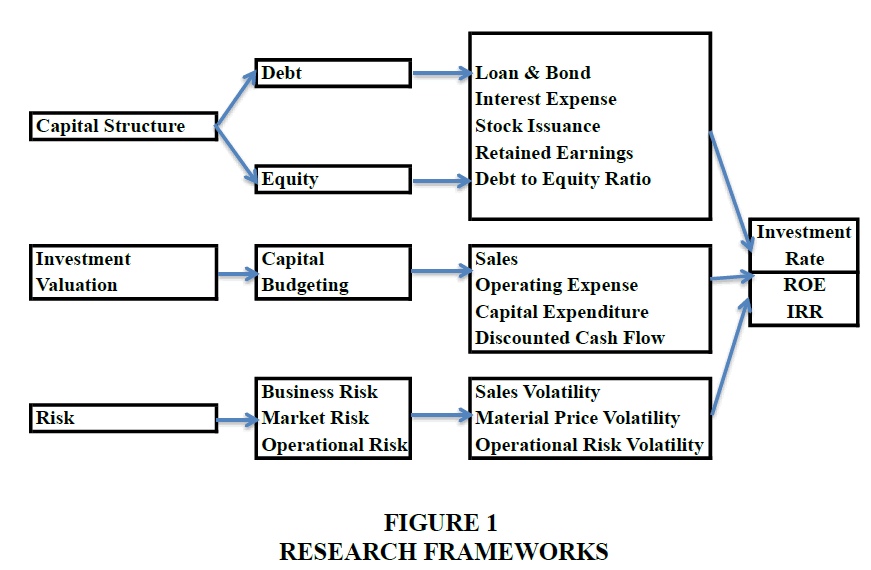

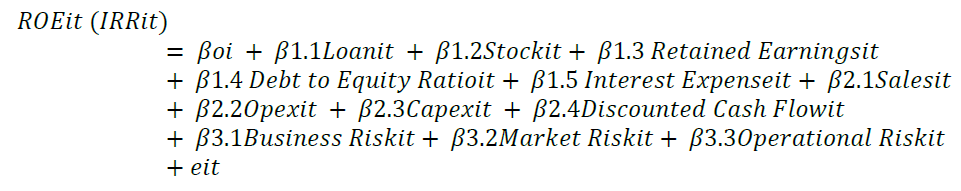

From the research frameworks in Figure 1, capital structure, investment valuation and risk will be X variables which will be analyzed to variable Y namely investment rate by using multiple regression with 10 years data from 2009 to 2018 from all companies listed in the Indonesian Stock Exchange under construction and property sector (Jakproperty). The statistical equation is

The main hypotheses for the research are as follows:

H1 Capital Structure (Loan, Stock, Retained Earnings, Debt to Equity Ratio, Interest Expense) impacts Investment Rate (ROE and IRR);

H2 Investment Valuation (Sales, Opex, Capex, Discounted Cash Flow) impacts Investment Rate (ROE and IRR);

H3 Risk (Business Risk, Market Risk, Operational Risk) impacts Investment Rate (ROE and IRR)

Results and Discussion

From Table 3, it can be concluded that most of Indonesian property and construction companies have used more equity rather the debt. It can be seen from the mean, the usage of stock and retained earnings is bigger than the loan with average debt to equity ratio of 42.57%.

| Table 3 Capital Structure of Indonesian Property and Construction During 2009-2018 | |||||

| Item(s) | Loan | Debt to Equity Ratio | Interest Expense | Stock Issuance | Retained Earnings |

| Mean | 737.4817 | 0.42566667 | 109.5267 | 1544.1633 | 1265.7067 |

| Median | 352.5000 | 0.34000000 | 40.5000 | 1022.0000 | 719.0000 |

| Mode | 257.00 | 0.040000a | 3.00 | 733.00 | .00 |

| Std. Deviation | 1089.94123 | 0.362204171 | 154.48041 | 1371.06065 | 1532.21708 |

| Variance | 1187971.892 | 0.131 | 23864.197 | 1879807.294 | 2347689.171 |

| Skewness | 5.036 | 2.225 | 2.133 | 1.749 | 1.633 |

| Std. Error of Skewness | 0.141 | 0.141 | 0.141 | 0.141 | 0.141 |

| Kurtosis | 42.850 | 10.413 | 4.105 | 3.244 | 2.171 |

| Std. Error of Kurtosis | 0.281 | 0.281 | 0.281 | 0.281 | 0.281 |

| Minimum | 5.00 | 0.010000 | 0.00 | 16.00 | 0.00 |

| Maximum | 12239.00 | 3.130000 | 772.00 | 7090.00 | 7109.00 |

| Sum | 221244.50 | 127.700000 | 32858.00 | 463249.00 | 379712.00 |

Nevertheless, the standard deviation from retained earnings and stock issuance was higher than loan. So if the capital market goes down, value of the firm can be reduced. This cause difficulties if companies wants to have corporate action in fundraising by rights issue in stock. Higher standar deviation also signaled that not all companies will close to the average mean. From the maximum point in the table also can be inferred that there are some companies that have higher loans and also higher debt to equity ratio with maximum of 313%. The samples from this overlevered condition were government state owned enteprise, the big four major contractors.

From Table 4, the average sales during 2009-2018 were 1.93 trillion IDR (133 million USD) with the opex of 270 billion IDR (18.6 million USD) and capex of 241 billion IDR (16.6 million USD) but interestingly to note the discounted free cash flow was negative, meaning the next project will be harder to use internal financing, companies should seeking for external financing like debt. Higher standar deviation in sales and discounted cash flow also makes uncertainty if sales decline due to sluggish property market, this phenomenon will make corporations harder to accumulates retained earnings, also problem for paying interest rate from loan to the banks or creditors. To create better investment valuation, number of sales must be higher with small standard deviation. In the case of public housing, it needs guarantee from government by securing property sales to reduce standard deviation.

| Table 4 Investment Valuation of Indonesian Property and Construction During 2009-2018 | ||||

| Item (s) | Sales | Operational Expenditure | Capital expenditure | Discounted Cashflow |

| Mean | 1932.5500 | 270.0600 | 241.6133 | -67.2620 |

| Median | 1087.5000 | 163.5000 | 90.5000 | -20.4500 |

| Mode | 35.00a | 17.00a | 3.00 | -352.00a |

| Std. Deviation | 2362.53157 | 288.54143 | 345.09421 | 467.77962 |

| Variance | 5581555.439 | 83256.157 | 119090.017 | 218817.775 |

| Skewness | 2.217 | 2.020 | 2.131 | -1.098 |

| Std. Error of Skewness | 0.141 | 0.141 | 0.141 | 0.141 |

| Kurtosis | 5.822 | 4.840 | 4.405 | 4.637 |

| Std. Error of Kurtosis | 0.281 | 0.281 | 0.281 | 0.281 |

| Minimum | 21.00 | 7.00 | 1.00 | -2220.90 |

| Maximum | 13863.00 | 1647.00 | 1609.00 | 1710.50 |

| Sum | 579765.00 | 81018.00 | 72484.00 | -20178.60 |

Table 5 above has concluded that sales volatility was higher than operational cost volatility and material cost volatility. The standard deviation also confirms that sales volatility was riskier than operational cost and material price volatility. Therefore, private companies and government should discuss together to secure sales in order to make investment rate under PPP scheme for becoming feasible and profitable as it will attract private sector in public housing investment.

| Table 5 Risk of Indonesian Property and Construction During 2009-2018 | |||

| Item(s) | SalesVolatility | Material Price Volatility |

Operational Cost Volatility |

| Mean | 118.6293 | 8.1223 | 18.6360 |

| Median | 48.0339 | 6.9000 | 9.1087 |

| Mode | 1.30a | 6.82 | 0.71 |

| Std. Deviation | 202.04381 | 4.52571 | 27.99826 |

| Variance | 40821.699 | 20.482 | 783.902 |

| Skewness | 3.314 | -1.691 | 3.251 |

| Std. Error of Skewness | 0.141 | 0.141 | 0.141 |

| Kurtosis | 12.327 | 16.825 | 12.272 |

| Std. Error of Kurtosis | 0.281 | 0.281 | 0.281 |

| Minimum | 0.43 | -24.28 | 0.43 |

| Maximum | 1238.76 | 17.32 | 182.40 |

| Sum | 35588.80 | 2436.70 | 5590.79 |

The Table 6 has exhibited that average ROE was 9.675 % with maximum point ROE of 34.25% and the minimum of -24.45 % while for IRR, the average was 13.77% with minimum of 10 % and maximum was 19 % for property and construction projects. These numbers have described the expectation from the private sectors that IRR should be in the range of 10 to 19 % while the ROE minimum meets the average 9.6 to 10 % and maximum was 34.26%.

| Table 6 Investment Rate of Indonesian Property and Construction During 2009-2018 | ||

| Item (s) | ROE | IRR |

| Mean | 9.6750 | 0.137700 |

| Median | 0.093250 | 0.140000 |

| Mode | 0.1223 | 0.1300 |

| Std. Deviation | 0.0876230 | 0.0221059 |

| Variance | 0.008 | 0.000 |

| Skewness | 0.259 | 0.135 |

| Std. Error of Skewness | 0.141 | 0.141 |

| Kurtosis | 0.804 | -0.821 |

| Std. Error of Kurtosis | 0.281 | 0.281 |

| Minimum | -0.2445 | 0.1000 |

| Maximum | 0.3426 | 0.1900 |

| Sum | 29.0251 | 41.3100 |

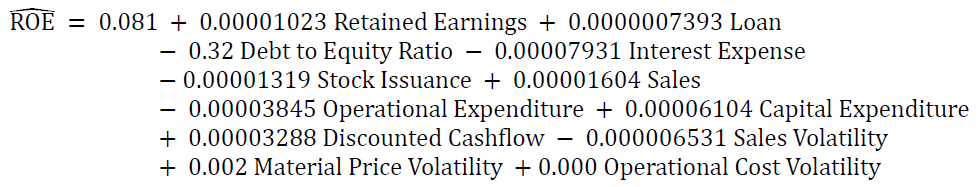

The model has used SPSS 23.0 with the equation

The equation showed results of Fcounts that was 11.574 > F table (2.8) with Sig. F Change = 0.000 <α = 0.05. This signified that capital structure, investment valuation and risk simultaneously impact ROE so all hypotheses were accepted with the adjusted R squared of 31.5%.

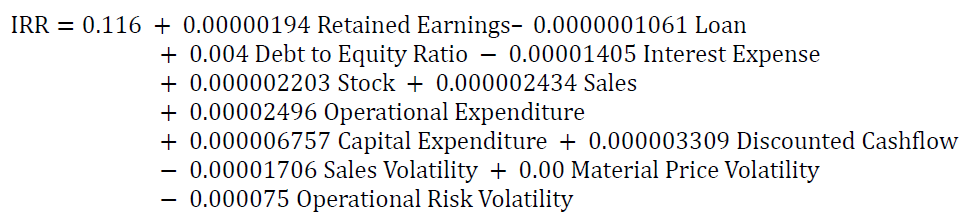

While the the other statistical equation was

The equation showed Fcounts by 23.799 a> F table (2.8) with Sig. F Change = 0.000 <? = 0.05. This also proved capital structure, investment valuation and risk simultaneously impact IRR so all hypotheses were accepted with the adjusted R squared of close to 50%. Therefore, IRR is better in predicting investment rate rather than ROE. Nevertheless, ROE should also be used together with IRR. IRR is the best used for predicting the feasibility rate before public housing start to commence and ROE will be used later on when the projects already in the operational stage every year as shareholders, companies and governments will have to see and to evaluate annual scorecard like ROE. The equation also showed that beside capital structure and invesment valuation matters, risk is also significantly critical, especially sales volatility as a proxy for measuring business risk. Based on the statistical equation, sales volatility was simultaneously impact IRR and ROE with negative sign. There is a chance that the more volatile for business risk, the more negative for ROE and IRR. Risk mitigation strategy must be set up in advance in order to reduce sales volatility. For the capital structure side, companies must not only managing loan but also have to accumulate retained earnings and managing stable debt to equity ratio. Overlevered in debt to equity ratio will lead to negative sign of interest expense which will negatively impact to ROE and IRR. For the investment valuation, the main driver is managing sales but sales also have large swing volatility, this can be shown from the value of sales volatility in the equation which is larger than market price volatility and operational cost volatility. As all alternative hypotheses are significant, private sectors must take a look closely some parameters like debt, retained earnings, stock, debt to equity ratio, sales, opex, capex, discounted cash flow, business risk, market risk and operational risk. Those parameters would have impacts to investment rate like ROE and IRR.

Conclusion

As a conclusion, sales volatility also impacts investment rate simultaneously with capital structure variables like loan and investment valuation like sales. Sales is important factor in investment valuation but it has significant deviation and volatility. Companies should mitigate sales volatility as a proxy of business risk indicator. There are some recommendations to reduce sales volatility such as diversifying the business other than renting public housing like creating recurring fee based income from services; developing mixed used buildings not only for settlement project but also linking to transit oriented development project like a transportation hub, building store, shops, food groceries, offices and other commercial spaces including public facilities like schools and hospitals as it will generate additional streams of recurring revenues.

The other recommendation is negotiation between private sectors and government to secure sales. Government persuades people to live in public housing with some incentives and subsidies or government pays viability gap fund (vgf) if sales volatility occurs. The vgf can be counted by seeing the difference between actual IRR and forecasted IRR. If actual IRR is lower than its forecast, then government can pay the vgf to private sectors. But before government pays the VGF, Private Sectors must see the annual effort in maximizing sales by doing several initiatives like business diversifications, optimizing fee based income as well as doing cost efficiency/cost reduction program. On annual basis, government will eventually evaluate and see the actual IRR and ROE. If all initiatives already proceeded but the result is still below expectation then government can give support and subsidy like vgf. Government role must be a supporter of last resort in business risk management. Those mentioned points are necessarily considered into a financial policy designed by the government and deliver to market to attract private sector investment in public housing under PPP scheme with the average investment rate, ROE by 9.6750% (rounds to 10%) and IRR by 13.77% (rounds to 14%) as the number founds from average historical data from 2009 to 2018.

References

- Babatunde, S.O., Adeniyi, O., & Awodele, O.A. (2017). Investigation into the causes of delay in land acquisition for PPP projects in developing countries. Journal of Engineering, Design and Technology, 15 (4), 552-570,

- Brealey, R., & Myers, S. (1981). Principle of corporate Finance, Mc Graw-Hill International Book co.

- Brealey, R.A., & Myers, S.C. (2003). Financing and risk management. McGraw Hill Professional.

- Brown, R., & Young, M. (2011). Coherent risk measures in real estate investment. Journal of Property Investment and Finance, 29(4-5), 479-493.

- Carbonara, N., Costantino, N., & Pellegrino, R. (2014a). Concession period for PPPs: A win–win model for a fair risk sharing. International journal of project management, 32(7), 1223-1232.

- Carbonara, N., Costantino, N., & Pellegrino, R. (2014b). Revenue guarantee in public-private partnerships: Afair risk allocation model. Construction management and economics, 32(4), 403-415.

- Chan, T.S.F. (1999). Residential construction and credit market imperfection. The Journal of Real Estate Finance and Economics, 18(1), 125-139.

- Chiang, Y.H., Cheng, E.W., & Lam, P.T. (2010). Epistemology of capital structure decisions by building contractors in Hong Kong. Construction Innovation.

- Crouhy, M., Galai, D., & Mark, R. (2005). The Essentials of Risk Management, Chapter 1-Risk Management-A Helicopter Views. McGraw Hill Professional.

- Damodaran, A. (2007). Strategic risk taking: a framework for risk management. Pearson Prentice Hall.

- Damodaran, A. (2010). Applied corporate finance. John Wiley & Sons.

- Dey, P.K. (2002). Project risk management: a combined analytic hierarchy process and decision tree approach. Cost Engineering, 44(3), 13-27.

- Donaldson, G. (1961). Corporate debt capacity: a study of corporate debt policy and the determination of corporate debt capacity (Harvard Graduate School of Business Administration, Boston). Edition Addison Wesley Longman.

- Fama, E.F., & French, K.R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33

- Kwofie, T.E., Afram, S., & Botchway, E. (2016). A critical success model for PPP public housing delivery in Ghana. Built Environment Project and Asset Management.

- Liang, J., Li, L.F., & Song, H.S. (2014). An explanation of capital structure of China's listed property firms. Property Management.

- Markowitz, H. (1952). Portfolio analysis. Journal of Finance, 8, 77-91.

- McGrath, R.G., Ferrier, W.J., & Mendelow, A.L. (2004). Real options as engines of choice and heterogeneity. Academy of Management Review, 29(1), 86-101.

- Meins, E., & Sager, D. (2015). Sustainability and risk. Journal of European Real Estate Research.

- Modigliani, F., & Miller, M.H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261-297.

- Myers, S.C. (1984). Capital structure puzzle. National Bureau of Economic Research.

- Myers, S.C., & Majluf, N.S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. National Bureau of Economic Research.

- Sharpe, W.F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425-442.

- Stulz, R.M. (1996). Rethinking risk management. Journal of Applied Corporate Finance, 9(3), 8-25.

- Trangkanont, S., & Charoenngam, C. (2014). Private partner's risk response in PPP low-cost housing projects. Property Management, 32(1), pp.67-90

- Van Eijck, K., & Lindemann, B. (2014). Strategic practices of creating public value: How managers of housing associations create public value. Public Value Management, Measurement and Reporting, 3, 159-187.

- Zavadskas, E.K., Kaklauskas, A., & Vilutiene, T. (2009). Multicriteria evaluation of apartment blocks maintenance contractors: Lithuanian case study. International Journal of Strategic Property Management, 13(4), 319-338.

- Zhang, M., & Rasiah, R. (2016). Localization of state policy: Shandong's experience in financing Cheap Rental Housing in urban China. Habitat International, 56, 1-10.