Research Article: 2020 Vol: 19 Issue: 5

Sustainable Development of the Company on the Basis of Expert Assessment of the Investment Strategy

Henryk Dzwigol, Silesian University of Technology

Mariola Dzwigol-Barosz, Silesian University of Technology

Abstract

The article proposes to form the sustainable development of the company within the optimization framework of mechanisms for attracting investments. It is proposed to determine the investment needs in the coordinate system of the used investment strategy in order to optimize the input parameters of the tactical and strategic development of the company. The influencing factors on the strategic decision about the beginning of the investment realization, made by investor and the recipient company are substantiated. An algorithm for calculating the appropriateness of attracting investments into the company based on the expert evaluation model has been developed.

Keywords

Investment Strategy, Company, Investor, Strategic Decision, Model Of Expert Assessments, Strategic Plan Of Company Development.

Introduction

The success of international companies depends mostly on the availability of potential opportunities to attract the necessary amount of capital for the implementation of planned investment projects and the implementation of the aimed investment strategy. Investment for the company is one of the most important factors for its long-term economic development. Therefore, the usage of mechanisms to attract investment and formulate an investment strategy is a part of successful commercial company. Investments can be a origin of resources to improve a company's financial position,as well as, to increase its market share, introduce innovative products, create and implement competitive advantages within the corporate strategy.

Literature Review

The issue of timely attraction of the necessary investments amounts by companies on favorable conditions was investigated in the works (Narula & Dunning, 2010; Salacuse & Sullivan, 2005; Drobyazko et al., 2020). A range of scientists (Warner et al., 2002; Durmanov et al., 2019) focus on investment attraction and strategic development issues. However, issues of inaccuracies and ambiguities in the field of investment activity, as well as, provisions on economic valuation and regulation of investment attraction mechanisms remain to be beyond the attention of these and other researcher. The works of (Dunning & Narula, 2002; Xu, 2000; Dzwigol, 2020; Dzwigol et al., 2020) deals with the issues of evaluation of the company`s investment strategy, effectiveness evaluation of the mechanisms for attracting investment in the implementation process of investment projects, construction of econometric models of dependence of the attracted investments volume on the duration and cost of their involvement process while determining the feasibility of regulating the attracting investments mechanisms and applying the model of their economic evaluation and regulation.

Methodology

The methodological basis of the article is made of the conceptual provisions, that state the following: 1) the main source of investment for companies are their own resources. This is due to the instability of the economic and political environment of their functioning, as well as the shortage of effective tools for interaction with investors. Thus, there is a need to form new ways of cooperation between recipients and donors of capital, taking into account current trends; 2) successful formation of investment strategy and usage of mechanisms for attraction of investments, enables the company to attract the necessary amount of capital in time, which, in its turn, will increase their competitiveness in the conditions of unstable environment and ensure sustainable development; 3) usage of attraction mechanisms of investments in a way that combines elements of tactical and strategic company`s development.

Findings and Discussion

Mechanisms of Investments Attraction into the Company

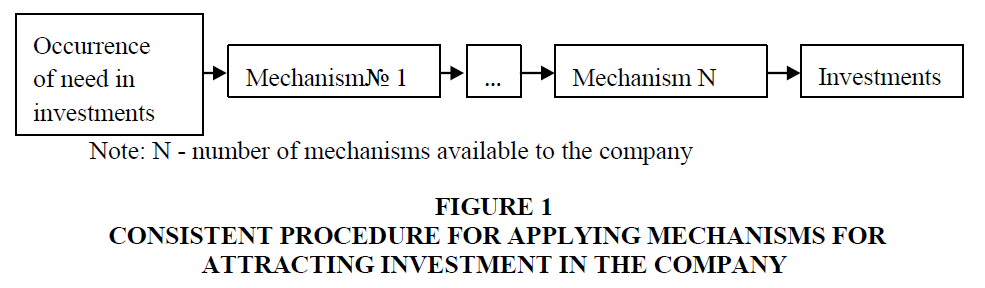

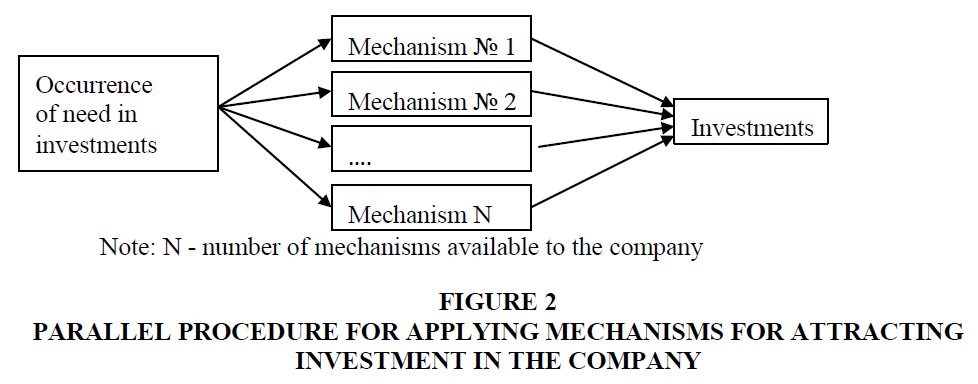

In practice of modern business, it is quite possible that the company has a set of mechanisms for attracting investments, but these mechanisms are characterized by different types of economic efficiency. Then the usage of one of the mechanisms is optional, thus, the company can apply several mechanisms, thereby increasing the likelihood of successful completion of the investment attraction process. In Figures 1 and 2 different ways to apply the mechanisms of attracting investment are presented.

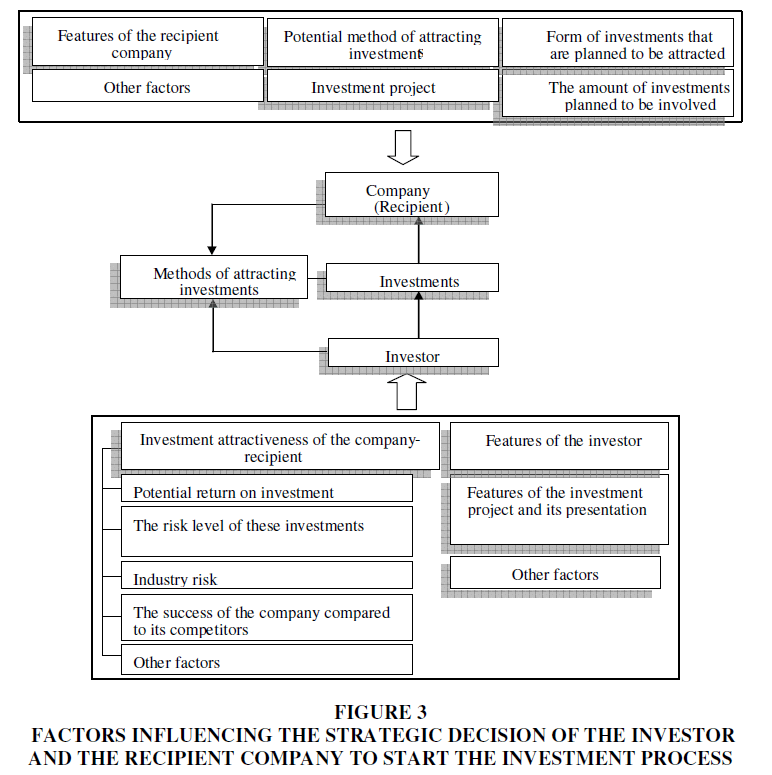

The usage of several mechanisms, in different order, provides a high opportunity for the company to successfully attract the required amount of investments within the implementation of investment strategy. From this point of view, the problems of economic assessment of investment attraction mechanisms are particularly acute, since the order of their application will be affected by the level of economic efficiency of each mechanism. Let's suppose, a company has a set of mechanisms for attracting investments, the economic efficiency of which differs. Then their consistent application must start with a mechanism that is endowed with the highest level of economic efficiency. It is advisable to use the parallel procedure for attracting investments when the economic evaluation of the mechanisms has shown that the application of none of them will make it possible to attract the necessary amount of investments in time (Bebbington et al., 2008). Then several mechanisms are used at the same time, which increases the chances of successful completion of the investment attraction process. Thus, it should be noted that during the economic evaluation of the mechanisms of attracting investment, it is necessary to take into account the factors that influence the decision of the investor and the recipient company to start the investment process and about its features (Figure 3).

Figure 3 Factors Influencing the Strategic Decision of the Investor and the Recipient Company to Start the Investment Process

As we can infer from Figure 3 the decision to initiate cooperation between an investor and a recipient company, as well as, the nature of the interaction, is influenced by many different factors that can also be structured (Mortimore, 2004). For example, the investment attractiveness of the recipient can be considered as a separate factor. However, there are also factors that affect the investment attractiveness of the company and, thus, affect the result of using these investment attraction mechanisms, that is why, these factors should also be taken into account in the economic assessment of investment attraction mechanisms.

Under the notion of the inclination for a particular type of investment can be understood as the tendency of investors to direct or portfolio investing, as well as, short or long term investing, etc. Factors that affect the outcome of the investment attraction process, and which are the individual characteristics of the recipient company, can be attributed various factors specific to the company. Thus, to confirm this assumption, it is advisable to mention the statement (Barry et al., 2003) who believed that each organization is unique and therefore the usage of universal concepts in managing it is inappropriate. Extrapolating from this thesis, it can be summarized that not only the management of the organization, but also the forecasting of the decisions, made by its management, requires the application of a situational approach. Thus, it should be noted that the presence of factors that affect the economic assessment of the attracting investment mechanisms and that characterize the individual characteristics of the recipient company is obvious. It is also worth noting that all the factors cannot be taken into account in the economic assessment of investment attraction mechanisms.

Analyzing the level of investment attractiveness of a particular company is a difficult procedure, because, when it is implemented, it is necessary to take into account a large amount of data, some of which is inaccessible because some of the motives for such actions are hidden by the companies themselves. At the same time, investor is obviously trying to analyze as much data as possible, when making a decision to invest in a particular company. However, the potential investor is usually only able to analyze the information that is freely available. It may include information on the value of securities issued to certain companies, data on the economic situation of the industry in which the company data operates, financial statements, etc. (Metelenko et al., 2019). Some experts deny the need to consider all factors, as the conclusions drawn from this consideration can often be contradictory. In order to sum up everything mentioned above, it should be noted, that in order to ensure the success of the investment attraction process, it is necessary to have certain information about the potential investor's decision-making system for making certain investments. As such information is not always freely available, the investment attractiveness of the company should be analyzed on the basis of well-known methods of forecasting the dynamics of a particular investment instrument (in this case, the shares of the recipient company are the priority).

Case: Assessing the Strategic Necessity to Attract Investment for the Sustainable Development of the Company

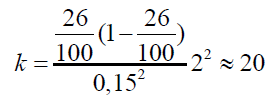

Since the economic evaluation of the mechanisms for attracting investment is influenced by many different factors and the impact of some of them is accidental or temporary, the experts were interviewed by the authors, on the basis of this poll, the main factors influencing the economic evaluation of the mechanisms were identified. Among the 200 experts, selected for the survey, 26 had the most experience in the investment field, so with a probability level of 0.95 and an error margin of 0.15, the number of experts to be interviewed is:

The experts were asked to assess the analyzed factors of economic evaluation of the mechanisms on a scale from 10 to 100 (step of assessment - 10). The Table 1 shows the results of the expert survey.

| Table 1 The Value of Assessing the Factors Importance Obtained from the Expert Survey | ||||||||||

| Experts | Assessment of the factors importance, points | |||||||||

| A | B | C | D | E | F | G | H | I | J | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 1 | 90 | 80 | 80 | 70 | 60 | 50 | 50 | 30 | 20 | 20 |

| 2 | 80 | 90 | 70 | 60 | 60 | 60 | 40 | 30 | 20 | 10 |

| 3 | 80 | 90 | 80 | 70 | 70 | 60 | 50 | 50 | 40 | 30 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 4 | 90 | 80 | 70 | 70 | 60 | 50 | 40 | 30 | 30 | 20 |

| 5 | 90 | 90 | 80 | 70 | 70 | 60 | 50 | 50 | 40 | 30 |

| 6 | 80 | 70 | 90 | 60 | 50 | 50 | 40 | 30 | 20 | 20 |

| 7 | 80 | 80 | 90 | 70 | 60 | 50 | 40 | 40 | 30 | 20 |

| 8 | 70 | 90 | 80 | 60 | 50 | 40 | 40 | 30 | 20 | 10 |

| 9 | 90 | 70 | 80 | 60 | 60 | 40 | 50 | 30 | 20 | 20 |

| 10 | 90 | 90 | 70 | 60 | 80 | 50 | 50 | 50 | 40 | 40 |

| 11 | 90 | 80 | 80 | 80 | 60 | 70 | 40 | 40 | 30 | 50 |

| 12 | 80 | 80 | 90 | 70 | 60 | 60 | 50 | 40 | 30 | 30 |

| 13 | 90 | 70 | 70 | 80 | 60 | 50 | 40 | 40 | 20 | 10 |

| 14 | 80 | 70 | 90 | 60 | 60 | 40 | 50 | 30 | 30 | 20 |

| 15 | 90 | 70 | 60 | 80 | 80 | 50 | 40 | 30 | 20 | 10 |

| 16 | 90 | 90 | 70 | 80 | 60 | 60 | 50 | 40 | 30 | 30 |

| 17 | 80 | 70 | 90 | 60 | 60 | 50 | 40 | 30 | 30 | 20 |

| 18 | 90 | 70 | 70 | 80 | 50 | 60 | 60 | 40 | 20 | 10 |

| 19 | 80 | 90 | 70 | 70 | 60 | 50 | 40 | 40 | 30 | 20 |

| 20 | 70 | 60 | 90 | 80 | 80 | 40 | 50 | 30 | 30 | 20 |

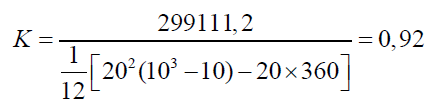

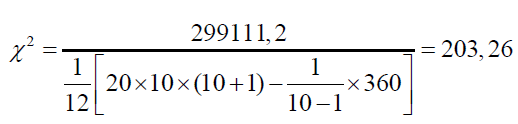

The concordance coefficient is:

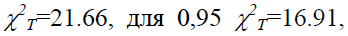

Check the statistical significance of the concordance coefficient by Pearson's criterion:

For a probability level of 0.99  the value of the concordance coefficient should be considered statistically significant and can be used in practice.

the value of the concordance coefficient should be considered statistically significant and can be used in practice.

The Table 2 presents the results of the aggregated indicators calculation on the basis of expert estimates array.

| Table 2 Generalized Indicators of the Studied Factors Importance of Economic Evaluation of the Attracting Investment Mechanisms, Obtained On The Basis Of Expert Estimates | ||||||||||

| Name of indicators | Factors | |||||||||

| A | B | C | D | E | F | G | H | I | J | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 1. Sum of ranks | 33 | 44 | 47 | 68 | 89 | 116 | 133 | 153 | 177 | 191 |

| 2. Average rank | 1.65 | 2.2 | 2.35 | 3.4 | 4.45 | 5.8 | 6.65 | 7,65 | 8.85 | 9.55 |

| 3. Average value in points | 84 | 79 | 78.5 | 69.5 | 62.5 | 52 | 45.5 | 36.5 | 27.5 | 22 |

| 4. Frequency of maximum possible estimates | 0.44 | 0.36 | 0.32 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 5. Average weight (normal rating) |

0.151 | 0.142 | 0.141 | 0.125 | 0.112 | 0.093 | 0.082 | 0.066 | 0.049 | 0.039 |

| 6. Scope | 20 | 30 | 30 | 20 | 30 | 30 | 20 | 20 | 20 | 40 |

| 7. Expert activity rate | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

As the value of the coefficient of concordance approaches to 1 (0.92), we can note the high level of experts' opinions consistency, regarding the studied factors importance of economic evaluation of the attracting investments mechanisms. As we can see, the factors that affect the recipient's investment attractiveness, can be divided into two groups: factors known to the investor and factors unknown to them. (Caves & Caves, 1996). Thus, the influence of some factors, which is due to various reasons, such as a small customer base, a large proportion of the debt in the assets of the recipient company, may not properly inform the investor.

As we have already mentioned, investment attraction mechanisms should be considered as a set of interacting elements. Moreover, some of these elements are endowed with the ability to think (recipient and investor). This factor is especially relevant, because predicting the outcome of the thinking subjects interaction is an extremely complex process. This task is also complicated by the assumption, that these subjects, when making a decision, take into account many factors. On this basis, we can draw an obvious conclusion: the arrange of factors, that the recipient and investor take into account when deciding to cooperate with each other, are not always identical, moreover, they may not intersect at all.

Recommendations

Recommendations may be practical directions for further application of investment attraction mechanisms, with their previous economic evaluation and formation of the optimal order of their application for different companies. This will make it possible to rationally plan the process of attracting investments and to attract the necessary amount of capital for the company, within a certain period of time and on favorable terms for the company, moreover, within the investment strategy framework. By identifying the factors that influence the economic effectiveness evaluations of the mechanisms for attracting investment and proposing methods for carrying such process, it will be possible to make a relevant assessment of the economic effectiveness of the attracting investment mechanisms of different companies.

Conclusion

Investigating the essence of the attracting investments mechanisms concept and determining the nature of their impact on the status of the company, the method of their economic evaluation was proposed and the feasibility of analyzing the possibilities for improving the used investment strategy was determined. To solve this problem, it is necessary to study the factors that influence the process of implementation of attracting investment mechanisms. It was suggested to attribute the volume and nature of investments to the factors that influence the efficiency of implementation of investment attraction mechanisms, as well as the peculiarities of the investor and the recipient. Besides this, the result of the investment attraction mechanisms usage is influenced by the political and economic situation, in which the relevant investment project is implemented. Thus, as a result of this analysis, two groups of factors were distinguished, the first consists of factors that influence the investor's decision to start cooperation with the recipient, and the second group of factors influences the decision of the recipient.

References

- Barry, F., Görg, H., & McDowell, A. (2003). Outward FDI and the investment development path of a late-industrializing economy: evidence from Ireland. Regional studies, 37(4), 341-349.

- Bebbington, J., Larrinaga, C., & Moneva, J.M. (2008). Corporate social reporting and reputation risk management. Accounting, Auditing & Accountability Journal , 21(3), 337-361

- Caves, R.E., & Caves, R.E. (1996). Multinational enterprise and economic analysis. Cambridge university press.

- Drobyazko, S., Vinichenko, O., Chayka, Y., Nechyporuk, N., & Khasanov, B. (2020). Increasing efficiency of entrepreneurial potential in service sector. Journal of Entrepreneurship Education.

- Dunning, J.H., & Narula, R. (2002). The investment development path revisited. JH Dunning, Theories and Paradigms of International Business Activity. The Selected Essays of John H. Dunning, 1, 138-172.

- Durmanov, A., Bartosova, V., Drobyazko, S., Melnyk, O., & Fillipov, V. (2019). Mechanism to ensure sustainable development of enterprises in the information space. Entrepreneurship and Sustainability Issues, 7(2), 1377-1386.

- Dzwigol, H. (2020). Methodological and Empirical Platform of Triangulation in Strategic Management. Academy of Strategic Management Journal, 19(4), 1-8.

- Dzwigol, H., Dzwigol-Barosz, M., Miskiewicz, R., & Kwilinski, A. (2020). Manager competency assessment model in the conditions of Industry 4.0. Entrepreneurship and Sustainability Issues, 7(4), 2630-2644.

- Metelenko, N.G., Kovalenko, O.V., Makedon, V., Merzhynskyi, Y.K., & Rudych, A.I. (2019). Infrastructure security of formation and development of sectoral corporate clusters. Journal of Security and Sustainability Issues, 9(1), 77-89.

- Mortimore, M. (2004). The impact of TNC strategies on development in Latin America and the Caribbean

- Narula, R., & Dunning, J.H. (2010). Multinational enterprises, development and globalization: Some clarifications and a research agenda. Oxford Development Studies, 38(3), 263-287.

- Salacuse, J.W., & Sullivan, N.P. (2005). Do BITs really work: An evaluation of bilateral investment treaties and their grand bargain. Harv. Int'l LJ, 46, 67-130.

- Warner, M., Fowler, J., & te Velde, D.W. (2002). Linking corporate investment and international development. Optimsing the Development Performance of Corporate Investment.

- Xu, B. (2000). Multinational enterprises, technology diffusion, and host country productivity growth. Journal of Development Economics, 62(2), 477-493.