Research Article: 2021 Vol: 20 Issue: 2S

RMC and Firm's Performance Should the Establishment Remain Voluntary for Listed Companies in Malaysia?

Flicia Rimin, Arshad Ayub Graduate Business School

Imbarine Bujang, Universiti Teknologi MARA

lice Wong Su Chu, Universiti Teknologi MARA

Jamaliah Said, Accounting Research Institute

Keywords

Separate Risk Management Committee, Combined RMC, Static Panel Data Technique, OLS, Agency Theory, Tobin’s Q, ROA.

Abstract

Risk management is a prevalent concept that underlines the value of providing good quality control and risk management functions to effectively monitor the corporate risk management framework. Previously, the MCCG 2007 mandated listed companies to include a risk management team in the internal audit committee to assess the efficacy of the organization’s risk management, internal control, and governance process. However, due to recent corporate failures and ineffectiveness of audit committee to monitor firm performance, there is a growing need for a separate RMC. Thus, the purpose of the study is therefore to analyse the risk management committee’s structure and effectiveness distinguishing two (2) models; a separate and combined RMC on the firm financial performances of listed companies in Malaysia. The research is based on a Static Panel data technique involving regression based on FEM, REM and Pooled Ordinary Least Square (OLS). The findings indicate that a company that set up an RMC consisting of a majority of independent non-executive directors, specifically a separate RMC, would significantly improve the firm's performance. The latter results support Agency Theory which suggests that independent non-executive directors enhanced the transparency of corporate boards as they improved the firm’s compliance with the disclosure requirements.

Introduction

Firm performance has been the main focus of any company to sustain its corporate success in the long term. However, higher firm performance achievement often entails higher risk, which requires awareness of risk management to maintain organizational performance and improve investor relations. Akindele (2012) postulated that a company’s performance is mainly dependent on the risk management mechanism. Managing risks ultimately leads to enhanced firm performance and reduced the probability of unforeseen losses and reputational damage. According to Boniface & Ibe (2012), risk management is an important element that affects the future growth and profitability of the company. Of this reason, it is crucial to understand and analyze the complex risk environment in which a company operates to ensure the efficiency of risk communication with stakeholders (Jia, Li & Munro, 2019).

The 1997 Asian financial crisis significantly raised awareness on the importance of corporate governance, making it an integral part of company management, including the formalization of its framework and guidelines. Since then, corporate governance has been identified as one of the critical instruments to alleviate conflict of interest among stakeholders. Indeed, unexpected business failures and recurrence of financial crisis worldwide have led to strategies shift towards emphasizing internal control. Brown, Steen & Foreman (2009) argued that all companies must be more receptive to changing circumstances by adopting risk management strategy as part of the operational framework. As a result, risk management reform is taken more seriously in many developed countries with more operational shifts to risk control. An effective risk management system allows organizations to achieve their objective, improves the quality of financial reporting, and enhances company reputation (Subramaniam, McManus & Zhang, 2009). According to Ghazali & Manab (2013), the Malaysian Code on Corporate Governance 2007 marked a significant move in corporate governance practices as it is now mandatory instead of voluntary for companies to have its internal auditing committee that includes a risk management team. The revised Code in 2007 outlined three (3) primary areas that need to be considered by the chief of internal audit. They include reviewing and evaluating the effectiveness of (1) risk management, (2) internal control and (3) governance process in the organization. In view of its necessity, prior study indicates companies that are proactive in risk management activities are not only able to detect and deter fraud, but also can improve the quality of their financial reporting (Yatim, 2010).

Nevertheless, recent corporate governance scandals and the involvement of companies’ management in illegal practices have significantly increased expectations about the roles of corporate governance participants, including regulators and local and international investors for expanded risk management activities (Yatim, 2010). The recurrence of business collapses substantially casts doubt about the effectiveness of an audit committee in overseeing and executing risk management program (Bates & Leclerc, 2009). This is because a combined RMC would not only have to control the risk management process but would also have to be actively involved in financial reporting and the pertaining audit oversight role (Alles, Datar & Friedland, 2005). As a result, time constraints and exhaustion had impede the desire and ability of the committee members to conduct a more thorough analysis of the various reports and processes. Past study also reported that several members of the audit committee found it is uncomfortable to be overburdened with workloads in risk oversight and did not have the time or inclination to oversee risk management (Daly & Bocchino, 2006). This matter implies the need for a separate risk management committee since audit committee was negligent in monitoring in some of the companies that had a corporate failure which indicates its inability to perform functions of both audit committee and risk management committees (Badriyah, Sari & Basri, 2015; Bates & Leclerc, 2009). In like manner, Brown, Steen & Foreman (2009) also supported the notion that the audit committee may not be able to monitor both financial and non-financial risks, thus suggest the committee be independent of the RMC to preserve the integrity and protect against fiduciary malfeasance (Bugalla, Kallman, Lindo & Narvaez, 2012). In line with this view, many researchers have suggested that delegating responsibility to a separate RMC would be more effective in creating better risk management practices rather than a combined committee (Aebi, Sabato & Schmid, 2012; Mongiardino & Plath, 2010). Indeed, having a separate RMC could provide specialized insight into risk management decision-making, enable members to obtain the necessary risk information and make correct and timely risk management decisions (Pirson & Turnbull, 2011;). Nonetheless, several studies reported the negative association between the presences of an RMC towards firm performances (Sani, Latif & Al-dhamari, 2018; Onga, Heng, Ahmad & Muhammad, 2015; Jia, Hutchinson & Hogarth, 2016). Further, although the RMC is strongly recommended, its formation is still voluntary and not mandatory in most countries in the world, including Malaysia (Ishak & Yusof, 2013). The researchers added that the role of the RMC in risk management is relatively unexplored, and the literature in that field is limited and scant. This serves as a strong reason to further investigate the effectiveness of the establishment of an RMC towards Malaysian Public Listed Companies’ performances by considering several attribute of RMC and firm characteristics that may influence the relationship. Hence, the study aims to examine the effect of the establishment of a Risk Management Committee (RMC) (either combined or separate RMC) towards Malaysian Public Listed Companies’ performances.

Theory and Literature Review

Theory

In this research, the agency theory offers a rich theoretical basis pertaining to the establishment of a Risk Management Committee (RMC) in an organisation. The theory arises due to the problem of the separation of ownership and control, which leads to a conflict of interest between the principal and the agent. According to researchers, the delegation of decision-making authority from the principal to the agent is problematic because; (1) the interests of the principal and the agent will typically diverge; (2) the principal cannot perfectly and cost-effectively monitor the agent’s actions; (3) the principal cannot acquire the information available to or possessed by the agent (Barney et al., 1996). This implies that agents usually know more about the tasks than the principal (information asymmetry). Hence, when one party (the principal) seeks some outcome but requires the assistance of an agent to carry out the necessary activities, such as supervisor-subordinate, it is assumed that both parties are motivated by self-interest and that these interests may diverge. Of this reason, the principal seeks to gain information through inspection or evaluation and to develop incentive systems to ensure the agent’s actions are in accordance with the principal's interests. Past studies argued that monitoring board committees are seen to provide better quality monitoring, leading to lower opportunistic behaviour by managers. Such board committees are, thus, predicted to exist in situations where agency costs are high, for example, high leverage and greater firm complexity and size (Subramaniam, McManus & Zhang (2009). Indeed, agency literature suggests that outside directors contribute expertise and objectivity that minimizes opportunistic behaviour and expropriation of firm resources (Yatim, Iskandar & Nga, 2016; Byrd & Hickman 1992). As a result, boards with a higher proportion of outside directors are likely to set up a Risk Management Committee (RMC) to enhance their monitoring capability following previous studies such as Sheikh, Wang & Khan (2013) and Goodwin-Stewart and Kent (2006).

Another theory that is relevant to the current study is the Stewardship Theory. Unlike agency theory, this theory implies that stewards are fulfilled and inspired by the achievement of organisational success. It emphasises employees or executives' role to work more independently in order to optimise shareholders’ returns and to be seen as effective stewards of their company (Fama, 1980). Additionally, the theory also accentuates that managers are expected to be stewards in the organisation by protecting the interests of shareholders as a means of instilling good corporate governance in order to reduce the risk of loss to shareholders. Indeed, this will mitigate the expense of monitoring and managing actions (Davis, Schoorman & Donaldson, 1997).

Related Literature Review

Risk and risk management have captured the attention of regulators and financial report users. Traditionally, risk management activities have been embedded as part of the critical functions of an audit committee. The need for a thorough review of day-to-day business operations and to ensure accountability and transparency in the management of corporate funds has contributed to the start of the credibility of the audit (Guxholli, Karapici & Dafa, 2013). However, the trust placed on the audit committee in protecting shareholders’ investments is somehow challenged by several corporate failures and scandals, such as in the cases of HIH Insurance, Enron, and WorldCom. These crises alerted investors and corporate governance reform advocates the importance of risk sources and uncertainty, which has obliged directors to disclose their internal control mechanisms. The increased concern regarding risk management practices has considerably prompted legislative reforms worldwide. In Malaysia, for example, the central bank, BNM made changes in the financial regulatory environment to instil corporate governance values in the financial service industry. More specifically, the audit committee has been in principle redefined in terms of roles and responsibilities after the official requirement is announced for the setup of a new committee, the RMC in 2003. From the decomposition of the integrated functions earlier, the audit committee is now focused on maintaining the integrity and transparency of financial reporting process; while the RMC oversees activities conducted by the senior management in key risk areas; in addition to the duty to ensure that insurers have an appropriate risk management process that functions effectively in companies (BNM, 2010). The substantial changes or enhancements in the risk management practices can also be seen through the development of the Codes of Corporate Governance. Unlike the previous versions of the MCCG, the revised code of MCCG 2017 has specifically designed one section that falls under principles of good governance which is known as effective audit and risk management.

This principle underlies three (3) practices that advocate companies to implement which includes (1) Practice 9.1: to establish effective risk management and internal control framework; (2) Practice 9.2: to disclose the features of its risk management and internal control framework, as well as the adequacy and effectiveness of this framework; and (3) under paragraph 9.3, the code suggests the board to establish Risk Management Committee (RMC) which consist of a majority of independent directors. The formation of a risk management committee was believed to demonstrate a greater awareness of the importance of risk management and control (Hermanson, 2003) as well as the reliability of risk management disclosure (Abdullah & Shukor, 2017). Accordingly, Fields & Keys (2003) argued that RMCs have gained prominence as relevant monitoring committees and appears to serve as a core governance mechanism supporting board and management in managing risk (Ng, Chong & Ismail, 2012) although the establishment of RMC is still voluntary in non-financial services sectors (Badriyah, Sari & Basri, 2015; Ishak & Yusof, 2013).This is consistent with the expectation towards an RMC as a risk monitoring mechanism to improve the level of risk oversight, resulting in a reduction in agency costs and information asymmetry (Jensen & Meckling, 1976). Studies have also shown that the existence of an RMC can improve internal control of the corporate risk profile, increasing the quality of financial reporting (Subramaniam et al., 2009; Ishak & Yusof, 2013). Consequently, the concept of risk management, corporate governance and internal control are interlinked (Yatim, 2010) and the RMC turns out to be a crucial governance mechanism that assists boards and management in managing risks (Ng, Chong & Ismail, 2012).

Given this, several studies showed a positive association between the existence of the committee and firm performance. For example, a recent study in 2017 by Halim, Mustika, Sari, Anugerah & Mohd-Sanusi (2017) reported that there is a significant positive relationship between the establishment of RMC and firm performance in the Indonesia Stock Exchange (ISE). The researchers reported that there are only 46.15% of 299 non-financial listed companies who set up an RMC for the financial year of 2014. Similarly, a prior study by Yatim (2010) reported that firms establishing a stand-alone risk management committee are likely to have good internal corporate governance structures in place. This is because by having an RMC, the oversight responsibilities of the board are greatly enhanced as it considers a broader view of all aspects of good corporate governance practices. Ishak & Yusof (2013) argued that the establishment of an RMC is seen to be a complement to the oversight function of the board of directors and might be able to reduce the burden of the task faced by the audit committee. Prior studies claimed that the workload of audit committees has risen significantly in recent years due to regulatory changes. The researchers reported that several members of the audit committee found it is uncomfortable to be overburdened with workloads in risk oversight and did not have the time or inclination to oversee risk management (Ishak & Yusof, 2013). Fraser & Henry (2004) supported the likelihood that only a limited range of risks will be resolved if the specialization of both internal auditors and audit committee members lies solely in financial matters. This is because risk is more than a financial context description; it includes operational, economic, sustainability, enforcement, technology and more. Accordingly, Subramaniam, et al., (2009) argued that time constraints and exhaustion are more likely to arise in the combined committees, which could, therefore, hinder the willingness and capacity of the committee members to conduct a more thorough analysis of various risk assessments and processes but rather increase the potential for risk management inefficiencies. Prior research documented that the lack of expertise among the members of the audit committee makes it difficult to evaluate various types of risks and has no time to evaluate the detail on the external risks such as business opportunity, marketing and completion (Zaman, 2001). In light of the more complex risk environment, Aebi, Sabato & Schmid (2012) strongly recommended the establishment of an independent RMC as it is unreasonable to expect audit committee to perform a higher level of risk analysis when its members have limited capabilities and time resources. Similarly, Bugalla, Kallman, Lindo & Narvaez (2012), among others, proposed that an audit committee should be independent of the RMC to preserve credibility and safeguard against fiduciary malfunctions. In fact, companies with separate RMC are also thought to develop superior risk management practices due to issues related to the combination of audit and risk committees (Daly & Bocchino, 2006).

Despite a strong recommendation to establish an RMC, several studies indicated the negative association between the presence of RMC and firm performance. For example, a study by Sani, et al., (2018) found a significant negative relationship between RMC and firm performance on the impact of RMC on real earnings management through sales manipulation of listed companies in Nigeria. The researchers clarified that the establishment of the RMC could deter managers from irregular production activities. Similarly, Jia, et al., (2016) also reported that the establishment of RMC is insignificant towards the firm's performance and the likelihood of bankruptcy. Consistent with Onga, et al., (2015), the findings also indicate that the existence of risk management may not have a role in preventing restatement practices. As such, although the establishment of the committee is strongly recommended, the setting up of RMCs has not been made mandatory (Yatim, 2010). While many advocates of RMC have highlighted the numerous benefits of a stand-alone committee to oversee risk, Ng, et al., (2012) stated that the empirical finding in this association remains vague and narrow. Furthermore, it is still unclear to what extent the risk management committee could influence the risk management activities and practices of the company.

In view of the mixed evidence and limitation, the study aims to investigate further the effectiveness of the establishment of an RMC relative to public listed companies’ performances and by considering several attributes of an RMC and firm characteristics such as firm size, leverage and firm complexity. It is expected that the size of the RMC, could have implications on a company’s performance. Ng, et al., (2012) argued that RMC size is vital in determining the effectiveness of the committee, particularly in the insurance sector. This is because, there is a need to have more members in an RMC who can fully participate in deliberating risk issues, especially at a different strategic level. Be´dard, Chtourou & Courteau (2004) also argued that a large committee provides not only strength but also the diversity of opinion and expertise that makes it more effective to find out and resolve potential problems. Nonetheless, other researchers indicate the opposite contribution of a large size committee towards firm performance. This can be seen when findings by Kakanda, Salim & Chandren (2018) indicate that there is a negative and significant relationship between RMC size and firm performance which suggest that a larger committee size can lower the market-based measure of firm performance due to higher administrative cost associated with the committee members. Hence, it is recommended for companies to properly determine a reasonable size of an RMC as the results were found to have detrimental effects on performance.

Meanwhile, the independence of committee members is a central aspect of corporate governance and is considered essential for controlling management behaviour (Fama & Jensen, 1983). Yatim (2010) argued that the independence of the RMC is vital to ensure proper internal control and risk management processes. The researcher explained that the Board of Directors (BOD) may not have a clear picture of the risk appetites and risk activities of the management when the management compromises issues relating to the independence of the risk committee. Thus, the value of outside directors is generally related to their ability to independently assess the performance of firms (Sheikh, Wang & Khan, 2013). Several studies also documented positive association in relation to the existence of independent directors in a committee. For instance, in a recent study by Kakanda, Salim & Chandren (2018), the researchers found that the composition of the risk management committee (measured by the number of non-executive directors on the RMC) had a significant positive impact on the firm performance measured by the market-to-book value ratio of financial service firms (banks and non-bank financial firms) listed on the Nigerian Stock Exchange for a period of five years (starting from 2012 to 2016). Meanwhile, Tao & Hutchinson (2012) also reported that the composition of the risk committee is positively related to the risk and performance of financial firms in Australia. Black & Kim (2012) also supported that the existence of outside directors in a company has a positive effect on firm value. Nevertheless, certain studies indicate the negative association in relation to the existence of independent directors and firm performance which suggested that non-executive independent directors fail in their monitoring role of the company’s operation (Kota & Tomar, 2010). Indeed, in a study by Kallamu (2015), the result obtained indicated that independent RMC is significantly negatively related to ROA. The negative association could be explained by inadequate monitoring of independent non-executive directors due to their busy schedule or due to inadequate technical knowledge and experience needed to perform the monitoring role effectively (Tao & Hutchinson, 2012). Given the mixed evidence found between RMC independence and firm performances, Kakanda, et al., (2018) also argued that there had been limited studies on the above relationship.

In the meantime, past researches indicate that a regular meeting provides an excellent opportunity for RMC members to openly communicate, discuss, and achieve a common goal in risk monitoring and control. This is due to reason as a number of meetings could be an indicator of an active monitoring mechanism as it helps in minimizing the possibilities of severe outcomes of top management decision; thus, aid the board in identifying and solving the problematic issues at a relatively early stage (Menon & Williams, 1994). A general expectation is that frequent meetings ensure a smooth and effective monitoring process and decision making. Researchers emphasized that an inactive committee likely cause ineffectiveness; thus, regular meetings are necessary (Abbott, Parker & Peters, 2004; Menon & Williams, 1994). In a study by Mishra & Kapil (2018), the researchers also found that board meeting is impacting both Tobin’s Q and ROA positively and significantly. This indicates that more number of board meetings send a positive signal to the market and are found to be value-creating. Indeed, it is expected that various issues of a firm could be discussed during a board meeting and the more frequent of board meetings can lead to favourable firm performance (Kakanda et al., 2016). Nonetheless, the revised code of MCCG 2017 does not explicitly state the number of meetings to be held by a Risk Management Committee (RMC); however, a considerable number of meetings is encouraged for better decisions of firms.

Methodology

This paper focuses on Malaysian public-listed companies of the Financial Times Stock Exchange 100 Index or also known as the FTSE 100 for a period of 11 years starting from the year 2008 until 2018. The year 2008 has been chosen as the starting period of the study due to the fact that the requirement on best practices of the Code was made mandatory in MCCG 2007 for companies to include a risk management team in its internal auditing committee (Ghazali & Manab, 2013). Meanwhile, the sample selection is due to MCCG 2017 requirement, where, the Code applies to all listed companies in Malaysia. Certain practices are only applicable to ‘Large Companies’ that are companies on the FTSE Bursa Malaysia Top 100 Index or companies’ with market capitalization of RM2 billion and above at the start of their financial year. The sample size of the data were determined based on a census study involving two (2) filtration processes, which is first to exclude firms related to financial industries such as banks and insurance companies due to special and extra requirements by authorities especially on risk management practices towards the industry (Ishak & Nor, 2017). Meanwhile, the second filtration is to eliminate samples that do not establish an RMC or meet the criteria set by the MCCG 2017. In relation to the latter process, the researcher considers the existence of a separate or combined RMC as a control unit of analysis, where if an annual report discloses the RMC as a distinct committee with the title of ‘risk management committee’; it represents the presence of a separate RMC. Meanwhile, a combination of tasks and responsibility of risk management with audit committee’s tasks is termed as combined RMC (i.e. Audit and Risk Management Committee, ARMC). However, any company that does not report the existence of either a separate RMC or a combined RMC has to be removed from the study. Likewise, if the company reported the establishment but without complying a majority of its members to comprise of independent directors, the list is also excluded, therefore, reduced the sample size. Hence, the total sample size of the current work consists of 42 which include companies that establish separate and combined RMC. Nonetheless, only 60% of the constituents (25 listed companies) were found to establish a separate RMC, while, the remaining 40% (17 constituents) were found to have an audit committee combined with an RMC.

The data analyses of this study were performed using Static Panel Data analyses in which a separate and combined risk management committee represent the control unit of analysis. The two (2) models of this study are developed based on the dependent variables of Return on Assets (ROA) and Tobin’s Q, in which each model was tested against six (6) variables distinguishing between the establishment of a separate RMC and combined RMC. The development of the empirical models depicts the main objective of this study which is to examine the effect of the establishment of an RMC towards public listed company’s performances in Malaysia. Hence, the empirical models of 1 and 2 are based on the firm to firm framework (Panel data technique); while Model 3 and 4 are based on Cross Sectional Analysis.

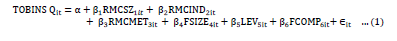

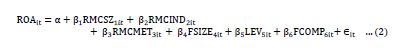

Model 1: The model is used to test for both separate and combined RMC relative to firm performance (Tobin’s Q)

Model 2: The model is used to test for both separate and combined RMC relative to firm performance (ROA)

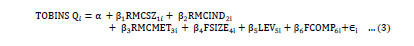

Model 3: The model is used to test for both separate and combined RMC relative to firm performance (Tobin’s Q)

Model 4: The model is used to test for both separate and combined RMC relative to firm performance (ROA)

The hypothesis testing of this study is based on non-directional hypothesis whereby the null hypothesis indicates no significant relationship between the explanatory and dependent variables. Meanwhile, the alternate hypothesis indicates a significant relationship between the variables.

Data Analysis and Findings

The current work involved an in-depth investigation of the effects of RMC establishment on firm performance as measured by firm market valuation (Tobin's Q) and accounting return (ROA). It provides critical perspectives on the relationship between RMC existence and firm performance to the public and potential investors. As noted earlier, the results and findings for the statistical analyses are meant to answer specific objectives of the research which distinguished two (2) types of analyses; 1) separate RMC; and 2) combined RMC.

Thus, based on the outcome presented in Table 1, it was found out that the empirical models for the first analyses are poolable to Panel data technique and the Hausman specification tests results suggest that the two dependent variables are based on the Random Effect Model (REM). Consequently, the results of the study were adjusted for heteroscedasticity and serial correlation problems to provide robust standard errors and unbiased results. Hence, as shown from the table, the findings of the analysis indicate that there is a positive relationship between the establishment of a separate RMC and firm performances. A significant correlation between the RMC size and firm market performance indicates that an increase in the size of the committee may contribute positively and significantly towards firm performance. The relationship reported a significant result at 95% confidence level of which is consistent with several studies that suggest a large committee offers not only strength but also a diversity of opinions and expertise that helps identify and resolve potential issues more effectively (Be´dard et al., 2004). Accordingly, the results are also supported by Jia, Li & Munro (2019), who found a significant positive relationship between RMC size and Risk Management Disclosure (RMD) pertaining to the establishment of a stand-alone RMC. The researchers claimed that the monitoring function of a separate RMC is related to higher risk management disclosure quality. In a similar vein, Ng, et al. (2012) also argued that there is a need to have more members in an RMC who can actively engage in deliberating risk issues, particularly at different strategic levels. Meanwhile, a positive and insignificant relationship between the size of the RMC and the ROA suggests that having more members in the committee may not generally lead to increasing the return on assets of the company. Nevertheless, past studies have argued that the company benefits from a diversity of opinions and expertise that can help identify and effectively address potential risk issues (Abubakar, Ado, Mohamed & Mustapha, 2018; Be'dard et al., 2004).

| Table 1 Results based on the Multivariate Regression Analysis Test (Separate RMC Analysis) |

||||

|---|---|---|---|---|

| Pooled OLS | Random Effect (lnTOBINSQ) | Random Effect (ROA) | ||

| Variables | lnTOBINSQ (HAC) | ROA (FE Robust) | ||

| RMCSZ | 0.0159 | -0.0017 | 0.0374*** | 0.0009 |

| -1.36 | (-1.33) | -4.44 | -0.72 | |

| RMCIND | -0.0336 | 0.0038 | 0.0203 | 0.0016 |

| (-1.21) | -1.28 | -1.05 | -0.48 | |

| dRMCMET | 0.0042 | -0.0008 | -0.0039 | 0.0002 |

| -0.2 | (-0.35) | (-0.54) | -0.23 | |

| dlnFSIZE | 0.2573 | 0.0608*** | 0.3444** | 0.0619 |

| -1.26 | -2.79 | -2.42 | -1.45 | |

| LEV | -0.167 | -0.1104*** | 0.2555 | -0.0701 |

| (-0.57) | (-3.54) | -0.84 | (-1.17) | |

| lnFCOMP | -0.1801*** | -0.0238*** | -0.0972 | -0.0288 |

| (-5.48) | (-6.78) | (-1.12) | (-1.36) | |

| Constant | 0.8941*** | 0.1767*** | 0.3196 | 0.1830** |

| -6.41 | -11.88 | -0.93 | -2.43 | |

| BP-LM Test | 568.67 | 184.63 | - | |

| (0.0001)*** | (0.0001)*** | - | ||

| Hausman Test | - | 6.14 | 1.72 | |

| -0.4074 | -0.9434 | |||

| R-squared (R2) | 0.1456 | 0.2586 | 0.1221 | 0.0842 |

| Wald Chi2 P-value | - | 26.49 | - | |

| - | (0.0002)*** | - | ||

| F (6, 24) P-value | - | - | 1.3 | |

| - | - | -0.2968 | ||

| Observations | 250 | |||

In the meantime, a positive relationship between RMC independence and firm performances indicate that a committee with a majority of independent non-executive directors will enhance firm performances measured by Tobin’s Q and return on assets. The findings are consistent with the theoretical expectation based on agency theory and supported prior studies that suggested an increase of independent directors on the board can protect the shareholders’ interests (Ramdani & Witteloostuijn, 2009) and ensure earnings above-average stock price returns (Dennis & Sarin, 1997). Similarly, the earlier study also indicates that companies with more independent directors tend to be more profitable compared to those with fewer independent directors (You, Caves, Smith & Henry, 1986). However, the findings indicate that there have been lower correlation and insignificant between RMC independence and firm performances, which suggest that having a majority of independent directors may not necessarily contribute to enhance firm performances. The result is consistent with the findings of Jia, Li & Munro (2019) since the RMC independence has a positive relation with risk management disclosure indicators, but insignificant. The researchers, therefore, argued that RMC independence does not play a major role in the quality of RMD and its impact on firm performance is not significant. In a different study by Aliyu (2019), the researcher reported that there is a positive yet insignificant relationship between RMC composition, which comprised of non-executive directors and the level of corporate environmental reporting disclosures. The findings suggest that the presence of the independent directors do not give effect on the voluntary disclosure of the company to the stakeholders despite the expectation for the company to voluntarily disclose a report that improved the well-being of individuals, society, workforce, market and environment. In view of this, prior studies justified that an independent director does not always play an active role in overseeing operations, as directors frequently rely on information from the management because of their busy schedules and dedication to other activities (Ismail & Rahman, 2011). Abdullah & Ismail (2015) also claimed that the independent directors’ decision-making can be affected by management due to their appointment as directors and a long period of experience in the company.

Meanwhile, findings between the RMC meeting (RMCMET) and firm performances showed opposite results between Tobin’s Q and Return on Assets (ROA). Nonetheless, both results showed insignificant relationship towards dependent variables, which may indicate that RMC meeting does not appear as the critical predictor for improved firm performance. Jia, Li & Munro (2019) stated that although the number of RMC meetings has a positive relationship with the disclosure of risk management (RMD), the results are insignificant which suggested that the number of RMC meetings does not take on a significant role in the quality of risk management disclosure.

Correspondingly, the results of the firm characteristics indicate that the firm size has a positive effect on firm performances, especially when measured by Tobin's’ Q. The findings indicate a favourable effect of the establishment of a separate RMC in a company which implies that the market believes a firm with a separate RMC has a good monitoring mechanism, thus, increases the firm market performance and return on assets indirectly. The results are also consistent with the previous findings that suggest the size of the company is substantially related to the presence of RMCs (Subramaniam et al., 2009). Similarly, Mirawati (2014) also found that larger corporations tend to establish RMCs as they possess greater amount of assets due to the tendency to rely on external funding to finance capital market activities, thereby placing greater risks on the company. Meanwhile, a positive relationship between leverage and Tobin’s Q indicates that higher levels of leverage in the capital structure are associated with a stronger firm market performance which suggests that leverage boosts the market performance of listed companies in Malaysia. This finding is consistent with that of Ibhagui & Olokoyo (2018) which found a positive relationship between financial leverage and firm market performance, yet an inverse relationship between financial leverage and return on assets. On the other hand, a negative relationship between leverage and ROA indicate that the result supports the assumptions of the pecking order theory and is consistent with that of Quang & Xin (2014), who found that the capital structure of the listed firms (non-financial firms) in Vietnam has a negative effect on financial performance measured by ROA and ROE. Additionally, the study of Saeedi & Mahmoodi (2011) concerning the relationship between financial leverage and firm performance of listed companies on the Tehran Stock Exchange (TSE), also suggested a negative relationship between capital structure and ROA. In the meantime, the natural logarithm of firm complexity appeared to have negative relationship towards firm performances which indicates that the higher the firm complexity, the greater the risk which will lower the firm market value and return on assets. Subramaniam et al., (2009) argued that companies with more production lines and departments or marketing strategies increase the complexity of risks at different levels, including operational and technological risks, resulting in a higher need for monitoring of such risks. Nevertheless, the negative relationships on both dependent variables are seen to be insignificant which implies that the risk arises due to higher firm complexity may not represent a critical source to decline the firm performances in relation to the establishment of the separate RMC. It can also be justified from the test results that having a separate RMC will help to increase the perceived level for monitoring the risk management compared to the company without the RMC (Subramanian et al., 2009).

Overall, the findings of this study indicate a board that establish a stand-alone committee demonstrate their commitment to improving the overall corporate governance structures of their firms (Chatterjee & Bose, 2007). The results suggest that by having a separate RMC could provide specialized insight into risk management decision-making, allowing members to obtain the necessary risk information and to make correct and timely risk management decisions.

Meanwhile, Table 2 shows the results of the combined RMC analysis which suggests that the empirical models of the study could not be pooled for the Panel data technique, as the p-values of the Breusch and Pagan Lagrange Multiplier (BP-LM) test recorded values greater than 0.05. As a result, the study did not continue with the Hausman Specification test, but with a regression-based on the Ordinary Least Square (OLS) test. In this analysis, the outcomes suggest that given the negative relationship between each RMC attribute and the firm performance, it does not support the advantages of establishing a combined RMC in a company. A negative relationship between the size of the RMC (RMCSZ) and the firm performances suggest that an increase in the size of the committee will result in a decrease in the firm's market performance and return on assets by 0.1651 and 0.0084 respectively. The results are consistent with a recent study by Kakanda et al., (2018) that suggests the negative and significant relationship between the size of the RMC and the firm performance indicates that a larger committee size may reduce the market-based measure of firm performance due to higher administrative costs associated with the members of the committee. In like manner, Fali, Philomena, Ibrahim & Amos (2020) also found a negative and insignificant result in which the coefficient is -0.004 and a p-value of 0.906 between RMC size and firm performance measured by ROA. The researchers explained that the risk committee does not influence the financial performance of listed insurance firms in Nigeria for a period of 7 years, starting from 2012 to 2018. Similarly, other researchers also argued that increased board and committee size has resulted in disturbance and delay in decision-making, collaboration and conflict of interest between shareholders and management, which eventually affects the performance of the company (Kakanda et al., 2018).

| Table 2 Multivariate Regression Analysis Based on ROA And Tobin’s Q (Combined RMC Analysis) |

||

|---|---|---|

| Variables | Pooled OLS (Newey-west) | |

| dTOBINSQ | dROA | |

| dRMCSZ | -0.1651 | -0.0084 |

| (-0.27) | (-0.45) | |

| dRMCIND | 0.2853 | 0.0112 |

| -0.45 | -0.61 | |

| dRMCMET | -0.0148 | -0.0026 |

| (-0.28) | (-1.09) | |

| lnFSIZE | -0.1327 | -0.0018 |

| (-1.30) | (-0.97) | |

| LEV | 0.4688 | -0.0337 |

| -0.71 | (-1.26) | |

| d2FCOMP | -0.0046* | -0.0003** |

| (-1.85) | (-2.00) | |

| Constant | 2.0123 | 0.03 |

| -1.27 | -1.02 | |

| BP-LM Test | 0 | 0 |

| -1 | -1 | |

| Hausman Test | - | |

| R-squared (R2) | 0.0378 | 0.0352 |

| F (6, 146) P-value | 1.33 | 1.38 |

| -0.249 | -0.2262 | |

| Observations | 153 | |

Note: *** Significant at 1% level; ** Significant at 5% level and * Significant at the 10% level. BP-LM represents Breusch and Pagan Langrangian Multiplier Test whereas VIF represents Variance Inflation Factor. The symbol “-“indicates a non-related test for the model

Consistently, the negative relationship between the RMC meeting (RMCMET) and the firm performance also implies that an increase in the number of meetings may decrease Tobin's Q and ROA by 0.0148 and 0.0026, respectively. The findings are inconsistent with the earlier study in corporate governance, suggesting that a higher number of meetings are likely to result in superior performance (Lipton & Lorsch, 1992). In the meantime, Menon & Williams (1994) also argued that the number of meetings could not really offer any indication of the work carried out but only a crude measure of the activities by the committee.

Meanwhile, a positive relationship between RMC independence and firm performance suggests that a combined RMC with a majority of independent non-executive directors would maximize the firm market performance and return on assets by 0.2853 and 0.0112, respectively. The findings are consistent with the results under the separate RMC analysis, which indicates that a committee with a majority of independent non-executive directors will enhance firm performances measured by Tobin’s Q and return on assets. However, in view of the insignificant relationship between the variables, the findings indicate that RMC independence does not give a major impact on the firm performances. The results support prior study by Fali et al., (2020) who reported similarly in which the risk management committee independence has a coefficient of 0.003 and a p-value of 0.661 which is statistically insignificant. Nonetheless, a positive relationship implies that the study does not support the theoretical concept of the Stewardship theory which suggests that the executive directors are good stewards and are more motivated to act in the best interest of the corporation than in their self-interest. Indeed, Black & Kim (2012) also reinforced that the existence of outside directors in a company has a positive effect on firm value. Of this reason, the findings are seen to support more of the theoretical expectation of the agency theory which suggests that the existence of an RMC comprised of majority independent directors is better in monitoring firm performances than executives.

In general, the above findings on the attributes of the RMC reported mostly negative and insignificant relationships towards dependent variables, which imply that it does not support the benefits in establishing a combined RMC in a company as opposed to the test results under the separate RMC analysis. The results contradicted to the findings under the separate RMC analysis which indicates that a company with a combined RMC may not be seen as favourable to the organization due to the weaknesses of combining an audit committee with the risk management team. As a matter of fact, prior study indicated that the combined relationship between RMC and the board particularly the Audit Committee may affect the effectiveness of RMC, and eventually influence the disclosure level. This is because the absolute control of decision-making is still under the management influence (Abdullah & Ismail, 2015). Similarly, Hassan, Saleh, Yatim & Rahman (2012) also claimed that the mixed role played by members of the RMC as a result of the establishment of the RMC through the Audit Committee may undermine the function of the Committee because they performed similar functions.

In the meantime, the findings on the firm characteristics of the combined RMC analysis also reported mostly negative towards firm performances suggesting that an increase in the control variable will decrease the dependent variables as measured by the firm market performance of Tobin’s Q and return on assets. However, the findings are obvious on the relationship between firm complexity and firm performances, where the results appeared to be negative and significant as opposed to the findings under the separate RMC analysis. This indicates that despite the existence of a combined RMC, the risk arises from the complexity of a firm has significantly affected the firm performance which suggests the inability of the combined RMC to oversee both financial and non-financial risks.

Thus, in relation to the tendency of larger companies to take on greater risks, Ng, et al., (2012) suggested that it is necessary for a company to consider establishing a separate RMC as risks are claimed to be associated with the size of the company due to their tendency to obtain external funds to support funding in the capital market (Mirawati, 2014). Further, many researchers have suggested that delegating responsibility to a separate RMC would be more effective in creating better risk management practices rather than a combined committee (Aebi, Sabato & Schmid, 2012; Mongiardino & Randzio-Plath, 2010; Kirkpatrick, 2009; Brancato, Tonello, Hexter & Newman, 2006). This is because having a separate RMC could provide specialized insight into risk management decision-making, enable members to obtain the necessary risk information and make correct and timely risk management decisions (Pirson & Turnbull, 2011). Accordingly, earlier studies also documented that the lack of expertise among the members of the audit committee makes it difficult to evaluate those types of risks and has no time to evaluate the detail on the external risks such as business opportunity, marketing and completion (Zaman, 2001). Other researchers also argued that a combined RMC would not only have to control the risk management process but would also have to be actively involved in financial reporting and the pertaining audit oversight role (Alles, Datar & Friedland, 2005). For this reason, many researchers have strongly recommended the setup of an independent RMC given the more complex risk environment as the committee is believed to strengthen the internal control mechanism (Bugalla et al., 2012; Liew et al., 2012; Aebi et al., 2012; Mongiardino & Randzio-Plath, 2010; Yatim, 2010; Kirkpatrick, 2009; Brown et al., 2009; Daly & Bocchino, 2006; De Lacy, 2005, etc.). Indeed, the formation of a separate RMC has been found to have a positive and significant effect towards a risk management disclosure quality, which is consistent with several studies that claimed the existence of a stand-alone RMC could increase risk monitoring and reduce agency costs and information asymmetry (Jia et al., 2019).

Based on the above findings, the study shows several implications towards Malaysian public listed companies, institutional policymakers, as well as the stakeholders of the company particularly the shareholders and potential investors. As a preliminary point, the study highlights the value of continuing good corporate governance for Malaysian publicly listed firms, as it has become a necessary prerequisite for any corporation to be managed effectively in the globalized market. Despite its lack of emphasis and the fact that the establishment of RMC itself is voluntary, results from the current work strongly argue that having a separate RMC is the key to a firm’s performance and longevity. Indeed, the positive and significant relationships between the attributes of RMC and firm performance particularly the association between the RMC size and firm market value indicates the ability of the RMC members to enhance firm performance. In this regard, mandating a separate RMC to perform the risk oversight function at the board level is vital. Abdullah & Shukor (2017) also testified the importance of having an RMC, in which the presence of a separate RMC increases the reliability of voluntary risk management disclosure, thus increasing firm performance. In fact, the establishment of an RMC may flag the board’s commitment to high-quality corporate governance, as it reflects better quality internal risk-monitoring mechanism compared to a combined committee. The arguments in this study supports that of Subramanian, et al., (2009) who argued that having a separate RMC will allow committee members to fully focus on the various risk processes and reports. In turn, this will lead to a better quality internal monitoring compared to having a combined committee. Apart from that, the results also highlighted the importance of RMC attributes as a measure towards the effectiveness of the committee particularly RMC size, as the larger the size of the committee may contribute positively and significant towards firm performance. This initiative will better inform policymakers in reviewing current practices of MCCG 2017 with regard to transparency, composition of RMC members and RMC size.

Finally, with regard to the theoretical aspects of the study, the findings on the RMC independence suggest that the Agency Theory is relevant in explaining the relationship between corporate governance and firm performance particularly in the Malaysian context. Therefore, these findings can be used as a guide post for researchers who are interested in investigating governance-performance relationship and firm performance indicators. Aside from that, evidence from this study can also inform the literature on the theory of corporate governance.

Limitations and Future Study

As this research paper contributes to corporate governance and internal control debate, there are several impediments inherent in the study. First, this research is highly dependent on the availability of annual reports. Thus, any missing annual reports for a certain period will result in the availability of certain information for a particular listed company. In relation to its dependency as well, only firms that reported having a Risk Management Committee (RMC) for the financial year will be included in the study since the establishment of an RMC is still voluntary and not all listed companies form the committee (Badriyah, Sari & Basri, 2015). Of this reason, it is proposed that future research to consider alternative methods of data collection, such as questionnaires and interviews with auditors, board members and risk officers. These methods may provide a more in-depth insight on the establishment of a separate risk management committee (RMC) that may have been overlooked through the use of secondary sources. Apart from that, the audit committee effectiveness is not considered in this study, even though audit committee independence and audit committee expertise are likely to contribute to a sound internal control system and risk management process (Yatim, 2010). Hence, the study focuses solely on the establishment of RMC, either it is combined or separated from the audit committee. Third, in relation to the establishment of an RMC, it is suggested that future studies consider other RMC attributes such as gender diversity, tenure, expert and more in determining the effectiveness of the committee towards firm performance. Finally, it is also recommended that future researchers consider the sources of potential endogeneity in the corporate governance–performance relation since the study did not address the endogeneity issues as argued in previous studies (Wintoki, Linck & Netter, 2012). Therefore, it is believed that the suggestions for future research pertaining to Malaysian context will help to expand the knowledge gained from the study as well as to enhance the overall governance structure of the firm and increase investors’ confidence in companies.

Conclusion

The present study was conducted to examine the effect of the establishment of a Risk Management Committee (RMC) (either combined or separate RMC) towards Malaysian Public Listed Companies’ performances. Based on the investigation carried out in this dissertation, two key findings emerged. With regard to the first research objective, the analysis indicates that there is a positive relationship between the establishment of a separate RMC and firm performances. This can be seen when both firm performances measurement recorded a positive relationship with RMC attributes especially on the RMC size (RMCSZ) and RMC independence (RMCIND). A significant relationship between the RMC size and firm market performance pertaining to the establishment of a separate RMC has also rejected the null hypothesis which suggests that there is no significant effect between the variables. This finding suggests that having a separate RMC in an organisation can improve risk management framework and consequently enhance firm performance. This discovery is echoed by previous work that suggested the benefits of having a separate RMC to provide risk oversight in a company. Meanwhile, with regard to the second analysis of the study, it was discovered that having a combined RMC in an organisation does not improve firm performance in terms of risk oversight and policy implementation. The negative and insignificant relationships between the independent and dependent variables specifically on the RMC size and RMC independence seem to imply that the presence of a combined RMC is not instrumental to a company’s success and longevity. Overall, the study contributes to the literature on corporate governance, particularly on the role of risk management committee in the Malaysian context. The formation of a separate RMC as a board committee is capable of enhancing the effectiveness of the risk oversight role of the BOD and suggests that a combined RMC does not contribute to the improvement of the firm's performance.

References

- Abbott, L.J., Parker, S., & Peters, G.F. (2004). Audit committee characteristics and restatements. Auditing: A Journal of Practice and Theory, 23(1), 69-87.

- Abdullah, A. & Ismail, K.N.I.K. (2015). Hedging activities information and risk management committee effectiveness: Malaysian evidence. Australian Journal of Basic and Applied Sciences. Retrieved from https://doi.org/10.31235/osf.io/kxfqe.

- Abdullah, M. & Shukor, Z.A. (2017). The comparative moderating effect of risk management committee and audit committee on the association between voluntary risk management disclosure and firm performance. UKMJournal of Management, 51(2017), 159-172.

- Aebi, V., Sabato, G. & Schmid, M. (2012). Risk management, corporate governance and bank performance in the financial crisis. Journal of Banking & Finance, 36(12), 3213-3226.

- Akindele, R.I. (2012). Risk management and corporate governance performance—Empirical evidence from the Nigerian banking sector. IFE Psychologia: An International Journal, 20(1), 103-120.

- Alles, M.G., Datar, S.M., & Friedland, J.H. (2005). Governance-linked D&O coverage: Leveraging the audit committee to manage governance risk. International Journal of Disclose and Governance, 2(2), 114-29.

- Badriyah, N., Sari, R.N., & Basri, Y.M. (2015). The effect of corporate governance and firm characteristics on firm performance and risk management as an intervening variable. Procedia Economics and Finance, 31, 868-875.

- Bates, E.W.II., & Leclerc, R.J. (2009). Boards of directors and risk committees. The Corporate Governance Advisor, 17, 15-17.

- Be´dard, J., Chtourou, S.H. & Courteau, L. (2004). The effect of audit committee expertise, independence, and activity on aggressive earnings management. Auditing: A Journal of Practice and Theory, 23(2), 13-35.

- BNM (2010). Minimum standards for prudential management of insurers (Consolidated), Bank Negara Malaysia, Kuala Lumpur.

- Boniface, U., & Ibe, I. G. (2012). Enterprise risk management and performance of Nigeria’s brewery industry. Developing Country Studies, 2(10), 60-67.

- Brancato, C., Tonello, M., Hexter, E. & Newman, K.R. (2006). The role of US corporate boards in enterprise risk management. The Conference Board Research Report.

- Brown, I., Steen, A. & Foreman, J. (2009). Risk management in corporate governance: A review and proposal. Corporate Governance: An International Review, 17, 546-58.

- Bugalla, J., Kallman, J., Lindo, S. & Narvaez, K. (2012). The new model of governance and risk management for financial institutions. Journal of Risk Management in Financial Institutions, 5, 181-93.

- Byrd, J.W., & Hickman, K.A. (1992). Do outside directors monitor managers? Evidence from tender offer bids. Journal of Financial Economics, 32, 195-221.

- Chatterjee, D. & Bose, S.K. (2007). Corporate governance, risk management and internal Audit: A case study. Management and Labour Studies, 32(4), 515-521.

- Daly, K. & Bocchino, C. (2006). “Where is the risk”. Audit Roundup, Directorship, available at www.directorship.com.

- Davis, J.H., Schoorman, F.D., & Donaldson, L. (1997). Toward a stewardship theory of management. Academy of Management Review, 22(1), 20-47.

- De Lacy, G. (2005). How to review and assess the value of board subcommittees. Sydney: Australian Institute of Companies Directors.

- Fali, I.M., Philomena, O.N., Ibrahim, Y. & Amos, J. (2020, May). Risk management committee size, independence, expertise and financial performance of listed insurance firms in Nigeria. International Journal of Research and Innovation in Social Science (IJRISS), 4(5), 313-319.

- Fama, E.F. (1980). Agency problems and the theory of the firm. The Journal of Political Economy, 88, 288-307.

- Fields, M.A., & Keys, P.Y. (2003). The emergence of corporate governance from Wall St to Main St: Outside directors, board diversity, earning management and managerial incentives to bear risk. The Financial Review, 38(1), 1-24.

- Ghazali, Z., & Manab, N. A. (2013). The effect of Malaysian Code of Corporate Governance (MCCG) implementation to companies’ performances. Journal of Accounting, Finance and Economics, 3(2), 43-52.

- Goodwin-Stewart, J. & Kent, P. (2006). The use of internal audit by Australian companies. Managerial Auditing Journal, 21(1), 81-101.

- Guxholli, S., Karapici, V., & Dafa, J. (2013). Audit as an important tool of good governance. International Journal of Management Cases, 14(2), 76-82.

- Halim, E.H., Mustika, G., Sari, R.N., Anugerah, R., & Mohd-Sanusi, Z. (2017). Corporate governance practices and financial performance: The mediating effect of risk management committee at manufacturing firms. Journal of International Studies, 10(4), 272-289.

- Hermanson, D.R. (2003). What else in corporate governance should be changed? Internal Auditing, 18(1), 44-45.

- Ibhagui, O.W., & Olokoyo, F.O. (2018). Leverage and firm performance: New evidence on the role of firm size. North American Journal of Economics and Finance, 45, 57-82.

- Ishak, S., & Md Yusof, M. (2013). The formation of separate risk management committee and the effect on modified audit report. Malaysian Management Journal (MMJ), 17, 43-58.

- Ishak, S., & Nor, M.M. (2017). The role of board of directors in the establishment of risk management committee. SHS Web of Conferences.

- Jensen, M.C. & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3, 305-360.

- Jia, J., Hutchinson, M., & Hogarth, K. (2016). Does firm’s human capital in risk management reduce the likelihood of financial distress? Brisbane, Australia. Retrieved from https://eprints.qut.edu.au/102748/.

- Jia, J., Li, Z., & Munro, L. (2019). Risk management committee and risk management disclosure: evidence from Australia. Pacific Accounting Review, 31(3), 438-461.

- Kakanda, M. M., Salim, B., & Chandren, S. A. (2018). Risk management committee characteristics and market performance: Empirical evidence from listed review financial service firms in Nigeria. International Journal of Management and Applied Science, 4(2), 6-10.

- Kallamu, B.S. (2015). Risk management committee attributes and firm performance. International Finance and Banking, 2(2), 1-24.

- Kirkpatrick, G. (2009). Corporate governance lessons from the financial crisis. OECD Journal: Financial Market Trends, 2009(1), 61-87.

- Kota, H.B. & Tomar, S. (2010). Corporate governance practices in Indian firms. Journal of Management & Organization, 16(2), 266-279.

- Lipton, M., & Lorsch, J.W. (1992). A modest proposal for improved corporate governance: Business source. Business Lawyer.

- Malaysian Code on Corporate Governance (2017). Kuala Lumpur, Malaysia: Securities Commission.

- Menon, K., & Williams, J.D. (1994). The use of audit committees for monitoring. Journal of Accounting and Public Policy, 13(2), 121–139.

- Mirawati, M. (2014). The effect of ownership structure and company size on profitability in property and real estate companies listed on the Indonesian stock exchange. Journal of the Faculty of Economics, Raja Ali Haji Maritime University.jurnal.umrah.ac.id.

- Mishra, R.K., & Kapil, S. (2018). Effect of board characteristics on firm value: Evidence from India. South Asian Journal of Business Studies, 7(1), 41-72.

- Mongiardino, A. & Plath, C. (2010). Risk governance at large banks: Have any lessons been learned?. Journal of Risk Management in Financial Institutions, 3(), 116-123.

- Ng, T. H., Chong, L. L., & Ismail, H. (2012). Is the risk management committee only a procedural compliance? An insight into managing risk taking among insurance companies in Malaysia. The Journal of Risk Finance, 14(1), 71-86.

- Onga, T.S., Heng, T.B., Ahmad, N. & Muhammad. (2015). H. Institutions and Economics 7, 56.

- Pirson, M. & Turnbull, S. (2011). Corporate governance, risk management, and the financial crisis: an information processing view. Corporate Governance: An International Review, 19(5), pp. 459-470.

- Quang, D.X., & Xin, W.Z. (2014). The impact of ownership structure and capital structure on financial performance of Vietnamese firms. International Business Research, 7(2), 64-71.

- Saeedi, A., & Mahmoodi, I. (2011). Capital structure and firm performance: Evidence from Iranian companies. International Research Journal of Finance and Economics, 70(11), 20-29.

- Sani, A.A., Latif, R.A., & Al-dhamari, R.A. (2018). Risk management committee and real earnings management through sales: Evidence from Nigeria. Journal of Advanced Research in Business and Management Studies, 12(1), 62-69.

- Sheikh, N.A., Wang, Z., & Khan, S. (2013). The impact of internal attributes of corporate governance on firm performance. International Journal of Commerce and Management, 23(1), 38-55.

- Subramaniam, N., McManus, L., & Zhang, J. (2009). Corporate governance, firm characteristics and risk management committee formation in Australian companies. Managerial Auditing Journal, 24, 316-339.

- Tao, N.B., & Hutchinson, M. (2012). Corporate governance and risk management committee: The role risk management and compensation committees. Retrieved from http://ssrn.com/abstract=1979895.

- Wintoki, M.B., Linck, J.S., & Netter, J.M. (2012). Endogeneity and the dynamics of internal corporate governance. Journal of Financial Economics, 105(3), 581-606.

- Yatim, P. (2010). Board structure and the establishment of a risk management committee by Malaysian listed firms. Journal of Management and Governance, 14, 17-36.

- Yatim, P., Iskandar, T.M. & Nga, E. (2016). Board attributes and foreign shareholdings in Malaysian listed firms. Journal of Management & Governance, 20, 147-178.

- Zaman, M. (2001). Turnbull – generating undue expectations of the corporate governance role of audit committees. Managerial Auditing Journal, 16(1), 5-9.