Research Article: 2021 Vol: 20 Issue: 3

Taking Informal Liabilities into Account When Valuing a Company

Alexander Viktorovich Shchepot'ev, OOO Consulting group "a New Paradigm"

Tatyana Alexandrovna Fedorova, The Higher Technological School ANO DPO

Abstract

This article substantiates the scientific and methodological approach to accounting for informal liabilities in the course of assessment procedures. As part of the study of the process of identifying and accounting for informal liabilities in the course of assessing the value of a company, the transformation of the concept of “liabilities” has been investigated. The authors examined the legal framework for the concept of liabilities, and also analyzed the possibility of accounting for valuation activities (and other analytical procedures) of informal liabilities, i.e., liabilities that do not have all the formal qualifications of the liabilities. As part of informal liabilities, hidden, imaginary and probabilistic liabilities, as well as economic analogues of liabilities, are considered. As a result of the analysis in this article, it is proved that there are liabilities that are not reflected in accounting, but ultimately affect the value of the company. Such liabilities cannot be entered into accounting and reflected in the accounting (financial) statements, as they do not meet the qualification requirements, at the same time, liabilities that are unreasonably reflected there due to an error or due to loss of liabilities may be reflected in accounting their qualifications. These liabilities are identified by the authors as informal. The authors proposed a scientific and methodological approach to identifying, classifying and determining the value of informal liabilities that companies have.

Keywords

Informal liabilities, Hidden Liabilities, Imaginary Liabilities, Probabilistic Liabilities, Economic Analogue of Liabilities, Valuation Activity, Business Valuation, Management Accounting, Financial Analysis, Bankruptcy.

JEL Classifications

C13, G12, M41, ?12

Introduction

Evaluation activity was formed as an independent professional activity, the results of which are actively used in all areas of economic relations. Taking into account the development of the valuation activity itself, scientific research in this area is actively developing (Fedorova & Fedorova, 2018). The results of valuation activities can be used to make managerial decisions in the process of lending or investing in a business, to manage the investment attractiveness of a company, etc. (Fedorova, 2008). The results of valuation activities, in the light of modern trends in scientific thought, are also used to manage the value of the company (Valdaitsev, 2001). This article is devoted to the issues of using informal liabilities in practice of valuing a company that do not meet all the formal qualifications inherent in this economic concept. In the framework of this study, it is advisable to consider in more detail such an economic category as “liabilities”, as well as analyze the development and transformation trend of this term to identify, classify and informal liabilities.

Methodology

During the research, methods of regulatory regulation, analysis, generalization and comparison were used. The authors substantiate the need to improve the tools of assessment procedures. As part of the study, an analysis is made of the change in the concept of “commitment” in modern conditions. During the study, the authors analyzed regulatory sources governing the identification, accounting, and determination of the value of a liability. The authors conducted a comparative analysis of regulatory sources and scientific literature describing the accounting of liabilities of companies, during the generalization of which the corresponding results were obtained. In their studies, the authors reasonably prove that, taking into account current trends in scientific economic thought, for the purposes of valuation, managerial accounting and financial analytical procedures, along with traditionally defined liabilities, it is also advisable to take into account informal liabilities.

Results and Discussion

The concept of “commitment” is widely used in various economic sciences (accounting, management accounting, audit, taxation, valuation, financial analysis, etc.), however, it should be noted that this concept (in various contexts, if there are relevant goals) may have a similar basis, but various distinctive features (Civil Code of the Russian Federation (Part One), 1994; Tax Code of the Russian Federation (Part One), 1998; Tax Code of the Russian Federation (part two, 2000); Federal law “On accounting”, 2011; Shchepot’ev, 2019). Recently, especially taking into account the tendencies of convergence of the Russian accounting rules, audits, and appraisal activities to international standards and norms, the concept of “liability” undergoes appropriate transformations, clarifying and supplementing concepts appear (Decree of the Government of the Russian Federation of “On approval of the Accounting Reform Program in accordance with international financial reporting standards”, 1998). Speaking about the economic category of “liabilities”, we note that a number of economic concepts that include or clarify this definition, taking into account the features or distinctive characteristics, have a regulatory basis. But some derivatives of the concept of “liabilities”, included in scientific circulation, are used in valuation activities, financial analysis and other analytical procedures, but do not have a legislative basis. In the framework of this study, we analyze the concept of “liabilities”, enshrined in regulatory documents, as well as its derived meanings. Consider the trends in the transformation of the concept of “liabilities” used to account for and evaluate it. According to the terminology of jurisprudence, “an liabilities is an liabilities of one person (debtor)” to perform a certain action in favor of another person (creditor), such as: transfer property, perform work, provide a service, contribute to a joint activity, pay money, etc., or to refrain from a specific action, and the creditor has the right to demand from the debtor the performance of his duties. Liabilities arise from contracts and other transactions, as a result of harm, as a result of unjust enrichment, as well as from other grounds (Article 307, Civil Code of the Russian Federation (Part One), 1994. According to the principles laid down in the regulatory documents governing accounting, the liabilities is “the organization's existing debt at the reporting date, which is the result of completed projects of its economic activity and calculations on which should lead to an outflow of assets. A liability may arise due to the validity of a contract or legal norm, as well as business customs” (The concept of accounting in the market economy of Russia, 1997). Cancellation of a liabilities provides for the cancellation of the creditor's claims, with the simultaneous deprivation of any property (property rights) from the organization itself. Debt can be repaid by paying money, transferring assets, providing services, in the form of replacing one type of liabilities with another, removing claims from the lender, forgiving the debt, offsetting, converting the liabilities into capital and in other ways not prohibited by law. In accounting, as well as in financial statements, the liabilities is reflected when the settlement of the liabilities provides a high probability of the outflow of assets that can bring economic benefits to the organization, and when the amount of the liability can be measured with a sufficient degree of reliability. If the accounting object (in this case, the liabilities) cannot be measured with a sufficient degree of reliability, then it should not be included in the forms of financial statements, but should be reflected and explained in the notes to the statements (The concept of accounting in the market economy of Russia, 1997). To ensure the usefulness of information (generated in accounting), in appropriate cases, an estimate of the value of liabilities is formed in the balance sheet (accounting) assessment, but for greater accuracy, data from the open market (market value) are used. To assess the value of the company (existing business), as a rule, the list of liabilities presented to the appraiser according to the accounting and accounting (financial) statements is used, but for a more reliable determination of the value of the company, it is advisable to take into account informal liabilities. It should be noted that informal assets are also subject to special definition and accounting, but this issue is an independent research topic. The concept of “liabilities” is disclosed and described in various regulatory documents governing the Russian accounting system (RAS) (Order of the Ministry of Finance of Russia “On approval of the Accounting Regulation “Accounting for Assets and Liabilities, the Value of which is Expressed in Foreign Currency”, 2006); Order of the Ministry of Finance of Russia “On approval of the accounting regulations”, 2008); Order of the Ministry of Finance of Russia “On approval of the Accounting Regulation Estimated Liabilities, Contingent Liabilities and Contingent Assets”, 2010). In the practice of economic relations, taking into account the trends towards the convergence of the Russian accounting system to the international financial reporting system, derivative concepts of the analyzed concept have also formed:

• Debt liabilities (Article 269, Tax Code of the Russian Federation (part two, 2000);

• Contingent liabilities

• Estimated liabilities (Order of the Ministry of Finance of Russia “On approval of the Accounting Regulation Estimated Liabilities, Contingent Liabilities and Contingent Assets”, 2010).

• Liabilities arising from the prevailing practice in the organization (International Standard for Financial Reporting (IAS) 19 Employee Benefits, 2015).

• Referred tax liabilities (Order of the Ministry of Finance of Russia “On approval of the Accounting Regulations Accounting for calculations of corporate income tax”, 2002) and others.

It should be noted that in determining the presence of all qualification features of liabilities, it is necessary to use the principle of prudence provided for by applicable law. “When compiling information in accounting, certain caution should be exercised in judgments and estimates that take place in conditions of uncertainty, so that assets and income are not overstated, and liabilities and expenses are not underestimated. Moreover, the creation of hidden reserves, the deliberate understatement of assets or income and the deliberate overstatement of liabilities or expenses are not allowed” (The concept of accounting in the market economy of Russia, 1997). A similar, in fact, norm exists in the formation of accounting policies. In accordance with the principle of prudence in the accounting policies of an organization, an economic entity shall be more likely to recognize liabilities and expenses in

accounting than the estimated assets and income, i.e. it is necessary to be more skeptical about the recognition of assets than liabilities (Order of the Ministry of Finance of Russia “On approval of the accounting regulations”, 2008). The legislator speaks of the need to approach with a reasonable degree of skepticism and prudence in determining the value of society's liabilities. Analyzing the economic category of “liabilities”, one cannot ignore this concept, which is determined by international financial reporting standards. A liability is an entity's existing liabilities arising from past events, the settlement of which is expected to result in the disposal of resources containing economic benefits from the organization (International Standard for Financial Reporting (IAS) 37 “Estimated Liabilities, Contingent Liabilities and Contingent Assets” 2015). According to the international financial reporting system (IFRS), an liabilities is considered to be all liabilities that an organization has, including liabilities arising under lease agreements, sureties, i.e. liabilities that, according to RAS, should be reflected on off-balance accounts of accounting (Shchepot’ev, 2020). According to RAS, liabilities (for accounting purposes) are considered to be liabilities that meet all the qualification characteristics of liabilities. Note that certain types of liabilities (liabilities to return leased property; liabilities on property accepted for safekeeping; issued guarantees) under RAS, in contrast to IFRS principles, are not reflected in accounting (financial) statements, but must be recorded on off-balance accounts. And according to accounting procedures, in accordance with which the accounting (financial) statements are prepared in accordance with IFRS, the availability and application of off-balance accounts is not provided. From an economic and legal point of view, this difference, according to the authors, is the most significant between RAS and IFRS when defining the concept of “liabilities”. As already noted, in the implementation of valuation procedures in relation to the value of the company, the information reflected in the accounting and reporting registers is taken as the basis.

Based on the analysis, the authors believe that the calculation of liabilities for valuation procedures will be more reliable if information on liabilities is taken from accounting registers formed in accordance with IFRS. After analyzing and summarizing the terminology used in regulatory documents and scientific literature regarding the liabilities of the organization, the authors came to the conclusion about the existing qualifications that are inherent in formal (in terms of accounting) liabilities, in the form of the following main criteria:

• organization has an liabilities, including an liabilities to receive assets under its control (for example, under a lease, storage, commission, etc.);

• This liabilities currently exists as a result of past events;

• The accounting item (liability) can be measured with a sufficient degree of reliability;

• The liabilities has a value (valuation), the value is determined in monetary units;

• Repayment of these liabilities (liabilities) provides for the transfer of an economic resource (economic benefits).

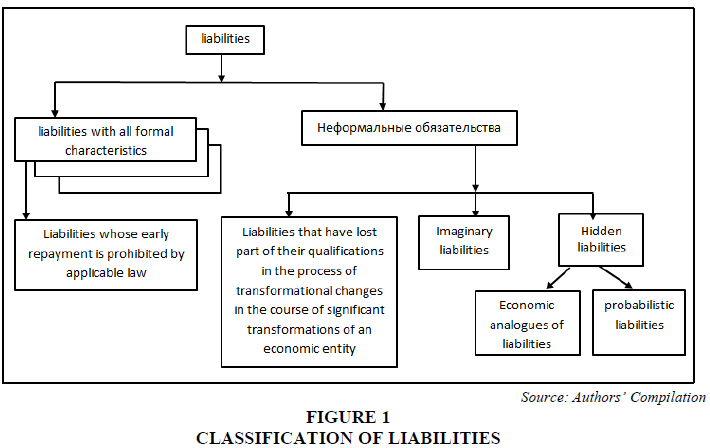

The authors note that if we consider the liabilities for the purposes of business valuation, management accounting, operational and strategic management, conducting analytical financial analysis procedures, the concept of “liabilities” meets the criteria of liabilities under IFRS to a greater extent than under RAS. Existing legislation in the field of valuation activity gives some freedom with respect to more limited accounting rules in the choice by professional appraisers of methods, techniques and tools in the implementation of valuation procedures (Federal Law “On Valuation Activities in the Russian Federation”, 1998). The above definitions of the various types of liabilities used in RAS and IFRS are fixed at the legislative level and are used, as already noted, in accounting, taxation and audit (Chaya & Chicherina, 2009). In modern conditions, when evaluating a business, as mentioned above, informal liabilities should also be taken into account. Informal liabilities - an existing or probabilistic liabilities of an economic entity (arising from past events, the settlement (cancellation) of which will lead or may lead to the disposal of the organization of resources containing economic benefits), which does not fully meet all the requirements for the concept of “liabilities”. The concept of “informal liabilities” has a wide enough scope, including the terms “liabilities with an indefinite amount and / or due date” (“estimated liability”), “contingent liability” not subject to reflection and valuation in accounting, as well as such economic categories as “Hidden liabilities”, “imaginary liabilities”, “economic analogue of the liabilities”, “probabilistic liabilities” and other liabilities and liabilities that do not have all the characteristics of the liabilities. Informal liabilities are determined not only from the point of view of existing accounting rules and they are not subject to reflection in accounting and financial (accounting) statements, however, there is reasonable assurance that such liabilities (informal liabilities, from the point of view of existing accounting rules) have sufficient signs within the framework of the relevant economic science, discipline or direction for recognition as an liabilities and can be used for assessment procedures, management accounting, financial analysis, business planning and other analytical procedures not regulated by accounting rules. Informal liabilities that do not meet all the signs of formal liabilities (from an accounting point of view), but affecting, ultimately, the value of the company (Shchepot’ev, 2019). For a more complete and visual representation of all the economic benefits of the organization, we present the Figure 1 “Classification of liabilities”.

Informal liabilities, despite the fact that they are not subject to reflection in accounting and accounting (financial) statements, can be taken into account in analytical procedures, as there is reasonable assurance that such liabilities (informal liabilities, from the point of view of existing accounting rules) have, in essence, sufficient evidence of liabilities in the framework of valuation activities and can be used for valuation procedures, management accounting, financial analysis, business planning and other analytical procedures not regulated by accounting rules (Shchepot’ev, 2019). Imaginary liabilities include those liabilities that are unreasonably reflected in accounting (and accounting (financial) statements), but are not subject to reflection for various reasons. Moreover, the reasons for unreasonable reflection in accounting may be different, for example:

• Loss of certain qualification characteristics by liabilities in the course of significant transformation processes in the company (change of ownership, mass dismissal of employees, reorganization, liquidation, etc.)

• The presence of an accounting error or deliberate misrepresentation of accounting and accounting (financial) statements.

Let us consider informal liabilities element by element in more detail.

Liabilities that have Lost Part of their Qualifications in the Process of Transformational Changes in the Course of Significant Transformations of an Economic Entity

A change in the qualification features of liabilities can occur during the transformation processes during the implementation of significant transformations of an economic entity (Shchepot’ev, 2019). An example is the situation when the evaluated organization has significant events. Similar situations can be:

• Reorganization of the evaluated organization, including unfriendly takeover;

• Liquidation or bankruptcy of the company;

• Change of legislation;

• Adoption of a judicial act affecting the activities of the company being evaluated.

In such cases, traditionally individual recorded liabilities are transformed into informal liabilities and are likely to be written off and charged to the financial result (profit or reduction of uncovered loss). In certain cases, such liabilities cease to meet all criteria of liabilities, will not (should not) be repaid to third parties and are subject to write-off (allocation to the financial result) (Shchepot’ev, 2020). The following liabilities can be cited as an example:

• Estimated liabilities in the form of reserves for future expenses (in some cases) (Order of the Ministry of Finance of Russia “On approval of the Accounting Regulation “Estimated Liabilities, Contingent Liabilities and Contingent Assets”, 2010; International Standard for Financial Reporting (IAS) 37 "Estimated Liabilities, Contingent Liabilities and Contingent Assets", 2015).

• Deferred tax liabilities (in the case of a company having deferred tax assets or current losses (in tax accounting), which in a calculated way will cover the existing deferred tax liabilities) (Order of the Ministry of Finance of Russia "On approval of the Accounting Regulations Accounting for calculations of corporate income tax", 2002; International Standard for Financial Reporting (IAS) 12 "Income Taxes", 2015).

• Deferred tax liabilities are determined in a special manner when combining businesses (International Financial Reporting Standard (IFRS) 3 "Business Combinations", 2015).

• Debt or other liabilities to affiliates (may be recognized in court by own means (liabilities to increase capitalization by the owner (shareholder or participant).

Consider the list of reasons for the transformation of liabilities into informal liabilities.

Example 1

The Company has formed estimated liabilities in the form of reserves for future expenses for warranty repairs and maintenance of previously manufactured products. The amount of the available reserve (estimated liability) is 3,000,000 monetary units (for 3 years of uniform use), taking into account the practice of expenses for warranty repairs and maintenance (1,000,000 monetary units per year, i.e. 83,333 monetary units per month). The owner decided to liquidate the company. According to current standards, this liquidation will be completed in 6 months, all claims will be accepted (and will be settled in the prescribed manner). In this case, the estimated liability (reserves for future expenses for warranty repairs and maintenance) is subject to adjustment, recalculation and corresponding write-off. Over the next 6 months, claims (warranty repair and service) in the amount of 500,000 monetary units (for 6 months) will be presented (forecast value). Then the company will be liquidated, claims cannot be brought to the liquidated legal entity. Therefore, the liabilities in the amount of 2,500,000 monetary units is subject to transformation, will affect the value of the company at the current moment (during its liquidation). Liabilities in the amount of 2,500,000 monetary units will not occur during the life cycle of this company. Another reason for the loss of liabilities of certain of their qualifications and, as a consequence, the termination of the liabilities of the organization may be the introduction of bankruptcy procedures (Shchepot’ev, 2020). The use of various analysis techniques during bankruptcy can lead to the need for a comprehensive view of the assets and liabilities of a bankrupt entity (Algina, & Kobozeva, 2015; Demich, & Buglova, 2018). Consider another example.

Example 2

An entity has deferred tax liabilities of 100,000 monetary units. Income tax rate of 20%. The company in the current period received a loss (in accounting and tax accounting) in the amount of 1,200,000 monetary units, the bankruptcy proceedings began. Accordingly, the existing loss (in this case, in tax accounting) will cover the deferred tax liabilities in the amount of 100,000 monetary units (the base for calculating deferred tax liabilities is 500,000 monetary units). Due to the resulting loss, it is advisable for the appraisal and analytical procedures to recalculate the amount of deferred tax liabilities to 0 monetary units. It should be noted that liabilities to related parties, for example, debt liabilities (under a loan agreement) to an affiliate (shareholder, participant) can be considered as the company's own funds. This possibility is due to the current legislation (clause 2 of article 170, Civil Code of the Russian Federation (Part One, 1994) or according to the rules on circumvention of the law (clause 1 of article, Civil Code of the Russian Federation (Part One, 1994), paragraph 8 of article 2, Federal Law "On Insolvency (Bankruptcy, 2002)). These norms are confirmed by judicial practice (in bankruptcy cases) when a shareholder’s borrowed funds are excluded by a judicial act from the register of creditors (the liabilities to increase the capitalization of the analyzed company by the owner (shareholder or participant) (The determination of the Supreme Court of the Russian Federation, 2017). From an economic point of view, it is advisable to consider such liabilities as equity rather than payables (borrowings) (liabilities). The authors note that the practice of re-qualifying one relationship into another exists not only in judicial practice, but also in economic scientific thought. In the methodology of financial analysis of solvency of enterprises A.D. Sheremet long-term loans are conditionally equivalent to the organization’s own funds (Sheremet & Sayfulin, 1998).

Imaginary Liabilities

Imaginary liabilities reflected in accounting, but not meeting the criterion of reality, when determining the value of a company is subject to exclusion from the liabilities (Shchepot’ev, 2012). For one reason or another, such accounting objects were not written off in a timely manner to financial results; this adjustment is necessary when carrying out valuation procedures. The concept of imaginary liabilities should also include imaginary and feigned objects of accounting, defined by such applicable law. “An imaginary object of accounting means a non-existent object reflected in accounting only for the type (including unfulfilled expenses, ... facts of economic life that did not take place), a false object of accounting means an object reflected in accounting instead of another object for the purpose of cover it (including feigned deals)” (Federal law “On accounting”, 2011). As an example of imaginary assets, expired payables or debts owed to a liquidated company can be cited.

Hidden Liabilities

Hidden liabilities - loan, credit and other payables of an organization to the budget, extra-budgetary funds, individuals and / or legal entities, which the organization actually has, but is not reflected in the balance sheet in the valuation, and is also not taken into account when calculating net assets or own funds organizations (not accounted for or not subject to accounting in accordance with the law), the presence of which has led or will lead in the foreseeable future to the need to pay off accounts payable by the transfer of property (return, transfer of ownership or other alienation) of property, assets belonging to the organization. Lack of accounting for “hidden” liabilities is an underestimation of the organization’s liabilities over liabilities that actually arose and are to be settled in the process of conducting financial and economic activities (Shchepot’ev, 2013).

Moreover, hidden liabilities can be divided into separate independent groups.

The Economic Analogue of Liabilities

The Economic Analogue of Liabilities can be considered as one of the elements of hidden liabilities. The economic analogue of liabilities is not subject to reflection in accounting under the accounting rules, but can bring economic benefits to the company. As an example, we give an economic analogue of a deferred tax liability (for organizations that are under special taxation regimes) (Shchepot’ev, 2019).

Probabilistic Liabilities

Probabilistic liabilities of an economic entity, the settlement (cancellation) of which will lead to or may lead to the disposal of the organization of resources containing economic benefits), which may appear with a certain probability in the future as a result of inaction of the organization and/or occurrence (non-occurrence) of one or several future uncertain events not controlled by the organization.

A probabilistic liabilities does not meet all the criteria of an liabilities, a contingent liability or a contingent liability for accounting purposes, but within the framework of the corresponding economic science, discipline or direction has sufficient signs for recognition as a liability and can be used for valuation procedures, management accounting, financial analysis, business planning and other analytical procedures not regulated by accounting rules. A probabilistic liabilities is to be determined, including with a low (less than 50%) probability of occurrence, and a cost estimate using economic and mathematical tools to determine the likelihood of an adverse financial event occurring (for example: the possibility of bringing to subsidiary liability and recovering losses from the analyzed (estimated) ) organizations as a management company (functions of the executive body) or as the owner, co-owner of a subsidiary or dependent company; the presence of pre-trial and/or judicial financial claims; liabilities arising as a result of judicial contestation of previously concluded transactions, etc.) (Shchepot’ev, 2019). Speaking about the transformation of the concept of “liabilities” in the scientific literature, it should be noted that the process of changing the semantic load put into the analyzed concept is caused not only by changes in existing legislation, expressed in approximation to the norms and rules of most developed countries (international standards and rules), but and the development of scientific thought, within the framework of which the development and expansion of the corresponding concept takes place. Of course, the economic phenomenon “liabilities” itself (especially for accounting, auditing and taxation) should have clear formal features, but, according to the authors, formal aspects should be minimized, and reality, completeness of perception (as a real economically justified liabilities (and not necessarily formal) should be at the forefront of understanding the liabilities of the business entity. Note that the current accounting rules indicate the priority of content over the form (in preparing the accounting policies of the organization), i.e. understanding of basic economic terms and concepts (including the concept of “liabilities”) should be determined not so much from their legal form as from their economic content (Order of the Ministry of Finance of Russia “On approval of the accounting regulations”, 2008), which allows the concept of “informal liabilities” to be introduced into scientific circulation. The principle of priority of content over form should, according to the authors, be one of the fundamental principles of the construction, formation, transformation and development of economic scientific thought in modern conditions. Formal signs of liabilities should go to a secondary plan, liabilities should be determined, taken into account and evaluated (cost value determined) taking into account the requirements of reality and completeness of information. Based on the studies, the authors propose introducing into the economic terminology such a concept as “informal liabilities”. Let us repeat the idea that informal liabilities (in the existing legal framework of the current scientific turnover on accounting, auditing and taxation issues) are not liabilities that have all the qualification characteristics of liabilities (such informal liabilities can be used in valuation activities (when evaluating a business), in financial analysis, in forecasting, in bankruptcy procedures, legal issues, etc.), however, informal liabilities taken into account when conducting appraisal tests cedure can significantly adjust the market value of object of evaluation. Studying the development of terminology in relation to liabilities in modern conditions, the authors note that the definition and identification of such a category as informal liabilities is not exhaustive. Returning to the issue of using informal liabilities in assessment procedures (in relation to evaluating an existing company) in modern scientific thought, the authors see a tendency to deviate from the formalized criteria for determining liabilities, without emphasizing the legal aspects of liabilities. The divergence and divergence of the conceptual apparatus in various related sciences existed and exists, however, in order to create a single scientific and legal language, it is advisable to remove such problems. If for the purposes of individual scientific areas any concept (including the one analyzed in the framework of this study (“commitment”) has wider boundaries in interpretation and understanding, then it is reasonable and expedient to expand narrower boundaries than to narrow down the existing ones. Otherwise, part of the phenomenon (individual elements of the phenomenon) will not fall under the corresponding definition. As an example illustrating this idea, we can cite the liabilities recorded on off-balance sheet accounts. Such liabilities will not be liabilities from an accounting point of view (under RAS), but may be liabilities from a financial or estimated point of view. Consider in the framework of this study the question of the methodology of valuation activities in relation to informal liabilities. The determination of the value of informal liabilities will have its own specifics, however, the fundamental principles of this process are based on valuation tools. Presumably, for the majority of the identified informal liabilities, it will be necessary to use a reduction factor, determine the cost value taking into account the probability of the occurrence of certain facts, etc. Along with this, all the fundamental principles of valuation activities apply to the assessment of informal liabilities. A more detailed definition of the direct assessment tools (approaches, methods, techniques) of informal liabilities is an independent topic for in-depth research.

Conclusion

Informal liabilities can and should be actively used in assessing the value of a business, as this will provide more accurate and fair results. Summing up the study, the authors note that the use of informal liabilities in the valuation procedures in determining the market value of the company can positively or negatively affect the determined result. However, the determination and assessment of the impact of informal liabilities on the value of the company should be carried out without fail. In some cases, the influence of informal liabilities on the final result of business valuation may be minimal, in other cases - significant. Informal liabilities (to one degree or another) are present in every business entity. And the task of a qualified appraiser (possibly with the participation of an auditor, financier or accountant) is to identify them, determine the value and evaluate the impact on the property complex as a whole. The authors of the study hope that the active introduction of such a concept as “informal liabilities” into the scientific revolution will improve the tools of valuation activities and introduce new trends into the professionalism of appraisers, which will make it possible to determine the value of the company more clearly and accurately. Explained activity costing, proposed global credential and gift tax in the light of liabilities under the context of Bangladesh.

References

- Algina, M.V., & Kobozeva, N.V. (2015). Improving the system of indicators characterizing the solvency of the debtor in order to identify signs of intentional bankruptcy. Economics of Sustainable Development, 2(22). 13-20.

- Chaya, V.T., & Chicherina, K.N. (2009). Comparative evaluation of the principles of RAS and IFRS. International Accounting, 5, 29-38.

- Civil Code of the Russian Federation (Part One). (1994).

- Decree of the Government of the Russian Federation of "On approval of the Accounting Reform Program in accordance with international financial reporting standards." (1998).

- Demich, I.E., & Buglova, P.A. (2018). Comparative analysis of methods for assessing potential bankruptcy. Politics, Economics and Innovation, 3 (20). 16.

- Law. (2011). Federal law on accounting ? 402- FZ.

- Law. (2002). Federal law on insolvency (Bankruptcy) ? 127- FZ.

- Law. (1998). Federal Law On Valuation Activities in the Russian Federation 135- FZ.

- Fedorova, T.A. (2008). The formation of the strategic value of the enterprise. Finance and Credit, 10, 64-69.

- Fedorova, T.A., & Fedorova, E.A. (2018). The role of valuation activities in reforming the Russian economy. Management of Economic Systems: Electronic Scientific Journal, 6, 46.

- International Financial Reporting Standard (IFRS). 3"Business Combinations" (entered into force on the territory of the Russian Federation by Order of the Ministry of Finance of Russia). (2015). ? 217n).

- International Standard for Financial Reporting (IAS) 12 "Income Taxes" (entered into force on the territory of the Russian Federation by Order of the Ministry of Finance of Russia). (2015). ? 217n).

- International Standard for Financial Reporting (IAS) 19 "Employee Benefits" (entered into force on the territory of the Russian Federation by order of the Ministry of Finance of Russia). (2015). ? 217n).

- International Standard for Financial Reporting (IAS) 37 "Estimated Liabilities, Contingent Liabilities and Contingent Assets "(entered into force on the territory of the Russian Federation by order of the Ministry of Finance of Russia). (2015). ? 217n.

- Order of the Ministry of Finance of Russia "On approval of the Accounting Regulations". (2002).Accounting for calculations of corporate income tax "PBU 18/02" (Registered in the Ministry of Justice of Russia on December 31, 2002 ? 4090).. ? 114n

- Order of the Ministry of Finance of Russia "On approval of the accounting regulations". (2008). Together with the "Regulation on accounting" Accounting policies of the organization "(PBU 1/2008)". ? 106?

- Order of the Ministry of Finance of Russia “On approval of the Accounting Regulation “Accounting for Assets and Liabilities, the Value of which is Expressed in Foreign Currency” (PBU 3/2006)” (Registered in the Ministry of Justice of Russia on January 17, 2007 ? 8788). (2006). N 154n

- Order of the Ministry of Finance of Russia “On approval of the Accounting Regulation “Estimated Liabilities, Contingent Liabilities and Contingent Assets” (PBU 8/2010)” (Registered in the Ministry of Justice of Russia on 03.02.2011 No. 19691). (2010). ? 167n

- Shchepot’ev, A.V. (2012). Imaginary liabilities taken into account when calculating the net assets of the organization. Management Accounting, 10. 82-92.

- Shchepot’ev, A.V. (2013). Hidden liabilities taken into account when calculating the net assets of the organization. Management Accounting, 5, 58-67.

- Shchepot’ev, A.V. (2019). Expansion of the conceptual apparatus and terminology while improving the tools of valuation activities, financial analysis and other analytical procedures. Slovak International Scientific Journal, 35(2), 20-26.

- Shchepot’ev, A.V. (2019). Hidden assets and liabilities of an organization as economic analogues of deferred tax assets and liabilities in financial analysis and business valuation. Property Relations in the Russian Federation, 2, 77-83.

- Shchepot’ev, A.V. (2019). Use of informal assets and liabilities in analytical procedures. Collection of scientific articles on the basis of the work of the International Scientific Forum Science and Innovation - Modern Concepts. Moscow: Infinity Publishing House, 120.

- Shchepot’ev, A.V. (2020). Features of Accounting and Valuation of Assets of Bankrupt Companies and Companies Being Liquidated. Journal of Advanced Research in Dynamical and Control Systems – JARDCS, 12(S2), 505-510.

- Shchepot’ev, A.V. (2020). Principles of fair market valuation of rights under leasing agreement with the option to purchase the property. International Journal of Psychosocial Rehabilitation, 24(6), 983-989.

- Sheremet, A.D., & Sayfulin, R.S. (1998). Business finance. - M., INFRA-M. 343.

- Tax Code of the Russian Federation (Part One). (1998).

- Tax Code of the Russian Federation (Part Two). (2000). 117- FZ.

- The concept of accounting in the market economy of Russia. (1997). Approved by the Methodological Council for Accounting at the Ministry of Finance of the Russian Federation, the Presidential Council of IPB of the Russian Federation.

- The determination of the Supreme Court of the Russian Federation. (2017), 308-ES17-1556.

- Valdaitsev, S.V. (2001). Business valuation and enterprise value management: A textbook for high schools. M.: Unity-Dana. 720.