Research Article: 2019 Vol: 18 Issue: 1

Strategic Investment Management and Formation of Investment Strategy of the Enterprise

Yuliia ?. Makarenko, Oles Honchar Dnipro National University

Sergii Kudlaienko, Vinnytsia Institute of Trade and Economics of Kyiv National University of Trade and Economics

Yuliia V. Roschyna, Crimean Federal University V.I. Vernadsky

Lesia Rudych, Poltava University of Economics and Trade

Inna Suray, National Academy of Public Administration under the President of Ukraine

Abstract

The article defines the process role of strategic investment management in the sustainable development of the enterprise and the importance of forming its open investment strategy. The main factors of influence on the investment strategy are substantiated and the model of development and implementation of the investment strategy of the enterprise is developed. The criteria for evaluating the effectiveness of the developed investment strategy of the enterprise are highlighted.

Keywords

Strategic Investment Management, Enterprise Investment Strategy, Enterprise Development, Investment Directions, Resource Potential.

JEL Classifications

M21

Introduction

Given the current crisis business conditions, the issues of formation of perspective directions of investment activity of the enterprises and, in particular, formation of an investment strategy (IS) become especially relevant. Strategic investment planning is an effective tool for solving this problem. At the present stage the implementation of the investment strategy at the enterprises is limited mainly by real investments. But with the development of the world investment market, the potentials of enterprises to improve their efficiency by expanding their investment activity are growing significantly.

Literature Review

A wide range of issues related to the formation and implementation of enterprise investment strategy has been reflected in the works Arnold (2010); Bodie et al. (2009); Gatzert & Kosub (2014). From the point of view of strategic management, an investment strategy is one of the functional strategies in the strategic set of the enterprise, that is, one of the supporting strategies determining the strategic orientation of the investment activity, which ensures it to achieve its goals. At the same time Aguiar & Reddy (2017); Delas et al. (2015); Jones (2010) refer investment strategy to “key” functional strategies together with innovation and financial strategies. In spite of the large number of works on the above mentioned issues, the issues related to the evaluation criteria and the process of formation of the investment strategy remain underdeveloped and contradictory (Drobyazko et al. 2019a & b).

Methodology

Investment strategy as part of the overall enterprise development strategy (functional strategy) is a system of long-term goals of investment activity and the selection of the most effective ways to achieve them. It is subordinate to the enterprise development strategy and should be consistent with its goals and directions. The long-term goals of the investment strategy imply its sensitivity to economic fluctuations and require adaptability to changes in the environment of the enterprise. However, an effective implementation of an investment strategy requires adaptation not when the changes have come and the company feels their negative impact, or notices the lost benefits and profits, but when they are only expected.

Findings and Discussion

We believe that the investment strategy is the main action plan of the enterprise in the sphere of its investment activity, which determines the priorities of its directions and forms, the nature of formation of investment resources and the sequence of stages of implementation of long-term investment goals that ensure the effective development of the enterprise. The rating of the investment attractiveness of the enterprise ranges from favorable to unfavorable. A favorable rating promotes active investor activity, stimulates capital inflows, and an unfavorable rating increases the risk for investors by slowing down investment activity (Mishkin & Eakins, 2012). The main factors influencing investment strategies are presented in Table 1.

| Table 1 The Main Factors Influencing Investment Strategies | |

| Factors | Indicators revealing the essence |

| Workforce | Number of economically active population, unemployment rate, income of employees, qualification level of staff. |

| Production and technical facilities | Basic production assets, capacity utilization level, age of equipment, measure of depreciation of fixed assets. |

| Scientific and technical potential | Volumes of investments directed to the development of economy, including foreign ones. Level of investment risks. State of the technical equipment of production, use of innovations and development of R&D. |

| Financial credit system | Tax and credit policy, level of profitability and cost effectiveness, enterprises of the real sector of economy. Pricing policy and pricing system. |

| Infrastructure | State of development of banking system, reliability of transport network, telecommunication networks, commodity and stock exchanges, marketing, consulting services, insurance industry. |

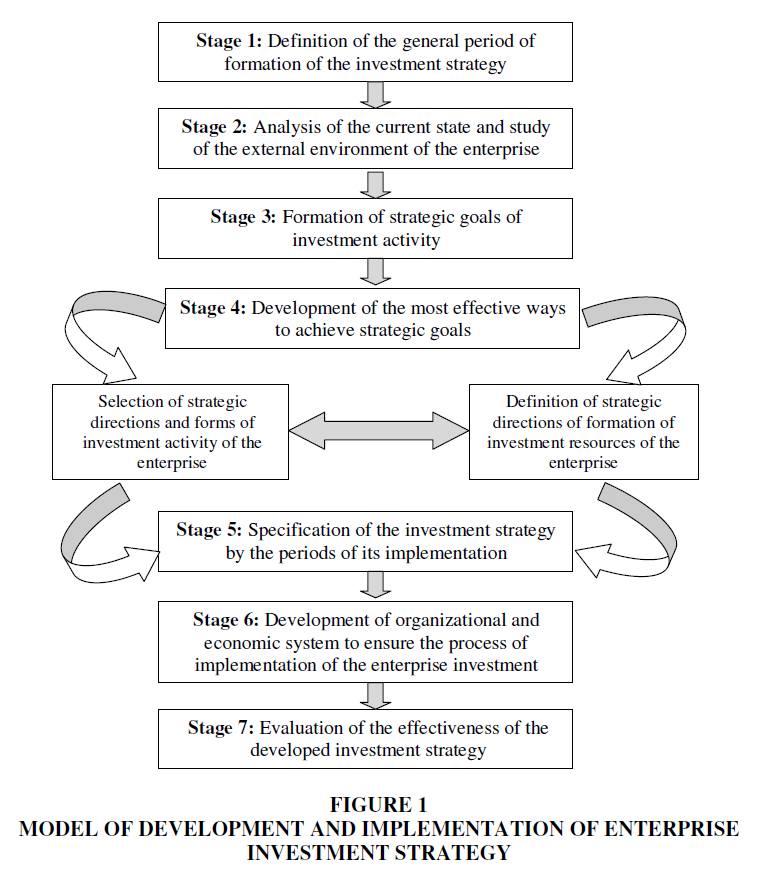

The selection of an investment strategy is related to search and evaluation of alternative investment solutions that are most relevant to the purpose of the enterprise and perspectives of its development. There are a number of factors that influence the selection of an investment strategy of the enterprise, namely: stage of the life cycle of the enterprise; general enterprise development strategy; state of foreign and domestic markets of investment resources; investment attractiveness of the enterprise as an investment object and the like (Severinson & Yermo, 2012). The investment strategy development process includes the stages shown in Figure 1.

The above sequence and content of the main stages of the investment strategy development of the enterprise as a whole reflect the generally accepted principles in economic science and methodological approaches. It is clear that unreasonable investment does not yet guarantee the enterprise market success if there is no coherence in the investment sector, which is based on the investment strategy. At the same time, the investment strategy is based on the overall economic development strategy of the enterprise and should be consistent with it by the goals and stages of development. Taking into account the relationship of investment strategy with other components of the strategic set will greatly improve the effectiveness of its development (Barnea, et. al. 2005).

When specifying the IS by the periods of its implementation, external synchronization is envisaged, which implies consistency in the timing of IS implementation with the overall economic development strategy of the enterprise, with predictable changes in the investment market conditions, as well as internal synchronization, which implies consistency in the timing of the implementation of individual investment directions with the formation of the necessary investment resources (Galbreath & Galvins, 2008).

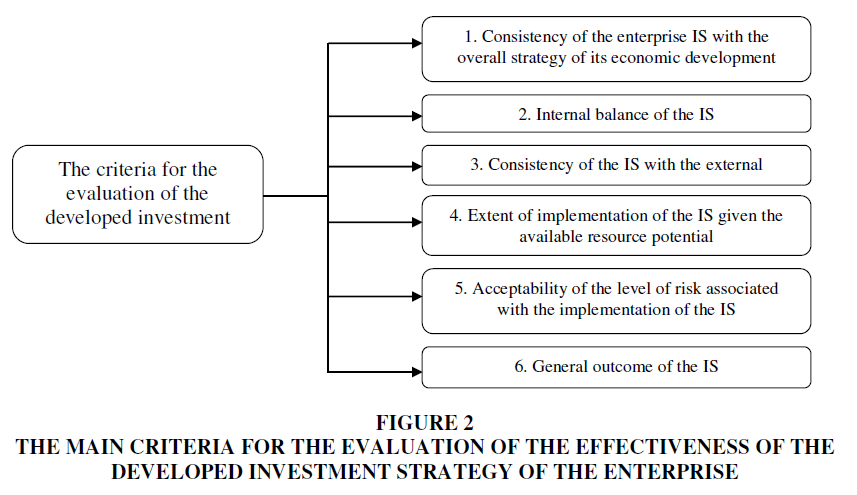

The developed IS is evaluated based on the criteria (Figure 2). When the IS of the enterprise is aligned with the overall strategy of its economic development, the consistency of goals, directions and stages of implementation of these strategies is examined.

Figure 2 The main criteria for the Evaluation of the Effectiveness of the Developed Investment Strategy of the Enterprise

When assessing the internal balance of the IS, the degree of consistency of individual strategic goals and directions of investment activity, as well as the sequence of their implementation and the acceptable timeframe for the implementation of the investment strategy are determined.

When the IS is aligned with the external environment it is determined how the developed IS is sensitive to the projected changes in the economic development and investment climate of the country, as well as the conditions of the investment market.

Developed Investment Strategy of the Enterprise

When assessing the implementation possibilities of the IS with consideration for the available resource potential, the potential of the enterprise in the formation of all necessary resources – financial, labor, technological, energy, etc. – is considered (Francis & Ibbotson 2002).

When assessing the acceptability of the risk level associated with the implementation of the IS, the levels of the main investment risks and their possible financial and business consequences for the enterprise, as well as the absence of significant obstacles to the implementation of the IS are considered. The evaluation of the effectiveness of investment programs is based, first of all, on determining the economic efficiency of their implementation (Karpenko et al., 2018; Umar et al., 2018). Additionally, non-economic results are also evaluated, i.e. improving the image of the enterprise, improving the working conditions of its employees, the prestige of economic zones proposed by the strategy, etc.

The relevance of the development of the investment strategy of the enterprise in the current economic crisis conditions is due primarily to significant changes that have occurred and are occurring in the external environment of business entities. In such circumstances it becomes impossible to manage the investment activity of enterprises only by using the traditional theoretical and methodological foundations of investment management. It is necessary to develop the basics of adaptive management of this area of activity of the enterprise.

Recommendations

We believe that an important condition that determines the relevance of the development of investment strategy of enterprises is its adequacy to the stage of the life cycle of the enterprise. From this perspective, the investment strategy will allow to adapt the investment activity of the enterprise to the possible drastic changes in its economic development. At the same time, the changes in the goals of operational activity of the enterprise caused by the diversification of production also determine the relevance of the development of investment strategy. In order to avoid a period of “recession”, in which, as a worst case scenario, the liquidation phase may occur, it is necessary to diversify the activity of the enterprise in time, that is, to refrain from the non-profit activities. The appropriate diversification of the forms of investment activity of the enterprise under these conditions should be forecasted and optimally balanced taking into account the resource potential of the enterprise, which will be ensured by the development of an effective investment strategy.

Conclusion

The growth of uncertainty in the context of periodic global financial and economic crises causes an increase in the role of investment strategy in ensuring the effective development of the enterprise. The process of developing an investment strategy is an important part of the overall system of strategic management of the enterprise. Taking into account the relationship of investment strategy with other components of the strategic set of the enterprise will significantly increase the effectiveness of its development. The formation of the investment strategy should be based on a comprehensive analysis of the features of the external economic and legal environment, the specifics of the industry and the internal features of the enterprise.

References

- Aguiar, E., & Reddy, Y.V. (2017). Corporate diversification on firm's financial performance: An empirical analysis of select FMCG companies in India.

- Arnold, G. (2010). Investing: the definitive companion to investment and the financial markets. Financial Times. New Jersey: Prentice–Hall.

- Barnea, A., Heinkel, R., & Kraus, A. (2005). Green investors and corporate investment. Structural Change and Economic Dynamics, 16(3), 332-346.

- Bodie, Z., Kane, A., & Marcus, A.J. (2005). Investment. Six Edition.

- Delas, V., Nosova, E., & Yafinovych, O. (2015). Financial security of enterprises. Procedia Economics and Finance, 27, 248-266.

- Drobyazko, S., Barwi?ska-Ma?ajowicz, A., ?lusarczyk, B., Zavidna, L., & Danylovych-Kropyvnytska, M. (2019a). Innovative entrepreneurship models in the management system of enterprise competitiveness. Journal of Entrepreneurship Education.

- Drobyazko, S., Okulich-Kazarin, V., Rogovyi, A., & Marova, S. (2019b). Factors of influence on the sustainable development in the strategy management of corporations. Academy of Strategic Management Journal.

- Francis, J.C., & Ibbotson, R.G. (2002). Investments: a global perspective. Prentice Hall.

- Galbreath, J., & Galvin, P. (2008). Firm factors, industry structure and performance variation: New empirical evidence to a classic debate. Journal of Business Research, 61(2), 109-117.

- Gatzert, N., & Kosub, T. (2016). Insurers’ investment in infrastructure: Overview and treatment under Solvency II. In The Geneva Papers. Palgrave Macmillan, London.

- Jones, C.P. (2010). Investments: Principles and concepts. Wiley.

- Karpenko, L.M., Serbov, M., Kwilinski, A., Makedon, V., & Drobyazko, S. (2018). Methodological platform of the control mechanism with the energy saving technologies. Academy of Strategic Management Journal, 17(5), 1-7.

- Mishkin, F.S., & Eakins, S.G. (2012). Financial markets and ?nstitutions. Essex: Pearson Education Limited.

- Severinson, C., & Yermo, J. (2012). The effect of solvency regulations and accounting standards on long-term investing.

- Umar, A., Sasongko, A.H., & Aguzman, G. (2018). Business model canvas as a solution for competing strategy of small business in Indonesia. International Journal of Entrepreneurship.