Research Article: 2019 Vol: 18 Issue: 6

Strategic Decision and Transnational Corporation Efficiency

Igor Kryvovyazyuk, Lutsk National Technical University

Liubov Kovalska, Lutsk National Technical University

Larysa Savosh, Lutsk National Technical University

Liudmyla Pavliuk, Lutsk National Technical University

Iryna Kaminska, Lutsk National Technical University

Kateryna Oksen?uk, Lutsk National Technical University

Olena Baula, Lutsk National Technical University

Olena Zavadska, Lutsk National Technical University

Abstract

The purpose of the study is to reveal the relationship between the justification of strategic decisions and the increase in efficiency of transnational corporations (TNC). The conceptual bases of the justification of strategic decisions for increasing the efficiency of TNC are suggested, the development of which involves research of the preconditions on which their implementation is based, analysis of the main aspects of TNC's activity and accordance with the principles of justification of strategic decisions, strategic decision-making. The results of the comprehensive diagnostic examination of TNC of leading bearings manufacturers are presented, which revealed the problems of their functioning on the market, changes in the dynamics of performance indicators, differences in the use of opportunities, financial state, strategic positions on the market, the efficiency of made decisions. A model for selecting a decision strategy for TNC is suggested. Practical recommendations of implementing strategic decisions for increasing the efficiency of activity of TNC of leading bearings manufacturers are given.

Keywords

Concept, Strategic Decisions, Strategy, Efficiency, TNC.

Introduction

The success of the TNC operation in modern conditions depends on the justification, quality, and compliance with applied technologies of designing and strategic decision-making that implemented by the management of corporation. Often, it is difficult for TNC managers to determine what to focus on in the long run-on goals or results, on the market or on efficiency? That is why; strategic decisions require not only detailed planning and proper organization of the process of their implementation, but also comprehensive balance, priority assessment, constant monitoring and strict control over established goals or results in the future. A clearly defined and justifies strategy can assist in the implementation of strategic decisions. Efficiency is not less interesting for managers of the corporation. Efficient activity becomes the basis for increasing equity, the rate of securities, investment and improving the image of the corporation. Therefore, disclosure of the relationship between justification of strategic decisions and increase in the efficiency of the TNC activity should be considered as the important scientific and methodological and practical task.

Literature Review

Strategic decisions in the publications of contemporary scholars Gooderham et al. (2019); Gilbert & Behnam (2009); Jarosz et al. (2019); Johnson et al. (2017); Kryvoviaziuk (2013); Morschett et al. (2015); Nouri & Soltani (2017); Shenkar et al. (2014) are mostly associated with the provision of strategic tasks set by the TNC managers: improving existing strategic position towards competitors, forecasting consumer behavior, improving product policy, development of market opportunities, etc.

However, the problem of analyzing the impact of strategic management on business efficiency, which is extremely important for the TNC, is increasingly rising in scientific research. After all, in order to function successfully, TNC must not only clearly define the mission and vision, but also apply the principles of strategic management to improve business efficiency (Agwu, 2018). At the same time, efficiency should be analyzed both from the point of view of the effective use of techniques and technologies, as well as changes that accompany productivity of personnel (Britchenk et al., 2018). Gaur et al. (2019) claim that exactly effective transfer of knowledge is critical for the survival and performance of MNCs. Another publication proves the link between global talent management and multinational enterprises’ performance (Collings et al., 2019). An important point is that most of enterprises included in TNC represent high-tech industries where structural changes require an assessment of the efficiency of made strategic decisions (Batkovskiy et al., 2018). Therefore, market research, where the TNC operates, should be paid more attention. The justification of decisions increasingly requires the use of results of diagnostic (Bozhydarnik & Kryvovyazyuk, 2014), which serve as an information basis for the development and adoption of development strategy of company. The choice of such a strategy is determined by existing innovative potential (Chorna et al., 2019), strategic opportunities of corporations (Kryvovyazyuk & Strilchuk, 2016), and the growing importance of taking account of changes of institutional environments (Hitt, 2016). The complexity of implementing a strategy emphasizes the neccesity to combine central intent and direction with decentralization and autonomous initiatives in the TNC (Andersen & Andersson, 2017; Andersen & Hallin, 2017). It should be taken into account the fact that strategic decisions making is more concentrated in the minds of owners and top managers, while the motivation and interaction of the latter with the managers of subsidiaries relatively to the parent TNC are often simply absent (Contractor et al., 2019). Therefore, the resolution of the conflict between strategic goals and sustainable development of TNC is one of the most important tasks facing its managers in the context of growing globalization, mergers and acquisitions of business (Meglio & Park, 2019). The ambiguity of scientists’ opinions about TNC decision making on key strategic issues allows highlighting the following approaches: the resource-based perspective on the firm; transaction cost economics; institutionalism; the network approach; and the actor-centered perspectives (Drahokoupil, 2014). The above highlights the complexity of developing and making strategic decisions for the TNC in today's business environment, the necessity to determine the relationship between justification of strategic decisions and increase of the efficiency of the TNC activity.

Methodology

In this research, the statistical sample consists of TNC that belong to the TOP-10 largest corporations in the world in the field of bearings production, with a long history of implementing strategic decisions, developing measures to improve activity efficiency (Schaeffler Group, SKF Group, Timken Company). The theoretical basis of the research is a systematic approach, and the methods of theoretical generalization, scientific abstraction and grouping are used for the development of conceptual foundations of justification of economic decisions based on the results of diagnostic analysis. While identifying problems of operation of TNC of bearings production next scientific methods were used: economic comparison, analysis and synthesis (for analysis of market and competition), graph-analytical, matrix, method of coefficient analysis, SWOT-analysis, chain substitutions, financial and operational analysis for generalization the results of diagnosis of strategic decisions efficiency of TNC of bearings production, the matrix approach when choosing strategies for implementing decisions for the TNC. While developing strategic decisions, in order to improve efficiency of TNC methodology of project analysis was used.

Results and Discussion

In modern conditions of economic environment, the results of analytical tests of TNC state are the basis for the justification of strategic decisions. In order to increase the efficiency of TNC activity, it is expedient to use the results of diagnostics of TNC state, which serve as a basis for the system of views of managers for the development of strategic decisions. Further integration of strategic decisions and diagnostic procedures through the implementation of a systematic approach to management serves as the basis for the development of a conceptual framework for justifying strategic decisions for the TNC (Table 1).

| Table 1 Conceptual Foundations of Justifying Strategic Decisions for TNC | |||||

| Goal setting and planning the process of justifying strategic decisions for TNC | |||||

| Achieve parity of interests in subsystems “owners-shareholders”, “goals-results”, “tactics-strategy” | Determination of the interrelations of elements of the process of justifying strategic decisions | Outline of time and resource constraints of the strategic horizon of implementing decisions | |||

| Optimization of the process of justification of strategic decisions in order to achieve efficiency of the TNC | |||||

| Reconciliation of organizational, economic, technic-technological, legal, environmental, social, psychological and corporate aspects of attaining efficiency |

Ensuring compliance with the principles of purposefulness, justification, comprehensiveness, economy, measurability, responsibility, coherence, scientific, systematic, objectivity and timeliness | Coherence of the scales of activity and means of motivating the achievement of goals with the degree of efficiency of planed decisions | |||

| Factors influencing the process of justification of strategic decisions | |||||

| Micro level: Economic activity; degree of use of opportunities; financial and economic condition; strengths and weaknesses; Strategic position; efficiency of decisions. | International level: Environment uncertainty and risks; political factors; economic situation in the world; foreign economic relations; availability of Resources; social responsibility of business. | Global level: changes in trends in world markets development; strategic factors of growth, barriers of entering the market; analysis of new market opportunities. | |||

| Instruments for preparing an information base for justification of strategic decisions for the TNC | |||||

| Methods of comparison, matrix, analysis of coefficient, SWOT- analysis, financial and strategic |

Grouping method, effect of financial and operational leverage, generalization method | Trend analysis, checklist, analysis of priorities, generalization and grouping | |||

| Selecting a strategy for implementing strategic decisions for TNC | |||||

| Diversification strategy | Strategy of stabilizing growth | Strategy of sales growth | Restructuring strategy | ||

| Justification of strategic decisions to improve TNC efficiency | |||||

In the process of justification of strategic decisions, it is important to establish the regularities in the TNC's activity, determine its current state, problems of functioning, achieved through the use of comprehensive diagnostic analysis of activity. The results of the diagnostic analysis of activity of the leading TNC bearings manufacturers discovered a set of problems of their functioning (Table 2).

| Table 2 Results of Diagnostics of Problems of Functioning of TNC Manufacturers of Bearings | ||

| SKF Group | Timken Company | Schaeffler Group |

| Analysis of market and competition | ||

| Increased competition in the market, monopolization of the market, fluctuations in demand for bearings | ||

| Analysis of the dynamics of the main performance indicators | ||

| Fluctuations in revenue and profit from sales of products, return on assets, productivity of labour and return on equity | Fluctuations in equity, revenue and profit from sales, labor productivity and return on assets, profitability indicators, losses | Fluctuations in revenue and profit from sales of products, the efficiency of using fixed assets, return on equity, low return on capital |

| Analysis of the use of market opportunities | ||

| Insufficient use of marketing and financial opportunities | Low level of opportunities use | Insufficient use of organizational and marketing opportunities |

| Financial and economic analysis | ||

| Low financial independence, high concentration of borrowed capital, insufficient provision of own funds, reduction of inventory turnover, working capital and fixed assets |

Insufficient availability of own working capital, reducing the turnover of assets, inventories, receivables, current and fixed assets | Low current liquidity, financial independence and stability, reduced profitability of sales, insufficient provision of own funds, high concentration of debt capital and financial risk, decrease in turnover of inventories and fixed assets |

| Analysis of strengths and weaknesses, opportunities and threats | ||

| Presence of threats to external environment, requiring constant attention of company |

Presence of weaknesses that do not allow fully utilize the opportunities of external environment | Presence of threats to external environment, requiring constant attention of company |

| Analysis of the strategic position | ||

| Sustainable competitive position, “star” segment |

Weak competitive position, “question mark” segment | Leadership in the market, “star” segment |

| Analysis of the factors influencing performance indicators | ||

| Reduction of profit from sales of products due to the effect of changes in the liquidity of assets |

Reduction of profits from sales of products due to changes in turnover of working capital, liquidity and return on equity | Reduction of profits from sales of products due to changes in turnover of working capital, return on equity and current liabilities |

| Analysis of activity risks | ||

| High market and financial risks | High legal, financial, market, environmental risks and brand risks | High financial and managing subsidiaries risks |

| Analysis of the efficiency of made strategic decisions | ||

| Ineffective decisions about functional activities | Tendency to decrease the efficiency of solutions |

Insufficiently effective decisions on functional activities |

It has been established that next factors are influencing efficiency of implementing strategic decisions of leading in the world TNC bearings manufacturers, such as changes in trends in development of market and competition, negative dynamics of some activity efficiency indicators, insufficient use of market opportunities, threats to external environment and some weaknesses, financial parameters of the internal environment of corporations, high risks of activity.

The obtained results are the basis for changing strategic approaches in the process of justifying and decision making for the leading world TNC bearings manufacturers. This should be reflected in the refinement of the TNC's development strategies and the implementation of investment decisions aimed at improving the efficiency of their activities.

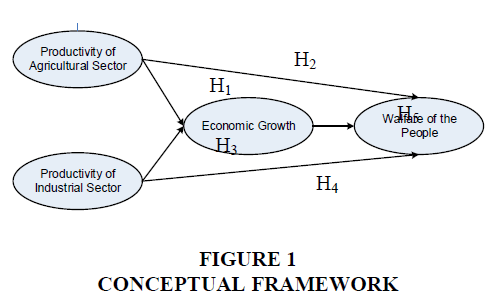

The development of conceptual foundations of justification of strategic decisions based on research results in one of its stages involves justifying the choice of strategy for their implementation. After all, for TNC that operate in a market environment, it is necessary to make choice of such strategic development paths that will help to achieve their long-term goals. The scientific community has fierce debate about the use of approaches that are appropriate to use when choosing a strategy (Agwu, 2018; Contractor et al., 2019; Gaur et al. 2019; Gooderham et al., 2019; Johnson et al., 2017). For TNC, it suggested to use the following criteria for choosing a strategic direction of development: the efficiency of strategic decisions and the pace of change in volume of sales of products on the market. They serve as the basis for building a model for choosing a strategy for implementing decisions for leading TNC bearings manufacturers (Figure 1).

The strategy of stabilizing growth is to ensure a uniform increase in volumes of products sales of TNC, to maintain leading position in the market using gained experience and customer confidence, as well as constant support of the achieved level by investing in improving product quality in order to maintain competitive advantages.

The strategy of market or commodity diversification is to rapidly increase the sales of existing products of TNC by expanding the geographical boundaries of the market or moving from a declining market to growing, manufacturing products of unsatisfied demand.

The strategy of sales growth involves investing in the expansion of products manufacturing of TNC in order to meet the growing demand and increase the efficiency of the use of resources through the achievement of effect of scale of the production.

Strategy of restructuring involves organizing events aimed at changing the management structure, forms of ownership, TNC management methods, mergers and acquisitions in order to gain a strong competitive position in the market.

Using the matrix of selecting strategy of implementing decision, it is suggested in the leading TNC bearings manufacturers to implement the strategy of stabilizing growth, as strategic decisions of companies are efficient, and sales volumes of their products are increasing. In order to achieve the best result from the implementation of the chosen strategy, it is important to ensure the use of the most efficient aspects of the enterprise activity, which are manifested through supporting strategies. The results of a comprehensive diagnostic analysis have revealed that supporting strategies for SKF Group are competitive, production, marketing and innovative, for Timken Company production, financial and managerial, for Schaeffler Group-competitive, financial and managerial.

The solution of practical tasks to improve the efficiency of TNC activity is possible by adopting justified strategic decisions within the chosen strategy.

For the SKF Group, when implementing the strategy of stabilizing growth, it is suggested to make a strategic decision to improve product quality. In the framework of the strategy implementation it is recommended to implement an investment project, the main idea of which is to establish modern measuring equipment that will improve the accuracy of the measurements of the bearings details. The main advantage of such equipment is to reduce errors in measurements due to the use of the automated system and the limitation of the influence of the human factor. It will improve the product quality and reputation of the SKF Group in the market, as well as competitiveness. To implement the investment project, it is suggested to purchase coordinate measuring machines “Axiom too” for the price of 48.07 thousand dollars per unit. The total investment costs of the project will be 14.86 million dollars. Expected net profit will be 2.08 million dollars. The efficiency of the decision will be 14.0%.

For Timken Company, in implementing the strategy of stabilizing growth, it is suggested to make strategic decision of expanding production facilities and markets of sales by purchasing a company in China. Timken Company’s share in the global bearings market is 9.2% and only 43% of the volume of sales is exported. The investment project will increase sales volumes in Asian countries and increase the company’s share in the global bearings market, which will help strengthen its competitive position. To realize the investment project, it needs to purchase shares of Shanghai Bearing Company, located in Shanghai. The value of the shares will amount to 59.2 million dollars. It is required to change its manufacturing according to Timken Company’s technology and standards, and to train its staff, which requires another 1.8 million dollars. Total capital investments will amount to 61 million dollars. Expected net profit will be 18.9 million dollars. The efficiency of the decision will be 31.0%.

For the Schaeffler Group, in implementing the strategy of stabilizing growth, it is suggested to make a strategic decision to expand the markets for sales through the acquisition of production facilities in the USA. The share of sales of Schaeffler Group products to the countries of North and South America in the company's sales structure is the smallest and equals 20.8%. The investment project will allow expanding the sales geography and strengthen the competitive positions in this market. In order to implement the investment project, it is suggested to purchase shares of General Bearing Corporation, located in the USA in New York. The value of shares will amount to 72.2 million dollars. For redefining manufacturing in accordance with Schaeffler Group technology and standards and training its staff 2.3 million dollars required. The total capital investment of the investment project will be 74.5 million dollars. Expected net profit will be 26.5 million dollars. The efficiency of the decision will be 35.6%.

Conclusion

Strategic decisions taken by TNC managers affect efficiency of their activity. The development of conceptual foundations for the justification of strategic decisions for TNC provides clarification of objectives and improves the process of planning for the development and implementation of decisions, determines the principles of optimization and specifies the factors of influence on the process of their justification, as well as the tools of information preparation for making strategic decisions, reveals possible strategies for their implementation, connection to efficiency of TNC. The basis of the justifying strategic decisions is the results of a comprehensive diagnostic test of the state of the TNC, which serves as the basis for identifying the problems that accompany the operation of the TNC, in particular, changes in the efficiency of their activity and the efficiency of made strategic decisions. In order to ensure an adequate level of these indicators, it is appropriate to use a model for choosing a strategy for implementing decisions for TNC that takes into account such important parameters as efficiency of strategic decisions and the rate of change in sales volume on the market. As a practical means of supporting the implementation of strategic decisions, it is suggested to carry out investment projects, the results of which, with good justification, will provide increase in efficiency of the TNC activity.

References

- Agwu, E. (2018). Analysis of the impact of strategic management on the business performance of SMEs in Nigeria. Academy of Strategic Management, 17(1).

- Andersen, T.J., & Andersson, U. (2017). Multinational corporate strategy-making: Integrating international business and strategic management. In The Responsive Global Organization: New Insights from Global Strategy and International Business. Emerald Publishing Limited.

- Andersen, T.J., & Hallin, C.A. (2017). Democratizing the multinational corporation (MNC): Interaction between intent at headquarters and autonomous subsidiary initiatives. In The Responsive Global Organization: New Insights from Global Strategy and International Business. Emerald Publishing Limited.

- Batkovskiy, A.M., Efimova, N.S., Kalachanov, V.D., Semenova, E.G., Fomina, A.V., & Balashov, V.M. (2018). Evaluation of the efficiency of industrial management in high-technology industries.

- Bozhydarnik, T.V. & Kryvovyazyuk, I.V. (2014). Rationale of business decisions and diagnostics of an industrial enterprise: Modern format. Lutsk, RVV LNTU.

- Britchenk, I., Monte, A.P., Kryvovyazyuk, I., & Kryvoviaziuk, L. (2018). The comparison of efficiency and performance of Portuguese and Ukrainian enterprises. Economic Studies, 27(1).

- Chorna, M., Nord, G., Bezghinova, L., Melushova, I., & Diadin, A. (2019). Company Development Strategy Choice on the Grounds of Innovative Potential Assessment. Academy of Strategic Management Journal.

- Collings, D.G., Mellahi, K., & Cascio, W.F. (2019). Global talent management and performance in multinational enterprises: A multilevel perspective. Journal of Management, 45(2), 540-566.

- Contractor, F., Foss, N.J., Kundu, S., & Lahiri, S. (2019). Viewing global strategy through a microfoundations lens. Global Strategy Journal, 9(1), 3-18.

- Drahokoupil, J. (2014). Decision-making in multinational corporations: Key issues in international business strategy. Transfer: European Review of Labour and Research, 20(2), 199-215.

- Gaur, A.S., Ma, H. & Ge, B. (2019). ?NC strategy, knowledge transfer context, and knowledge flow in MNEs. Journal of Knowledge Management, 23(3).

- Gilbert, D.U., & Behnam, M. (2009). Strategy process management in multinational companies: status quo, deficits and future perspectives. Problems and Perspectives in Management, 7(1), 59-74.

- Gooderham, P.N., Grøgaard, B., & Foss, K. (2019). Global strategy and management. Edward Elgar Publishing.

- Hitt, M.A. (2016). International strategy and institutional environments. Cross Cultural & Strategic Management, 23(2), 206-215.

- Jarosz, P., Kusiak, J., Ma?ecki, S., Morkisz, P., Oprocha, P., Pietrucha, W., & Sztangret, ?. (2019). Multi-criteria optimization strategies for tree-structured production chains. International Journal of Material Forming, 12(2), 185-196.

- Johnson, G., Whittington, R., Scholes, K., Angwin, D., & Regnér, P. (2017). Exploring Strategy (Onceaba ed.).

- Kryvoviaziuk, I. (2013). Implementation of matrix approach to management of enterprise’s logistic development based on a concept of demand-driven techniques. Economic Journal-???, (09-10 (1)), 60-64.

- Kryvovyazyuk, I.V., & Strilchuk, R.M. (2016). Strategic opportunities management at engineering enterprises. Actual Problems in Economics, (183), 144.

- Meglio, O., & Park, K. (2019). Strategic decisions and sustainability choices. Springer International Publishing.

- Morschett, D., Schramm-Klein, H., & Zentes, J. (2015). Strategic international management. Springer.

- Nouri, B.A., & Soltani, M. (2017). Analyzing the use of strategic management tools and techniques between Iranian firms. Academy of Strategic Management Journal.

- Shenkar, O., Luo, Y., & Chi, T. (2014). International business. Routledge.