Research Article: 2021 Vol: 20 Issue: 1

The Auditors Characteristics for Big Four Audit Companies: Empirical Analysis in the Brazilian Market

Isabel Oliveira, North Lusíada University

António Cardoso, University Fernando Pessoa

Luciano Medeiros, University Fernando Pessoa

Jorge Figueiredo, North Lusíada University

Margarida Pocinho, Coimbra School of Health Technology

Elizabeth Real de Oliveira, North Lusíada University

Abstract

The phenomenon of globalization, the dependence on markets and the emergence of possible competitors, impose on organizations other forms of management and professionals with new capabilities. In this sense, it is crucial to identify the requirements most valued by companies, with regard to the skills of an auditor.

The purpose of this article is to analyze the skills that accounting graduates must possess, in view of the characteristics sought by auditing companies when hiring their professionals.

The sample consists of 62 questionnaires to professionals from Big Four audit companies in Brazil, a country with few studies in this area. The methodology used is a model of structural equations. The developed model consists of twenty observed variables, divided into three constructs, auditing, universities and graduates.

The results show the importance of technical, accounting, technological knowledge and previous internships and/or jobs, as well as, of the institution that the graduate acquired the training. However, some behavioral characteristics (attendance, leadership) indicated less weight in the market demand process. The model presented thus corroborates the information for the selection process of professionals, as it indicates variables/characteristics in the binomial training/demand of the audit market.

Keywords

Audit, Big four, Audit companies, Training, Labour market.

Introduction

Today's society is characterized by the globalization of the economy, integration of markets and large corporate institutions with international capital. These factors dictated the need for investors to have relevant and reliable information, so that their strategies are efficient, diversified and international. Accounting has a primary role in the preparation of this information.

In this sense, the evolution of accounting over time was paramount. Initially, standardization at the national level, and later, because of globalization, international harmonization. To this end, the International Accounting Standards Committee - IASC was created, which gave rise, in 2001, to the International Accounting Standards Board - IASB, with the objective of creating standards (International Financial Reporting Standards - IFRS) for the preparation of financial statements and promoting international acceptance. In this sense, the IASB seeks to replace a variety of national accounting standards with a single international standard, making it possible to compare financial statements in any country or territory that adopts them. However, for this objective to be achieved, it is crucial to have institutions that oversee the procedure adopted in the preparation of the financial statements. The purpose of the audit is to assess whether the financial statements disclosed and published by the companies were made in accordance with the accounting standards in force (Franco & Marra, 2000).

In this evolution, the importance of accounting is questionable, although there are doubts about the adequacy of the teaching of this science in Universities (IES), in view of the professionals' requirements (Iudícibus & Marion, 1986).

The objective of this investigation is to analyze the competencies/characteristics that a graduate in accounting must present, in view of the demand of the job market, in Big Four Brazilian audit companies. Additionally, it is intended to know, in the perception of these companies, if those graduated by the IES present the characteristics they are looking for. The methodology used includes a descriptive and explanatory method, with a review of the literature and the use of empirical research in the Big Four audit companies. To achieve this objective, a model of structural equations (Partial Least Square) is built, with twenty measurable (observable) variables, divided into three latent variables (constructs).

There are several factors that explain the relevance of this investigation. Although there are studies that analyze the characteristics that the audit job market seeks in accounting graduates, research with samples in the Brazilian context is relatively recent, hence it is an asset for graduates, IES and auditing companies. Graduates will be able to seek skills appropriate to the requirements of the market. IES will be able to adjust curricula and syllabus to form graduates with skills suited to demand. Audit firms now have professionals more suited to their requirements and without the need to provide them with training to do so. On the other hand, the methodology used a model of structural equations, presents advantages in relation to other methodology, by allowing an analysis of the causal relationships between the latent variables and their respective observed variables.

Literature Review

In Brazil, Ricardino & Carvalho (2004) argue that it is not possible to indicate a date for the appearance of the first audit work. However, it is undeniable that after the Second World War, many foreign organizations settled in Brazil and implemented the habit of accounting auditing (Franco & Marra, 2000). After this date, the audit has undergone an increasing evolution1. Currently, greater competition among companies requires auditing companies to be more concerned with creating value, customer satisfaction, self-regulation, among others (Pinho et al., 2007).

It should be noted that the evolution of the audit is not unrelated to the evolution of accounting and, consequently, to the evolution of accounting education. Despite the evolution of accounting education in Brazil, there is still a need for some adjustments in the teaching of this science in IES. With a sample made up of IES in the State of Paraíba, Moreira et al. (2015) find that the teaching of this science is predominantly theoretical. The authors conclude that it is not possible to conceive in the accounting formation of the IES the practice dissociated from the theory and vice versa. Similar conclusions are reached by Rodrigues et al. (2016) in a sample of 128 finalist students in the accounting science course at the IES in Natal. Rodrigues et al. (2016) verify that there is little relationship between students and professionals in the labour market; hence they conclude that professors in the disciplines of accounting sciences are unable to integrate academic and professional environments.

The teaching of accounting must be adjusted according to some characteristics of the students. For Neto et al. (2009) the recognition of different cognitive styles of learning and assessment allows the possibility of adapting teaching strategies to the individual characteristics of students, thus allowing opportunities to continuously improve the quality of teaching.

Other studies analyses the skills that graduate in accounting must have to satisfy the demands of the labour market. Cory & Huttenhoff (2011), in a sample of 170 accounting professionals in the USA, found that the most important characteristics they should have are: (1) critical thinking, (2) good written and oral communication, (3) good interpersonal skills, (4) the ease of working as a team, (5) the spirit of leadership, (6) professionalism and (7) the continuous search for training. The most important areas of knowledge acquired in IES are accounting, auditing, taxation and ethics. Cory & Pruske (2012), in a sample of 464 professionals from the USA, found that graduates, before entering the job market, must have computer knowledge, be creative in solving problems and raise awareness of ethical issues. McMullen & Sanchez (2010) found in a sample from the USA that persistence, reasoning and good interpersonal relationships are the most important characteristics for professionals. As for basic knowledge, financial accounting, problem solving, data analysis and information technology stand out.

Chaker & Abdullah (2012), in a sample of 77 graduates from Kazakhstan, consider that these professionals must have knowledge of professional ethics, interpersonal and communication, financial accounting and management.

Souza & Vergilino (2012) based on job vacancy announcements, published in Exam Magazine, for Rio Grande do Sul, between January 2008 and December 2009, find that the market is looking for more and more specialized accounting professionals, this that is, they must have knowledge of IFRS, account consolidation and other requirements, such as fluency in languages, proactivity, responsibility and knowing how to work in a team, under pressure.

For Santos (2012), the training offered by the IES is adapted to the needs of the market. Result that is not corroborated by Machado & Nova (2008). In a sample referring to companies in São Paulo, winners of the Exam Magazine Yearbook “bigger and better” in the year 2005 and 120 students from the main IES in this city, Machado & Nova (2008) conclude that the job market presents great demands for specific knowledge (national and international accounting standards and logical and mathematical reasoning). But, the students under analysis do not consider meeting these requirements. Similar conclusions are reached by Diaconu et al. (2011), in students from Romania. Machado et al. (2014) when analyzing the IES in Goiânia, international audit standards are important, but, in most cases, these are in the form of topics in the syllabus. For Degenhart et al. (2016) students know the requirements and skills required in the labour market and students do not have difficulties to enter the labour market, despite finding in the IES that there is no reconciliation between theory and practice.

As a sample, 373 job vacancy announcements on three specialized human resources recruitment sites, between August and September 2006, Oro et al. (2009) verify that in the competence profile of the accounting professional, it is necessary to have professional experience and to master English. Faria & Queiroz (2009) found in advertisements for job offers in the city of São Paulo, in the years 2007 and 2008, that professionals must have knowledge of international standards, information technology and foreign languages, preferably English.

From the empirical studies analysed, it is emphasized that the labour market requires professionals with great skills, not only accounting, but also in other domains, such as computer science, foreign languages, entrepreneurship, ethics and, above all, updated knowledge, which reflects the importance of the search through continuous training. Howieson et al. (2014) argue, through a sample from Australia, that it is unlikely that the IES will satisfy all the requirements demanded by the market, however, these institutions should offer postgraduate courses to fill some gaps.

After realizing the characteristics required by the job market, it is necessary to know whether the IES are preparing professionals suited to these characteristics. Santos et al. (2014) find a gap between training and the demands of the labour market and some students think they have not acquired the necessary skills to enter the labour market.

Hoff et al. (2017) in a sample consisting of 376 audit companies and 72 professors from public and state universities with accounting courses, find that in approximately seventy-five percent of the subjects analyzed, the IES correspond to the expectations that the market attributed to the discipline of audit. They also conclude that the teachers in charge of teaching the audit have little qualifications; only a small percentage has a master's degree or endowment. An identical conclusion was obtained by Ricardino (2003) when he stated that: (1) teachers without basic training in accounting (20%) and little graduates in accounting (three teachers with master's degrees and one with a doctorate), (2) teachers with little or no professional experience in auditing or accounting, (3) the average teaching time of the discipline is not more than 4.5% of the total course load, (4) the audit books indicated by the teachers are anachronistic, with regard to the techniques of audit in use by the main companies in the area. Situation that reveals an inadequate teaching for accounting students to exercise the profession of auditors. Situation that justifies the audit companies to carry out training courses for beginning auditors.

In the current economic context, it is unquestionable that the labour market requires professionals, increasingly qualified and with greater knowledge, hence the responsibility of IES in training professionals with skills required by the labour market is also essential. For Marques et al. (2017) accounting science students from a private institution in Minas Gerais demonstrate high satisfaction with the accounting course for the job market.

In short, students, teachers/IES and managers must fulfil their role in society. Students must expand their knowledge and develop skills and competencies necessary for the exercise of the profession. Teachers/IES and managers need to keep up to date in relation to technical, scientific and pedagogical knowledge, always aiming at improvement.

Methodology

The objective of the present investigation is to analyse whether the teaching of auditing in IES, through graduates in accounting, presents the characteristics that the Big Four of Brazilian auditing seek in these professionals.

Quantitative and qualitative methodology was used, divided into several stages: (1) review of the literature on the characteristics that the market seeks and that graduates present, (2) elaboration of the questionnaire and definition of the sample, (3) sending and receiving of the questionnaire, (4) statistical analysis of the sample and, (5) analysis of the results based on the model of structural equations, to obtain the final conclusions.

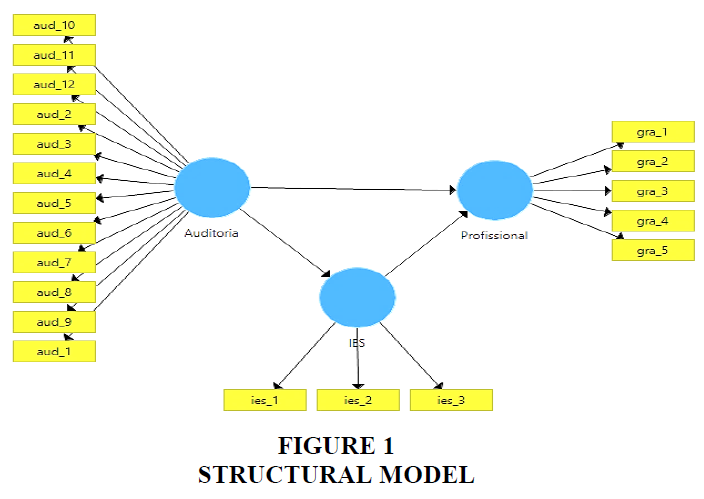

In the analysis of the competencies required in the hiring of a new worker by the audit companies, a model of structural equations is defined, based on the literature review and consisting of two models, the structural and the measurement. The structural model allows assessing the degree of adherence of professionals to the labour market, and consists of three latent variables, which make up the three constructs analyzed: audit (AUD), universities (IES) and graduates (GRA). The measurement model consists of twenty observable variables, divided by the three constructs of the structural model and intended for their measurement (Table 1).

| Table 1 Constructs and Observable Variables | ||

| Construct | Variable | Cod |

| Audit | Knowledge of accounting and/or IFRS | AUD_1 |

| Need for previous professional experience | AUD_2 | |

| Knowledge of a foreign language (preferably English) | AUD_3 | |

| Ethical and moral conduct (previous and current) | AUD_4 | |

| Perspective that the auditing company may have on the professional | AUD_5 | |

| Ability to perform multiple tasks at the same time | AUD_6 | |

| Interpersonal skills | AUD_7 | |

| Critical analysis capability | AUD_8 | |

| Knowledge of fiscal and tax matters | AUD_9 | |

| Commitment to deadlines | AUD_10 | |

| Commitment to quality | AUD_11 | |

| Writing skills and language adequacy | AUD_12 | |

| Universities | IES classification in Ministry of Education | IES_1 |

| IES image in the market | IES_2 | |

| IES curriculum content | IES_3 | |

| Graduates | Assiduity | GRA_1 |

| Leadership potential | GRA_2 | |

| Knowledge of technological tools (for example Excel) | GRA_3 | |

| Ability to accept/perform routine jobs | GRA_4 | |

| Evaluation of previous internships and/or jobs | GRA_5 | |

The questionnaire consists of twenty questions, which correspond to the twenty observable variables identified in Table 1. The scale used is the Likert scale, the values range from 1-totally disagrees to 5-totally agree. The questionnaire was made available on the electronic platform Google Documents and distributed to 180 professionals from the four largest Brazilian audit firms. Of these, 62 responses were obtained, thus constituting the sample under analysis.

The model developed is Partial Least Squares, from Linear Equation Models (PLS-SEM), which allows analyzing the links between latent and observable variables, through linear relationships. The software used is SmartPLS 3.0.

Figure 1 presents the structural model, developed using the SmartPLS 3.0 software and consisting of three latent variables with their respective connections, that is, variables that directly or indirectly influence changes in the values of other variables.

After estimating the model, according to the PLS-SEM methodology, its overall quality is analyzed to assess its predictive capacity. First, the measurement model is evaluated, and after adjustments, the structural model is evaluated (Henseler et al., 2009; Götz et al., 2010). In the measurement model, the Confirmatory Factor Analysis (CFA) is performed and the indicators are qualified: convergent validity, internal consistency, composite reliability and discriminant validity. In the structural model, the indicators are analysed: determination coefficient, resampling, predictive validity, effect dimension, and study of the effect.

Empirical Results

This section aims to analyse the explanatory power of the proposed model. Table 2 presents the indicators to assess the quality of the measurement model, except for the discriminant validity of each observable variable, in relation to each of the three latent variables found in Table 3. In this Table 3, are also presented the results to assess the statistical significance of each observed variable, with 500 resamples.

| Table 2 Measurement Model Indicators | ||||||

| Discriminant Validity Correlation Coefficients |

Converging Validity |

Internal Consistency |

Composite Reliability |

|||

| AUD | IES | GRA | AVE | Alpha | Dillon | |

| AUD | 0.529 | - | - | 0.680 | 0.762 | 0.778 |

| IES | 0.324 | 0.926 | - | 0.857 | 0.917 | 0.933 |

| GRA | 0.668 | 0.530 | 0.574 | 0.529 | 0.485 | 0.506 |

| Table 3 Discriminant Validity and Factor Loads of Observed Variables | |||||||

| Model Indicators | |||||||

| Variable | Measurement Model | Structural Model | |||||

| Discriminant Validity | Resampling | ||||||

| AUD | IES | GRA | Factorial Loads | Standard Deviation | T-sample | P-value | |

| AUD_1 | 0.628 | 0.316 | 0.373 | 0.628 | 0.128 | 4. | 0.000 |

| AUD_2 | 0.421 | 0.173 | 0.343 | 0.421 | 0.128 | 3.294 | 0.001 |

| AUD_3 | 0.602 | 0.175 | 0.486 | 0.602 | 0.111 | 5.407 | 0.000 |

| AUD_4 | 0.294 | -0.041 | 0.004 | 0.294 | 0.175 | 1.685 | 0.093 |

| AUD_5 | 0.319 | 0.182 | 0.186 | 0.319 | 0.137 | 2.332 | 0.020 |

| AUD_6 | 0.356 | -0.006 | 0.119 | 0.356 | 0.156 | 2.279 | 0.023 |

| AUD_7 | 0.470 | 0.144 | 0.274 | 0.470 | 0.159 | 2.952 | 0.003 |

| AUD_8 | 0.460 | 0.058 | 0.269 | 0.460 | 0.160 | 2.873 | 0.004 |

| AUD_9 | 0.725 | 0.271 | 0.474 | 0.725 | 0.106 | 6.809 | 0.000 |

| AUD_10 | 0.655 | 0.131 | 0.474 | 0.655 | 0.169 | 3.879 | 0.000 |

| AUD_11 | 0.683 | 0.227 | 0.391 | 0.683 | 0.143 | 4.763 | 0.000 |

| AUD_12 | 0.509 | 0.110 | 0.368 | 0.509 | 0.132 | 3.852 | 0.000 |

| IES_1 | 0.212 | 0.896 | 0.483 | 0.896 | 0.083 | 10.793 | 0.000 |

| IES_2 | 0.273 | 0.961 | 0.446 | 0.961 | 0.044 | 21.877 | 0.000 |

| IES_3 | 0.391 | 0.919 | 0.532 | 0.919 | 0.030 | 30.262 | 0.000 |

| GRA_1 | 0.390 | 0.131 | 0.402 | 0.402 | 0.185 | 2.175 | 0.030 |

| GRA_2 | 0.289 | 0.301 | 0.483 | 0.483 | 0.162 | 2.980 | 0.003 |

| GRA_3 | 0.465 | 0.308 | 0.686 | 0.686 | 0.113 | 6.059 | 0.000 |

| GRA_4 | 0.289 | 0.128 | 0.537 | 0.537 | 0.206 | 2.608 | 0.009 |

| GRA_5 | 0.443 | 0.518 | 0.702 | 0.702 | 0.109 | 6.462 | 0.000 |

The values shown in Table 2 are a good adherence to the measurement model. The average variance extracted (AVE) of each construct explains on average whether the variables correlate positively with their construct. For Henseler et al. (2009), the average variances (AVE) of the constructs must be greater than 0.5, to be an acceptable model, verified in the proposed model.

The internal consistency, Cronbach's Alpha, Alpha, and the composite reliability (Dillon's ρ-rho), Dillon, aim to analyze whether the sample does not include bias, or whether the variables as a whole are reliable. The Dillon indicator is more suitable for PLS-PM, as it prioritizes variables according to their reliability, because Alpha is more sensitive to the number of variables in each construct. Alpha and Dillon values greater than 0.6 and 0.7, respectively, are considered satisfactory (Hair et al., 2016). It appears that the values for the proposed model are higher than the indicated limits, except for the latent variable GRA, which presents slightly lower values in the two indicators. Note that this variable also shows a value close to suitable for AVE.

In the discriminant validity, it is intended to analyze whether the constructs are independent (Hair et al., 2016), in which two indicators are analyzed, correlations between the constructs and the analysis of cross loads. The correlations between the latent variables show that most of the diagonal values are superior to the other correlations, thus corroborating the quality of the model (Table 3).

Table 3 shows that the factor loads of each variable observed are higher in the construct to which it belongs, in relation to the factor load in the remaining two constructs; hence, according to Chin (1998), the model has discriminant validity.

In short, from the analyzed indicators, it is concluded that the measurement model in question presents adherence to reality.

The indicators to assess the quality of the structural model are shown in Table 4 and the resampling, in Table 3.

| Table 4 Structural Model Indicators | |||||

| Variable | R2 Pearson |

Q2 Stone-Geisser |

F2 Cohen |

Relationship | Effect |

| AUD | 0.782 | 0.550 | 0.619 | AUD®IES | 0.324 |

| IES | 0.653 | 0.573 | 0.248 | AUD®GRA | 0.668 |

| GRA | 0.550 | 0.612 | 0.188 | IES®GRA | 0.351 |

The resampling technique was used2, with 500 resamples, and the values obtained in the t-test, for a level of statistical significance of 5%, the null hypothesis of the observed variables being equal to zero is rejected, that is, the proposed variables are statistically significant (Table 3). There is only one exception for the variable AUD_4, however, if the level of statistical significance increases to 10%, it is also concluded that this variable is statistically significant.

The first analysis of the structural model is the adjusted determination coefficient, which indicates the proportion that the model-dependent variable (construct) is explained by its independent (observed) variables. The higher this coefficient, the greater the explanatory capacity of the model. The values of the determination coefficients, Table 4, vary between 55%, for the GRA construct and 78%, for the AUD construct. For Sanchez (2013), values between 30% to 60%, the construct presents a moderate explanatory capacity, which is the case of GRA, and values above 60%, the construct presents high explanatory capacity, which is verified for AUD and IES.

From the values obtained for the Stone-Geiser indicator (Q2) and for the Cohen indicator (F2) in each of the constructs, it can be said that the analyzed model has explanatory capacity or adherence to reality as well as the proposed constructs are relevant for the model.

To test the significance of the relationships in the model using the resampling technique, the total effects on the AUD variable and other latent variables were estimated, based on the structural coefficients. The values related to the total effects (Table 4) suggest the behavior of the audit companies, regarding the selection of professionals, considering their training and the legal requirements of the profession.

From the above, it can be concluded that the model is adapted to reality. Regarding validity and conceptual adherence, it is demonstrated in the discriminant validity values, that the latent variables are independent from each other, the cross loads of each observed variable are higher in the latent variable to which it belongs, compared to the other latent variables. The average variances (AVE) of the observed variables are higher than the reference value, according to Fornell & Larcker (1981). In the discriminant validity, there are two negative relations, AUD_4 and AUD_6. However, such relationships are not limited to the original construct, AUD. From the indicators, Cronbach's and Dillon's alpha, it is concluded that the sample does not present bias. It should be noted that the graduated construct presents a value lower than the reference in Alpha, of 0.485, however, it is not a very relevant value, since the central focus is the audit construct. The structural effect audit?graduates the 0.668 confirms the analysis carried out in the literature review, the need for candidates to have certain skills in view of the demands of the labour market.

In the audit construct, the variables with the highest factor load are AUD_9, technical knowledge of tax and tax matters, and AUD_11, commitment to quality, of 0.725 and 0.683, respectively. These are the most relevant skills that professionals must have in view of the demands of the labour market. The ethical and moral conduct of the candidate (AUD_4) and the perspective of the client of these companies vis-à-vis the professional (AUD_5), have less factor load, hence, the less importance attributed by the audit companies.

In the graduates construct, the variable GRA_5, which evaluates professionals, based on having previous internships and/or jobs, has the highest factor load, 0.702, hence, being the most important requirement when selecting the candidate. Conversely, attendance (GRA_1) and leadership potential (GRA_2) are the least important factors. It is concluded that the audit companies attach greater importance to the professional's technical skills that are directly related to the practice of the profession.

In the construct of universities, the three variables observed have high factor loads. However, it should be noted that the variable IES_3, program content of the IES course, which has a factor load of 0.919, corroborates the three-dimensional relationship Audit/IES/Professional, hence the importance of IES in the training of professionals. The variables IES_1 and IES_2, classification of the IES in the Ministry of Education and image of the IES in the market, respectively, present the largest factor loads of this construct, of 0.896 and 0.961 respectively.

Conclusions

The objective of the present study is to analyze the characteristics that accounting graduates must have to meet the demand of the Big Four auditing companies in Brazil and, simultaneously, if those graduated by the IES present the characteristics that the market seeks. In the pursuit of this objective, a sample consisting of 62 questionnaires to professionals from Big Four Brazilian auditing companies is used in the empirical analysis.

The literature review allowed the selection of the three constructs, audit, graduates and IES, as well as the twenty variables observed, to be included in each construct. The proposed model of structural equations consists of two models, measurement and structural. The methodology used is the Partial Least Squares of the Linear Equation Models (PLS-SEM) using the SmartPLS software.

In assessing the quality of the adjustment, various statistical indicators are analyzed. In the measurement model, convergent validity, discriminant validity, internal consistency and composite reliability are analyzed. In the structural model, Pearson's determination coefficient, bootsraping, relevance or predictive validity, effect size and model adequacy index are analyzed.

The results obtained in this investigation, based on the sample used, allow us to state several conclusions:

1. The statistical indicators analyzed allow assessing the quality and adherence to the reality of the model developed.

2. The main competences that the labour market of auditing companies emphasize for their professionals are: tax and tax knowledge (AUD_9), being concerned with the quality of the work performed (AUD_11). The higher education institution that the professional obtained the training is important, as regards the classification in Ministry of Education (IES_1), image of the institution (IES_2) and curriculum content of the training obtained (IES_3). Knowledge of technological tools (GRA_3) and whether they have previous internships and/or jobs.

3. The skills that the audit companies labour market does not give emphasis to their professionals are: professional ethical and moral conduct (AUD_4), perspective that the company may have on the candidate (AUD_5), attendance (GRA_1) and leadership potential (GRA_2).

The conclusions obtained in this investigation are relevant. First, because there are few studies in the Brazilian market, this is the reason for filling an existing gap. Second, it allows to identify the profile/skills that professionals must have in view of the requirements of audit companies. At the same time, it allows IES to adapt the teaching of auditing so that graduates can acquire the required skills and, it allows professionals to seek to acquire certain skills, if they do not have them, but that the market values. In view of the above, it can be said that all stakeholders, professionals, IES can have an added value with also positive repercussions on audit companies, which now have professionals with greater skills.

The results found generate additional questions for future research. Considering the importance of auditing firms and accounting science, it is crucial to improve higher education throughout the entire Brazilian territory. It is suggested, as a line for further studies, a similar analysis, expanding the sample to include more IES, private and public, offering specialization courses in the audit area and/or extending the geographic area to other countries, to assess similarity results in Brazil.

End Notes

1. In Brazil, the audit activity is regulated and supervised by the Brazilian Securities and Exchange Commission (SEC), by the Regional Accounting Councils (RAC) and by the Federal Accounting Council (FAC). These bodies, in conjunction with the Institute of Independent Auditors of Brazil (IBRACON), issue norms and guidelines of an ethical, technical and professional nature.

2. In the resampling technique, the following processing parameters were used, based on Hair et al. (2016): missing value algorithm, sign changes, 62 cases 62 and 500 samples.

References

- Chaker, M., & Abdullah, T. (2012). What accountancy skills are acquired at college? International Journal of Business and Social Science, 2, 18.

- Chin, W.W. (1998). The partial least squares approach to structural equation modeling. Modern Methods For Business Research, 295(2), 295-336..

- Cory, S., & Huttenhoff, T. (2011). Perspectives of non-public accountants about accounting education and certifications: An exploratory investigation. Journal of Finance and Accountancy, 6(3), 1-14.

- Cory, S., & Pruske, K. (2012). Necessary skills for accounting graduates: an exploratory study to determine what the profession wants. Proceedings of the American Society of Business and Behavioral Sciences, 19(1), 208-218.

- Degenhart, L., Turra, S., & Biavatti, V.T. (2016). Job market in the perception of graduating students of the accounting science course in the state of Santa Catarina. ConTexto, 16(32).

- Diaconu, P., Coman, N., Gorgan, V., & Sandru, C. (2011). The needs of the financial labour market in Romania and the answer of the local universities to this social demand. Journal of Accounting and Management Information Systems, 10(1), 55-73.

- Faria, A.C., & de Queiroz, M.R.B. (2009). Demand for qualified professionals in international accounting in the labor market in the city of São Paulo. Revista Contábil Magazine, 5(1), 55-71.

- Fornell, C., & Larcker, D. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Franco, H., & Marra, E. (2000). Accounting audit. Atlas. Sao Paulo.

- Götz, O., Liehr-Gobbers, K., & Krafft. M. (2010). Evaluation of structural equation models using the partial least squares (PLS) approach. Handbook of Partial Least Squares, 691-711.

- Hair Jr, J.F., Hult, G.T.M., Ringle, C., & Sarstedt, M. (2016). A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications.

- Henseler, J., Ringle, C., & Sinkovics, R. (2009). The use of partial least squares path modeling in international marketing. Advances in International Marketing, 20, 277-320.

- Hoff, J., Alberton, L. & Camargo, R. (2017). The view of academia and the labor market on teaching audit. Accounting Education and Research Magazine, 11(1), 52-68.

- Howieson, B., Hancock, P., Segal, N., Kavanagh, M., Tempore, I., & Kent, J. (2014). Who should teach what? Australian perceptions of the roles of universities and practice in the education of professional accountants. Journal of Accounting Education, 32(3), 259-275.

- Iudícibus, S., & Marion, J. (1986). The faculties of accounting sciences and the formation of the accountant. Revista Brasileira de Contabilidade, 15(56), 50-56.

- Machado, L., Guerra, F., & Machado, M. (2014). Auditor training in higher education institutions and professional training in audit firms. Accounting Magazine UFBA, 8(1), 4-20.

- Machado, V., & Nova, S. (2008). Comparative analysis between the knowledge developed in the undergraduate course in Accounting and the profile of the Accountant required by the job market: A field survey on Accounting Education. Accounting Education and Research Magazine, 2(1), 1-23.

- Marques, V., Silva, L., & Dias, K. (2017). Professional expectations of accounting science students: An analysis of a minas gerais educational institution. Academic Path, 6(11), 1-21.

- Mcmullen, D., & Sanchez, M. (2010). A preliminary investigation of the necessary skills, education requirements, and training requirements for forensic accountants. Journal of Forensic & Investigative Accounting, 2(2), 30-48.

- Moreira, J., Vieira, M., & Silva, C. (2015). Between theory, practice and technology: relationship between theoretical knowledge and practical knowledge in the context of accounting training and the thinking of jüngen habermas. Brazilian Business Review, 12 (4), 130-148.

- Neto, J., Oliveira, V., & Miranda, C. (2009). Cognitive styles: a survey of accounting students. Brazilian Business Review, 6 (1), 82-103.

- Oro, I., Dittadi, J., Carpes, A., & Benoit, A. (2009). The profile of the controllership professional from the perspective of the Brazilian labor market. Pensar Contábil Magazine, Brasília, 11 (4), 5-15.

- Pinho, A.F.D., Leal, F., Montevechi, J.A.B., & Almeida, D.D. (2007). Combination between flowchart and process map techniques in mapping a production process. National Meeting of Production Engineering, 27.

- Ricardino, Á., & Carvalho, L. (2004). Brief retrospective of the development of audit activities in Brazil. Accounting & Finance Magazine, 15 (35), 22-34.

- Ricardino, A.A (2003). Some limitations of teaching auditing in accounting courses in Brazil.

- Rodrigues, A., Moreira, F., Firmino, J., & Silca, M. (2016). The perception of students of the accounting science course about teaching and the labor market in accounting expertise The perception of students on the course of accounting about the labor market and education in forensic accounting. Capital Scientific Magazine - Electronics, 14 (2), 1-16.

- Sanchez, G. (2013). PIS path modeling with R. Trowchez Edition. Berkeley.

- Santos, D., Araujo, V., Cavalcante, P., & Barbosa, E. (2014). Academic background in accounting sciences and their relationship with the labor market: the perception of accounting sciences students from a federal institution of higher education. XI USP Congress of Accounting and Controllership, New Perspectives in Accounting Research, São Paulo.

- Santos, NDA (2012). Determinants of academic performance of students in accounting science courses. Unpublished doctoral dissertation, University of São Paulo.

- Souza, M., & Vergilino, C. (2012). Um perfil do profissional contábil na atualidade: estudo comparativo entre conteúdo de ensino e exigências de mercado. Administração: Ensino e Pesquisa, 13(1), 183-223.