Research Article: 2021 Vol: 24 Issue: 6S

Study of the State of Microenterprise Financing in Colombia

Palacios Rozo, Jairo Jamith, Universidad Colegio Mayor de Cundinamarca

Dueñas Peña, Alex, Universidad Colegio Mayor de Cundinamarca

Barbosa-Guerrero, Lugo Manuel, Universidad Colegio Mayor de Cundinamarca

Simanca H, Universidad Libre

Fredys A. Universidad Libre

Amaya Cocunubo, Universidad Colegio Mayor de Cundinamarca

Iván Fernando, Universidad Colegio Mayor de Cundinamarca

Abstract

The financing of microenterprises is a factor that worries their managers and administrators, since they do not have the backing of ordinary financial institutions. However, they have encountered leverage different from traditional banking that call attention to the impact it has had on their working capital and sustainability of productive processes. What is presented in this paper is the result of a descriptive study with a mixed approach where a review of specialized literature that provides the theoretical context of the research is combined with the use of numerical data that allowed to appreciate and interpret the perceptions of the 300 micro entrepreneurs located in the city of Bogota, Colombia. The study was able to establish that in the city of Bogotá there is a diversity of sources of leverage in the operation of the microenterprise production process, and that the impact of this financing is related to working capital, investment and improvement of competitiveness.

Key words

Entrepreneurship, Financing, Microcredit, Correlational

Introduction

In the micro-entrepreneurial topic, among the issues that draw attention is that of scarce financing, especially that it does not have firm support from traditional banking due to the fact that they do not have the economic capacity to back it up and generate a wide risk for the financial sector (Hernández, 2018). However, micro entrepreneurs in their entrepreneurial spirit seek different types of financing with which they can face the requirements of competitiveness in relation to financing, sustainability of production and guarantee of maintenance required of inventories and raw materials (Olivares, 2015). These variables are elements to measure the competitiveness of sources of employment for men and women between 22 and 70 years of age who are working in the three productive sectors.

Entrepreneurship, its implementation and credit are part of the equation to be taken into account in the competitiveness of companies in general and microenterprises in particular (World Bank Group, 2017), thus, credit is an option that is available to carry out the start, maintenance and development of economic activities at the time that the resources of investors are not enough (Madrid, 2018). Therefore it is the opportunity that is given, where it intervenes for the actors the opportunity cost, every time that the users of the same make decisions in front of options and on the other hand, the additional income of those who have resources available for the loan that will be assigned from incentives such as the interest rate or price of money over time, a factor that impacts the two parties, the clear in the interveners refers to the exchange, in addition to their respective needs must have the trust factor (Gonzalez & Diez, 2010).

There are two important variables: confidence and interest rate. Formally, in the case of credit, it is called interest rate or placement price, which varies according to the perceived risk or knowledge generated from the users of little belief or distrust in the consequences potentially associated with the possibility of partial or total loss of resources placed in the market (López, 2014).

It is the credit component of the monetary and financial system of a society, it is through this that allows financial intermediation between the central bank, commercial banks and the real sector. It is then a relevant factor in the functioning and development of society (Camacho, 2017). Credit in its different types, in the case of the Colombian market (Table 1.)

| Table 1 Types Of Credit From Financial Institutions |

|

|---|---|

| Type of credit | Feature |

| Commercial | Used for the purpose of financing needs related to the productive activity, used for the acquisition of raw materials, purchase of merchandise and/or machinery, or to finance accounts receivable, i.e., when sold on installments. |

| Consumption | The financial entity makes this type of credit available to the client to finance various needs, such as buying a car, taking a trip, covering expenses, etc., which allows the economy to be boosted. |

| Mortgage | Loans aimed at financing natural persons whose purpose is the acquisition of a property: built, housing, land, offices and other real estate, with the guarantee of the mortgage on the property acquired or built. |

| Microcredit and SMEs | These types of loans are small loans to finance productive activities of small companies (purchase of inventories, purchase of raw materials, purchase of machinery, etc.). |

| Real | This type of credit is secured or backed by an asset, e.g., a house, a car, etc. |

The above offers are common in the banking sector in different countries and thanks to this the dynamics and development of the economic sectors, since the services offered by financial institutions are transversal to all sectors (Cajas & González, 2015), and at the same time they are the ones who in tune with the state promote savings, the banking penetration of the population, the financing of personal and business projects, the financing of education and housing (Dávila, Gotera, Martínez, Mendoza, Parra & Romero, 2017).

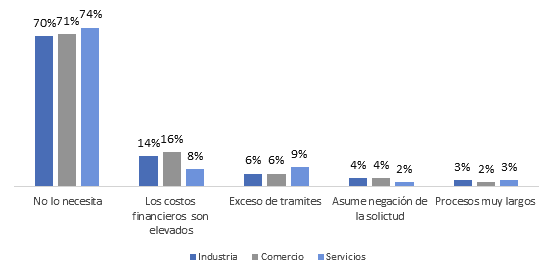

Within the possibilities of additional financing to that of ordinary banking with products, among others, such as those mentioned in Table 1, is the non-formal for being flexible types that give support to microenterprise operation that they do not dare to apply in traditional banking for various reasons that has given them the experience as stated by the National Association of Financial Institutions "ANIF" in its 2018 results report on the large survey of Microenterprises. as shows in Figure 1.

Figure 1: Percentage Of Credit Demand Constraints To Traditional Banks.

Source: Taken from the National Association of Financial Institutions "ANIF", 2018.

The alternative to formal credit is financing through suppliers, a particular option for companies in general; however, it has become for micro-entrepreneurs a credit that is agreed in its amount depending on the behavior of the demand for the good or market service, which consists of assigning, under the trust granted by the supplier to the micro-entrepreneur, resources that are worked in the short term, guaranteeing working capital. In this regard ANIF (2018) reports that "This alternative financing occupies 12% in Industry and commerce and 9% in services" (p.13). Likewise, it refers that relatives and friends occupy 10%, 7% and 4% in industry, services and commerce. It can be affirmed that the ways to obtain resources from micro entrepreneurs are varied.

There is the competitive advantage approach proposed by Porter where competitive strategies are developed in aggressive or defensive actions in an industry (Porter, 2009), focused on motivating the opposition and at the same time facing competitive forces. In this regard Porter in (Landázuri & Montenegro, 2018) refers that performance is based on sustainable competitive advantage. And the third approach, global competitiveness, reflects on the development and growth of the relationship between countries and what this implies: On the one hand, there is the concern that on the demand side there is the need for the ability to meet international requirements on technical standards, product differentiation and adaptation to cultural norms and particular demands of consumers, and on the supply side, it is widely necessary to develop a significant capacity for adaptation and development of innovative technical changes, both in the process that develops the product and in the product itself (Palacio & Veliz, 2017).

For (Saavedra, 2017), who takes up Porter and Krugman, those who compete are not the nations; they are definitely the companies. So, countries are competitive because competitive companies have led to that. Business competitiveness is a capacity achieved to contend in a market with others, where it has reached a positively favorable and differential position in performance compared to those it competes with, both in the national context and in a possible global one. From another approach and in collaboration with the above, it is reported that companies compete and evaluate their competitive participation based on their profitability obtained in the context where other companies with the same characteristics participate, Lall, Albaladejo & Mesquita (2005).

In this order of ideas generated from the referents cited, it is inferred that competitiveness is the variable to be taken into account to support the organizational strategy, likewise, business competitiveness is based on the competitive advantage developed and achieved through production processes that differentiate it from its competition (Abdel & Romo, 2004).

Companies in the demanding context of competitiveness are committed to factors that can be framed at three levels: a) country competitiveness, which is defined by the behavior of variables that account for macroeconomic stability, trade and capital openness and the different regulations of the business sector; b) regional infrastructure; and c) business competitiveness, which explains the competitiveness of companies and is related to what happens within the entity itself (Dueñas, 2019).

Business competitiveness, which explains the competitiveness of companies and is related to what happens within the entity itself (Dueñas, 2019), are factors that involve organizations and lead them to develop their capacity to increase or maintain their participation in the highly competitive market, which implies constant development of business strategies to finance their activities, reduce costs, sustain and increase productivity and increase sales (Chamber of Commerce of Bogota and Mayor's Office of Bogota, 2019).

METHODOLOGY

It is a correlational study, taking into account that the usefulness and main purpose of correlational studies is to know how a concept or variable can behave knowing the behavior of other related variables (Hernández, 2014) for this study are the variable financing that allow the productivity of microenterprises. The technique used for data collection was the survey, through the use of the questionnaire with Likert-type scale, composed of 21 items of which 3 were used. These are related to the variable financing and support for the procurement of inventories and production in general for microenterprises in the city of Bogota.

RESULTS

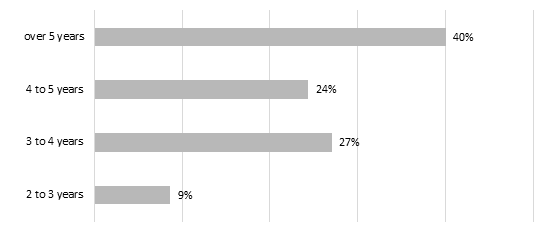

It was found that the ages of the companies involved in the research varied, but with a predominance of companies older than 4 years. Figure 2 shows the diversity of ages found in the study.

Figure 2: Age Of The Establishment In The Market As A Percentage Of The Total Number Of Years In Operation

Source: Own elaboration, 2021.

The existence of this variety of ages, especially those over 3 years old, which represent 91.3% of the businesses surveyed, allows the authors of the study to have information on micro entrepreneurs with experience in their productive processes as well as in the financing of their activities.

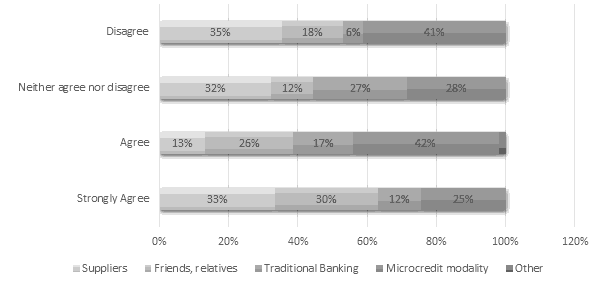

The microenterprises observed showed how true it is that financing in its different types has been an important factor in guaranteeing the production of their productive processes developed in the respective business units. On the one hand, it was found that the form of financing they use the most is as follows: 23%, 22%, 22%, 18%, 35% represented by suppliers, family and friends, traditional banking and microcredit system respectively. as shows in Figure 3.

Figure 3: Type Of Financing Vs. Agreement That It Has Been Important To Guarantee Business Production In %

Source: Own elaboration, 2021.

Likewise, 1% corresponds to loans known as "gota, gota", which have the particularity of having extremely high interest rates and in turn are extra-banking transactions of little legality carried out by unscrupulous people. Figure 3 summarizes the shares by type of financing used by micro entrepreneurs, where the modality of microcredit and suppliers is outstanding, as well as ordinary credit issued by traditional banks.

It was found, regardless of the type of financing used, that the micro entrepreneurs have had financing that has guaranteed their production over time. In this way, 19% of the respondents totally agreed, 48% agreed, 27% neither agreed nor disagreed and 6% disagreed, and there was no one who answered "totally disagreed". Table 3 shows in detail each response to the level of agreement of the micro entrepreneurs that financing has been an important factor in production over time. as shows in Table 2.

| Table 2 Use Of Financing Vs Importance Of This The Sustainability Of Production. |

|||||||

|---|---|---|---|---|---|---|---|

| Types of financing used | |||||||

| Credit is key to guaranteeing production | Suppliers | Friends, relatives | Traditional banking | Microcredit modality | Another | Total, responses | |

| Totally agree | 33% | 30% | 12% | 25% | 0% | 57 | |

| Agreed | 13% | 26% | 17% | 42% | 2% | 145 | |

| Ni-Ni | 32% | 12% | 27% | 28% | 0% | 81 | |

| Disagree | 35% | 18% | 6% | 41% | 0% | 17 | |

Regarding the question of whether credit has made it possible to finance the working capital with which to guarantee the operation of their production, it was found that micro entrepreneurs consider that they have been able to obtain financing several times to obtain raw materials or feed their inventories. It was found that 44% of the micro entrepreneurs have had at least twice the opportunity to guarantee their inventories or raw materials and thus develop their productive activities, however, there are 16% who report that this has not happened despite the fact that 42% of them are supported by suppliers and 46% by credits from traditional banks and microcredit modality, see Table 3 with the different statements regarding the impact according to the type of financing.

| Table 3 Use Of Financing Vs. Obtaining Raw Materials Or Inventories |

|||||||

|---|---|---|---|---|---|---|---|

| Types of financing used | |||||||

| Number of times credit has been used to obtain raw materials or inventories | Suppliers | Friends, relatives | Traditional banking | Microcredit modality | Another | Total, responses | |

| Not at any time | 6,7% | 4,7% | 2,0% | 2,7% | 0,0% | 48 | |

| Once | 8,3% | 11,0% | 5,7% | 14,3% | 0,7% | 120 | |

| Twice | 7,0% | 5,3% | 8,7% | 14,7% | 0,3% | 108 | |

| More than twice | 1,3% | 1,3% | 2,0% | 3,3% | 0,0% | 24 | |

The information corresponding to these three variables was taken: use of financing, perception that it has been fundamental in production and in the provision of inventories and/or materials, since they allow articulating the competitiveness factor in terms of increasing or remaining with the participation in the market and obtaining financing for activities (Chamber of Commerce of Bogotá, 2019), this in order to know the perception of micro entrepreneurs, the relationship that currently exists between the sustainability in the market of the business units because of financing. The Pearson's Chi-square test with an Alpha of 0.05 was then used. as shows in Table 4.

| Table 4 Use Of Financing And Procurement Of Raw Materials Or Inventories. |

|||

|---|---|---|---|

| Value | Asymptotic sign (bilateral) | ||

| Pearson's Chi-square | 43, 860a | 0,008 | |

| Gamma | 0,145 | 0,001 | |

| No. of valid cases | 300 | ||

Note: a. 19 boxes (54.3%) have expected a count of less than 5. The minimum expected count is 0.05.

It was found that Pearson's Chi-square is 0.00 compared to 0.05 of the Alpha, establishing that there is a positive relationship between the competitiveness of microenterprises and the use of their financing, while the Gamma of 0.00 compared to 0.05 of the Alpha establishes that this association between the variables is not very significant. This reflection gives an answer to the hypothesis that had been put forward at the beginning, which stated that there was an important relationship between financing and the competitiveness of microenterprises, taking elements of perception of the micro entrepreneurs regarding production and obtaining inventories or raw materials, which they have guaranteed thanks to the support of financing.

Conclusions

Despite the circumstances of scarce backing for credit from the financial sector, the entrepreneurs use sources such as suppliers, microcredit, friends and relatives. The different modalities have allowed them to guarantee the general production of the economic units by obtaining inventories or raw materials; thus, the micro entrepreneurs attest to having guaranteed the survival and sustainability of their businesses thanks to the credit obtained through the different modalities. From the correlation analysis developed, it is established that there is a direct but not conclusive relationship between financing and the competitiveness of microenterprises.

References

- National Association of Financial Institutions ANIF (2018). Large survey of microenterprises: report of results 2018. https://www.anif.com.co/sites/default/files/publicaciones/gem18_.pdf

- Abdel, G., & Romo, D. (2004). Series of working documents in competitiveness studies. Autonomous Technology of Mexico. Mexico City, Mexico.

- Cajas, N., & González, O. (2015). Analysis of a proposal for a profile subject to credit aimed at financial entities that grant mortgage loans in the city of Guayaquil. Ecuador: Catholic University of Santiago de Guayaquil.

- Chamber of Commerce of Bogotá and Mayor's Office of Bogotá. (2019). Characterization of Cultural and Creative Industries of Bogotá. https://bibliotecadigital.ccb.org.co/handle/11520/23124

- Camacho, A. (2017). Microcredit and its influence on the economy. Santiago from cali, Colombia: University.

- Dávila, J., Gotera, E., Martínez, R., Mendoza y Romero, J. (2017). Strategic planning of the Colombian banking sector. Unpublished Master's Thesis, Pontificia Universidad Católica del Perú

- Dueñas, A. (2019). Study on the analysis of the impact of microcredits and other types of financing in Bogota's microenterprises. Unpublished doctoral thesis. University of Celaya. Celaya, Mexico.

- González, J., & Díez, N. (2010). Credit and delinquency in the Spanish financial system. Dialnet, (2997), 51-65. Recuperado de https://dialnet.unirioja.es/servlet/articulo?codigo=3291827

- Hernández, M. (2018). Financial risks in the banking sector. Bogota, Colombia: Luminus.

- Hernández, R., Fernández, C., & Baptista, P. (2014). Research methodology (6th edition). México D.F., México: McGraw-GrawHill Interamericana

- Lall, S., Albaladejo, M., & Misquita, M. (2005). The industrial competitiveness of latin america and the challenge of globalization. Buenos Aires, Argentina: INTAL-ITD

- Landázuri, S., & Montenegro, N. (2018). Michael Porter's strategic approach to MSMEs: Ibarra case. Scientific journal Findings, 21(3), 1-8. Recuperado de https://revistas.pucese.edu.ec/hallazgos21/article/view/227/133

- López, V. (2014). Microfinance and ICT: Innovative Experiences in Latin America. Santiago: Planet

- Madrid, A. (2018). Entrepreneurship as an entrepreneur's motivation in the 21st century. Mexico: University of Guadalajara.

- Olivares, M. (2015). Microfinance and its contribution to the development of families. Quito: Central University.

- Palacio, E., & Veliz, G. (2017). Global competitiveness. Business Magazine, ICE-FEE-UCSG. 11, 41-47. Recovered de https://dialnet.unirioja.es/descarga/articulo/6479348.pdf

- Porter, M. (2009). Competitive strategy. Techniques for analyzing the company and its competitors. Pyramid.

- Saavedra, M. (2017). A proposal for determining competitiveness in Latin American SMEs. Thinking and management, (33), 93-124.

- Scotiabank, C. (2021). Types of credit. Financial entities offer various types of credit. Recovered from: https://www.scotiabankcolpatria.com/educacion-financiera/finanzas-personales/tipos-de-credito

- World Bank Group. (2017). Business participation and access to financial services. Berlin, Germany: World Bank