Research Article: 2022 Vol: 21 Issue: 3

Strategic Management of Carbon Footprint Using Carbon Collectible Non-Fungible Tokens (NFTS) on Blockchain

Sumit Kumar, Indian Institute of Management Kozhikode

Citation Information: Kumar, S. (2022). Strategic management of carbon footprint using carbon collectible non-fungible tokens (NFTS) on blockchain. Academy of Strategic Management Journal, 21(S3), 1-9.

Abstract

The market for non-fungible tokens (NFTs) has exploded in recent years. The majority of the NFTs currently in the market are either related to art collectibles or gaming, but the role of NFTs can be extended to various aspects of life. One such application is Carbon Collectibles Non-Fungible tokens (CCNFTs). In the present paper, we examined the development of the NFT market in general and CCNFTs. We reviewed the possibility of CCNFT as an instrument to manage the carbon footprint. We concluded that the growth of NFT might be strategically used to mitigate carbon footprint by offering economic benefits to the landowner with forest land. This is the basic premise on which CCNFTs are designed. This provided the conceptual framework for Carbon Collectible Non-Fungible Tokens (CCNFTs). We also found that CCNFTs follow a trading standard in structure and pricing. Therefore there is enormous potential to trade it in a Blockchain marketplace for value creation and ESG factor integration into the investment portfolio.

Keywords

NFTs, Blockchain, Ethereum, ESG, Carbon Footprint, Bitcoin, Cryptocurrency.

Introduction

A General Introduction of Bitcoin and Market

As the acceptance of Bitcoin is getting increased, its adverse effect is to the environment has become a new topic of debate. Bitcoin trading has gained momentum, and as an asset, bitcoin has given excellent returns during the Covid time. At the hourly frequency, Urquhart & Zhang (2019) examine Bitcoin's risk diversification features and find it functions as a hedge, diversifier, and safe haven for several other currencies. According to Guesmi et al. (2019), using Bitcoin in a portfolio of gold, oil, and emerging market stocks reduces portfolio risk significantly. The potential of giving better returns with an ability to diversify risk has made bitcoin one of the more sought-after investments.

With the increase of bitcoin trading and the acceptability of bitcoin in a digital transaction increased, the necessity of more bitcoin mining (Lewis, 2014) shoots up. Bitcoin mining is complex (Aljabr et al., 2019), with very high electricity consumption (Bitcoin Mining Council, 2021). There is a quest for alternative energy for bitcoin mining (Kumar & Baag, 2021a).

Fungible and Non-Fungible Tokens

Tokens (E&Y, 2018) reign supreme in the cryptocurrency industry. A token is an object that serves as a physical representation of information or a characteristic, and it can be something of value. Tokens are not confined to a single function; instead, they can play various roles in their native environment. Tokens can be used for multiple purposes, such as a conduit to decentralized apps "DApps" (MetCalfe, 2020). Furthermore, they may empower the holders to certain voting privileges. Fungible tokens are interchangeable, and monetary systems are an example of fungible assets. The rising popularity of “Crypto Kitties”, a virtual cat collector game, has propelled non-fungible tokens into the mainstream.

Fungible tokens:Blockchain is the ideal technology for managing all forms of digital assets due to its decentralization, security, and immutability. This would not be feasible without such transferable tokens. For cryptocurrencies, such tokens are great to help for their fungibility feature, and in fact, fungibility is a critical element of any currency. Tokens of this type are constructed in such a way that each fraction of a token is equal to the next. For example, Bitcoin, the most widely used cryptocurrency, is fungible, meaning that one Bitcoin is equivalent to another Bitcoin and all other Bitcoins. It is presumed that such tokens are interchangeable and divisible. To put it another way, these are cryptographic tokens that are nearly identical or uniform and maybe interchanged freely with other fungible tokens of the same type. Such tokens are related to the things we use on a daily basis, and they apply to both real-world and digital assets.

Non-Fungible tokens (NFTs): Non-fungible tokens are distinct from fungible tokens in that they constitute specific collectible items. They're one-of-a-kind since they can't be divided or exchanged for other non-fungible tokens of the same sort. NFTs can be thought of as non-fungible tokens that provide several unique uses for blockchain technology. An NFT is a digital certificate of ownership, which could be for any underlying asset (KPMG, 2021). Three striking differences between Fungible and Non-Fungible tokens are summarized in the Table 1 below.

| Table 1 Comparison of Fungible and Non-Fungible Tokens (Author's Depiction) | |

| Fungible Token | Non-Fungible Token |

| Exchangeable | Not Exchangeable |

| Divisible | Non-Divisible |

| Uniformity | Uniqueness |

Non-fungible tokens (NFTs) can be used in a variety of contexts. Such tokens can be utilized to generate entirely new forms of collectibles. Application of NFTs can be extended in Art Collections, Unique Property Ownership, Voter ID Cards and other forms of ID cards, Reward Programs, Copyright on innovation inventions and Patents, Medical track record, etc. A digital artist is known as "Beeple" had sold an NFT of his artwork for $69 million (The Verge, 2021). NFTs are applicable in various walks of life, and almost everything that is preservable can be represented with NFTs. In recent years, the Non-Fungible Token (NFT) industry has exploded and is expected to increase. The notion of NFT was inspired by an Ethereum token standard that aimed to distinguish each token using distinct signatures. NFTs are different from cryptocurrencies because they are pure assets with no fungibility, making them specific and peculiar (Dowling, 2021). As its unique identifiers, this sort of token can be coupled with virtual/digital attributes (Wang et al., 2021; Nadini et l., 2021).

The NFT Market

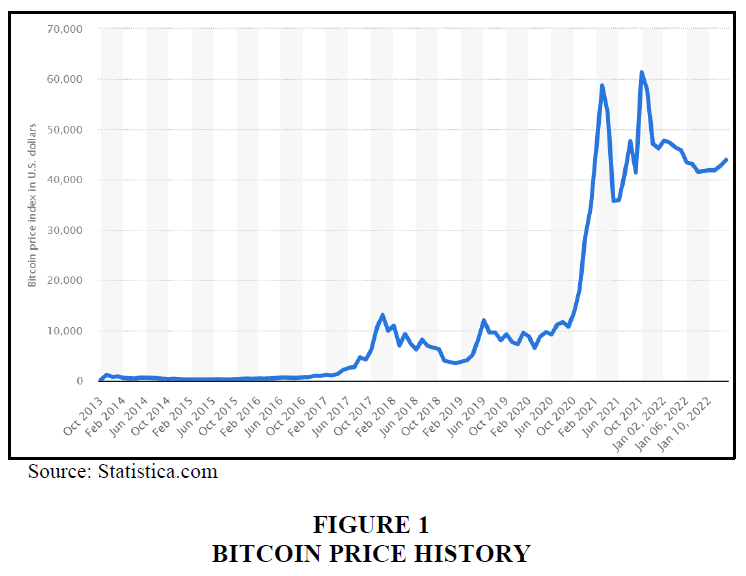

The NFT market has really grown by leaps and bounds in the last few years. The NFT market divides traded products into collections based on their common characteristics. Art, Collectibles, Games, Metaverse, Other, and Utility are the most common categories for collections (Nandini et al., 2021). The current NFT market comprises “Art and Collectibles” and “Gaming.” Weekly NFT Sales have surpassed the one million mark (Figure 1).

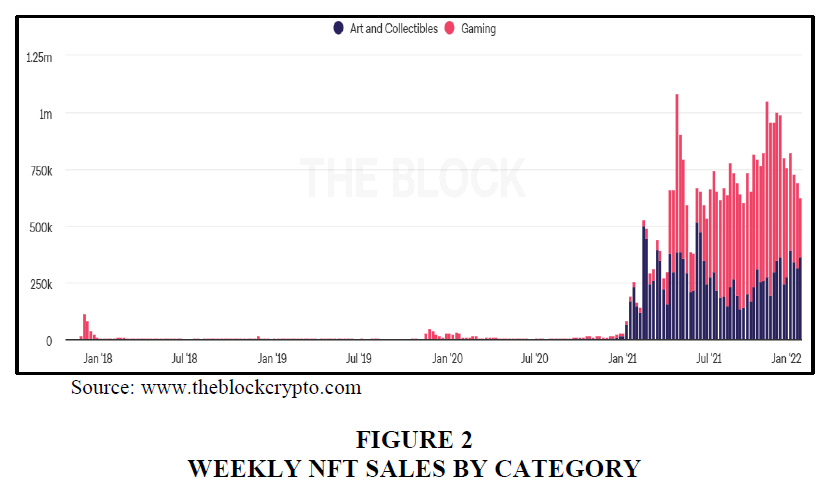

Due to its inherent property of preserving values of the art collectibles, the demand for NFTs has surged. The Art auction seems to have been gyrated towards NFT based transactions (The Verge, 2021). As a result, we can also see the dramatic increase in the trade volume of these NFTs. As we can notice in Figure 2, the NFTs of Art and collectibles have shot up at the start of this year 2022. A tight bid and ask to spread also explain its liquidity in the market (George & Longstaff, 1993). NFT has received more trading interest than some of the cryptocurrencies.

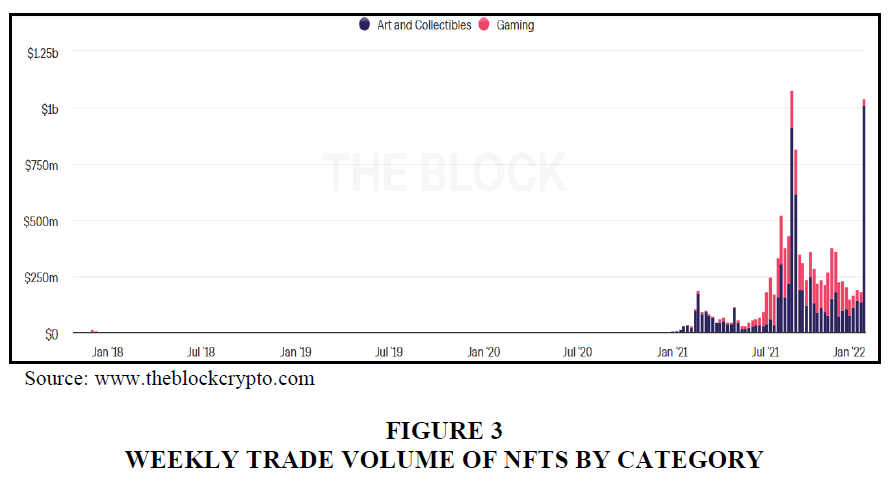

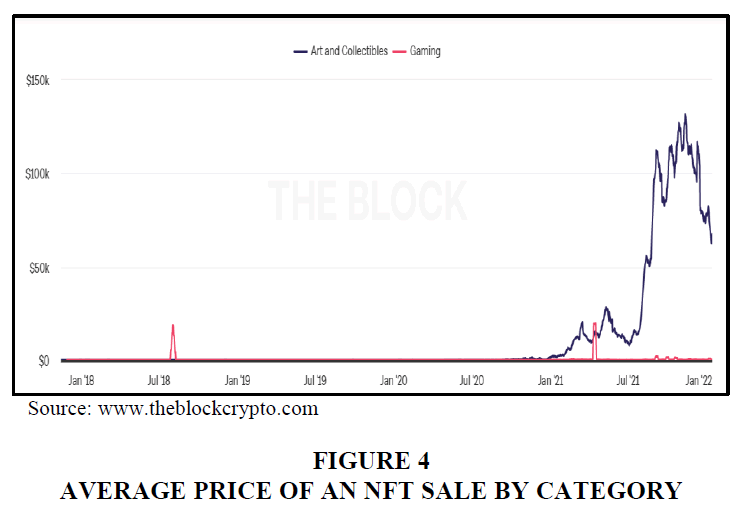

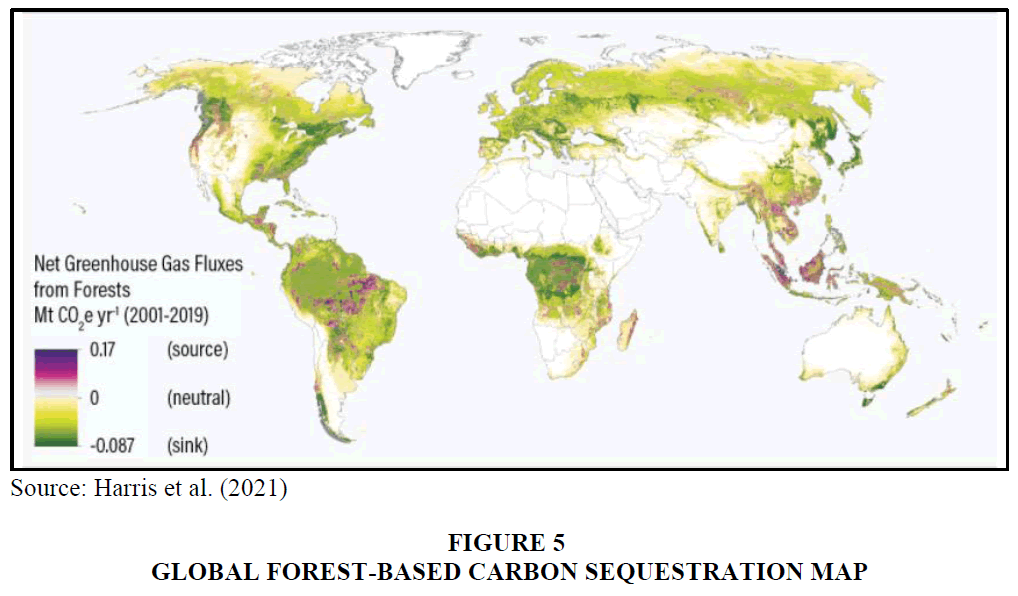

Demand and Supply govern the equilibrium price of a traded object. A price surge starting in the mid of last year (July 2021) indicates the demand for NFT in the market. The average price of the regular NFT even touched USD 130K (Figure 3). Some researchers believe there is a direct relationship between the cryptocurrency market and the NFT market. Some of the research outcomes reveal that the cryptocurrency market affects the development and growth of the NFT market, but vice-versa has not been observed yet (Ante, 2021). NFT market has also instilled some confidence in the investors and traders. In another research, the risk and return characteristics of NFT-based companies listed on the cryptocurrency market are investigated. This research demonstrates that the NFT portion of the cryptocurrency market leads market recovery after the fall in mid-2021, with a return of about 350 percent. In the final analysis of the study, this research also discovers that integrating NFT infrastructure into existing blockchains raises the market value of these networks. NFTs enable new ways to organize, consume, move, program, and store digital data and have seen rapid adoption in fields such as art, athletics, broadcasting, content creation, and tech-crypto business (Wilson et al., 2021). Non-fungible Tokens (NFTs) have recently attracted a lot of investor interest, with some NFTs achieving selling prices that were previously unfathomable for a non-fungible virtual asset (Chohan, 2021). This is also depicted in the rising average price, as shown in Figure 4 and Figure 5.

During dangerous periods, such as the COVID-19 crisis, and especially during the huge March 2020 market fall, NFTs may provide diversification benefits (Aharon & Demir, 2021). The total value of NFT sales across several blockchains reached about 2.5 billion dollars in the first half of 2021, compared to only 95 million dollars in 2020. In the first two quarters of 2021, sports and collector NFTs are the most popular categories (Howcroft, 2021). This could also let the investor throng upon NFTs in the search for safe harbor.

Sustainability Debate and NFTs

NFTs (like all cryptocurrencies) have a significant environmental impact. To ensure that the encryption is valid, NFT transactions must be confirmed using Blockchain, which requires a lot of energy. Bitcoin is blamed for being one of the biggest hurdles towards sustainability (Lanteri & Rattalino, 2021). NFTs promises exclusivity and substantial returns for digital creatives and investors; nonetheless, they bring unique risks to artists, are systemically exploitable, represent significant environmental damage, and are thus unsustainable in the long run (Kastrenakes, 2021; Khawaja, 2021). Research suggests that Ethereum, which is the skeletal basis of NFT (Dowling, 2021), presently consumes 58.49 TWh of electricity (equivalent to Uzbekistan's power usage) and emits 27.78 Mt of CO2 (equivalent to Syria's carbon footprint), which is dangerous ( GBBC, 2021), and an impediment to sustainability goals as set United Nation sustainability development goals (UNSDG, 2030). Since the complex is involved in the generation and mining, there is no authentic research on the carbon impact of NFTs. There are very few scientific peer-reviewed publications on the subject, making it difficult to determine the carbon footprint of minting NFTs. Still, since it's mainly based on Ethereum, we can guess some rough estimates. A single Ethereum transaction has a carbon footprint of 33.4 Kg CO2, according to Digiconomist (Digiconomist, 2020), while an average transaction for NFTs has a carbon footprint of roughly 48 kg CO2, according to Memo Akten, an artist and programmer. It's important to remember that each time an NFT is minted or sold, it's a separate transaction. According to their calculations, a single NFT transaction has a carbon footprint that is more than 14 times that of sending an artwork, which Quartz estimates to be 2.3 Kg CO2. Despite the uncertainties in the calculations, this information is sufficient to determine if a large carbon footprint is acceptable for the act of selling art. The fundamental reason for the high energy consumption of blockchains like Ethereum and Bitcoin is that they use a technique called Proof-of-Work (PoW), which is a power-consuming technique. Researchers are proposing the use of a blockchain with a different system, such as Proof-of-Stake, as an alternative (PoS). Tezos, Symbol, and Polygon (all three allow NFTs) are PoS blockchains that do not require a lot of computing power and so use a lot less electricity. Tezos claims that their Blockchain uses only 0.00006 Twh of energy per year, compared to 33.57 Twh for Ethereum (Earth.org, 2021).

Carbon Collectible Nfts and Carbon Footprint Reduction

Carbon sequestration via afforestation/reforestation: Carbon offsets are mechanisms that allow people and organizations to “offset” carbon dioxide (CO2) and other greenhouse gas-emitting actions (such as air travel) by supporting mitigation measures (such as landfill methane capture) elsewhere (Kim & Pierce, 2018). Carbon offset activities/ Projects may involve the development of renewable energy projects, capture and potency of GHG (Green House Gases), reducing deforestation and encouraging afforestation, etc. The use of forestry to mitigate global climate change was initially proposed in the 1970s (Dyson, 1977). The method of trapping and storing atmospheric carbon dioxide is known as carbon sequestration. It is one way of lowering carbon dioxide levels in the atmosphere with the purpose of slowing global warming.

Diplomatic efforts did not examine this possibility till the late 1990s when they pushed for a conceptualization and measurement of the importance of forests, as well as a framework for international collaboration. As a result of widespread concern over global warming, the Framework Convention on Climate Change (FCCC) was adopted in 1992. The Convention aims to limit human-caused disruptions to the global climate system by stabilizing greenhouse gas concentrations in the atmosphere. The industrialized and developing countries that are parties to the FCCC (Annex 1 Parties) agreed to conduct national inventories of greenhouse gas emissions and carbon sinks, as well as work toward voluntary emission reduction targets. The Kyoto Protocol to the Framework Convention on Climate Change was agreed upon at the third meeting of the Conference of the Parties, which took place in Kyoto, Japan, in December 1997. Thirty-nine industrialized countries (including a significantly updated list of Annex 1 Parties) committed to cutting greenhouse gas emissions by at least 5% between 2008 and 2012 compared to 1990 levels. Parties can meet this commitment by lowering greenhouse gas sources or conserving or improving greenhouse gas sinks. Changes originating from direct human-induced land-use change and forest operations, limited to afforestation, reforestation, and avoidance of deforestation, are included in the Kyoto Protocol. The carbon sequestration potential of afforestation/reforestation varies greatly depending on the species, location, and management practices used. In tonnes of Carbon per hectare per year, typical afforestation/reforestation rates are 0.8 to 2.4 tonnes in boreal forests, 0.7 to 7.5 tonnes in temperate zones, and 3.2 to 10 tonnes in the tropics (Brown et al., 1996).

Relation between the CO2 Footprint of Ethereum and Carbon Sequestration by the Forest

As per the Ethereum Energy Consumption Index (EECI), the total energy required by all Ethereum transactions annually is 106.99 TWh (Terawatt Hour), and the carbon footprint it generates is 50.82 Mt of CO2. A single Ethereum transaction generates 115.26 Kg of CO2 as a carbon footprint. According to a recent study (Harris et al., 2021 ), between 2001 and 2019, the world's forests stored about twice as much carbon dioxide as they released. In other words, forests act as a “carbon sink,” absorbing a net 7.6 billion metric tonnes of CO2 each year, 1.5 times the amount of CO2 emitted by the United States.

Forests may trap up to 11 tonnes of CO2 per hectare per year in above-ground Carbon and extra Carbon below ground in regions where they are most productive (i.e., subtropical and tropical climates), and this number can easily increase by better forest management (Mendelsohn et al., 2012).

Conceptualization of Carbon Collectibles

As we have noted in the previous section, around 11 Tonnes of CO2 can be completely absorbed by 1 hectare of forest land, which means 5 hectares of forest land can negate the carbon footprint of the entire Ethereum transaction per annum. The primary reason for deforestation is to generate economic benefits from the land. Most of the time deforestation happens to increase the agricultural land. It is possible that if counterbalance the economic benefit of deforestation by incentivizing the reforestation or preservation of forest with better forest management, we might find people who will be happy to own the forest. Research (Mendelsohn et al., 2012) quantifies the economic benefit of holding the forest and preserving it from deforestation. It concluded that forest owners would be prepared to sequester around 4 billion tonnes of extra CO2 in forests each year if they were compensated $30 per tonne of CO2 permanently stored. Reduced deforestation, 31 percent forest management, and 27 percent afforestation might contribute to around 42 percent of this carbon storage in an effective program. Because new trees take a long time to acquire Carbon and because forestland has a high opportunity cost, afforestation accounts for only a small portion of the increased carbon storage. Around 70% of carbon sequestration should occur in tropical regions in an effective scheme (developing economies). Over 80% of the world's forest carbon is concentrated in only 20 countries. The five greatest carbon-storing countries (Brazil, Canada, the Democratic Republic of Congo, Russia, and the United States) were included in the category, as are Indonesia, Malaysia, and other South American and African countries that are responsible for the majority of world deforestation.

Forest owners might be ready to store much more Carbon if they were paid substantially more than $30 per tonne of CO2. It's also true that given a longer time, trees may store more Carbon. Programs like afforestation grow more successful with time. With a final price of US$50 per tonne CO2, roughly 367 billion tonnes of CO2 might be stored in forests by 2100, representing about 25% of the total abatement throughout this time. By 2100, nearly 1.4 trillion tonnes of CO2 could be stored at the cost of US$110 per tonne (Sathaye et al., 2007). After around ten years, trees are projected to absorb 48 pounds of CO2 per year, indicating that they have reached their most productive stage of carbon storage (About 8.5 MTs of CO2 per acre per year). They're releasing enough oxygen back into the atmosphere to support two people at that pace. One metric ton of CO2 is equal to one voluntary carbon offset. According to this model, one acre of mature trees offers a carbon sequestration value equivalent to around 8.5 voluntary carbon credits. That works up to about 20 carbon offsets per acre.

Carbon Collectible NFT as an Asset

Carbon Collectibles work in a very similar way. It is NFT based reward of holding and promoting forest land in a given geography and measurement. Carbon collectibles NFT are available to purchase. The customer will obtain virtual and digital rights to a1 one hectare of mature forests by purchasing carbon collectibles. This covers mixed reality rights as well as carbon sequestration rights based on satellite photography. On the Polygon Blockchain, the digital rights related to the carbon collectible NFTs are tracked (Carbon Collectible NFTs, 2021).

Every Carbon NFT has a validity period of one to ten years. Current owners of NFTs can extend them by submitting the subscription price before the expiration date. Any NFTs that are not extended by the current owner will be reverted to the pool for resale, culminating in a Carbon Collectible Non-Fungible (CCNFT) market. In a private exchange, any existing owner can sell their NFT to a new owner. The history of the NFT will be transferred to the future owner through a private transaction. A single purchase order might be as little as one unit (1 NFT for one year) or as large as 1000 units (100 NFTs each for ten years). So, we can see that the Carbon Collectible NFTs are very similar to any asset that can be traded in the market. Since Carbon collectibles can be a pivotal asset that can help reduce carbon footprints, it is expected to provide a more inclusive return to the shareholder along with other stakeholders. Stakeholder's theory (Reference) of asset return ensures the return to all the stakeholders, and ESG performance of a firm or traded entity is a measure of stakeholder's theory (Kumar & Baag, 2021b). We can conclude that Carbon Collectible NFTs are assets under stakeholder theory, and they can create values for all the stakeholders.

Conclusion

NFT (Non-Fungible Token) market has seen tremendous growth over the last couple of years, especially from mid of last year. When most of the investment was down, NFTs provided a safe passage from the “Risk and Diversification” perspective. The growth of NFT can be utilized strategically to manage carbon footprint by providing economic benefit to the owner of the forest land without deforesting it. This gave the conceptualizing thought behind Carbon Collectible Non-Fungible Tokens (CCNFTs). These NFTs have set criteria and standard format to be called an entity that can be traded privately or in a Blockchain marketplace. These Carbon Collectible NFTs have a direct relationship with the carbon footprint. Being the NFT of forested land, it will also be in demand for the investors who want to factor in ESG components to their investment. Overall, we highlighted the concepts and potential of Carbon Collectibles in managing Carbon Footprint as well as providing return and value creation for stakeholders.

References

Aljabr, A.A., Sharma, A., & Kumar, K. (2019). Mining process in cryptocurrency using blockchain technology: Bitcoin as a case study. Journal of Computational and Theoretical Nanoscience, 16(10), 4293-4298.

Indexed at, Google Scholar, Cross Ref

Ante, L. (2021). The non-fungible token (NFT) market and its relationship with Bitcoin and Ethereum.

Indexed at, Google Scholar, Cross Ref

Bitcoin Mining Council. (2021). Global Bitcoin mining data review, Q2 2021.

Brown, S., Sathaye, J., Cannell, M., & Kauppi, P.E. (1996). Mitigation of carbon emissions to the atmosphere by forest management. The Commonwealth Forestry Review, 75(1), 80-91.

Carbon Collectible NFTs. (2021). Carbon Collectible NFTs Releases More Details About Their Carbon Offset Mission. Retrieved from https://www.marketwatch.com/press-release/carbon-collectible-nfts-releases-more-details-about-their-carbon-offset-mission-2021-12-22

Chohan, U.W (2021). Non-Fungible Tokens: Blockchains, Scarcity, and Value. Critical Blockchain Research Initiative (CBRI) Working Papers.

Digiconomist. (2020). Ethereum energy consumption index. Retrieved from https://digiconomist.net/ethereum-energy-consumption/

Dowling, M. (2021). Is non-fungible token pricing driven by cryptocurrencies?. Finance Research Letters, 102097.

Indexed at, Google Scholar, Cross Ref

Dyson, F.J. (1977). Can we control the carbon dioxide in the atmosphere?. Energy, 2(3), 287-291.

Indexed at, Google Scholar, Cross Ref

E&Y. (2018). Tokenization of Assets, Decentralized Finance (DeFi).

Earth.org. (2021). What are NFTs, and what us their Environmental Impact?.

GBBC. (2021). Overview of Non-Fungible Tokens (NFTs), 4Q 2020-2Q 2021, Global Blockchain Business Council.

George, T.J., & Longstaff, F.A. (1993). Bid-ask spreads and trading activity in the S&P 100 index options market. Journal of Financial and Quantitative Analysis, 28(3), 381-397.

Indexed at, Google Scholar, Cross Ref

Guesmi, K., Saadi, S., Abid, I., & Ftiti, Z. (2019). Portfolio diversification with virtual currency: Evidence from bitcoin. International Review of Financial Analysis, 63, 431-437.

Indexed at, Google Scholar, Cross Ref

Harris, N.L., Gibbs, D.A., Baccini, A., Birdsey, R.A., De Bruin, S., Farina, M., Fatoyinbo, L., Hansen, M.C., Herold, M., Houghton, R.A., & Tyukavina, A. (2021). Global maps of twenty-first century forest carbon fluxes. Nature Climate Change, 11(3), 234-240.

Howcroft, E. (2021). NFT Sales Volume Surges to $2.5 Bn in 2021 First Half.

Kastrenakes, J. (2021). Beeple sold an NFT for $69 million.

Khawaja. (2021). NFT Research Essay. Are NFTs the future of digital art?

Kim, R., & Pierce, B.C. (2018). Carbon offsets: An overview for scientific societies.

Kumar, S., & Pankaj, B. (2021a). ESG performance of a firm is a measure of stakeholder’s theory.

Kumar, S., & Pankaj, B. (2021b). An impact on sustainability from the mining of bitcoin: A case assessment of the use of geothermal power in bitcoin mining and its socio-economic impact.

Lanteri, A., & Rattalino, F. (2021). Bitcoin must become more sustainable, for its own good (as well as the planet’s).

Lewis, A. (2014). A gentle introduction to bitcoin mining, brave new coin. Digital Currency Insights.

Mendelsohn, R., Sedjo, R., & Sohngen, B. (2012). Forest carbon sequestration. In Fiscal Policy to Mitigate Climate Change. International Monetary Fund.

Metcalfe, W. (2020). Ethereum, Smart Contracts, DApps. In Blockchain and Crypt Currency (pp. 77-93). Springer, Singapore.

Nadini, M., Alessandretti, L., Di Giacinto, F., Martino, M., Aiello, L.M., & Baronchelli, A. (2021). Mapping the NFT revolution: market trends, trade networks and visual features.

Indexed at, Google Scholar, Cross Ref

Sathaye, J., Najam, A., Cocklin, C., Heller, T., Lecocq, F., Llanes-Regueiro, J., Pan, J., Petschel-Held, G., Rayner, S., Robinson, J., & Winkler, H. (2007). Sustainable development and mitigation. In Climate Change 2007: Mitigation of Climate Change (pp. 691-743). Cambridge University Press.

Urquhart, A., & Zhang, H. (2019). Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. International Review of Financial Analysis, 63, 49-57.

Indexed at, Google Scholar, Cross Ref

Wang, Q., Li, R., Wang, Q., & Chen, S. (2021). Non-fungible token (NFT): Overview, evaluation, opportunities and challenges.

Indexed at, Google Scholar, Cross Ref

Wilson, K.B., Karg, A., & Ghaderi, H. (2021). Prospecting non-fungible tokens in the digital economy: Stakeholders and ecosystem, risk and opportunity. Business Horizons.

Indexed at, Google Scholar, Cross Ref

Received: 15-Jan-2022, Manuscript No. ASMJ-22-10876; Editor assigned: 16-Jan-2022, PreQC No. ASMJ-22-10876(PQ); Reviewed: 23-Jan-2022, QC No. ASMJ-22-10876; Revised: 27-Jan-2022, Manuscript No. ASMJ-22-10876(R); Published: 31-Jan-2022