Research Article: 2021 Vol: 20 Issue: 1

Security of Strategic Economic Interests of Mining and Metallurgical Enterprises in Post-Industrial Conditions As Factor of Their Investment Attractiveness

Mishchuk Ievgeniia, Kryvyi Rih National University

Nusinov Volodymyr, Kryvyi Rih National University

Kashubina Julia, Kryvyi Rih National University

Polishchuk Irina, Kryvyi Rih National University

Pasichnyk Natalia, Kryvyi Rih National University

Abstract

In order to ensure the security of strategic economic interests of the enterprise, it is proposed to take into account the expanded perception of the objective reality conditions (dangers - opportunities - requirements of stakeholders) in the past, present and future time horizons. It is substantiated that the integrity of management actions is ensured by mental and cognitive processes of assessing past experience, the current state of the enterprise and awareness of business environment promising parameters. Based on this, it is proposed to form an information base for development and implementation of integrated set of management actions aimed at achieving and maintaining the economic security desired level in the long run based on strategic compliance of processes and resources with future business environment. The approbation of the proposed approach was performed on the example of mining and metallurgical complex enterprises of Ukraine. Implementation of the developed proposals will be an important basis for increasing the investment attractiveness of mining and metallurgical enterprises.

Keywords

Dangers, Mining and Metallurgical Complex, Opportunities, Requirements of Stakeholders, Strategic Security.

Introduction

The mining and metallurgical complex ensures the functioning of other sectors and forms a significant contribution to the country's economy. Therefore, the state of the economy of the entire country depends on ensuring the security of the strategic economic interests of enterprises in this complex. At the same time, security ensuring of the complex enterprises depends not so much on results of their current activities, but on the insurance of strategic economic interests. The latter should take into account the modern external post-industrial conditions of activity. In particular, developed IT industry is an important factor in ensuring the security of strategic interests of the enterprises of mining and processing complex.

In 2019, the value of the IT sector in Ukraine is $ 5.8 billion, which is 4.5% of Ukraine's GDP. Given the high rate of growth of the IT sector, one of the most popular in the economy: it is 20-25%. At the same time, all exports fall on development of the OECD region, and half of exports fall on the United States. It is expected that the IT market in Ukraine will continue to grow at 20-30% annually (Cabinet of Ministers of Ukraine, 2020). It would be expedient for mining and processing plants to increase their own demand for cloud IT solutions, improve cybersecurity, use of big data analysis technologies, digital transformation of business processes, etc. (Lu (2017); Mishchuk et al., 2020). However, the mining and metallurgical complex is in no hurry to use the existing potential of cooperation between the powerful IT sector and industry.

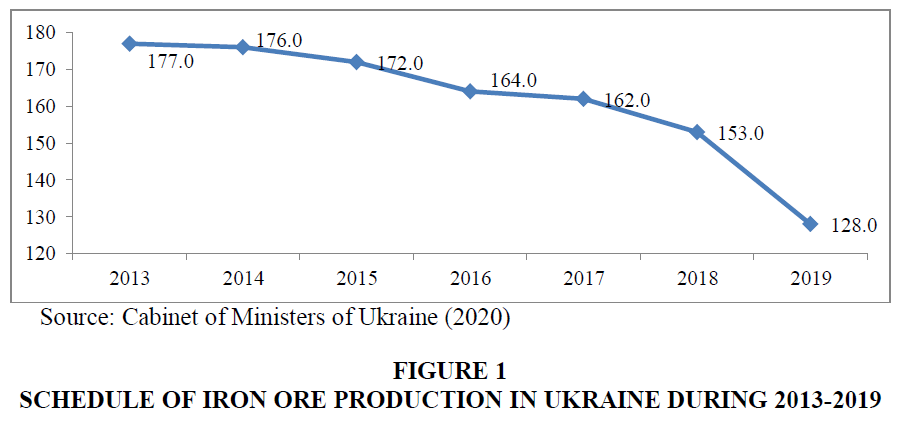

In addition, in Ukraine there are about 12.2 thousand explored mineral deposits (including complex deposits), but only 4.6 thousand of them are being developed. According to experts, based on the analysis of numerous ore occurrences and promising geological formations, there is a reasonable probability of the presence of new mineral deposits. Ukraine has rich deposits of iron and manganese ores, on the basis of which ferrous metallurgy is developing. Ukraine contains 5% of all deposits of industrial minerals in the world, they are also the most common in terms of both the number of species and the number of discovered and developed deposits. Despite their leading positions in the world in the extraction of iron, manganese and titanium ores, Ukrainian companies do not use all available opportunities. Iron ore mining in Ukraine has been systematically declining (Figure 1).

According to the National program of development of the mineral resource base of Ukraine for the period up to 2030 for increasing the mineral resource base of iron ores has been provided:

1. Carrying out exploration works within the deposits of rich iron ores.

2. Carrying out of search, search and estimation works for the purpose of exploration of rich ores and easily enriched magnetite quartzite’s within the limits of existing ore areas.

3. Development, testing and implementation of modern rational technologies of iron ores complex research to ensure their quality objective assessment, reasonable increase in reserves and operational support of mining and processing to ensure the final products liquidity.

The work is planned to be performed by attracting private investment.

All of the above indicates the presence of opportunities that are either not used at all by the enterprises of the mining and metallurgical complex or their use is incomplete and limited. In this regard, additional research is required by other factors of external environment of the post-industrial conditions of mining and metallurgical complex enterprises, which can act as an effective tool for ensuring the security of their strategic economic interests.

Thus, we can point to the following causal chain: using opportunities of external post-industrial conditions of the enterprise → ensuring security of strategic economic interests of the enterprise → increasing of the enterprise investment attractiveness.

Therefore, the aim of the article is to develop proposals for implementation of opportunities to increase the value added flows of mining and metallurgical complex enterprises in post-industrial conditions to ensure the security of strategic economic interests of these enterprises.

Literature Review

Issues of ensuring and forming strategic economic security are presented in numerous publications of Ukrainian and foreign scholars. They are mainly associated with the need to respond to threats that are changing environmental and internal factors. In this case, it is necessary to take into account the fact that the external environment, on the one hand, can carry for the same enterprise both opportunities, and threats which positive or negative influence on its development will depend on efficiency of management and adaptability of the enterprise (Captain, 2007; Meheda & Savchenko, 2014).On the other hand, it is well known that the same environmental factors can affect different enterprises in different ways (positively affect the economic situation of some and to promote the bankruptcy of others, to promote the development of some and hinder their competitors, etc.).

The team of authors (Kozachenko et al., 2003) to ensure the economic security of the enterprise (mainly in the context of protection against threats) considers the purpose of adaptation, and scientists Ladyko et al. (2004) and others (Yachmenyova, 2007; Noorit et al., 2020) believe that the adaptability of the enterprise is necessary for its self-preservation, adaptation in conditions of instability and changes in the external environment. The analysis of scientific literature allows us to conclude that the processes of ensuring strategic economic security are considered by scientists in connection with negative changes (impacts) of the external (less often internal) environment of the enterprise. Therefore, the issues of ensuring the security of the strategic economic interests of the enterprise in the conditions of the opportunities provided by the external environment were not covered. Thus, it is important to find opportunities to manage security, strategic economic interests of the enterprise by minimizing the degree of inconsistency of internal system characteristics of business requirements of stakeholders and environmental trends with opportunities to increase value flows in terms of permanent dynamic changes in the enterprise.

Methodology

The study used general scientific theoretical methods: generalization, critical analysis, grouping - to analyze the views of economists and practitioners on the object of research, formulate conclusions of content analysis of primary sources, as well as to form the space of objective reality of the activities of Ukrainian mining and metallurgical enterprises. In addition, in the process of research, analysis and synthesis, induction and deduction were used to substantiate a new conceptual provision on ensuring the security of the strategic economic interests of an enterprise on the basis of the integrity of management actions in the system of danger – opportunity – requirements of stakeholders.

Results and Discussion

The product portfolio of mining and processing plants has a limited range: concentrate, agglomerate, pellets. Accordingly, the plants do not differ significantly in degree of raw materials processing. However, the products of most domestic mining and processing plants do not meet the modern requirements of European stakeholders for the level of product quality, which allows the use of iron ore products in the technological processes of direct reduction of iron. This leads to an imperfect sales structure (Table 1).

| Table 1 Regional Structure of Sales of Iron Ore Products in 2018-2019 | |||||||||

| Enterprises | Ukraine | China | Czech Republic | Poland | Slovakia | Romania | Serbia | Hungary | Others |

| 2018 | |||||||||

| PrJSC “ Ingulets GZK ” | 77.6 | 3.5 | 5.3 | 10.7 | 3.0 | ||||

| JSC “ Southern GZK ” | 33.1 | 50.9 | 6.2 | 8.9 | 0.9 | ||||

| PrJSC “ Northern GZK ” | 67.3 | 15.4 | 9.5 | 5.7 | 2.0 | ||||

| PrJSC “ Central GZK ” | 10.6 | 23.3 | 5.5 | 22.2 | 18.2 | 14.9 | 5.3 | ||

| 2019 | |||||||||

| PrJSC “ Ingulets GZK ” | 72.8 | 12.8 | 5.7 | 4.9 | 4.3 | ||||

| PrJSC “ Southern GZK ” | 13.3 | 72.0 | 3.3 | 4.2 | 7.1 | ||||

| PrJSC “ Northern GZK ” | 64.3 | 24.4 | 4.9 | 3,9 | 2.5 | ||||

| PrJSC “ Central GZK ” | 1.1 | 14.1 | 9.5 | 26.2 | 2.5 | 14.2 | 21.8 | 5.1 | 5.5 |

An example of the danger of focusing on markets limited number is the activity of JSC “Southern mining and processing plant” (JSC “Southern GZK”) (Kriviy Rih, Ukraine), whose iron ore products are supplied exclusively to the Ukrainian market, and 60% of the concentrate is exported to China. Even today, in a pandemic, we can state how threatening such the implementation structure is. Experts predict a large-scale recovery in demand from China, due to the completion of construction and other projects that began in 2019. However, there is a danger of increasing supply from world leaders who have low operating costs and the ability to transport products by sea: Rio Trinto, Fortescue Metals Group Ltd and others. It is worth emphasizing that the high quality of rollers of PrJSC “Central mining and processing plant” (PrJSC “Central GZK”) (Kriviy Rih, Ukraine) allowed to make the most of the export potential. Top management's attention to the diversification of sales sources contributed to the expansion of sales markets of PrJSC “Central GZK” in 2019: 40 thousand tons of rolls were delivered to the UK at the Tata Steel plant. Regarding metallurgical plants, we note that the operation of PJSC “ArcelorMittal Kriviy Rih” (Kriviy Rih, Ukraine) as part of international holding is manifested in the application of foreign management practices focused on the fullest use of market opportunities. However, the implementation of such an approach is constrained by the inherited technical and technological base, slows down the rapid achievement of operational excellence high level. At the same time, despite the rather limited breadth (compared to Metallurgical Plant “Azovstal” (PrJSC “M? Azovstal”) and Mariupol Metallurgical Plant named after Ilyich (PrJSC “MM? them. Ilyich”)) (Mariupol, Ukraine), PJSC “ArcelorMital Kriviy Rih” has the most perfect structure of sold products and the most diversified markets (Table 2).

| Table 2 Regional Structure of Sales of Metal Products in 2018-2019 | |||||||||||||

| Enterprises | Ukraine | United States | Turkey | Poland | Russia | Italy | Iraq | Egypt | Lebanon | Algeria | Great Britain | Hungary | Others |

| 2018 | |||||||||||||

| PJSC “ArcelorMittal Kriviy Rih” | 21.9 | 5.3 | 8.0 | 8.7 | 6.8 | 6.2 | 5.3 | 37.7 | |||||

| PrJSC “M? Azovstal” | 7.3 | 4.8 | 8.6 | 6.1 | 49.6 | 6.1 | 3.4 | 14.1 | |||||

| PrJSC “MM? them. Ilyich” | 7.0 | 25.0 | 6.0 | 7.0 | 7.0 | 10.0 | 38.0 | ||||||

| 2019 | |||||||||||||

| PJSC “ArcelorMittal Kriviy Rih” | 22.3 | 7.5 | 6.7 | 13.7 | 4.3 | 45.5 | |||||||

| PrJSC “M? Azovstal” | 9.0 | 4.6 | 5.1 | 50.6 | 6.7 | 4.7 | 19.3 | ||||||

| PrJSC “MM? them. Ilyich” | 16.8 | 14.7 | 5.3 | 6.5 | 8.5 | 11.1 | 37.1 | ||||||

In general, it is worth noting that metallurgical enterprises have a more diversified export structure, with the exception of PrJSC “M? Azovstal”, which sells almost 50% of its products on Italian market – it is the largest importer of slabs from Ukraine. This is critically dangerous, especially in pandemic. It will be difficult to quickly reorient to new sales markets in the context of market stagnation in 2020, and accordingly, it will be forced to “conserve” its production capacity. PJSC “ArcelorMittal Kriviy Rih” used export opportunities, which allowed to increase sales in markets with high growth potential (Africa, Middle East, CIS, Balkans) while increasing the share of rolled products in total sales. It is also worth noting that the hire of PJSC “ArcelorMittal Kriviy Rih”, which is used in construction, is competitive in Russian and Turkish markets. According to the logic of the proposed approach to ensuring economic security, the analytical component also provides for deepening of the retrospective analysis in terms of: the capabilities of business environment, the requirements of stakeholders and threats/dangers (Table 3).

| Table 3 The Space of Objective Reality of Mining and Metallurgical Enterprises Activity in 2019-2020 | |||

| Dangers / threats | Requirements of stakeholders | Opportunities | |

| used | unused | ||

| Reduction of metal products consumption: 2019 reduction of demand for steel in the EU countries by 3.1%, in MENA countries - by 7%, in Turkey - by 20%; reduction of demand for metal products by 50% in the II and III quarters of 2020 | Consumers: increasing requirements for the quality of iron ore products (iron content 70%); increasing demand for unique types of rental products. Government institutions of importing countries: restrictions on imports, creating conditions for domestic producers. Owners, top management: keeping the level of operational security at more than 25%. |

Improving compliance degree of iron ore products quality with market requirements | |

| PrJSC “ Central GZK ”: realization of lump factory modernization project with production possibility with the iron content of 70,5% | JSC “ Southern GZK ”: suspension of sinter production without implementation of lump factory construction project | ||

| Growth of iron ore products offers from world leading companies (Vale, Rio Tinto, Fortescue, BHP Group) | Exports in new markets increasing | ||

| PrJSC “ Central GZK ”: pellets exports to Great Britain (Tata Steel plant) started | Focusing on the domestic market: PrJSC “ Ingulets GZK ”– 73%; PrJSC “ Northern GZK ”– 64.3% | ||

| Falling prices for products: for metal products by 19%; projected reduction in iron ore value to $50/t by the end of 2020 | Export diversification increasing | ||

| PrJSC “ M ? Azovstal ”: beginning of production structure formation taking into account the needs of EU and Middle East producers | Geographical focus of trade flows: JSC “ Southern GZK ”– 72% China; PrJSC “ M ? Azovstal ” – 50.6% Italy, which led to shutdown of blast furnace No 4 in pandemic | ||

| Strengthening of protectionism in foreign markets, shortfall in the income of Ukrainian mining and metallurgical plants by $ 100 million in 2019 and $ 370 million in 2020 | Customized demand satisfaction | ||

| PJSC “ ArcelorMittal Kriviy Rih ”: development of armature production in riots in 2020 | PrJSC “ M ? Azovstal ”: despite the uniqueness of the rental range, its share in sales – 28% | ||

| Economic downturn due to the coronavirus pandemic | |||

| Increase in environmental tax rates: in 2019, the CO2 emission tax rate increased almost 25 times (from UAH 0.41/t to UAH 10/t) | State, society: reducing emissions of pollutants into the atmosphere, increasing the requirements for environmental friendliness of business | Environmental friendliness production level improving | |

| PJSC “ ArcelorMittal Kriviy Rih ” : martin shop closure in 2020, environmental activities investment increase in – $ 700 million until 2025 | Introduction of traditional point technical and technological measures to increase filtration level and gas purification; lack of focus on fundamental changes in technology on innovative basis | ||

| PrJSC “ Northern GZK ”: reduction of dust emissions by 500t / year due to the installation of electrostatic precipitators; PrJSC “ MM ? them. Ilyich ”: 90% due to gas cleaning at sinter plant | |||

| Increase in tariffs for rail freight: by 14.2% since March 30, 2019, increase in costs of enterprises in the industry at $ 100 million level | Owners, top management: minimizing the decline in business profitability in face of uncontrolled factors of government regulation | Optimization of operating costs controlled by management | |

| PJSC “ ArcelorMittal Kriviy Rih ”: implementation of World Class Manufacturing production management system (cost savings of $ 120 million / year) | Focus primarily on technical and technological areas of reducing operating costs, limited to repair, restoration, reconstruction of equipment, that is, they have low level of innovation | ||

| Increase in shipping costs as a result of new IMO fuel standard 2020 introduction from 1.01.2020 at level of about $ 15 billion / year | |||

Analysis of objective reality of the studied enterprises activities in 2019-2020 proves the objective need to transform the management focus from countering dangers / threats to using the capabilities of business environment in the process of the enterprise economic security ensuring. Retrospective results of analysis indicate that the full use of opportunities today is constrained by the low level of innovation in the processes of improving the technical and technological level of operational excellence, which are mainly aimed at major repairs of equipment, its partial modernization and reconstruction. Low level of innovative technical and technological processes of operational excellence ensuring limits the implementation of organizational processes to expand export opportunities, satisfaction of customized demand, and increase production of eco-friendliness. Summarizing the dangers of the operation of mining and metallurgical enterprises in the current period, it is worth noting that the domestic surplus of demand for products is transformed into a global surplus, and the negative downward trends of economies are undeniable.

It is worth emphasizing that for the domestic mining and metallurgical complex, China is the largest consumer of iron ore: in 2018, exports of 8.9 million tons worth $ 646.1 million; in 2019 - 15.4 million tons worth $ 1.17 billion (34% of total exports in monetary terms) (GMK Center, 2020). Such export volumes cannot be quickly reoriented to other markets. For metallurgical companies, the reduction of the Chinese market is not so threatening, as supplies of Ukrainian metal products to China in 2019 were insignificant: 110.9 thousand tons of pig iron by $ 29.5 million; 32 thousand tons of ferroalloys for $ 71.3 million; 150 tons of alloy steel billets for $ 2.05 million; 234 tons of seamless pipes for $ 1.14 million. However, the critical situation is that due to the market of the EU and others in the short term (during 2020) is projected to reduce demand for metallurgical products by 50% due to the quarantine regime and economic downturn (GMK Center, 2020). In March 2020, EU countries closed a number of metallurgical enterprises, and others limited the production of metal products. But these opportunities cannot be used by domestic producers in full due to the deepening of protectionism in foreign markets.

Thus, only in 2019 the following measures were introduced: tariff quotas in EU countries, the volume of which is lower than the volume of exports; protective duties on imports of metal products in Egypt; antidumping duties and tariff quotas on imported imports to the EAEU countries. According to analysts of GMK Center, these measures in 2020 will lead to the loss of Ukrainian producers at the level of 370 million US dollars (2020). In 2020, a new round of revision of trade restrictions in EU countries and their implementation in other regions (for example, in India) is expected, which will increase competition in the industry market. The problem is that the decrease in the price of iron ore products is determined by the tendency to close blast furnaces and reduce steel production capacity in the EU, North America, Japan, Brazil, which consumed about 8 million tons of iron ore products per month. The danger is exacerbated by the increasing supply of world companies - leaders in the production of iron ore products. It is impossible to ignore the revaluation of the hryvnia, which during 2019 strengthened by 13.4% amid the devaluation of the currencies of competing countries (China, India, and Turkey) provided the latter with undeniable advantages. Instead, domestic producers have reduced the amount of free funds to invest and repay debts. In addition, the revaluation contributes to the growth of imports of metal products into the domestic market of Ukraine, and the structure of these imports is represented by products that can be manufactured in Ukraine: fittings, wire rod, cold-rolled sheets and more.

The leveling of the influence of uncontrolled management factors of the business environment of the studied plants leads to exceptional weight with the possibilities of the short and medium term, to which, according to the analysis results, the following are attributed:

1. The end of quarantine, which will contribute to a significant increase in demand for the products of mining and metallurgical enterprises, especially in the markets of Western Europe.

2. Work “to the warehouse”, which will allow accumulating reserves of finished products to meet the growing demand after the end of the pandemic.

3. The fall in oil prices due to COVID-19, which affected the cheaper freight and allows domestic producers to focus on the markets of Asian countries, by the way, one of the few regions where demand has already begun to recover.

4. Increasing domestic demand due to the implementation of state programs for the reconstruction of highways, the development of port and railway infrastructure, the construction of regional airports.

5. Strengthening supply chains and entering new sales markets through M&A transactions, provides industry consolidation and prevents trade restrictions.

6. Technical re-equipment within the framework of existing technologies and the introduction of tools of the “Industry 4.0” concept (Internet of things, smart devices, intelligent modeling, creation of a single information management environment, etc.) to reduce the material and energy consumption of products.

7. Expanding the customer base by increasing the degree of personalization - offering a unique specification of the range for each customer.

8. Application of bimodal supply chains - a combination of two logistics “modes”: the first (traditional) focused on lean efficiency, low risk and high predictability; the second is aimed at the speed of change, speed of response and situational decision-making in unforeseen circumstances.

Conclusion and Recommendations

Thus, the current dynamic conditions of business environment require the development of an integrated approach to managing the economic security of the enterprise, which organically combines operational and strategic management levels. In order to ensure the security of strategic economic interests of the enterprise, it is proposed to take into account the expanded perception of the conditions of objective reality (dangers - opportunities - requirements of stakeholders) in the past, present and future time horizons. The integrity of management actions is ensured by mental and cognitive processes of assessing past experience, the current state of the enterprise and awareness of the promising parameters of the business environment. Based on this, it is proposed to form an information base for the development and implementation of an integrated set of management actions aimed at achieving and maintaining the desired level of economic security in the long run based on strategic compliance of processes and resources with future business environment. The implementation of the developed proposals will be an important basis for increasing the investment attractiveness of the enterprises of the mining and metallurgical complex. The use of the developed proposals will be useful not only for enterprises - the objects of study of this article, but also for enterprises of other sectors of the economy and other countries. This is possible by increasing the understanding of security approaches from the perspective of using the capabilities of the business environment. In addition, the proposals will be useful for potential investors, who better understand the prospects of enterprises - objects of investment.

Ensuring economic security in the current global recession should be aimed at:

1. Increasing the level of operational excellence in the direction of creating conditions for optimizing operating costs and accelerating the efficiency of responding to changes in the business environment.

2. Transformational shifts in the structure of sold products with an increase in the share of products with a high degree of processing.

3. The fullest use of export opportunities.

Appendix

End Notes

Acknowledgement

References

- Cabinet of Ministers of Ukraine. (2020). Audit of the Ukrainian economy. Retrieved November 25, 2020, from https://nes2030.org.ua

- Captain, Y.O. (2007). Strategic adaptation of the enterprise to the external environment.

- GMK Center. (2020). Analytical Internet resource of the mining and metallurgical industry in Ukraine. Retrieved November 25, 2020, from https://gmk.center

- Kozachenko, G.V., Ponomarov, V.P., & Lyashenko, O.M. (2003). Economic security of the enterprise: essence and mechanism of support. Kiev: Libra.

- Ladyko, I., Yu., & Sumtsov, V.G. (2004). General management. Luhansk: Volodymyr Dahl East Ukrainian National University Publishing House.

- Lu, Y. (2017). Industry 4.0: A survey on technologies, applications and open research issues. Journal of Industrial Information Integration, 6, 1-10.

- Meheda, N.G., & Savchenko, A.P. (2014). Influence of the external environment on the activity of the enterprise. Retrieved July 30, 2020, from http://www.rusnauka.com/15_NNM_2014/Economics/10_170149.doc.htm

- Mishchuk, I., Zinchenko, O., & Adamenko, M. (2020). Sustainable competitive innovative development and economic security of enterprises under unstable conditions: mutual dependency and influence.

- Noorit, N., Thapayom, A., & Pornpundejwittaya, P. (2020). Guidelines for adaptation of the thai industrial business to support the digital economy. Academy of Strategic Management Journal, 19(6), 1-15.

- Yachmenyova, V.M. (2007). Identification of stability of activity of industrial enterprises. Simferopol: Fate.