Research Article: 2019 Vol: 18 Issue: 3

Strategic Determinants and Stability of Real Exchange Rate in Bangladesh: 1976-2017

Nurul Mohammad Zayed, Daffodil International University

Jasia Mustafa, Daffodil International University

K.B.M. Rajibul Hasan, Agrani Bank Limited

Muhammed Sahajalal, Economic Relations Division

Md. Sariful Islam, Independent Researcher

Abstract

The lesson has been accompanied to scrutinize the determinants of exchange rate In Bangladesh economy for the period from 1976 to 2017. The broad objectives of this study is to analyze what are the determinants of Real Exchange Rate and Stability scenario that touch the inflation rate and overall economy in Bangladesh since 1976 to 2017. Real Exchange Rate, Inflation Rate, Interest Rate and Income Level or Real GDP is used as clarifying variables. These are the utmost central factors of exchange rate which have a key influence on Real Exchange Rate. This study’s inference includes how the Inflation Rate, Interest Rate and Income Level or Real GDP has impact on Real Exchange Rate. It is evident from the study found that still there have been long run relationship among real exchange rate, interest rate, inflation rate and real gross domestic product. Paper also shows that if interest rate, inflation rate and real GDP go down then at a time the real exchange rate goes down.

Keywords

Real Exchange Rate, Inflation Rate, GDP Growth Rate, Interest Rate, Real GDP, Stability.

Introduction

In economics, an exchange rate is the rate at which one notes will be substituted for another. It is furthermore observed as the worth of one nation’s currency in next of kin to another currency. The real exchange rate is a rate which dealings how loads of times an item of goods gaining locally; can be purchased from out of the country. It specified the ratio of objects are purchased in the domestic market with the items are purchased in the foreign market. The objective of this study is to analyze the influence of real exchange rate changes on relative price, Inflation rate, GDP growth rate, Interest Rate and Real GDP or Income level in Bangladesh during 1976-2018 by applying the Johansen Long run Co integration technique.

Literature Review

Chowdhury et al. (2014) studied a discrepancy in the empirical calculations of the exchange rate regime alternative. The piece defines a set of variables that helped to clarify the preference of exchange rate in Bangladesh for the period 1990-2011 with employing a time series analysis that elucidates interest rate; GDP growth rate; inflation rate and current account balance have affirmative relation with exchange rate. Hossain & Ahmed (2009) studied that explores exchange rate policies of Bangladesh under a floating rate regime in a widespread mode. The real exchange rate and the nominal exchange rate both ware considering in this examination with a recommendation that real exchange rate of euro should be alleviated. Hassan et al. (2016) stumble on convincing proof of the loss of aggressiveness of exports due to the real effective exchange rate admiration has been recognized in Bangladesh. Nevertheless, remaining nominal exchange rates runs and approval of the Real Effective Exchange Rate (REER) for the declared era pointed out that Bangladesh looks upper inflation than its trading colleague countries. Uddin et al. (2013) stated that an exchange rate activity considerably depends upon the macro rudiments of the particular countries. This study also indicates that the nominal exchange rate is influenced by the rise in the relative debt is another important source. Upholding mediumto- long time flexibility and short-term constancy should be the common purpose of exchange rate determination strategies in Bangladesh. Islam & Hossain (2014) examines the connection between the exchange rate, GDP growth rate and exports in Bangladesh for the period 1981 to 2013 with the conclusion of the positive relationship. They suggested the strategy makers should also prolong to get on prolific behaviors that will boost Bangladesh’s exports more than imports. Akther et al. (2013) considered that demand alarms particularly created from exterior area are accountable for pointed depreciation of BDT exchange rate throughout the two periods. As per econometric scrutiny supply shocks are also significant for exchange rate variation. Williams et al. (2016) reveals that the inflation rate of Bangladesh is relatively higher than the People’s Republic of China and also comparatively higher than the inflation rate in India until 2009. Independent Review of Bangladesh’s Development (2018) studied that the Central Bank should now focus on bringing stability to the exchange rate market. This may deplete the foreign exchange reserve in the coming months. Such steps will also help to contain money supply in the domestic market. Bhattarcharjee (2015) specifies that there are equally exterior and internal issues that affect inflation in small, open developing economies aand work on inflation is still developing. These lessons also will set the point for more quantitative research on inflation in little developing economies. Sultana & Uddin (2013) indicates inflation reasons by alters on the supply side of the market would linger mostly unaffected by the policies suggested by the IMF and assumed by the Bangladesh Bank. This Study also suggested that the government should obtain demanding possible strict events according to the inflation position of Bangladesh under the deliberation of the worldwide.

Objectives

The intention of this study is to hit upon the followings:

1. The relationship between Real Exchange rate, Interest rate, Inflation rate and Real GDP.

2. The effect of Interest rate, Inflation rate and Real GDP on Real Exchange rate in Bangladesh Economy with the reference to 1976-2017.

Methodology

This investigate is expressive in nature and the statistics is quantitative in nature. Only the minor data were employed. Secondary data were gathered from the Bangladesh Bureau of Statistics, World Development indicators report, World Bank indicators report, Bangladesh Bank annual report, Bangladesh economy in FY 2017-2018 and websites. The study period was 1976 to 2017. All relevant information was quoted in perpetual term. The study proposed a model to measure the Real Exchange rate, Inflation rate and Real GDP percent pressure in Bangladesh economy.

Theory and Model

rt =α+β0+β1intt+β2inft+β3GDPt+?t (1)

In this model rt is representing the real exchange rate, intt is interest rate, inft is inflation rate, and GDPt is Gross Domestic Product (GDP).

For examining the short run dynamic in relationship among real exchange rate, interest rate, inflation rate and gross domestic product, an ECM model has been developed.

Δlnr= α0+ α1Δlnintt-I + α2lninft-I +lnGDPt-I +Δlnrt-I + α2Ut-I + ?t

Where,

Ut-I=lnr2t- β0- β1lnintt- β1inf1- β1GDPt (2)

Where, α4Ut-1 express the error modification term, it is the residual from the cointegrating equation, α3 indicated the error amendment co-efficient and αi are the projected short term co-efficient. If the real exchange rate rises (under devaluation of currency) then the growth of the economy is quite evident.

Results

The descriptive statistic result showing that real exchange rate, inflation rate, interest rate and gross domestic product are asymmetrically distributed. Table 1 also shows positive Kurtosis meaning that all variables’ distribution is peaked in this paper.

| Table 1: Descriptive Statistics | ||||

| RER | INT | INF | GDP | |

| Mean | 47.046 | 6.06 | 8.256 | 4.995 |

| Median | 42.84 | 5.776 | 8.205 | 5.1 |

| Maximum | 82.7 | 34.75 | 25 | 7.28 |

| Minimum | 15.02 | -11.68 | 1 | 0.82 |

| Std. Dev. | 21.864 | 6.891 | 4.476 | 1.516 |

| Skewness | 0.1 | 1.16 | 1.309 | -0.55 |

| Kurtosis | 1.713 | 9.325 | 6.188 | 2.973 |

| Jarque-Bera | 2.968 | 79.454 | 29.795 | 2.121 |

| Probability | 0.226 | 0 | 0 | 0.346 |

| Sum | 1975.97 | 254.533 | 346.779 | 209.8 |

| Sum Sq. Dev. | 19600.2 | 1947.06 | 821.739 | 94.239 |

| Observations | 42 | 42 | 42 | 42 |

(Sources: Estimated)

Abbreviation: RER: Real Exchange Rate, INT: Interest, INF: Inflation Rate, and GDP: Gross Domestic Product.

From Table 2 Augmented Dikky Fuller (ADF) unit root test, it can be said that all these macroeconomic variables are stationary.

| Table 2: Augmented Dikky Fuller Test (ADF) Unit Root Test | |||

| Variable | C (constant) and T (trend) in the equation | ADF statistics | Optimum lag |

| RER | C and T | 0.2191 | 0 |

| INF | C and T | -2.6450 | 2 |

| INT | C and T | -6.2948 | 0 |

| GDP | C and T | -5.1620 | 0 |

(Source: Estimated)

By testing Johansen Test (Table 3) for co-integrating it has been estimated that at least there has 1 co integrating equation in this model, trace statistic and Max-Eigen statistics also support this co-integrating equation.

| Table 3: Johansen Test For Co-Integration | ||||||

| Hypothesized no. of CE(s) | Trace statistic | 0.05 critical value | Eigen value | Hypothesized no. of CE(s) | Max-Eigen statistics | 0.05 Critical value |

| None* | 63.380 | 47.856 | 0.557 | None* | 32.571 | 27.584 |

| At most 1 | 34.808 | 29.797 | 0.503 | At most 1 | 27.997 | 21.131 |

| At most 2 | 6.810 | 15.494 | 0.155 | At most 2 | 6.726 | 14.264 |

| At most 3 | 0.084 | 3.841 | 0.002 | At most 3 | 0.084 | 3.841 |

(Sources: Estimated)

Note: *denoted significance level at 5%.

From the Table 4 it can be said that there exist negative relationship among real exchange rate, interest rate, inflation rate and gross domestic product. Here is the retrieved co-integration equation.

| Table 4: Corresponding Adjustment Coefficients And Normalized Co-Integrating Vectors | ||||

| Variable | β coefficients | α Coefficients | Standard error | t-value |

| RER | 1.000 | -2.055 | . | . |

| INT | -1.494074 | 0.63441 | 0.46454 | -1.187139 |

| INF | -0.240334 | 0.89869 | 0.03905 | 0.014619 |

| GDP | -20.97145 | 2.09857 | 1.97101 | -20.80922 |

| Constant | -336.6601 | . | . | . |

rt=1.00-1.494 intt-0.240 inft-20.971GDPt-336.66?t (3)

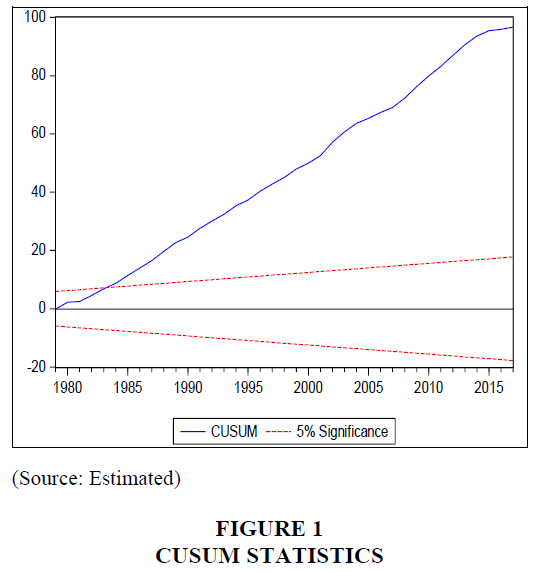

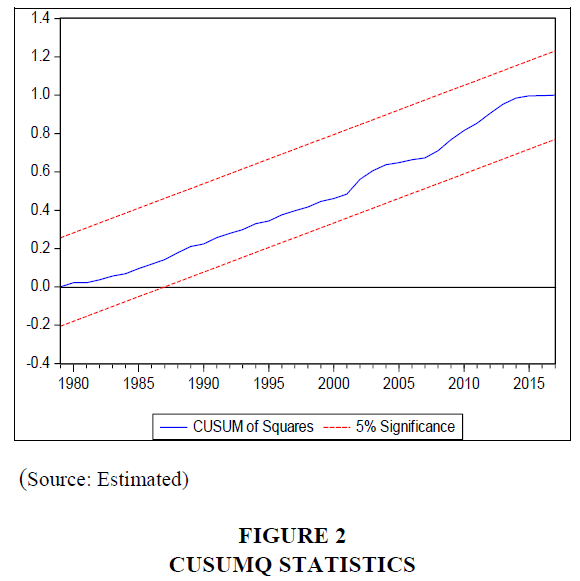

From Table 5, it is very clear that the relationship among all those macroeconomic variables were not stable during 1976-2017. From R-squared value it is worth of saying that the data sets is relatively good for this work. Here real exchange can be explained properly because F-Statistic is robust enough at 5% significant level (Figures 1 and 2).

| Table 5: Error Correction Representations | ||||

| Variable | Coefficient | Standard error | t-value | |

| Constant | 2.234194 | 0.47524 | 4.70124 | |

| D (RER (-1)) | 0.071307 | 0.17181 | 0.41502 | |

| D (RER (-2)) | -0.36684 | 0.16393 | -2.23773 | |

| D (INT (-1)) | 0.154652 | 0.08202 | 1.88563 | |

| D (INT (-2)) | 0.086830 | 0.05388 | 1.61161 | |

| D (INF (-1)) | 0.221646 | 0.15568 | 1.42376 | |

| D (INF (-2)) | 0.009421 | 0.10016 | 0.09407 | |

| D (GDP (-1)) | 0.460071 | 0.25479 | 1.80569 | |

| D (GDP (-2)) | 0.350432 | 0.24071 | 1.45582 | |

| D (RER) | D (INT) | D (INF) | D (GDP) | |

| R-squared | 0.302613 | 0.436741 | 0.671026 | 0.745258 |

| Adj. R-squared | 0.086183 | 0.261937 | 0.568931 | 0.666200 |

| Sum sq. resids | 104.6820 | 443.2848 | 139.5461 | 32.02753 |

| S.E. equation | 1.899928 | 3.909691 | 2.193612 | 1.050903 |

| F-statistic | 1.398202 | 2.498455 | 6.572554 | 9.426722 |

| Log likelihood | -74.59224 | -102.7363 | -80.19785 | -51.4978 |

| Akaike AIC | 4.338063 | 5.781348 | 4.625531 | 3.153732 |

| Schwarz SC | 4.764618 | 6.207903 | 5.052085 | 3.580286 |

| Mean dependent | 1.735385 | 0.378179 | -0.499436 | 0.005385 |

| S.D. dependent | 1.987502 | 4.550882 | 3.341078 | 1.818944 |

Discussion

In Bangladesh economy during the study period 1976-2017 Real exchange didn’t hold. The findings of this paper shows that still there have long run relationship among real exchange rate, interest rate, inflation rate and real gross domestic product. From Equation 3 it has found that the real exchange rate influenced by interest rate, inflation rate and real GDP. Equation 3 shows that if interest rate, inflation rate and real GDP go down then at a time real exchange goes down. In Bangladesh during the study period 1976-2017 the model of this paper was instable according to CUSUM, CUSUMQ Statistics and ECM (Chowdhury et al., 2014).

Conclusions And Policy Recommendations

This paper fully focused on determined and stability of Real exchange rate in Bangladesh during the year of 1976-2017. This study shows some new findings which can improve Bangladesh overall economic policy. From this study it can say that now government should focused to keep interest rate in moderate level for economic growth. On the other hand economic policy maker to keep inflation in stable level because if inflation goes down or goes up certainly then it would be create a big problem in short run also in long run. So we are highly hopeful that government of Bangladesh and Economic policy maker will give high concentrate in their new economic policy.

References

- Akther, M., Sarkar, M.M., & Md Saidjada, K. (2013). Sources of exchange rate fluctuations in Bangladesh. Research Department, Bangladesh Bank.

- Bhattarcharjee, D.H. (2015). Inflation in Bangladesh: An econometric investigation.

- Chowdhury, M.T.H., Bhattacharya, P.S., Mallick, D., & Uluba?o?lu, M.A. (2014). An empirical inquiry into the role of sectoral diversification in exchange rate regime choice. European Economic Review, 67, 210-227.

- Hassan, R., Chakraborty, S., Sultana, N., & Rahman, M.M. (2016). The impact of the real effective exchange rate on real export earnings in Bangladesh. Monetary Policy and Research Department, Bangladesh Bank.

- Hossain, M., & Ahmed, M. (2009). An assessment of exchange rate policy under floating regime in Bangladesh. The Bangladesh Development Studies, 27(4).

- Independent Review of Bangladeshs Development. (2018). In state of the Bangladesh economy in FY2017-18. Independent Review of Bangladesh’s Development (IRBD).

- Islam, T., & Hossain, M.T. (2014). Exchange rates and economic growth in Bangladesh: An econometric analysis. Trade and Development Review, 2(2), 79-92.

- Sultana, S., & Mohammad Saif Uddin CISA, F. (2013). Inflation, perspective Bangladesh: A trend analysis since independence.

- Uddin, K.M., Quaosar, G.A., & Nandi, D.C. (2013). Factors affecting the fluctuation in exchange rate of the Bangladesh: A co-integration approach. The International Journal of Social Sciences, 18.

- Williams, M., Barksdale, W., & Penkar, S. (2016). Bangladeshi real exchange rates and compettitive positions in export markets relative to the two asian largest countries, 10, 160-174.