Research Article: 2019 Vol: 18 Issue: 5

Strategic Balancing of Pre-Investment Practice and Post-Investment Effects of Venture Capitalists (VCs)

Fatema Nusrat Chowdhury, Daffodil International University

K.B.M. Rajibul Hasan, Agrani Bank Limited

Umme Kulsum, Daffodil International University

Sharmin Akhter, Bangladesh University of Business & Technology (BUBT)

Nurul Mohammad Zayed, Daffodil International University

Abstract

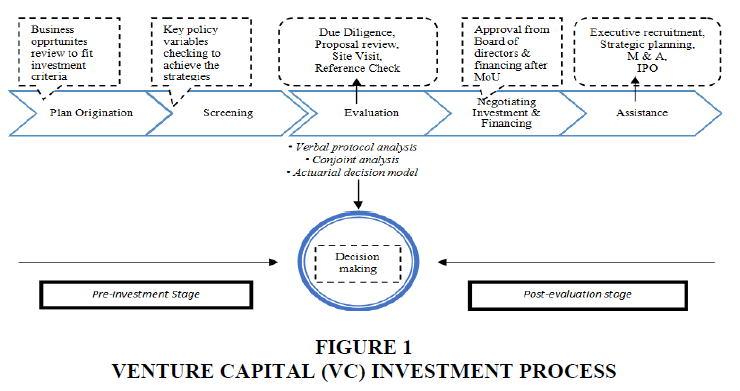

Venture Capitalists (VCs) practice investment activities for financing potential startups with innovative ideas. This paper initially addresses the investment process including five consecutive stages of business plan origination, screening, evaluation, negotiating investment and financing with assistance. Thereafter it identifies the challenges faced by VCs over their investment decision diving into pre and post investment segments taking consideration of potential biases and moral hazard. Finally, to offset such challenges by heuristics, three sophisticated methods-verbal protocol analysis, conjoint analysis, and actuarial decision model are generated for VCs to spur entrepreneurs by profitable investment. The consequences of the study are helpful for VCs in their investment decision-making process to amplify their prosperity rate.

Keywords

Venture Capitalists, Investment Process, Evaluation, Decision-Making, Entrepreneur.

Introduction

Entrepreneurs and new ventures with innovative ideas often get financially nurtured from both private equity and public equity financing for becoming succoring and productive. Side by side, intuitional investors hunt down emerging economies for the prospective return on investment, as they typically expertise quicker economic growth with a lot of bigger risk than those found in advanced economy. To address this issue, Venture Capitalists (VCs) is the blessing option for capital funding potential upcoming businesses with a great combo of unique ideas, young energetic entrepreneurs, developed business plan and steady growth in emerging industries. However, it doesn’t only invest in financial form but also it can be done by managerial or technical expertise. “Investment capital cycle” initiates with fundraising and continues through capital investing, monitoring the appreciation in firm valuation with optimum profit and finally ends with existing strategy of acquisition, merger or Initial Public Offering (IPO). The purpose of the study is to illustrate an identical model for VCs while taking investment decision by balancing the gap between pre and post investment practices in developing nations. The rest of the paper is structured as follows. Section 2 highlights relevant literature reviews. The objectives along with the methodology of the study are depicted. Under section 4, the investment process used by VCs is discussed. This section also highlights the challenges such as biases and moral hazard by differentiating pre-investment practice from post investment impact on VCs and suggested three decision-making methods as heuristics to combat those challenges faced by VCs while evaluating an entrepreneur’s business plan. Section 5 concludes with some suggestive remarks for both VCs and fund-seeking potential entrepreneurs.

Literature Review

Grossman & Hart (1986) concluded if entrepreneurs failed to uphold their business prospects with full of confidence, it turned out to be difficult to form a financing documentation from investors. Hart & Moore (1998) suggested VCs can finance young firms with information gaps and allow them to receive the equity financing that they cannot rise from other sources. Sahlman (1990) pointed out VCs use staged capital infusion as a potential weapon by controlling financing duration with fluctuating evaluation of firm time to time. Later on, Gompers (1995) examined this strategy on venture capital-financed firms found VCs stops refinancing after getting reduction in returns of investment. Previously Lerner (1994) tested this hypothesis and found VCs getting the second opinion from similar or better experienced VCs while doing the early stage of syndicate investment in firms. Jensen & Meckling (1976) suggested that distributing stock option to a number of employees can be an effective tool to address the moral hazard where control is separated from ownership. According to Fama & Jensen (1983) VCs participating in the board of directors can shape the need of oversight with advice and support. Lerner (1995) tried to check the number of representatives of VCs on the board with need for insight and found investor’s board memberships mainly reduce the cost of long-distance monitoring and agency problem. Moreover, Shleifer & Vishny (1997) added VCs take an active role on board of directors with the intention of governance by monitoring growth time to time. Baker & Gompers (1999) explained VCs widely use stock offering as compensation to the top level managers for addressing agency problems. Sorenson & Stuart (2001) mentioned that a decision criterion of VCs is the most complex task by evaluating the firm’s economic value which may vary depending on an industry basis. Sharma (2015) explained multi-criteria perspective is used by VCs for decision making of funding new ventures. Here multi-criteria includes industry types, geographic proximity and growth stage and investment size. They also suggested the generation of the actuarial decision model for VCs, designed with crucial investment criterion to avoid biases and moral hazards for profitable financing.

Objectives and Methodology

The objective of the study is to balance the impact of a pre-investment decision with post-investment consequences such as biases and moral hazards. The final outcome of this study is to demonstrate such sophisticated decision-making tools (verbal protocol analysis, conjoint analysis and actuarial decision model) as heuristics to combat those challenges faced by VCs. In order to ascertain the objectives of this descriptive study, the data is qualitative in nature and primarily based on secondary data. For the generation of an actuarial decision model, the secondary data was collected from various publication related to the topic. To clarify different conceptual matters, the internet and different articles published in the journals and magazines was used.

Results and Discussion

Venture Capital (VC) Investment Process

Firstly Tyebjee & Bruno (1984) suggested a five-segment VC investment process including: identifying potential firm as deal origination, proposals reviewing as deal screening, plan assessment on risk as deal evaluation, negotiating and establishing VC agreement as deal structuring and providing value-added guidance as post-investment activities. While investing VCs covers all of the scopes of both seed capital and expansion-stage by following five consecutive stages: Plan Origination, Screening, Evaluation, Negotiating Investment and Financing with Post-Investment Assistance. In Figure 1, the pre-investment stage begins with the VCs conducting an initial review of the business proposal to check investment criteria. If so, a meeting will be arranged with the entrepreneur to demonstrate key policy variables to achieve the strategies outlined in the plan and VCs usually look carefully at the team's functional skills and backgrounds for this business screening. Then VCs evaluate due diligence checklist for identifying the key risks associated with the investment and develop a risk mitigation plan. If the VCs act as a lead investor in a syndicate, then they may also share the outcome of their due diligence with other investors. Typically investment approval leads to a Memorandum of Understanding (MoU) after getting approval of due diligence report by the venture capital fund’s board of directors. Finally VCs assess the market viability and provide financing and guidance to the entrepreneur with hiring key members of the management team, planning financial strategy, and transforming into acquisition, merger or Initial Public Offering (IPO).

Challenges Faced by VCs during Evaluation and Post Investment Period

Initially, Fama (1998) mentioned biases, which significantly make an impact on the evaluation state of VCs. While taking a decision on how investors are reacting get highly influenced suggested by Forrester. Mitteness et al. (2012) identified the aspects of biases as overconfidence, framing, habit, the perception of risk, inconsistency, experience, beliefs. A few of these cognitive factors underlying behind the evaluation system of the VCs are addressed while making a decision before investment. As a result, there appears a gap between the pre-investment scenario and post-investment assessment. To address biases, staged capital infusion and syndication investment with other expert VCs of similar industry lowers the risk of financing entrepreneurs by second opinion for diversifying industry risk. Moral hazard is another challenge faced by VCs after the funding in a young business. Initially with prospective idea and strategies with lack of capital entrepreneur successfully make an impact on VCs. Moral hazard appears between investors and entrepreneur due to an unobservable correct distribution of fund to the business project by the entrepreneur after capital financing from VCs. Practically most of the cases entrepreneur make a small portion of cash inflow in the business project by keeping the rest of the portion in a personal account. As a result, entrepreneurs shrink the success rate as well as the efficiency of capital-induced, which lead to conflict of interest known as agency problem. Thus at the negotiating stage of investment, there must be effective design to address the fund computability along with individual participation. The contract might include that specific condition limiting the entrepreneur carry on the project once the agreement has expired, as by transferring position of the VCs. If such prevention is not taken; the entrepreneur can present financial planning to any of the VCs again for funding. Membership of VCs in the board of directors, hiring executives, a stock option for compensation may work well to reduce this sort of agency cost faced by VCs as a result of moral hazard.

Heuristics of VCs Decision-Making Process

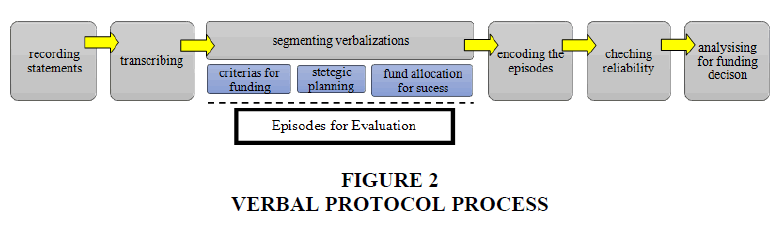

Being rule of thumb, Heuristics states the methods to solve these challenges of VCs. Shefrin (2000) mentioned it as an experienced-based solution to deal the raising issues while making decisions of financing. Simon & Houghton (2002) suggested it as a technique by brainstormed logical reasoning by the decision maker. Best investment decision needs much effort from VCs to avoid such noises as biases before evaluation and moral hazard after investment. There is no information asymmetry initially between the investor and entrepreneur but the asymmetry rise over time after the funding. Here the hub of asymmetric information derives from the unobservable allocation of the fund by the entrepreneur and leads to unsuccessful investment. Before considering the optimal financial contract between them, there is a need for a sophisticated method for analyzing the efficient investment decision making policy without the potential biases and double moral hazard problem. Verbal protocol analysis allows VCs to think again and again for evaluation based on aspects of financing from recorded verbal declaration of entrepreneurs. Here in Figure 2 it shows VCs record the statement of entrepreneur in an interview followed by transcribing the verbalization and segmenting into episodes of evaluation aspects separately. VCs proceed by assessing funding criteria, financial strategy and usage of fund allocation. By encoding the episodes, reliability is tested and finally, VCs comes to the point to make the investment or not.

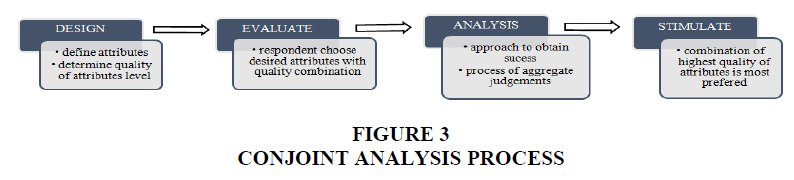

Another decision-making process, conjoint analysis identifies how and when evaluation criteria are used in the analysis process. Here entrepreneurs are judged by VCs by assessing their priorities and making series based on their business profiles. Here Figure 3 illustrates four step by step process of conjoint analysis starting with design, where attributes with their quality level are defined for the respondent’s choice; moving to evaluation by checking the combination of respondent’s priorities attributes with quality level; the third stage formulates the analysis to set the respondent’s preferred approaches to obtain success and identifying the process of aggregate judgments; finally the process stimulates the investor to generate a combination of highest quality of attributes preferred by respondents for target achievements.

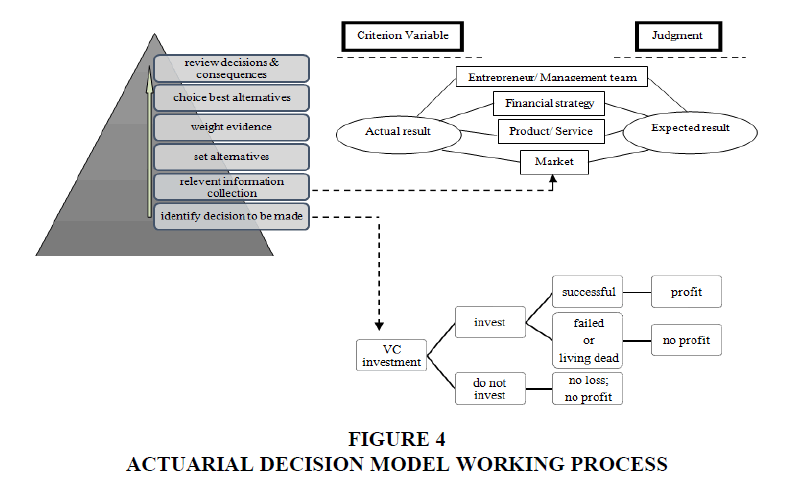

The actuarial decision model is another sophisticated model that breaks down a decision into indicators and recombines those indicators to forecast the potential result. For VCs decision, an actuarial model may defragment a business proposal into results regarding the key management team of entrepreneur, market, financial strategy and product. The sub-component results get readjusted to get an overall evaluation of the new business potentials. In Figure 4, it shows how VCs uses actuarial decision model to make a decision by following six steps starting from the decision to make, followed by relevant information collection, alternative fixing, putting weight on factors, and choosing best choice till making final financing decision considering consequences of an investment in the specific business project.

Conclusion and Policy Recommendations

The results of this study have relevant implications to venture capital firms for prospective investors. The implications of developing three decision-making methods- verbal protocol analysis, conjoint analysis and actuarial decision model as heuristics may lead to profitable evaluation of VCs before investing. The success of these methods can be attributed to their consistency over various business proposals (Sahlman, 1990). VCs being human decision makers often get biased by altering major information signs that lead them to misconceive other important signs. On the other hand, the entrepreneurs also practice moral hazard while making the allocation of funds after the investment of VCs. This paper mainly highlights a generalized actuarial decision model, by which each VCs can evaluate their fund-seeking entrepreneurs that match its certain decision criteria. Thereby there will be a balance between the pre-investment practice and the post-investment impact on VCs by offsetting the impactful challenges of investment such as biases and moral hazards (Lerner, 1995).

References

- Baker, M., & Gompers, P. (1999). Executive ownership and control in newly public firms: The role of venture capitalists. SSRN Electronic Journal.

- Fama, E.F. (1998). Market efficiency, long-term returns, and behavioral finance. Journal of Financial Economics, 49(3), 283-306.

- Fama, E., & Jensen, M. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301-325.

- Gompers, P. (1995). Optimal investment, monitoring, and the staging of venture capital. The Journal of Finance, 50(5), 1461-1489.

- Grossman, S., & Hart, O. (1986). The costs and benefits of ownership: A theory of vertical and lateral integration. Journal of Political Economy, 94(4), 691-719.

- Hart, O., & Moore, J. (1998). Default and renegotiation: A dynamic model of debt. The Quarterly Journal of Economics, 113(1), 1-41.

- Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics , 3(4), 305-360.

- Lerner, J. (1994). The syndication of venture capital investments. Financial Management, 23(3), 16.

- Lerner, J. (1995). Venture capitalists and the oversight of private firms. The Journal of Finance, 50(1), 301.

- Mitteness, C., Sudek, R., & Cardon, M. (2012). Angel investor characteristics that determine whether perceived passion leads to higher evaluations of funding potential. Journal of Business Venturing, 27(5), 592-606.

- Sharma, A.K. (2015). Venture capitalists’ investment decision criteria for new ventures: A Review. Procedia-Social and Behavioral Sciences, 189, 465-470.

- Sahlman, W. (1990). The structure and governance of venture-capital organizations. Journal of Financial Economics, 27(2), 473-521.

- Shefrin, H. (2000). Beyond greed and fear: Understanding behavioral finance and the psychology of investing. Oxford University Press.

- Shleifer, A., & Vishny, R. (1997). A survey of corporate governance. The Journal of Finance, 52(2), 737-783.

- Simon, M., & Houghton, S.M. (2002). The relationship among biases, misperceptions, and the introduction of pioneering products: Examining differences in venture decision contexts. Entrepreneurship Theory and Practice, 27(2), 105-124.

- Sorenson, O., & Stuart, T. (2001). Syndication networks and the spatial distribution of venture capital investments. American Journal of Sociology, 106(6), 1546-1588.

- Tyebjee, T., & Bruno, A. (1984). A model of venture capitalist investment activity. Management Science, 30(9), 1051-1066.