Research Article: 2022 Vol: 21 Issue: 2S

Taxation as a Strategy for Circular Economy Through Sustainability Reporting: The Agency Theory Perspective

Hussein Alfatlah, Universiti Teknologi Malaysia

Rafidah Othman, Universiti Teknologi Malaysia

Rohaida Basiruddin, Universiti Teknologi Malaysia

Akeel Almagtome, University of Kufa

Keywords

Sustainability Reporting, Agency Costs, Taxes, Political-Economic

Citation Information

Alfatlah, H., Othman, R., Basiruddin, R., & Almagtome, A. (2022). Taxation as a Strategy for Circular Economy Through Sustainability Reporting: the Agency Theory Perspective. Academy of Strategic Management Journal, 21(S2), 1-12.

Abstract

Greenhouse gas emissions and energy usage have grown because of increasing awareness of sustainability reporting, more concerns about climate change, and new laws and levies. Audit committees, management, internal auditors, external auditors, and other stakeholders may all have a role in sustainability reporting. This article examines the potential impact of agency cost (AC) from a tax perspective on sustainability reporting (SR) in a global context. This study uses data from 693 companies from 54 countries. This study uses its model to estimate the interaction of AC and GRI to assess SR. The results show that the lowest tax rate is in the countries of the Middle East and Africa. Egypt, Iraq, Jordan, Estonia, Tanzania, and Burkina Faso recorded the lowest disclosure rate. These results reflect that taxes describe the reporting of sustainability information. This study provides a new perspective on AC; Also, the results add to our understanding of other predictors of SR quality that demonstrate more explicit approaches to predicting its efficiency. Finally, the article presents some conclusions, as well as more research possibilities. Our findings point to the need for effective monitoring. According to agency theory, there is no single explanation that thoroughly explains our results.

Introduction

The circular economy (CE) is a critical approach to strategic management research. It is seen as a way to help businesses operate more sustainably. It is recognized as a means of reconciling the competing demands for economic development and environmental conservation in the face of the limits of the linear economy. Despite the assertion that CE requires additional engagement globally, it is alleged that CE seeks to fundamentally improve the current business model by applying preventive and regenerative eco-industrial development and increased well-being. The word "sustainability" has become a catchphrase in the twenty-first century. It reflects the hope for social change into a much more equal and stable society in which the natural environment and our cultural contributions are maintained for future generations (Khaghaany, 2019). This pledge touches on basic expectations and concerns that have previously influenced and challenged thousands of academics. For the last 150 years, the pursuit of global prosperity and social justice has been a significant issue (Hummel & Schlick, 2016). Worry about the holding potential of natural environments links together the current significant threats that humankind is experiencing. Given companies' environmental, social and economic impacts, companies are now subject to an increasing array of regulatory requirements covering ecological concerns, labor conditions, and human rights (Hameedi, 2021). Management will, hence, for two purposes, provide information on sustainability. First, management can provide environmental and social disclosures to protect its interests to cultivate, maintain, and validate relationships by projecting an appearance of support to society in general. In addition, organizations can report sustainability-related information to avoid potential Organizational interference. The government, like other shareholders, is looking for reports from companies to keep track of how resources are being used. Lemon & Cahan (1997) argue that increasing environmental information disclosure is related to the tax level. It is the core of the Agency Theory.

The agency's problem occurs because the agent may not always behave in the principal's best interests. This chance provides rise for AC. It includes monitoring costs incurred by the principal to restrict the agent's discretionary behavior, bonding expenses incurred by the agent to limit and guarantee the agent's discretionary conduct. The residual losses are arising from the agent's discretionary conduct to the principal(s). Due to' excessive' rates of executive compensation, it is one aspect of this latter element of ACs-residual losses. Stakeholders are motivated to adopt selfish policies due to various conflicts of interest between managers and stakeholders. The cost of solving conflicts of interest imposes specific expenses called ACs (Ross, 2008). Ross argues that an AC is a form of internal company cost resulting from an agent's activities working on a principal's behalf. Jensen and Meckling (1976) assert that If both parties involved in the contract are profit-driven, there is a decent possibility that the agent does not always act in the principal's best interests. According to Jensen and Meckling, the principal will mitigate interest differences by providing fair opportunities for the agent and incurring monitoring costs to reduce the agent's aberrant behavior (Al-Wattar, Almagtome, & AL-Shafeay, 2019). However, in some cases, it will request that the agent spend resources on bonding costs and guarantee that it will not take any action that will influence the principal or if the principal will be charged. In the context of ACs, the green or environmental tax has drawn rising attention in the face of increasing worries about significant ecological challenges. Several researchers have concluded that pollution taxes are an effective tool to achieve environmental goals (Baumol et al., 1988). Bovenberg and De Mooij (1994) claim that several researchers have moved much further to indicate that green taxes can bring benefits beyond a cleaner environment. Policymakers, in specific, can use pollution tax income to lower other distortionary taxes. Green taxes can thus create a double profit, not just a clean environment. This argument suggests that green taxes could be moved above that of a tool for protecting the environment and that these instruments could also be used as an income-raising tool. Some policymakers' green target is the first dividend, which is to reduce carbon emissions. Some European countries follow carbon dioxide taxes and different measures to achieve these goals: fuel levy. The use of carbon-emitting fossil energy is discouraged by such a tax. Social security contributions (SSC) are among the non-wage employment tax collected by businesses for each employee.

Prior studies have not yielded a clear picture of the relationship between SR and AC. In particular, ideas from agency theory are not concerned (A. Almagtome, Khaghaany, & Önce, 2020). According to agency theory, the government enacts rules, legislation, and taxes to regulate corporate conduct. As a consequence; therefore, we suggest that corporations' sustainability efforts and reports should be affected. Future research should concentrate on how information is reported rather than on SR quantity by categorizing disclosure items as reported or non-disclosed in previous studies. Furthermore, proxies for taxes and SR must capture similar material to measure the theoretical consequences of agency theory and Political cost theory.

Literature Review and Hypotheses Development

Many elements have been identified in the accounting literature that helps to explain why firms provide more feedback than is required. Among empirical studies, agency theory is the most thoroughly studied theoretical framework (Ifada, 2021; Tran, 2021). For the reason that the connection between the shareholder and the manager of the company is composed of a perfect agency agreement, it should be unsurprising that the issues surrounding the separation of ownership and management in modern diffuse companies are inextricably linked to the overall agency conflicts (Jensen & Meckling, 1976). The agency definition, which is used to describe conceptual, financial decisions, voluntary transparency, and the mandatory appointment of auditors. The organizational impact on proposed accounting standards is used to understand pay issues in an entity due to the division of ownership and capital control (the primary agent concern) (Morris, 1987). Financial disclosure is a way of tracking management behavior; managers are therefore encouraged to disclose information voluntarily. Furthermore, according to the agency hypothesis, more competitive firms are more vulnerable to market pressure and, therefore, more likely to employ self-regulation tactics to counteract external influence. More capital resources will be available for profitable firms to deal with new reporting requirements (Ng & Koh, 1994). AS are higher for firms with a higher debt ratio in their capital structure. As a result, sharing more details would help them save money at the company. Furthermore, most debt covenants contain provisions for voluntary disclosure. As a result, organizational profitability can be an essential factor, and heavily leveraged companies are more inclined than low geared firms to comply with voluntary pronouncements (Bradbury, 1992; Almagtome, 2020). Managers have also benefited from the advanced understanding and exchange of competitive intelligence industries to increase firm value and management benefits. Executives can include sustainability disclosure to reduce agency costs, remove tight internal control, and benefit from the availability of sustainability reporting in stock markets.

Under the agency theory, the legitimacy theory is described as the most popular theory that justifies SR (Azizul & Deegan, 2008). Like the main-agent relationship, the legitimacy theory suggests a connection between the organization and society and those firms seek credibility by meeting societal standards. Considering that the community has allowed the company to use social and environmental resources, the company should carefully use them. Hahn & Kühnen (2013) bring a statement of legitimacy theory. Reporting of sustainability is expected to be a prerequisite for a company's claim to legitimacy. It provides a broader justification for companies disclosing sustainability-related data. Companies are being pressured to do business socially responsibly, and sustainability disclosure responds to that pressure. In this context, Hummel & Schlick (2016) claim that only sustainability companies prefer high-quality reporting of sustainability to show their superior market performance. Moreover, based on the theory of legitimacy, weak sustainability practitioners prefer disclosure of low-quality sustainability to mask their actual performance and secure their reputation at the same time.

In terms of political-economic theory, Ramanathan (1976) argues the idea of the social contract, which implies that an organization’s existence depends on society’s help, in general, is based on the Bourgeois political economy perspective. If the government believes the company is engaging in immoral social practices, it may withdraw its funding, causing it to fail. Management may release information about their environmental and social activities to escape this situation and retain their social standing. According to the political-economic theory, the government is an essential player in safeguarding the shareholder's interests. Governments, according to advocates, play a crucial role in meeting the identities of stakeholders trying to achieve their goals. Governments will protect human rights throughout societies where an organization's activities impact or are perceived to impact the broader community. However, intervention could negatively impact the company's objectives. Using the agency theory framework, Ng & Koh (1994) indirectly refers to the AC by mentioning the various stakeholders who pressured the company to make broader disclosures while also referring to non-mandatory disclosure practices as an SR expression. Ng & Koh investigate the impact of company size, performance, liquidity, operational complexity, sector, and auditor on voluntary accounting disclosure. Non-obligatory Reporting accounting is more likely to be followed by specific, significant, profitable, and highly focused businesses. Furthermore, firms in the manufacturing and commercial sector and those audited by large public accounting firms are more likely to comply with voluntary disclosure than their competitors. The table below summarises related literature:

| Table 1 Summary Of Research Gap For The Relationship Between Ac And Sr |

|||

|---|---|---|---|

| Author and Year of Publication | Objective | Findings | What needs to be done |

| (Mgammal, 2015) | In Malaysia, investigate the relationship between tax preparation and tax reporting. | In Malaysia, tax preparation and tax disclosure have a favorable connection. | The relationship between AC using taxes, SR is not examined yet. Studying from the agency theory perspective need to be done. |

| (Hong, Li, & Minor, 2016) | Examine the connection between corporate governance and the presence of CSR-related executive pay. | Direct rewards for CSR executives are an essential way to improve a company's social efficiency. | The relationship between AC using taxes, SR is not examined yet. Studying from the agency theory perspective need to be done. |

| (Zhu, Bu, Jin, & Mbroh, 2020) | The author of this article explores the influence of China's carbon tax policy on green financial outcomes, accounting, and transparency in the green sector. | China's environmental tax policy influences financial actions to be more environmentally friendly. | The relationship between AC using taxes, SR is not examined yet. Studying from the agency theory perspective need to be done. |

| (Masoumzadeh, Alpcan, & Nekouei, 2020) | Assesses how to build tax and subsidy opportunities in Australia to encourage a sustainable and low energy sector. | The importance of enacting policies that encourage people to be more environmentally conscious. | The relationship between AC using taxes, SR is not examined yet. Studying from the agency theory perspective need to be done. |

| (Mohammed, 2020) | Investigate the long-term relationship between Denmark's environmental tax and economic development. | The implementation of a green tax is successful in increasing the use of renewable energy. | The relationship between AC using taxes, SR is not examined yet. Studying from the agency theory perspective need to be done. |

Previous studies have not provided a good understanding of the SR-AC relationship. Concepts from agency theory, in particular, are not interested (Alfatlah, 2021). The government adopts laws, regulations, and taxes to control corporate behavior, according to agency theory. Consequently, we propose that sustainability efforts and reports of companies should be affected. Rather than focusing on how much SR is disclosed or not, future studies should categorize disclosure items and concentrate on how data is posted. Besides, tax proxies and the SR must collect similar information so that the theoretical implications resulting from the agency's theory and political cost theory are correctly measured. Based on the debate and analysis of the gaps in the literature referred to above, it is apparent that the agency's costs and the disclosure are related to a reciprocal partnership that may have a mutual effect. Therefore, the costs of the agency can have an impact on SR. However, this relationship requires further testing since the above studies have primarily focused on executive compensation as a measure of AC and social SR only. Consequently, the relationship between the AC from taxes standpoint and the comprehensive SR remains vague. According to the general ground rules of Agency theory, companies provide information on sustainability in response to the demands of the institutions of the social, political, and economic processes that framed their work. As a result, it is suggested that differences in the quality and quantity of SR released across countries may be due to differences in tax features that form the socio-political and economic structures of the nations.

H1: There is a significant relationship between tax as an AC and the level of SR

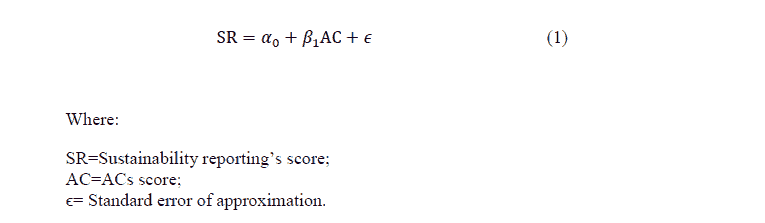

As a result, the regression equation is used to analyze the connection between AC's level from a tax standpoint and the predictor variables, SR score level. It will determine the extent to which ACs can explain SR. This analysis is in line with the study's hypotheses. As a result, the regression equation is:

Methodology, Measurement and Sampling

Agency Costs Measurement

According to the agency theory assumptions, many of the administrative, Laws, regulations, and self-regulatory frameworks intended to track the agent and stakeholders' relationships are agency relationships. Suppose they are internal or external auditors, regulatory agents, public relations offices, government regulators, insurance firms, financial consultants, or credit rating agencies. In that case, the monitors are working on behalf of stakeholders (Shapiro, 2005). Shapiro argues that all these agency relationships are facing ACs. AC comes from many sources. However, stakeholders try to reduce them. Because principals cannot monitor agent behavior, they rely on other deficient strategies. Based on this discussion, the government is an essential part of the agency contract that imposes obligations and costs on the company to protect its economic interests and protect the audience's social and environmental nature interests. Government issuing laws, regulations, and taxation to control companies' behavior, these arrangements can produce political costs. Positive accounting theory considers the company as a ligament of opportunistic working economic agents. The approach can help explain contractual debt obligations, administrative incentive arrangements, and political costs in the context of SR. This theory predicts that personality-interest will motivate all people. Direct social and environmental practices and associated reports should only happen if they positively affected the management (Watts & Zimmerman, 1986). Under the political cost theory, executives believe that this could encourage them to expose social information under intense government criticism and public pressure (Setyorini & Ishak, 2012).

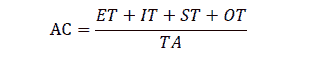

The political-cost theory assumes that management facing the possibility of politically forced wealth transfers will use accounting techniques that minimize the transfer's probability or size (Cahan, 1992). Watts and Zimmerman (1978) claim that governments and their representatives equate high net profit with monopolization, arguing that governments and their representatives lack incentives or cannot entirely undo accounting information. Therefore, large-income companies will be particularly vulnerable in the form of legislation, regulation, and taxes to wealth-extracting political transfers. Managers in these companies will be forced to use accounting strategies that minimize taxable income. Researchers have investigated alternatives for political costs (ALAM, ABBAS, ZAHID, BATOOL, & KHAN, 2021). (Sutton, 1988) states that in the 1970s, the UK due to price controls in the United Kingdom. Over-profit firms were likely to be subject to government regulators' scrutiny. Sutton continues to use profitability as a political cost proxy. Indicating using the taxes as political costs measurement, Wong (1988) also discusses New Zealand's tax reform campaign in the early 1980s to promote such measures as recorded tax rates. Political leaders can influence corporate income re-distributions through corporate tax rates, laws, and subsidies, corresponding to Watts and Zimmerman. Certain environmental, social, and economic groups have opportunities to advocate for nationalizing, expropriating, breaking up, or controlling businesses or companies, which are viewed as providing political measures to encourage these acts. In its annual report, SR can be used creatively to monitor the relationship between a corporation and the community. It works that would improve its wealth (Setyorini & Ishak, 2012). Taxes will be used as an indicator of increasing or decreasing political pressure on organizations to expose their social, ecological, and economic responsibility, based on the discussion above. Consequently, taxes will represent the AC for sustainability disclosure. On this basis, the measurement model of AC will be as following:

Where:

AC = Agency cost

ET = Environmental tax amount

IT = Income tax amount

ST = Social tax amount

OT = Other tax amount

TA = Total assets

Total assets are included in the denominator because the tax amounts paid will vary according to the company's size. Consequently, dividing the total taxes paid on the company's size will give an accurate and comparable indicator to the percentage of taxes paid by each company.

Sustainability Indicator

Many companies are releasing sustainability reports, also recognized as CSR reports or financial, social, and governance reports, in response to increasing demand from multiple stakeholder groups such as policymakers, customers, and investors to be more transparent about their environmental, economic, and social impacts (ESG). The SR arrangement of the GRI assists companies in defining, compiling, and disclosing this data straightforwardly and comparably. The Global Reporting Initiative (GRI) is the most well-known platform for companies worldwide to report their fiscal, financial, and social governance disclosures. GRI is a non-profit international standards organization that helps businesses, politicians, and organizations consider and communicate their effects on global warming, human rights, and corruption. There are two forms of Mandatory Reporting, according to GRI G4: General Standard Reporting requirements and Unique Standard Reports. In this study, a score (0), (0.5), and (1) is given based on a sustainability disclosure index. The index consists of 154 items measuring the sustainability disclosure level where the items are classified into five groups which are (general, governance, economic, environmental, and social disclosers). Content analysis will be dependent on reviewing the annual report to check out the existence or absence of statements related to sustainability issues mentioned in the study's index. The evaluation is measured on a scale of zero to one. Zero is given for non-described items, and half is given for partially-described items; one point is awarded for each item fully described in the annual report.

Sample

The present research is using a mixed-method between the quota and Convenience sampling methods. On the one hand, Quota sampling is a sampling technique that guarantees the representation of a particular attribute or category of a population sample. This sampling design enables all types to be included in the studied framework. On the other hand, using the quota sample is to ensures the diversity of the model. Besides, companies in each country are divided into different business sectors and sizes to ensure the variety of the sample in terms of business sectors and companies' size. As a result, data is collected under the following criteria: Companies must be publicly traded on a stock exchange. Companies must have a functional website. Companies must have an SR in the GRI database that has been published; The SR and annual reports would all be available in English. The total number of available reports is (12716). This number has been subtracted from the (6379) companies that have submitted 2017 reports. Non-listed companies and reports written in languages other than English were also excluded. The final available reports are (3101). As a result, 693 companies were chosen as the research sample for 2017, accounting for 22 percent of all available information.

| Table 2 Companies Involved By Country |

|||||

|---|---|---|---|---|---|

| Region | Number | Region | Number | Region | Number |

| Australia | 15 | Indonesia | 14 | Italy | 12 |

| Canada | 12 | Malaysia | 8 | Spain | 13 |

| Ireland | 13 | Philippines | 6 | Argentina | 14 |

| New Zealand | 17 | South Korea | 14 | Chile | 11 |

| South Africa | 9 | Taiwan | 12 | Colombia | 8 |

| U. K | 10 | Thailand | 11 | Mexico | 13 |

| USA | 22 | Japan | 40 | Peru | 12 |

| Hong Kong | 29 | Belgium | 10 | Portugal | 9 |

| Singapore | 23 | Brazil | 18 | Uruguay | 5 |

| India | 23 | France | 20 | Germany | 20 |

| Nigeria | 8 | Tanzania | 3 | Zambia | 3 |

| Switzerland | 15 | Greece | 15 | Estonia | 3 |

| Denmark | 10 | Iraq | 10 | Latvia | 4 |

| Finland | 10 | Jordan | 5 | Russia | 30 |

| Netherlands | 10 | Chine | 50 | Ukraine | 10 |

| Norway | 10 | Lebanon | 5 | Angola | 5 |

| Sweden | 10 | Morocco | 9 | Burkina Faso | 3 |

| Egypt | 5 | Turkey | 10 | Ghana | 7 |

| Total\Firms\Countries | 693\54 | ||||

The total number of companies included in the study is 693, as seen in the list above, with companies from 54 different countries represented. The research sample is diverse enough to include participants from all over the world. By having a broader spectrum of developed countries than prior research, the current analysis contributes to our understanding of sustainability. In addition, it helps to identify the behavior of sustainability disclosure all over the world. Furthermore, the above table shows that secondary data from China, Japan, Russia, Hong Kong, Singapore, India, and the United States of America account for 30% of the research sample, ranked sequentially based on the number of companies. On the other hand, African countries are underrepresented in the study sample due to the lack of online availability of sustainability reports and the difficulty accessing them in English.

Findings and Discussion

The table below shows the AC results calculated according to the research model. In general, the AC results indicate that Burkina Faso (0.001) has the lowest percentage of tax. Angola (0.079 percent), Morocco (0.621 percent), Jordan (0.624 percent), Turkey (0.801 percent), Egypt (0.822 percent), Estonia (0.880 percent), Iraq (0.897 percent), and Ireland (0.976 percent) all have less than one percent. Therefore, these nations use the minimum necessary taxation policies that could increase the performance of SR disclosure since they do not use social security. It is worth noting that the lowest corporation tax is found in a region of Middle Eastern and African countries.

| Table 3 Agency Costs (Ac) By Country |

||||||

|---|---|---|---|---|---|---|

| Country | AC | Country | AC | Country | AC | |

| Australia | 2.56% | Indonesia | 1.99% | Italy | 1.21% | |

| Canada | 2.54% | Malaysia | 2.53% | Spain | 2.89% | |

| Ireland | 0.98% | Philippines | 2.42% | Argentina | 1.91% | |

| New Zealand | 1.78% | South Korea | 1.86% | Chile | 1.74% | |

| South Africa | 2.91% | Taiwan | 1.34% | Colombia | 1.53% | |

| U. K | 1.77% | Thailand | 1.53% | Mexico | 2.39% | |

| USA | 2.64% | Japan | 1.69% | Peru | 1.20% | |

| Hong Kong | 1.32% | Belgium | 2.05% | Portugal | 1.35% | |

| Singapore | 1.12% | Brazil | 1.57% | Uruguay | 1.92% | |

| India | 3.06% | France | 1.16% | Germany | 2.84% | |

| Nigeria | 2.30% | Tanzania | 2.62% | Zambia | 2.58% | |

| Switzerland | 1.25% | Greece | 1.74% | Estonia | 0.88% | |

| Denmark | 3.84% | Iraq | 0.90% | Latvia | 1.09% | |

| Finland | 1.73% | Jordan | 0.62% | Russia | 2.49% | |

| Netherlands | 1.41% | Chine | 1.33% | Ukraine | 1.91% | |

| Norway | 1.34% | Lebanon | 1.13% | Angola | 0.08% | |

| Sweden | 2.54% | Morocco | 0.62% | Burkina Faso | 0.00% | |

| Egypt | 0.82% | Turkey | 0.80% | Ghana | 1.01% | |

On the other hand, Malaysia (2.531%), Sweden (2.539%), Canada (2.545%), Australia (2.562%), USA (2.641%), Germany (2.841%), Spain 2.895%, South Africa (2.906%), India (3.059%), Denmark (3.838%), in ascending order, achieved the highest rate of tax collection. In general, 17% of the research sample countries achieved a ratio of ACs less than 1%. The highest ACs are in only two countries (India, Denmark), representing 4% of the total research sample. Also, 52% of the research sample countries achieved ACs ranging from 1% to 1.9%. Consequently, most of the results indicate that the ratio of ACs ranges between 1% and 2.3%. The SR results in Table 2 show, on the other hand, that sustainability disclosure accounts for between 22% and 90% of the total information that should be available. Among the sample countries, Egypt, Iraq, Jordan, Estonia, Tanzania, and Burkina Faso had the lowest disclosure rate. The majority of African countries reach less than a 57 percent transparency threshold. Additionally, the Middle Eastern countries' findings represent a deficiency in transparency regarding sustainability. Finland, Colombia, Turkey, the USA, South Korea, Germany, China, and Uruguay, on the other hand, have the highest sustainability disclosure rates, ranging from 73% to 90%.

| Table 4 SR Score By Country |

|||||

|---|---|---|---|---|---|

| Country | GRI Score | Country | GRI Score | Country | GRI Score |

| Australia | 112 | Indonesia | 74 | Italy | 101 |

| Canada | 110 | Malaysia | 96 | Spain | 99 |

| Ireland | 101 | Philippines | 105 | Argentina | 86 |

| New Zealand | 98 | South Korea | 124 | Chile | 95 |

| South Africa | 96 | Taiwan | 93 | Colombia | 117 |

| U. K | 106 | Thailand | 83 | Mexico | 112 |

| USA | 122 | Japan | 91 | Peru | 104 |

| Hong Kong | 82 | Belgium | 93 | Portugal | 100 |

| Singapore | 73 | Brazil | 72 | Uruguay | 139 |

| India | 96 | France | 81 | Germany | 126 |

| Nigeria | 83 | Tanzania | 55 | Zambia | 74 |

| Switzerland | 90 | Greece | 106 | Estonia | 49 |

| Denmark | 104 | Iraq | 39 | Latvia | 63 |

| Finland | 113 | Jordan | 47 | Russia | 113 |

| Netherlands | 110 | Chine | 130 | Ukraine | 90 |

| Norway | 108 | Lebanon | 66 | Angola | 65 |

| Sweden | 109 | Morocco | 95 | Burkina Faso | 57 |

| Egypt | 34 | Turkey | 117 | Ghana | 86 |

It is noteworthy that the majority of African nations fall short of the 57 percent criteria for transparency. Additionally, the Middle Eastern countries' findings represent a deficiency in transparency regarding sustainability. On the other hand, European countries achieve the highest reporting rate, ranging from 64% to 82%. In terms of Asian countries, the percentage of SR is compared to the G4 average. The table below presents the statistical findings of the SPSS, which investigates the relationship between taxes and the level of SR practices. The correlation findings indicate that the relationship between variables is positive and statistically significant (0. 702) at the level of 0.01. This observation adds credence to the preceding debate. Furthermore, the Kendall test result for tax and SR is statistically significant, with a correlation (0.547). The Spearman test reveals the same indicators, indicating a statistically significant correlation between agency costs and SR. The results in the table below are based on the following information:

| Table 5 Kendall And Spearman Correlations |

||||

|---|---|---|---|---|

| AC | SR | |||

| Pearson Correlations | AC | Pearson Correlation | 1 | .702** |

| Sig. (2-tailed) | .000 | |||

| N | 660 | 660 | ||

| SR | Pearson Correlation | .702** | 1 | |

| Sig. (2-tailed) | .000 | |||

| N | 660 | 660 | ||

| Kendall's tau_b | AC | Correlation Coefficient | 1.000 | .547** |

| Sig. (2-tailed) | . | .000 | ||

| N | 660 | 660 | ||

| SR | Correlation Coefficient | .547** | 1.000 | |

| Sig. (2-tailed) | .000 | . | ||

| N | 660 | 660 | ||

| Spearman's rho | AC | Correlation Coefficient | 1.000 | .694** |

| Sig. (2-tailed) | . | .000 | ||

| N | 660 | 660 | ||

| SR | Correlation Coefficient | .694** | 1.000 | |

| Sig. (2-tailed) | .000 | . | ||

| N | 660 | 660 | ||

The following table illustrates testing the central hypothesis of this article. The linear regression model result shows that the p-value is less than 0.05. It shows the significance of the research's regression model and brings us to embrace the hypothesis.

| Table 6 Linear Regression |

||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 52909.995 | 1 | 52909.995 | 51.840 | .000b |

| Residual | 669534.255 | 656 | 1020.631 | |||

| Total | 722444.250 | 657 | ||||

| a. Dependent Variable: SR | ||||||

| b. Predictors: (Constant), AC | ||||||

The tax index and disclosure relationship are positive - upward in terms of the relationship between the two research variables. A countries-level analysis is, in general, the indicator suggests that corporate taxes have a favorable impact on SR activities. These findings support agency theory and political cost theory discussions, which explain the possibility of taxation for purposes other than economic gain.

Conclusion

Local governments have recognized sustainability as a critical issue in ensuring the continued provision of public services to future generations in recent years. While most of the world's countries have launched programs to promote their sustainable development, their local governments differ significantly in management practices and produce different results due to the changes. The current study evaluates the impact of different types of institutions, the current state of the economy, and current government policies on sustainability in other countries to identify and explain the similarities and differences in the impact of tax policy on the effectiveness of sustainable development strategies globally. This article conducted an experimental investigation of 693 company reports from 54 countries in the relationship between AC and SR. Regression analysis results for a study of 693 observations confirm our hypothesis that Agency Theory explains the reporting concentrations of sustainability information. Furthermore, we prove that advanced tax regulations enable high-volume SR to signal long-term success to the marketplace. On the other hand, weak tax systems hide their motivational value toward a sustainable future while companies in such an environment attempting to preserve their credibility by offering low-quantity sustainability information. The outcomes of several model variations and additional studies confirm the accuracy of our findings. According to the existing evidence, half of the selected countries have enacted taxation or charges on natural resource production, carbon emission, toxic goods, and facilities, as well as a social tax. In Africa and the Middle East, the majority of tax systems effort also focuses on economic contribution. This evident through its corporate tax volume.

On the other hand, although some countries have achieved high rates of SR, the researchers concluded that, overall, sustainability transparency is still at an intermediate level. Our research makes significant contributions to the corpus of knowledge in many aspects. To our understanding, this is the first work to look at the effectiveness of both Agency theory and political cost theory to explain the interaction between taxes and sustainability transparency. First, we introduce a research environment where we can contextualize our assumptions by shifting the scope of inquiry from SR's quantity to what motivates SR practices. Second, we have reliable analytical data that confirms our arguments using a dataset of 693 organizations from 54 countries worldwide. Furthermore, our findings add to our understanding of other predictors of sustainability disclosure quality, lacking in Africa and the Middle East. Third, we refine and make more clear approaches to forecasting sustainability efficiency, considering economic, environmental, governance, and social factors. Future research in this area can benefit from the implementation of these research arrangements. Fourth, our results show the need for precise and binding reporting criteria for essential quantitative sustainability information in Africa and the Middle East from a realistic standpoint. The relationship between SR and AC has not been established in previous research. Ideas from agency theory, in particular, are not taken into account. According to agency theory, the government controls corporate activity by enacting laws, regulations, and taxes. As a result, we believe that businesses' sustainability efforts and reports should be influenced. Rather than concentrating on SR quantity in past studies by categorizing disclosure items as published or non-disclosed, research should focus on how information is reported.

References

Alam, A., Abbas, S.F., Zahid, A., Batool, S.I., & Khan, M. (2021). Determinants and outcomes of financial derivatives: Empirical evidence from Pakistani banks. The Journal of Asian Finance, Economics and Business, 8(4), 591-599.

Crossref, GoogleScholar, Indexed At

Alfatlah, H. (2021). A systematic review on the circular economy initiatives through the sustainability reporting: A socio-cultural approach. Turkish Journal of Computer and Mathematics Education (TURCOMAT), 12(7), 1892-1906.

Crossref, GoogleScholar, Indexed At

Almagtome, A.H., Al-Yasiri, A.J., Ali, R.S., Kadhim, H.L., & Bekheet, H.N. (2020). Circular economy initiatives through energy accounting and sustainable energy performance under integrated reporting framework. International Journal of Mathematical, Engineering and Management Sciences, 5(6), 1032-1045.

Crossref, GoogleScholar, Indexed At

Almagtome, A., Khaghaany, M., & Önce, S. (2020). Corporate governance quality, stakeholders’ pressure, and sustainable development: An integrated approach. International Journal of Mathematical, Engineering and Management Sciences, 5(6), 1077-1090.

Crossref, GoogleScholar, Indexed At

Al-Wattar, Y.M.A., Almagtome, A.H., & AL-Shafeay, K.M. (2019). The role of integrating hotel sustainability reporting practices into an accounting information system to enhance hotel financial performance: Evidence from Iraq. African Journal of Hospitality, Tourism and Leisure, 8(5), 1-16.

Azizul Islam, M., & Deegan, C. (2008). Motivations for an organisation within a developing country to report social responsibility information: Evidence from Bangladesh. Accounting, Auditing & Accountability Journal, 21(6), 850-874.

Crossref, GoogleScholar, Indexed At

Baumol, W.J., Baumol, W.J., Oates, W.E., Baumol, W.J., Bawa, V., Bawa, W., & Bradford, D.F. (1988). The theory of environmental policy. Cambridge university press.

Crossref, GoogleScholar, Indexed At

Bovenberg, A.L., & De Mooij, R.A. (1994). Environmental levies and distortionary taxation. The American economic review, 84(4), 1085-1089.

Crossref, GoogleScholar, Indexed At

Bradbury, M.E. (1992). Voluntary disclosure of financial segment data: New Zealand evidence. Accounting & Finance, 32(1), 15-26.

Crossref, GoogleScholar, Indexed At

Cahan, S.F. (1992). The effect of antitrust investigations on discretionary accruals: A refined test of the political-cost hypothesis. Accounting Review, 77-95.

Hahn, R., & Kühnen, M. (2013). Determinants of sustainability reporting: a review of results, trends, theory, and opportunities in an expanding field of research. Journal of Cleaner Production, 59, 5-21.

Crossref, GoogleScholar, Indexed At

Hameedi, K.S., AL-Fatlawi, Q.A., Ali, M.N., & Almagtome, A.H. (2021). Financial performance reporting, IFRS implementation, and accounting information: Evidence from Iraqi banking sector. The Journal of Asian Finance, Economics and Business, 8(3), 1083-1094.

Crossref, GoogleScholar, Indexed At

Hong, B., Li, Z., & Minor, D. (2016). Corporate governance and executive compensation for corporate social responsibility. Journal of Business Ethics, 136(1), 199-213.

Crossref, GoogleScholar, Indexed At

Hummel, K., & Schlick, C. (2016). The relationship between sustainability performance and sustainability disclosure – Reconciling voluntary disclosure theory and legitimacy theory. Journal of Accounting and Public Policy, 35(5), 455-476.

Crossref, GoogleScholar, Indexed At

Ifada, L.M., Indriastuti, M., Ibrani, E.Y., & Setiawanta, Y. (2021). Environmental performance and environmental disclosure: The role of financial performance. The Journal of Asian Finance, Economics and Business, 8(4), 349-362.

Crossref, GoogleScholar, Indexed At

Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305-360.

Crossref, GoogleScholar, Indexed At

Khaghaany, M., Kbelah, S., & Almagtome, A. (2019). Value relevance of sustainability reporting under an accounting information system: Evidence from the tourism industry. African Journal of Hospitality, Tourism and Leisure, 8, 1-12.

Lemon, A.J., & Cahan, S.F. (1997). Environmental legislation and environmental disclosures: Some evidence from New Zealand. Asian Review of Accounting, 5(1), 78-105.

Crossref, GoogleScholar, Indexed At

Masoumzadeh, A., Alpcan, T., & Nekouei, E. (2020). Designing tax and subsidy incentives towards a green and reliable electricity market. Energy, 195, 117033.

Crossref, GoogleScholar, Indexed At

Mgammal, M.H. (2015). The effect of tax planning and corporate governance on tax disclosure in Malaysia. Universiti Utara Malaysia.

Mohammed, M. (2020). Green tax shocks and economic growth. International Journal of Energy Economics and Policy, 10(2), 302.

Crossref, GoogleScholar, Indexed At

Morris, R.D. (1987). Signalling, agency theory and accounting policy choice. Accounting and Business Research, 18(69), 47-56.

Crossref, GoogleScholar, Indexed At

Ng, E.J., & Koh, H.C. (1994). An agency theory and probit analytic approach to corporate non-mandatory disclosure compliance. Asia-Pacific Journal of Accounting, 1(1), 29-44.

Crossref, GoogleScholar, Indexed At

Ramanathan, K.V. (1976). Toward a theory of corporate social accounting. The Accounting Review, 51(3), 516.

Ross, S.A., Westerfield, R., & Jordan, B.D. (2008). Fundamentals of corporate finance. Tata McGraw-Hill Education.

Setyorini, C.T., & Ishak, Z. (2012). Corporate social and environmental disclosure: a positive accounting theory viewpoint. International Journal of Business and Social Science, 3(9).

Shapiro, S.P. (2005). Agency theory. Annual Review of Sociology, 31, 263-284.

Crossref, GoogleScholar, Indexed At,

Sutton, T.G. (1988). The proposed introduction of current cost accounting in the UK: Determinants of corporate preference. Journal of accounting and economics, 10(2), 127-149.

Crossref, GoogleScholar, Indexed At

Tabak, B.Y. (2021). Education expectations and income level of families: An assessment within the framework of human capabilities approach. Educational Administration: Theory and Practice, 27(1), 985-1004.

Crossref, GoogleScholar, Indexed At

Tran, Q.T., Nguyen, N.K.D., & Le, X.T. (2021). The effects of corporate governance on segment reporting disclosure: A case study in Vietnam. The Journal of Asian Finance, Economics and Business, 8(4), 763-767.

Crossref, GoogleScholar, Indexed At

Watts, R.L., & Zimmerman, J.L. (1978). Towards a positive theory of the determination of accounting standards. Accounting Review, 112-134.

Crossref, GoogleScholar, Indexed At

Watts, R.L., & Zimmerman, J.L. (1986). Positive accounting theory.

Crossref, GoogleScholar, Indexed At

Wong, J. (1988). Political costs and an intraperiod accounting choice for export tax credits. Journal of accounting and economics, 10(1), 37-51.

Crossref, GoogleScholar, Indexed At

Zhu, N., Bu, Y., Jin, M., & Mbroh, N. (2020). Green financial behavior and green development strategy of Chinese power companies in the context of carbon tax. Journal of Cleaner Production, 245, 118908.

Crossref, GoogleScholar, Indexed At

Received: 21-Nov-2021, Manuscript No. asmj-21-9283; Editor assigned: 23- Nov -2021, PreQC No. asmj-21-9283 (PQ); Reviewed: 28- Nov-2021, QC No. asmj-21-9283; Revised: 10-Dec-2021, Manuscript No. asmj-21-9283 (R); Published: 06-Jan-2022