Research Article: 2020 Vol: 19 Issue: 6

Strengthening Internal Audit at Public Companies to Improve the Quality of Financial Statements: A Case Study of Hanoi Stock Exchange, Vietnam

Vu Thi Phuong Lien, Academy of Finance (AOF)

Tran Van Hoi, Academy of Finance (AOF)

Phi Thi Kieu Anh, Academy of Finance (AOF)

Abstract

Nowadays, internal audit plays a significant role in public companies. It can evaluate and make recommendations for improving the management process or consulting on management issues performed. Besides, internal audit has the conferring of the incomplete governance systems or on backlog management problems. Therefore, the paper's goal is to evaluate internal audit activities at public companies listed on the Hanoi Stock Exchange (HNX), Vietnam. The authors surveyed 700 accountants working for 350 public companies in HNX; each company has two accountants joined, and authors got Data from February 2020 to June 2020. The authors applied quantitative methods such as testing Cronbach's Alpha and testing structural equation modeling (SEM). Study results showed three factors influencing the internal audit and the quality of financial statements at public companies of HNX with significance at 1.0 percent. Based on the results, the authors proposed the recommendations to strengthen internal audit at public companies to improve the quality of financial statements in Vietnam.

Keywords

Internal, Audit, Public Companies, Financial Statements, AOF.

Introduction

In the world, internal audits have been present for a long time in enterprises' business activities. In Western countries, after the global economic crisis, economic managers around the world re-evaluated the models and saw the role of risk management and the role of internal audit (Soh & Martinov-Bennie, 2011). Internal audits have become increasingly important. Companies have been more proactive in identifying risks, primarily material risks that can adversely affect their business systems. At the same time, they also build more effective methods, programs, and approaches to audit in America. However, in Vietnam, the role of internal audit is quite fuzzy; this is partly because the corporate governance system of Vietnamese enterprises is not synchronous. The internal audit field has not attracted highly qualified human resources, along with that the human resource not properly trained and specialized. The specific content of the audit is audit programs. The sample audit for internal audit issued, so companies are building their own audits, making it difficult to assess quality control (Abuazza et al., 2015). The previous viewpoint said that internal auditors are responsible for the audit of financial statements and focus on the inspection of the accounting and financial information of the company. However, the modern internal audit point of view has extended no longer limited to the inspection of financial statements. However, in addition to the audit of efficiency, compliance of all activities, and consulting for managers to perfect the internal control system. Therefore, the authors chose the topic “Strengthening internal audit at public companies to improve the quality of financial statements: a case study of Hanoi Stock Exchange, Vietnam” is a paper goal.

Literature Review

Internal Audit (IA)

An internal audit is an independent observer to ensure that the company's operations comply with national laws, business ethics, and company operating regulations. The next function of internal audit is to help business owners improve weaknesses from the management system and corporate governance (Brandon, 2010). Internal audit is an independent and objective guarantee and assurance activity designed to increase the value and efficiency of events in an organization. Internal audit helps an organization achieve its objectives by providing a systematic and disciplined approach to evaluate and improve the effectiveness of its risk management, control, and management processes treatment (Ali, 2018).

Internal audit is an independent evaluation and consulting activity within an organization, designed to improve and add value to the actions of that organization (Wooten, 2003). The internal audit helped an organization achieve its goals by systematically evaluating and improving its management, control, and risk management processes (Arel et al., 2011). An internal audit is a tool to help detect and improve the organization's management system's weaknesses. For businesses, the Internal Audit can assist the board of directors and the board of directors in better controlling operations and managing risks whenever the size and complexity of the business are beyond their control (Johl et al., 2013).

The Quality of Financial Statements (QFS)

The quality of financial statements provides information about the business' financial performance, such as assets, debt, equity, revenue, profit, and cash flow (Smith& Wood, 2019). The report often published a period at the end of each quarter and the end of the year. Financial statements are the product of financial accounting and are the output of the accounting information system (Lennox, 1999). The purpose of financial statements is to provide useful financial information about the business to current and potential investors, lenders, and other creditors in making decisions about the provision of business (Abbott et al., 2016). A useful financial report is a financial report with the required quality characteristics, and necessary and complementary factors also influence this quality. Besides, the quality of financial statements has comparable, verifiable, timely, and understandable are qualitative characteristics that improve the usefulness of relevant information and faithfully presented in a financial report (Gras?Gil et al., 2012).

Professional Capacity (PC)

Auditors’ professional capacity must perform audit work with the full necessary professional qualifications, with the highest caution and diligent working spirit (Elaoud & Jarboui, 2017). Auditors are responsible for maintaining, updating, and enhancing knowledge in practical operations in the legal environment and technical advances to meet job requirements. Through theoretical analysis, previous research, mainly based on foreign technology research combined with qualitative research shows that professional capacity, independence, and objective are the three factors that affecting the internal audit with math content (Fowzia, 2010). From there, the presentations are established. Therefore, the following hypothesis built.

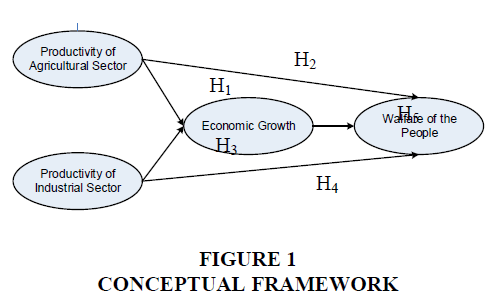

H1 Professional capacity factor affecting the internal audit of public companies in HNX.

H2 Professional capacity factor affecting the quality of financial statements listed companies

Objective (OB)

Auditors must be fair, respect the truth, and must not be biased or biased. Relationships that lead to prejudice, bias, or the influence of others that could lead to a violation of objectivity, should not accept gifts or give gifts, attend entertainment or invite entertainment to the extent possible (Alzeban & Gwilliam, 2014). Internal audit can significantly affect career assessments or those with whom you work. Auditors must be frank, honest, and have a definite opinion. Integrity also emphasizes fairness and credibility (Boon et al., 2005). The management behavior theory is that internal auditors will work better when working in a corporate environment that supports each other and is objective (Balsam et al., 2003). Therefore, the following hypothesis built.

H3 Objective affecting the internal audit of public companies in HNX.

H4 Objective capacity factor affecting the quality of financial statements at public companies in HNX.

Independence (IN)

Independence is the primary practice principle of auditors. Independence includes Independent of thought - A state of thinking that allows one to give opinions without being affected by the effects contrary to professional judgments, allowing an individual to act with integrity and objectivity and have professional caution (Lone, 2018).

Formal independence is the absence of working relationships and circumstances that have significant influence that makes a third party understand that it is not independent, or understand the professional integrity, objectivity and prudence of Company employees or members of service delivery groups are not maintained (Abbott et al., 2016). Besides, auditors must keep confidential the information obtained in the audit process; not to disclose any information without the permission of an authorized person unless it is obligated to publish it as required by law or within the scope of its professional powers Al-Chahadah et al. 2018). Therefore, the following hypothesis built (Figure 1).

Figure 1 Factors Affecting the Internal Audit Affecting the Quality of Financial Statements at Public Companies in HNX Methods of Research

H5 Independence affecting the internal audit of public companies in HNX.

H6 Independence affecting the quality of financial statements at public companies in HNX.

H7 The internal audit factor affecting the quality of financial statements at public companies in HNX.

The authors had factors affecting the internal audit and the quality of financial statements at public companies in HNX, which had many steps following. To collect data and identify the factors affecting internal audit and the quality of financial statements, we implement the following research process and methods: Select a data collection template consistent with research. Conduct data collection through many stages with specific jobs (Hair et al., 1998).

1. The authors identified the research title. The title is a factor that affects the internal audit affecting the quality of financial statements at public companies in HNX. This study is usually chosen based on group discussions of experts who are knowledgeable about internal audit and financial statements.

2. The authors found out study objectives. The study’s goal tested factors that affecting the internal audit affecting the quality of financial statements at public companies in HNX.

3. The authors searched the research theories and related to studies. After this stage, the authors build a model of factors that affecting the internal audit affecting the quality of financial statements at public companies in HNX (Hair et al., 1998).

4. Based on step 3. The authors built preliminary scales and the initial model based on the formal discussion: authors collected qualitative data through formal studies with subjects that are representatives of the independent audit company. The authors interviewed experts in audit subjects. The authors surveyed 30 experts about accounting and auditing to improve the scale and design of the surveying of questions.

5. The authors adjusted the research model. This step made a better model. The authors had an adjustment and refined scale by testing Cronbach's Alpha and exploratory factor analysis (EFA). The authors surveyed 100 auditors working for 50 companies of auditing. In this step, authors chose the participants to discuss based on the criteria of in-depth knowledge, auditing experience, and audit expected to help us discover the factors that affect factors that affecting the internal audit affecting the quality of financial statements at public companies in HNX (Hair et al., 1998).

6. The authors continued to survey 700 accountants working for 350 public companies in HNX; each company has two accountants joined, and authors got Data from February 2020 to June 2020. We determine the number of samples from researchers. Specifically, the number of samples determined at the level of information collected is almost no different from the previous examples, then continue. Select one more sample to confirm the saturation point. If no new information is detected, it stopped. The authors tested Cronbach's Alpha and EFA. This paper had 19 items and 675 accountants processed. The authors conduct an in-depth analysis of each case's data and compare the data of each case to determine similarities and differences. Surveyed subjects are those who directly participate in the audit or directly sign/review the quality of the audit, so they are the people who know best about the factors that affect the quality of the work by themselves so that the survey results will be highly reliable.

7. The authors continued testing Cronbach's Alpha, EFA, SEM. The authors used a random sampling technique and spent 30 minutes on a survey. Besides, the authors continued to confirmatory factor analysis (CFA). CMIN/df ≤ 2, some cases CMIN/df is ≤ 3.0 or < 5.0; GFI, TLI, CFI ≥ 0.9. RMSEA ≤ 0.08. Finally, based on the results of step 7, the authors had conclusions and recommendations to strengthen internal audit at public companies to improve the quality of financial statements in Vietnam (Hair et al., 1998).

Results

The authors had the survey questionnaire sent to 700 auditors from 350 companies approved to audit the financial statements of listed companies in 2019. The result of collecting 675 valid votes, the rate of vote recovery was 96.43% of the total. Seven hundred auditors sent to vote.

The feedback sample considered to have a reasonably high rate because the example selected is the auditors named in the list of approved auditors of the listed corporate financial statements among nearly 2,000 independent auditors practicing auditing in Hanoi, Vietnam. The authors had the research results testing for factors that affecting the internal audit affecting the quality of financial statements at public companies in HNX.

Table 1 had Cronbach’s entire Alpha that is greater than 0.6. Cronbach's Alpha for professional capacity (PC) is 0.961; Cronbach's Alpha for objective (OB) is 0.851; Cronbach's Alpha for independence (IN) 0.954; Cronbach's Alpha for internal audit (IA) is 0.942, and Cronbach's Alpha for the quality of financial statements (QFS) is 0.866.

| Table 1 Factors Affecting the Internal Audit Affecting the Quality of Financial Statements at Listed Companies in HNX | ||

| Items | Content | Cronbach's Alpha if Item Deleted |

| PC1 | Having international and Vietnamese practice certificates | 0.939 |

| PC2 | Update knowledge annually organized by the practitioner Association | 0.961 |

| PC3 | Ability to predict and identify opportunities and risks associated with a listed company | 0.956 |

| PC4 | Ability to judge and detect material mistakes | 0.939 |

| Cronbach's Alpha for professional capacity (PC) | 0.961 | |

| OB1 | Conduct audit work with due care | 0.796 |

| OB2 | Review, consider all aspects of the audit before giving an opinion that is objectively auditing | 0.811 |

| OB3 | Attitude with integrity, objectivity, and fairness | 0.841 |

| OB4 | Arrange the audit properly and scientifically Perform audits in a flexible and strict and objective way |

0.794 |

| Cronbach's Alpha for objective (OB) | 0.851 | |

| IN1 | Independent in social relations with the listed business | 0.933 |

| IN2 | Independent of economic ties with listed companies | 0.954 |

| IN3 | Independent in collecting and evaluating the audit evidence obtained | 0.943 |

| IN4 | Statement of independent commitment before conducting the audit of listed companies | 0.927 |

| Cronbach's Alpha for independence (IN) | 0.954 | |

| IA1 | Professional capacity affecting the internal audit of public companies in HNX | 0.929 |

| IA2 | Objective affecting the internal audit of public companies in HNX | 0.881 |

| IA3 | Independence affecting the internal audit of public companies in HNX | 0.935 |

| Cronbach's Alpha for internal audit (IA) | 0.942 | |

| QFS1 | Professional capacity affecting the quality of financial statements at public companies in HNX | 0.844 |

| QFS2 | Objective affecting the quality of financial statements at public companies in HNX | 0.800 |

| QFS3 | Independence affecting the quality of financial statements at public companies in HNX | 0.853 |

| QFS4 | The internal audit affecting the quality of financial statements at public companies in HNX | 0.815 |

| Cronbach's Alpha for the quality of financial statements (QFS) | 0.866 | |

Table 2 had a statistical test with significance level 0.01 and a column of the P-value, showing that all hypotheses supported. These results indicated that three factors influence the internal audit and the quality of financial statements at listed companies with significance at 1.0 percent. Besides, having an internal audit affecting the quality of financial statements with significance at 1.0 percent.

| Table 2 Testing Structural Equation Modeling | ||||||

| Relationships | Estimate | S.E. | C.R. | P | ||

| IA | <--- | PC | 0.109 | 0.026 | 4.105 | *** |

| IA | <--- | OB | 0.201 | 0.038 | 5.318 | *** |

| IA | <--- | IN | 0.480 | 0.031 | 15.381 | *** |

| QFS | <--- | PC | 0.045 | 0.014 | 3.136 | .002 |

| QFS | <--- | OB | 0.075 | 0.022 | 3.446 | *** |

| QFS | <--- | IN | 0.131 | 0.021 | 6.359 | *** |

| QFS | <--- | IA | 0.200 | 0.025 | 8.079 | *** |

Table 3 had Chi-square/df = 3.230 (< 5.0); GFI = 0.939; TLI = 0.968; CFI = 0.975. All of index had more than 0.8 and RMSEA = 0.058 (<0.08). The tested model results are very good and reliable enough for making recommendations.

| Table 3 Testing Model Fit Summary | |||||

| Model | NPAR | CMIN | DF | P | CMIN/DF |

| Default model | 57 | 429.567 | 133 | 0.000 | 3.230 |

| Saturated model | 190 | 0.000 | 0 | ||

| Independence model | 19 | 12266.550 | 171 | 0.000 | 71.734 |

| GFI | 0.939 | ||||

| TLI | 0.968 | ||||

| CFI | 0.975 | ||||

| RMSEA | 0.058 | ||||

Conclusion

Internal audit is considered the last line of defense of the business, supporting the business in coping with risks and taking advantage of opportunities to optimize operating results. In Vietnam, many factors make internal audit not fully and adequately recognized and concerned. Therefore, building and developing an internal audit according to international practices is an inevitable trend in Vietnam. The authors surveyed 700 accountants working for 350 listed companies in HNX; each company has two accountants joined, and authors got Data from February 2020 to June 2020. The need to improve accountability and transparency in operations makes businesses increasingly pay attention to the internal audit function. The results showed that three factors influenced the internal audit and the quality of financial statements at listed companies with significance at 1.0 percent. Besides, the authors had an internal audit affecting the quality of financial statements with significance at 1.0 percent. Based on the results, the authors proposed the recommendations to strengthen internal audit at public companies to improve the quality of financial statements in Vietnam.

Managerial Implications

First of all, through the research results on the attributes of the auditor's expertise, if the auditor has extensive experience, it means that the auditor shows that he has the knowledge and deep understanding of the business field, customers, specifically, the auditor will have (1) the ability to predict and identify opportunities and risks related to listed companies; (2) Ability to judge and detect material mistakes; (3) The ability to self-research and cultivate knowledge related to accounting, auditing and the fields in which customers operate; (4) Auditor experience and (5) Auditor experience of companies with the same profession. Besides, the State management agency studies early to issue more incentives and attract a contingent of talented domestic and foreign experts and lecturers to participate in training and to give incentives to investors. Foreign countries in the establishment and management of specialized training institutions in the field of accounting and auditing. Early set up standards for accounting and auditing training based on international standards and put them into public teaching. Besides, in universities promoting autonomy and increasing quality accreditation by independent organizations, the testers will base these standards on evaluating and publishing results to society. The training program must ensure flexibility, convenience, and in line with the content of the training program with professional certificates of accountancy and audit to recognize diplomas, change subjects or continue studying at The higher-order is favorable. In particular, the accounting training program needs to renew the direction of equipping students with knowledge and skills suitable to the reality. Focus on rebuilding the training program in the course of approaching international accounting standards such as ISA, IFRS. Simultaneously, increasing the teaching of foreign languages and specialized languages allows students to switch to international degrees (ACCA, CPA Australia, CIMA) more easily. Auditing majors also need higher foreign language output standards than today.

To attach importance to the training and fostering a contingent of teachers and educational administrators who have sufficient qualifications, abilities, teaching qualifications, scientific research, and management—strengthening faculty capacity through sending to study, studying study programs from countries with advanced education and accounting majors, such as USA, Australia, Singapore. Auditors must be aware that in-depth experience is the most critical factor that enables them to perform a quality audit and thereby enables the auditor to faceless occupational risks. Career more or avoid mistakes or lawsuits if it affects your professional reputation. Thus, it requires auditors to regularly self-consciously cultivate specialized experience in the profession to meet the intensive audit requirements.

Secondly, the auditor needs to enhance the expertise; the auditing company should pay attention to the recruitment and training of experienced staff/auditors, in-depth ability to meet the customers' audit needs. The difficulty of the current audit firms is to focus on meeting the number of practicing auditors but not focused on training specialized auditors. However, auditing firms wishing to provide high-quality services must quality filled and professional staff, regularly maintain, update, improve knowledge, and develop the ability. Immediately, new employees must train, and the training will continue throughout their time at the audit firm. The training can do through the actual job or the leading training courses of the company. Professional training is usually for specialized qualifications and needs to participate in career development programs specialized in finance, banking, construction. Depending on the audit market share, the company is aiming for, for example, auditing firms tend to audit in-depth for clients who are commercial banks. The company needs a team of auditors with expertise in this area. Listed companies in HNX should have training programs, and retraining of staff and auditors is strategic and vital because auditing is a professional activity. Specificity with deep expertise and high independence; the auditors' professional capacity, professional ethics, and behavioral culture determine the quality and efficiency of audit activities, the existence and reputation of the State Auditor. The audit profession training and fostering have many stages and solutions, but it has a breakthrough nature, have including the two most important they have Developing training programs and building a contingent of trainers. In addition, the auditing profession training and fostering will be the practice and application of knowledge into practice; attaching importance to educating personality, professional ethics, lifestyle, communication, legal knowledge, information technology with the achievements of the 4educationtion for auditors according to the process, in accordance with international auditing practices and standard under need to study practical training programs practicing, being active in the process of building a system of Vietnamese accounting standards, positive exchange and gain experiences from practitioners in countries with accounting systems development as well as international standards-issuing organizations. The university needs to promote it.

Scientific research groups on the fields of accounting and auditing mentioned above, products need to be released and disseminated as a basis for further research. Auditing firms should have clear incentive and sanction policies for auditors assigned to audit clients with complex business lines. Auditing work at listed companies is a high-risk multiple that assigned to auditors who are trained and have sufficient professional skills and competencies to meet actual requirements. Therefore, working hours should also pay higher; at the same time, there should also be a heavy punishment for authors who do not complete the quality of work. The universities' training program in the field of accounting needs to be renewed, equipping students with knowledge and skills suitable to the current situation of Vietnam and preparing for the premise steps to converge with international accounting. The program system, as well as teaching materials, should be appropriately redesigned and updated regularly issued accounting standards. Universities, colleges, specialized training places industry needs to become a bridge between businesses, and the application of legal documents new accounting regulations in the role of guiding and collecting comments from the party’s enterprise. In the training process, universities need to continue promoting connections with enterprises, reputable accounting, and professional auditing associations to enhance their professional practice skills so that graduates can well meet the needs of the market. Students will have the opportunity to learn about reality in enterprises through field trips, exchanges, and exchanges with business leaders. In particular, promoting the implementation of the motto of practical training, organizing training should organize seminars on accounting, discussing newly issued documents with the participation of practicing units.

Finally, audit teachers continue innovating teaching methods, trying to combine well between theory and practice, giving students regular practical access to improve their practice. Constantly adjust, update, and supplement teaching lesson plans close to the human needs of businesses in practice. Actively update knowledge, new domestic and international accounting regulations and standards, not only help to improve qualifications, but also create diversity in knowledge transmission for students. Focus on applying technology in teaching to achieve the highest efficiency.

Besides, learners should promote the creative initiative in learning, learning effective learning methods, improving scientific research, and learning associated with the practice. Determine that learning is taking knowledge, maturing in thinking, and life skills are the basis of going to work, not studying for a degree. Vietnam joined the ASEAN economic community, as committed, accounting, and auditing services will be one of the eight service sectors that are freely open to not only legal entities but also natural persons. Auditors have a practicing certificate and have recognized vocational skills. They are participating in forums and groups on accounting to improve their skills as well as rubbing reality, serving after graduation.

Recommendations to reduce the pressure and ensure the independence of the auditor/audit team. Although pressure factors are independent, they assessed as factors that have a lower influence than in-depth, conscious, and professional experience on the quality of internal audit. To reduce audit pressure on auditors, in addition to ensuring the number of auditors, auditing companies need to pay attention to assisting auditors with the best means and working tools possible such as developing a suitable sample audit process, professional statistical methods in sampling, evidence collection. In ensuring independence, the firm needs to adopt an effective quality management policy that commits and controls the auditor regularly to maintain his work's independence by standards. At the same time, professional standards and company policies attached to the administration of rewarding and punishing publicly for all employees of the company. They are improving working conditions, in which focusing on designing a method and professional audit implementation tools. To create better working conditions for auditor/audit teams in enhancing audit quality, companies need to focus on developing a professional audit method and apparatus - criteria: The evaluation belongs to the requirements with the most significant impact on the quality of audit. This instrumental approach involves building an effective sample audit process or an in-depth audit process for clients of the same industry. Improve the professional ethics of auditors. Professional ethics are guidelines for members always to maintain a correct professional attitude to protect and enhance the reputation of the profession. Practicing auditors' responsibility is not limited to meeting the needs of the individual customers or the business where the practicing auditor provides services, but also must understand and comply with ethical standards' requirements for the benefit of the public. To continue to improve the professional ethics of auditors in the future.

Audit students continuously improve professional development through professional improvement courses. They regularly learn and share experiences with colleagues about compliance with professional, ethical standards. It is necessary to periodically cultivate and improve the quality of professional staff, train themselves to be intuitive, independent, impartial, fair, careful, diligent, and responsible. Audit students always have the right attitude, learn, and draw practical experiences. This job helps to shape your practice skills and the quality to become a professional practitioner.

References

- Abbott, L.J., Daugherty, B., Parker, S., & Peters, G.F. (2016). Internal audit quality and financial reporting quality: The joint importance of independence and competence. Journal of Accounting Research, 54(1), 3-40.

- Abuazza, W.O., Mihret, D.G., James, K., & Best, P. (2015). The perceived scope of internal audit function in Libyan public enterprises. Managerial Auditing Journal , 30(7), 560-581.

- Al-Chahadah, A.R., Soda, M.Z., & Al Omari, R. (2018). The impact of the internal audit on the quality of accounting information in the jordanian commercial banks. International Journal of Economics and Finance, 10(9), 157-167.

- Ali, B.O. (2018). Factors influencing the effectiveness of internal audit on organizational performance. International Journal of Advanced Engineering, Management and Science, 4(4), 239983.

- Alzeban, A., & Gwilliam, D. (2014). Factors affecting the internal audit effectiveness: A survey of the Saudi public sector. Journal of International Accounting, Auditing and Taxation, 23(2), 74-86.

- Arel, B., Beaudoin, C., & Cianci, A. (2011). The impact of ethical leadership and the internal audit function on financial reporting decisions. The Institute of Internal Auditors, 23(2), 1-19.

- Balsam, S., Krishnan, J., & Yang, J.S. (2003). Auditor industry specialization and earnings quality. Auditing: A journal of practice & Theory, 22(2), 71-97.

- Boon, K., Crowe, S., McKinnon, J., & Ross, P. (2005). Compulsory audit tendering and audit fees: Evidence from Australian local government. International J ournal of A uditing, 9(3), 221-241.

- Brandon, D.M. (2010). External auditor evaluations of outsourced internal auditors. Auditing: A Journal of Practice & Theory, 29(2), 159-173.

- Elaoud, A., & Jarboui, A. (2017). Auditor specialization, accounting information quality and investment efficiency. Research in International Business and Finance, 42, 616-629.

- Fowzia, R. (2010). Co-operation between internal and external auditors: A comparative study on nationalized and foreign banks in Bangladesh. World Journal of M anagement, 2(2), 22-35.

- Gras?Gil, E., Marin?Hernandez, S., & de Lema, D.G.P. (2012). Internal audit and financial reporting in the Spanish banking industry. Managerial Auditing Journal , 27(8), 48-57.

- Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E., & Tatham, R.L. (1998). Multivariate data analysis. Upper Saddle River, NJ: Prentice hall.

- Johl, S.K., Johl, S.K., Subramaniam, N., & Cooper, B. (2013). Internal audit function, board quality and financial reporting quality: evidence from Malaysia. Managerial Auditing Journal , 28(9), 780-814.

- Lennox, C.S. (1999). Audit quality and auditor size: An evaluation of reputation and deep pockets hypotheses. Journal of Business Finance & Accounting, 26(7?8), 779-805.

- Lone, W.H (2018). The role of the audit committee in improving the internal audit function in jordanian insurance companies. Journal of Management Information Systems, 1(4), 9-20.

- Smith, T.K., & Wood, H.A. (2019). Internal audit quality and earnings management. The Accounting Review, 84(4), 1255-1280.

- Soh, D.S., & Martinov-Bennie, N. (2011). The internal audit function: Perceptions of internal audit roles, effectiveness and evaluation. Managerial Auditing Journal, 26(7), 605-622.

- Wooten, T.C. (2003). Research about audit quality. The CPA Journal, 73(1), 48.