Research Article: 2023 Vol: 26 Issue: 5S

Strengthening Tax Administration System: Upgrading Payment Options for Real Property Taxpayers in Cainta

Adrian A. Mabalay, Ateneo De Manila University

Citation Information: Mabalay, A.A. (2023). Strengthening tax administration system: upgrading payment options for real property taxpayers in Cainta. Journal of Legal, Ethical and Regulatory Issues, 26(S5), 1-19.

Abstract

In today’s setting, most local government units are adopting and implementing innovative approaches to tax collection efficiency through convenient and better payment options for taxpayers. This study describes the current situation of real property tax collection in Cainta. It establishes that an automated real property tax collection through information technology is more efficient than the existing tax administration system. This allows citizens to pay their tax dues without proceeding to the city hall, where long lines and miscellaneous costs haunt them. This research found that alternative payment options are more efficient than manual real property tax payments in terms of cost and time. Although these automated systems are not yet widely adopted, this study strongly recommends implementing and adopting an automated tax administration system in Cainta through various payment options, including online payment, mobile money, satellite centers, accredited banks, payment centers, and automated teller machines. It is hoped that this system will help address issues in the existing real property tax system ensuing in a continuous decline in the number of delinquent taxpayers and an increase in Cainta’s tax collection rate.

Keywords

Payment Options, Real Property Tax, Revenue, Tax Administration System Taxpayer Behavior, Technology Acceptance Model, Technology Infrastructure, User Adoption.

Introduction

Real property tax payment is an essential revenue source for local governments in the Philippines. However, collecting real property taxes has been challenging for many local government units (LGUs) for several reasons, including inefficient collection systems, low tax compliance rates, and lack of transparency in tax collection.

One of the major challenges in real property tax payment in the Philippines is the low tax compliance rate among property owners. According to a study by Uy & Macasaquit (2017), “the low compliance rate among property owners is due to a lack of understanding of tax policies, inadequate information dissemination, and inefficient tax collection systems”. In addition, many property owners in the Philippines do not have the necessary documents, such as land titles, to prove their ownership, which makes it difficult for LGUs to identify and collect taxes from them.

Another challenge is the inefficient collection systems used by LGUs. A study by Tan & Villanueva (2018) found that “many LGUs in the Philippines still rely on manual tax collection systems, which are prone to errors, delays, and corruption”. Moreover, the lack of transparency in tax collection has also been a major issue, leading to mistrust and suspicion among taxpayers and undermining tax compliance.

The Philippines’ richest municipality is not exempted from this. With an annual revenue of about PhP2 billion, Cainta relies mostly on local taxes, including business tax, real property tax (RPT), and non-tax revenues such as regulatory fees. Other external sources include the share of LGUs from the Internal Revenue Allotment (IRA). Improving the quality of services for its citizens to alleviate the quality of life in the municipality requires revenue. Therefore, patching the holes in the LGU’s revenue stream is needed. As one of the main contributors to Cainta’s revenue/budget, the real property tax, which is more than 9% of the total receipt, is also one of the most settled (by many) and avoided (by some) tax duties by the public, aside from business tax. This, according to A. Enriquez (personal communication, July 08, 2016) must be addressed vehemently, especially the delinquent taxpayers who, in other words, are constant tax evaders.

Several proposed solutions have been identified to address real property tax payment challenges in the Philippines. One proposed solution is using information technology (IT) to improve tax collection systems. According to a study by Sabularse & Azucena (2019), “IT can automate tax collection processes, reduce errors, and improve transparency in tax collection”. For instance, online tax payment systems and mobile applications can make it easier for taxpayers to pay their taxes and for LGUs to monitor tax collections.

Another proposed solution is the improvement of tax education and information dissemination. A study by Delos Reyes (2018) found that “many property owners in the Philippines are not aware of their tax obligations and do not have a clear understanding of tax policies and procedures”. Providing tax education and information to property owners can help increase tax compliance rates and reduce the number of delinquent taxpayers.

Given the situation, there is a need to describe the current real property tax collection situation in Cainta and identify possible options for improving and streamlining its collection by adopting an automated payment option. Therefore, this study aims to streamline the real property tax collection in Cainta by identifying the issues in Cainta's existing real property tax collection; establishing that an automated real property tax collection is more efficient than the existing system; promoting an automated real property tax system in Cainta; and recommending possible solutions to address the issues encountered in an automated real property tax collection.

Brief Literature Review

The management gap of real property tax (RPT) payment in the Philippines has been the subject of numerous studies due to its importance as a source of revenue for local government units. This critical review will examine the findings of various studies on the management gaps in Philippine RPT payment, focusing on the identified gaps and suggested solutions. A brief discussion on taxpayer behavior and studies on alternative real property payment options follows.

Management Gaps in Philippine Real Property Tax Payment

Abrigo et al. (2018) identified several management gaps in the RPT collection in the Philippines, including poor tax assessment and valuation, inadequate tax monitoring and enforcement, and lack of taxpayer education and engagement. The study also found a lack of transparency in the RPT collection process, leading to taxpayer mistrust and low collection rates. Similarly, a study by Garcia (2019) noted that non-compliance was a major problem in RPT payment, with many taxpayers not paying their RPT on time or declaring the correct property value. The study identified several factors contributing to non-compliance, including complex tax regulations, weak enforcement mechanisms, and lack of taxpayer education and awareness.

Inconsistencies in the implementation of the RPT system across different municipalities in the Philippines were highlighted in a study by Lanzona & Tiangco (2017). The study found that some areas had more efficient and effective RPT systems than others, with factors such as political will, capacity building, and stakeholder engagement playing a significant role in the RPT collection success.

Several studies have suggested using technology to address RPT management gaps in the Philippines. For instance, a study by Aldea & Dulay (2019) proposed using mobile applications to improve tax compliance and enhance taxpayer engagement. Similarly, a study by Ramos et al. (2018) suggested using online payment systems to simplify the RPT payment process and reduce opportunities for corruption.

Taxpayer Behavior

Taxpayer behavior refers to the attitudes and taxpayer actions toward tax compliance. Tax compliance has been a persistent issue in the Philippines, particularly with real property taxes. This brief review explores existing research on taxpayer behavior in the Philippines, focusing on the factors influencing tax compliance and non-compliance.

Factors affecting taxpayer behavior

Several factors have been identified as influencing taxpayer behavior in the Philippines. One of the most significant factors is the perceived fairness of the tax system. According to a study by Alm & Torgler (2018), “taxpayers are more like to comply with tax obligations when they perceive the tax system as fair and just”. However, the perceived fairness of the Philippine tax system has been questioned due to issues such as corruption and inefficiency in tax collection.

Another factor influencing Filipino taxpayers is the level of trust in government institutions. According to a study by Bautista (2020), “taxpayers are more likely to comply with tax obligations when they trust that the government will use tax revenues for the public good”

However, trust in Philippine government institutions has been low, particularly with corruption and political instability.

Moreover, the level of tax knowledge and awareness among taxpayers has been found to influence tax compliance behavior. According to a study by Pascual & Roque (2019), “taxpayers who have a better understanding of the tax system and their obligations are more likely to comply with tax requirements”. However, the level of tax knowledge and awareness among Filipino taxpayers has been relatively low, particularly with real property taxes.

Challenges to tax compliance

There are several challenges to tax compliance for Filipino real property taxpayers. One of the main challenges is the lack of transparency and accountability in the tax collection process. “The lack of transparency and accountability in tax collection processes can erode taxpayer trust and reduce tax compliance rates” (Lopez & Platon, 2021). Another challenge to tax compliance is the complex and cumbersome tax system. “The complex and cumbersome tax system can lead to confusion and non-compliance among taxpayers, particularly those who lack tax knowledge and awareness” (Teves & Mendoza, 2020). The lack of technological infrastructure and digital literacy in some areas of the country can also hinder taxpayer compliance.

In conclusion, taxpayer behavior in the Philippines is influenced by several factors, including the perceived fairness of the tax system, the level of trust in government institutions, and the level of taxpayer knowledge and awareness. However, there are also challenges to tax compliance, including the lack of transparency and accountability in the tax collection process, the complex and cumbersome tax system, and the lack of technological infrastructure and digital literacy. To address these challenges and improve tax compliance in the Philippines, it is crucial to enhance tax collection transparency and accountability, tax system simplification, and improve taxpayer knowledge and awareness (Alola et al., 2021).

Upgrading Real Property Tax Payment Options

One study by Layugan & De Leon (2018) found that introducing online payment options for real property taxes in Baguio increased compliance rates and more efficient tax collection. Similarly, another study by Tanchuling & Yap (2018) found that using mobile technology for real property tax payments in Makati improved collection efficiency and reduced administrative costs.

However, challenges still need to be addressed despite the efforts to upgrade real property tax payment options. One of the challenges is the limited access to technology and internet connectivity, particularly in rural areas. Balbontin & Caleda (2020) noted that many rural taxpayers still rely on manual payment methods due to limited access to technology and infrastructure. This highlights the need for more inclusive approaches to real property tax payment, such as using mobile payment options that do not require internet connectivity.

Research gaps

Research on Philippine real property tax payments has been ongoing for many years. However, there are still gaps in understanding the factors that affect compliance and the effectiveness of policies to improve payment rates. One area that requires further investigation is the role of taxpayer education in promoting voluntary compliance. Studies have shown that a lack of knowledge about tax obligations and payment procedures is a major barrier to compliance (Alipio & Tolentino, 2020; Escresa, 2016). However, there is limited research on the effectiveness of taxpayer education programs in the Philippines and the factors that influence their success.

Another research gap is the impact of corruption on tax collection and payment. Corruption remains a significant problem in the Philippines, and there is evidence that it affects tax compliance and revenue collection (BIR, 2018; Sano & Macasaquit, 2017). However, there is a lack of research on the specific forms of corruption that affect real property tax payments and the strategies that can be used to address them.

Finally, there is a need for more research on the use of technology in real property tax payments. The Philippine government has introduced several initiatives to improve tax collection efficiency and transparency, including electronic payment systems and online tax portals (BIR, 2019). However, there is limited research on the effectiveness of these initiatives and the factors that influence their adoption and use by taxpayers.

In conclusion, while there has been significant research on real property tax payment in the Philippines, there are still several gaps in our understanding of the factors that affect compliance and effectiveness of policies to improve payment rates. Further research is needed to explore the role of taxpayer education, corruption's impact, and technology's use in real property tax payments.

Methodology

Theoretical Foundation

The technology acceptance model (TAM) is a theoretical framework that can be used to understand how individuals adopt and use technology. It posits that perceived usefulness (PU) and perceived ease of use (PEOU) are the critical determinants of an individual’s intention to use technology, which ultimately leads to actual usage behavior (Davis, 1989).

TAM can help identify factors influencing taxpayers’ adoption of new payment options in the context of upgrading real property payment options in the Philippines. For instance, if a new payment option is perceived as more useful and easier to use than traditional methods, taxpayers may be more likely to adopt it. In addition, TAM can also help identify potential barriers to adoption, such as concerns about the security of online payments or the level of trust in the tax administration system (Venkatesh et al., 2003).

Furthermore, recent studies have highlighted the importance of perceived trust as a key factor in adopting new payment technologies (Kim et al., 2020). Therefore, tax administrators must ensure that the new payment options are perceived as trustworthy and secure to increase adoption rates among taxpayers.

Overall, TAM provides a valuable framework for understanding the factors that influence the adoption of new real property tax payment options in the Philippines. By considering factors such as perceived usefulness, ease of use, and trust, tax administrators can design payment options more likely to be adopted by taxpayers and ultimately lead to improved tax collection rates.

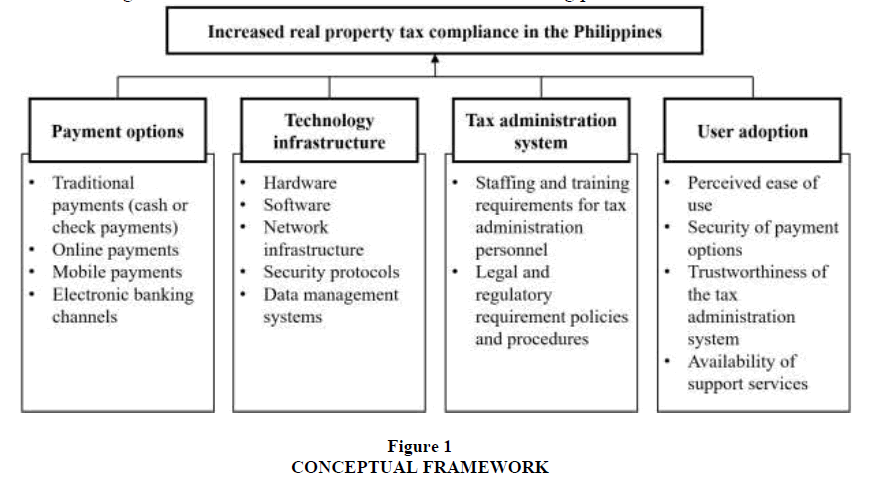

Conceptual Framework

This study combined the ideas of Davis (1989) technology acceptance model. By considering these key elements, tax administrators can refer to this conceptual framework in Figure 1 for upgrading real property tax payment options based on a holistic view of the factors influencing payment behavior. This can enable tax administrators to design and implement payment options that are more aligned with the needs and preferences of taxpayers, ultimately leading to improved tax collection rates and more efficient tax administration processes.

1. Payment options: This refers to the different channels through which taxpayers can make real property tax payments. These can include traditional payment options, such as cash or check payments, and newer options, such as online payments, mobile payments, or electronic banking channels. 2. Technology infrastructure: This refers to the technological capabilities required to enable different payment options. This includes the hardware, software, and network infrastructure needed to support online or mobile payment options, as well as the security protocols and data management systems required to ensure the safety and confidentiality of payment information. 3. Tax administration system: This refers to the organizational and administratDavisive processes involved in collecting, processing, and managing real property tax payments. This includes the staffing and training requirements for tax administration personnel and the policies and procedures required to ensure compliance with legal and regulatory requirements. 4. User adoption: This refers to the extent to which taxpayers are willing and able to adopt new payment options. This can be influenced by various factors, including the perceived ease of use and security payment options, the trustworthiness of the tax administration system, and the availability of support services to assist with payment processing.

Research Philosophy

Interpretivism is a research philosophy that aims to understand the social reality of a phenomenon and how individuals make sense of it. In the context of upgrading real property tax payment options, interpretivism can help understand the perspectives of taxpayers and tax administrators toward adopting new technologies and systems for tax payment. The interpretive approach allows for the exploration of the experiences and perceptions of individuals toward real property tax payment options, which can lead to a better understanding of the factors that influence their decision-making processes.

Research Design

Given the operational framework, this study is descriptive and exploratory, utilizing a case study design. This research examines the issues encountered by stakeholders in real property tax collection. It provides recommendations on various innovations as bases for answering how Cainta can improve its RPT collection. This qualitative research used primary data from interviews, including focus group discussions, observations, and a normative survey. In contrast, secondary data come from a comprehensive review of published and unpublished references.

Locale of the study

This research uses Cainta as its case study. As a first-class urban municipality, one of Cainta’s revenue sources is the real property tax, which is collected annually from property owners in the municipality. Cainta’s annual revenue is valued to be about PhP2 billion. Founded on August 15, 1571, it is one of the oldest municipalities in the country, with a land area of about 4,299 hectares (10,620 acres). Cainta has seven barangays namely: San Andres (Pob.), San Isidro, San Juan, San Roque, Sta. Rosa, Santo Domingo, and Santo Niño. According to the Philippine Statistics Authority, Cainta’s estimated population as of August 1, 2020, is 332,909, making it the most populous Philippine municipality. This represents a significant increase from the previous census conducted in 2015, where the population was recorded at 322,128. The real property taxpayers are the “clientele” from these barangays. Their involvement in this study is relevant so that the issues of geographical location, time, and miscellaneous expenses in settling their taxes are addressed more efficiently and effectively.

Data collection methods

The primary data were acquired from interviews and focus group discussions with real property taxpayers to acquire principal information relevant to the study. Other informants were the local government employees who are the main proponents and implementers of the program and other key players who could give relevant information for the development of real property tax payments. Key officials from Valenzuela City were likewise interviewed to provide crucial information on how they came up with a similar regulatory simplification process.

Supplemental to data gathering, a categorical “nominal” survey was used where specific names or labels as possible answers were provided. The purpose of a survey is to solicit feedback from the municipality's clientele and employees. The questionnaires were personally handed to the respondents by a third-party survey contractor commissioned by the author to get their input on the existing process/procedure, including the issues they encounter in real property tax payment anchored in the 3Cs of the program (i.e., convenience, simplification and streamlining of payment options; confidence, reduction in red tape and the impression that taxpayer’s money is put to good use; and competence, world-class payment facilities and instruments).

Using the sample size formula, the number of respondents needed for this study is 97 based on a population of 332,128 (PSA, 2015) inhabitants. As part of the data sampling and data collection methods, most of the respondents came from Brgy. San Isidro, the farthest barangay in Cainta, where Balanti, a sitio or community located in the same area, is the farthest geographical location in the municipality. Respondents from an area far from the munisipyo provided significant information on how they settled their taxes.

Another form of gathering primary data was time and motion study through observation. In this way, this research assessed the time spent by each participant in settling their real property tax obligation. Secondary data was also necessary for the success of this research. For comparative purposes, this research utilized data from 2013 to 2015. Existing documents such as a statement of receipts, various documents relating to real property tax, the schedule of the assessed value of real property in the locality, the citizen’s charter, a copy of an ordinance adopting the upgrading of payment options/automation of the payment process in Valenzuela City, and other published and unpublished sources from government, the private sector, and academic institutions relevant to the completion of this study were comprehensively reviewed.

Methods of Data Analysis

The data gathered through interviews and FGDs from key personnel were analyzed using narrative and textual presentations. Interviews from other agencies utilized the same analysis. The information from the survey was presented through comparative and explanatory measures based on the inputs of the respondents. Their feedback is vital information on the perspectives of real property taxpayers in correlation with the suggested upgrading of payment options. Information acquired from planned observation provided a first-hand overview of the actual real property tax payment process. Finally, secondary data from published and unpublished references were highlighted in the study through tabular and textual presentations.

Ethical Considerations

Ethical considerations were crucial in the conduct of this research. Informed consent was obtained from participants free to decline participation or withdraw without penalty. Confidentiality of personal information was maintained, and data security and privacy protection were ensured. Respect and non-discrimination towards participants were upheld as essential ethical principles. Ethical clearance was obtained from an institutional review board or ethics committee before conducting the study to ensure ethical and responsible research. Adhering to these principles ensured that the study respected participants’ rights and wellbeing and contributed to the societal good.

Results

Real Property Tax Situation

The total assessed value of Cainta’s real property is around PhP30 billion. In an interview with Cainta’s municipal assessor, it is assumed that Cainta’s real property assessment is one of the country’s highest if only the national government could consolidate all data from the different regions indicating the assessed values of real property per local government unit (D. Pagkatipunan, personal communication, July 08, 2016). He added that the treasurer’s responsibility is collecting real property tax. The assessor is only responsible for submitting the real property tax assessment value to the treasurer, where the latter would base the taxes imposed on real property shown in Table 1.

| Table 1 Real Property Tax Computation |

||

|---|---|---|

| Market value | Assessed value | Real property tax rate |

| Residential | 20% | 2% |

| Commercial/Industrial | 50% | 2% |

| Agricultural | 40% | 2% |

Source: Cainta Treasurer’s Office (2016).

Tax computation

There are factors to be considered in the computation of real property taxes, such as (a) the taxable assessed value of unidentified properties and those within the contested areas; (b) the assessed value of road lots, alleys, and easements; (c) assessed value of open spaces; and (d) a certain percentage room for error—the sum of which are deducted from the total taxable assessed value generated for a particular year, which is the basis for the real property tax computation of the succeeding year. The following are the standard formulae used to compute real property tax by type: residential property tax (1), commercial/industrial property tax (2), and agricultural property tax (3).

For example, if the market value for a residential property is valued at PhP1 million, the assessed value would be PhP200,000 multiplied by 2% is equal to PhP4,000, which is the real property tax to be paid. On the other hand, if the commercial/industrial property’s market value is at PhP1 million, the assessed value would be PhP500,000 multiplied by 2%. Therefore, the real property tax is equal to PhP10,000. Furthermore, if the agricultural property has a market value of PhP1 million, the assessed value is PhP400,000, multiplied by 2%. Therefore, the real property tax is equal to PhP8,000.

According to an interview with Cainta’s revenue collection officer, real property tax has a rate of levy equal to 2%. This 2% is divided into two, called the disposition of shares. The 1% goes to the basic tax (i.e., the general fund) and the other 1% goes to the special education fund (SEF). The 1% basic tax is divided into three: 40% goes to the municipality where the property is located, 35% goes to the province where the property is located, and the remaining 25% goes to the barangay where the property is located. On the other hand, the SEF is divided into two: 50% goes to the municipal SEF while the other 50% goes to the provincial SEF. Tax collection is a collective effort by the local governments where the property is located. She also said certain factors affect Cainta’s real property tax collection effort: (a) an alarming number of delinquent taxpayers, (b) the high assessment value of the assessor, (c) proper dissemination of real property tax orders, and (d) unreasonable discounts given to taxpayers (A. Enriquez, personal communication, July 08, 2016).

Table 2 shows the number of real properties according to their classification as of FY 2015. For tax collection purposes, LGUs shall appraise all real properties, whether taxable or exempt, at their current and fair market value prevailing in the localities where they are situated. In this case, the total taxable properties in Cainta are 85,882. The bulk is from residential properties (79,210), while the least of real property units come from one recreational property. Other taxable properties include agricultural properties (425), commercial properties (1,596), industrial properties (934), and road units (3,716). On the other hand, exempt properties include charitable institutions (4), religious institutions (11), educational institutions (14), and government institutions (187). This gives a total of 216 exempt properties in Cainta. Cainta’s total real property units are 86,098, with a total assessed value of PhP30,349,438,040.

| Table 2 Number Of Real Property Taxpayers According To Classification |

||||

|---|---|---|---|---|

| Taxable | Exempt | Total taxable units | ||

| Property classification | No. of real property units | Property classification | No. of real property units | |

| Residential | 79,210 | Government | 187 | |

| Agricultural | 425 | Religious | 11 | |

| Commercial | 1,596 | Charitable | 4 | |

| Industrial | 934 | Educational | 14 | |

| Road | 3,716 | |||

| Recreation | 1 | |||

| Total taxable | 85,882 | Total exempt | 216 | 86,098 |

Source: Cainta Treasurer’s Office (2016).

Delinquency disposition

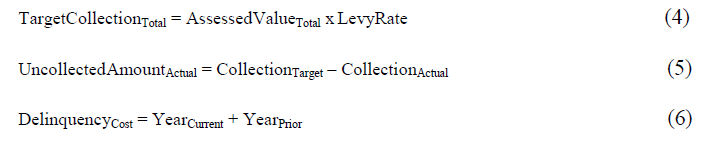

After discussing all these, what are the issues with Cainta’s real property tax administration? Using these formulae: total collection target (4), actual uncollected amount (5), and cost of delinquency (6), the following shows where the concern for governance innovation comes in.

If the total assessed value as of December 2015 is PhP30,349,438,040, then substituting the values in (4) equals PhP606,988,760.80. However, the actual collection for 2015 is PhP455,695,798.10. Therefore, substituting the values in the formula (5) equals PhP151,292,962.70. As of December 2015, the total delinquency = PhP1,678,308,825.36. Using (6) equals PhP1,678,308,825.36.

The cost of delinquency (or total delinquency) accumulated through the years, from prior to the current year, is alarming. For example, considering the amount for CY 2015 at PhP151,292,962.70, using the same formula for the net shares, the total net loss for basic tax (general fund) is PhP30,258,592.54 (i.e., PhP121,397,752.16, instead of just PhP91,139,159.62), while for SEF at PhP37,823,240.68 (i.e., PhP151,747,190.20, instead of just PhP113,923,949.53). Considering the uncollected amount, including prior years, amounting to PhP1,678,308,825.36, the total loss is PhP335,661,648.14 for basic tax (GF), while PhP419,577,060.17 for SEF. The figures show that much work is needed to improve Cainta's real property tax collection efforts.

Implementing alternative payment channels for real property tax will significantly improve Cainta’s tax rate (A. Enriquez, personal communication, July 08, 2016). It will benefit the local government and taxpayers. However, she added that automation also has its disadvantages. Streamlining business processes increases client satisfaction and contributes to a positive working environment for government employees. However, reducing red tape reduces contact between the taxpayer and the frontlines, which could require a lesser workforce. This may result in employee reassignment or termination, as necessary. Second, it will mean higher revenue for the LGU. Since human interaction is no longer present, favorable discounts to taxpayers, excluding regular discounts given to early taxpayers during December and from January to March yearly, may affect client satisfaction who regularly asks favors from someone they know from the inside.

Automation will improve local tax collection efforts, increasing revenue and addressing tax delinquents. It will address taxpayer issues geographically located in the peripheries of the munisipyo who exert too much effort and expenses just to pay their taxes. This includes delinquent taxpayers outside Cainta whose properties are still locally intact. Automation will also help monitor and evaluate the municipality’s tax collection performance and minimize red tape. These and the notice of delinquency will at least help improve local tax collection rates (A. Enriquez, personal communication, July 08, 2016). Table 3 shows the number of delinquent accounts listed and settled for 2015. There were only 17 out of 189 accounts settled for the prior and current year combined, with only a 9% efficiency ratio.

| Table 3 Number of delinquent accounts listed vs. Settled |

|

|---|---|

| Delinquent accounts auctioned | 189 |

| Accounts settled | 17 |

| Percentage of accounts settled vs. accounts auctioned | 9 |

Source: Department of Budget and Management (2016).

Local real property tax rate vs. the Philippine GDP

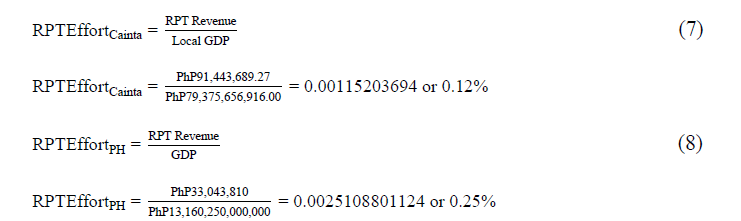

To measure the extent of Cainta’s current real property tax rate vis-à-vis the Philippines, whether it is significant (material) or insignificant (immaterial) to the local economy, the tax effort must be computed using the local and national RPT revenue and use the GDP for the same period (FY 2015) as the divisor. Using (7) and (8), the tax effort for Cainta and the Philippines suggests an insignificant economic value. Although insignificant, this does not mean that the revenue generated through RPT and the issue of RPT collection efficiency must be set aside. It only suggests improvements must be considered.

On another note, respondents of the short interviews also cited geographical location as a reason for their tax delinquency, particularly those living in remote areas. The time and money required to travel to the municipal hall were burdensome, causing them to neglect their tax obligations. One area of concern in this study is the distance between the municipal hall and Balanti, Cainta’s farthest community.

Taxpayers residing in Balanti face significant challenges. They must cross the boundaries of two cities, Marikina and Antipolo, just to reach the Cainta’s municipal hall. The distance often discourages residents from fulfilling their tax duties. In addition, real property owners living abroad find it difficult to pay their taxes due to limited payment channels. Although some have caretakers or relatives who can pay on their behalf, they still miss the opportunity to settle their taxes because the owners are not interested in sending money to the Philippines due to time constraints and personal reasons (A. Enriques, personal communication, July 08, 2016).

Survey Results

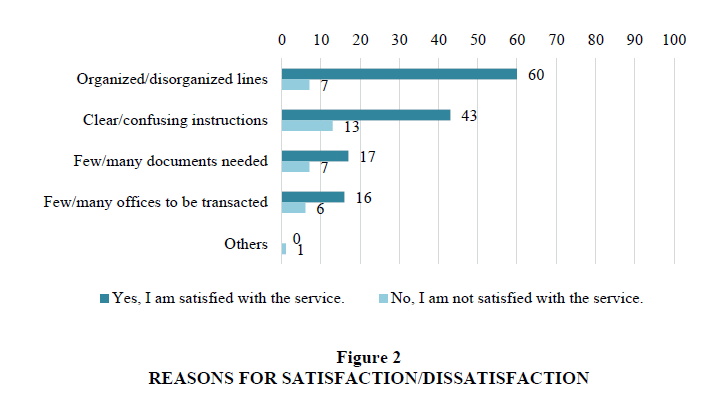

This report summarizes the responses of 99 property owners in Cainta regarding their experience in paying their real property tax. The report provides information on the number of years respondents have owned their property, their responsibility in paying taxes, the time they spend on RPT payment, waiting time, expenses incurred, level of satisfaction, experience transacting with the cashier, RPT collection speed, reasons for satisfaction or dissatisfaction, and words that best describe the RPT collection process. The discussion was based on the English survey. Charts were also employed for visual comprehension shown in Figure 2.

Most respondents have owned their property for over 11 years (70, 70%) followed by those who owned it for six to ten years (16, 16%). Only two (2%) owned their property for one to two years. Meanwhile, 55 (55%) of respondents religiously pay their real property tax obligations and never missed any year, while 42 (42%) oftentimes miss their taxes. However, they still fulfilled their duties given the right time and opportunity. Regarding time and waiting time allotted in paying their RPT, the majority (42, 42%) spent three to four hours, while some (38, 38.38%) waited for 16 to 20 minutes. Moreover, 53 (53.54%) of respondents spent more than PhP90, while 15 (15%) incurred no expense in settling their RPT aside from the amount due. About 50 (50.51%) were satisfied with the payment process, while 27.27% were most satisfied. On the other hand, 10 (10%) were least satisfied and 11 (11%) were dissatisfied.

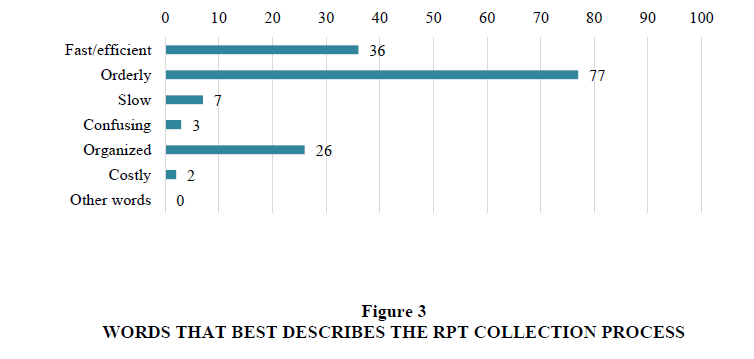

Concerning the speed of the RPT payment process, the majority (51, 51%) said the process was fast, while some (38, 38%) described it as faster than expected. Only three (3%) found it slower than expected. Moreover, respondents who were satisfied with the process found it organized with clear instructions and minimal documentary requirements. In contrast, dissatisfied respondents complained about disorganized cueing lines, confusing instructions, many documentary requirements, and many offices to deal with. When asked to describe the RPT collection process, the respondents chose “clear instructions” the most (43, 43%), followed by some (16, 16%) saying “a minimal number of offices to transact with to pay.” For the overall rating of Cainta’s RPT service, some (50, 50%) were satisfied, while others (21, 21%) were dissatisfied shown in Figure 3.

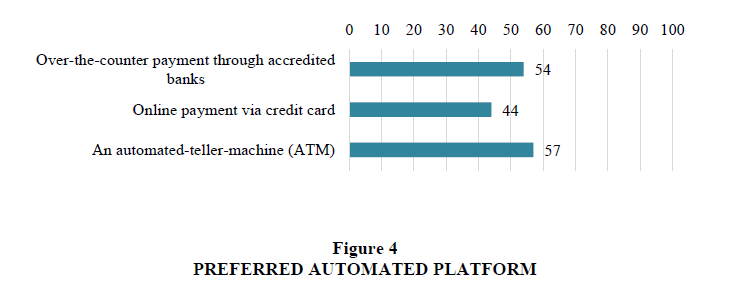

Furthermore, gauging taxpayers’ awareness and interest in other payment channels, only 31 (31%) were aware that other payment options can be made available, while 64 (64%) were unaware. However, most (65, 65%) were interested in using other payment channels, while some (32, 32%) were not interested. When asked about their preferred platform, some respondents misunderstood the question, leading to difficulty in interpreting the results. Nonetheless, 54 (54%) respondents favored over-the-counter payment through accredited banks, 44 (44%) chose online payment, and 57 (57%) preferred automated teller machines. The survey did not include other options, such as mobile applications (GCash). However, this does not mean respondents are not open to these channels. The findings suggest that different payment channels can be considered during implementation to cater varying taxpayer preferences shown in Figure 4.

Further, the respondents were also asked for any comments, suggestions, and/or opinions on the topic for discussion purposes. A few notable expressions include satisfaction with the service, stating that they have nothing to suggest for improvement. However, they offer various suggestions to enhance the tax payment process, such as assigning more tellers to reduce queues, becoming high-tech and updated with the latest methods, using new payment channels to speed the process, updating files and reducing requirements, and applying new strategies to avoid inconvenience. The respondents also wish for a faster process and lower taxes imposed. They also suggested various payment options, such as over-the-counter or online bank deposits and other online services. They hope implementing these alternative channels will improve real property tax management and address corruption in tax collection. The taxpayers value the overall convenience and efficiency of the tax process.

Conventional Process vs. Automation

Cainta’s conventional RPT process is shown in Table 4. There are two major parts to the process. First, a taxpayer must present their latest real property tax order of payment (RPTOP), proof of last payment, or the previous transaction’s official receipt. Without an official receipt, taxpayers may proceed to the municipal assessor to secure a copy of their tax declaration. Once the documents are properly presented to the designated window at the treasurer’s office, payment for real property tax is settled. The payment of RPT will not exceed five minutes, provided all requirements are complete. The second part is the acquisition of tax clearance. If the property is cleared of any tax obligations, a copy of the tax clearance shall be issued in less than three minutes. The entire process shall not exceed five minutes. The assessment and payment process must follow the service standard equivalent to five minutes in accordance with the LGU’s policy standards for efficient public service.

| Table 4 Real Property Tax Payment In Cainta |

|||||||

|---|---|---|---|---|---|---|---|

| No. | Steps/Process | Duration | Requirements | Fees | Person Responsible | Location | |

| Client | Provider | ||||||

| 1 | Inquiry/ Request for last payment and/or delinquency | Prepares real property tax order of payment (RPTOP | 2 mins. | Proof of last payment (official receipt) | No fees required | List of employee names concerned in the process | Treasurer’s office |

| Payment | Acknowledges receipt of payment by issuing the corresponding official receipt | In the absence of the official receipt, the taxpayer may proceed to the municipal assessor to request a copy of your tax declaration | The amount reflected in the official receipt | ||||

| 2 | Issuance of tax clearance | Preparation and approval of tax clearance for the current year | 3 mins. | Proof of payment for the current year (lot and improvement) | PhP40 per tax declaration inclusive of DST | List of employee names concerned in the process | Treasurer’s office |

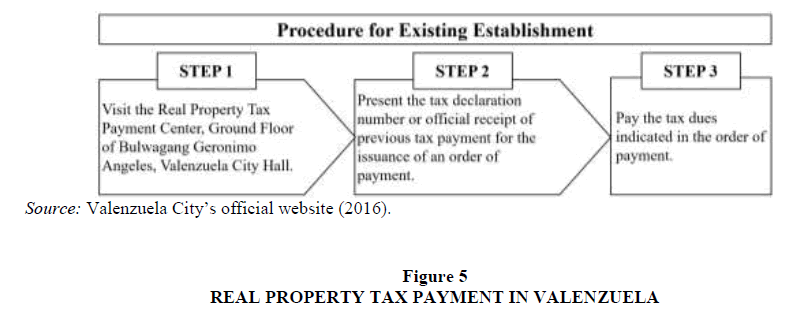

Figure 5 comparably shows Valenzuela’s RPT payment flow. A taxpayer shall first present their tax declaration number or official receipt of the previous tax payment for issuing a corresponding payment order. This payment order is presented to the cashier for the payment. An official receipt is then issued to the taxpayer. The complete process can be found on the city’s official website. However, it only shows the procedure for “existing” real property establishments.

Cainta and Valenzuela’s RPT payment processes exhibit similarities. Technically, the manual process takes about five minutes, given that all requirements are available on-hand. This conventional system exists in almost all localities in the country.

Payment Automation

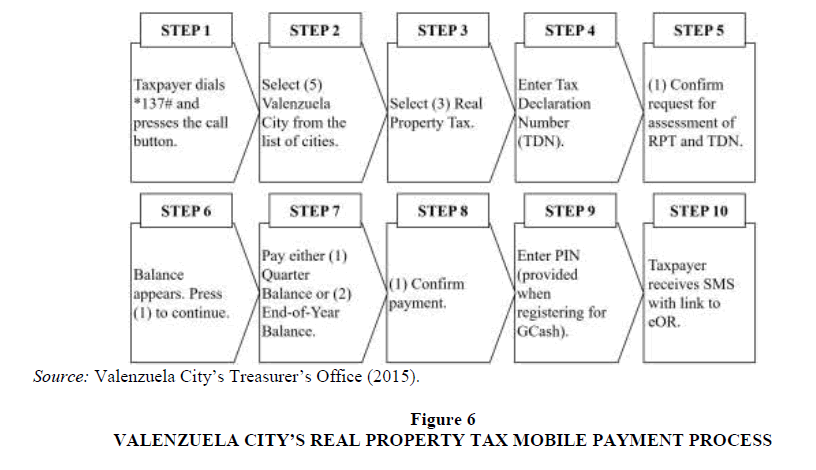

In an interview with one of Valenzuela’s officials, mobile money (or m-money) is a payment service introduced by the United States Agency for International Development (USAID) in Valenzuela City through the Scaling Innovations in Mobile Money (SIMM) Project (C. Andrade, personal communication, January 17, 2017). This payment service is done over a cellphone. Money is received and transferred in electronic form in real time. Mobile money is an easy, secure, and economical way to transact. A mobile money account may be opened through BPI Globe BanKO, Globe GCash, and Smart Money. At this point, Globe GCash is the only available payment service for settling government fees and taxes in Valenzuela. GCash is a mobile money service that transforms the cellphone into a virtual wallet, allowing customers to buy loads, pay bills, send money, and shop online. Soon taxpayers may pay via other mobile money brands such as Smart Money and BPI Globe BanKO. Transactions are posted in the taxpayer’s ledger. A taxpayer can check if the transaction has been posted by sending GCash an inquiry. GCash will respond with a billing statement indicating zero tax due shown in table 5.

| Table 5 Gcash Mobile Money Channel |

|

|---|---|

| 1.GCash mobile payment | To start using GCash, a taxpayer should have a cellphone with a Globe or TM sim card. GCash registration is free. To register: (1) dial *143#; (2) press call; and (3) fill out the form with the necessary details. Registrants will receive an SMS confirmation from 2882 if registration is successful. |

| 2.Funding GCash accounts | Taxpayers must fund/replenish their GCash accounts to start/continue making transactions. Loading a GCash account with the fund can be through any of the following: (a) GCash outlets: Globe stores, Puregold supermarkets, SM department stores, partner pawnshops, Villarica pawnshops, Tambunting pawnshops, partner rural banks, and Globe load distributors; (b) mobile banking: BPI mobile banking and UnionBank; (c) online: megalink online cash-in; and (d) ATM: BancNet ATMs. There is a minimal fee applied for every successful transaction. |

| 3.Payment processing time frame | The payment process happens in real time. As soon as the taxpayer confirms the payment, GCash relays the transaction details (e.g., TDN, date and time of the transaction, transaction reference number, and amount paid) to Valenzuela LGU. |

On the other hand, Figure 6 shows Valenzuela City’s mobile RPT payment process. It indicates the 10 vital steps, each not exceeding 30 seconds. Otherwise, the process will restart. This indicates the strict time observance in each step. A taxpayer must already have the necessary documents on-hand while the process is ongoing. Table 6 shows Valenzuela’s other real property tax payment options as of 2014.

| Table 6 Alternative Payment Channels |

||

|---|---|---|

| Type of transaction | Number of payments | Total revenue (in PhP) |

| Online payments | 32 | 588,389.92 |

| Credit card payments | 1,703 | 35,846,210.26 |

| Debit card payments | 113 | 1,117,293.10 |

Source: Valenzuela City’s Treasurer’s Office (2015).

Time-Motion Study Findings

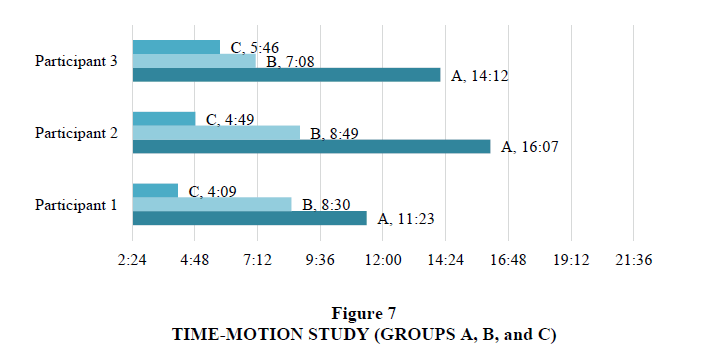

This research conducted a time-motion study of the actual assessment and payment process of nine non-delinquent taxpayers in Cainta. This method allowed this research to evaluate the processes and performance of the existing real property tax collection. Divided into three groups on three different occasions, the first was held last December 27, 2016, when advance payment for 2017 was already open for those who wanted to pay their RPT beforehand and avail of the 20% discount. The second run was on January 12, 2017, while the last was held on January 27, 2017, when both real property and business tax payments were almost due (extended in the case of Cainta). The discount for January to March was only 10%. Figure 7 shows the results of the time-motion study of the actual assessment and payment process done on the premises of the municipal hall.

Participant 1A recorded a time of 11:23 minutes. Participant 2A finished in 16:07 minutes, the longest time among all participants in any group. Whereas participant 3A, a senior citizen, has a surprising time of 1 :12 minutes regardless of the senior citizens’ lane. Group A established its time-motion study on December 27, 2016. The time-motion study of Group B was conducted on January 12, 2017. Participant 1B has a recorded time of 8:30 minutes. Participant 2B finished in 8:49 minutes, while Participant 3B finished in 7:08 minutes. Group C recorded the shortest time among the three groups. Their time-motion study was conducted on January 27, 2017. This is the busiest week of the month when most taxes are settled. Participant 1C only took 4:09 minutes to finish the process. This is the shortest time among all group participants. Participant 2C finished in 4:49 minutes, while Participant 3C completed the process in 5:46 minutes.

Implications and Future Research

Policy Implications

To ensure that Cainta’s taxpayers have access to alternative payment options, the local government should identify which barangays would benefit the most from these options. Given that Cainta has seven barangays, each with unique geographical advantages and disadvantages, it is recommended that the barangays with low tax compliance rates be prioritized. The local government can establish satellite stations or annexes in strategic locations through the municipality to facilitate this process. Valenzuela City’s approach, which involves setting up major satellite offices and payment centers in different barangays only during tax payment season, has been successful. This approach, called the “3S, or the Sangay ng Sama-samang Serbisyo [Branch of Collective Services] Center,” houses local government offices that residents frequently demand. Cainta should consider adopting a similar approach, which could be named the “3Cs (or the Cainta Constituents Concern) Center.” Three satellite offices could be strategically located in Brgy. San Isidro, Brgy. San Juan, and Brgy. San Andres.

In addition to establishing satellite offices, tax administrators should also consider pursuing automated payment channels similar to Valenzuela. This will provide taxpayers with a convenient and low-cost alternative to the conventional approach. This includes creating a user-friendly website and providing a secure cashless payment scheme to assure taxpayers’ safety and confidence. Adopting mobile payment options, such as GCash, is also a viable option. Furthermore, it is recommended that further investigation be conducted on other taxes, particularly business tax.

For best practices development, the 3Cs can stand for three key principles: First, convenience epitomizes efficiency in delivering public services through process simplification, user-friendliness, and accessibility. Second, confidence entails the assurance that the services are secured and safe and that there is a reduction in red tape in the bureaucracy. Finally, competence involves investing in information technology as the road to good governance.

Services Implementation and Promotion

An intensive information campaign is required to promote alternative payment channels for real property tax. The aim is to inform residents about the new payment channels, increasing awareness and convincing taxpayers that these new services are safe and convenient compared to the conventional method. The increase in the number of taxpayers and revenue can serve as indicators for success. To effectively promote the new services, this study recommends combining conventional and digital platforms.

Further Recommendations

This research also recommends reconciling data between Cainta’s municipal treasurer and municipal assessor, emphasizing the latter to organize their reports and fix discrepancies related to real property tax assessments. Additional problems may arise from the existing situation without immediate and proper action. It is strongly recommended that these offices seriously address delinquent taxpayers. The study also encourages real property taxpayers to settle their obligations religiously. The government provides a 20% early-bird discount every December and a 10% discount from January to March.

Conlcusion

Cainta’s current real property tax process involves two major steps, which the local government handles. The first step involves requesting a copy of the last payment and/or delinquency, and the second involves issuing a tax clearance. The main issue encountered by the LGU is the low number of taxpayer compliance, leading to a need for improvement in collection efficiency. While many taxpayers are satisfied with the RPT process, there remains a significant number of dissatisfied taxpayers. This suggests that the LGU needs to continue improving its RPT service delivery to ensure higher overall satisfaction among taxpayers

The study also reveals that the mobile real property payment method is more efficient than the conventional manual payment method practiced in most local government units. The survey and time-motion study demonstrate that the manual payment process takes longer than the prescribed time, with most respondents experiencing more than 10 minutes of processing time. The mobile payment option only takes three minutes, which is significantly shorter. Additionally, the costs incurred by taxpayers are relatively high, with more than half of the respondents spending over PhP90.00, which contrasts with the convenient and free mobile or online payment options available in Valenzuela City. The findings suggest that local government units should implement more efficient and cost-effective payment options to enhance taxpayer satisfaction and increase compliance.

Furthermore, the findings indicate that while alternative payment options have been implemented in Valenzuela City, their significance in terms of revenue generated is still negligible. owever, the survey results show interest among Cainta’s taxpayers to avail of alternative payment options if implemented, despite a majority being unaware of their availability. The study also suggests that the low adoption rate of alternative payment options may be due to factors such as Cainta’s aging population and traditional lifestyle, the cash transactions over cashless preferences among Filipinos, and the lack of direct or stable access to IT platforms among taxpayers. These findings highlight the need for further research and efforts to increase awareness and adoption of alternative payment options among Cainta’s taxpayers and similar communities.

References

Abrigo, M., Fabella, R., & Reside, R. (2018). Issues and challenges in local property tax collection in the Philippines. Asia-Pacific Social Science Review, 18(1), 27-36.

Aldea, A. & Dulay, N. (2019). Improving local government unit revenues through mobile tax payment application: The case of selected municipalities in Cavite Province, Philippines. Journal of Research in Business, Economics, and Management, 12(4), 2194-2201.

Alm, J. & Torgler, B. (2018). Tax compliance and taxpayer behavior: Lessons from the Philippines. Journal of Tax Administration, 4(1), 99-123.

Alola, U.V., Avc?, T., & Oztüren, A. (2021). The nexus of workplace incivility and emotional exhaustion in hotel industry. Journal of Public Affairs, 21(3), e2236.

Indexed at, Google Scholar, Cross Ref

Balbontin, R. & Caleda, E. (2020). An assessment of the determinants of real property tax compliance among agricultural landowners in the Philippines. Land Use Policy, 95, 104622.

Bautista, A. (2020). Trust, tax morale, and tax compliance: Evidence from the Philippines. Asia-Pacific Social Science Review, 20(1), 71-85.

BIR. (2018). Annual report 2017. Bureau of Internal Revenue.

Davis, F. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319-340.

Indexed at, Google Scholar, Cross Ref

Delos Reyes, R. (2018). Real property tax collection in the Philippines: An analysis of compliance and collection problems. Asia Pacific Journal of Multidisciplinary Research, 6(2), 45-52.

Escresa, L. (2016). Property taxes in the Philippines: Issues and challenges. Philippine Institute for Development Studies.

Garcia, J. (2019). Determinants of real property tax compliance in the Philippines. Philippine Review of Economics, 56(2), 43-70.

Kim, H., Chan, H., & Gupta, S. (2020). Understanding the determinants of mobile payment continuance usage intention: An empirical analysis of China and South Korea. Information Systems Frontiers, 22(2), 317-330.

Lanzona, L. & Tiongco, M. (2017). Determinants of local government tax effort: The case of Philippine provinces. Journal of Asian Finance, Economics, and Business, 4(4), 5-12.

Layugan, D. & De Leon, (2018). E-payment system for real property taxes in Baguio City: A study on the view of taxpayers. Asian Journal of Applied Sciences, 6(4), 110-118.

Lopez, J. & Platon, R. (2021). Transparency, accountability, and participation in local governance: Evidence from the Philippines. Local Government Studies, 47(2), 209-228.

Ramos, F., Abad, G., Magkalas, L., & Perez, R. (2018). Developing a web-based real property tax payment system for municipalities in Region II, Philippines. International Journal of Advanced Computer Science and Applications, 9(1), 160-167.

Sabularse, J. & Azucena, M. (2019). Analysis of local government unit tax collection system in the Philippines. International Journal of Computer Science and Mobile Computing, 8(2), 65-72.

Sano, H. & Macasaquit, M. (2017). Corruption in the tax system and its impact on tax compliance in the Philippines. In Proceedings of the Asia-Pacific Conference on Business and Social Sciences 2017 (APCBSS 2017). Atlantis Press.

Tan, K. & Villanueva, R. (2018). An assessment of the real property tax collection system in the Philippines: Issues and challenges. Philippine Journal of Public Administration, 62(2), 110-136.

Tanchuling, M. & Yap, D. (2018). An assessment of the mobile payment system for real property taxes in Makati City, Philippines. Asia Pacific Journal of Innovation and Entrepreneurship, 12(2), 163-172.

Uy, J. & Macasaquit, R. (2017). Factors affecting the compliance of real property owners with local tax regulations in the Philippines. Journal of Public Administration and Governance, 7(4), 46-59.

Venkatesh, V., Morris, M., Davis, G., & Davis, F. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425-478.

Indexed at, Google Scholar, Cross Ref

Received: 04-May-2023, Manuscript No. JLERI-23-13560; Editor assigned: 05-May-2023, Pre QC No. JLERI-23-13560(PQ); Reviewed: 19-May-2023, QC No. JLERI-23-13560; Revised: 29-June-2023, Manuscript No. JLERI-23-13560(R); Published: 29-June-2023