Research Article: 2020 Vol: 19 Issue: 3

Strategic Management of the Implementation of Potential Corporate Restructuring Projects

Yurji Arsenyev, Tula of Branch RANEPA

Elvira Danilova, National Aviation University

Zorina Shatskaya, Kyiv National University of Technologies and Design

Oksana Osetrova, Oles Honchar Dnipro National University

Yuliia Dzhepa, Sumy National Agrarian University

Abstract

The article is devoted to the scientific problem of applying strategic management in the implementation of corporate restructuring projects. The model of the strategic process of corporate restructuring in the form of three stages has been substantiated: preparation for restructuring, implementation of restructuring, and integration of companies. The analytical model has been developed on the basis of the project-potential modification of the revenue approach to conducting a strategic assessment of the effectiveness of restructuring.

Keywords

Strategic Management, Restructuring Strategy, Revenue Approach, Potential Project, Strategic Integration Prospects.

Introduction

Integration solutions are one of the most important strategic decisions that provide an increase in the market potential of a modern company. Choosing the potential of the initiator company of integration process in the course of evaluation, preparation and implementation of restructuring processes, is intended to determine all the important factors of development, especially the efficiency of re-creation of corporate assets, their forecasted growth and prospects for the development of the company. The relevance of this study is that in the process of evaluation of restructuring, one can assess the potential of the process initiator in value terms before and after the operation, and such a change in potential in value terms will allow estimating the effectiveness of possible integration.

The issue of applying restructurisation in an environment of corporate entities and models are quite widely represented in the work of such scientists and researchers as: (Drucker, 2004; Nilakant & Ramnarayan, 2006; Norley et al., 2001; Schmitt 2009; Weber 2015; Drobyazko et al., 2019 a & b; Nesterenko, 2019). At the same time, scientific thought pays insufficient attention to the processes of assessing the effectiveness of company restructuring through the use of a project potential indicator, which can be determined on the basis of a profitable approach and analysis of possible corporate integration projects (Kwilinski, 2018; Tkachenko et al., 2019).

The purpose of the article is to develop and justify the use (in a company's integration policy) of a model of assessment of potential growth via a profitable approach to possible restructuring projects.

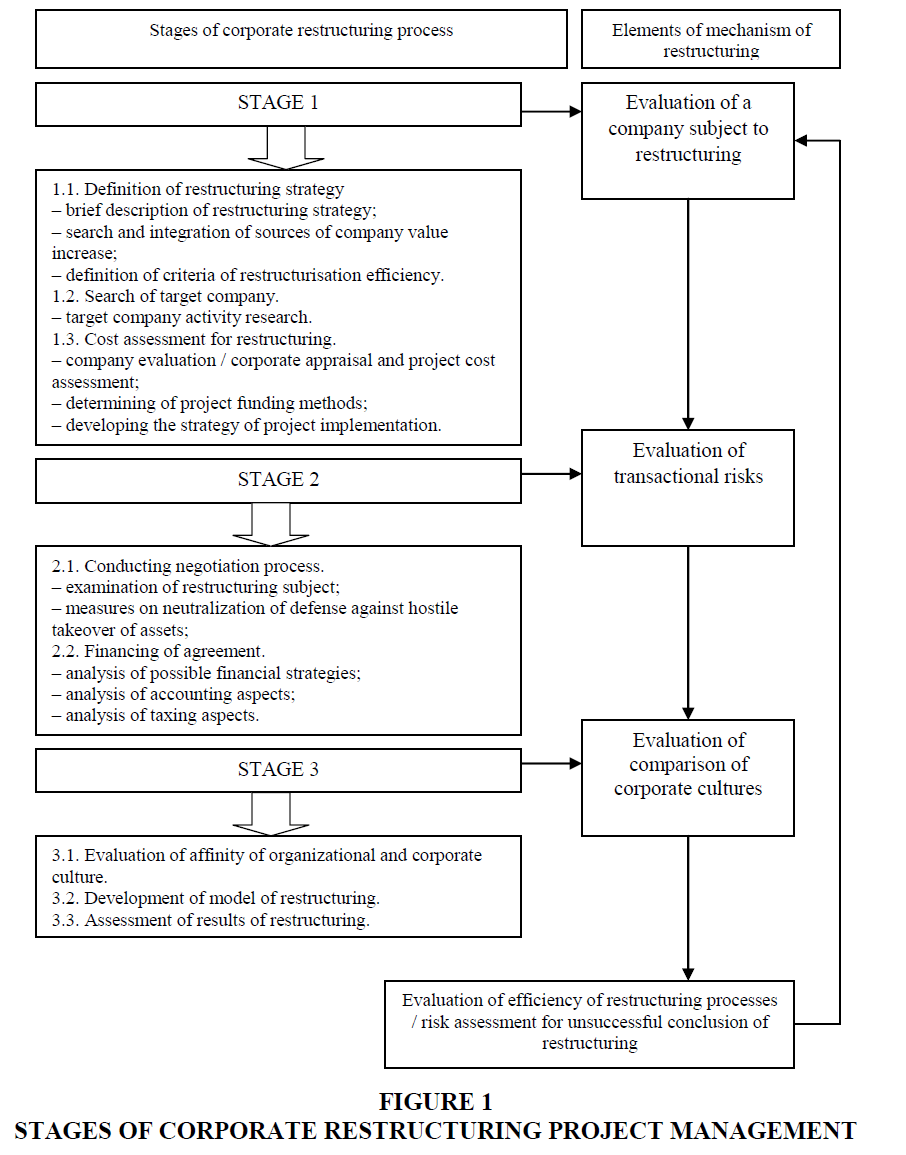

The organization of a typical corporate restructuring process can be divided into three main stages: preparation for restructuring, actual conclusion of the agreement, and integration of companies. The main stages of the restructuring process are presented in Figure 1. Each of the stages of company transformation has its own peculiarities and implies carrying out a number of measures, which causes certain difficulties in formalizing this process and calculating the risks associated with restructurisation.

Findings and Discussion

In the process of evaluating the effectiveness of restructuring, the following aspects are subject to investigation: financial and operational aspects; issues related to transactional risks; as well as the issues related to the external and internal environment of the company, which is being consolidated.

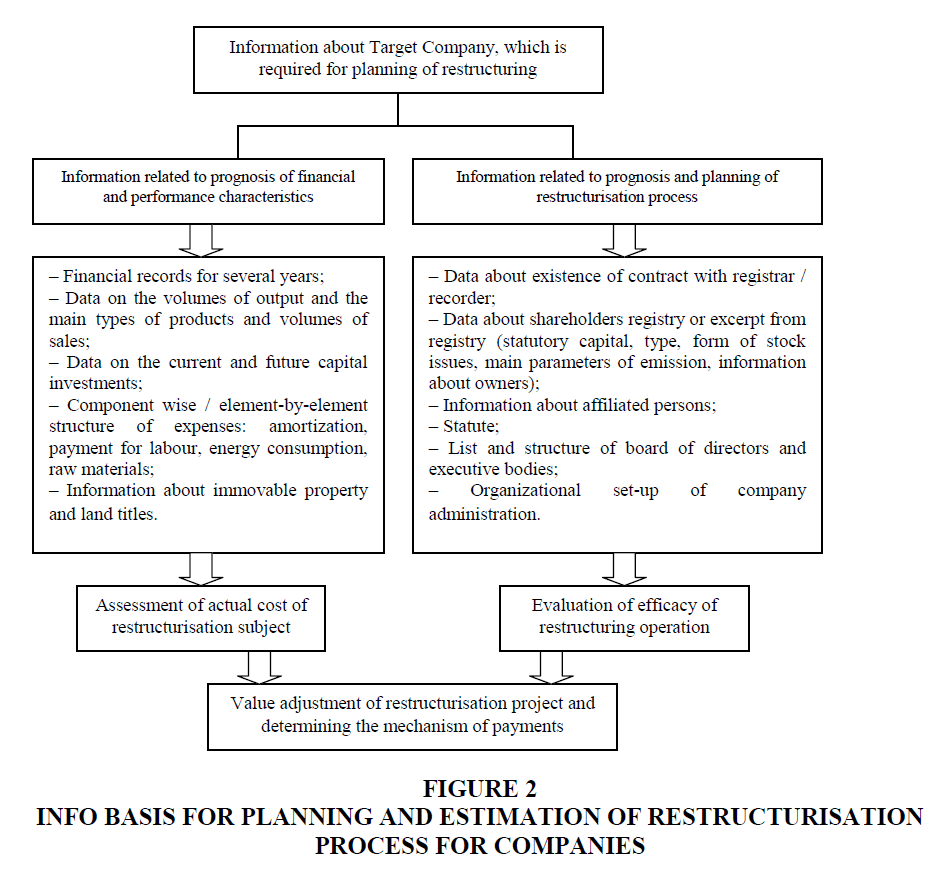

The information base needed to make decisions when managing company restructuring processes is presented in Figure 2 (Riany et al., 2012; Schoenberg et al., 2013).

It should be noted that the quality of corporate management is a significant factor in the internal environment of a company. It is precisely the quality of corporate management in the company which determines the quality and timeliness of disclosure of information on the company being consolidated, the transparency of the ownership structure, and respect for shareholders’ rights as well.

As pointed out by Makedon & Korneyev (2014), it may be that the mismatch of cycles between the movement of funds and the changes in economic stages which leads to liquidation of a company. It should be pointed out, that in a number of cases significant organizational restructuring leads to reorganization: at the stage of growth companies merge with others, at the stage of saturation they change their legal and organizational form, at the stage of recession they are divided into several companies. Relations of the stages of a company's life cycle with the peculiarities of cash flow formation and structural transformations are summarized in Table 1.

| Table 1 Relation of Life-Cycle Stages and Cash Flow Features During Restructuring of a Company | ||

| Life cycle stage | Peculiarities of cash flow formation | Structural transformation |

| Growth | Scarcity of financial funds | Consolidation/Incorporation/Acquisition |

| Saturation | Formation of stable flows of monetary funds | Change of legal and organizational form, buyout via debt financing |

| Recession | Decrease of a company’s ability to form monetary fund flows | Divestments |

| Liquidation | Loss of financial resources | Transition to another business area |

For critical analysis of cash flows in assessing the potential of a company, a projectpotential modification of a profitable approach to evaluation of restructuring is proposed: the valuation should take into account discounted cash flows from some of the most acceptable projects (MAPs) for restructuring over a given planning period. Three groups of restructuring projects are proposed to be introduced as MAPs, whose net discounted income will be taken into account in the valuation (Dentchev & Heene, 2004; Makedon et al., 2019): active/current (group 1) - traditional projects of a company, which are ongoing at the time of valuation; planned (group 2) - company’s projects, which are planned for realization; potential (group 3) - projects, realization of which by a company is possible.

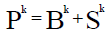

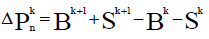

It is this division of total cash flow into the flows from each individual project that can enable a sufficiently critical approach to their forecasting and realization. The potential of a company in terms of value is proposed to be calculated by the formula:

(1)

(1)

Where: Pk– potential of a company k;

Bk– the amount of net present value of the most acceptable projects for a company k;

Sk– the potential residual value of a company k at the end of the planning period

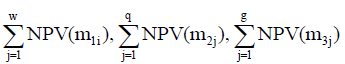

Package of projects for any company which is initiating a restructuring agreement includes the following project groups:

– Group M1 (active) – traditional projects of a company (m11,...m1w), which are running at the moment of valuation;

– Group ?2 (planned projects) – company’s projects (m21,...m2q), which are planned for realization;

– Group ?3 (potential projects) – projects (m31,...m3g), realization of which by a company is possible.

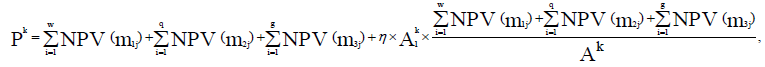

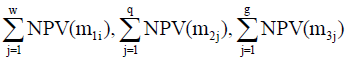

In a more detailed form, valuation of a company’s potential can be presented as the formula:

(2)

(2)

Where:  – the potential of a business entity;

– the potential of a business entity;

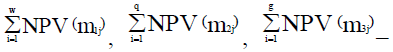

the amounts of net present values of active w, planned q and potential g projects of a company;

the amounts of net present values of active w, planned q and potential g projects of a company;

– The net asset value of a company at the moment of valuation;

– The net asset value of a company at the moment of valuation;

– The adjustment factor takes into calculation retention of a company profile after the end of the forecast period (0<η<1);

– The adjustment factor takes into calculation retention of a company profile after the end of the forecast period (0<η<1);

– discounted value of net assets at the end of the planning period (excluding cash)

– discounted value of net assets at the end of the planning period (excluding cash)

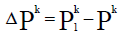

Integration (disintegration) is effective if the value of a company’s potential growth  is calculated using the following formula:

is calculated using the following formula:

(3)

(3)

Where:  – Potential of business entity before integration (disintegration);

– Potential of business entity before integration (disintegration);

– Potential of business entity after integration (disintegration);

– Potential of business entity after integration (disintegration);

The following groups of projects are considered in assessing the potential of the base structure without the target company incorporation:

– Group M1 (active projects) – traditional projects of a base structure (m11,...m1w), which are running at the moment of valuation;

– Group ?2 (planned projects) – those projects of a base structure (m21,...m2q), which are planned for realization;

– Group ?3 (potential projects) – projects (m31,...m3g), realization of which by a base structure is possible.

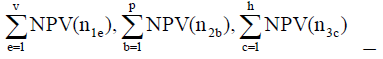

For a united structure (as a result of incorporation/acquisition) the groups of projects are as follows:

– Group N1 (active projects) – traditional projects of a base structure and a target company (n11,..n1v) which are planned for realization after consolidation (with probable increase of efficacy due to synergy);

– Group N2 (planned projects) – projects of a base structure and a target company (n21,..n2p) which had been planned before consolidation and remain possible afterwards (with probable increase of efficacy due to synergy);

– Group N3 (potential projects) – those projects (n31,..n3h), realization of which becomes possible in case of consolidation.

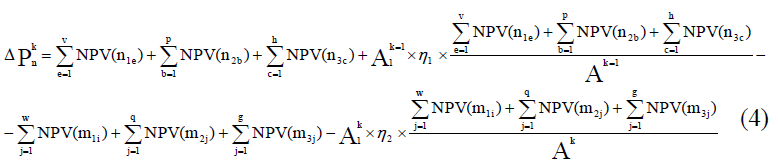

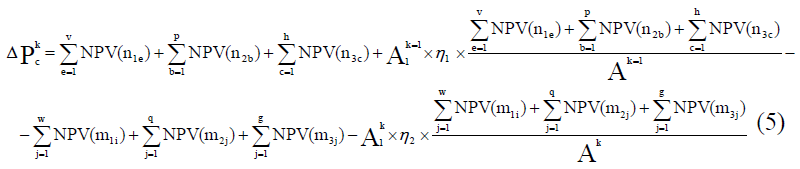

It is suggested that the increase/gain of the potential in the case of a company l acquisition by company k be calculated using the following formula:

Where,  – gain of the potential of the base structure upon consolidation;

– gain of the potential of the base structure upon consolidation;

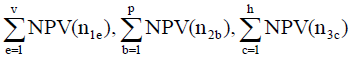

– The amounts of net present values of active v, planned ? and potential h projects of united structure;

– The amounts of net present values of active v, planned ? and potential h projects of united structure;

– The amounts of net present values of active w, planned q and potential g projects of base structure;

– The amounts of net present values of active w, planned q and potential g projects of base structure;

– discounted net assets of the combined entity at the end of the planning period (excluding cash);

– discounted net assets of the combined entity at the end of the planning period (excluding cash);

– The net assets value of united company at the time of valuation;

– The net assets value of united company at the time of valuation;

– discounted value of net assets of base structure (excluding cash) at the end of planning period;

– discounted value of net assets of base structure (excluding cash) at the end of planning period;

– Net asset value of base structure at the time of valuation;

– Net asset value of base structure at the time of valuation;

η1, η2 – adjustment factors that take into calculation retention of activity profile of a consolidated company and base structure after the end of the forecast period.

Money flows from projects belonging to groups M1, M2, ?3, N1, N2, and N3 are discounted at rates that take into account the cost of capital, the risks of each project and possible inflation (Jong (2000). Valuations of potential gain of base structure upon consolidation are conducted in a similar way to valuations of potential gain of base structure. To identify the gain of potential upon consolidation, a set of projects M1, ?2, ?3, N1, N2, N3 for the base and united structures is allocated. In the case of consolidation of base structure and Target Company in the form of integration, it is suggested to evaluate the gain of potential by the following formula:

Where,  – gain of potential of base structure upon acquisition;

– gain of potential of base structure upon acquisition;

The amounts of net present values of active v, planned ? and potential h projects of the united structure;

The amounts of net present values of active v, planned ? and potential h projects of the united structure;

– The amounts of net present values of active w, planned q and potential g projects of base structure;

– The amounts of net present values of active w, planned q and potential g projects of base structure;

– discounted net assets value of the united company at the end of planning period (excluding cash);

– discounted net assets value of the united company at the end of planning period (excluding cash);

– The net assets value of the united company at the time of valuation;

– The net assets value of the united company at the time of valuation;

– discounted value of net assets of the base structure (excluding cash) at the end of the planning period;

– discounted value of net assets of the base structure (excluding cash) at the end of the planning period;

– The net assets value of the base structure at the time of valuation;

– The net assets value of the base structure at the time of valuation;

η1, η2 – adjustment factors that take into calculation the retention of activity profile of a consolidated company and base structure after the end of the forecast period.

Monetary flows from projects of groups M1, M2, ?3, N1, N2, and N3 are discounted at rates that take into account the cost of capital, the risk of each project and the possible inflation. Evaluation of the sale effectiveness by the company of its part is intended to give an opportunity to make decision on the expediency of consolidation, taking into account the alteration of the seller's potential. For target-company, in order to make a decision to sell its share, it is necessary to estimate the loss (gain) of its potential from a probable transaction, through valuation of the initial potential and the forecasted potential after the transaction (Lin et al., 2006). It is necessary to identify project groups for the target company that will reflect its activities prior to the sale of its share (P1, ?2, ?3) and after the sale (R1, R2, R3):

– Group ?1 (active projects) – traditional projects of a target company (p11,.., p1f), which are running at the moment of valuation;

– Group ?2 (planned projects) – those projects of a target company (p21,.., p2d), which are planned for realization;

– Group ?3 (potential projects) – projects (p31,.., p3o), realization of which is possible.

– Group R1 (active projects) – traditional projects of a target company (r11,.., r1u), which can be realized after the sale of its share;

– Group R2 (planned projects) – those projects of a target company (r21,.., r2x), which are planned for realization and can be realized after the sale of its share;

– Group R3 (potential projects) – those projects (r31,.., r3y) which can be realized by a target company after the sale of its share.

Recommendations

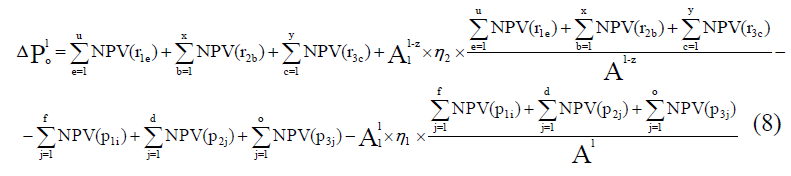

Correspondingly, it is suggested to calculate losses (gains) of the potential using the following formula:

In case if the ratio of the amount of the net present values of the company’s projects multiplied by the adjustment factor η to the net assets at the valuation date is less than one, then this ratio is taken to be equal to one in the calculation of the potential (this ratio is the coefficient of asset productivity / efficiency αk).

In case if the price (S1) of the transaction provides the change of value of potential >=0 by formula (8), then the transaction is acceptable for target company. An alternative approach involves estimating the potential buyer's potential gain - from acquiring the share of the target company. S2 - the price, which the buyer is ready to pay for the share of the target company, in case of a certain value of positive change of potential according to formula:

(9)

(9)

The price of sale Sn may lie within the interval from S1 to S2 and may be determined by agreement between the buyer and the seller of the assets during restructuring.

Conclusion

Thus, looking upon the process of corporate transformation from the organizational side, we can draw the following conclusions: 1) It is established, that the leading factor that will ensure the efficiency of restructuring is the state of internal environment of a company, namely: the quality of corporate governance; timely disclosure of incorporated company info; "transparency" of ownership structure; respect for the rights of shareholders; 2) The process of organizing a corporate transformation operation in the form of restructuring should be divided into three stages, such as: preparation for restructuring, conclusion of the agreement, and implementation of the integration model between the buyer company and the target company; 3) It is determined that certain lifecycle stages of an international company require the use of certain types of corporate transformation; with the growth stage should be considered the most advantageous phase for restructuring. In this case, the buyer of assets is highly likely to successfully integrate these assets into the active business structure; 4) In order to approve a decision to carry out a restructuring operation, it is necessary to evaluate the probable gain or loss of one’s potential due to possible agreement for both the buyer company and the target company.

References

- Dentchev, N.A., & Heene, A. (2004). Managing the reputation of restructuring corporations: Send the right signal to the right stakeholder. Journal of Public Affairs: An International Journal, 4(1), 56-72.

- Drobyazko, S., Barwi?ska-Ma?ajowicz, A., ?lusarczyk, B., Zavidna, L., & Danylovych-Kropyvnytska, M. (2019a). innovative entrepreneurship models in the management system of enterprise competitiveness. Journal of Entrepreneurship Education, 22 (4).

- Drobyazko, S., Okulich-Kazarin, V., Rogovyi, A., & Marova, S. (2019b). Factors of influence on the sustainable development in the strategy management of corporations. Academy of Strategic Management Journal.

- Drucker, P.F., & Simionescu, A. (2004). Managementul viitorului. ASAB.

- Jong, H.W. (2000). Mergers and competition policy: Some general remarks. Mergers and competition policy in the European community.

- Kwilinski, A. (2018). Mechanism of modernization of industrial sphere of industrial enterprise in accordance with requirements of the information economy.

- Lin, B., Lee, Z.H., & Peterson, R. (2006). An analytical approach for making management decisions concerning corporate restructuring. Managerial and Decision Economics, 27(8), 655-666.

- Makedon, V., & Korneyev, M. (2014). Improving methodology of estimating value of financial sector entities dealing in mergers and acquisitions. Investment management and financial innovations, (11, Iss. 1), 44-55.

- Makedon, V., Kostyshyna, T., Tuzhylkina, O., Stepanova, L., & Filippov, V. (2019). Ensuring the efficiency of integration processes in the international corporate sector on the basis of strategic management. Academy of Strategic Management Journal.

- Nesterenko, S., Drobyazko, S., Abramova, O., & Siketina, N.H. (2019). Optimization of factorial portfolio of trade enterprises in the conditions of the non-payment crisis.

- Nilakant, V., & Ramnarayan, S. (2006). Change management: Altering mindsets in a global context. SAGE Publications India.

- Norley, L., Swanson, J., & Marshall, P. A. (2001). Practitioner’s guide to corporate restructuring.

- Riany, C.O., Musa, G.H., Odera, O., & Okaka, O. (2012). Effects of restructuring on organization performance of mobile phone service providers. International Review of Social Sciences and Humanities, 4(1), 198-204.

- Schmitt, A. (2009). Innovation and growth in corporate restructurings: Solution or contradiction. Springer Science & Business Media.

- Schoenberg, R., Collier, N., & Bowman, C. (2013). Strategies for business turnaround and recovery: a review and synthesis. European Business Review.

- Tkachenko, V., Kwilinski, A., Klymchuk, M., & Tkachenko, I. (2019). The economic-mathematical development of buildings construction model optimization on the basis of digital economy. Management Systems in Production Engineering, 27(2), 119-123.

- Weber, Y. (2015). Development and training at mergers and acquisitions. Procedia-Social and Behavioral Sciences, 209, 254-260.