Research Article: 2021 Vol: 20 Issue: 3

Strategic Management Process: Bank National in Improving Performance Before and During Covid-19 Pandemic

Zainul Arifin, University Brawijaya Malang

Abstract

In general, bank business activities focused on the public fund collection and redistribution in the form of credit and financing in addition to other banking service procurement. Which must be able to have strategies to identify, commensurate and minimize global banking risks at “Strategic Management Process”? This study uses a type of explanatory research that examines the effect of the research variables. Research were 43 Bank National at Indonesia business, data collected in this study consisted of primary data from “annual report 2017-2020 from www.idx.co.id › en-us. Various tests were used for conducting inferential statistics, including T-tests for independent samples, F-test for analysis of variance, Pearson correlations.

The results of the research and hypothesis testing prove that the overall effect of the research variables is strong influence, the research hypothesis proves that all independent variables. The novelty that can be taken that in the strategic management at bank enterprises a factors “examining the strengths and weaknesses” at strategic management process for “careful strategy brings the right results” before and during Covid-19 Pandemic.

Keywords

Strategic Management, Careful Strategy, Brings the Right Results, Bank and Financial Sector.

Introduction

Companies go international for a variety of reasons, but still, the typical goal is the company growth or expansion. “The conditioning of the banking performance on the content of banking management in general, and especially on that of financial-foreign exchange risk management, evident for almost all banks, explains the interest of researchers and practitioners to this area”. The competitiveness of the banks today has its origin in the strategies they adopt and apply, strategies in which risk management plays a key role. The importance of commercial banks after the ravage of the liberation war to develop a better economy was severally needed and it is needed now and will be required in future also. In time to time Government of Indonesia agreed to permit the private commercial banking in the country.

This research is consep Resource Based Theory (RBV) think; the process of strategic management includes usually basic and periodically repeating set of consecutive stages, through which the companies create, implement and control achievement of the long-term business objectives (Johnson et al., 2006; David et al., 2011; Skokan et al., 2013).

1. Strategic analyses,

2. Formulation of strategy,

3. Strategy implementation,

4. Feedback, ex-post evaluation and correction.

Risk management is an integral part of the bank’s strategy, addressing this vulnerability and complexity of the environment in which the bank operates. It is accepted that the risk profile is an essential component of the bank and therefore further development of banking strategy will be achieved if current and future risk profile are neglected (Panzaru, 2011). In general, “bank’s business activities focused on the public fund collection and redistribution in the form of credit and financing in addition to other banking service procurement. Bank had determined the appropriate strategies marked by the significant increase of its performance”. Several banks, it has been growing faster as one of the leaders of the new generation banks in the private sector in respect of business and profitability as it is evident from the financial statements for the last 5 years. Mission of the bank; to be the premier financial institution in the country providing high quality products and services backed by latest technology and a team of highly motivated personnel to deliver Excellence in Banking.

Literature Review

Back the Resource Based Theory (RBV); “strategic management has the advantage of developing corporate value, managerial capabilities, organizational responsibility and an administrative system that unites operational and strategic decision-making in all management hierarchies and connects internal and external business conditions of the company” (Wheelen & Hunger, 1996). Thus strategic planning almost always starts with “what can happen”, not starting from “what happened”. The speed of new market innovations and changing consumer patterns requires core competencies. Companies need to look for core competencies in the business they are doing (Hamel & Prahalad, 1995; Susanto, 2014). Strategy is a pattern or plan that integrates the main goals of the organization, policies, or actions into an integrated linkage. A good strategy is expected to help integrate various interests. For the internal interests of the organization, the strategy is expected to be able to assist in the utilization and allocation of organizational resources (Bower, 2007). For the external interests of the organization, the strategy is expected to be able to help anticipate environmental changes. Organizational wheels should advance along with the development of the environment (Mintzberg & Quinn, 1991). Strategic thinking will familiarize managers with training foresight to look outward at consumer needs, new opportunities, and competitive positions, in addition to sharpening managers' foresight in seeing operations in the company. It is very important for managers to direct attention to the evolving needs of consumers. Higher income and consumer knowledge have an impact on increasing the types of needs, tastes, services, comfort, and safety of the products to be purchased (Thompson & Strickland, 1987).

Strategic management is a number of decisions and actions that lead to the preparation of a strategy or a number of effective strategies to help achieve company goals. The strategic management process is the means by which strategic planners set goals and make decisions (Glueck, 1980). So that strategic management has the advantage of developing corporate value, managerial capabilities, organizational responsibility and an administrative system that unites operational and strategic decision-making in all management hierarchies and connects internal and external business conditions of the company (Wheelen & Hunger, 1996).

Strategic management is a series of processes or stages, so this process is intended to integrate the mission and objectives associated with internal and external conditions in the form of strengths, weaknesses, threats and opportunities in order to obtain the right strategy (De Wit & Meyer, 2005). The strategic management process must be carried out based on the stages above, it cannot be piecemeal, but must be as a whole in order to achieve maximum results (Bower, 2007). Strategic management has advantages for; Strategy formulation activities strengthen the company's ability to prevent problems. Strategic decisions based on groups are likely to result from the best available alternatives (Kasali, 2010). Employee involvement in strategy formulation increases understanding of the reward productivity in each strategic plan and thereby enhances their motivation. Gaps and overlaps between individual and group activities are reduced because participation in the formulation of strategies clarifies the differences in their respective roles and decreases resistance to change (Kurniawan & Hamdani, 2008).

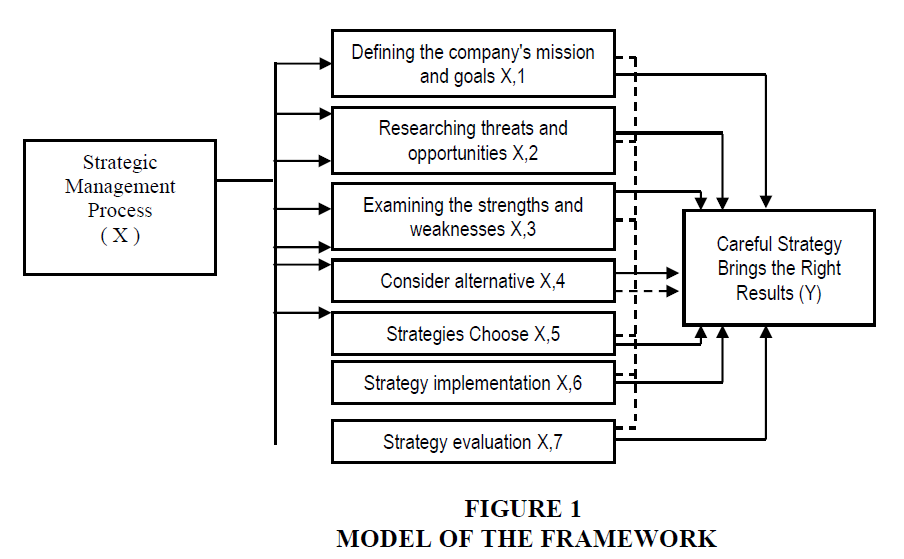

The strategic management process (Figure 1) must be carried out based on the above stages, not in bits and pieces, but as a whole in order to achieve maximum results. So it can be underlined that the stages in strategic management include: Establishing the company's mission and goals (Rangkuti, 2008). Company goals and mission are important to determine the judgment of the company's most important decision makers. Researching threats and opportunities. Examining threats and opportunities undertaken to determine the company's ever-changing external environment. Researching strengths and weaknesses this is done to determine the internal strengths and weaknesses of the company (Fandy, 2015). Considering alternative strategies, to determine which strategy will be chosen according to the company's circumstances and environmental conditions both at present and in the future. Choosing a strategy, after considering alternative strategies, a strategy selection is made, namely to ensure the right strategy. In implementing the strategy, the company must be able to allocate resources and adjust functional policies in accordance with the chosen strategy. Strategy evaluation, to ensure the implementation of the strategy can achieve the goals or not and what actions must be taken to overcome them (Untoro & Halim, 2007).

Determining the right strategy must start with analyzing and diagnosing the ever-changing environment. The more easily the environment changes, the greater the impact on the organization. Therefore, companies need to conduct a careful analysis of the environmental situation, both the current environmental situation and the environmental situation in the future. Environmental analysis is an analysis to determine opportunities and threats that have important meaning for the company in the future which also includes efforts to determine the strengths and weaknesses of the company at the present time or that may be developing (Tambunan, 2012). Environmental analysis is a process of observing an organization to identify current and future threats and opportunities that affect the company's ability to achieve its goals. Some of the definitions mentioned above explain that environmental analysis is used to monitor the company's environment (Muljono, 2012). Meanwhile, the specific definition of strategy is an action that is continuously increasing and carried out in accordance with the point of view of what consumers want and expect for the future. With this strategy, there is something that almost starts with what always happens and not what happens (Taufiqurokhman, 2016).

Thus the company can be ready to face an ever-changing environmental situation, can identify and make a priority scale, and finally be able to formulate its strategy appropriately. Environmental analysis has an important meaning in itself that makes companies feel they must and need to do it (Suwarsono, 2000). The importance of environmental analysis is often emphasized by experts according to their respective versions. So that management can be responsive to important problems that occur in the company environment and can be formulated in decision making (Hadari, 2005).The strategic choice approach is embedded in strategic management literature and focuses on the central role of strategy as a determinant of firms’ performance. According to strategic choice approach, firms are assumed to be open systems that confront and respond to challenges and opportunities in their environment (Child, 1997).

Methodology

Based on the thoughts that have been presented to answer the research objectives, the type used is explanatory research. It is explained that explanatory design is typically used to explain and interpret quantitative results by collecting and analyzing follow-up qualitative data. It can be especially useful when unexpected results arise from a quantitative study. In this case, the qualitative data collection that follows can be used to examine these surprising results in more detail. This strategy may or may not have a specific theoretical perspective (Creswell & Creswell, 2017).

In this study, the number of samples taken was 43 bank or financial sector business, with the proportional sampling technique. Samples selected in accordance with established criteria, among others; The business has been running for more than 3 years, is willing to become a respondent and provide the necessary data, has been registered. The institusi as Indonesia stock exchange (www.idx.co.id › en-us). The data collected in this study consisted of primary data from “annual report 2017-2020” and secondary data which were considered relevant to this study, among others; journals, research reports, accessible company documents and other supporting documents. The model that can be made for this research is described below (Figure 1), based on the picture from the conceptual model of the framework created in the study, the research hypothesis can be figure and formulated as follows.

Based on the picture from the conceptual model of the framework created in the study, the research hypothesis can be formulated as follows-hypothesis;

H1 the process of strategic management of bank national in financial sector business significant affects the careful strategy brings the right results.

H1a The ability of bank national in financial sector business in setting the company's mission and goals X1 affects the Careful Strategy Brings the Right Results (Y).

H1b The ability of bank national in financial sector business in researching threats and opportunities X2 affects the Careful Strategy Brings the Right Results (Y).

H1c If there is the ability of bank national in financial sector business to examine the strengths and weaknesses of X3 then it will affect the Careful Strategy Brings the Right Results (Y).

H1d If the business bank national in financial sector business owner is careful in considering the alternative strategy X4 then it will affect the Careful Strategy Brings the Right Results (Y).

H1e If the business bank national in financial sector business can choose X5 strategy, it will affect the Careful Strategy Brings the Right Results (Y).

H1f For business bank national in financial sector business who can implement the X6 strategy, it will affect the Careful Strategy Brings the Right Results (Y)

H2 Evaluating strategy at the process of strategic management of bank national in financial sector business high affects the careful strategy brings the right result.

Testing instruments in this study used validity and reliability tests with a significant standard, the test results Table 1 proved that all instruments from the research variables were declared valid with a p value less than 0.5 and were declared reliable with a Cronbach's Alpha value greater than 0.600.

| Table 1 Contructur Validity and Reliability Test | ||||

| Variable | Pearson Correlation | Cronbach's Alpha | Kolmogorov-Smirnov Z | Asymp.Sig. (2-tailed) |

| Defining the company's mission and goals X1 | 0.430 | 0.766 | 2.203 | 0.079 |

| Researching threats and opportunities X2 | 0.552 | 0.787 | 1.818 | 0.103 |

| Examining the strengths and weaknesses X3 | 0.530 | 0.820 | 1.464 | 0.118 |

| Consider alternative X4 | 0.449 | 0.790 | 2.069 | 0.081 |

| Strategies Choose X5 | 0.472 | 0.788 | 1.826 | 0.093 |

| Strategy implementation X6 | 0.302 | 0.828 | 2.426 | 0.106 |

| Strategy evaluation X7 | 0.629 | 0.803 | 1.479 | 0.076 |

| Careful Strategy Brings the Right Results (Y) | - | - | 1.592 | 0.115 |

Testing instruments in this study used validity and reliability tests with a significant standard, the test results proved that all instruments from the research variables were declared valid. The Kolmogorov-Smirnov significance above 0.05 means that there is no significant difference between the data to be tested and the standard normal data, that is, yes. It means that the data we test is normal, right? It is not different from standard normal (Appendix Table A1).

Results and Discussion

This study regression analysis of this study shows that the results of the overall influence of the variables; Determining the mission and objectives of the company, Researching threats and opportunities, researching strengths and weaknesses, considering strategic alternatives, choosing strategies, implementing strategies, and evaluating strategies for Careful Strategy Brings the Right Results of 0.651 or 65.1% so that they have a strong influence (Table 2) which is supported by the F-test value of 9.326 at a significant p value of 0.000, then the management process strategy has a strong influence on careful strategy brings the right results.

| Table 2 Results of Regression Test | ||

| Variable | T test |

Sig. (p value) |

| Defining the company's mission and goals X1 | 2.864 | 0.007 |

| Researching threats and opportunities X2 | 2.311 | 0.027 |

| Examining the strengths and weaknesses X3 | 3.294 | 0.000 |

| Consider alternative X4 | 2.421 | 0.013 |

| Strategies Choose X5 | 2.968 | 0.004 |

| Strategy implementation X6 | 2.845 | 0.007 |

| Strategy evaluation X7 | 2.819 | 0.008 |

| R Square 0.651;F test 9.326 | ||

The results of testing the hypothesis of this study found that

Hypothesis [1]; the ability of business owners in setting the mission and goals of the company X1 has an effect on Careful Strategy Brings the Right Results (Y) as evidenced by a tcount of 2.864 with p value of 0,007 Then for the second that the ability of business owners to examine threats and opportunities X2 affects the Careful Strategy Brings the Right Results (Y) is also accepted or proven with a t-count value of 2.311 with a p value of 0.027. Furthermore, the third if there is the ability of the business owner to examine the strengths and weaknesses of X3, and then it affects the Careful Strategy Brings the Right Results (Y) is also accepted with a tcount of 3.294 with a p value of 0.000. Furthermore, for the fourth if the business owner has carefulness in considering the alternative X4 strategy, then the effect on the Careful Strategy Brings the Right Results (Y) is proven with a t-count value of 2.421 with a p value of 0.012. The fifth is that if the business owner can choose X5 strategy, it will affect the Careful Strategy Brings the Right Results (Y) as evidenced by a t-count value of 2.968 with a p value of 0.004. Then in the sixth for business owners who can implement the X6 strategy, it will affect the Careful Strategy Brings the Right Results (Y) as evidenced by a value of 2.845 with a p value of 0.007. Finally, the second Hypothesis [H2] is that business owners who have accuracy in evaluating the X7 strategy greatly influence the Careful Strategy Brings the Right Results (Y) as evidenced by a value of 2.819 with a p value of 0.008.

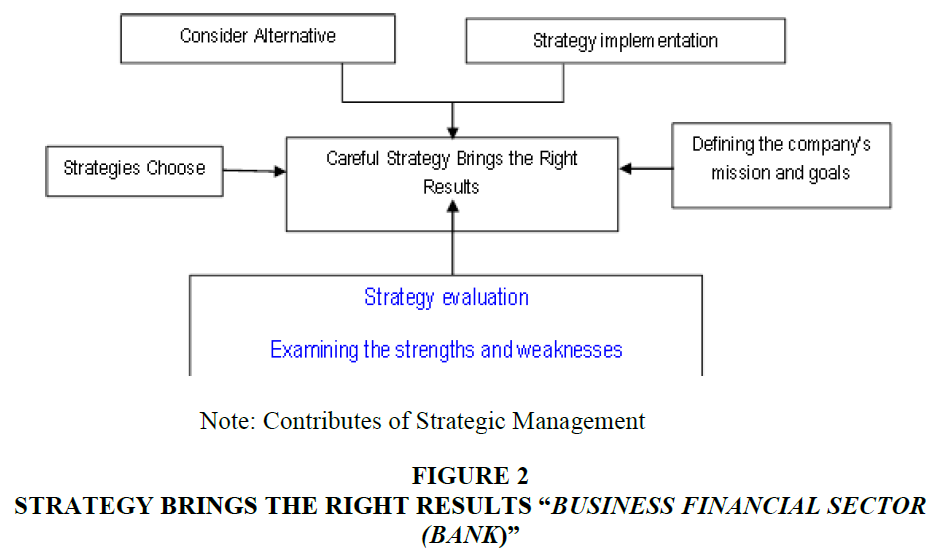

The research results test and support the Resource Based Theory (RBV) of (Thompson & Strickland, 1987; Mintzberg & Quinn, 1991; Hamel & Prahalad, 1995; Wheelen & Hunger, 1996; Bower, 2007), so that strategic management is not only for the company. Bank National at Indonesia enterprises, large and international scale businesses must also pay attention to strategic management in anticipation of increasingly fierce competition. Attention to strategic management is important for business actors in an effort to achieve short-term and long-term goals, namely the continuity and development of an increasingly good business. The problem with this approach is that the activities are carried out largely in isolation and without guidance from the enterprise strategy. This partition of responsibilities creates the gulf between an organization’s strategy and its processes, systems, and people. Attention to strategic management is important for business actors in an effort to achieve short-term and long-term goals, namely the continuity and development of an increasingly good business (Figure 2).

Based on this model; the phases or stages obtained in the above model may change, this is due to various reasons, among others; competitive conditions, the ability to analyze the strengths and weaknesses, the existence of threats and opportunities that can be entered. The foresight of the manager or owner is the main key in determining a superior and optimal competitive strategy. An owner is viewed in this study as a managerial employee who is tasked to oversee the successful execution of strategic initiatives. While issues of strategic planning have presented challenges to strategic leaders, it is in the area of strategy implementation where these leaders have encountered a number of challenges reported that although formulating a consistent strategy and making it work is fairly easy, implementing it throughout the organisation is even more difficult. Based on the results of the analysis and research hypotheses, to face increasingly competitive competition in various situations and conditions (including Covid-19), the ability to plan and evaluate strategies is required. Therefore, leaders or business owners must learn and explore various information related to business strategy management from various relevant sources.

Conclusion

According to the results of data processing that have been described in the study, it can be seen that the first aspect that has a big influence on the strategy for Bank National at Indonesia enterprises is; “Considering alternative strategies” followed by “strategy implementation” and “choosing strategies”. However, Bank National at Indonesia business owners should not ignore other variables, namely; “Establishing the mission and objectives of the company, researching threats and opportunities, researching strengths and weaknesses and evaluating strategies” because all these variables have a significant influence on the Careful Strategy Brings the Right Results.

Appendix

| Table A1 Banks Registered on the Indonesian Stock Exchange | |||

| No. | Code | Bank Name | Register |

| 1 | AGRO | Bank Rakyat Indonesia Agroniaga Tbk | 08-Agust-2003 |

| 2 | AGRS | PT Bank Agris Tbk | 22-Des-2014 |

| 3 | ARTO | PT Bank Artos Indonesia Tbk | 12-Jan-2016 |

| 4 | BABP | PT Bank MNC Internasional Tbk | 15-Jul-2002 |

| 5 | BACA | Bank Capital Indonesia Tbk | 04-Okt-2007 |

| 6 | BBCA | Bank Central Asia Tbk | 31-Mei-2000 |

| 7 | BBHI | PT Bank Harda Internasional Tbk | 12-Agust-2015 |

| 8 | BBKP | Bank Bukopin Tbk | 10-Jul-2006 |

| 9 | BBMD | PT Bank Mestika Dharma Tbk | 8-Jul-2013 |

| 10 | BBNI | Bank Negara Indonesia Tbk | 25-Nop-1996 |

| 11 | BBNP | Bank Nusantara Parahyangan Tbk | 10-Jan-2001 |

| 12 | BBRI | Bank Rakyat Indonesia (Persero) Tbk | 10-Nop-2003 |

| 13 | BBTN | Bank Tabungan Negara (Persero) Tbk | 17-Des-2009 |

| 14 | BBYB | PT Bank Yudha Bhakti Tbk | 13-Jan-2015 |

| 15 | BCIC | PT Bank JTrust Indonesia Tbk | 25-Jun-1997 |

| 16 | BDMN | Bank Danamon Indonesia Tbk | 06-Des-1989 |

| 17 | BEKS | PT Bank Pundi Indonesia Tbk | 13-Jul-2001 |

| 18 | BGTG | PT Bank Ganesha Tbk | 12-Mei-2016 |

| 19 | BINA | PT Bank Ina Perdana Tbk | 16-Jan-2014 |

| 20 | BJBR | Bank Pembangunan Daerah Jawa Barat dan Banten Tbk |

8-Jul-2010 |

| 21 | BJTM | Bank Pembangunan Daerah Jawa Timur Tbk | 12-Jul-2012 |

| 22 | BKSW | PT Bank QNB Indonesia Tbk | 21-Nop-2002 |

| 23 | BMAS | PT Bank Maspion Indonesia Tbk | 11-Jul-2013 |

| 24 | BMRI | Bank Mandiri (Persero) Tbk | 14-Jul-2003 |

| 25 | BNBA | Bank Bumi Arta Tbk | 31-Des-2009 |

| 26 | BNGA | Bank CIMB Niaga Tbk | 29-Nop-1989 |

| 27 | BNII | PT Bank Maybank Indonesia Tbk | 21-Nop-1989 |

| 28 | BNLI | Bank Permata Tbk | 15-Jan-1990 |

| 29 | BSIM | Bank Sinarmas Tbk | 13-Des-2010 |

| 30 | BSWD | Bank of India Indonesia Tbk | 01-Mei-2002 |

| 31 | BTPN | Bank Tabungan Pensiunan Nasional Tbk | 12-Mar-2008 |

| 32 | BVIC | Bank Victoria International Tbk | 30-Jun-1999 |

| 33 | DNAR | PT Bank Dinar Indonesia Tbk | 11-Jul-2014 |

| 34 | INPC | Bank Artha Graha Internasional Tbk | 29-Agust-1990 |

| 35 | MAYA | Bank Mayapada Internasional Tbk | 29-Agust-1997 |

| 36 | MCOR | PT Bank China Construction Bank Indonesia Tbk |

3-Jul-2007 |

| 37 | MEGA | Bank Mega Tbk | 17-Apr-2000 |

| 38 | NAGA | PT Bank Mitraniaga Tbk | 9-Jul-2013 |

| 39 | NISP | Bank OCBC NISP Tbk | 20-Okt-1994 |

| 40 | NOBU | PT Bank Nationalnobu Tbk | 20-Mei-2013 |

| 41 | PNBN | Bank Pan Indonesia Tbk | 29-Des-1982 |

| 42 | PNBS | PT Bank Panin Dubai Syariah Tbk | 15-Jan-2014 |

| 43 | SDRA | PT Bank Woori Saudara Indonesia 1906 Tbk | 15-Des-2006 |

References

- Bower, J.L. (2007). How managers' everyday decisions create or destroy your company's strategy. Strategic Direction.

- Child, J. (1997). Strategic choice in the analysis of action, structure, organizations and environment: Retrospect and prospect. Organization studies, 18(1), 43-76.

- Creswell, J.W., & Creswell, J.D. (2017). Research design: Qualitative, quantitative, and mixed methods approaches. Sage publications.

- David, F.R. (2011). Strategic management: Concepts and case. Harlow.

- De Wit, B., & Meyer, R. (2005). Resolving strategy paradoxes to create competitive advantage. London. Thomson Learning.

- Fandy, T. (2015). Marketing strategy. Publisher, Yogyakarta. Andi Ofset Publisher Center.

- Glueck, W.F. (1980). Business policy and strategic management. Tokyo: McGraw-Hill Kogakusha, Ltd.

- Hadari, N. (2005). Management strategy. Yogyakarta.

- Hamel, G., & Prahalad, C.K. (1995). Management. New Delhi: Tata McGraw HilL.

- Johnson, G., Scholes, K., & Whittington, R. (2006). Exploring corporate strategy.

- Kasali. (2010). Strategy in building company image. Publisher, Alpha Beta. Bandung.

- Kurniawan, F., & Hamdani, M. (2008). Strategic management in organizations. Yogyakarta: Media Presindo

- Mintzberg, H., & Quinn, J.B. (1991). The strategy process, concepts, contexts, cases. New York: Prentice-Hall Inc, Englewood Cliffs.

- Muljono, D. (2012). Smart book of savings and loan cooperative business strategies. Yogyakarta.

- Panzaru, S. (2011). Strategic management in commercial banks. Review of General Management, 14(2), 122-129.

- Rangkuti, F. (2008). SWOT analysis, techniques for dissecting business cases, reorienting strategic planning concepts to face the 21st century. Jakarta: Publisher of PT. Gramedia Main Library.

- Skokan, K., Pawliczek, A., & Piszczur, R. (2013). Strategic planning and business performance of micro, small and medium-sized enterprises. Journal of Competitiveness, 5(4).

- Susanto, A.B. (2014). Strategic management for students and practitioners. Jakarta, The publisher, Erlangga.

- Suwarsono, M. (2000). Strategic management: Concepts and cases. Yogyakarta. UPP AMP YKPN.

- Tambunan, T. (2012). Strategic management of small and medium enterprises in Indonesia.

- Taufiqurokhman. (2016). Strategic management.

- Thompson, A.A., & Strickland, A.J. (1987). Strategic management, conceptual cases. Homewood, Illinois: Business Publiction. Inc.

- Untoro, W., & Halim, A. (2007). Strategic Management in the Public Sector Organization: Publicness Implication on the Process and Dimension. Jurnal Bisnis dan Manajemen, 7(1).

- Wheelen, T.L., & Hunger, J.D. (1996). Strategic management and business policy. Massachusetts: Addison Wesley Publishing Company.