Research Article: 2021 Vol: 24 Issue: 1S

Role and Relation of Each Actor in National Budget Policy Making Process at the Peoples Representative Council of Indonesian Republic

Safri, Malang Brawijaya University

Abdul Hakim, Malang Brawijaya University

Bambang Santoso Haryono, Malang Brawijaya University

Keywords

Compilation, Policy, State Budget, Mass Media, Role

Abstract

Objective of this research is to describe and analyze relation of actors in National Budget policy making process at the People’s Representative Council of the Republic of Indonesia. Method of this research is qualitative approach, which is aimed to provide description and analysis about political process realities at People’s Representative Council during National Budgetpolicy making process. Results of research show that there are two type of actorsinvolved in National Budget policy making process, namely government actors and council actors. Government actors are Fiscal Analysis Agency, which is responsible to the Minister of Finance and making reports about items such as fiscal and macroeconomic trends in the last two years, fiscal performance estimation for the current budget year. Council actors include: Fractions at the People’s Council; Budget Agency for the People’s Council that will held several work meetings with Government (Minister of Finance/Minister of National Development Planning) and Governor of Bank Indonesia; Formulator Team for National Budget Draft; Commission VII and Commission XI. This research attempts to produce comprehensive explanations and interpretations about actors and their role and relation in National Budget policy making process, and also about role of mass media in socializing this process and making it more transparent.

Introduction

New Public Management (NPM) affects directly the national budget concept. This effect is marked by a change from traditional budget model to performance-based budget. The age of New Public Management has urged many countries to take more systematic approach to national budget planning. In political perspective, NPM paradigm views budgeting as incremental function (distribution of benefits and burden). Tjiptoherijanto & Manurung (2010:167) explained that budgeting function, according to NPM perspective, handles two matters, precisely, production of goods and services, and regulation of public sector outputs and impact of these outputs (outcomes). Budgeting orientation, as NPM suggest, shall be put on output rather than input (money, personnel, and capital). As previously said by Keban (2008:102), NPM paradigm also changes financial managementfunction, where budget is no longer describing financial aspects only, but also explaining political aspects. Public budget is the priority of governmental activity, which represents the reflection of interest groups’ interests and also gives direction concerning what must be done or considered important by government in one budget-year. The involvement of stakeholders’ interests makes budgeting process becoming a political process, where each of stakeholders (government, political parties, and interest groups) insists their interests to be accommodated into budget plan.

Performance-based budgeting (PBB) is the making of budget that emphasizes on the interrelation between input (funding) and output (efficiency in using the fund) (referring to Article 7 section (1) of Government Regulation No.21/2004). Performance-based budgeting requires the presence of performance indicators, cost standards, and evaluation against performance of each program and its activities (pursuant to Article 7 section (2) of Government Regulation No.21/2004). The conditions expected to emerge after using PBB are: (1) improving effectiveness of budget allocation through programs and activities directed to achieve the predetermined outputs; (2) improving efficiency of expenditure through determination of cost unit of the outputs; and (3) increasing credibility and accountability. Regardless budgeting system applied, main problem of national financial administration is about how to formulate and implement decisions concerning planning, execution, accounting, reporting, and supervision against the procurement and use of funding. Goals desired by national financial administration are accountability, efficiency, and effectiveness in procurement and use of funding. Function of planning national finance is handled by budgeting function of People’s Representative Council. Strategic role of the Council is to be representative institution with discretions in designing, formulating and validating the laws. Principally, the Council’s authority of making the laws is attributive discretion given by Article 21 of the 1945 Constitution, which before it, this discretion was possessed by President (Article 5 section (1) of pre-amendment of the 1945 Constitution). In other words, the amendment of the 1945 Constitution has assigned People’s Representative Council as law maker institution.

Wildavsky & Caiden (2004) examined political dimension in budgeting process. They found that varying interests are put into the budget and this represents political process in budgeting. Each stakeholder involved in budgeting process uses their influence “to put” their interests into budget policy. Alt & Lassen (2005) declared that People’s Representative Council and government bureaucrats only care about their own interests. Political parties always use political promises as instrument to win the general election. After the election, bureaucracy is not changing at all and only serving the interests of bureaucrats and political parties. Government elites only work for their own interests and material profits. Their political work does not yet produce budget that respects public interests. Political decisions are only made with temporary interests. These elites are required to complete two noble jobs, which are, using their right in budgeting process, and formulating and enforcing pro-public budget.

Given the fact that National Budget making process is political, therefore, the discussion concerning National Budget in Parliament always involves fractions, commissions and Budget Agency. Before budget is discussed by commissions and Budget Agency, each fraction conveys a conspectus about National Budget Draft submitted by President, and then Minister of Finance as government representative gives response. These two activities are done at different time allocation during Plenary Session. After these two activities, each commission in Parliament, along with its affiliates, will discuss the detail of the Draft, particularly to items relating with Ministries and non-ministerial institutions. Meanwhile, Budget Agency discusses the Draft to determine few points such as macro-economic assumptions, national incomes, national expenses, deficit policy, and deficit closure funding. Any changes in macro-economic assumptions will impact on national incomes, national expenses, and deficit closure funding. The allocation of budget function to be strategic role of People’s Representative Council is crucial because budget function is making operational the other functions, including legislation function and supervision function. Budget function, therefore, greatly affects the performance of People’s Representative Council (Wasistiono, 2009). Legislative institution (Parliament) is overwhelmed by many situations viewed by mass and social media as the decay of performance, behavior and rule of parliament members. Deviant behaviors of Parliament members have produced unfavorable image to them. One prominent deviation is corruption in budgeting process, where Parliament members take fee in exchange for accommodating certain interests into National Budget. Since 2012, there are many legislative members convicted for corruption. They come from political parties, such as: Golkar with 14 persons; Democrat Party with 10 persons; PDIP with 8 persons; PAN with 8 persons; PKB with 4 persons; Gerindra with 3 persons; and 2 persons, either from PKS and PPP (Jawa Pos, January 1st, 2013, p.2. “Corrupt Politicians in 2012”, Source: ICWIP).

Based on this background, problem of research is formulated as “How is the role and relation of each actor in National Budget policy making process at People’s Representative Council of Indonesian Republic?” Referring to this problem, research is then aimed to describe, analyze, and interpret the role and relation of each actor in National Budget policy making process at People’s Representative Council of Indonesian Republic.

Method of Research

Knowledge about public sector budget, especially concerning political process in public sector budgeting (National Budget), should enrich theoretical domain of national finance field. This knowledge helps budget maker to answer the question about the goal of planning and implementing national finance. Analytically, National Budget contains several aspects, such as: (a) allocation, concerning with whether National Budget can ensure the precise flow of funding to economic sector that needs it; (b)distribution, associating with how far National Budget can ensure the balance of public funding distribution across regions, across social classes, or between public sector and private sector, and between government and private, based on their representation in public policy making; (c) stabilization, relating with the use of public expenses for stabilizing macroeconomics; and (d) growth, measured with question of how far the use of expense authority by government can support economic growth and prosperity acceleration.

All these aspects have been analyzed. This analysis helps researcher not only in understanding political process of each aspect but also factors that possibly constrain the achievement of National Budget goals. Knowledge about budgeting process and budget validation are similarly important and enriching theoretical knowledge of National Budget policy making process. Theories underscoring National Budget aspects are supported by knowledge about political process in National Budget. Besides these theories, some relevant theories are also taken into consideration, especially theories about financial reformation at public sector, which may be useful to produce more transparant and accountable budgeting model.

Researcher expects that results of this research will be useful for financial planners and financial policy makers who must work for the sake of national interests. After reading this research, it is also expected that they will use principles of participatory, transparency, and accountability in planning financial administration of the nation. Therefore, practitioners can avoid corruption dilemma that recently shadows on financial management practice of the nation.

Research Type

Qualitative approach is used by this research. This approach is used by researcher with the aim to understand and analyze political process phenomenon surrounding budget policy making process. Researcher implements this approach by providing comprehensive description about research topic through words and specific languages, and then conducting inductive analysis by comparing coherent theories and research phenomenon (Sugiyono, 2007:9; Moleong, 2008:6).

Therefore, it can be said that the qualitative research is conducted by researcher to describe, analyze, and interpret the role and relation of each actor in National Budget policy making process at People’s Representative Council of Indonesian Republic. National Budget policy making process involves government, commissions, and external institutions. Descriptive data are obtained from the field, and the data take forms of verbal or non-verbal information, either about words or behaviors of the informant. Documents are also used but it is optional only if research focus needs to be enforced.

In this research, socio-political symptoms that accompany budget policy making process are understood through organizational and managerial aspects. Both aspects are examined to see its compatibility with principle of good financial governance. In this qualitative research, researcher is positioned as human instrument. Data collection method involves participant observation where researcher must observe directly the meetings that discuss budget policy, and in-depth interview used by researcher to understand political process surrounding budget policy making process, role of each actor, and its constraining factors. Therefore, researcher must interact with data sources, or in other words, researcher is actually knowledgeable about field conditions and making close acquaintance with the source individuals (informants).

Considering the statement above, it is possible to say that this research is using interpretative analysis. This research interprets information obtained from data sources, and then the result of interpretation is poured comprehensively and deeply in the form of research report.

Research Focus

Pursuant to problem and objective of research, some focuses are then determined, and these are given as following:

1. Political process in National Budget policy making process is reviewed through several aspects: (a) the preliminary discussion about governmental work plan for National Budget Draft; (b) the discussion about National Budget Act Draft; (c) the discussion about First-Semester Realization Report and Second-Semester Prognosis for National Budget at the current fiscal year; (d) the discussion of National Budget Revision at the current fiscal year; (e) the discussion and approval of Accountability Act Draft for National Budget at previous fiscal year;

2. Role and relation of each actor in National Budget policy making process at People’s Representative Council, which involves: role of government; role of budget-administering commissions in the Council; and role of society through non-government organization and mass media;

3. Factors supporting and constraining National Budget policy making process at People’s Representative Council, and the focus is given upon: (a) internal factors at commission level, and (b) external factors of government, private and society; and

4. Model that illustrates National Budget policy making process at People’s Representative Council, and the model is differentiated into the currently applied model (existing model) and the suggested model (recommended model). The recommended model is designed based on result of analysis on strength and weakness of the existing model.

Data Source

Data source of this research includes informants, event and documents. Each is explained in the following.

Informants

Informants of this research are those who have knowledge and capability to obtain information and data needed by this research. In qualitative research, informants are individuals who actually know about phenomenon that becomes research object and who can help researcher in exploring information (Miles & Huberman, 1992). Early informants are chosen purposively (through purposive sampling), or that the key informants are predetermined by researcher based on research objective. Other informants are determined through snowball technique based on guidance of the key informants, or based on the relevancy of information.

After sample determination, the included informants are: (1) the Chair of Commission, the Chair of Fraction, and the member of budget-administering commission at People’s Representative Council; (2) staffs of the Ministry that represents government in budget discussion, which is usually the Ministry of Finance or other related ministry; (3) staffs who work at the Secretariat of budget-administering commission at National People’s Representative Council, or staffs who work at the Secretariat of Regional People’s Representative Council; and (4) members of non-government organization (NGO) who are invited into budget discussion. Information provided by these informants are processed as good as possible to help researcher to strengthen the database. Key informants in this research are the Chair of Commission, the Chair of Fraction, and the Expert Staff for the Minister of Finance.

Several considerations are involved in determining informants. Each consideration is explained as following:

(1) Accuracy and validity of the obtained information must be ensured. Number of informant depends on the expected result. If the informant is individual who is familiar with research problem, then information from this individual is used in the analysis process.

(2) Number of informant depends on the achievement of research findings. If research problem is already answered by one informant, and after further investigation against next information (data source triangulation), there is no further answer variation among informants (data are saturated), then number of existing informant is considered proper and adequate.

(3) Researcher has authority to determine informant despite job or rank. Researcher may not use certain information if this information is unreliable.

Snowball technique is used to select information out of purposively determined key informants. This technique is applied sustainably until data are saturated. Spradley (1979) had provided guidances for the use of this technique, which include: (1) what the informants know about their own behavior; (2) what concept the informants use to classify what they experience with; (3) how the informants define their concept; (4) in what way the informants explain what they experience with; and (5) how researcher translates informants’ knowledge into description understandable by researcher. The final informant is chosen based on data saturation, or when there is no longer variation of data given by informant. As explained by Lincoln and Guba (quoted in Moleong, 2000), “As many as possible variation is only obtained if the current sample unit is already determined and the previous sample unit is already determined and analysis. Each of the next sample unit can be selected to empower the information obtained previously by allowing them to be questioned, which therefore, information gap can be always filled”.

There is no early limitation for number of informant because it is always set depending on the variation of answer given by informant. If researcher thinks that there is no longer variation of answer after conducting triangulation, then number of informant is considered as adequate.

Events

Other data source is events happening in research context and relevant to research problem. Events in this research are referred to events related with budget discussion meetings. Such events are meetings held by budget-administering commissions at People’s Representative Council, and the consultation session between Ministry of Finance and related commissions.

Documents

Document-based source in this research includes the Report of Meeting held by budget-administering commissions, National Budget Draft, work plan of budget-administering commissions, and other documents.

Data Collection

Some techniques are used to collect research data. Each is elaborated in the following.

Observation

Observation is conducted directly to research location or object. Researcher conducts direct observation on budget meetings, internal meetings of the commissions, or meetings between commission and government. This observation is carried out to understand factual condition of political process in National Budget discussion. Type of this observation is called participant observation because researcher is also legislative member and taking active involvement in every budget discussion meeting.

Interview

Informants are interviewed either with or without interview manuals. Type of the interview is in-depth interview, which is done to complete the data if something is felt to be less. In general, in-depth interview is a process to obtain information that involves face-to-face question-answer session between the interviewer and the interviewed. Within context of this research, researcher conducts in-depth interview by asking questions to informants concerning factors affecting (supporting and constraining) National Budget policy making process, role of every actor in the process, and the relation of these actors. The interview is open-ended, and therefore, researcher is not necessary subject to formal situation but still preserving the seriousness. Such interview strategy can be made flexible based on research condition.

Documentation

Documentation is done to obtain secondary data, literatures and references considered relevant to research. The documents collected by researcher are written documents in commission level at People’s Representative Council, or in government level, which is represented by Ministry of Finance. Audio visual materials and photographs are also collected.

Location and Site of Research

The orientation of research is the policy making process of the 2017 National Budget at People’s Representative Council. There are four strategic reasons why this orientation is considered. First, during this fiscal year, role and position of the Council are already legitimate and strongly supporting its status as policy maker. Second, political process and political dynamic at the Council are dominated by interests of commissions, fractions, political parties and government. Third, during this fiscal year, the process in making public policy disregards people aspirations. Based on these reasons, therefore, research location is decided at the Office of National People’s Representative Council in Jakarta.

Some research sites are considered, and these include the operational room of the Chair of Commission, the operational room of the Chair of Fraction, the operational room of the Expert Staff for Financial Minister, the secretariat room of the commission, the operational room of Council member, and the data room at the Council.

Data Truthworthiness Test

Data truthworthiness is measured with four criteria, namely, credibility, transferability, dependability, and confirmability. Each criterion is explained as following.

Credibility

To fulfill this criterion, researcher did some activities, such as prolonged engagement, persistent observation, triangulation, peer debriefing, referential adequacy checks, and revaluate research findings (member checks). Each action is elaborated as following.

a) Prolonged Engagement: This activity helps researcher to get trust from research subjects and to avoid distortion against the presence of researcher on the field. Through prolonged engagement, researcher has plenty of times to learn about political process in budget policy making, especially in the 2017 National Budget.

b) Persistent Observation: This activity is aimed to find out the most prominent issue and then researcher concentrates on this issue. This activity is done by continuously observing research phenomena and deeply participating into the subject’s activity to obtain comprehensive description about National Budget policy making process at People’s Representative Council. For example, through this activity, researcher can check whether there is opinion dispute concerning budget proportion allocated to every ministry or institution.

c) Triangulation: This activity is to check data truth worthiness by confirming the data with other informant (source triangulation). This triangulation is done against more than one source to avoid mistakes in data interpretation. Besides, triangulation is also done by comparing data from interview with those from observation. Question asked to a member of commission is given again to a member of another commission, until there is no longer variation of answer across informants.

d) Peer Debriefing: This activity involves sharing of knowledge with co-workers, either the fellow students of doctorate program or the fellow researcher in budget-administering commissions at People’s Representative Council. This sharing helps researcher to understand the aspects in National Budget policy making process that need to be explored.

e) Referential Adequacy Checks: This activity is to check all field notes and documents, and therefore, the compatibility between research data and proposition can be ensured.

f) Member Checks or reevaluate research findings: This activity is final part of the interview, especially when interview is already completed. What researcher must do is to reevaluate the findings based on information delivered by informant.

Dependability

This criterion requires researcher to ensure whether research process has reached the desired quality or not. Researcher is required to conduct audit or scrutiny on all components of research process and outputs. Main auditor of this research is promotor and co-promotor, precisely,Prof. Dr. Abdul Hakim, M.Si., Dr. Mardiyono, MPA., and Dr. Bambang Santoso Haryono, MS. Other auditor is the member of Dissertation Examiner Team.

Conformability

This criterion is used to assess the quality of research outputs and emphasized on tracing data, information and interpretation supported by materials obtained from investigation or audit trail. To fulfil this criterion, researcher must prepare field notes, analysis results, and discussion minutes of Focus Group Discussion (FGD). Researcher holds discussion with promoter and co-promoter either in formal way at commission meetings or through individual consultation (face-to-face meetings). This discussion provides researcher with inputs that can increase conformability of research findings. Seminar forum of research findings is also forum used by researcher to confirm the findings with relevant experts. There are also commission meetings where researcher confirms research findings with promoter team.

Transferability

Researcher satisfies this criterion by presenting research findings in a way that can enrich scientific discourse and allow the comparison of research with other same or relevant research. Researcher must compare data precisely to describe research problem and answer research objective, and then escort readers properly to understand research substance. Transferability level can be seen from the achieved similarity of understanding and context between researcher and reader. Through the understanding about research substance, reader may get description about context situation that allows them to transfer the findings. It is expected that the findings can be applied to political process in the discussion of public policy other than budget. So far, the requirement of transferability for other policy is relatively same either in process or context.

Data Analysis

Analysis is a process to arrange the data in certain way for the easiness of interpretation. Data arrangement is defined as an effort to classify data based on pattern, theme or category. Qualitative analysis is used if the data have qualitative characteristic. This research uses qualitative analysis. In qualitative research, data analysis must be done as early as possible. The collected data must be transcribed immediately to be analyzed.

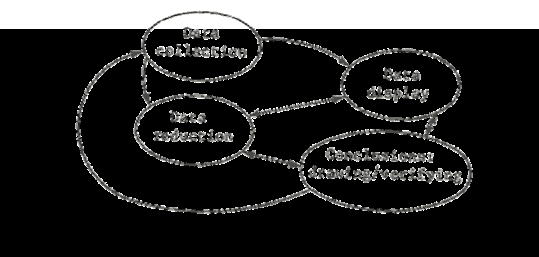

Data analysis technique of this research is considering data analysis model suggested by Miles, et al., (2014), which is popularly known as “Interactive Model”. This model comprises components such as data condensation, data display, and conclusion: drawing/verifying. The explanation of each component is presented as following:

Data condensation

This component involves several activities such as sorting the data based on its relevancy with research focuses, simplifying the data, making abstract, and changing the data transcribed already on field notes, and modifying the data obtained from documents and observation. The condensed data are summarized and codified based on research focuses, and therefore, researcher can get categories and themes of data that enable the process of data analysis and conclusion making.

Data Display

The condensed data are sorted and separated based on the group, and then arranged into compatible categories to be displayed in research frame, along with temporary conclusion proposed during data condensation.

Conclusion

It is a process to produce a deep description about data categories before researcher arrives at the point of answering research problem. Actually, conclusion can also be made before answering research problem, especially during interaction with condensation process or data display.

Interactive model that is used in data analysis is illustrated in the following figure 1.

Result of analysis is presented in form of proposition as final part of research activity. This proposition is made based on data collected, data analysis, and discussion. However, this research has limits, precisely:

a) Research method is not actually qualitative descriptive, but it is more like mixed method because problem scope is quite extensive and complex, which therefore, more comprehensive method is possibly needed.

b) This research focuses only on one problem. Therefore, the collected data, data analysis, and discussion are not deeply enough to signify the characteristic of qualitative research.

c) Research duration should be extended, at least to the timeline that produces adequate observation, such as one service term (5 years) of People’s Representative Council and President, which may allow researcher to understand the pattern or direction of political policy concerning budgeting.

Result and Discussion

Result

Role of Government and Budget-Managing Commissions

National Budget is a financial plan annually made by central government that needs to be approved by People's Representative Council. Central government collects and expends the funds every year through National Budget. Indonesian National Budget is formally referred to the budget of revenues and expenditures managed by central government of Indonesia. Because National Budget refers to the budget managed by central government, then Regional Budget and the budget for State Owned Enterprises are not included. In accordance with the 1945 Constitution, National Budget must be legalized into law (National Budget Act), and in this case, President is obliged to prepare National Budget Draft and submit it to People's Representative Council. National budget making process is a set of activities that involve a lot of entities, including all ministerial and non-ministerial institutions and the People Council. The active role of the People Council in this process in recent years has allowed the process to be more democratic, more transparent, more objective, and more accountable.

All revenues that are entitled to the government and all expenses that must be paid by the government in a certain fiscal year must be arranged into National Budget. Few understandings about role of the government and People's Representative Council in national budget making process are obtained from interview with BW, which are summarized as follows:

“..... National budget making process is a set of activities that involve a lot of entities, including all ministerial and non-ministerial institutions and People's Representative Council.

The active role of the People Council in this process in recent years has allowed the process to be more democratic, more transparent, more objective, and more accountable. The active role of the People Council in this process in recent years has allowed the process to be more democratic, more transparent, more objective, and more accountable. .... all revenues titled to the government and all expenses paid by the government in a certain fiscal year must be arranged into National Budget” (Interview, June, 2017).

Role of central government is to convey to People's Representative Council of fiscal policy principles and macroeconomic frames for the next fiscal year no later than the middle of May of the current year. Central government and the People Council will discuss fiscal policy principles and macroeconomic frames submitted by central government in the preliminary discussion concerning National Budget Draft for the next fiscal year. During the discussion, central government and the People Council also discuss general policies and budget priorities that will be used as work guidance by ministerial/non-ministerial institutions in proposing budgeted items. During the process of making National Budget Draft, Minister, as the leader of ministerial institution, or Ministry, and also leaders of non-ministerial institutions, who both are the executor of National Budget, must make work plan and budget plan of their institutions for the next fiscal year. Both are made based on the targeted work achievement (performance) along with expenditure estimation for the next fiscal year. Both are then submitted to People's Representative Council to be discussed in preliminary discussion of National Budget Draft.

Results of discussion about institutions’ work plan and budget plan are delivered to Minister of Finance that will use it as materials in drafting National Budget Act for the next fiscal year. Central government can also make its own version of National Budget Act Draft, which is accompanied with financial notes and its supporting documents, and it must be submitted to People's Representative Council on month of August of the previous year (a year before discussion). The discussion of National Budget Act Draft is done based on the law that regulates the composition and position of People's Representative Council. However, the People Council can propose ideas that may change items of revenues and expenses in the National Budget Act Draft. People's Representative Council must decide the fate of National Budget Act Draft no later than two months before the intended fiscal year. The approved Draft shall contain the details of the responsible organization units, and their functions, programs, activities and expenditure type. If the People Council does not approve the Draft, then central government can make expenditure as much as figure at National Budget in previous fiscal year. Few statements were given by PG, one Chair of a Faction at People's Representative Council, and these are summarized as follows:

“..... the process of making National Budget Draft, Minister, as the leader of ministerial institution, or Ministry, and also leaders of non-ministerial institutions, who both are the executor of National Budget, must make work plan and budget plan of their institutions for the next fiscal year. Both are made based on the targeted work achievement (performance) along with expenditure estimation for the next fiscal year. Both are then submitted to People's Representative Council to be discussed in preliminary discussion of National Budget Draft ...... results of discussion about institutions’ work plan and budget plan are delivered to Minister of Finance that will use it as materials in drafting National Budget Act for the next fiscal year. Central government can also make its own version of National Budget Act Draft, which is accompanied with financial notes and its supporting documents, and it must be submitted to People's Representative Council on month of August of the previous year” (Interview, June, 2017).“..... the process of making National Budget Draft, Minister, as the leader of ministerial institution, or Ministry, and also leaders of non-ministerial institutions, who both are the executor of National Budget, must make work plan and budget plan of their institutions for the next fiscal year. Both are made based on the targeted work achievement (performance) along with expenditure estimation for the next fiscal year. Both are then submitted to People's Representative Council to be discussed in preliminary discussion of National Budget Draft ...... results of discussion about institutions’ work plan and budget plan are delivered to Minister of Finance that will use it as materials in drafting National Budget Act for the next fiscal year. Central government can also make its own version of National Budget Act Draft, which is accompanied with financial notes and its supporting documents, and it must be submitted to People's Representative Council on month of August of the previous year” (Interview, June, 2017).

Observation data had shown that National Budget drafting process involves many actors. Role of each actor is explained as follows:

a) Central government conveys fiscal policy principles and macroeconomic frames of the next fiscal year to People's Representative Council no later than month of May of the current year;

b) Central government and People's Representative Council discuss fiscal policy principles and macroeconomic frames proposed by central government in preliminary discussion concerning National Budget Draft for the next fiscal year; and

c) Based on results of discussion of fiscal policy principles and macroeconomic frames, central government and People's Representative Council discuss general policies and budget priorities that will be used as work guidance by ministerial/non-ministerial institutions in proposing budgeted items.

Role of People's Representative Council in National Budget drafting process is a political dynamic. For example, one faction at the People Council had once rejected the draft of the 2018 National Budget. Functional Groups Party (Golkar) condemned this rejection as image-building activity and threatened to overthrow it. Indeed, National Budget is an instrument used by the nation to prosper the people because inside National Budget, there are a lot of programs emphasized for national development along with funds expended for them. The programs may include the operational of general schools and religion-based education; civil servant payroll; infrastructures of road, reservoir, and farming irrigation; health structure; subsidy for fertilizer and farming seeds; and Rural Fund and Social Security.

All funds in National Budget are for Indonesian citizens without exception, and without discrimination based on political background, political affiliation or political party. If there is a political party that is dauntless to reject National Budget on political reason, it must be a dangerous mind. It is possible that the repellent political party fails to understand National Budget function as an instrument to achieve national development as required by Constitution. Political views at People's Representative Council are indeed allowed to disagree with the government or to be in opposition with the ruling government. An informant, PG, described this situation as following:

“...... National Budget drafting process is a dialectical democratic certainty that provides rooms for opposite opinions. Using National Budget as a political instrument and rejecting it as instrument to prosper the people, which therefore also denies constitutional mandate, are considered dangerous and prohibited in modern democratic system of Indonesia. Golkar Party understood that 2018 was a hot political year anticipating general election in 2019. Indonesian citizens must condemn the hidden intention of building political image behind the rejection against National Budget. Essentially, National Budget will be used for Indonesian citizens without seeing their political party. ..... for example, tax ratio was targeted around IDR 1,600 trillion, but government only achieved IDR 1,472 trillion. Failing to achieve tax revenue target, the government then released national bonds but it led to the increased national burden. Debt was then used to close budget deficit gap and to finance national development. Tenet that National Budget is a national instrument to prosper the people seems understated. Therefore, the discourse of many factions to reject the 2018 National Budget Draft must be stopped because it is truly a transient image building effort”. (Interview, June, 2017).

National Budget Act, Article 15, has stated that the mechanism of National Budget drafting process involves several considerations as following:

a) Central government can make its own version of National Budget Act Draft, which is accompanied with financial notes and its supporting documents, and submit it to People's Representative Council on month of August of the previous year (a year before discussion);

b) The discussion of the Draft is done based on the law that regulates composition and position of the People Council;

c) The People Council can propose ideas that may change items of revenues and expenses in the Draft;

d) The People Council is allowed to file revision on the Draft as long as not increasing budget deficit;

e) The People Council must decide the fate of the Draft no later than two months before the intended fiscal year;

f) The approved Draft shall contain the details of the responsible organization units, and their functions, programs, activities and expenditure type.

g) If the People Council does not approve the Draft, then central government can make expenditure as much as figure at National Budget in previous fiscal year.

One Chair of a Faction at People's Representative Council, DP, illustrated the dynamic of budget drafting process at legislative floor in the following words:

“People's Representative Council is a political institution that looks after people aspirations. The determinant factor to this goal is National Budget. So far, Democratic Party (Demokrat) is a Faction at the People Council that maximally endeavoured to produce pro-people National Budget, and it was done by initiating reviews, meetings and discussions with government and other fractions at the People Council. The fact showed that the 2018 National Budget drafted by the government is very conservative on its determination of value and summation. Anyway, it was still tolerated but Democratic Party attempted to ensure that National Budget will be used properly and more respecting people interest rather than political parties ...... government’s assumption of the 2018 economic growth at 5.4-6.1 percents was considered as not realistic by some political parties, including Democratic Faction. They said that this projection is overly optimistic and disregarding the facts those global economic still struggles for recovery and domestic economic performance is low. The government was in a very difficult position ...... moreover, economic growth in 2016-2017 appeared to be stagnant around 4.9-5.0 percents. These figures are surely too optimistic and less realistic to be the guidance of economic targets in 2018. Inflation rate of 3.5% with plus and minus of 1% still needs a deep calculation because low and stable inflation rate shall be balanced with the increasing of the purchasing power. Exchange rate was assumed at range of IDR 13,500-13,800 per US$, and by this rate, the government was expected to be able to coordinate and collaborate with Bank Indonesia (BI) to guard the value of Indonesian rupiahs in order to provide certainty to entrepreneurs and investors. Democratic Faction exclaimed that political process over National Budget policy is considered appropriate only if it is aimed to people welfare. Therefore, they require the government to set the development targets that can possibly give positive impact on Indonesia in 2018. These targets include setting unemployment rate at range of 5.0-5.3 percents, securing poverty rate at range of 9.5-10.0 percents, reducing gini ratio to 0.38, and improving Human Development Index ...... high economic growth can also bring along many benefits, such as opening and expanding job vacancies, increasing skills and competencies, providing job-intensive programs, stabilizing prices, providing access to health service, and improving access to education and also education quality. Certain risks such as the potential dilution of rupiah exchange rate against US dollar, or when the assumed crude oil prices misses too far from macroeconomic assumptions, all can affect electricity subsidies” (Interview, June, 2017).

Budget Agency is founded by People’s Representative Council to be the stationary unit that assists the People Council on budget issues. The People Council determines composition and membership of Budget Agency based on the balance and distribution of faction membership at the People Council. This determination is done on early period of Council membership and also on early period of Council sessions. National Budget Act has arranged composition and membership of Budget Agency. The Act requires that Agency’s members are selected from each commission based on the balance of membership of all factions at the People Council and also based on advice of the factions. Budget Agency comprises some individuals who work together in a way of collectively or collegiality. Budget Agency leadership consists of one leader and no more than three vice leaders selected from or appointed by Agency members based on proportional consensus principle because it must still be considerate to woman representation in accordance with the balance of membership of each faction. Tasks of Budget Agency are described as follows:

a) Along with the government, usually represented by related minister, discussing and determining fiscal policy principles and budget priorities that will be used by ministerial and non-ministerial institutions to set up their budget items;

b) Along with the government, determining national income targets by referring to the advice of related commissions;

c) Along with President, usually represented by related minister, discussing National Budget Draft by referring to the results of work meeting between government and related commission concerning budget allocation for functions, programs and activities of ministerial and non-ministerial institutions;

d) Synchronizing the results of work meeting with the results of commission discussion concerning work plan and budget plan of ministerial and non-ministerial institutions;

e) Discussing realization report and prognosis concerning National Budget; and

f) Discussing the explanatory principles of National Budget Accountability Act Draft.

Budget Agency only discusses budget allocation that has been decided by the budget-managing commissions. Members of commissions in the Agency must serve budget allocation desired by the budget-managing commissions, and convey the results of their service to these commissions. Preliminary discussion concerning National Budget Draft is attended by Budget Agency of People’s Representative Council, and Government, which is represented by Minister of Finance, Minister of National Development Planning/Head of National Development Planning Agency, and Governor of Bank Indonesia. This preliminary discussion was held from May 29 to July 3 as required by constitutional mandate of Law No.27/2009. To simplify the discussion, it is divided into some points and each point is handled by different working committee, which respectively include: (1) Working Committee for Fundamental Assumptions, Fiscal Policy, Revenue, Deficit, and Financing Issues in National Budget Draft; (2) Working Committee for Government Work Plan; (3) Working Committee for Central Government Expenses; and (4) Working Committee for Regional Transfer and the establishment of formulation team.

Political dynamic of role of People’s Representative Council, through Budget Agency, in National Budget drafting process, was conveyed by an informant, KBF, as following:

“...... National Awakening Party (PKB) has been committed to show gentle behavior and political politeness. This commitment crystalizes into a slogan "Politik rahmatan lil alamin" (Politic with God blessings). The Party uses this slogan to set out aspirative politic based on openness and equality. Under this slogan, the Party cannot escape from platonic conscience root that calls human as zoon politicon. Plato said that humans always do politic, and even their decision to avoid politic is actually political action. Therefore, politic is an important element in human life history, especially related with stateship. Under the context of political process around National Budget, fighting spirit of PKB is already clear, which is to produce pro-people National Budget ....... government must stay credible in executing the 2018 National Budget to prevent chaos in the national economic activities. As PKB Faction claimed, there should be a strong synchronization and communication between central and regional governments in executing new mechanism of Regional Transfer and Rural Fund, which the execution is done based on performances of fund absorption and output achievement. Also said by PKB Faction, the formula of rural fund allocation must attend the characteristic of beneficiary village and the suffering level of the village. The Faction agreed on the 2018 National Budget Act Draft and suggested to use this Act Draft as guidance for decision making based on the prevailed procedures, mechanisms and stipulations”. (Interview, June, 2017).

Budget Agency of People’s Representative Council had once, in a case, approved the 2017 National Budget Revision Act Draft and therefore, the Act Draft was available to be discussed at Plenary Session. Some notes were given on this Act Draft, which are mostly about cuts in ministerial budget, and adjustments on revenues and expenses to the current economic situations and conditions. Some ministries with budget cuts are: the Coordinator Ministry for Politic, Law and Security Issues, with cuts of IDR 40 billion, and the Coordinator Ministry for Maritime Issues, with cuts of IDR 50 billion. In the summary of the 2017 National Budget Revision Act Draft, Government and People’s Representative Council agreed on several macro assumptions, such as economic growth at 5.2 percents, inflation rate of 4.3 percents, the 3-month Treasury Notes’ interest rate at 5.2 percents, and Indonesian rupiah exchange rate at IDR 13,400 per United States dollar.

There was also agreement made on other matters, such as: Indonesian crude oil price at US$ 48 per barrel, crude oil lifting rate at 815 thousand barrels per day (bph), and native gas lifting rate at 1.15 million barrels of oil equivalent per day. National revenues were agreed at IDR 1,732.95 trillion, which increases from IDR 1,750.3 trillion in the original version of the 2017 National Budget. National expenses in the Revision Draft were projected at IDR 2,133.29 trillion, which increases from IDR 2,080.5 trillion in the original version of the 2017 National Budget. An informant, AS, described this agreement as following:

“...... The agreement was made after reconciling opinions of all factions. The recap showed full consents of eight factions, with one faction giving consent with notes, and one faction disapproving. The repellent was Gerindra Faction. If consensus principle is taken for granted, the agreement still prevails. The agreement made at Budget Agency level will be brought to Plenary Session on Thursday (27/7) to get approval from the second-order discussion of Plenary Session .....”.. (Interview, June, 2017).

People’s Representative Council played significant role in preparing the 2018 National Budget Act Draft. This role was played through Budget Agency, and at the time, the Act Draft was rejected by the Agency. After having some moments of adjournment, the Act Draft was then approved and brought to Plenary Session held on Wednesday, October 25, 2017. The posture of the 2018 National Budget weighted to IDR 2,220.6 trillion and got approval from 9 of 10 factions at the People Council. The agreement was validated by Budget Agency with acknowledgment of few related officials, such as: Minister of Finance, Sri Mulyani Indrawati; Minister of Law and Human Rights, Yasonna Laoly; Minister of National Development Planning/Head of National Development Planning Agency, Bambang Brodjonegoro; and Senior Deputy to Governor of Bank Indonesia, Mirza Adityaswara. An informant, AS, elaborated the process through the following words:

"The 2018 National Budget Act Draft had been agreed and therefore brought to Plenary Session to be discussed on Wednesday (October 25, 2017) at 10.00 am of West Indonesian Time. ...... most all members of Budget Agency gave consents. Of all factions, only Gerindra Faction disapproved the Act Draft. Gerindra Faction, despite rejecting, still respected the government’s decision to execute the Act Draft. At the work meeting that discusses the Act Draft, some agreements had been achieved. National revenue was targeted at IDR 1,894.7 trillion, which comprised domestic revenue of IDR 1,893.5 trillion and non-tax revenue of IDR 275.4 trillion. Besides this category, there was bequest grant revenue targeted at IDR 1,196.9 trillions. Some proportions in domestic revenue derived from tax revenue targeted at IDR 1,618 trillions. Tax revenue was differentiated into domestic tax revenue of IDR 1,579.3 trillion and international trade tax of IDR 38.7 trillion ...... non-tax national revenue consisted of few items, such as: revenue from natural resources of crude oil and native gas (non-renewable natural resources) targeted at IDR 80.3 trillion; revenue from natural resources except crude oil and native gas (renewable natural resources) targeted at IDR 23.3 trillion; revenue from the divided national wealth targeted at IDR 44.6 trillion; non-tax revenue in specific conditions (PNBP) targeted at IDR 83.7 trillion; and revenue from general service agency targeted at IDR 43.3 trillion ...... national expenses were agreed at IDR 2,220.6 trillion. This category comprised central government expenses at 1,454.4 trillion, and Regional Transfer and Rural Fund totaled to IDR 766.1 trillion. In summary, fiscal deficit in 2018 was IDR 325.9 trillion” (Interview, June, 2017).

Work Meeting in this context were led by the Chair of Budget Agency, Kahar Muzakir and Vice-Chair, Said Abdullah. It began with the working committees presenting their reports. After the reporting, the Agency members and government gave responses. People’s Representative Council represented by ten Factions did not reject the results. All political party factions at the People Council gave their consent, which then, the fate of the 2017 National Budget Act Draft was decided in Plenary Session. Government and Budget Agency had agreed on the posture of the 2017 National Budget Draft. Central government expenses were IDR 1,315.5 trillion, while the expenses of ministerial and non-ministerial institutions, in sequence, were IDR 763.6 trillion and IDR 552 trillion. Regional Transfer and Rural Fund were agreed at IDR 764.9 trillion in total, with details of IDR 704.9 trillion for Regional Transfer and IDR 60 trillion for Rural Fund. Work Meeting also discussed economic growth assumptions. The assumptions that had been agreed upon were: inflation rate of 4 percents, exchange rate of IDR 13,300 per USD, the 3-month Treasury Notes’ interest rate of 5.3 percents, crude oil price of USD 45 per barrel, crude oil lifting rate of 815,000 barrels per day, and native gas lifting rate of 1,150 barrels of oil equivalent per day. Budget deficit that government can control was maximally 2.41 percents of gross domestic product or at IDR 330.2 trillion. Minister of Finance, Sri Mulyani Indrawati, said that the 2017 National Budget Act Draft must be designed in balance and reflecting domestic economic conditions. She asserted that principally, posture of this Act Draft and macro assumptions within it have reflected national economic conditions and also the challenges that global economic must cope with.

The government had targeted the 2016 economic growth at 5.1 percents with inflation rate of 4 percents. Assumptions that the government use are exchange rate of IDR 13,300 per USD, crude oil price of USD 45 per barrel, and the 3-month Treasury Notes’ interest rate of 5.3 percents. Welfare target in the posture of the 2017 Budget can be detailed as poverty rate of 10.5 percents, unemployment rate of 5.6 percents, economic gap of 0.39, and Human Development Index of 70.1. Based on all the descriptions above, therefore, the role and relation of each actor in National Budget drafting process at People’s Representative Council, especially in relation with role of government and budget-managing commissions at the People Council, can be elaborated as follows:

Role of Government

Stages of ideation, execution, and accountability in National Budget drafting process always touch with the government. The government submits National Budget Draft in form of National Budget Act Draft to People’s Representative Council. After discussions, the People Council determines the fate of the Act Draft no lather than 2 months before the intended fiscal year begins. After National Budget is validated with the related Law, the execution is arranged through Presidential Decree. In the middle of fiscal year, National Budget can subject to change or revision. If revision on National Budget is desired, government must propose National Budget Revision Act Draft to People’s Representative Council to get the People Council’s approval. The Revision Draft must be submitted no later than the end of March and shall be discussed with the People Council’s Budget Agency. Under emergency occassion (for instance, natural disaster), government can make expenditure despite no budget allocation for it. Accountability stage of National Budget execution prevails no later than 6 months after the current fiscal year is ended. President submits National Budget Accountability Act Draft to the People Council, and the form of this Accountability Draft is Financial Statement that has been verified by Financial Examiner Agency.

Role of Budget-Managing Commissions at People’s Representative Council

As stated in National Budget Act, Article 4, section (1) letter b, budget-managing commissions are required to discuss the Draft and based on the results of discussion, it may approve or disapprove the Draft submitted by President. Besides making laws, People’s Representative Council, along with President, also prepares National Budget Draft. The drafting process at commission level involves some activities, such as:

1) Conducting preliminary discussion with Government concerning National Budget Draft, which all must be done within appropriate scope of tasks;

2) Discussing the Draft and suggesting perfection, which all must be done within appropriate scope of tasks;

3) Discussing and ensuring budget allocation to functions, programs and activities of ministerial and non-ministerial institutions as Commissions’ work partner;

4) Conducting discussion concerning financial statements, budget execution reports, and Financial Examiner Agency’s results of verification, which all must be done within appropriate scope of tasks;

5) Conveying results of preliminary discussion and Draft’s discussion to Budget Agency for synchronization;

6) Perfecting results of Budget Agency’s synchronization with Commissions’ suggestions; and

7) Returning the results of Commission’s discussion to Budget Agency for the finalization of the Draft.

Role of People through NGO and Mass Media

The discussion of National Budget is widely known as the job of government and People’s Representative Council, and therefore, it is far away from people’s mind. Outputs and realization of National Budget cannot be easily checked and enjoyed by the people. Like preparing meals, budget menu was cooked in a specific way at the kitchen where the cheft and the assistants (government and People’s Representative Council) used confidential recipes. The final cooking’s, therefore, may only be tasted by persons who understand the cuisines. Formal discussion of the budget is already made open and under guard of the press. However, media crews are called in only during the finishing, at least for giving final touch before the result is served to the public. People are never invited in the beginning process of menu drafting. The former chair of People’s Representative Council, Marzuki Alie, ever said that “common people cannot be invited to discuss new government building. Only elites do that. Only persons with the needed skilled are asked for suggestions”. This statement comes out from the former leader of legislative institutions, and it sounds very ironic.

Such anomalies are often found in National Budget discussion. People are like watching drama about money of trillions rupiahs. Despite the participation of mass media, economic experts and NGO during discussion, the effect of their role is not significant. National Budget discussion scheme at least involves two legal elements, namely, Law concerning People’s Consultative Assembly, People’s Representative Council, Regional Representative Board, and Order Conduct of People’s Representative Council. These legal elements are very complex and almost do not give space for people to speak up their expression.

In National Budget drafting process, public participation is only made available in two methods. However, the participation is only given during drafting phase, not in discussion phase. First method of public participation is by submitting proposals to People’s Representative Council or Regional Representative Board during the recess when legislative members go to their constituency to collect aspirations. This method has a weakness, precisely that the aspirations absorbed are mostly subjective because legislators only capture aspirations of their constituents or financiers who support their campaign for legislative seats. Second method is by submitting proposals to Goverment. Proposals can be delivered directly to President during presidential visit (blusukan). Or, people can use some governing units to evaluate goverment programs of the previous year. The weakness of this method is that public aspirations may still be required to be in accordance with development priorities set by Goverment. Even the best alternative options may still be difficult to enter discussion phase of National Budget Draft if the options are not in line with priorities in the Draft. With limited public participation in National Budget discussion, the best public aspirations may not be captured. It is like a boat swayed by huge wave, oscillated, and finally sunk. If people representatives hesitate to listen public aspirations, the outputs of legislative works become unclear. It can trigger public discomfort. One relevant case is when the 2018 National Budget decides to give allocation for new legislative buildings without considering public aspirations, and the consequence of this decision was social unrest.

After this social distrust was publicized by mass media broadcast, the allocation of new building was cancelled. The point that must be considered is not that people won their demand to stop the construction, but that National Budget drafting process has been actually ineffective and causing social unrest because public voices are not adequately considered. This cancellation in the middle of process is not followed up with budget reallocation to more effective programs. It causes double loss, namely social unrest and planning ineffectiveness. The Chair of Faction of National Mandate Party (PAN) explained the political dynamic of public participation in National Budget drafting process as following:

“........ National Mandate Party (PAN) hopes National Budget policy to be aimed at producing social prosperity through fair distribution of wealth (justice) with goodwill toward morality and respecting human esteem. Prosperity is held up by three pillars, namely, dynamic growth, stability and efficiency. Justice (fair distribution) is supported by freedom, equality, and social order. The Party wants to prioritize development agenda to eradicate poverty, minimize unemployment, and extend job opportunity. Immediate action must be taken to strengthen economic bases that warrant sustainable development. Sense of affection is enforced to build the orientation toward goodness and togetherness. Reformation should provide good momentum for Indonesian citizens to be the better persons. Therefore, legislators must understand that Indonesia was born from togetherness despite the differences. Faction of PAN insists Goverment and Bank Indonesia to control inflation and stabilize exchange rate of Indonesian currency in monetary market. Goverment is also importunated to anticipate national politic situation by 2018, which is hoped that everything will be conducive and international trust can be obtained. The Party advices Goverment to watch over cost recovery in 2018 because in 2015, Financial Examiner Agency had found cost recovery mark-up allegedly done by Cooperation Contractors (KKKS). If this problem is solved, it may give positive impact on establishing inclusive and sustainable economic growth”. (Interview, 2017).

Observation data showed that public role and participation in National Budget drafting process have been arranged in Law No.12/2011, Article 96. The Law has allowed the public to participate into law drafting process, including National Budget Act. People can send verbal or non-verbal inputs through many channels, such as public hearing, work visit, socialization, and seminar/workshop/discussion. Overall, it should be clearly understood that Government and People’s Representative Council must provide space for the public in law drafting process. However, it is only easy in theory but hardly realized in the fact.

For example, National Budget Act Draft was submitted by Government on date of August 16th. Pursuant to stipulations at National Finance Act, National Budget must be established in two (2) months before fiscal year begins (the end of October). In reality, it takes even two (2) months plus two (2) weeks for Government to only discuss National Budget, and this discussion phase is known as First-Order Discussion (August 17th – October 31st). First-order discussion of National Budget involved Budget Agency and the related Commissions. To achieve this discussion target, even, Government and People’s Representative Council must hold an overnight meeting. Such activity is hardly creating public participation, especially when National Budget Act Draft must subject to revision without consults from Government and the People Council. There are twenty two (22) countries dispersed in America, Australia, and Europe continents that have used Parliamentary Budget Office (PBO) to handle their National Budget drafting process. The Office hires independent observers and academicians who are given mandates to review National Budget Draft submitted by Government. Recommendation given by Government will guide People’s Representative Council to discuss National Budget Draft before deciding to approve or disapprove the Draft. The benefit of PBO is providing public space to the people in such that enable them to express their intellectual views. This space is also goodwill to accommodate public aspirations without political intervention. Non-partisan recommendations and academic reasons accompanying it can be used as the alternative to the governmental plans that are possibly vulnerable to the People Council’s disapproval during discussion.

The absorption of public aspirations during discussion is actually the obligation of Government and People’s Representative Council because the aspirations represent public voices at democratic realm. So far, there is no constitutions that deny public participation in National Budget discussion. As expressed by the Chair of Faction of Prosperous Justice Party (PKS), political dynamic concerning role and participation of the people in National Budget drafting process is explained as follows:

“...... Prosperous Justice Party (PKS) has put under scrutiny the 2018 National Budget prepared by Jokowi-JK administration. It was concluded is that the Budget is not healthy. The Budget is indeed a political product and also reflecting the political preferences of governmental policies in the future. However, the Budget is too optimistic and therefore, unrealistic. It is suggested to Government to learn from the emerging economics before preparing realistic National Budget. It was said that Jokowi-JK administration’s National Budget is less sustainable. President told that the money is already available and waiting to be used. Young members of PKS see the opposite, and they believe that money is not there and government is taking debts without doubts. The fiscally unhealthy National Budget will be dangerous. In normal condion, government is like already short of breath, and therefore, easily fainted during the crisis. Government seems spend too much monies for infrastructures. This great expenditure, in fact, does not produce great economic growth. Capital growth realization during Jokowi-JK administration is very low. Return on investment in infrastructures is quite slow. Therefore, PKS Faction reaffirmed that economic growth target of 5.4% in 2018 was overly optimistic. The reason is that primary balance still suffers from high deficit. The figure agreed upon at IDR 87.3 trillions represents a drastic upsurge from early target of IDR 9 trillions. This crazy hike reflects a great fiscal dependency that may threat fiscal sustainability. Budget deficit gets worse. Government take precautions by suppressing primary deficit realization. Deficit financing then shifts from debt withdrawal to Treasury Notes auction, but this shift has denominated Indonesian rupiahs. The worse is that foreign holding is still dominant. It affects macroeconomic indicators, especially monetary indicator (such as exchange rate) and banking indicator (double digits interest rate). Government is urged to improve its managerial capacity because the financial plan is not yet credible. Debts are not well absorbed, and the consequence is that this produces the so called Budget Financing Remainings (SILPA) at the current fiscal year”. (Interview, June 2017).

For short term goal, public aspirations can be inserted during preliminary discussion of National Budget Draft. Besides two main players in preliminary discussion, precisely Budget Agency and Commissions, there are also Regional Representative Board’s considerations. The considerations of the Regional Board are discussed at a separate forum in People’s Representative Council, which from this forum, the People Council can obtain formal considerations for the Draft as required by Legislative Act. In practice, however, this forum is just a formality and always conducted fast (in one day). Short-term mechanism such above involves holding public aspirations forum in coinciding with Regional Representative Board’s forum. However, such arrangement is available only if the ruler allows it. Public aspirations forum can be held in Plenary Session of People’s Representative Council just before discussing National Budget. This forum is better scheduled in coinciding with the Regional Board’s forum.

Indeed, Regional Representative Board forum and public aspirations forum are better held before the meetings of Commissions and technical ministries. Results of the two forums will give People’s Representative Council the best alternatives and also weaponize the People Council to challenge priority programs proposed by Government. In other side, technical ministries are required by Government to prepare programs on strong basis to defeat the People Council’s arguments. Guidances to fight these arguments derive from the Regional Board’s forum and public aspirations forum. Public aspirations forum is attended by various participants such as university, economic observers, entrepreneurs, farmer and fisher groups, and labour unions. However, the participants are selected by civil societies, such as religion organizations or popular higher education institutions. Therefore, forum membership becomes limited.

In long-term perspective, Government and People’s Representative Council can legalize the existence of public aspirations forum through the discussion of Legislative Act (UU MD3) and National Finance Act. Such legal base is needed to validate the Regional Board’s considerations and thus, to prevent these considerations from being used only for discourse. Government must prove that National Budget Draft is already logic and respecting people interest (pro-people). Therefore, it is expected that Government and People’s Representative Council would provide more public spaces in law making process. This provisioning of public spaces not only recognizes the equality of rights but also changes the viewpoint that will put the people no longer as the object but as the subject in people prosperity effort.

Regarding to the statements above, it can be said that role of NGO and the people in National Budget drafting process is to help Government to achieve its administration goals, including when Government must design development plans and its budget plans. These plans are usually discussed together with other policy stakeholders, mainly legislative institutions. In this process, Government applies participative development paradigm, which allows public participation to exist. Law No.25/2004 concerning National Development Planning System has required the implementation of Development Planning Deliberation (Musrenbang) at all government levels, which prevails either for long-term, middle-term, and short-term perspectives, and also emphasized the importance of synchronization of five approaches to national planning. The five approaches are: political, participative, technocratic, bottom-up, and top-down.

Also required by this Law, governmental plans must absorb public aspirations, and this can be done through the Deliberation (Musrenbang). This Deliberation is coordinated by the Ministry of Internal Affairs and the Ministry of National Development Planning/the Head of National Development Planning Agency. Both ministries have released joint circulars No. 0259/M.PPN/I/2005 and No. 050/166/SJ, which both speak about Technical Guide for Development Planning Deliberation (Musrenbang). The output of long process in the Deliberation at national level is Government’s Work Plans and Budget Plans (both are elements in National Budget Draft). Both plans will be discussed in Cabinet Meeting where Government submits National Budget Draft to People’s Representative Council, and the People Council legalizes the Draft into National Budget through National Budget Act. The procedures to implement Government’s Work Plans as the base of National Budget Draft have been regulated in Joint Circulars of the Ministry of Internal Affairs and the Ministry of National Development Planning/the Head of National Development Planning Agency. In those two joint circulars, No. 0259/M.PPN/I/2005 and No. 050/166/SJ, which both concerning about Technical Guide for Development Planning Deliberation (Musrenbang), it was said that “central and regional governments must prepare their documents of work plans as the base in drafting national and regional budgets in fiscal year 2006”. In Subsection A (Letter A) of the circulars, it was shown that both work plans are the products of Development Planning Deliberation. Third item in Subsection A (A.3) indicated that Development Planning Deliberation is functioned as a forum to produce agreement among development actors concerning central and regional work plans. The emphasis is given on discussing and synchronizing activity plans among ministries/agencies/work units, harmonizing central and regional government’s work plans, and absorbing public aspirations, which all are intended to facilitate the achievement of national and regional development goals.

Meanwhile, Government Regulation No.90/2010 mentioned that Work Plans and Budget Plans of Ministerial/Non-Ministerial Institutions (RKA-KL) should be made based on Work Plans of Ministerial/Non-Ministerial Institutions, Work Plans of Central Government, and Budget Standard of Ministerial/Non-Ministerial Institutions (Article 6, Section 1). Surprisingly, this Regulation did not anymore mention that Central Government’s Work Plans must be produced from Development Planning Deliberation from which public aspirations can be absorbed. It can be said that the preparation of RKA-KL as the raw material for National Budget Draft has been assumed as already accommodating public participation. Based on the Conduct Order of People’s Representative Council in 2009-2014, the people are allowed to suggest inputs, either verbal or non-verbal, to the People Council during the drafting process.

The people are indeed allowed to give their verbal (speech form) or non-verbal (written form) suggestions to legislators or other instruments at People’s Representative Council. Suggestions concerning National Budget drafting process are delivered to the Chair of related Commission. The identity of suggestions provider must be clearly defined, because this clarity helps the elements in the People Council (the chair of the People Council, the chair of related Commission, the chair of Joint Commission, the chair of special committee, the chair of Legislation Agency, and the chair of Budget Agency) in preparing and managing the discussions of act drafts, and conducting supervision on act execution or governmental policy. Verbal inputs from the people can be conveyed to the People Council through public hearing (RDPU) or via specific meeting attended by the chair of related Commission, the chair of Joint Commission, the chair of Special Committee, the chair of Legislation Agency, or the chair of Budget Agency, accompanied by some legislators who have significant role in law making process. Results of this meeting would surely be used as guide in law making process.

Mass media play very important role in Indonesian sociopolitical life, especially in relation with budget drafting process. Role of to communicate has been very determinant factor to the delivery of information and governmental policy. Aligning with the advancing communication technology in recent days, communication method also develops rapidly. But, all have same accentuation, which is that communicator delivers messages, ideas, and concepts to communicant. Model of the delivery may differ with the content. Concretely, communication method in contemporary world can be verbal and non-verbal communication, and the channels can include journalist, public relations, advertisement, exhibition/exposition, propaganda, and publication. Within the context of budget drafting process, propaganda is the most suitable method.